There could be a bubble in more speculative areas in the US, but with the UK having suffered billions of fund manager outflows, perhaps UK stocks could now prove a safe haven. Companies covered DIA, IHC and TSTL.

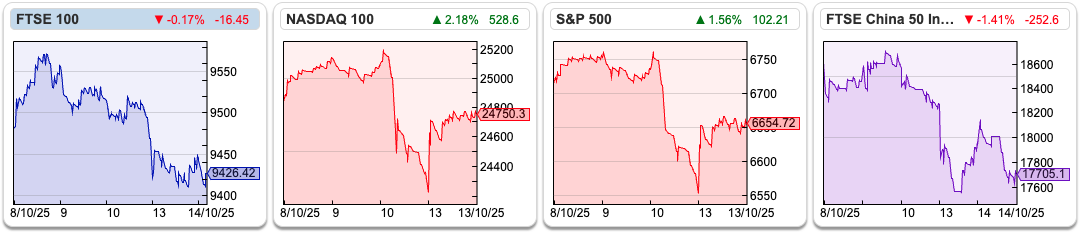

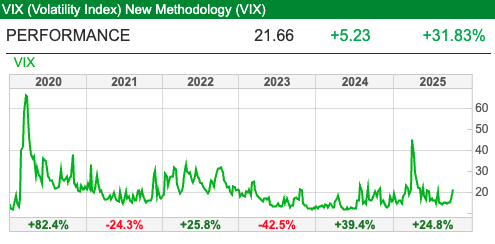

The FTSE 100 fell -0.65% to 9462 over the last 5 trading days. The Nasdaq100 and S&P500 were down -0.9% and -1.3%. There was a crypto sell off at the end of last week, with Doge down -20% and Bitcoin -8%. The VIX rose by a third to above 20. That’s its highest level in 6 months and compares to a peak of 45 at start of April when Trump announced his tariffs and 65 during the early stages of the pandemic.

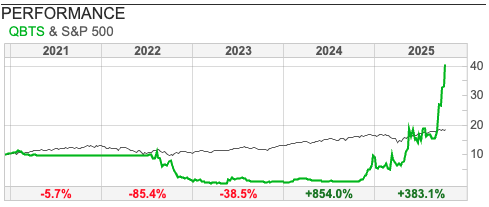

Many people are writing about the hundreds of billions being spent on AI capex, this substack author suggests $1.5 trillion. To give that large number some context, Amazon, Google, Meta, Microsoft, and Apple, generated $1.4 trillion in Free Cash Flow over the last 5 years. It’s not just AI in US markets. One of my programmer friends is excited about the performance of quantum computer stocks like D Wave (ticker QBTS).

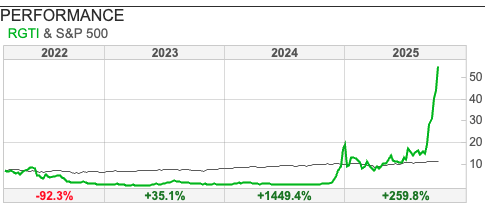

See also Rigetti (RGTI) below. He told me about these companies a year ago, and I spent some time on YouTube learning about quantum computing, for instance Grover’s Algorithm. I concluded that quantum computers were mostly hype – which could be true, but the charts disagree. Can’t win them all.

Historically, whenever bubbles have burst in US markets, this has been negative for AIM. AXX’s peak-to-trough fall from the top of the internet bubble was -80% and between 2007 and 2009 AXX fell -70%. Yet, this time the bubble seems specific to quantum computers, crypto and Artificial Intelligence. AIM doesn’t have exposure to these sectors.

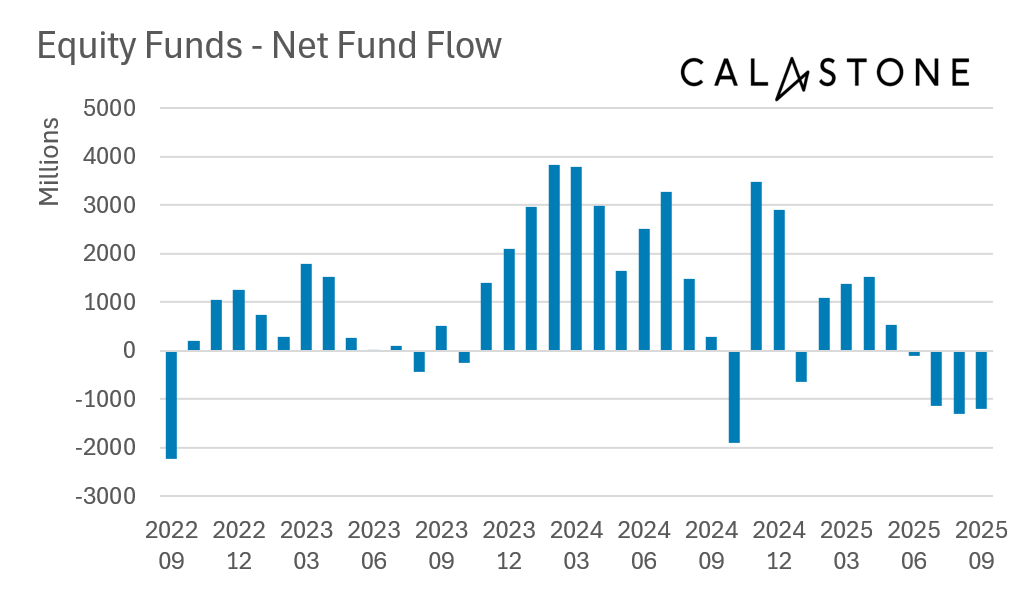

In addition, the chart below from Calastone, shows the exodus of funds from UK investors continued in Q3. So, we have avoided the wave of speculative excess going on the other side of the Atlantic, which makes me sanguine about the outlook for UK investors.

