This week Richard surveys an unusually high-quality crop of shares and takes a closer look at Nichols. The soft drinks company owns the Vimto brand and its secret formula.

Six of the 14 companies that published annual reports in the last fortnight and passed my minimum quality filter have impressive financial track records. That’s a pretty good hit rate!

|

Name |

TIDM |

Prev AR |

Holdings (%) |

Strikes |

# Strikes |

|---|---|---|---|---|---|

|

Barr (AG) |

BAG |

28/4/25 |

1.8 |

? Growth |

1 |

|

Gulf Marine Services |

GMS |

28/4/25 |

0.2 |

– Holdings – CROCI – Debt – Growth – ROCE – Shares |

X |

|

Property Franchise Group |

TPFG |

25/4/25 |

1.4 |

– Holdings ? Acquisitions – Shares |

3 |

|

EnQuest |

ENQ |

24/4/25 |

12.7 |

– CROCI – Debt – Growth – ROCE – Shares |

X |

|

Fevertree Drinks |

FEVR |

24/4/25 |

5.0 |

– CROCI |

1 |

|

Serica Energy |

SQZ |

23/4/25 |

25.0 |

? Acquisitions – CROCI – Growth – ROCE – Shares |

4 |

|

Alpha Group International |

ALPH |

17/4/25 |

1.9 |

? Shares |

0 |

|

Eurocell |

ECEL |

16/4/25 |

1.2 |

– Holdings – Debt – Growth – ROCE |

4 |

|

Greggs |

GRG |

16/4/25 |

0.0 |

– Holdings – Debt |

2 |

|

4imprint |

FOUR |

15/4/25 |

1.7 |

? Holdings |

0 |

|

Bodycote |

BOY |

15/4/25 |

0.2 |

– Holdings – Growth ? ROCE |

3 |

|

Central Asia Metals |

CAML |

15/4/25 |

1.2 |

– Holdings ? Acquisitions – Growth – Shares |

3 |

|

Genuit |

GEN |

15/4/25 |

0.1 |

– Holdings ? Acquisitions – Debt – Growth – Shares |

4 |

|

Science |

SAG |

15/4/25 |

21.5 |

– Growth |

1 |

Sweet six

4Imprint [? Holdings], the direct seller of promotional goods has a tremendous financial track record.

Promotional goods are freebies (like T Shirts, and USB sticks) given to employees, suppliers and customers, printed with corporate logos and messages. The shares have taken a beating lately because of the potential for tariffs to increase the cost and reduce the appeal of its products. It sources the majority of revenue in China and earns 98% of it in the USA.

I own shares in 4Imprint and will be writing up the long-term investment case soon here.

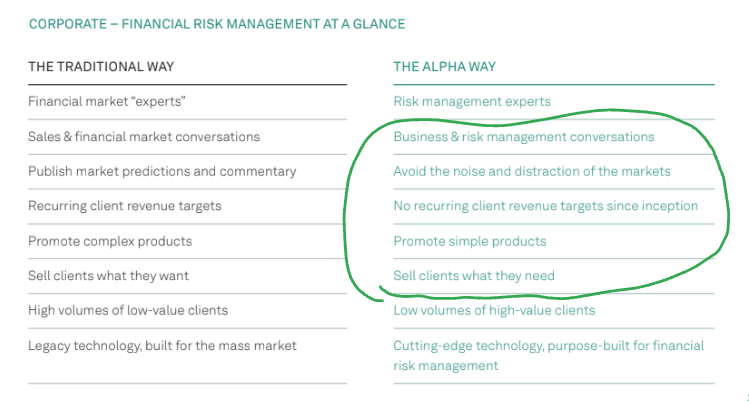

Alpha Group International [? Shares] also has an extraordinary track record. It manages currency risk for businesses and investment funds. The annual report explains why it fulfils the needs of these customers better than rivals.

I have always steered clear of financials, so Alpha is outside my sphere of competence. The emphasis on not milking customers for all they’re worth really appeals though.

Source Alpha Annual Report 2024

Bruce Packard and Michael Taylor’s accounts of Argentix’s recent demise are salutary though. Argentix is another currency hedging business that blew up a couple of weeks ago.

Bruce and Michael inspired me to search Alpha’s financial report for mention of zero-zero margin trades, which may have been the doomsday machine at the heart of Argentex. I couldn’t find any.

Alpha has buyers. Last Tuesday it received a takeover offer from Corpay, a large US-listed payments company. Alpha’s board rejected it.

