Richard collects all the shares that have passed his 5 Strikes system so far this year, a total of 81 businesses with good financial track records.

Six shares have made it past the minimum quality filter since I last updated you, but only two join the 79 shares that had already passed 5 strikes since the beginning of the year.

5 Strikes

There is too much to worry about in the financial track records of the first four shares in my table:

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| DFS Furniture | DFS | 25/9/25 | – Holdings – Growth – Debt | 3 |

| PZ Cussons | PZC | 25/9/25 | – Holdings – Growth – Debt – ROCE | 4 |

| Redcentric | RCN | 25/9/25 | ? Acquisitions ? CROCI – Debt – Growth – ROCE | 4 |

| Alumasc | ALU | 23/9/25 | – CROCI – Debt – Growth | 3 |

| Ashmore | ASHM | 18/9/25 | – Growth | 1 |

| City of London Investment | CLIG | 16/9/25 | ? Holdings – Growth – Shares | 2 |

| Click here for our 5 Strikes explainer | 01/10/2025 | |||

The last two shares, Ashmore (- Growth) and City of London Investment (? Holdings – Growth – Shares) are specialist fund managers. Ashmore specialises in emerging markets, and City of London Investment in investment trusts.

Although they achieved less than three strikes, these are not businesses I can bring myself to invest in.

Ultimately, I imagine the performance of asset managers depends on their ability to encourage investors to buy their funds, which is ultimately driven by the performance of those funds.

As I explained when the same two shares passed 5 Strikes last year, it is hard to determine whether a fund manager’s success or failure is due to skill or luck, and whether it is temporary or sustainable.

To my mind, shares in fund managers are not for buy and hold investors. They are for traders. You buy them when investors are buying the underlying funds, which generates more fees for the manager, and you sell shares in fund management companies when investors are selling the funds, and fee income is falling.

Ashmore: A lot of ups and downs, but the share price is below what it was in 2006

With no new ideas coming across my desk, it is a good point in time to take stock. Maybe there are good ideas that escaped my notice earlier in the year, when the flow was greater.

All the 0s

Twelve companies have passed the minimum quality filter and achieved no strikes since the beginning of the year. Since these shares have no obvious blemishes in their financial track records, they are likely to be good businesses and easy to investigate. Not surprisingly I have focused on them.

Six of are in the model Share Sleuth portfolio I run for interactive investor (indicated by the ii link) and consequently I have written them up in full. I have considered five others here on ShareScope (also linked).

| Name | TIDM | Prev AR | Strikes | # Strikes | Mentions |

|---|---|---|---|---|---|

| 4imprint | FOUR | 15/4/25 | ? Holdings | 0 | ii |

| Alpha International | ALPH | 17/4/25 | ? Shares | 0 | Beyond my ken |

| Auto Trader | AUTO | 27/6/25 | 0 | ii | |

| Bloomsbury Publishing | BMY | 13/6/25 | 0 | ii | |

| Cohort | CHRT | 20/8/25 | ? Acquisitions | 0 | Acquisition spend, ii, Median pay |