This week I look at a couple of turnaround situations: Dialight which does industrial lighting and medical equipment group Inspiration Healthcare. I finish with Tristel, the medical disinfectant company that looks like it might finally be able to expand into North American markets.

Dialight H1 Sept Trading Update

This industrial LED lighting company says that sales in H1 will be marginally down on H1 last year ($90m) due to tariff uncertainty. Following the cautious sounding guidance, management then go on to say in the second paragraph that their Transformation Plan is going well and they now expect to “significantly exceed the market expectation for Adjusted Operating Profit for the year ending 31 March 2026.” Net debt has fallen from $18m over the last six months to $10m at the end of September, helped by a couple of Covid related tax credits (but not included in the FY Mar 2026F guidance above).

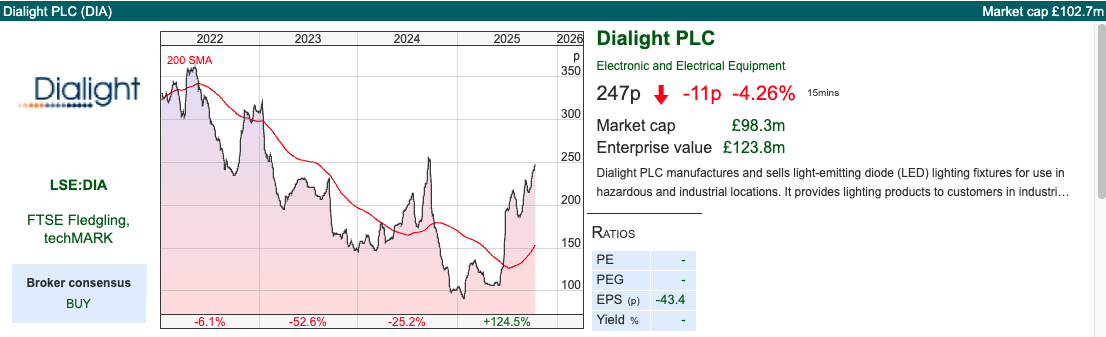

The shares are up 2.3x since the start of June, though I can’t see any RNS that triggered that prior to the FY Mar 2025 results which came out on the 24th of June. These were taken positively but the share price had already risen by +35% before that end of June announcement. Just something to be aware of, if you are going to buy into the story.

History: The shares have been listed on AIM since the mid-1990s, and the share price was above £10 per share in 2017. Then the company started reporting “short-term production challenges”, those “short-term” challenges resulted in the share price falling -90% over the next 7-8 years, to trough at 94p at the start of this year.

As a reminder, when management teams warn on profits, they will almost always try to convince investors that the problems are temporary and easily fixable. It’s worth being sceptical, but on the other side of the coin, if you avoid all companies where management have been too optimistic in their voluntary disclosure, then you can miss the turning point. Made Tech (which I missed for this reason) strikes me as a recent example.

