A look at the number of companies leaving AIM, and whether brokers’ hope of a recovery in IPOs will help investors. Companies covered SDI, CBG and BEG.

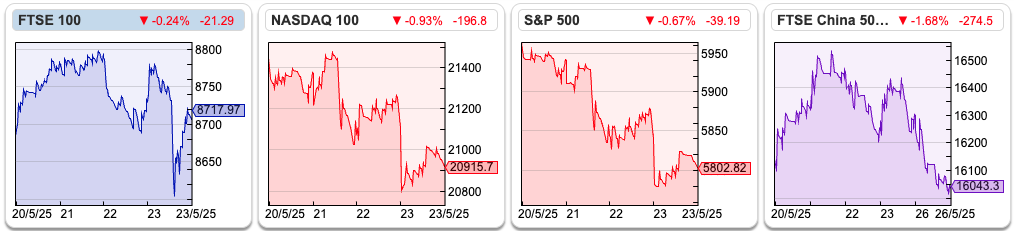

The FTSE 100 was up less than half a percent to 8,717 over the last 5 days. The index is now flat versus the start of April, just before Trump announced his tariffs. The Nasdaq100 and S&P500 were down -2.4% and -2.6% respectively in the last 5 days. The best-performing index since the start of the year has been the German DAX, followed by the FTSE Europe ex UK, both up c. +20% YTD. The worst performing has been the Nikkei 225, down -7% YTD. Both Japan and Germany consistently run an annual trade surplus of around $70bn a year with the USA, so if anyone has explained the divergent performance of their stockmarkets please do post in the Sharescope chat.

Last week we saw bids for pawnbroker H&T (44% premium to the undisturbed price), property services group Kinovo (41% premium) and industrial chains and power transmission company Renold (47% premium). Well done to holders of any of those. There doesn’t seem to be a consistent theme of which sectors are being bid for; just that smaller companies in the UK represent good value at this point in the cycle.

