A look at how scanning headlines is no substitute for assessing closely the investment case of individual stocks. Companies covered PEEL, CPI, OHGR

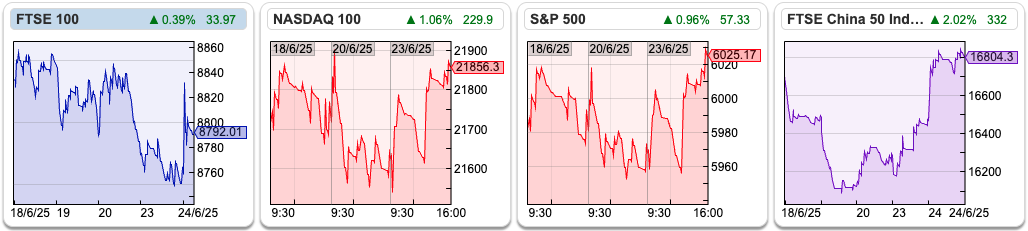

The FTSE 100 was down less than half a percent to 8,792 over the last 5 trading days. The Nasdaq100 and S&P500 were both up around +1% over the same timeframe. The FTSE China 50 was also up +1% and is now the best performing major index +21% YTD, just ahead of the DAX +19%. Weirdly, the broader Shanghai CSI 300 Index is the second worst performing index, down -2% along with the Nikkei 225 -4%. So, Trump has been good for large cap Chinese and German stocks, but negative for smaller Chinese and Japanese stocks. I’m unclear on the logic of that performance.

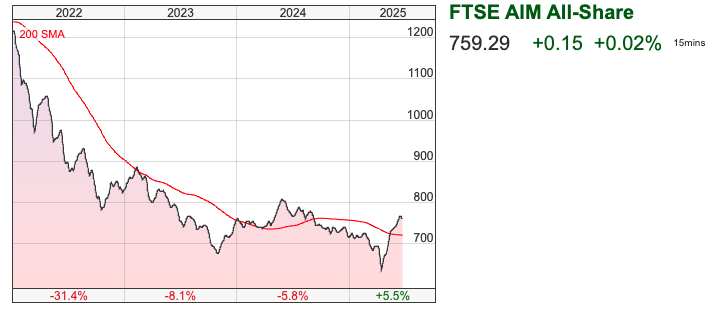

Hopefully, everyone has enjoyed the AIM bounce; hard to believe, but the index is now up +5.5% YTD. A couple of months ago, I was expecting market weakness following Trump’s 2nd April announcement and mistakenly thought that I was cautiously positioned. Unlike in 2020, Central Banks would struggle to create liquidity to support equity markets while Trump was throwing everyone off balance with tariffs. Or so I thought.

Despite my cautious expectations, I’m up +22% YTD, helped by BGEO and GAW, which are my two largest positions. I found that many of the shares that had disappointed me last year did very well when I was least expecting it. Examples include Sylvania +55% YTD, Close Brothers and Frontier Developments both up +52% YTD and SDI +48% YTD. I had averaged down into the last 3 mentioned, only to see them disappoint and fall further in 2024. My worst performer YTD has been Argentex, down -94%, as it blew up spectacularly. AGFX was the investment case that I was feeling confident about, as it should have benefited from currency market volatility.

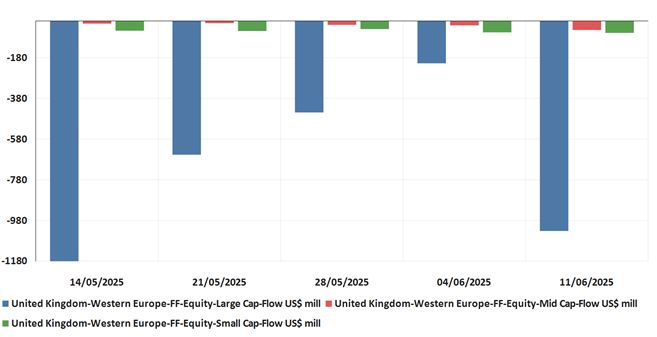

So, it’s nice to be hopelessly wrong about the world and make significant gains. It’s also bizarre that the bounce has come at a time when organisations like Calastone and EPFR continue to report UK fund manager outflows. The chart below was posted by Charles Hall, Peel Hunt Head of Research, on LinkedIn.

