Bruce takes a look back to the 1980’s, for inspiration on how to fix London’s broken IPO market. Companies covered: NFG’s disclosure around its Mach49 acquisition, and transport software group TRCS.

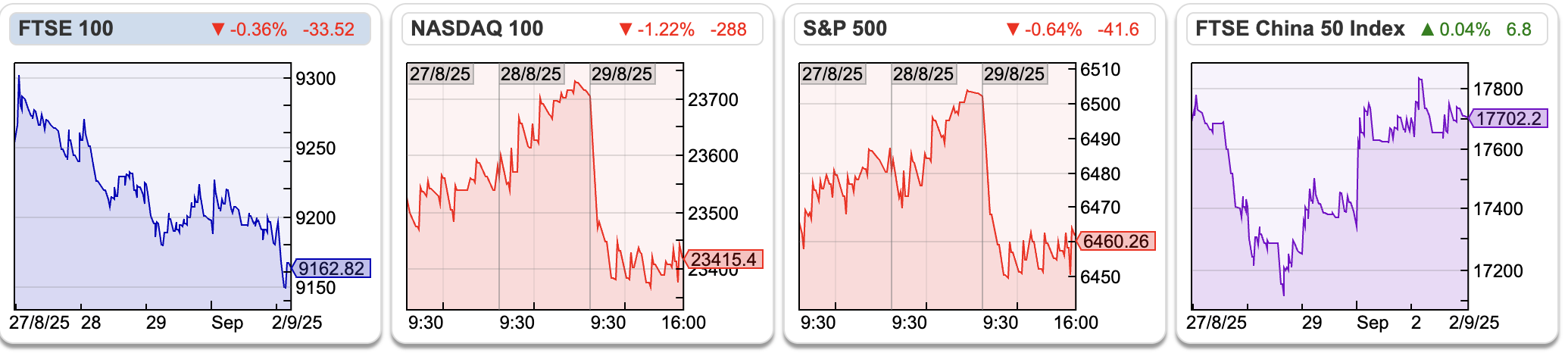

The FTSE 100 fell -1% to 9,162 over the last 5 trading days, driven by banks (NatWest down -8%, Lloyds -5%) as a think tank: the Institute for Public Policy Research (IPPR), published a report suggesting a windfall tax ‘QE reserves income levy’ on commercial banks. The UK banks have been a terrible sector for shareholders over the last two decades. QE was not a subsidy that benefited investors in UK banks, but helped support borrowers by keeping interest rates too low. So, if the government needs to raise taxes, BTL landlords would be a more obvious place to start, in my view.

The FTSE 100 fell -1% to 9,162 over the last 5 trading days, driven by banks (NatWest down -8%, Lloyds -5%) as a think tank: the Institute for Public Policy Research (IPPR), published a report suggesting a windfall tax ‘QE reserves income levy’ on commercial banks. The UK banks have been a terrible sector for shareholders over the last two decades. QE was not a subsidy that benefited investors in UK banks, but helped support borrowers by keeping interest rates too low. So, if the government needs to raise taxes, BTL landlords would be a more obvious place to start, in my view.

There have been several newspaper articles suggesting that the IPO market is seeing signs of life. In H1 we’ve seen recent IPOs MHA and One Health both rise by a third since their listing. Well done to anyone who backed them.

Historically, in the 1980’s IPOs were priced attractively, to encourage individual investors and fund managers to take part. If the government was the selling shareholder (for instance British Gas, British Telecom and BP) success was not maximum price on the sale, but instead a steadily rising share price after listing. It goes without saying that this resulted in a warm feeling among voters who had subscribed to the new issue. However, this was also true IPO’s from entrepreneurs, who liked the public validation of a rising share price in their company. Often investors would subscribe to IPO’s, but have their allocation scaled back to allow more people to benefit.

The process gradually changed, as it is not really Wall Street or The City’s style to give away “free money” to small investors. Instead, corporate financiers like Frank Quattrone, the former Credit Suisse technology investment banker, allocated hot IPO’s to favoured clients and contacts at tech firms, in exchange for future business. Quattrone, faced trial for forwarding an email that encouraged colleagues to “clean up those emails”, which prosecutors argued was tantamount to destroying evidence when he knew that SEC were investigating CSFB. Quattrone was found guilty and faced 25 years in prison but avoided that fate on appeal; he then went on to found a new firm which advised Mike Lynch on how to sell Autonomy to Hewlett Packard.

The process gradually changed, as it is not really Wall Street or The City’s style to give away “free money” to small investors. Instead, corporate financiers like Frank Quattrone, the former Credit Suisse technology investment banker, allocated hot IPO’s to favoured clients and contacts at tech firms, in exchange for future business. Quattrone, faced trial for forwarding an email that encouraged colleagues to “clean up those emails”, which prosecutors argued was tantamount to destroying evidence when he knew that SEC were investigating CSFB. Quattrone was found guilty and faced 25 years in prison but avoided that fate on appeal; he then went on to found a new firm which advised Mike Lynch on how to sell Autonomy to Hewlett Packard.