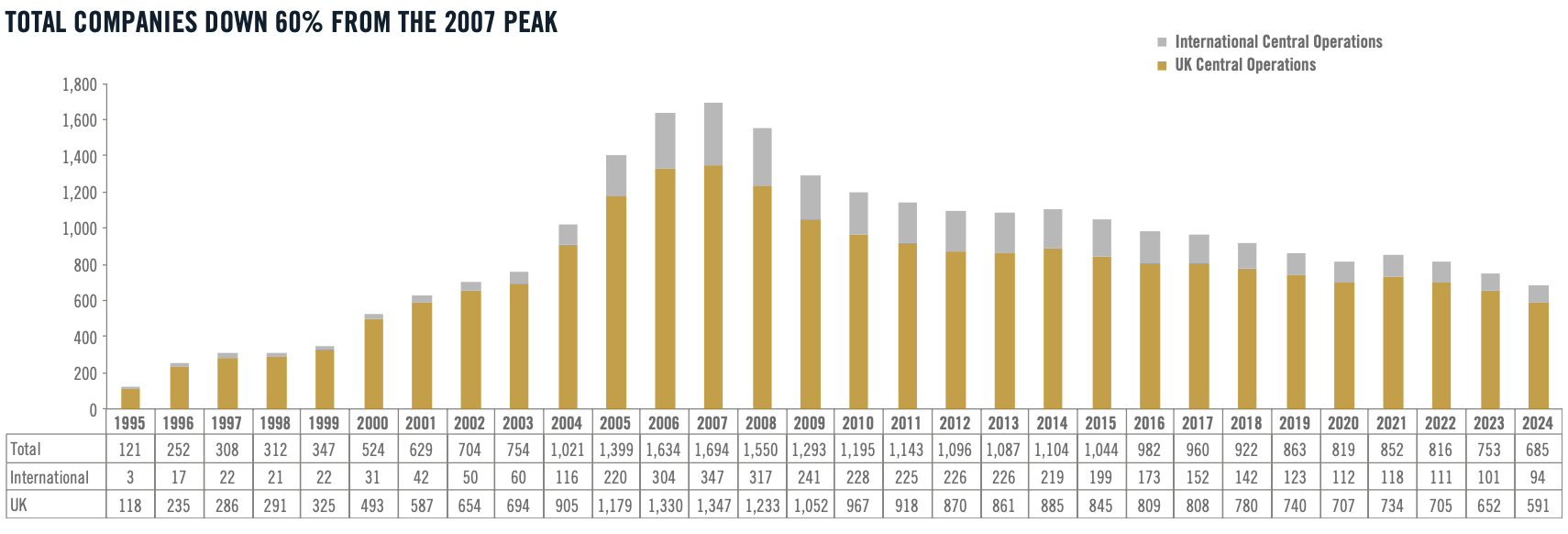

The number of stocks listed on AIM stands at around 600 now, shrinking by the day and down more than 60% from the peak in 2007, according to the chart below by Allenby Capital. In 2024, there were 28 AIM companies acquired. Of those 28, 11 bids came from Private equity, and just two were from other AIM-listed companies. UK-focused funds suffered their worst-ever quarter in Q1 this year, despite the rising stockmarket. As active managers are still seeing outflows from UK funds, then Private Equity and overseas corporates are stepping in to take advantage of the situation.

Brokers are keen that eventually this structural decline in listed companies will be reversed by more IPO’s. That may be good news for brokers like Peel Hunt, Panmure Liberum and Cavendish, but less so for investors if performance is anything like the 2021 vintage. In that year, 87 companies floated on AIM raising £3.7bn, but 67 (almost 80%) of those new issues are now down more than 60% or have de-listed. Less than 10 (just over 10%) of that 2021 vintage of IPO’s are trading above their initial float price.

A final reminder that the Mello 2025 Conference will be at the Clayton Hotel Chiswick, Tue 3rd June 2025 9am – Wed 4th June 2025 5pm, then socialising in the bar afterwards. I will miss the event this year, which is a shame because David has some excellent speakers and 40+ AIM and AQSE-listed companies. Sharescope will have a stand, so come and say “hello”.

Also, a link to the Investors Chronicle annual Celebration of Investment Awards 2025. As always, we would be extremely grateful to receive your vote in the Best Investment Software/Data Provider category.

This week I look at SDI, the scientific instruments company, Close Brothers, the merchant bank with car loans mis-selling overhang and Begbies Traynor, the insolvency specialist.

SDI FY Apr Trading Update

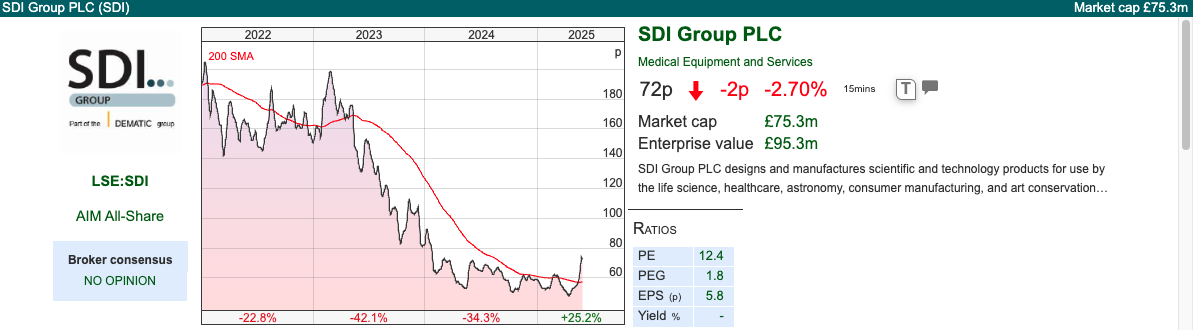

This laboratory and scientific equipment company looks to have formed a nice bowl. I own it and am disappointed that the shares were up +15% ahead of the announcement. Investors in AIM shares need to feel confident that there is a level playing field and that insiders do not have an information advantage ahead of everyone else.