I’m not sure how we square that circle of rising UK markets and continued fund manager outflows. Possibly it signals a return of direct investors, buying individual stocks rather than funds? Maybe there is money coming into the UK from international investors? Perhaps away from the USA, which has been the “default choice” for capital allocation. For instance, Chicago fund manager Driehaus has announced a disclosable stake in Filtronic. If AIM companies are attracting US based investors, that should help momentum.

Middle East conflict is normally negative for financial markets, but I came across this substack post arguing that the world had changed since the oil embargoes of the 1970’s, as Western economies are now less reliant on the Gulf for oil. Also, when Iran attacked a US base in Qatar, they were quickly thanked by Donald Trump for warning them in advance, in response oil fell -13% to below $70 a barrel. Iran has qualified for the FIFA World Cup next year, which will be hosted in the USA (as well as Mexico and Canada) despite Trump’s travel ban, which prevents the Iranian team from entering the country. I’m in “wait and see” mode.

This week, I look at stockbroker Peel Hunt’s FY Mar results and how Capita’s turnaround is progressing. Finally One Health Group, an IPO which listed on AIM in March. It’s early days, but I am open-minded about the investment case on ONGR.

Peel Hunt FY Mar 2025 Results

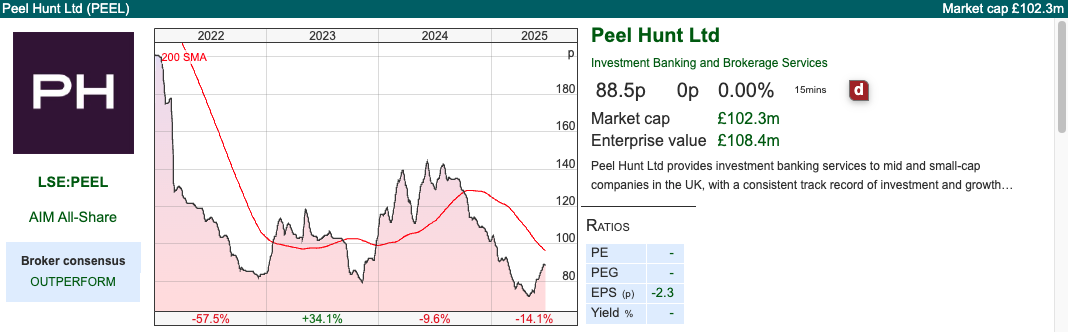

UK brokers like Cavendish and Peel Hunt have suffered a difficult few years since AIM peaked in Sept 2021. But given the strength of AIM, up +20% since the April trough, perhaps it is time to take another look at the sector?

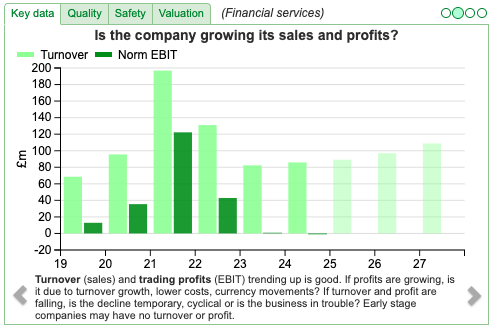

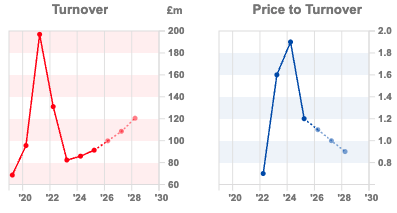

FY Mar 2025 revenue was up +6% to £91m, though that’s still less than half £197m FY Mar 2021. The group reported another Loss Before Tax of £3.5m, up slightly versus £3.3m last financial year. Cash balances were £20m, down from £38m previous March. It’s important to note that brokers need to operate with excess cash for regulatory and market-making purposes. Hence, the company has a £20m RCF with Lloyds and a £10m overdraft with Santander, which they’ve occasionally used to facilitate large client trades.