| Computacenter | CCC | 9/4/25 | 0 | ||

| Cranswick | CWK | 27/6/25 | 0 | Animal welfare | |

| Morgan Sindall | MGNS | 24/3/25 | 0 | Complexity as a virtue | |

| Nichols | NICL | 24/3/25 | 0 | Sweet is not good | |

| Porvair | PRV | 14/3/25 | ? Holdings | 0 | ii |

| Quartix | QTX | 3/3/25 | ? ROCE | 0 | ii |

| Warpaint London | W7L | 20/5/25 | – Shares | 0 | Big acquisition |

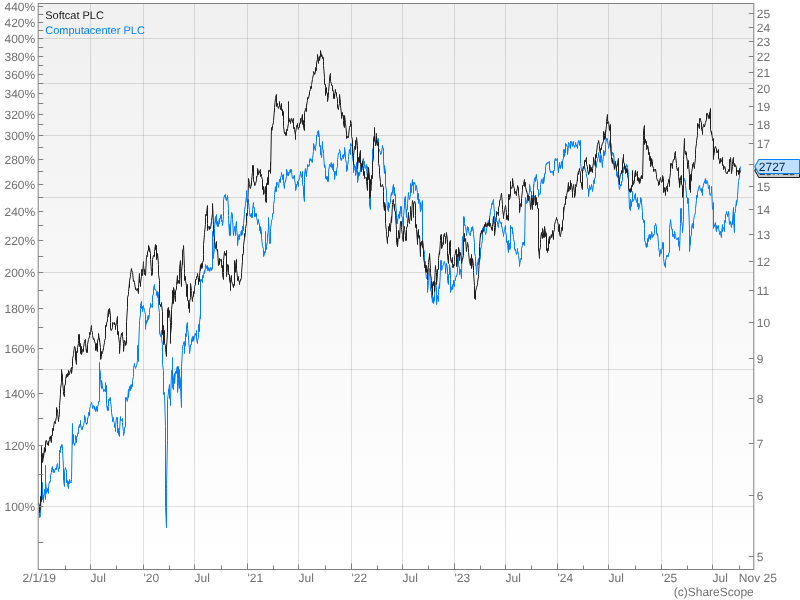

The obvious omission is Computacenter, which is an IT reseller. Back in 2018, I thought it might be a good business that was getting better, but my head was turned by Softcat, another IT reseller.

Perhaps it is time to update that analysis. Judging by their share price performance since then, the stock market hasn’t been able to pick a clear winner:

All the 1s

Thirty shares have achieved only one strike since 2025. There are a lot more holes in this table, but I am prejudiced against filling some of them for reasons not evident in the companies’ mostly good financial track records. Some of these reasons may seem whimsical, but I know they would temper my enthusiasm to research and hold the shares, and consequently stay invested for the long-term.

For example Barr (Irn Bru) sells sweet drinks, which I came out against when I looked at Nichols (Vimto). Clarkson, the shipping business, is complex and I do not want to butt heads with it. There are too few shares in public hands to pique an interest in London Security, which makes fire extinguishers. Under its Quixant brand, Nexteq makes gambling and betting terminals, which is not a market I approve of.

Fear keeps me from investigating FDM. It recruits, trains and contracts out entry-level software developers. These jobs, we are told, are most at threat from artificial intelligence. FDM’s last annual report says almost nothing about artificial intelligence. As a shareholder, I would need more reassurance, so I am not inclined to become one.

| Name | TIDM | Prev AR | Strikes | # Strikes | Mentions |

|---|---|---|---|---|---|

| Arcontech | ARC | 11/9/25 | – Growth | 1 | Too small |

| Ashmore | ASHM | 18/9/25 | – Growth | 1 | See above |

| Barr (AG) | BAG | 28/4/25 | ? Growth | 1 | |

| Clarkson | CKN | 2/4/25 | ? ROCE | 1 | |

| Colefax | CFX | 4/8/25 | ? CROCI ? Growth | 1 | Buy backs |

| Dunelm | DNLM | 11/9/25 | – Debt | 1 | |

| Eleco | ELCO | 12/5/25 | – Holdings ? Growth | 1 | Building lifecycle software |

| FDM | FDM | 8/4/25 | – Growth | 1 | |

| Fevertree Drinks | FEVR | 24/4/25 | – CROCI | 1 | Costly diversification |

| Games Workshop | GAW | 29/7/25 | – Holdings | 1 | ii |

| Gamma Communications | GAMA | 24/3/25 | – Holdings | 1 | |

| Halma | HLMA | 20/6/25 | – Holdings | 1 | |

| Hill & Smith | HILS | 11/4/25 | ? Holdings ? Acquisitions | 1 | |

| Howden Joinery | HWDN | 18/3/25 | – Holdings | 1 | ii |

| Inchcape | INCH | 25/3/25 | ? Debt ? Growth | 1 | |

| Kainos | KNOS | 25/7/25 | – Growth | 1 | People v AI |

| Latham (James) | LTHM | 24/7/25 | – CROCI ? Growth | 1 | ii |

| London Security | LSC | 16/5/25 | – Holdings | 1 | |

| M Winkworth | WINK | 1/5/25 | – Growth | 1 | Profitable and debt free |

| Me International | MEGP | 24/2/25 | – Growth | 1 | |

| Mony | MONY | 3/3/25 | – Holdings ? Growth | 1 | |

| Mortgage Advice Bureau | MAB1 | 4/4/25 | – Shares | 1 | Platform biz |

| Nexteq | NXQ | 19/3/25 | – CROCI | 1 | |

| Oxford Instruments | OXIG | 25/6/25 | – Holdings ? Growth | 1 | ii |

| Pets at Home | PETS | 18/6/25 | – Holdings | 1 | Everything store |

| Polar Capital | POLR | 7/7/25 | – Growth | 1 | |

| Ramsdens | RFX | 14/1/25 | – CROCI | 1 | |

| Rightmove | RMV | 28/3/25 | – Holdings | 1 | |

| Science | SAG | 15/4/25 | – Growth | 1 | Anything goes |

| Tatton Asset Management | TAM | 10/6/25 | – IPO | 1 |

That still leaves plenty of scope for investigation, before we even move on to the 2s…