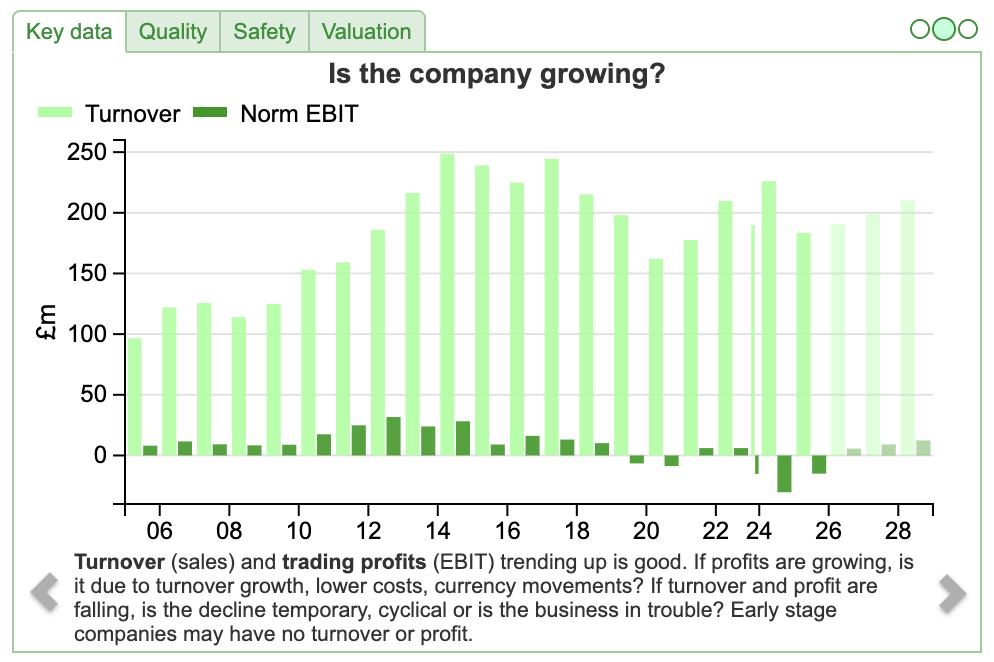

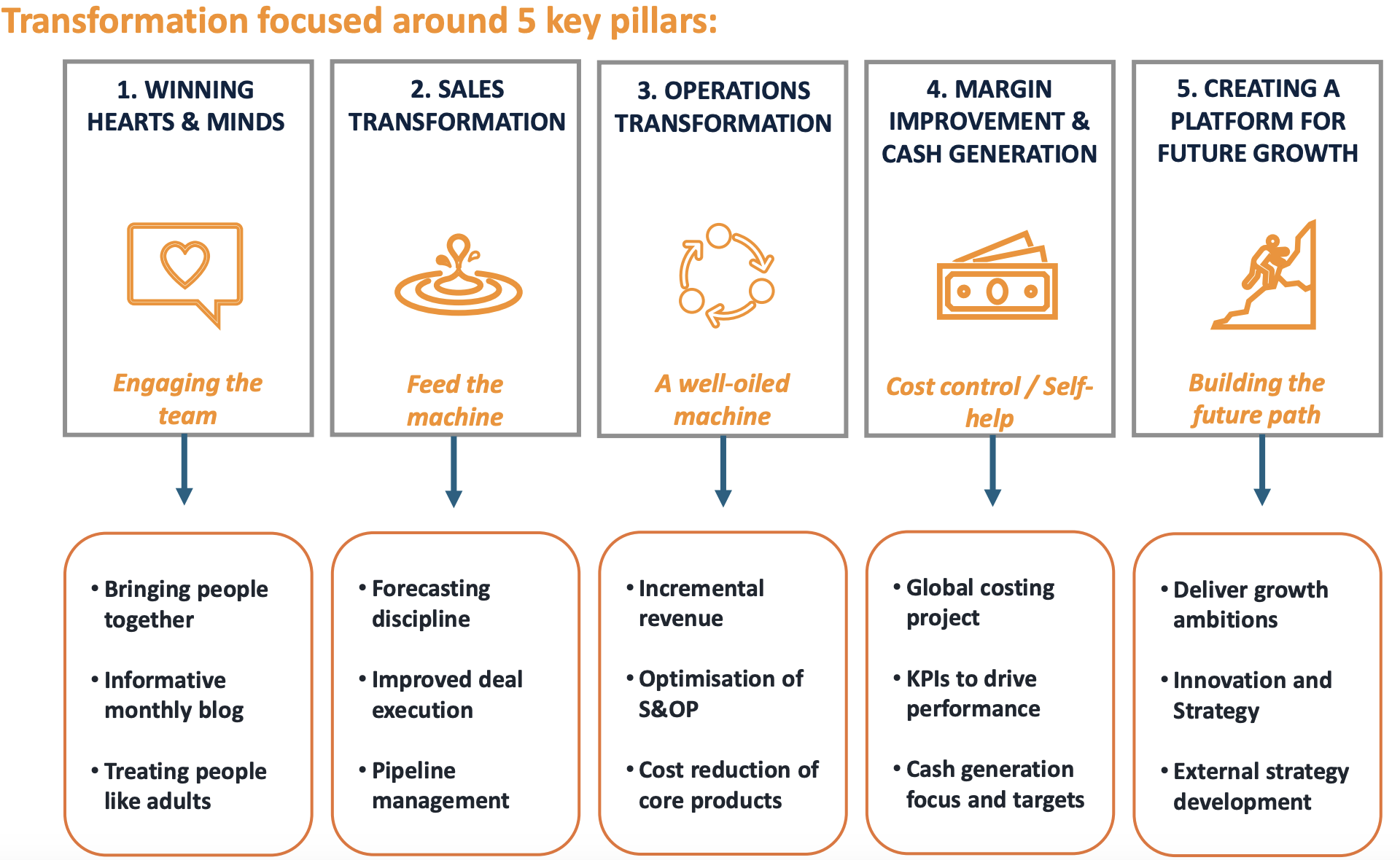

In response to their deteriorating performance, Dialight announced a Transformation Plan, cutting costs, improving productivity and accelerating growth. As part of this plan, management raised £10m at 189p in September 2023 to pay down debt and invest in the business. For example, improving support for the sales team, streamlining operational processes and optimising production capabilities. From a financial perspective they expected to improve margins and cash generation – though it should be noted that they were starting from a low base: the operating margin was under 1.5% and net debt was growing at $5m a year as the company struggled for cashflow FY Mar 2023. It’s taken a couple of years for the benefits of that Transformation Plan to come through, but this looks like it could be an interesting turnaround situation.

Performance against targets: Around the time of the capital raising management announced medium term financial targets in its 2026 financial year. These included: i) revenue to grow to c. £180m (net of selling non core businesses) v $190m forecast FY Mar 2026F rising to $199m FY Mar 2027F. NB the revenue target was announced in pounds, but the group changed both its reporting currency to dollars and year-end. FY Mar 2027F is likely the most appropriate 12M. ii) Gross margins of c.40% versus 36% reported FY Mar 2025 at the end of June. Iii) Underlying EBIT margins >10% versus 5% forecast FY Mar 2027F.

These targets were updated in June this year, with management now suggesting 3-5% revenue growth, gross margin of 45% and EBITDA margin of 15% in the medium term.

So it looks like management won’t achieve their original revenue and EBIT margin targets in that timeframe, but perhaps that doesn’t matter if i) the share price was so heavily sold off at the start of the year, ii) they will continue to improve over the next 3-5 years.

ShareScope’s quality indicators show that historic performance has been poor, management claim they are a “world leader” in industrial LEDs, yet this hasn’t resulted in “world leading” returns.

A horse that can count to 10 is numerate, maybe even “world leading” compared to other horses, but that horse can’t claim to be a “world leading” mathematician.