Management say that they’ve added 17 new clients. But that’s a gross number, which fails to take into account client losses; corporate clients fell from 150 last year to 147 as of Mar 2025.

Outlook: This financial year has started more positively, as money is rotating out of the USA and there’s more positive sentiment towards the UK. There’s a strong pipeline of transactions – but note that two years ago management talked about a gradual improvement in pipeline – which was then followed by 2 years of losses before tax. I don’t think I’ve ever read an outlook statement from a UK stockbroker that wasn’t upbeat about the future!

RetailBook: As active fund managers have seen years of persistent outflows, brokers need to think laterally and start providing a better service to amateur investors. Peel Hunt has backed RetailBook, which allows individuals to participate in company fund raisings alongside professional fund managers on the same terms. There’s a list of recent examples on their website, like Quantum Base (using quantum mechanics to authenticate luxury handbags). Given that primary funding raising market has been difficult, many of the deals are actually the UK DMO issuing treasury bills with 3-6 month maturity.

Valuation: The shares are trading on 35x PER Mar 2026F, dropping to 15x the following year, as forecasts assume PBT bounces 2.5x if markets conditions become more helpful. The shares are on 36x EV/EBITDA for FY Mar 2025 numbers, which would suggest a good deal of the recovery is already being priced in.

Opinion: We must be close to a cyclical low – but I think specialist fund managers like Impax AM or Premier Miton or maybe even IP Group might be a better way to benefit from any recovery? Stockbroking is not an easy industry, even at the best of times: the global banks win the most profitable deals, which leaves the independent brokers fighting for scraps. It’s a shame, because there used to be some real characters who worked at these smaller brokers, but times have changed. I’d like to see governments encourage global banks to become “narrower” and split out their equities businesses, which would make the playing field fairer. That’s unlikely to happen though, so we need to recognise when a sector is structurally challenged and move on.

Capita 5 month trading update (to end May)

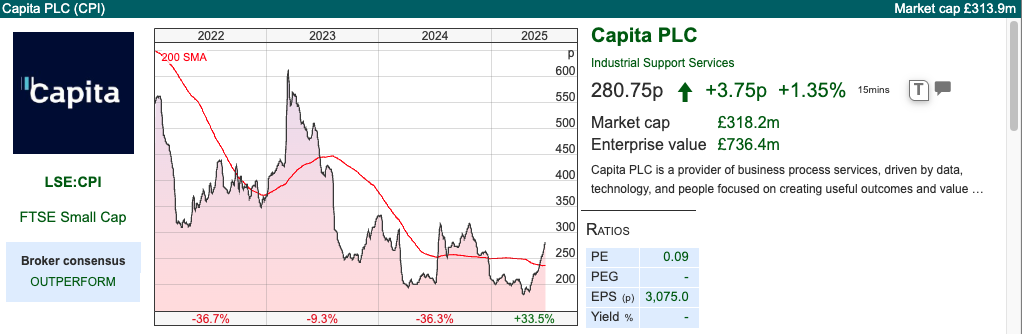

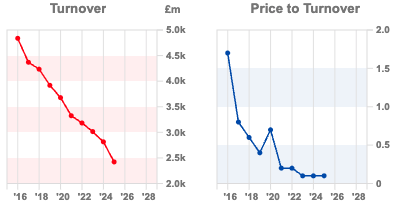

This outsourcing business was a former 300x bagger in the 1990-2016 era, during those better days it was a FTSE 100 constituent. They originally benefited from the trend of Public Sector outsourcing but then fell victim to a “growth regardless of profitability” mindset, took on too much debt (£1.9bn net debt in 2016) and won many government contracts with margins too thin to compensate for risk. The wheels began to fall off in 2016, and it’s fair to say the turnaround has taken much longer than initially expected.

I was intrigued because Richard Staveley at Rockwood Strategic has taken a position. He tends to be good at spotting turnarounds. He points out that the business has completely new management, targeting operating margins of c.4.5% to 6-8% (negative in both FY Dec 2024 and 2023, on a reported basis). The shares are up +34% YTD.