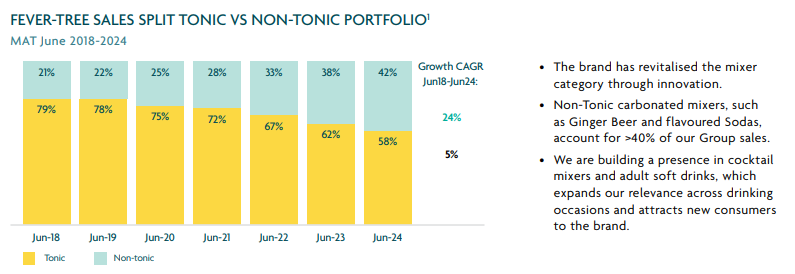

Fevertree [- CROCI] is not as profitable as it used to be and growth has all but stalled. However, with one strike to its name, it is still a candidate for investment if we can gain confidence the direction of travel will reverse.

The company, whose main product is tonic water, made its name during the “ginaissance” of the 2010s when the UK rediscovered its love of gin. Since then, the slowing growth of tonic sales, Feavertree’s main product, has encouraged it to diversify.

Source: Fever-Tree Annual Report 2024

Innovation of new mixers and drinks, and the cultivation of overseas sales, has no doubt come at a cost. Perhaps we should regard that cost as an investment in developing a more rounded business.

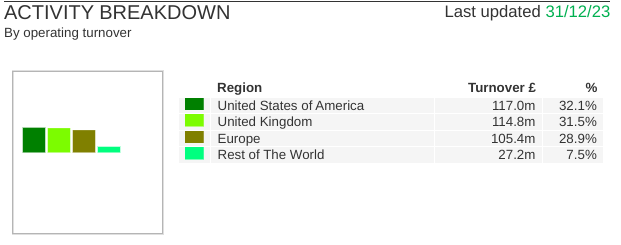

Today 42% of sales are non-tonic, compared to 21% in 2018, and Fever-Tree earned less than a third of turnover in the UK.

Source: ShareScope

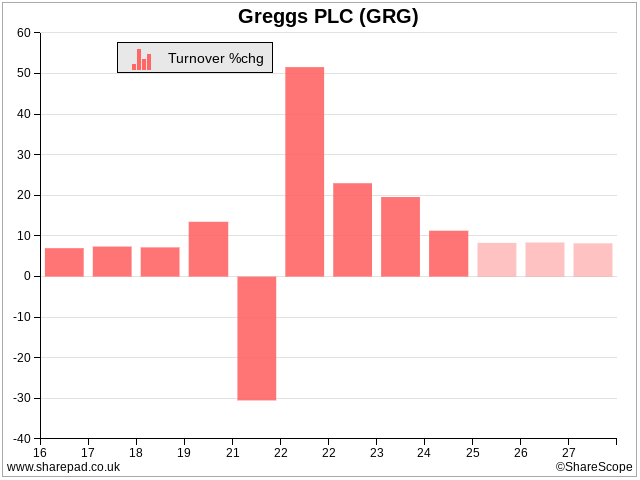

Greggs [- Holdings – Debt] is the ubiquitous sausage, pasty, doughnut and coffee chain. The big obvious objection to investing in Greggs is its ubiquity. Slowing growth could mean the UK has reached peak sausage roll after a period in which the company expanded from the high street into stations, motorway services and airports.

It’s difficult to imagine the format having appeal in overseas markets although reportedly a small team from Greggs were examining the possibility in 2023. It pulled the plug on a small Belgian operation about 15 years earlier.

The last time I caught up with Science [- Growth], a science and technology consultancy, I predicted it would pass the 5 Strikes test. It did, although turnover declined modestly in 2024 after strong growth in 2023.

Science is growing by acquisition. Acquisitions are probably a cheaper way to grow than recruiting more scientists and technicians directly. They have also brought Science products and systems, businesses it may be able to scale more easily and organically.

The company’s recent investment in Ricardo, a venerable listed consultancy that does not pass the 5 Strikes test, suggests Science is becoming even more ambitious.

The company has requisitioned a general meeting where it proposes to replace Ricardo’s chairman. Beyond that, it hopes to foster a turnaround plan or get the company to put itself up for sale.

Given Science’s history, it would probably be a buyer at the right price, though the company admits Ricardo’s other major shareholders might find that price too bitter a pill to swallow.