A horse that can count to 10 is numerate, maybe even “world leading” compared to other horses, but that horse can’t claim to be a “world leading” mathematician.

Valuation: The shares are trading on on 50x PER Mar 2026F, dropping to 26x the following year. On an EV/EBITDA that equates to 9x Mar 202F, so significant amounts of progress and margin expansion have already been anticipated by investors.

Opinion: I do like looking for turnaround situations, particularly of indebted companies with the cashflow allowing management to reduce debt. There’s good institutional ownership, Schroders (14%) and Odyssean IT (24%) who both increased their holding after the FY results came out at the end of June. So presumably management are telling a good story to institutional investors in face to face meetings. I feel like I am 3-6 months too late to this, but perhaps there will be an opportunity to buy in at a more attractive price.

Inspiration Healthcare H1 July Results

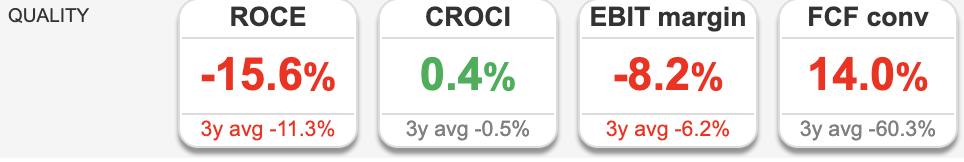

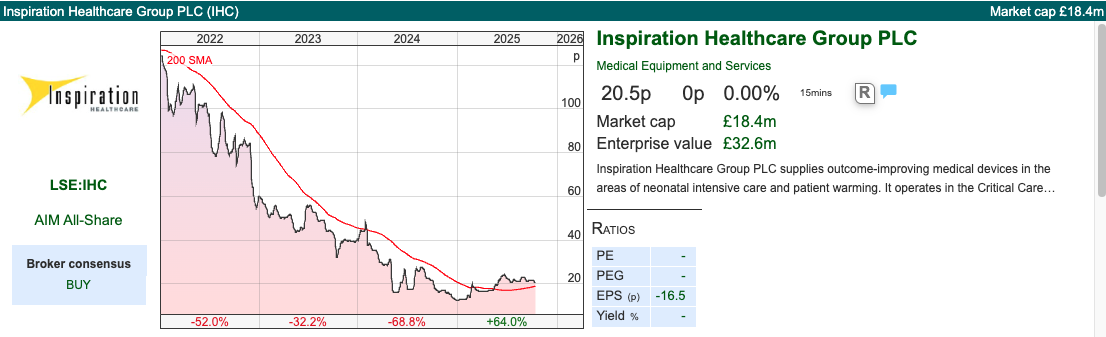

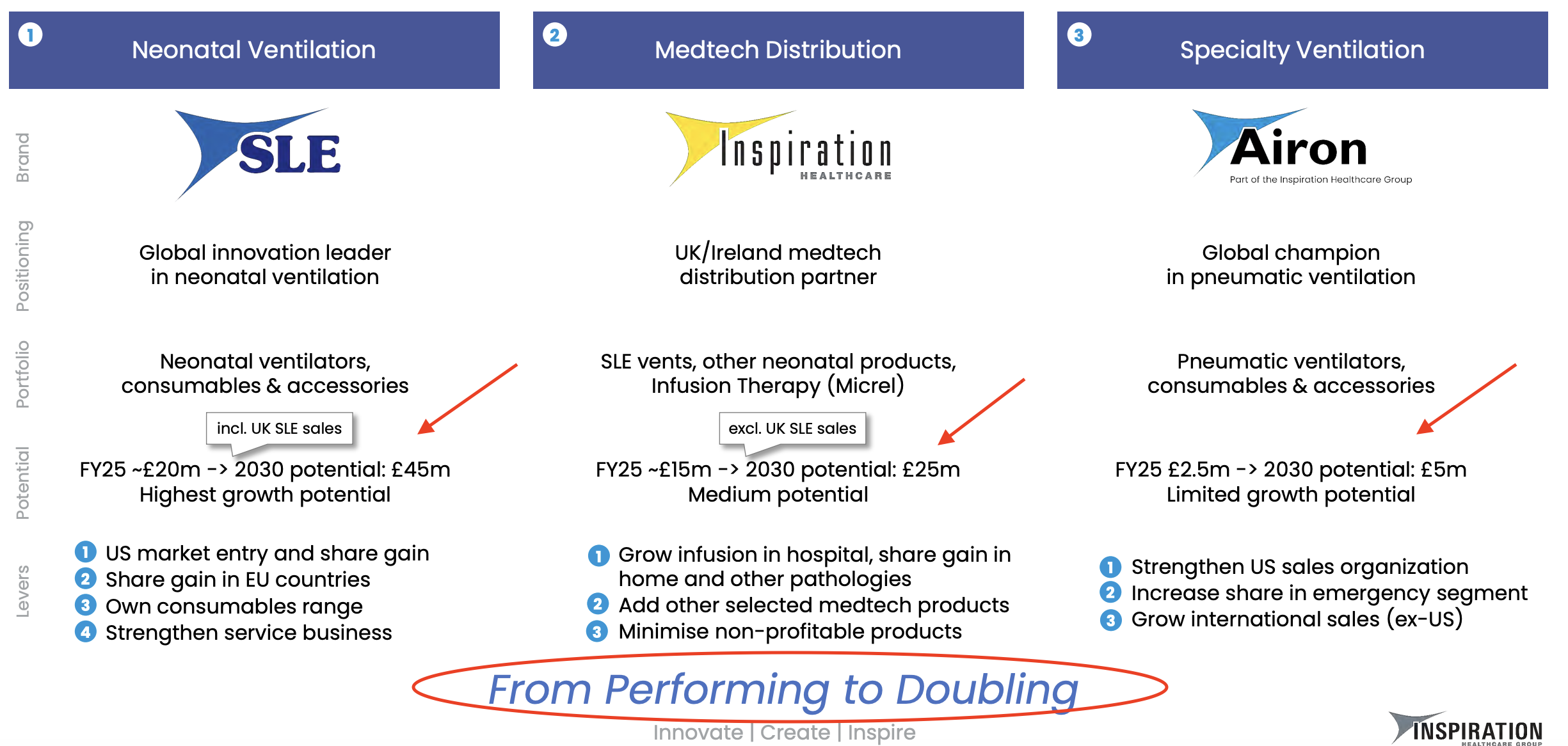