Management put out an RNS last week, for 5 months to May, reiterating FY Dec 2025F guidance of flat revenue and operating margin improvement, but weighted to H2. In the five months to 31 May, the Group won contracts with a Total Contract Value (TCV) of £969m, up 24% from the same period in 2024, with year to date TCV won up over 70% in Capita Public Service which more than offset the 49% reduction in TCV won in the Contact Centre business.

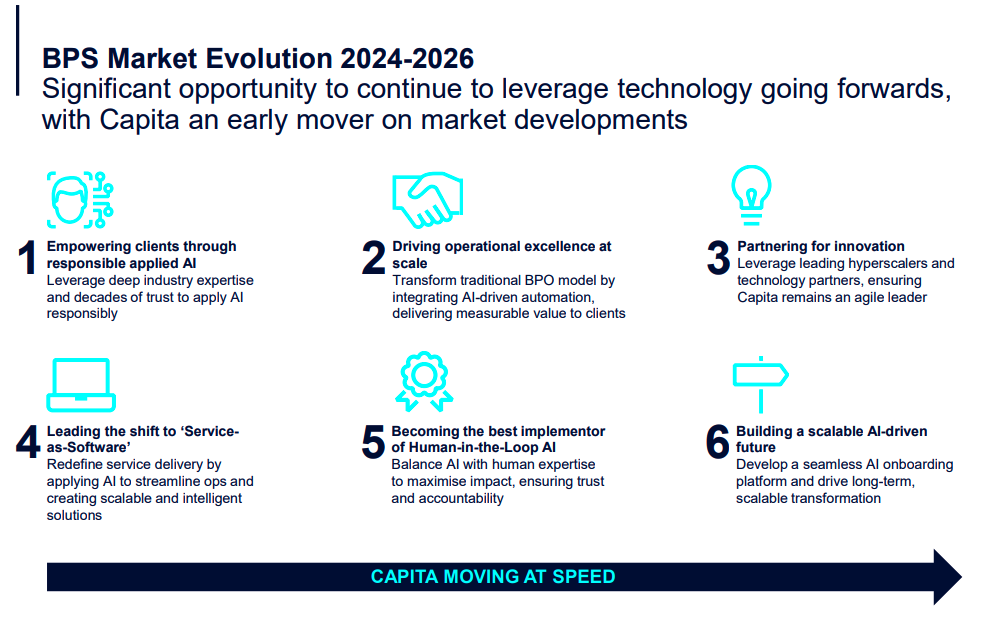

So there are two diverging trends between the divisions: Public Sector (c. 60% of group revenue) where CPI is the incumbent administration provider of a range of government services such as the Congestion Charge, The Student Loan Company and the TV License, and is seeing good growth in contracts won. Then there are the more private sector-focused areas, which include the barely profitable Contact Centre business (c. 27% of group revenue), where there has been a -49% reduction in contracts won. Across the group, significant cost is being taken out and new technology harnessed (in particular the use of AI) to improve productivity, efficiency and profitability. Clearly AI is a hot area at the moment, so management teams will mention AI in the hope of generating excitement and a valuation re-rating, but for CPI I think there could be something to this trend. Press 1 if you think AI could help make call centres less annoying, Press 2 if you think technology could help reduce costs.

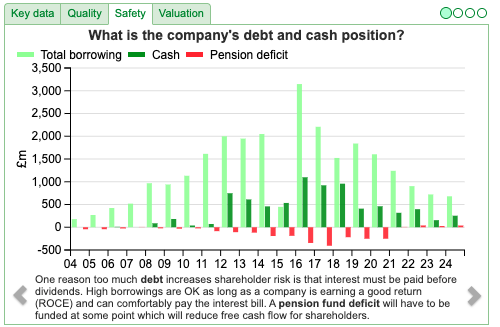

The company had been saddled with huge amounts of debt which have now been reduced through a series of business disposals. They also had a significant funding requirement for its pension fund, which has also been addressed. Net debt stood at £415m, or 2.3x adj EBITDA – however management also quote another figure “net financial debt pre IFRS 16” of £66m, or 0.5x adj EBITDA. I’m sceptical of companies that re-define net debt, so would go with the higher figure. There is a £1bn+ pension scheme, but helped by rising bond yields that now enjoys a surplus of £38m, there are no contributions to be paid at this time.