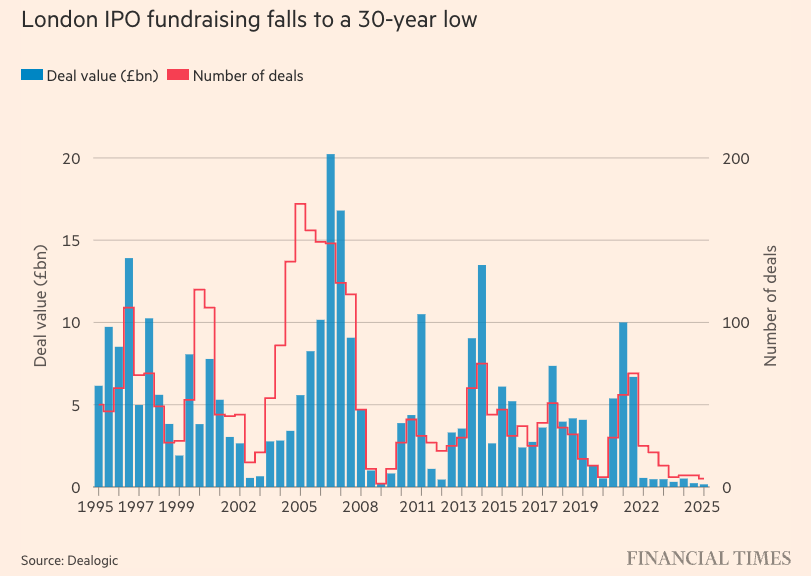

Hat Tip to Michael Taylor for this FT chart in his weekly email.

As the financial regulators looked closely at the IPO process, it became more common for institutional investors to invest pre-IPO and companies delay listing on public markets. For instance, Wellington and Fidelity were early investors in Metro Bank, which fell 95% from its IPO price. Neil Woodford’s fund was invested so heavily in unlisted shares, it blew up his fund. Unlisted payments business Stripe is valued just below $100bn and banking app Revolut $65bn, Databricks over $100bn and (of course) OpenAI and SpaceX each valued at over $400bn. None of these businesses have tested their valuation by floating on the public markets. This is unhealthy in all sorts of ways.

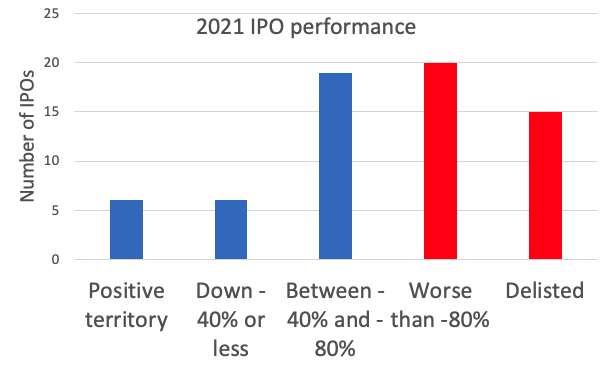

Whether you think that the responsibility goes to corporate financier or professional fund managers, the AIM 2021 vintage of IPO’s has been a disaster. There were 66 IPO’s on AIM in 2021, raising over £3.2 billion, the most active year for AIM IPOs since 2014 (75 IPOs). These included Life Science REIT (£350m) down -62%, Revolution Beauty (£300m) down -88% and Victorian Plumbing (£298m) down -79%. Using ShareScope’s filter function, I’ve shown the entire 2021 vintage below in histogram form.

Just 6 companies are now in positive territory, with a further 6 down 40% or less. 19 stocks were down between 40% and 80%, but 20 have seen a worse than 80% fall and 15 now have de-listed. Or, put another way, of the 66 IPO’s in 2021, just over half (35) have declined over -80% or de-listed entirely.

The model described above is broken, particularly as UK active fund managers have seen 3 consecutive years of outflows. I’d like to see a return to the 1980’s, when Bon Jovi were topping the charts and IPOs priced to attract money from individual investors. We should give it a shot. If it worked in the 1980s, why would it not function now?

There are a couple of interesting conferences in November in London. I’ll be attending the MoneyWeek Wealth Summit, Friday, 7th November 2025. Mello is a week and a half later: Tuesday 18th & Wednesday 19th November 2025. It’s great to mix with like-minded investors and discuss ideas, as well as the companies presenting.

This week I look at what has gone wrong at marketing & management consultancy company Next 15 Communications and a possible turnaround at Tracis.

Next 15 Closing down Mach49

Often I write “this is an acquisitive people business so I’d be reluctant pay a high multiple for the shares” – the analysis below explains that comment in more depth.