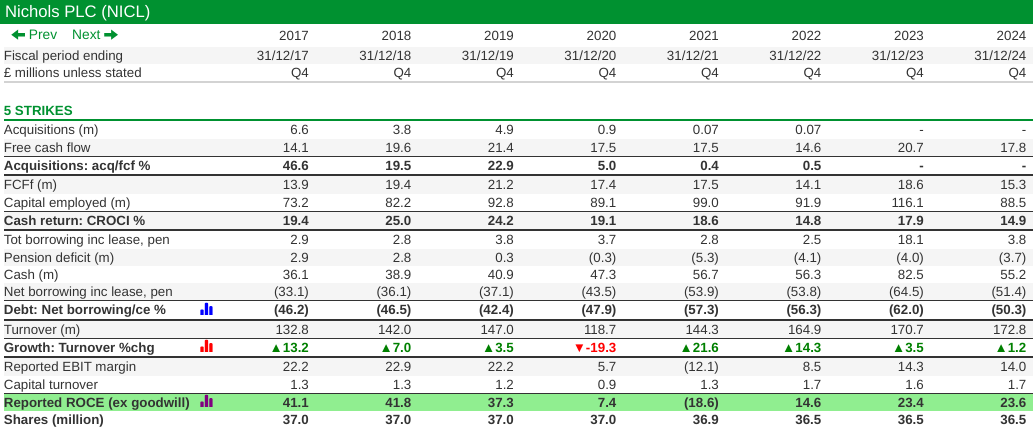

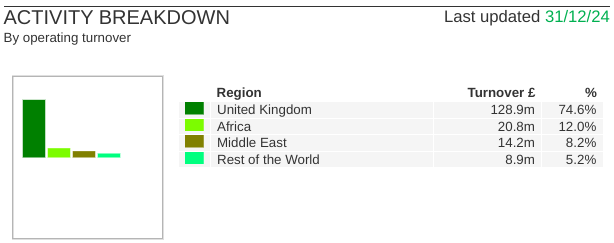

Catching up with Nichols

I promised to take a closer look at Nichols a fortnight ago. It is one of the shares that has achieved no strikes this year.

Nichols’ strong results may bear out my conclusion reached in 2020, which was reaffirmed last year that when it sticks to doing what it does best, marketing Vimto, it performs best. Subdued turnover growth in 2024 is partially a result of the company exiting unprofitable contracts in its Out-of-Home business, which supplies the hospitality industry with soft drinks brands.

My Big Obvious Objection to Nichols is the product. I don’t like soft drinks. They’re marketed as healthy and hydrating but soft drinks are ultra-processed foods that make us less healthy.

Nichols is proud of the fact that 99% of UK own-branded products are lower or no added sugar which is sufficient to exempt them from the Soft Drinks Industry Levy (the UK’s sugar tax).

52% of products sold in 2020 had no added sugar but that still left 48% with added sugar. Even no added sugar drinks contain extracts and concentrates, that contain sugar, and non-sugar sweeteners (NSS), specifically sucralose and acesulfame-k.

Although NSS have been thoroughly tested and declared safe by food regulators, that does not get sweeteners the hook entirely.

In 2023, The World Health Organisation advised against substituting sugar for NSS claiming a systematic review of the evidence shows they do not help with weight control over the long term.

It said: “NSS are not essential dietary factors and have no nutritional value. People should reduce the sweetness of the diet altogether, starting early in life, to improve their health.”

The notion that excessive sweetness has accustomed us to sweet foods dovetails with my own experience.

Nichols may well be leading the way in sugar reduction. It talks a good game, but if sweetness rather than sugar is the problem, I cannot imagine the company unilaterally reducing it. One of its marketing slogans is “In sweetness is our togetherness”.

If you have a sweet tooth for soft drinks makers, though, you may be reassured by a recent trading update from Nichols. The company says its direct exposure to the markets most affected by tariffs represents less than 2% of total revenue.

Most of its revenue comes from the UK, Africa and the Middle East.

Source: ShareScope

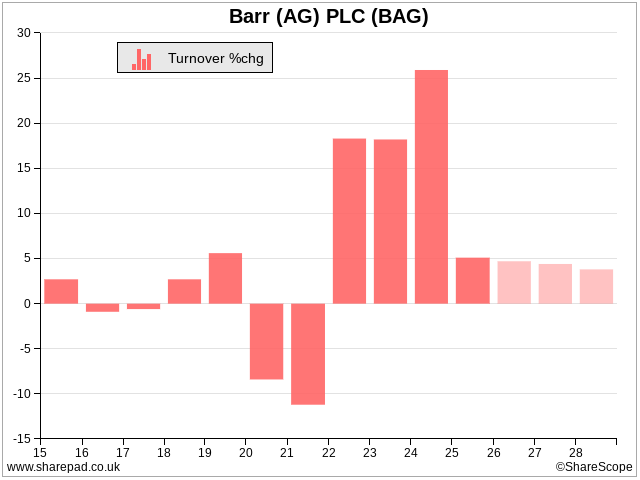

AG Barr [? Growth], another soft drinks company famous for Irn Bru, is also too sweet for me. The only strike in its financial track record is inconsistent growth. Turnover was growing very slowly before the pandemic and I would need to investigate why that was to gain confidence in the future.

Barr is in discussions to sell Strathmore, a spring water brand.

~

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the Sharescope chat. Login to Sharescope – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.