Michael looks at small but productive ways for traders to improve P&L with the first of this two-part checklist and walkthrough.

Let’s get one thing straight…

There are no shortcuts in trading.

I wish there was because it would’ve saved me a lot of time and money. But sadly, there is no way to quick riches – only a quick way to the poorhouse.

But there are hacks.

Not the dodgy kind like Forex signals or some algo that claims to be right 93% of the time, but small, effective, and repeatable actions that actually move the needle.

The reality is that most traders are too focused on outcomes and not focused enough on process.

Having studied this business intensely for close to a decade, the major problem people have is they want their wins quickly and lack patience.

I was the same when I started. I wanted to make money quickly, and when I did (because I was lucky and long in a small-cap bubble market), I wanted to make money even quicker…

…But developing patience and cultivating a mindset of process over outcomes will push your P&L higher over time rather than seeing the funds in your trading account circle the toilet bowl once again.

Here are some of the small, practical things I’ve done (and still do) that have made a real difference to my P&L and mindset.

1. Do your thinking when the market is closed.

You don’t think clearly when money is on the line.

That much is for certain. You’re one big bowl of bias-bolognese – it’s biology. When we’re in a trade and the price starts moving against us, our rational mind switches off and our lizard brain takes over.

That’s when you start doing stupid things like adding to a loser (“losers average losers” according to Paul Tudor Jones and he is correct), revenge trading, or hitting the buy button because something’s moving (yep, done that one plenty when I started out).

The fix? Do your thinking when the market is closed.

That means:

- Building watchlists in the evening

- Reviewing trades with fresh eyes

- Journaling what worked and what didn’t (more on that below)

When I was younger, I would sit at my screens watching charts, Level 2, monitoring Twitter for sentiment. I thought because I was a trader I needed to do something.

These days, I spend a lot of my actual trading time doing nothing. Not nothing as in literally nothing, but I’m not glued to Level 2 screens. Instead, I’ll be reading RNSs, researching stocks, doing some management calls, or reading; not to mention the bulk of the work that happens after hours.

Screening. Scanning. Planning. Trading without a plan is gambling. I know because I’ve done it.

Make sure you’re using ShareScope for its full use.

That means making use of:

- Watchlists

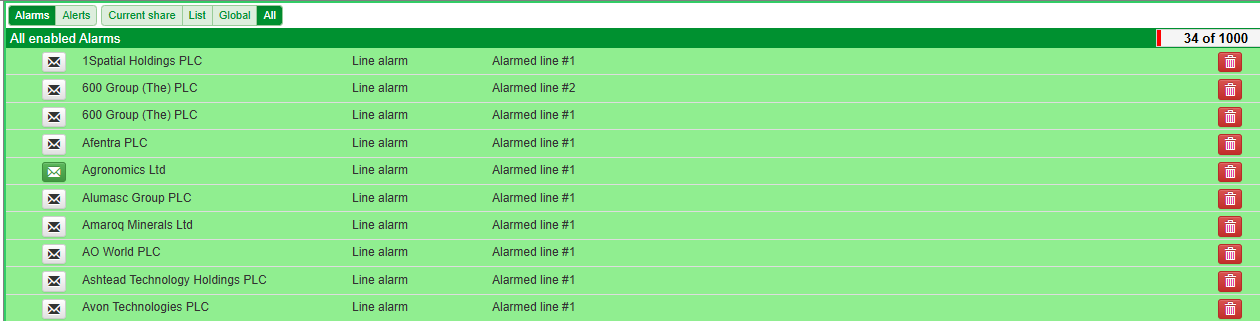

- Alerts and alarms

- Filters

- Baskets

Having a watchlist is great but it’s no use jamming it full of hundreds of stocks that you need to watch every night.

It’s far better to outsource this by using alarms to keep track of stocks.

You can also set email alerts in order to keep track of stocks better.