This medical technology company that designs and makes neonatal intensive care and infusion therapy devices, incubators, warmers & ventilators are around 2/3 of revenue and 1/3 infusion pumps, which deliver anaesthetic, nutrition or cancer treatments to patients. There’s also a small speciality ventilation business (Airon) that they hope to use as a bridgehead to expand into the USA.

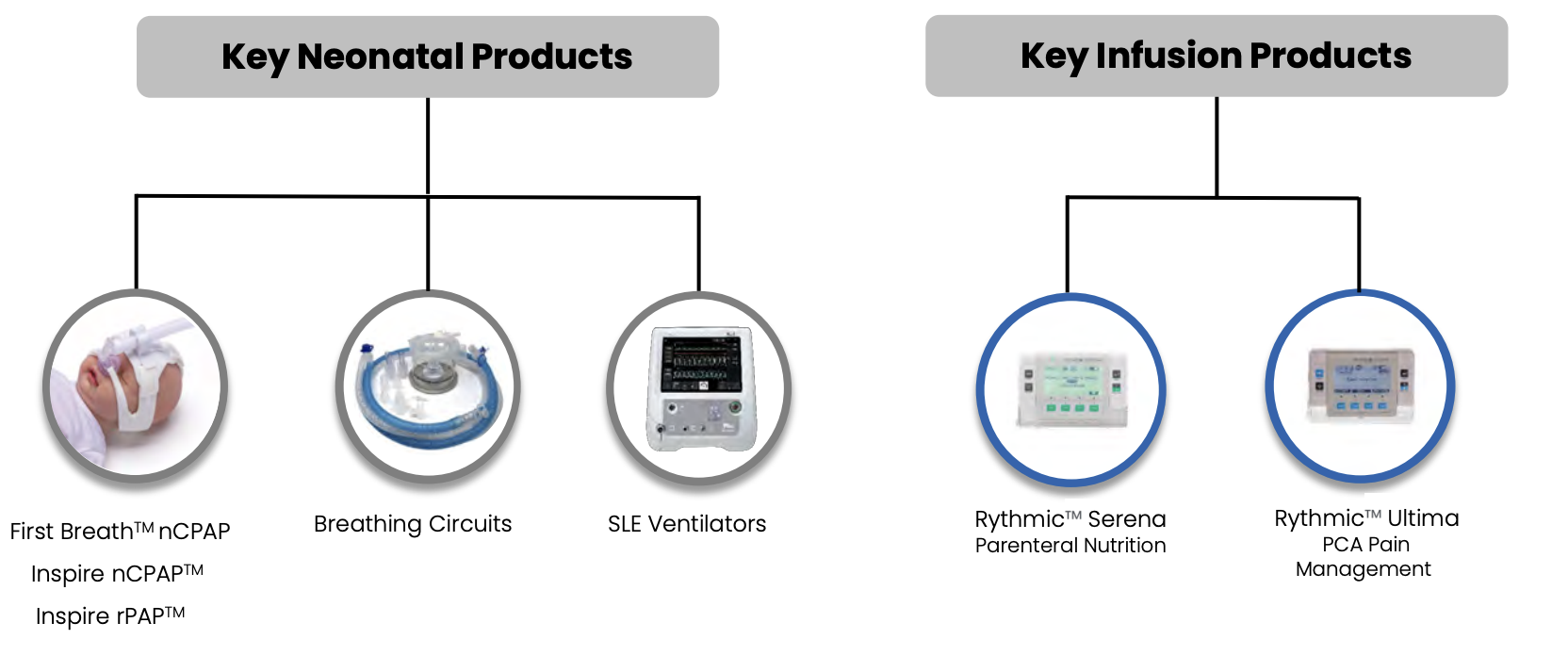

The IHC investment case was pitched at Mello as a turnaround in July last year by Paul Hill, when the share price was 17p. That was just after management had done a rescue placing at 14p per share, a discount of 43% to the then share price. The shares fell back to 13.5p on the last day of 2024, but are now up +64% YTD. That rescue placing raised £2.5m gross was caused by a difficult 2023: contract / regulatory delays, combined with inventory destocking. Revenue fell -9% FY Jan 2024 to £38m, resulting in a £6m loss that year, followed by a £16m loss FY Jan 2025. Despite those hefty losses the balance sheet doesn’t look terrible: net debt stood at £7m at the end of this July and is expected to improve further in the next 6 months, according to Paul Hill’s discussion with management.