Following that +15% bounce, SDI put out a trading statement last week to say FY Apr 2025F results would be “in line” with expectations – Sales of £66.5m and adj PBT £8.4m in the footnote of the RNS. The RNS follows a weak start to the financial year, but momentum seems to be picking up and carrying through to FY Apr 2026F. The order book is “robust” following an uptick in the Feb-Apr Q4. Net debt stood at £13.8m, down from £17m at the H1 stage.

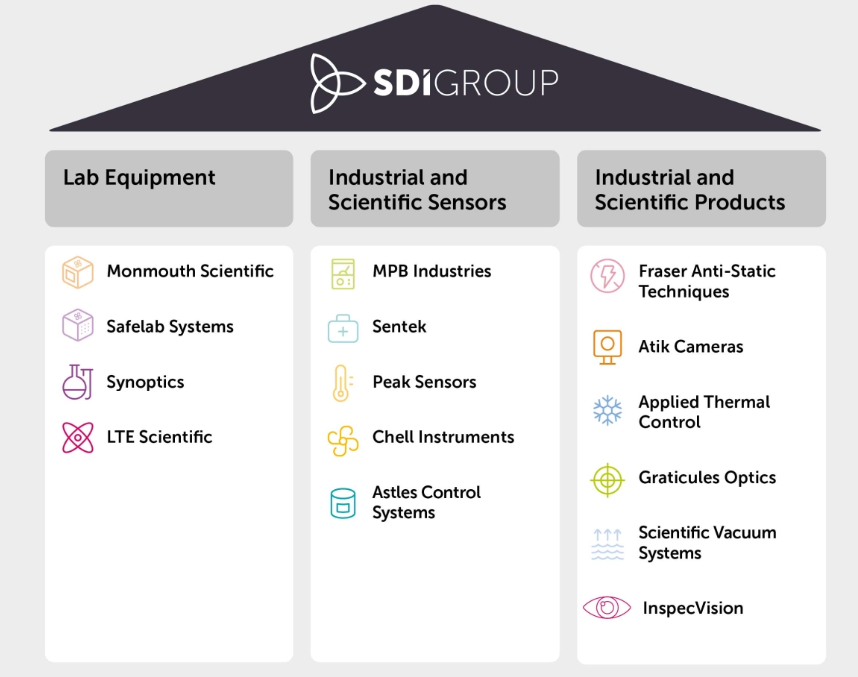

Outlook: Cavendish haven’t changed their forecasts for FY Apr 2026F, implying +11% sales and EPS growth. That looks achievable given that SDI acquired InspecVision (computer vision and meteorology, £3.2m of revenue) in Oct 2024 and Colins Walker (industrial boilers, less than £1m of revenue) in April 2025. It’s pleasing to see management mention contract wins at existing businesses Atik Cameras, Monmouth Scientific and Sentek. They say approximately 10% of revenues come from US, and they don’t think tariffs will have a material impact.

Valuation: Based on a PER of 10.4x Apr 2026F and an EV/EBITDA of 6x. For comparison, Judges Scientific trades on 20x PER Dec 2026F and 13x EV/EBITDA the same year. JDG has an excellent track record but is now 7x bigger than SDI by market cap. All else being equal, a smaller “buy and build” group should have a more attractive investment case, as there ought to be more opportunities before size becomes an anchor dragging on performance.

Opinion: This business was reporting a high 20’s CashRoCI in 2021 and 2022 as their Atik Camera’s division enjoyed a temporary benefit from PCR testing, which justified a high rating. Since then, the valuation has fallen to around 10x PER, and Sharescope’s Quality indicators have also deteriorated. I own it but should have taken profits when the share price peaked at over £2 per share a couple of years ago.

As the de-rating happened, investors were questioning whether the “build” part of the “buy and build” strategy is still working. That said, the number of shares in issue has only increased by 3% since 2022, so if management can demonstrate profitable organic revenue growth, then we could see a strong turnaround. From where we start now, I’d rather be a buyer than a seller.