Valuation: The shares are trading on around 5x PER, although details EPS forecasts were not feeding through at the time I finished writing this. I logged a query with support, so hopefully the forecasts come back by the time you read this.

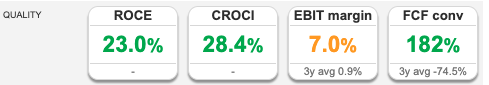

Opinion: Expectations are very low and ShareScope’s Quality Indicators are correctly identifying the disappointing track record – but I now think this could be interesting. We’ve seen a decade of declining revenues, but there are reasons to believe that the business is now on a more sustainable footing, so worth a second look?

One Health FY Mar 2025 Results

Readers will know I’m sceptical of IPO’s, particularly the 2021 vintage. When a company comes to market, the selling shareholders can time their exit to take advantage of the fact that they tend to know more than buyers. So the problem isn’t just high valuations (PER, EV/EBITDA), the more serious risk is that the sellers can foresee problems that aren’t showing up in the numbers yet; hence revenues and profits are lagging indicators. Think Peel Hunt IPO’ing at the top of the market only to see revenues decline -58% from FY Mar 2021, or CAB Payments, which issued a profit warning just 3 months after coming to market. Nonetheless, now market conditions are less frothy, I’m open-minded. ASOS was brought to market in 2003 by the once-mighty Seymour Pierce, just as AIM fell -80% peak to trough after the internet bubble burst.

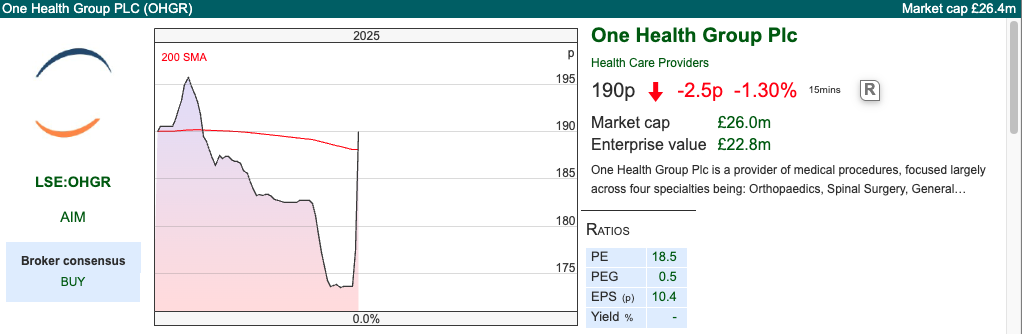

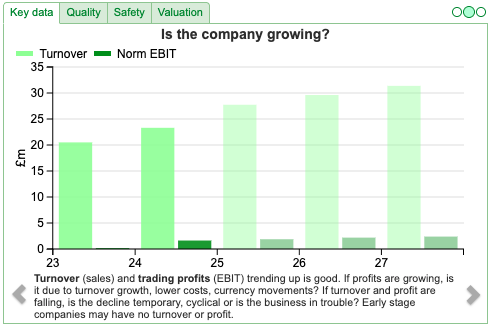

With that in mind, perhaps One Health Group’s maiden set of FY Mar results could be worth a look, after they raised £8m (£5.6m to the company and £2.2m gross to selling shareholders) and were admitted to AIM in March. The company provides medical procedures, funded by the NHS. Organic revenues rose +23% to £28m and statutory PBT was up +43%, to £1.5m. That’s all the more impressive because it includes £400K of AIM admission costs included in this year’s numbers and £150K gain on property re-valuation last year, without which PBT would have more than doubled.

Activities: The company’s history goes back almost 20 years to 2006, when the government introduced the ‘Patient Choice’ initiative. This allowed patients whose GPs have referred them for surgery to choose their own treatment provider. This may be the NHS or companies operating in the independent sector, such as One Health. The company engages 70 consultants, not including anaesthetists.

They raised money at 180p per share, in a difficult environment for IPO’s. A minimum of £5m of the money raised will go towards building a surgical hub. This is expected to cost between £8- £9m, and should be operational within one year of construction. They expect it to generate between £6 to £9m of revenue per annum. The Admission Doc says it should be earnings enhancing in the first full year of operation.