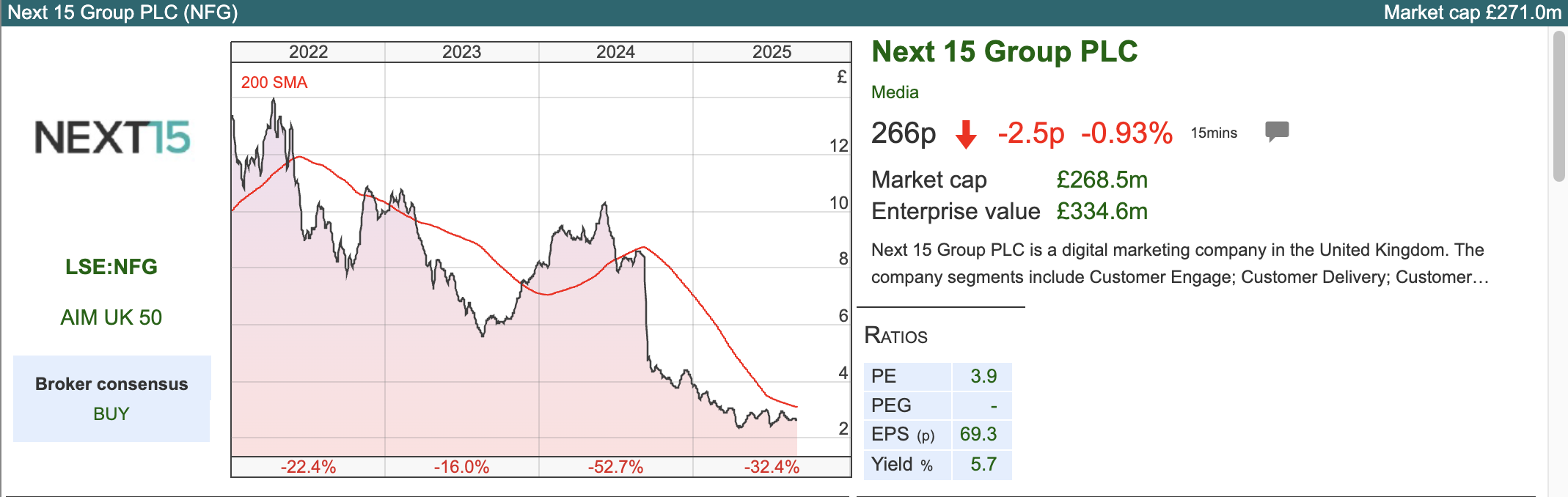

NextFifteen Communications is an acquisitive marketing consultancy, which offers customer insight (helping brands understand their customers better and stay relevant) but also business transformation, which means helping clients launch a new business venture or product. The shares are down -80% from their £14 per share peak in March 2022, when management were reporting £36m of net cash Jan 2022 year end. Last week management announced they will close down Mach49, a business they acquired in 2020, and are refusing to pay earn-outs plus taking legal action against former management of Mach49.

It makes an interesting case study in what can go wrong.

History: Tim Dyson, Next 15 CEO, announced the acquisition of Mach49, which at the time had revenues of $13m (v £300m for NFG) in September 2020. At the time NFG described Mach49 as a “Silicon Valley-based growth incubator for global businesses which becomes a cornerstone of our previously announced plan to create a $100m revenue innovation business.” The price paid for Mach49 was not disclosed in the RNS, though the January 2021 Annual Report did reveal that the consideration was $2m in cash and $3.7m deferred, plus further contingent consideration payable April 2023, April 2024 and April 2025 based on the EBIT performance of Mach49. In other words, the disclosure implied this was not a big deal.

Then in May 2022, NFG tried to buy M&C Saatchi for 247p per share, which itself had got into trouble with acquisition-related liabilities. However, the deal failed because NFG’s share price fell around -30%, which meant the paper component of the deal made the offer less attractive to SAA’s shareholders.

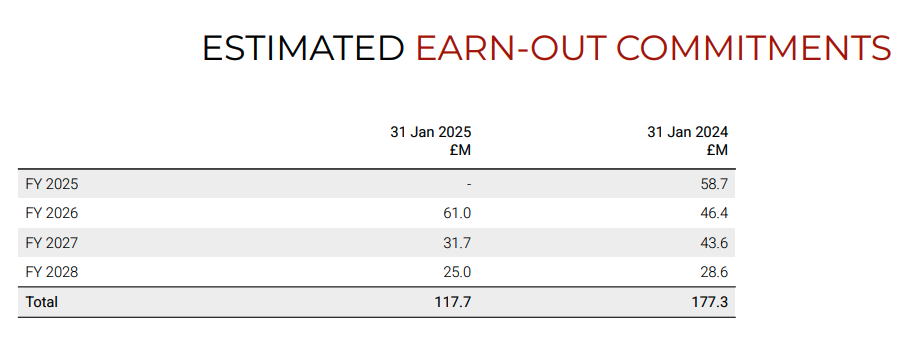

In September 2024, NFG management warned that “the loss of the significant Mach49 contract will have a material adverse impact on our FY Jan 2026 financial performance”. Six months later, in April 2025, they said problems with Mach49 would reduce revenues by £76m. There was also a £17m exceptional restructuring cost. Management then pointed out that future earn-out payments were recorded as a balance sheet liability, and in Jan 2024 this figure was $250m (£177m in the table below) – the largest and most subjective of which was Mach49. Given the disappointing performance of Mach49, they reduced the earn-out liability which resulted in a credit (ie increased profit) to the p&l of £23m.

In June this year, NFG said that they had identified serious misconduct at Mach49 and had fired senior management, including the founder and co-CEO, reporting Mach49 employees to the relevant law enforcement agencies. Tim Dyson, CEO of NFG stepped down. Last week NFG said that they were closing down Mach49.

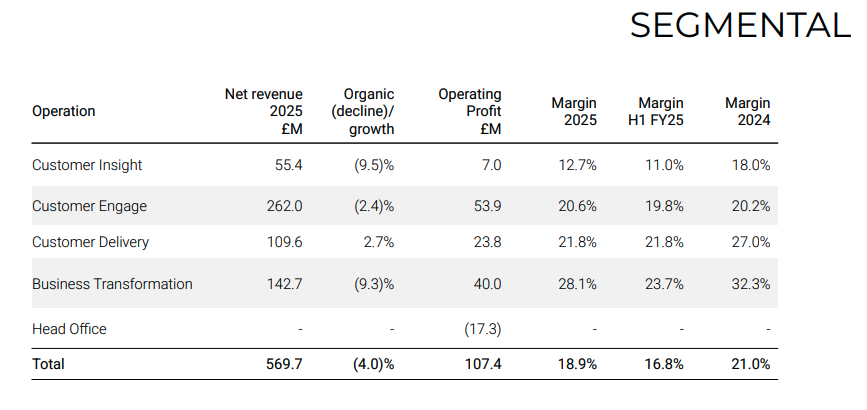

Outlook: The group said in last week’s RNS that they are inline with FY Jan 2026F adjusted operating profit consensus of £67.5m, though presumably the cost of closing down Mach49 will be a “one off” so excluded from that £67.5m figure. For context, that’s implies adj operating profit down by -16%. The next scheduled RNS will be H1 July results on 30 September. Worth noting that they are seeing organic revenue declines in 3 of their 4 divisions.

