Five companies pass the 5 strikes test. Richard takes a closer look at QinetiQ, the defence technology company underperforming in a booming market.

5 Strikes

Since my last update, 10 companies have published annual reports and passed my minimum quality filter. On closer inspection of their long-term financial track-records, five achieved less than 3 strikes and consequently join my to-research list.

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Halma |

HLMA |

20/6/25 |

0.0 |

– Holdings |

1 |

|

Mitie |

MTO |

20/6/25 |

1.0 |

– CROCI – Growth – Debt – ROCE – Shares |

X |

|

Record |

REC |

20/6/25 |

1.8 |

– Holdings – Growth |

2 |

|

Ashtead |

AHT |

17/6/25 |

0.1 |

– Holdings – Acquisitions – Debt |

3 |

|

Triad |

TRD |

16/6/25 |

29.8 |

– CROCI – Growth – ROCE |

3 |

|

Bloomsbury Publishing |

BMY |

13/6/25 |

2.7 |

0 |

|

|

Enwell Energy |

ENW |

13/6/25 |

0.0 |

– Holdings ? CROCI – Growth – ROCE |

4 |

|

Oxford Instruments |

OXIG |

13/6/25 |

0.0 |

– Holdings ? Growth |

1 |

|

PayPoint |

PAY |

12/6/25 |

0.4 |

– Holdings – Debt – Growth |

3 |

|

QinetiQ |

QQ. |

11/6/25 |

0.2 |

? Holdings ? Acquisitions – ROCE |

2 |

|

11/06/2025 |

|||||

First up is Halma [- Holdings]. It is a role model for other buy and build businesses, also known as roll-ups. It acquires and operates niche safety equipment, environmental and healthcare firms it describes as “life saving.” Halma has a truly remarkable track record, which I have previously examined here. 2025’s results do nothing to dent it.

I have never owned the shares or seriously considered them. I think that is because I am incredulous, I just cannot believe it will keep going despite the fact that it does. If that sounds irrational to you, it does to me too.

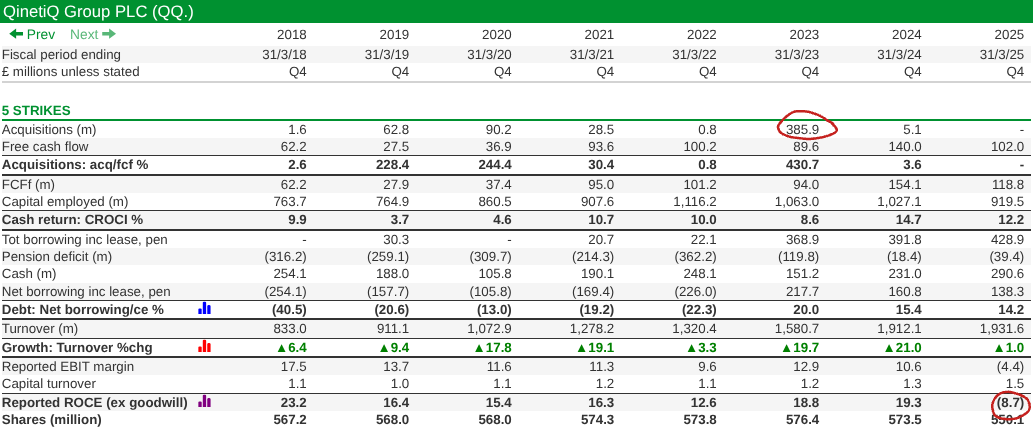

QinetiQ [? Holdings ? Acquisitions – ROCE] QinetiQ is a defence contractor. Until 2025 it was reliably profitable for over a decade, when, for much of the time, UK defence spending has been constrained. In 2025, it was profitable on an underlying basis, but reported a loss.

Currency manager and fund manager Record [-Holdings -Growth] suffered a rare contraction in the year to March 2025, a fact that its annual report does not dwell on. Following the retirement of founder Neil Record in 2023, it has experienced a wholesale change in management.

Bloomsbury Publishing [0 Strikes] and Oxford Instruments [- Holdings ? Growth] are members of interactive investor’s Share Sleuth portfolio, and I will be updating my analysis there shortly. Bloomsbury publishes books and educational resources. Oxford Instruments makes scientific equipment.

QinetiQ: When a loss is not a loss

QinetiQ’s negative Return on Capital Employed in the year to March 2025, is a puzzle. With wars in Europe and the Middle East, governments committed to more defence expenditure and orders rising at other defence contractors, we might expect the company to be making money, not losing it.

Source: ShareScope custom table

Source: ShareScope custom table

This anomalous result is only partly because the business performed poorly. Revenue grew 1%, and underlying operating profit fell by 14% to £185m according to QinetiQ’s figures.

Despite the general increase in defence spending, QinetiQ says orders were disrupted by the volatile geopolitical situation and the actions of the new US administration, for example the imposition of export restrictions.

The biggest hit was to Qinetiq’s “Global Solutions” business, which contributed about 23% of revenue, almost all of it from its US business unit. This division’s revenue fell 8%, and profit margin collapsed year-on-year due to events in the second half.

The “R” in Return on Capital Employed stands for return, or profit, which is expressed as a percentage of Capital Employed. My custom table uses reported profit, whereas the company’s underlying profit figure is adjusted.

The rest of the explanation for QinetiQ’s negative ROCE relates to costs the company has ignored in calculating profit because they cloud the businesses’ trading performance. In other words, how much it has made from selling products and services.