Close Brothers Q3 Trading Update

This merchant bank and specialist lender has been struggling with historic Discretionary Commission Arrangements (DCAs) for car finance customers. CBG put out a Feb-Apr Q3 trading update last week showing the balance sheet is not distressed with core Equity Tier 1 standing at 14%, despite taking a £165m provision in H1 Jan. They now expect the loan book to be flat in their financial year to 31 July 2025F.

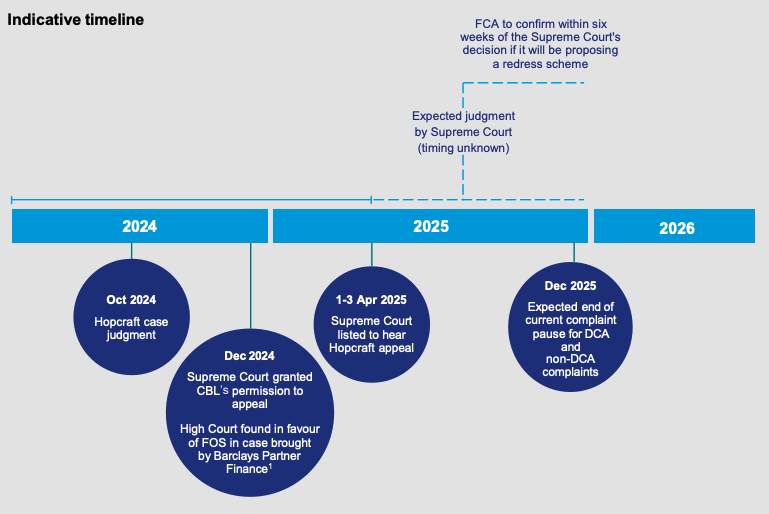

This mis-selling case was supposed to have been resolved in the second half of last year, as the FCA was expected to say whether customers were harmed and what redress those customers might receive. Then UK courts disrupted that process, the lower court had initially dismissed the (Hopcraft) claim against CBG in Sept 2023, but in October last year the Court of Appeal ruled against Close Brothers. The Court’s argument was that second-hand car dealers had a fiduciary duty to their customers – creating a potential mis-selling liability for Close Brothers. CBG has appealed to the Supreme Court (case heard in April, ruling expected in July) arguing that people’s understanding of second-hand car dealers and the existing legal frameworks are at variance with the Appeals Court decision.

Aside from the mis-selling overhang, performance seems on an even keel. Net Interest Margin is expected to be around 7%, and the bad debt ratio at 0.9% of loans is below the long-term average of 1.2%. For comparison, during the financial crisis, bad debts peaked at 2.6% FY Jul 2009. Falling interest rates should now provide a tailwind, and activity is beginning to pick up in Winterfloods, the quote-driven AIM market makers. Return on Tangible Equity was 7.4% for the group, if we adjust for the £165m motor finance provision.

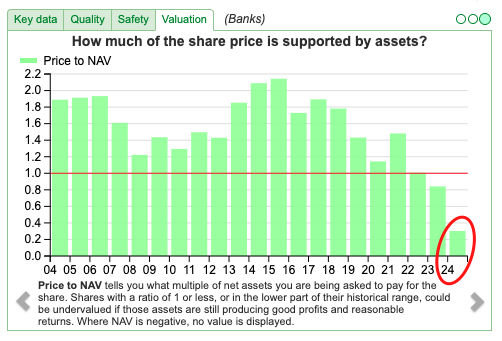

Valuation: Net tangible book value stood at £8.40 per share at the end of January, so CBG is trading on 0.4x tangible book, despite the shares having bounced +42% YTD. That compares to around 1.3x for large-cap UK banks like NatWest, Lloyds and HSBC, and well below the long-term average for CGB. The Sharescope chart below showed that peak valuation was over 2x book for CGB, achieved in 2015-6 when peak RoE was 18.5%.