The IHC investment case was pitched at Mello as a turnaround in July last year by Paul Hill, when the share price was 17p. That was just after management had done a rescue placing at 14p per share, a discount of 43% to the then share price. The shares fell back to 13.5p on the last day of 2024, but are now up +64% YTD. That rescue placing raised £2.5m gross was caused by a difficult 2023: contract / regulatory delays, combined with inventory destocking. Revenue fell -9% FY Jan 2024 to £38m, resulting in a £6m loss that year, followed by a £16m loss FY Jan 2025. Despite those hefty losses the balance sheet doesn’t look terrible: net debt stood at £7m at the end of this July and is expected to improve further in the next 6 months, according to Paul Hill’s discussion with management.

The most recent set of results show a strong bounce, with H1 July revenues up +41% to £24m. The group was still loss making, but only by £300K in H1 and cash generated from operations was a positive £3.6m, a significant turnaround from the cash outflow of £2.3m H1 July 2024. The positive cashflow does benefit from receiving a £700K R&D tax credit, but even so, that looks like impressive progress. Aside from the tax credit, the positive cashflow comes from prior years’ inventory build, which put a strain on working capital, when their orders fell through. So they’re currently selling physical assets held on the books into cash, but not profits.

The most recent set of results show a strong bounce, with H1 July revenues up +41% to £24m. The group was still loss making, but only by £300K in H1 and cash generated from operations was a positive £3.6m, a significant turnaround from the cash outflow of £2.3m H1 July 2024. The positive cashflow does benefit from receiving a £700K R&D tax credit, but even so, that looks like impressive progress. Aside from the tax credit, the positive cashflow comes from prior years’ inventory build, which put a strain on working capital, when their orders fell through. So they’re currently selling physical assets held on the books into cash, but not profits.

Outlook: They say the second half and FY Jan 26F should benefit from a strong order backlog and pipeline which underlines confidence in meeting market expectations for the full year. Sharescope shows revenue forecasts of £44m, implying +15% growth and PBT of just over half a million pounds. Worth noting though that the forecasts show revenue declining the following year and the group falling back into losses. That seems unduly cautious if management really have turned the corner, particularly with large international orders. There’s a slide suggesting that revenue could double by 2030 in the most recent analyst presentation – which I have annotated in red.

Valuation: The group isn’t forecast to be profitable in FY Jan 2027F, but trades on 15x EV/EBITDA that year. Again, that suggests much of the turnaround has been anticipated. The upside potentially comes from further margin improvement, as the shares trade on 0.4x sales.

Opinion: I can see that this could do well if management can execute, I wonder though if they can self-fund the revenue growth? That is, net debt is reducing nicely as they sell off existing inventory, but I doubt they can pay down net debt and invest for growth at the same time. So, the could be another placing, this time on the back of a stronger recent track record of delivery. In summary, the investment case remains speculative, but IHC strikes me as an example of AIM market being put to socially beneficial uses (saving young children’s lives). Paul Hill and Paul Scott discuss the investment case on YouTube here.

Tristel FY June 2025 Results

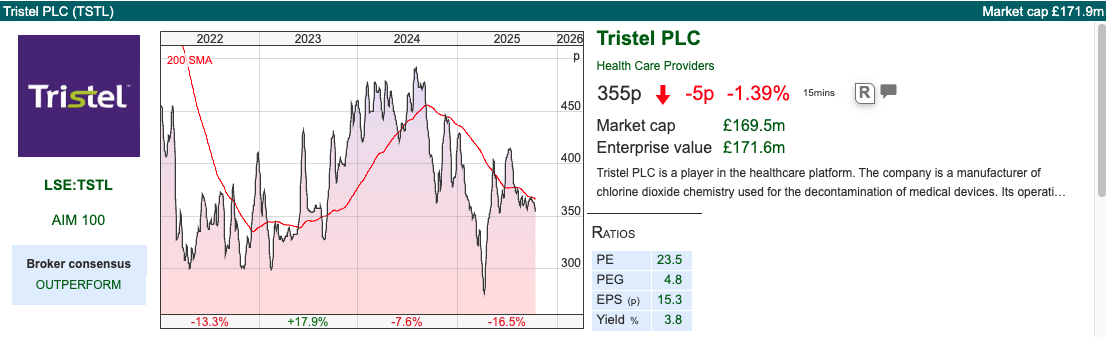

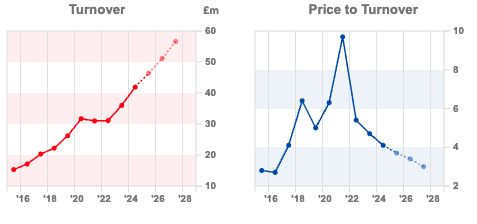

Staying with the medical sector, this chlorine dioxide to clean medical devices has tended to trade at premium valuation (PER above 30x, and between 5-10x sales) justified by hopes of expansion into the US market. That seemed to be bearing fruit, but then the shares fell by a third after Trump’s April tariff announcement. The share price recovered lost ground as the UK trade deal was announced, but remains below its 200 day moving average. There’s been a significant de-rating, I last wrote about it in mid 2023, when the share price was the same level as it is today.

Revenue was up +11% to £46.5m and reported PBT +18% to £8.4m. Net cash was £13m. Importantly the FDA cleared their High Level Disinfectant (HLD) foam for ophthalmic medical devices. 63% of revenue comes from overseas, and pleasingly this is growing at +13%, twice as fast the UK market at +6%.