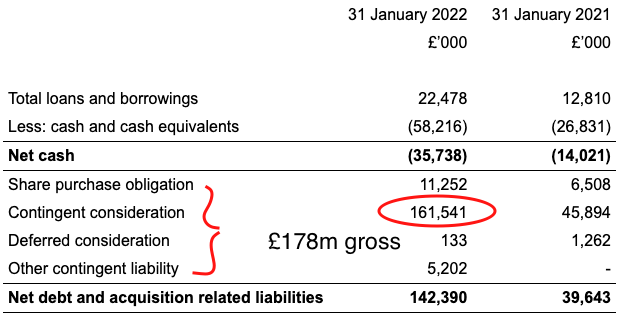

Lessons: I like to spend time looking at companies after things have gone wrong. One red flag was the lack of disclosure around the price of Mach49, I had to go digging in the Annual Report (not the results RNS) to find consideration of $6m (cash up-front and deferred), but the huge liability from earn-outs wasn’t spelt out. With hindsight, management were buying a small, high potential businesses for a tiny upfront payment and then weighting huge (undisclosed) contingent consideration, which created incentives for the acquired team to push too hard to make (make up?) the numbers. The headline £36m of net cash reported FY 2022 ignored the size of these undisclosed earn-outs. If you ignored the headline figure on page 1, and went digging into note 9) you could see net cash of £36m swinging to net debt of £142m, after deducting £178m of gross acquisition liabilities (mainly contingent consideration of £161.5m).

Opinion: A reminder that roll-ups of people businesses can be risky. Second, to be wary of companies excluding acquisition liabilities from their headline net cash figure. NFG claimed to be a “growth consultancy” helping brands expand and grow revenue, yet they themselves were reliant on acquisitions for growth.

Probably too early to get involved here, and I aim to revisit in 6 months. Last couple of years I have tried to call the bottom of several stocks (Close Brothers, Impax AM, Frontier Developments, for example). The ideas have actually worked, I just bought too early, so poor execution – I can see why many people like to wait until a bowl has formed.