Opinion: I think there’s a good chance that things go CBG’s way and I own the shares. Fiduciary duty is the highest standard of care in law and means that a professional must act in the best interests of clients. It’s normally reserved for IFAs, brokers, solicitors and other professionals, rather than second-hand car dealers. Earlier in the year, the Chancellor, Rachel Reeves, took the unusual step of seeking to intervene in the Supreme Court case, suggesting that redress should be proportionate to losses suffered. The Labour Government is clearly worried about the broader economic consequences of a huge customer redress bill for banks, coming not long after Payment Protection Insurance.

In my view, bank shareholders should not have to pay for historic mis-selling that they could not have been aware of at the time – if the commission arrangements were not disclosed to customers, how could the shareholders understand the risk? Perhaps regulatory protection should consider treating shareholders fairly, not just borrowers.

Begbies Traynor FY Apr Trading Update

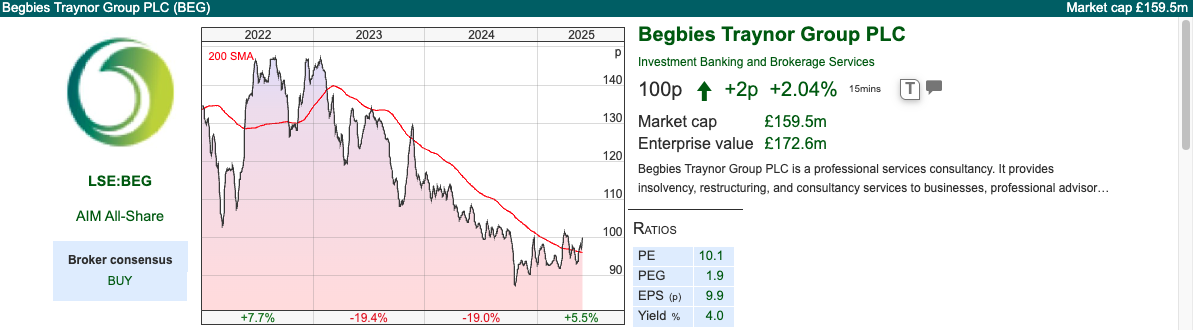

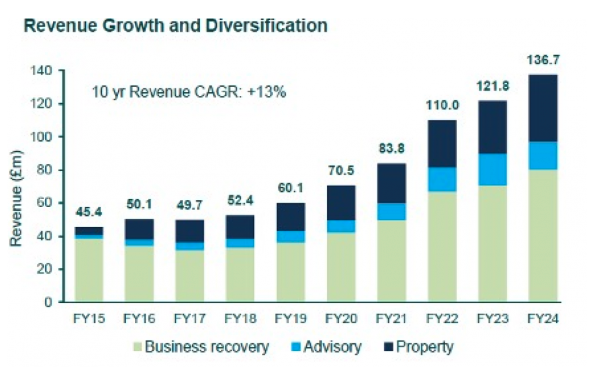

This professional services firm, which has branched out from insolvencies/business recovery to corporate finance and commercial property consultancy, announced an FY Apr trading update. Revenue is expected to grow +10% organically. Including acquisitions, the figure rises to +12% growth to £153m and adj PBT up +7% to £24m. The business had £0.9m of net cash.

History: The company was formed in 1989, and Ric Traynor, the founder, still owns 17%. They listed on AIM in 2004, at 40p per share, initially did well but fell -90% peak to trough in the aftermath of the financial crisis. I find Sharescope an excellent tool to quickly check the track record because a naïve assumption might be that this is a business that does well when the economy does badly. That’s not supported by the share price history, as through the financial crisis and the early stages of the pandemic BEG sold off heavily. Sharescope also shows profits fell from £10m in 2010 to £2.4m 3 years later and a loss in 2015. More recently, revenues have trebled in the past decade to £153m FY Apr 2025F. They now have a network of over 100 offices around the UK and 80 partners. Management have an ambition to grow to £200m, through organic growth and acquisitions of complementary professional services businesses.