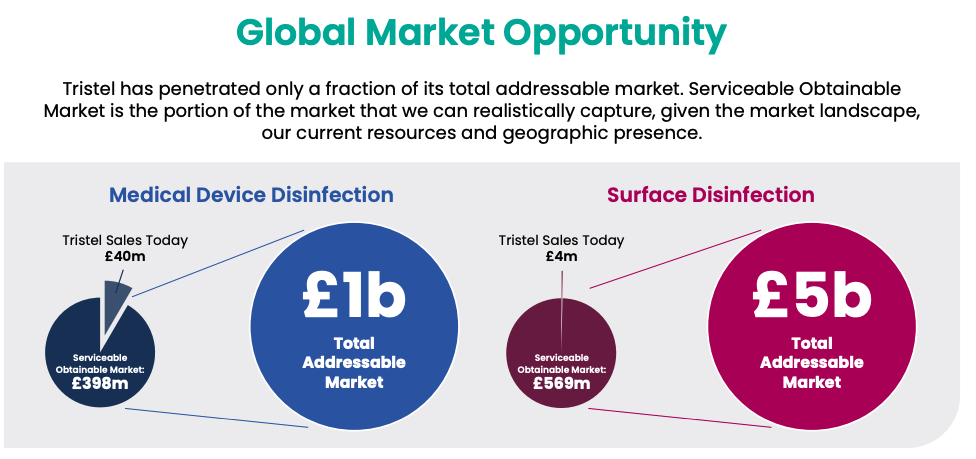

Outlook: Management suggest that growth will be driven by expansion into North America, but also improving performance in existing markets and innovations in the product portfolio. Sharescope shows +10% revenue growth FY June 2026F and 2027F, resulting in +12% and +19% EPS growth respectively. The group’s analyst presentation suggests there’s a substantial Total Addressable Market (TAM) for both medical device disinfection and surface disinfection.

Valuation: The shares are trading on a PER of 21x Jun 2026F, dropping to 17x the following year. The price to sales ratio has de-rated to 3.5x, which I think can be justified given that the gross margin is around 80% and the EBIT margin 20%.

Opinion: I like it, though don’t own any. I’m frustrated that I didn’t think of buying it when the UK trade deal was announced. A business with attractive economics and long-term growth potential ought to do well, if you can buy it at a fair price. The shares were very expensive during the pandemic (above 650p) but I can see that this could now make sense as a Growth at a Reasonable Price (GaaRP) type stock.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 15/10/2025 | DIA, IHC, TSTL | Riding the wave across the pond

There could be a bubble in more speculative areas in the US, but with the UK having suffered billions of fund manager outflows, perhaps UK stocks could now prove a safe haven. Companies covered DIA, IHC and TSTL.

The FTSE 100 fell -0.65% to 9462 over the last 5 trading days. The Nasdaq100 and S&P500 were down -0.9% and -1.3%. There was a crypto sell off at the end of last week, with Doge down -20% and Bitcoin -8%. The VIX rose by a third to above 20. That’s its highest level in 6 months and compares to a peak of 45 at start of April when Trump announced his tariffs and 65 during the early stages of the pandemic.

Many people are writing about the hundreds of billions being spent on AI capex, this substack author suggests $1.5 trillion. To give that large number some context, Amazon, Google, Meta, Microsoft, and Apple, generated $1.4 trillion in Free Cash Flow over the last 5 years. It’s not just AI in US markets. One of my programmer friends is excited about the performance of quantum computer stocks like D Wave (ticker QBTS).

See also Rigetti (RGTI) below. He told me about these companies a year ago, and I spent some time on YouTube learning about quantum computing, for instance Grover’s Algorithm. I concluded that quantum computers were mostly hype – which could be true, but the charts disagree. Can’t win them all.

Historically, whenever bubbles have burst in US markets, this has been negative for AIM. AXX’s peak-to-trough fall from the top of the internet bubble was -80% and between 2007 and 2009 AXX fell -70%. Yet, this time the bubble seems specific to quantum computers, crypto and Artificial Intelligence. AIM doesn’t have exposure to these sectors.

In addition, the chart below from Calastone, shows the exodus of funds from UK investors continued in Q3. So, we have avoided the wave of speculative excess going on the other side of the Atlantic, which makes me sanguine about the outlook for UK investors.

This week I look at a couple of turnaround situations: Dialight which does industrial lighting and medical equipment group Inspiration Healthcare. I finish with Tristel, the medical disinfectant company that looks like it might finally be able to expand into North American markets.

Dialight H1 Sept Trading Update

This industrial LED lighting company says that sales in H1 will be marginally down on H1 last year ($90m) due to tariff uncertainty. Following the cautious sounding guidance, management then go on to say in the second paragraph that their Transformation Plan is going well and they now expect to “significantly exceed the market expectation for Adjusted Operating Profit for the year ending 31 March 2026.” Net debt has fallen from $18m over the last six months to $10m at the end of September, helped by a couple of Covid related tax credits (but not included in the FY Mar 2026F guidance above).

The shares are up 2.3x since the start of June, though I can’t see any RNS that triggered that prior to the FY Mar 2025 results which came out on the 24th of June. These were taken positively but the share price had already risen by +35% before that end of June announcement. Just something to be aware of, if you are going to buy into the story.

History: The shares have been listed on AIM since the mid-1990s, and the share price was above £10 per share in 2017. Then the company started reporting “short-term production challenges”, those “short-term” challenges resulted in the share price falling -90% over the next 7-8 years, to trough at 94p at the start of this year.

As a reminder, when management teams warn on profits, they will almost always try to convince investors that the problems are temporary and easily fixable. It’s worth being sceptical, but on the other side of the coin, if you avoid all companies where management have been too optimistic in their voluntary disclosure, then you can miss the turning point. Made Tech (which I missed for this reason) strikes me as a recent example.