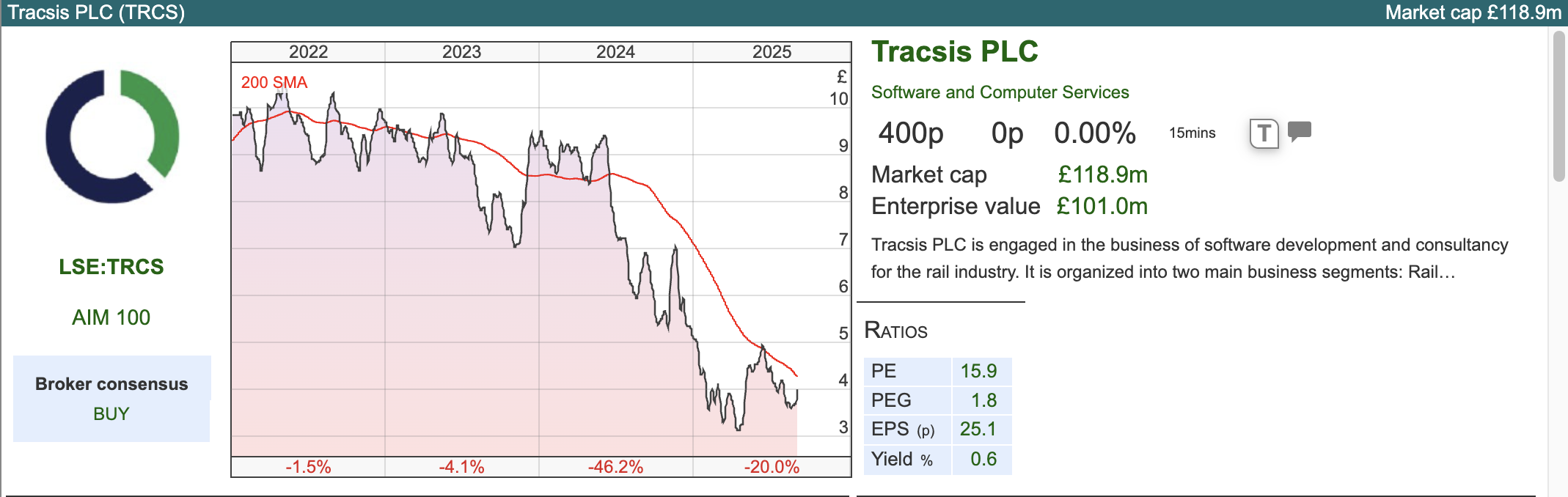

Tracis FY July Trading Update

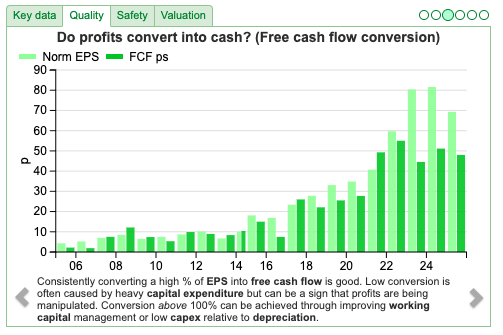

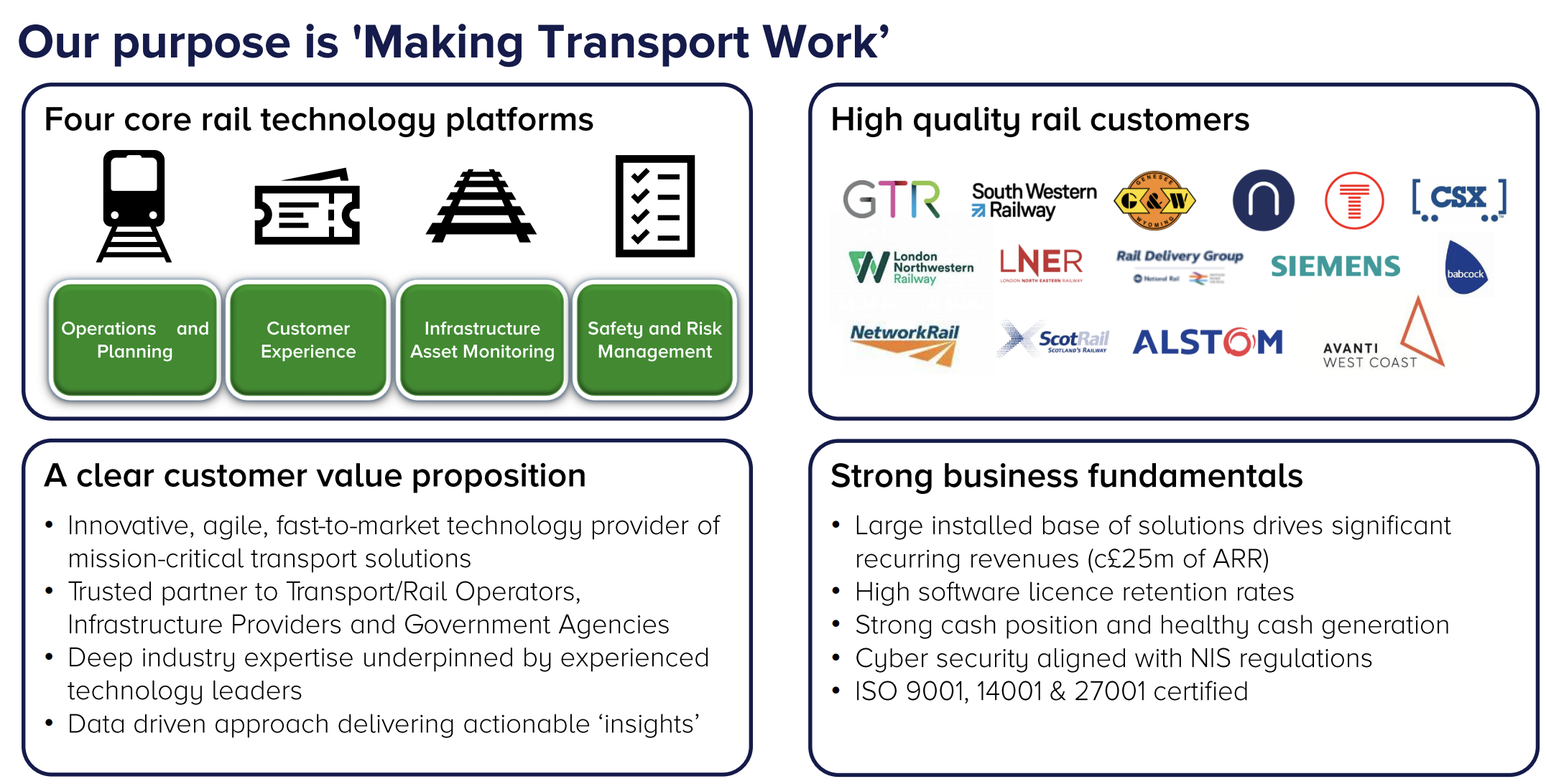

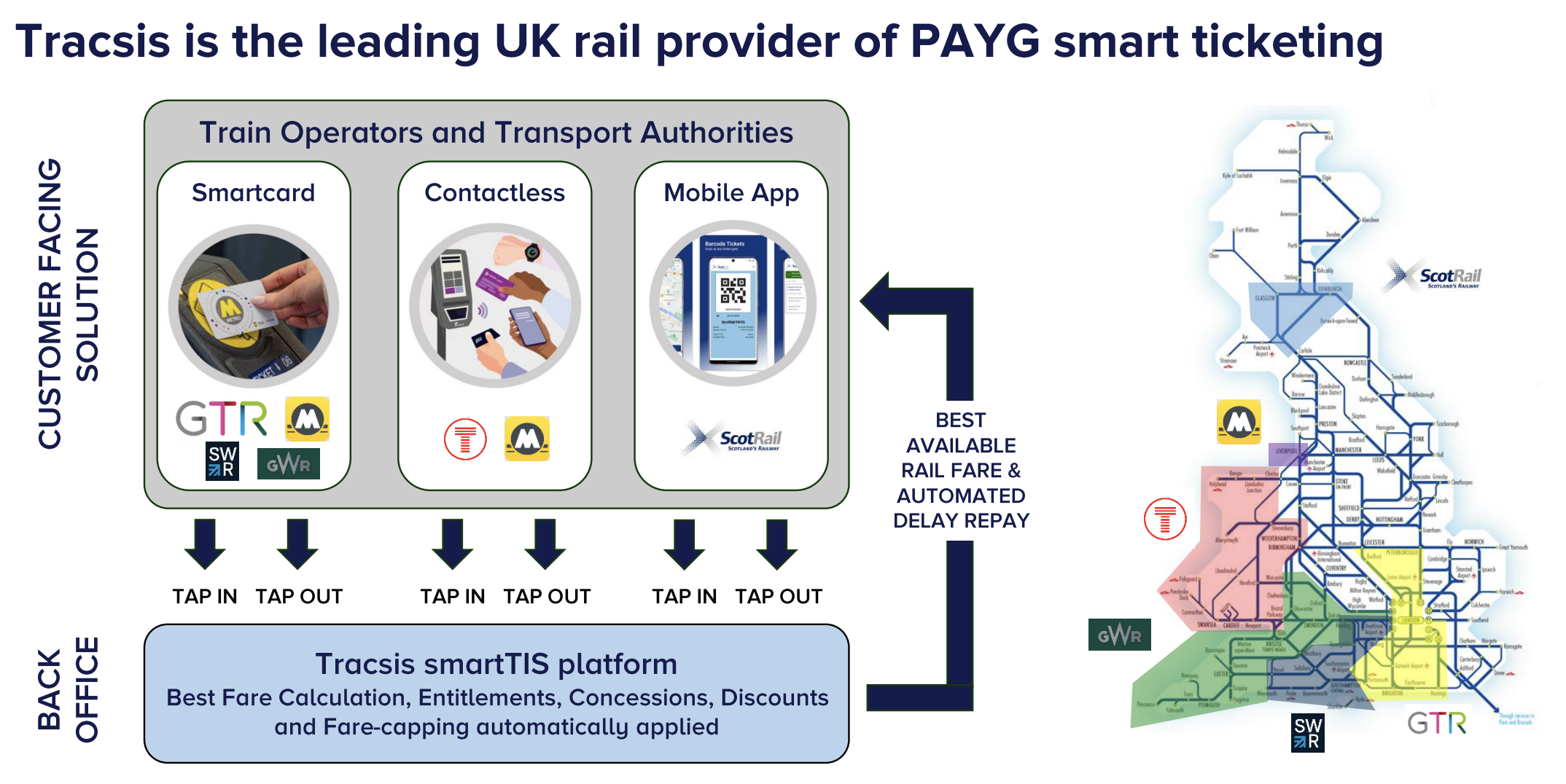

This software company is focused on the transport sector, reported FY revenue up +1% to £82m and adj EBITDA at the bottom end of guidance at £12.6m (range given in April £12.5m-13.5m). There’s no mention of PBT in the RNS, but in H1 Jan 2025 adj EBITDA of £3.8m resulted in a statutory loss of £742K. The balance sheet is fine, with £23m of cash (v just under £20m July 2024), particularly given that they announced an increased dividend and £3m buyback in April. So this is barely profitable but highly cash generative – I much prefer that way round, rather than highly profitable but struggling to generate cash (some litigation finance companies strike me as an example of the latter).

This software company is focused on the transport sector, reported FY revenue up +1% to £82m and adj EBITDA at the bottom end of guidance at £12.6m (range given in April £12.5m-13.5m). There’s no mention of PBT in the RNS, but in H1 Jan 2025 adj EBITDA of £3.8m resulted in a statutory loss of £742K. The balance sheet is fine, with £23m of cash (v just under £20m July 2024), particularly given that they announced an increased dividend and £3m buyback in April. So this is barely profitable but highly cash generative – I much prefer that way round, rather than highly profitable but struggling to generate cash (some litigation finance companies strike me as an example of the latter).