Following the raise, Derek Bickerstaff, the non Exec Chairman, stake fell from 57% to 40%. I did a quick word search of the document and didn’t see any lock-up agreement, which would prevent him from selling down his stake further. Previously they were quoted on AQSE, but they’ve cancelled that listing now they’re on AIM.

Valuation: The shares trade on 14x PER Mar 2026F, dropping to 13x the following year. That equates to 7x EV/EBITDA FY Mar 2026F.

Opinion: Growing very rapidly, and valuation seems reasonable. I wouldn’t expect this to be a higher margin business, but Sharescope suggests 20-30% RoCe and CashRoCI has been achieved historically. It’s not clear how large the market for this could be. I asked a LLM how many consultant surgeons the NHS employs, and it came up with a figure of around 2,700, which seems low compared to 1.6m of total employees for the NHS. I’d like to see management present and tell their story, but I’m open to this.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 25/6/2025 | PEEL, CPI, OHGR | Scary headlines, reassuring performance

A look at how scanning headlines is no substitute for assessing closely the investment case of individual stocks. Companies covered PEEL, CPI, OHGR

The FTSE 100 was down less than half a percent to 8,792 over the last 5 trading days. The Nasdaq100 and S&P500 were both up around +1% over the same timeframe. The FTSE China 50 was also up +1% and is now the best performing major index +21% YTD, just ahead of the DAX +19%. Weirdly, the broader Shanghai CSI 300 Index is the second worst performing index, down -2% along with the Nikkei 225 -4%. So, Trump has been good for large cap Chinese and German stocks, but negative for smaller Chinese and Japanese stocks. I’m unclear on the logic of that performance.

Hopefully, everyone has enjoyed the AIM bounce; hard to believe, but the index is now up +5.5% YTD. A couple of months ago, I was expecting market weakness following Trump’s 2nd April announcement and mistakenly thought that I was cautiously positioned. Unlike in 2020, Central Banks would struggle to create liquidity to support equity markets while Trump was throwing everyone off balance with tariffs. Or so I thought.

Despite my cautious expectations, I’m up +22% YTD, helped by BGEO and GAW, which are my two largest positions. I found that many of the shares that had disappointed me last year did very well when I was least expecting it. Examples include Sylvania +55% YTD, Close Brothers and Frontier Developments both up +52% YTD and SDI +48% YTD. I had averaged down into the last 3 mentioned, only to see them disappoint and fall further in 2024. My worst performer YTD has been Argentex, down -94%, as it blew up spectacularly. AGFX was the investment case that I was feeling confident about, as it should have benefited from currency market volatility.

So, it’s nice to be hopelessly wrong about the world and make significant gains. It’s also bizarre that the bounce has come at a time when organisations like Calastone and EPFR continue to report UK fund manager outflows. The chart below was posted by Charles Hall, Peel Hunt Head of Research, on LinkedIn.

I’m not sure how we square that circle of rising UK markets and continued fund manager outflows. Possibly it signals a return of direct investors, buying individual stocks rather than funds? Maybe there is money coming into the UK from international investors? Perhaps away from the USA, which has been the “default choice” for capital allocation. For instance, Chicago fund manager Driehaus has announced a disclosable stake in Filtronic. If AIM companies are attracting US based investors, that should help momentum.

Middle East conflict is normally negative for financial markets, but I came across this substack post arguing that the world had changed since the oil embargoes of the 1970’s, as Western economies are now less reliant on the Gulf for oil. Also, when Iran attacked a US base in Qatar, they were quickly thanked by Donald Trump for warning them in advance, in response oil fell -13% to below $70 a barrel. Iran has qualified for the FIFA World Cup next year, which will be hosted in the USA (as well as Mexico and Canada) despite Trump’s travel ban, which prevents the Iranian team from entering the country. I’m in “wait and see” mode.

This week, I look at stockbroker Peel Hunt’s FY Mar results and how Capita’s turnaround is progressing. Finally One Health Group, an IPO which listed on AIM in March. It’s early days, but I am open-minded about the investment case on ONGR.

