Michael looks at recent events and the importance of protection.

Well, it turns out China wasn’t big enough to bully Trump into submission. But the bond market was.

As my Grandad once told me… there’s always someone bigger.

And in this instance, US Treasury Bills are far bigger than any President.

The Federal Reserve doesn’t technically need people to hold Treasury Bills.

But the US government does, and the Fed plays a big role in making sure everything runs smoothly.

Here’s why…

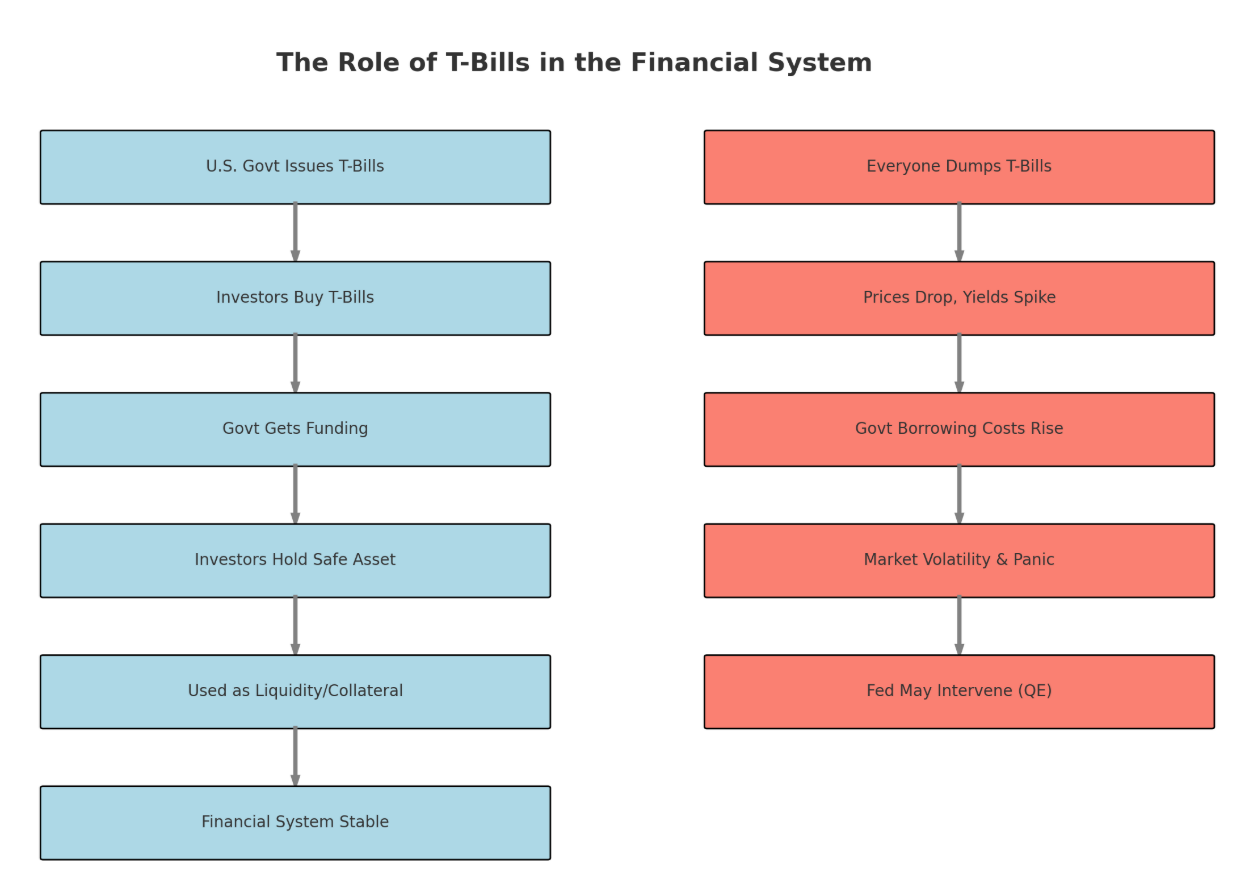

Treasury Bills (or T-Bills) are a way of funding the government in deficit (it spends more than it collects in tax revenue) by raising cash. Investors will buy these securities in exchange for the US government to pay them back with interest.

They’re a cheap way for the government to raise money, too, and the more demand there is for T-Bills, the lower the yield the government has to offer.

T-Bills are often considered “risk-free” because they’re backed by the US government. It sets the baseline for all other interest rates. So long as people are happy holders of T-Bills, then the financial system is stable.

But what if everyone dumps T-Bills?

Well, interest rates spike.

When selling pressure takes hold, yields on T-Bills rise. This means that borrowing costs go up for the government and interest rates go up, affecting mortgages, loans, and credit cards.

Plus, T-Bills are widely held by financial institutions, hedge funds, as well as foreign central banks. And if the price collapses, balance sheets take a hit. This can see liquidity dry up and the triggering of a broader market crisis.

It’s likely that many institutions were selling Treasuries as it’s a low risk and liquid asset in order to move into cash and protect themselves, as well as stem losses as prime brokers increasing their margin requirements on positions.

Finally, and perhaps more importantly, if investors lose faith in US debt, which is effectively what a spike in yields means, then it undermines the entire financial system as T-Bills are widely considered the safest asset.

This can sometimes see the Fed intervene, as it did during 2008 and 2020, where it prints money to buy US debt to stabilise the market. This is known as quantitative easing, or QE.

Now, as T-Bills were spiking, Trump was in danger of the whole system creaking and breaking.

And so the 90-day tariff delays came in, providing the best day in the S&P 500 since 2008.

Scott Bessent said that the President’s blinking and pausing was “art of the deal perfect execution”.

Let’s see if this is the case, but the reality is it could be ‘art of the squeal’.

The new leaders will reveal themselves

Almost all of my positions are gone due to stop losses.

It’s entirely possible stocks go higher without me in them. But I’m not big and tough, and nor am I going to fight against the market.

If I lose my capital, then my trading career would be over, and I would need to find a job and build up my capital again. Therefore, removing the risks of blowing your account has to come first for any trader. Look after the downside, and the upside will take care of itself.

Lots of bases have been smashed, and charts are tanking.

That means fewer stocks appearing on my filter and less action overall unless you’re scalping.

It would be tempting to pack up the screens and stop doing the work.

But when times become testing, amateurs pack up, and the people here to win go to work.

Now is absolutely the time to be waiting for the new leaders to emerge.

One thing is for sure, this market pullback will present lots of new opportunities in the coming bull run.

It’s easy to be despondent, but in the long run, crashes are normal.

Here’s the FTSE All-World zoomed out.

We can see the troughs in 2008, 2020, the long and drawn-out bear market in 2021 and 2022, and this new breakdown in 2025.

Whilst it’s never guaranteed, the market always bounces back.

For traders, this means there will always be breakouts and stocks to trade, so long as you don’t blow up.

And whilst the investing landscape has changed forever in my opinion, as tariffs are going to reduce global trade and damage investor confidence, betting on capitalism has historically been a good bet.

Stick around for the bad times, and you’ll be rewarded in the good.

As always, keep your risk tight and be sensible.

~

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.