TRCS have agreed a £35m Revolving Credit Facility, which seems unnecessary given the group’s cash balances and healthy cash generation. They mention that this RCF could be used for New Product Development or M&A.

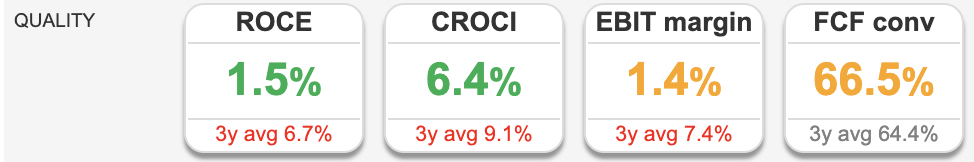

When I last wrote about the company in 2023, I noted that as a software company they reported an attractive gross margin above 60%, but the RoCE and operating margin were both below 4%. The gross margin declined to 56% at H1, which management said was caused by a “sharp increase in input costs across the supply chain that was not fully mitigated through pricing, in part due to the timing of when work is contracted.” I feel like we need a better explanation: if they are providing software services to clients there shouldn’t be much in the way of input costs of physical products. Management said they expected to deliver an increased margin in both businesses during H2 of FY25 with the full benefit of these actions being delivered in FY26.

When I last wrote about the company in 2023, I noted that as a software company they reported an attractive gross margin above 60%, but the RoCE and operating margin were both below 4%. The gross margin declined to 56% at H1, which management said was caused by a “sharp increase in input costs across the supply chain that was not fully mitigated through pricing, in part due to the timing of when work is contracted.” I feel like we need a better explanation: if they are providing software services to clients there shouldn’t be much in the way of input costs of physical products. Management said they expected to deliver an increased margin in both businesses during H2 of FY25 with the full benefit of these actions being delivered in FY26.