Outlook: The first sentence of the RNS says revenue, EBITDA and net cash were ahead of expectations. However, Shore published a note reducing EPS by about 4% according to Leo and Mark at Small Caps Life. Equity Development also published a research note suggesting revenue growth will fall to around +5% FY Apr 2026F and 2027F and EPS is forecast to grow mid-single digits. Between 2014 and 2021, insolvencies averaged around 15K a year. In the last couple of years, that number has leapt 60% to 24-5K in 2023 and 2024. I’m assuming that the decade before the pandemic is the normal level of insolvencies, though interest rates were very low, so perhaps they will be above that level in future years and BEG could benefit.

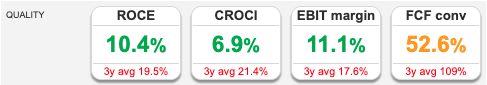

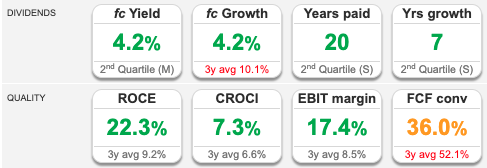

Valuation: The shares are trading on less than 10x Apr 2026F PER, dropping to 8.8x PER the following year. That equates to around 5x EV/EBITDA, so the shares don’t seem expensive. Sharescope quality indicators show that RoCE and EBIT margins have done very well recently, but in the years before the pandemic RoCE struggled to rise above low single digits, so it’s debatable how much value for shareholders the top-line growth achieved.

Opinion: When I started looking at this, I thought that the investment case on BEG might be a source of returns uncorrelated with the rest of the stockmarket. That doesn’t seem to be the case. There’s also not much evidence of operational gearing, profitability and margins seem to be at a cyclical high and may deteriorate from here. I will avoid it, though would be more positive if the +10% organic growth rate just reported was sustainable. Looking at broker forecasts, that doesn’t seem to be the case.

Notes

Bruce Packard

Bruce owns shares in SDI, CBG

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 28/5/2025 | SDI, CBG, BEG | AIM exits continue

The FTSE 100 was up less than half a percent to 8,717 over the last 5 days. The index is now flat versus the start of April, just before Trump announced his tariffs. The Nasdaq100 and S&P500 were down -2.4% and -2.6% respectively in the last 5 days. The best-performing index since the start of the year has been the German DAX, followed by the FTSE Europe ex UK, both up c. +20% YTD. The worst performing has been the Nikkei 225, down -7% YTD. Both Japan and Germany consistently run an annual trade surplus of around $70bn a year with the USA, so if anyone has explained the divergent performance of their stockmarkets please do post in the Sharescope chat.

Last week we saw bids for pawnbroker H&T (44% premium to the undisturbed price), property services group Kinovo (41% premium) and industrial chains and power transmission company Renold (47% premium). Well done to holders of any of those. There doesn’t seem to be a consistent theme of which sectors are being bid for; just that smaller companies in the UK represent good value at this point in the cycle.

The number of stocks listed on AIM stands at around 600 now, shrinking by the day and down more than 60% from the peak in 2007, according to the chart below by Allenby Capital. In 2024, there were 28 AIM companies acquired. Of those 28, 11 bids came from Private equity, and just two were from other AIM-listed companies. UK-focused funds suffered their worst-ever quarter in Q1 this year, despite the rising stockmarket. As active managers are still seeing outflows from UK funds, then Private Equity and overseas corporates are stepping in to take advantage of the situation.

Brokers are keen that eventually this structural decline in listed companies will be reversed by more IPO’s. That may be good news for brokers like Peel Hunt, Panmure Liberum and Cavendish, but less so for investors if performance is anything like the 2021 vintage. In that year, 87 companies floated on AIM raising £3.7bn, but 67 (almost 80%) of those new issues are now down more than 60% or have de-listed. Less than 10 (just over 10%) of that 2021 vintage of IPO’s are trading above their initial float price.

A final reminder that the Mello 2025 Conference will be at the Clayton Hotel Chiswick, Tue 3rd June 2025 9am – Wed 4th June 2025 5pm, then socialising in the bar afterwards. I will miss the event this year, which is a shame because David has some excellent speakers and 40+ AIM and AQSE-listed companies. Sharescope will have a stand, so come and say “hello”.

