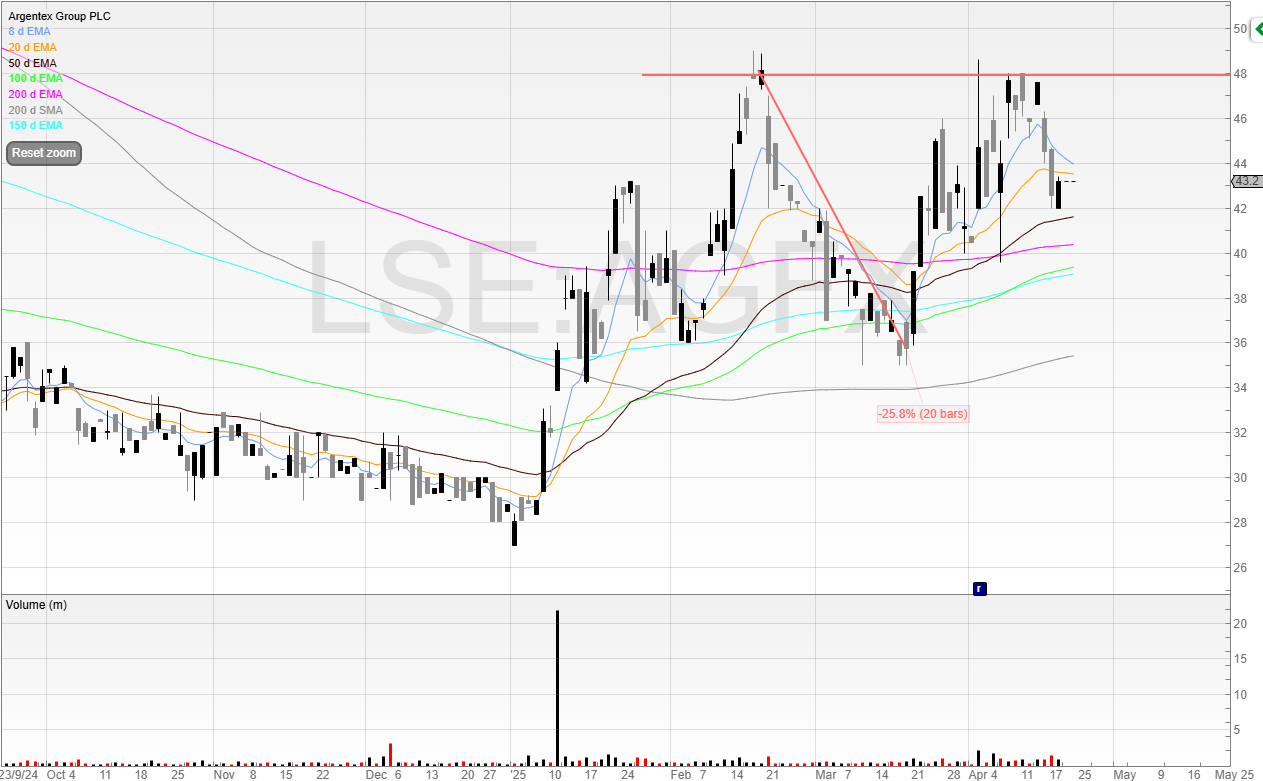

It’s gutting news for Argentex shareholders as earlier this week the business announced that it had suspended trading as a result of its financial position.

The latest is that the company is in “advanced discussions” with IFX Payments regarding a possible offer at 2.49p per share for Argentex stock.

Given that the last traded price was 42.64p, this is a 94.1% drawdown.

It’s also one that I narrowly avoided through sheer luck.

Had the price broken out, it’s likely I would’ve been long too.

What is surprising here is that the company has managed to mess up so badly.

Argentex Group is a UK-based financial services firm specialising in foreign exchange (FX) services and currency risk management for corporate, institutional, and high-net-worth clients.