Outlook: Management expect “modest” (very modest!) growth in FY July 2026F, pointing to analyst expectations of £82m revenue and adj EBITDA of £13m in a footnote. They do identify a couple of cyclical headwinds i) Network Rail Control Period 7 (CP7) funding is constrained, but should pick up as larger infrastructure projects are approved. There’s already £47bn allocated for CP7 Apr 2024-2029; ii) the re-nationalisation of Train Operating Companies is extending procurement timelines. Longer term they talk about transport industries adopting digital solutions. They mentioned tariff uncertainty in H1, but haven’t said anything more.

Comparison with Avingtrans: On Twitter, Paul Hill, points out the CP7 is a sector wide issue, but that Avingtrans subsidiary Booth Industries, which makes bomb proof doors for trains announced two contract wins last week. One for HS2 (£7.5m) and the other with Transport for London (£1.0m). Avingtrans is an an engineering company, mainly supplying to the energy sector, with a gross margin of 30% so not directly comparable. However, still useful to compare newsflow about contract wins in the same industry.

Valuation: TRCS are trading on 14x PER Jul 2026F dropping to 7x EV/EBITDA because of the cash. That looks about right if there’s no growth in the next 2-3 years, but perhaps management can beat low expectations? CashRoCI was above 20% pre-pandemic.

Opinion: I was negative on this when the share price was 760p in August 2023. At 400p the shares now looks better value, particularly if the growth does eventually come through. I have a soft spot for dull, cash generative, low growth, unprofitable companies. When the cash generation is real, then the problems seem easier to fix than other turnaround stories. At the moment TRCS seems a value investor type investment case. If anyone is good at looking charts perhaps they could say whether it has formed a “double bottom” or a “dead snake”? I don’t own any, but will continue to keep an eye on it.

Opinion: I was negative on this when the share price was 760p in August 2023. At 400p the shares now looks better value, particularly if the growth does eventually come through. I have a soft spot for dull, cash generative, low growth, unprofitable companies. When the cash generation is real, then the problems seem easier to fix than other turnaround stories. At the moment TRCS seems a value investor type investment case. If anyone is good at looking charts perhaps they could say whether it has formed a “double bottom” or a “dead snake”? I don’t own any, but will continue to keep an eye on it.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 03/09/2025 | NFG, TRCS | IPO process, living on a prayer?

Bruce takes a look back to the 1980’s, for inspiration on how to fix London’s broken IPO market. Companies covered: NFG’s disclosure around its Mach49 acquisition, and transport software group TRCS.

There have been several newspaper articles suggesting that the IPO market is seeing signs of life. In H1 we’ve seen recent IPOs MHA and One Health both rise by a third since their listing. Well done to anyone who backed them.

Historically, in the 1980’s IPOs were priced attractively, to encourage individual investors and fund managers to take part. If the government was the selling shareholder (for instance British Gas, British Telecom and BP) success was not maximum price on the sale, but instead a steadily rising share price after listing. It goes without saying that this resulted in a warm feeling among voters who had subscribed to the new issue. However, this was also true IPO’s from entrepreneurs, who liked the public validation of a rising share price in their company. Often investors would subscribe to IPO’s, but have their allocation scaled back to allow more people to benefit.

Hat Tip to Michael Taylor for this FT chart in his weekly email.

As the financial regulators looked closely at the IPO process, it became more common for institutional investors to invest pre-IPO and companies delay listing on public markets. For instance, Wellington and Fidelity were early investors in Metro Bank, which fell 95% from its IPO price. Neil Woodford’s fund was invested so heavily in unlisted shares, it blew up his fund. Unlisted payments business Stripe is valued just below $100bn and banking app Revolut $65bn, Databricks over $100bn and (of course) OpenAI and SpaceX each valued at over $400bn. None of these businesses have tested their valuation by floating on the public markets. This is unhealthy in all sorts of ways.

Whether you think that the responsibility goes to corporate financier or professional fund managers, the AIM 2021 vintage of IPO’s has been a disaster. There were 66 IPO’s on AIM in 2021, raising over £3.2 billion, the most active year for AIM IPOs since 2014 (75 IPOs). These included Life Science REIT (£350m) down -62%, Revolution Beauty (£300m) down -88% and Victorian Plumbing (£298m) down -79%. Using ShareScope’s filter function, I’ve shown the entire 2021 vintage below in histogram form.

Just 6 companies are now in positive territory, with a further 6 down 40% or less. 19 stocks were down between 40% and 80%, but 20 have seen a worse than 80% fall and 15 now have de-listed. Or, put another way, of the 66 IPO’s in 2021, just over half (35) have declined over -80% or de-listed entirely.

The model described above is broken, particularly as UK active fund managers have seen 3 consecutive years of outflows. I’d like to see a return to the 1980’s, when Bon Jovi were topping the charts and IPOs priced to attract money from individual investors. We should give it a shot. If it worked in the 1980s, why would it not function now?

There are a couple of interesting conferences in November in London. I’ll be attending the MoneyWeek Wealth Summit, Friday, 7th November 2025. Mello is a week and a half later: Tuesday 18th & Wednesday 19th November 2025. It’s great to mix with like-minded investors and discuss ideas, as well as the companies presenting.

This week I look at what has gone wrong at marketing & management consultancy company Next 15 Communications and a possible turnaround at Tracis.

Next 15 Closing down Mach49

Often I write “this is an acquisitive people business so I’d be reluctant pay a high multiple for the shares” – the analysis below explains that comment in more depth.