Also, a link to the Investors Chronicle annual Celebration of Investment Awards 2025. As always, we would be extremely grateful to receive your vote in the Best Investment Software/Data Provider category.

This week I look at SDI, the scientific instruments company, Close Brothers, the merchant bank with car loans mis-selling overhang and Begbies Traynor, the insolvency specialist.

SDI FY Apr Trading Update

This laboratory and scientific equipment company looks to have formed a nice bowl. I own it and am disappointed that the shares were up +15% ahead of the announcement. Investors in AIM shares need to feel confident that there is a level playing field and that insiders do not have an information advantage ahead of everyone else.

Following that +15% bounce, SDI put out a trading statement last week to say FY Apr 2025F results would be “in line” with expectations – Sales of £66.5m and adj PBT £8.4m in the footnote of the RNS. The RNS follows a weak start to the financial year, but momentum seems to be picking up and carrying through to FY Apr 2026F. The order book is “robust” following an uptick in the Feb-Apr Q4. Net debt stood at £13.8m, down from £17m at the H1 stage.

Outlook: Cavendish haven’t changed their forecasts for FY Apr 2026F, implying +11% sales and EPS growth. That looks achievable given that SDI acquired InspecVision (computer vision and meteorology, £3.2m of revenue) in Oct 2024 and Colins Walker (industrial boilers, less than £1m of revenue) in April 2025. It’s pleasing to see management mention contract wins at existing businesses Atik Cameras, Monmouth Scientific and Sentek. They say approximately 10% of revenues come from US, and they don’t think tariffs will have a material impact.

Valuation: Based on a PER of 10.4x Apr 2026F and an EV/EBITDA of 6x. For comparison, Judges Scientific trades on 20x PER Dec 2026F and 13x EV/EBITDA the same year. JDG has an excellent track record but is now 7x bigger than SDI by market cap. All else being equal, a smaller “buy and build” group should have a more attractive investment case, as there ought to be more opportunities before size becomes an anchor dragging on performance.

Opinion: This business was reporting a high 20’s CashRoCI in 2021 and 2022 as their Atik Camera’s division enjoyed a temporary benefit from PCR testing, which justified a high rating. Since then, the valuation has fallen to around 10x PER, and Sharescope’s Quality indicators have also deteriorated. I own it but should have taken profits when the share price peaked at over £2 per share a couple of years ago.

As the de-rating happened, investors were questioning whether the “build” part of the “buy and build” strategy is still working. That said, the number of shares in issue has only increased by 3% since 2022, so if management can demonstrate profitable organic revenue growth, then we could see a strong turnaround. From where we start now, I’d rather be a buyer than a seller.

Close Brothers Q3 Trading Update

This merchant bank and specialist lender has been struggling with historic Discretionary Commission Arrangements (DCAs) for car finance customers. CBG put out a Feb-Apr Q3 trading update last week showing the balance sheet is not distressed with core Equity Tier 1 standing at 14%, despite taking a £165m provision in H1 Jan. They now expect the loan book to be flat in their financial year to 31 July 2025F.

This mis-selling case was supposed to have been resolved in the second half of last year, as the FCA was expected to say whether customers were harmed and what redress those customers might receive. Then UK courts disrupted that process, the lower court had initially dismissed the (Hopcraft) claim against CBG in Sept 2023, but in October last year the Court of Appeal ruled against Close Brothers. The Court’s argument was that second-hand car dealers had a fiduciary duty to their customers – creating a potential mis-selling liability for Close Brothers. CBG has appealed to the Supreme Court (case heard in April, ruling expected in July) arguing that people’s understanding of second-hand car dealers and the existing legal frameworks are at variance with the Appeals Court decision.

Aside from the mis-selling overhang, performance seems on an even keel. Net Interest Margin is expected to be around 7%, and the bad debt ratio at 0.9% of loans is below the long-term average of 1.2%. For comparison, during the financial crisis, bad debts peaked at 2.6% FY Jul 2009. Falling interest rates should now provide a tailwind, and activity is beginning to pick up in Winterfloods, the quote-driven AIM market makers. Return on Tangible Equity was 7.4% for the group, if we adjust for the £165m motor finance provision.