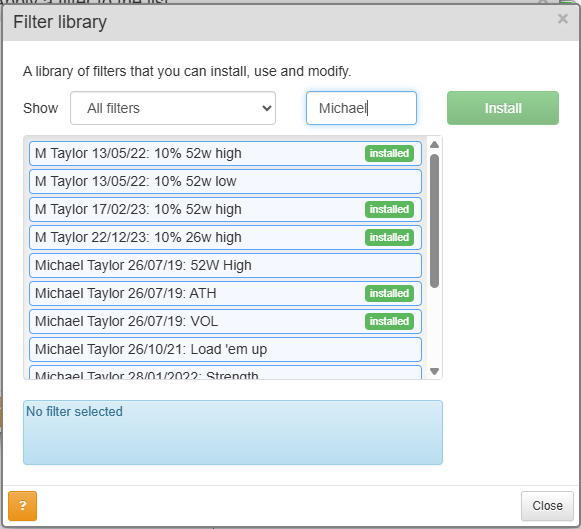

The filters that I use can be found on the filter library.

Click Filters > Apply or manage filter > Library.. then type “Michael” in the box at the top.

I use the 10% within 26-week high filter currently and the VOL filter.

Using these will give you a good selection of stocks as you’ll find breakout targets before they break out.

You will also be exposed to the next big winners in the market.

Every stock that goes on a huge run will be in the 10% within 26-week high filter regularly.

It’s a mathematical impossibility.

You might not trade it… but you’ll definitely see it.

Making sure you’re exposed to the best-performing stocks in the market is not a bad idea.

2. Log your trades

This one is boring. It’s tedious, but it works.

Most traders don’t log their trades. Most traders don’t make money.

There is a causative correlation here.

You absolutely need to be logging your trades because that data is rich in gold ready to be mined.

Without logging your trades, you won’t be able to spot bad habits, commonalities between winning and losing trades, and ultimately how to improve and boost your P&L.

You can take screenshots of your trades and the charts but you need to be looking at entry, exit, position size, intended stop and target, as well as notes to capture how you were feeling and what went wrong.

Also record your R-multiple and the setup, as well as including a column to check on the trade four weeks later.

Maybe 90% of your trades carry on without pulling back. This means you could take half off and run the other half with a tight stop.

But you wouldn’t know that if you didn’t collect the data.

Screenshotting trades has two benefits:

- It forces discipline – you’re far less likely to chase junk if you know Future You is going to review it.

- It creates a visual feedback loop so you see patterns emerge. You start to see which setups work and which ones just look good but never play out.

Most traders just move on to the next shiny chart. You’re here to win, so review your trades like a professional who reviews their actions.

3. Create a pre-trade checklist

Trading is about removing decision-making when emotions are high. The more you can standardise, the better. This is why I think traders should use pre-trade checklists.

Things you can include are:

- Is the stock liquid enough?

- Is there a clear setup with an obvious entry and stop?

- Am I trading my plan, or chasing noise?

- Does this trade fit my strategy and rules?

- Have I calculated my position size based on risk?

If a trade can’t tick all the boxes, then you shouldn’t take the trade.

Doing this saved me a lot of money, as it forced me to think objectively about what I was doing.

Here are some things I look at before entering a trade.

First is the chart.

If the chart is in stage 4 then move on. If it’s looking like a stage 3, maybe set an alert in case it breaks out (lined alarm) or again just move on.

If it’s stage 1 or early stage 2 then this could be of interest. Look at where breakout points could be. Points of significant repeated resistance? How deep are the pullbacks?

Use ShareScope’s pullback measuring tool to check.

If the chart is a green light, look at what the company does.