NextFifteen Communications is an acquisitive marketing consultancy, which offers customer insight (helping brands understand their customers better and stay relevant) but also business transformation, which means helping clients launch a new business venture or product. The shares are down -80% from their £14 per share peak in March 2022, when management were reporting £36m of net cash Jan 2022 year end. Last week management announced they will close down Mach49, a business they acquired in 2020, and are refusing to pay earn-outs plus taking legal action against former management of Mach49.

It makes an interesting case study in what can go wrong.

History: Tim Dyson, Next 15 CEO, announced the acquisition of Mach49, which at the time had revenues of $13m (v £300m for NFG) in September 2020. At the time NFG described Mach49 as a “Silicon Valley-based growth incubator for global businesses which becomes a cornerstone of our previously announced plan to create a $100m revenue innovation business.” The price paid for Mach49 was not disclosed in the RNS, though the January 2021 Annual Report did reveal that the consideration was $2m in cash and $3.7m deferred, plus further contingent consideration payable April 2023, April 2024 and April 2025 based on the EBIT performance of Mach49. In other words, the disclosure implied this was not a big deal.

Then in May 2022, NFG tried to buy M&C Saatchi for 247p per share, which itself had got into trouble with acquisition-related liabilities. However, the deal failed because NFG’s share price fell around -30%, which meant the paper component of the deal made the offer less attractive to SAA’s shareholders.

In September 2024, NFG management warned that “the loss of the significant Mach49 contract will have a material adverse impact on our FY Jan 2026 financial performance”. Six months later, in April 2025, they said problems with Mach49 would reduce revenues by £76m. There was also a £17m exceptional restructuring cost. Management then pointed out that future earn-out payments were recorded as a balance sheet liability, and in Jan 2024 this figure was $250m (£177m in the table below) – the largest and most subjective of which was Mach49. Given the disappointing performance of Mach49, they reduced the earn-out liability which resulted in a credit (ie increased profit) to the p&l of £23m.

In June this year, NFG said that they had identified serious misconduct at Mach49 and had fired senior management, including the founder and co-CEO, reporting Mach49 employees to the relevant law enforcement agencies. Tim Dyson, CEO of NFG stepped down. Last week NFG said that they were closing down Mach49.

Outlook: The group said in last week’s RNS that they are inline with FY Jan 2026F adjusted operating profit consensus of £67.5m, though presumably the cost of closing down Mach49 will be a “one off” so excluded from that £67.5m figure. For context, that’s implies adj operating profit down by -16%. The next scheduled RNS will be H1 July results on 30 September. Worth noting that they are seeing organic revenue declines in 3 of their 4 divisions.

Lessons: I like to spend time looking at companies after things have gone wrong. One red flag was the lack of disclosure around the price of Mach49, I had to go digging in the Annual Report (not the results RNS) to find consideration of $6m (cash up-front and deferred), but the huge liability from earn-outs wasn’t spelt out. With hindsight, management were buying a small, high potential businesses for a tiny upfront payment and then weighting huge (undisclosed) contingent consideration, which created incentives for the acquired team to push too hard to make (make up?) the numbers. The headline £36m of net cash reported FY 2022 ignored the size of these undisclosed earn-outs. If you ignored the headline figure on page 1, and went digging into note 9) you could see net cash of £36m swinging to net debt of £142m, after deducting £178m of gross acquisition liabilities (mainly contingent consideration of £161.5m).

Opinion: A reminder that roll-ups of people businesses can be risky. Second, to be wary of companies excluding acquisition liabilities from their headline net cash figure. NFG claimed to be a “growth consultancy” helping brands expand and grow revenue, yet they themselves were reliant on acquisitions for growth.

Probably too early to get involved here, and I aim to revisit in 6 months. Last couple of years I have tried to call the bottom of several stocks (Close Brothers, Impax AM, Frontier Developments, for example). The ideas have actually worked, I just bought too early, so poor execution – I can see why many people like to wait until a bowl has formed.

Tracis FY July Trading Update

TRCS have agreed a £35m Revolving Credit Facility, which seems unnecessary given the group’s cash balances and healthy cash generation. They mention that this RCF could be used for New Product Development or M&A.

Outlook: Management expect “modest” (very modest!) growth in FY July 2026F, pointing to analyst expectations of £82m revenue and adj EBITDA of £13m in a footnote. They do identify a couple of cyclical headwinds i) Network Rail Control Period 7 (CP7) funding is constrained, but should pick up as larger infrastructure projects are approved. There’s already £47bn allocated for CP7 Apr 2024-2029; ii) the re-nationalisation of Train Operating Companies is extending procurement timelines. Longer term they talk about transport industries adopting digital solutions. They mentioned tariff uncertainty in H1, but haven’t said anything more.

Comparison with Avingtrans: On Twitter, Paul Hill, points out the CP7 is a sector wide issue, but that Avingtrans subsidiary Booth Industries, which makes bomb proof doors for trains announced two contract wins last week. One for HS2 (£7.5m) and the other with Transport for London (£1.0m). Avingtrans is an an engineering company, mainly supplying to the energy sector, with a gross margin of 30% so not directly comparable. However, still useful to compare newsflow about contract wins in the same industry.

Valuation: TRCS are trading on 14x PER Jul 2026F dropping to 7x EV/EBITDA because of the cash. That looks about right if there’s no growth in the next 2-3 years, but perhaps management can beat low expectations? CashRoCI was above 20% pre-pandemic.

Bruce Packard

@bruce_packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.