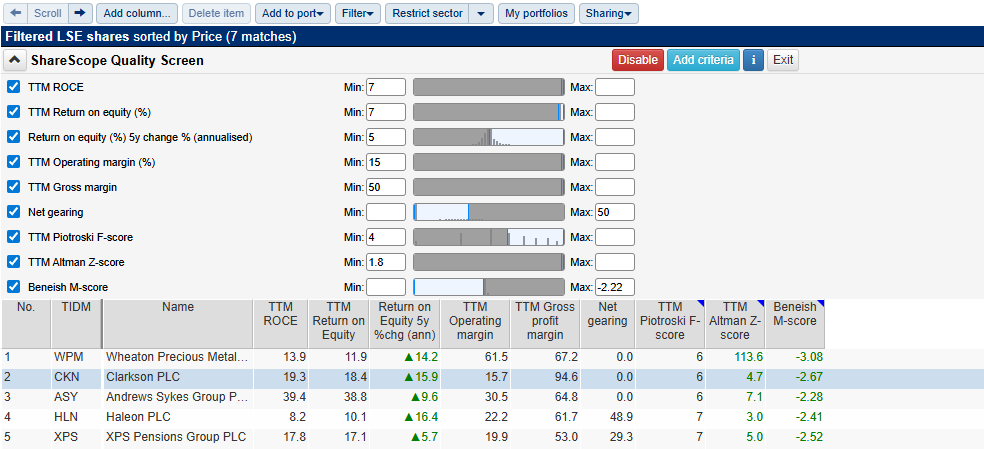

Looking to find financially sound businesses with ShareScope? We’ve created this Quality Stock Screening Guide to go with our off-the-shelf Quality Screen to help you learn how to spot them. It’s designed to highlight the key signals we believe matter when searching for companies built on strong foundations.

ShareScope subscribers can apply this screen at the click of a button on the home page in ShareScope – click on the “house” icon near top left of the program and then scroll down the home page to the Popular Stock Screen section.

Use it as a starting point: explore the logic, dig into the data, and then make the screen your own.

What Is a Quality Stock?

A quality stock belongs to a company with robust profitability, operational efficiency, and low financial risk. These businesses tend to be well-managed, financially stable, and capable of weathering economic cycles—making them ideal for investors focused on resilience and long-term value.

Why we choose these criteria

1. Profitability Metrics

- Trailing 12-Month ROCE ≥ 7%

Return on capital employed (ROCE) measures how efficiently a company generates profits from its capital. A value of 7% or higher suggests healthy returns and resourceful management.

Jargon Lite Version: The company earns at least £7 a year for every £100 invested in the business.

- Trailing 12-Month Return on Equity (v) ≥ 7%

ROE assesses how well shareholder equity is being used to generate earnings. Strong ROE is a hallmark of capital-efficient companies.

Jargon Lite Version: The company grows shareholder money by at least 7% a year.

- 5-Year Annualised ROE Change ≥ 5%

This tracks whether a company is improving its return on equity over time. It highlights sustained improvement rather than one-off strong results.

Jargon Lite Version: The business is getting better at generating returns year after year.

2. Operational Strength

- Trailing 12-Month Operating Margin ≥ 15%

A strong operating margin means the company keeps a good chunk of its revenue after covering operating expenses—a sign of pricing power and cost control.

Jargon Lite Version: The company keeps at least 15p of every £1 in revenue after operating costs.

- Trailing 12-Month Gross Margin ≥ 50%

High gross margins reflect strong core product profitability. This often suggests a competitive advantage or brand strength.

Jargon Lite Version: This means the company makes at least 50% more money on its products than it paid for them.

3. Financial Stability

- Net Gearing ≤ 50%

Gearing measures the level of a company’s debt relative to its equity. Keeping this below 50% limits exposure to financial strain and interest rate risk.

Jargon Lite Version: Less than half the business is financed with borrowing, reducing risk in tough times.

4. Quality Score Checks

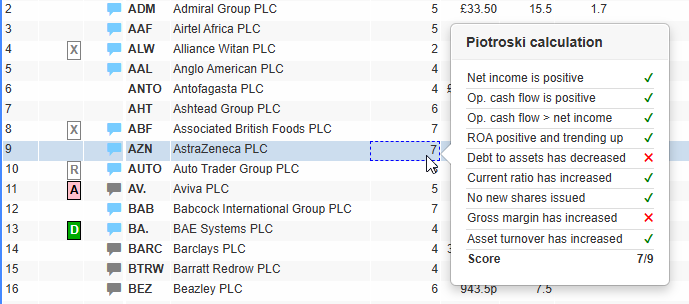

- Piotroski F-Score ≥ 4

This score combines nine financial criteria to evaluate a company’s fundamental strength. A score of 4 or more indicates the company has passed 4 or more of the criteria and typically indicates acceptable financial health.

Jargon Lite Version: An F-Score of at least 4 suggests a blend of profitability, efficiency, and low risk. The higher the score the more financially healthy a company is deemed to be.

- Altman Z-Score ≥ 1.8

Based on five financial ratios the Altman Z-Score is a formula used to assess a company’s likelihood of financial distress or bankruptcy. A higher Z-Score suggests a company is in a stronger financial position and less likely to default. This is used to predict bankruptcy risk, a score above 1.8 implies a low likelihood of financial distress. Scores above 2.99 indicates a company is in the “safe zone” and highly unlikely to go bankrupt.

Jargon Lite Version: A score above 1.8 means the company is unlikely to face financial distress.

- Beneish M-Score ≤ -2.22

This forensic accounting measure helps detect earnings manipulation using 8 financial ratios. Scores below -2.22 are considered safe and trustworthy.

Jargon Lite Version: Lower scores mean cleaner, more trustworthy financials.

Who Is This For?

This screen is ideal for:

- Long-term investors seeking reliable companies

- Risk-averse portfolios

- Those interested in “buy and hold” investing strategies

Make It Your Own

This screen provides a foundation for identifying top-tier businesses. You can customise it to suit your goals:

- Focus on sectors known for quality like healthcare or consumer staples

- Add valuation metrics to filter overpriced stocks

- Tighten thresholds to zero in on only the very best performers

Learn More About Quality Investing

Want to explore the art of picking high-calibre companies? Turn to Chapter 8 of our Step-by-Step Guide to Investing, where we dive into financial ratios, balance sheet strength, and how to spot red flags.

Read Chapter 8: Is this a good business?

We’d love to hear your take. Do these criteria reflect how you think about quality? What would you tweak or add? Maybe you’ve created your own quality screen that works well. Share your thoughts in the comments – whether it’s feedback, suggestions, or your own strategies.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before making any investment decisions or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Excellent explanation of why each metric would be used and of the investment strategy the screen is meant to help.

More articles along these lines would be very welcome and a useful supplement to the books by Phil Oakley and Algy Hall.