In response to their deteriorating performance, Dialight announced a Transformation Plan, cutting costs, improving productivity and accelerating growth. As part of this plan, management raised £10m at 189p in September 2023 to pay down debt and invest in the business. For example, improving support for the sales team, streamlining operational processes and optimising production capabilities. From a financial perspective they expected to improve margins and cash generation – though it should be noted that they were starting from a low base: the operating margin was under 1.5% and net debt was growing at $5m a year as the company struggled for cashflow FY Mar 2023. It’s taken a couple of years for the benefits of that Transformation Plan to come through, but this looks like it could be an interesting turnaround situation.

Performance against targets: Around the time of the capital raising management announced medium term financial targets in its 2026 financial year. These included: i) revenue to grow to c. £180m (net of selling non core businesses) v $190m forecast FY Mar 2026F rising to $199m FY Mar 2027F. NB the revenue target was announced in pounds, but the group changed both its reporting currency to dollars and year-end. FY Mar 2027F is likely the most appropriate 12M. ii) Gross margins of c.40% versus 36% reported FY Mar 2025 at the end of June. Iii) Underlying EBIT margins >10% versus 5% forecast FY Mar 2027F.

These targets were updated in June this year, with management now suggesting 3-5% revenue growth, gross margin of 45% and EBITDA margin of 15% in the medium term.

So it looks like management won’t achieve their original revenue and EBIT margin targets in that timeframe, but perhaps that doesn’t matter if i) the share price was so heavily sold off at the start of the year, ii) they will continue to improve over the next 3-5 years.

ShareScope’s quality indicators show that historic performance has been poor, management claim they are a “world leader” in industrial LEDs, yet this hasn’t resulted in “world leading” returns.

Valuation: The shares are trading on on 50x PER Mar 2026F, dropping to 26x the following year. On an EV/EBITDA that equates to 9x Mar 202F, so significant amounts of progress and margin expansion have already been anticipated by investors.

Opinion: I do like looking for turnaround situations, particularly of indebted companies with the cashflow allowing management to reduce debt. There’s good institutional ownership, Schroders (14%) and Odyssean IT (24%) who both increased their holding after the FY results came out at the end of June. So presumably management are telling a good story to institutional investors in face to face meetings. I feel like I am 3-6 months too late to this, but perhaps there will be an opportunity to buy in at a more attractive price.

Inspiration Healthcare H1 July Results

This medical technology company that designs and makes neonatal intensive care and infusion therapy devices, incubators, warmers & ventilators are around 2/3 of revenue and 1/3 infusion pumps, which deliver anaesthetic, nutrition or cancer treatments to patients. There’s also a small speciality ventilation business (Airon) that they hope to use as a bridgehead to expand into the USA.

Outlook: They say the second half and FY Jan 26F should benefit from a strong order backlog and pipeline which underlines confidence in meeting market expectations for the full year. Sharescope shows revenue forecasts of £44m, implying +15% growth and PBT of just over half a million pounds. Worth noting though that the forecasts show revenue declining the following year and the group falling back into losses. That seems unduly cautious if management really have turned the corner, particularly with large international orders. There’s a slide suggesting that revenue could double by 2030 in the most recent analyst presentation – which I have annotated in red.

Valuation: The group isn’t forecast to be profitable in FY Jan 2027F, but trades on 15x EV/EBITDA that year. Again, that suggests much of the turnaround has been anticipated. The upside potentially comes from further margin improvement, as the shares trade on 0.4x sales.

Opinion: I can see that this could do well if management can execute, I wonder though if they can self-fund the revenue growth? That is, net debt is reducing nicely as they sell off existing inventory, but I doubt they can pay down net debt and invest for growth at the same time. So, the could be another placing, this time on the back of a stronger recent track record of delivery. In summary, the investment case remains speculative, but IHC strikes me as an example of AIM market being put to socially beneficial uses (saving young children’s lives). Paul Hill and Paul Scott discuss the investment case on YouTube here.

Tristel FY June 2025 Results

Staying with the medical sector, this chlorine dioxide to clean medical devices has tended to trade at premium valuation (PER above 30x, and between 5-10x sales) justified by hopes of expansion into the US market. That seemed to be bearing fruit, but then the shares fell by a third after Trump’s April tariff announcement. The share price recovered lost ground as the UK trade deal was announced, but remains below its 200 day moving average. There’s been a significant de-rating, I last wrote about it in mid 2023, when the share price was the same level as it is today.

Revenue was up +11% to £46.5m and reported PBT +18% to £8.4m. Net cash was £13m. Importantly the FDA cleared their High Level Disinfectant (HLD) foam for ophthalmic medical devices. 63% of revenue comes from overseas, and pleasingly this is growing at +13%, twice as fast the UK market at +6%.

Outlook: Management suggest that growth will be driven by expansion into North America, but also improving performance in existing markets and innovations in the product portfolio. Sharescope shows +10% revenue growth FY June 2026F and 2027F, resulting in +12% and +19% EPS growth respectively. The group’s analyst presentation suggests there’s a substantial Total Addressable Market (TAM) for both medical device disinfection and surface disinfection.

Valuation: The shares are trading on a PER of 21x Jun 2026F, dropping to 17x the following year. The price to sales ratio has de-rated to 3.5x, which I think can be justified given that the gross margin is around 80% and the EBIT margin 20%.

Opinion: I like it, though don’t own any. I’m frustrated that I didn’t think of buying it when the UK trade deal was announced. A business with attractive economics and long-term growth potential ought to do well, if you can buy it at a fair price. The shares were very expensive during the pandemic (above 650p) but I can see that this could now make sense as a Growth at a Reasonable Price (GaaRP) type stock.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.