All the 2s

Thirty nine companies have achieved two strikes since the beginning of the year, and I am sure there are many good prospects here too:

| Name | TIDM | Prev AR | Strikes | # Strikes | Mentions |

|---|---|---|---|---|---|

| Alfa Financial Software | ALFA | 1/4/25 | – Growth – Float date | 2 | |

| Andrews Sykes | ASY | 15/5/25 | – Holdings – Growth | 2 | |

| Anpario | ANP | 19/5/25 | ? CROCI – Growth ? ROCE | 2 | ii |

| Aptitude Software | APTD | 26/3/25 | ? Holdings – Growth ? Shares | 2 | |

| BAE Systems | BA. | 3/3/25 | – Holdings ? Growth | 2 | |

| Berkeley | BKG | 4/8/25 | ? CROCI – Growth | 2 | Brownfield builder |

| Billington | BILN | 23/4/25 | ? Holdings – CROCI ? Growth | 2 | |

| Bunzl | BNZL | 20/3/25 | ? Holdings – Debt ? Growth | 2 | ii |

| Card Factory | CARD | 19/5/25 | – Holdings – Debt | 2 | Celebrations destination |

| Churchill China | CHH | 9/5/25 | – CROCI – Growth | 2 | ii |

| City of London Investment | CLIG | 16/9/25 | ? Holdings – Growth – Shares | 2 | |

| Domino’s Pizza | DOM | 24/3/25 | ? Holdings – Debt ? Growth | 2 | |

| GlobalData | DATA | 2/4/25 | ? Acquisitions ? ROCE – Shares | 2 | |

| Goodwin | GDWN | 14/8/25 | – CROCI – Growth | 2 | ii |

| Greggs | GRG | 16/4/25 | – Holdings – Debt | 2 | Question of growth |

| GSK | GSK | 3/3/25 | ? Holdings – Debt ? ROCE | 2 | |

| Hikma Pharmaceuticals | HIK | 19/3/25 | – Debt ? Growth – Shares | 2 | |

| IG | IGG | 12/8/25 | – Holdings – Growth | 2 | |

| IMI | IMI | 28/3/25 | – Debt – Growth | 2 | |

| InterContinental Hotels | IHG | 27/2/25 | – Holdings – Debt | 2 | |

| Intertek | ITRK | 21/3/25 | ? Holdings – Debt ? Growth | 2 | |

| ITV | ITV | 27/3/25 | ? Holdings – Debt – Growth | 2 | |

| Jet2 | JET2 | 4/8/25 | – Holdings – CROCI | 2 | ii |

| Johnson Service | JSG | 21/3/25 | – Holdings – Debt | 2 | |

| Luceco | LUCE | 26/3/25 | ? Acquisitions ? CROCI – Debt ? Growth | 2 | |

| Macfarlane | MACF | 11/4/25 | ? Holdings – Growth – Shares | 2 | ii |

| MS International | MSI | 15/7/25 | – CROCI – ROCE | 2 | |

| Next | NXT | 9/4/25 | – Debt ? Growth | 2 | |

| PageGroup | PAGE | 14/4/25 | – Holdings – Growth | 2 | |

| PHSC | PHSC | 21/8/25 | – Growth – ROCE | 2 | Small and contracting |

| QinetiQ | QQ. | 11/6/25 | ? Holdings ? Acquisitions – ROCE | 2 | Big adjustments |

| Record | REC | 20/6/25 | – Holdings – Growth | 2 | |

| RELX | REL | 20/2/25 | – Holdings – Debt | 2 | |

| Rotork | ROR | 26/3/25 | – Holdings – Growth | 2 | |

| Spirax | SPX | 8/4/25 | – Holdings – Debt ? Growth | 2 | Green dream |

| Spirent Communications | SPT | 15/5/25 | ? Holdings – Growth – ROCE | 2 | |

| SThree | STEM | 4/3/25 | – Holdings – Growth | 2 | |

| Unilever | ULVR | 14/3/25 | – Debt – Growth | 2 | |

| XPS Pensions | XPS | 10/7/25 | – Holdings – Debt | 2 |

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, web: beddard.net

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Useful. Thanks