Check ShareScope’s Single Page (press Enter on the stock and this loads)

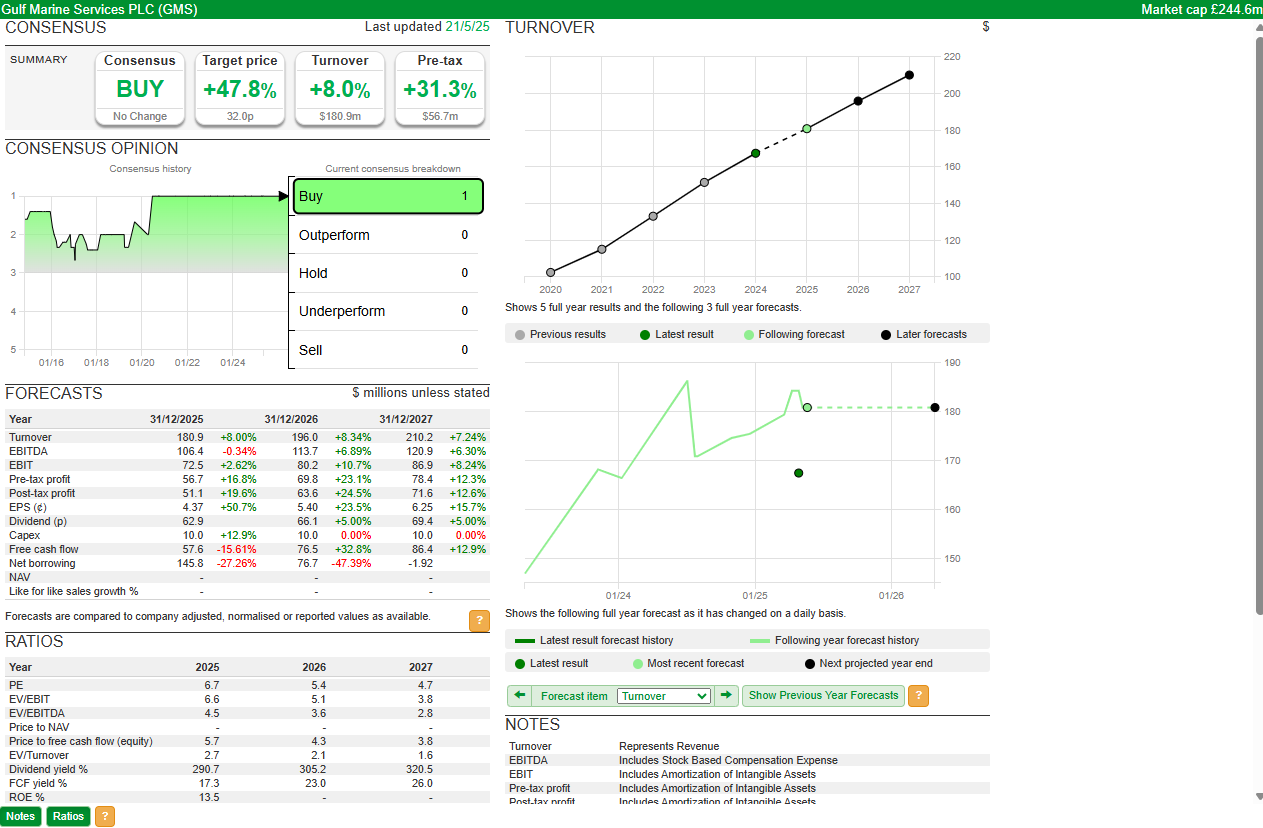

Once I have a quick overview of the stock, I’ll then check the Forecasts tab on ShareScope.

Once you have an idea of the forecasts, then move on to the financials for more red flag checkup.

- Are revenues growing?

- Is the balance sheet good?

- Does the company generate cash and if not, how long is it likely to have?

If this is a short-term trade then it doesn’t matter as long as there is not a high risk of a placing (if it has cash for 12 months plus and you’re in it for a few weeks max then fine etc).

I will cover more steps in my next article, and if you want to see a detailed view of my process I’ll walk you through this in my video here.

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Instagram: @shiftingshares | Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.