Peel Hunt FY Mar 2025 Results

UK brokers like Cavendish and Peel Hunt have suffered a difficult few years since AIM peaked in Sept 2021. But given the strength of AIM, up +20% since the April trough, perhaps it is time to take another look at the sector?

FY Mar 2025 revenue was up +6% to £91m, though that’s still less than half £197m FY Mar 2021. The group reported another Loss Before Tax of £3.5m, up slightly versus £3.3m last financial year. Cash balances were £20m, down from £38m previous March. It’s important to note that brokers need to operate with excess cash for regulatory and market-making purposes. Hence, the company has a £20m RCF with Lloyds and a £10m overdraft with Santander, which they’ve occasionally used to facilitate large client trades.

Management say that they’ve added 17 new clients. But that’s a gross number, which fails to take into account client losses; corporate clients fell from 150 last year to 147 as of Mar 2025.

Outlook: This financial year has started more positively, as money is rotating out of the USA and there’s more positive sentiment towards the UK. There’s a strong pipeline of transactions – but note that two years ago management talked about a gradual improvement in pipeline – which was then followed by 2 years of losses before tax. I don’t think I’ve ever read an outlook statement from a UK stockbroker that wasn’t upbeat about the future!

RetailBook: As active fund managers have seen years of persistent outflows, brokers need to think laterally and start providing a better service to amateur investors. Peel Hunt has backed RetailBook, which allows individuals to participate in company fund raisings alongside professional fund managers on the same terms. There’s a list of recent examples on their website, like Quantum Base (using quantum mechanics to authenticate luxury handbags). Given that primary funding raising market has been difficult, many of the deals are actually the UK DMO issuing treasury bills with 3-6 month maturity.

Valuation: The shares are trading on 35x PER Mar 2026F, dropping to 15x the following year, as forecasts assume PBT bounces 2.5x if markets conditions become more helpful. The shares are on 36x EV/EBITDA for FY Mar 2025 numbers, which would suggest a good deal of the recovery is already being priced in.

Opinion: We must be close to a cyclical low – but I think specialist fund managers like Impax AM or Premier Miton or maybe even IP Group might be a better way to benefit from any recovery? Stockbroking is not an easy industry, even at the best of times: the global banks win the most profitable deals, which leaves the independent brokers fighting for scraps. It’s a shame, because there used to be some real characters who worked at these smaller brokers, but times have changed. I’d like to see governments encourage global banks to become “narrower” and split out their equities businesses, which would make the playing field fairer. That’s unlikely to happen though, so we need to recognise when a sector is structurally challenged and move on.

Capita 5 month trading update (to end May)

This outsourcing business was a former 300x bagger in the 1990-2016 era, during those better days it was a FTSE 100 constituent. They originally benefited from the trend of Public Sector outsourcing but then fell victim to a “growth regardless of profitability” mindset, took on too much debt (£1.9bn net debt in 2016) and won many government contracts with margins too thin to compensate for risk. The wheels began to fall off in 2016, and it’s fair to say the turnaround has taken much longer than initially expected.

I was intrigued because Richard Staveley at Rockwood Strategic has taken a position. He tends to be good at spotting turnarounds. He points out that the business has completely new management, targeting operating margins of c.4.5% to 6-8% (negative in both FY Dec 2024 and 2023, on a reported basis). The shares are up +34% YTD.

Management put out an RNS last week, for 5 months to May, reiterating FY Dec 2025F guidance of flat revenue and operating margin improvement, but weighted to H2. In the five months to 31 May, the Group won contracts with a Total Contract Value (TCV) of £969m, up 24% from the same period in 2024, with year to date TCV won up over 70% in Capita Public Service which more than offset the 49% reduction in TCV won in the Contact Centre business.

So there are two diverging trends between the divisions: Public Sector (c. 60% of group revenue) where CPI is the incumbent administration provider of a range of government services such as the Congestion Charge, The Student Loan Company and the TV License, and is seeing good growth in contracts won. Then there are the more private sector-focused areas, which include the barely profitable Contact Centre business (c. 27% of group revenue), where there has been a -49% reduction in contracts won. Across the group, significant cost is being taken out and new technology harnessed (in particular the use of AI) to improve productivity, efficiency and profitability. Clearly AI is a hot area at the moment, so management teams will mention AI in the hope of generating excitement and a valuation re-rating, but for CPI I think there could be something to this trend. Press 1 if you think AI could help make call centres less annoying, Press 2 if you think technology could help reduce costs.