Valuation: Net tangible book value stood at £8.40 per share at the end of January, so CBG is trading on 0.4x tangible book, despite the shares having bounced +42% YTD. That compares to around 1.3x for large-cap UK banks like NatWest, Lloyds and HSBC, and well below the long-term average for CGB. The Sharescope chart below showed that peak valuation was over 2x book for CGB, achieved in 2015-6 when peak RoE was 18.5%.

Opinion: I think there’s a good chance that things go CBG’s way and I own the shares. Fiduciary duty is the highest standard of care in law and means that a professional must act in the best interests of clients. It’s normally reserved for IFAs, brokers, solicitors and other professionals, rather than second-hand car dealers. Earlier in the year, the Chancellor, Rachel Reeves, took the unusual step of seeking to intervene in the Supreme Court case, suggesting that redress should be proportionate to losses suffered. The Labour Government is clearly worried about the broader economic consequences of a huge customer redress bill for banks, coming not long after Payment Protection Insurance.

In my view, bank shareholders should not have to pay for historic mis-selling that they could not have been aware of at the time – if the commission arrangements were not disclosed to customers, how could the shareholders understand the risk? Perhaps regulatory protection should consider treating shareholders fairly, not just borrowers.

Begbies Traynor FY Apr Trading Update

This professional services firm, which has branched out from insolvencies/business recovery to corporate finance and commercial property consultancy, announced an FY Apr trading update. Revenue is expected to grow +10% organically. Including acquisitions, the figure rises to +12% growth to £153m and adj PBT up +7% to £24m. The business had £0.9m of net cash.

History: The company was formed in 1989, and Ric Traynor, the founder, still owns 17%. They listed on AIM in 2004, at 40p per share, initially did well but fell -90% peak to trough in the aftermath of the financial crisis. I find Sharescope an excellent tool to quickly check the track record because a naïve assumption might be that this is a business that does well when the economy does badly. That’s not supported by the share price history, as through the financial crisis and the early stages of the pandemic BEG sold off heavily. Sharescope also shows profits fell from £10m in 2010 to £2.4m 3 years later and a loss in 2015. More recently, revenues have trebled in the past decade to £153m FY Apr 2025F. They now have a network of over 100 offices around the UK and 80 partners. Management have an ambition to grow to £200m, through organic growth and acquisitions of complementary professional services businesses.

Outlook: The first sentence of the RNS says revenue, EBITDA and net cash were ahead of expectations. However, Shore published a note reducing EPS by about 4% according to Leo and Mark at Small Caps Life. Equity Development also published a research note suggesting revenue growth will fall to around +5% FY Apr 2026F and 2027F and EPS is forecast to grow mid-single digits. Between 2014 and 2021, insolvencies averaged around 15K a year. In the last couple of years, that number has leapt 60% to 24-5K in 2023 and 2024. I’m assuming that the decade before the pandemic is the normal level of insolvencies, though interest rates were very low, so perhaps they will be above that level in future years and BEG could benefit.

Valuation: The shares are trading on less than 10x Apr 2026F PER, dropping to 8.8x PER the following year. That equates to around 5x EV/EBITDA, so the shares don’t seem expensive. Sharescope quality indicators show that RoCE and EBIT margins have done very well recently, but in the years before the pandemic RoCE struggled to rise above low single digits, so it’s debatable how much value for shareholders the top-line growth achieved.

Opinion: When I started looking at this, I thought that the investment case on BEG might be a source of returns uncorrelated with the rest of the stockmarket. That doesn’t seem to be the case. There’s also not much evidence of operational gearing, profitability and margins seem to be at a cyclical high and may deteriorate from here. I will avoid it, though would be more positive if the +10% organic growth rate just reported was sustainable. Looking at broker forecasts, that doesn’t seem to be the case.

Notes

Bruce Packard

Bruce owns shares in SDI, CBG

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.