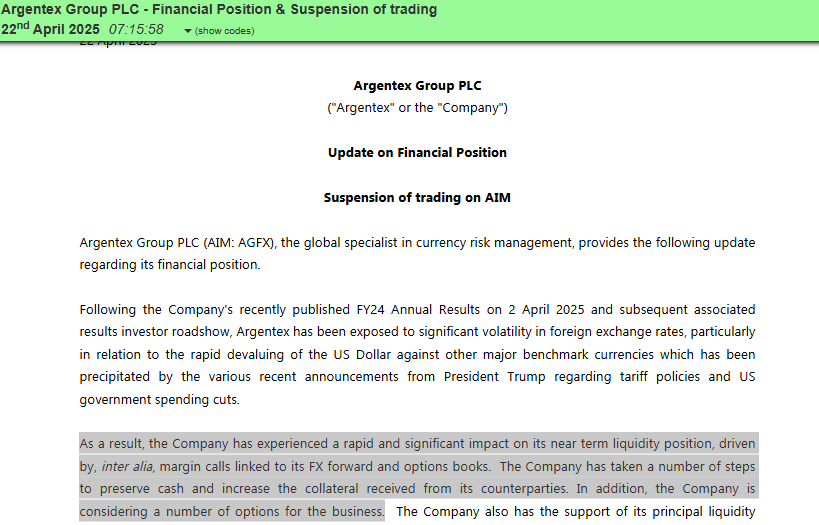

The company is saying that the rapid devaluing of the US dollar has exposed the business to significant volatility.

You’d imagine that, this being their job to manage risk and volatility, that it wouldn’t affect them, but something has clearly gone wrong.

And whilst it doesn’t mention losses, it does talk about margin calls linked to FX forward and options books.

This can happen when volatility spikes, prime brokers want more margin upfront.

And if you don’t have it, you can then be forced to close the position regardless of P&L.

For example, let’s say to put on a trade of £20,000 in Vodafone, you only need £4,000 upfront to place the trade.

But if your broker then suddenly said they needed another £4,000 to put up against that £20,000 position in Vodafone, which is what is known as a margin call, then if you don’t have it, you’d be forced to close the position.

This is what looks to have happened with Argentex.

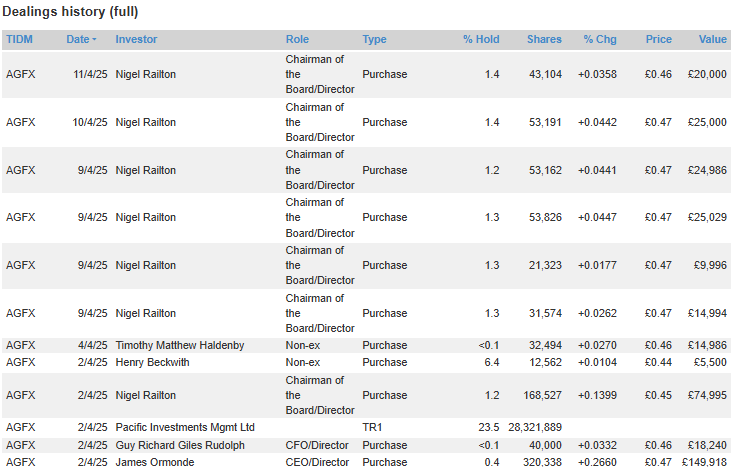

What is more surprising is that the directors appear to have had no clue.

All of these buys came after the company put out better-than-expected results on 2 April 2025.

Directors only buy for two reasons:

1) A bit of PR

2) They think the stock will rise

Therefore, to me, it seems as if the management were just incapable of doing what they were supposed to do.

I personally don’t believe any shareholder can blame themselves here.

Losses are an occupational hazard and they’re unavoidable.

And if you position size for every position to go to zero – because one day it will – then whilst this is unpleasant news it shouldn’t be enough to wipe you out of business.

Risk management is absolutely key for traders and it’s the only way you can protect yourself.

Understanding Risk Management

At its core, risk management involves identifying, assessing, and mitigating potential losses in trading activities.

You can never eliminate risk. That’s impossible.

But we can control it to ensure that no single trade or series of trades can decimate your account.

Firstly, there is risk per trade.

This is determining the percentage of your capital you’re willing to risk on a single trade.

I suggest you keep this small (1%) and scale down when losing.

You can use my position size calculator here in order to adjust your position size for risk and keep risk constant.

There is also the risk-reward ratio.

There is no point risking 1 to make less than 1, in my opinion. That means you need to be right a lot more than you are wrong in order to compensate for the reduced gains.

Better to have a risk-reward ratio of at least 1 to make 1.5. If you’re then only right 45% of the time – you’re still making money.

The Significance of Position Sizing

Position sizing determines how much capital to allocate to a particular trade.

We get this by adjusting our position size for risk as seen in my calculator above.

When the account is in drawdown, you must scale down.

If you risk 1% then you can face 100 losses before your capital is blown.

However, if you scale down to 0.75% and 0.5% as you hit certain drawdowns, you dramatically increase your run rate.

I’ve never seen a trader go bust due to small losses.

There was unexpected volatility and large position sizes every single time.

Too many traders try to make too much too quickly and end up giving plenty of their accounts away to the market.

And if you’re doing 50%, then you need to gain 100% just to get back to breakeven.

This is why risk management and position sizing is the most important thing.

Argentex is a stark reminder of why.

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.