The company had been saddled with huge amounts of debt which have now been reduced through a series of business disposals. They also had a significant funding requirement for its pension fund, which has also been addressed. Net debt stood at £415m, or 2.3x adj EBITDA – however management also quote another figure “net financial debt pre IFRS 16” of £66m, or 0.5x adj EBITDA. I’m sceptical of companies that re-define net debt, so would go with the higher figure. There is a £1bn+ pension scheme, but helped by rising bond yields that now enjoys a surplus of £38m, there are no contributions to be paid at this time.

Valuation: The shares are trading on around 5x PER, although details EPS forecasts were not feeding through at the time I finished writing this. I logged a query with support, so hopefully the forecasts come back by the time you read this.

Opinion: Expectations are very low and ShareScope’s Quality Indicators are correctly identifying the disappointing track record – but I now think this could be interesting. We’ve seen a decade of declining revenues, but there are reasons to believe that the business is now on a more sustainable footing, so worth a second look?

One Health FY Mar 2025 Results

Readers will know I’m sceptical of IPO’s, particularly the 2021 vintage. When a company comes to market, the selling shareholders can time their exit to take advantage of the fact that they tend to know more than buyers. So the problem isn’t just high valuations (PER, EV/EBITDA), the more serious risk is that the sellers can foresee problems that aren’t showing up in the numbers yet; hence revenues and profits are lagging indicators. Think Peel Hunt IPO’ing at the top of the market only to see revenues decline -58% from FY Mar 2021, or CAB Payments, which issued a profit warning just 3 months after coming to market. Nonetheless, now market conditions are less frothy, I’m open-minded. ASOS was brought to market in 2003 by the once-mighty Seymour Pierce, just as AIM fell -80% peak to trough after the internet bubble burst.

With that in mind, perhaps One Health Group’s maiden set of FY Mar results could be worth a look, after they raised £8m (£5.6m to the company and £2.2m gross to selling shareholders) and were admitted to AIM in March. The company provides medical procedures, funded by the NHS. Organic revenues rose +23% to £28m and statutory PBT was up +43%, to £1.5m. That’s all the more impressive because it includes £400K of AIM admission costs included in this year’s numbers and £150K gain on property re-valuation last year, without which PBT would have more than doubled.

Activities: The company’s history goes back almost 20 years to 2006, when the government introduced the ‘Patient Choice’ initiative. This allowed patients whose GPs have referred them for surgery to choose their own treatment provider. This may be the NHS or companies operating in the independent sector, such as One Health. The company engages 70 consultants, not including anaesthetists.

They raised money at 180p per share, in a difficult environment for IPO’s. A minimum of £5m of the money raised will go towards building a surgical hub. This is expected to cost between £8- £9m, and should be operational within one year of construction. They expect it to generate between £6 to £9m of revenue per annum. The Admission Doc says it should be earnings enhancing in the first full year of operation.

Following the raise, Derek Bickerstaff, the non Exec Chairman, stake fell from 57% to 40%. I did a quick word search of the document and didn’t see any lock-up agreement, which would prevent him from selling down his stake further. Previously they were quoted on AQSE, but they’ve cancelled that listing now they’re on AIM.

Valuation: The shares trade on 14x PER Mar 2026F, dropping to 13x the following year. That equates to 7x EV/EBITDA FY Mar 2026F.

Opinion: Growing very rapidly, and valuation seems reasonable. I wouldn’t expect this to be a higher margin business, but Sharescope suggests 20-30% RoCe and CashRoCI has been achieved historically. It’s not clear how large the market for this could be. I asked a LLM how many consultant surgeons the NHS employs, and it came up with a figure of around 2,700, which seems low compared to 1.6m of total employees for the NHS. I’d like to see management present and tell their story, but I’m open to this.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the ShareScope “Weekly Market Commentary” chat. Login to ShareScope – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.