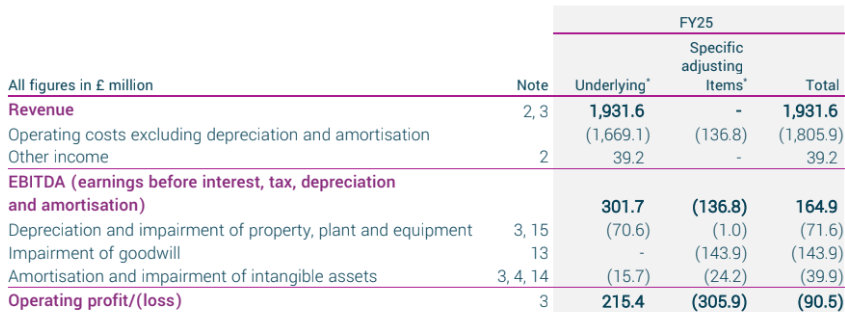

We can see the impact these items and others in the following table, which shows how QinetiQ arrived at underlying profit:

Source QinetiQ annual report, 2025

By adding back a total of £305.9m (middle column) in “Specific adjusting items”, QinetiQ turned an operating loss of £90.5m (right hand column) into an operating profit of £215.4m (left hand column). The company deducts Research and Development Expenditure Credits from underlying profit, so underlying operating profit is £185.4m.

£185.4m as a percentage of capital employed of £919.5 (excluding goodwill, according to ShareScope) is 20% ROCE. On an underlying basis, the company remains highly profitable.

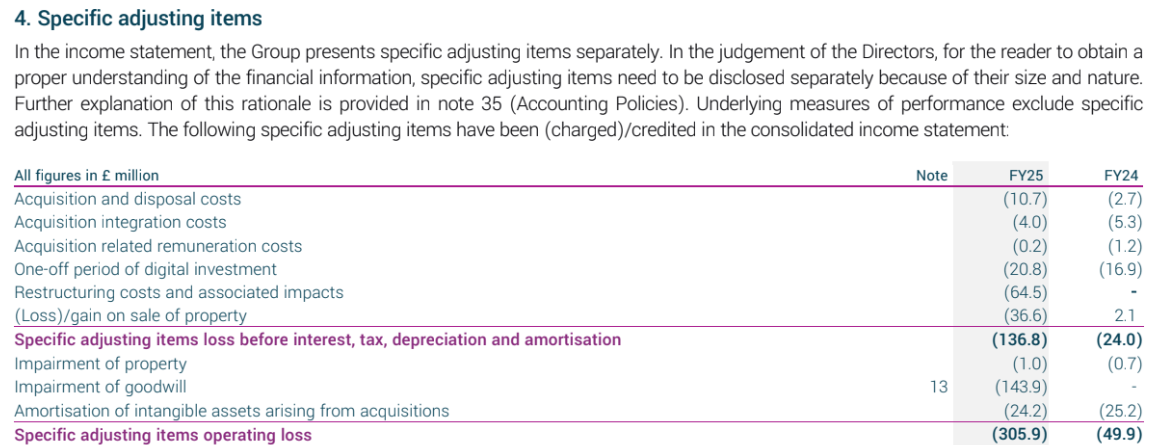

In the notes to the accounts, QinetiQ tells us what the adjustments were:

The biggest single adjustment was a £143.9m goodwill impairment. It relates to QinetiQ’s US business.

It’s easy to disregard goodwill impairments because they reflect adjustments to the value of businesses acquired in the past, rather than cash costs in the present. However, companies impair goodwill when they believe that the prospects of acquired businesses have diminished, which suggests that management overpaid for them.

A substantial part of the impairment relates to a relatively recent acquisition. In 2023, QinetiQ acquired Avantus Federal, a cyber, data, and software development company serving US military and civilian customers.

Avantus was QinetiQ’s biggest ever acquisition, costing more than four times free-cash flow and adding £264.6m in goodwill to £80.9m attributed to two other US business units. Although the company does not disclose the goodwill allocated to each of these individual business units today, a substantial amount of the £149.3m US impairment must be Avantus goodwill.

QinetiQ’s new US chief executive restructured the business unit at a cost of £64.5m in 2025. This is the second biggest adjusting item. It has been added back to underlying profit along with other one-off costs like digital investment and acquisition related costs primarily relating to Avantus.

Long-term perspective

This isn’t my first look at QinetiQ, but it is my first look since my first look in 2020. Back then, QinetiQ had experienced a decade of subdued acquisition activity and profitable growth. This record was a lot more comforting than its first four or five years as a listed company in the naughties when a string of acquisitions weakened its balance sheet.

I thought QinetiQ might be worth our time. Evidently I didn’t follow up on it, and I am dithering about pursuing it this time around.

On the plus side, most of the adjustments in underlying profit are non-cash, QinetiQ earned decent cash flow in 2025 and achieved a record order book. It is only modestly in debt, so the company may well move on prosperously. Avantus revenue was flat in 2025, implying that it was less badly impacted by events than the rest of the US business.

Steve Wadey has been chief executive since 2015, so he was partly responsible for the business I liked in 2020. But he was also responsible for acquiring Avantus.

We have the benefit of hindsight, so perhaps it is unfair to blame management for not fully appreciating the risk associated with the already volatile geopolitical situation in 2023, and the possibility of increased disruption should president Trump return to power.

But looking at QinetiQ’s numbers this year has reminded me how complicated it is. And when I buy shares for the long-term, I want to be confident companies will take measured risks. In the 2023 annual report, Wadey said:

“We recognise the challenges and some of the difficulties faced previously acquiring in the US, so this has been a considered and well thought-through acquisition, across the three lenses of strategy, economics and integration.”

It doesn’t look that way to me now.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.