“When a man is tired of London, he is tired of life.” Or so said Samuel Johnson back in 1777.

Back in that time, high mortality rates and the disgusting living conditions suppressed the birth rate and life expectancy of native Londoners, and so the city grew only because of new migrants who replaced the dead.

London is now much more appealing. Crime is high, and it’s not perfect, but sadly, nothing ever is.

That is certainly the case with the London Stock Exchange. Originally starting in Jonathan’s Coffee House in Exchange Alley, it saw the South Sea Bubble and the panic of 1745.

Today, the London Stock Exchange Group owns the stock market it is traded on, Refinitiv, LSEG Technology, and in 2007 acquired the Milan-based Borsa Italiana (sold to Euronext in 2021). It almost merged with Deutsche Börse in 2016 and became a bid target for Hong Kong Exchanges and Clearing in 2019.

And whilst the London Stock Exchange has become a global financial centre, if nothing changes, then within 10 years it will be finished.

In 2024, the London Stock Exchange saw big changes. Specifically, 88 companies either delisted or transferred their primary listing from the LSE’s main market, marking the highest exodus since the 2009 financial crisis. This trend was influenced by factors such as declining liquidity and lower valuations in London compared to other markets, prompting some companies to seek listings in markets like the United States, which offer deeper capital pools and higher trading volumes.

If that wasn’t enough, takeovers contributed further to this decline, with around 45 companies delisting for this reason, the highest number since 2010.

Overall, the LSE faced a net reduction in listed companies, with only 18 new listings in 2024, resulting in a net loss of 70 companies from its main market.

In 2025, this doesn’t look to be changing.

What can be done?

Simplifying and modifying listing regulations would be a good start. Nobody likes red tape, and the danger of having too loose regulation means that the quality of companies overall goes down. Look at AIM and all the garbage that lists there.

But making it easier and cheaper to list would be a good start.

Secondly, removing the 0.5% Stamp Duty on share transactions for companies listed on the main market would be great. You can get around this using spread bets and CFDs, but the commissions for these products, not to mention the financing fees, can be high. Anyone buying shares in an ISA will pay 0.5%, and this adds up on regular share purchases.

The government should want investors to buy and sell shares. Why not make it easier for them?

Much has been said about encouraging domestic investment. I’m all for this, but forcing people to allocate a certain amount of capital to UK equities is a silly idea. Just like with the British ISA, this was very easy to get around. Simply reduce your UK exposure elsewhere by £5,000, and use the additional £5,000 in the British ISA to get the same effect.

This idea has now, of course, been binned.

Reducing taxes for businesses would be a great start. The new employer’s National Insurance starts in a few weeks, and business owners are already claiming it will add on additional costs, inevitably forcing some to close. It may not be a direct tax on the taxpayer, but we will all shoulder the cost.

UK entrepreneurs are leaving the country if they can. Some would leave regardless of the tax, as paying little to no tax will always be more attractive, but the reality is the more you tax people the more incentivised they are to avoid it.

And whilst AIM doesn’t need more junior miners or speculative ideas far from ever switching on the revenue taps, the reality is it needs new listings and new businesses.

Whether anything is done, we will see.

Layering the puke

The Puke trade is what I call taking the other side of capitulation.

It’s a high-risk trade, and not a common one, but it relies on sharp price movements into a key level.

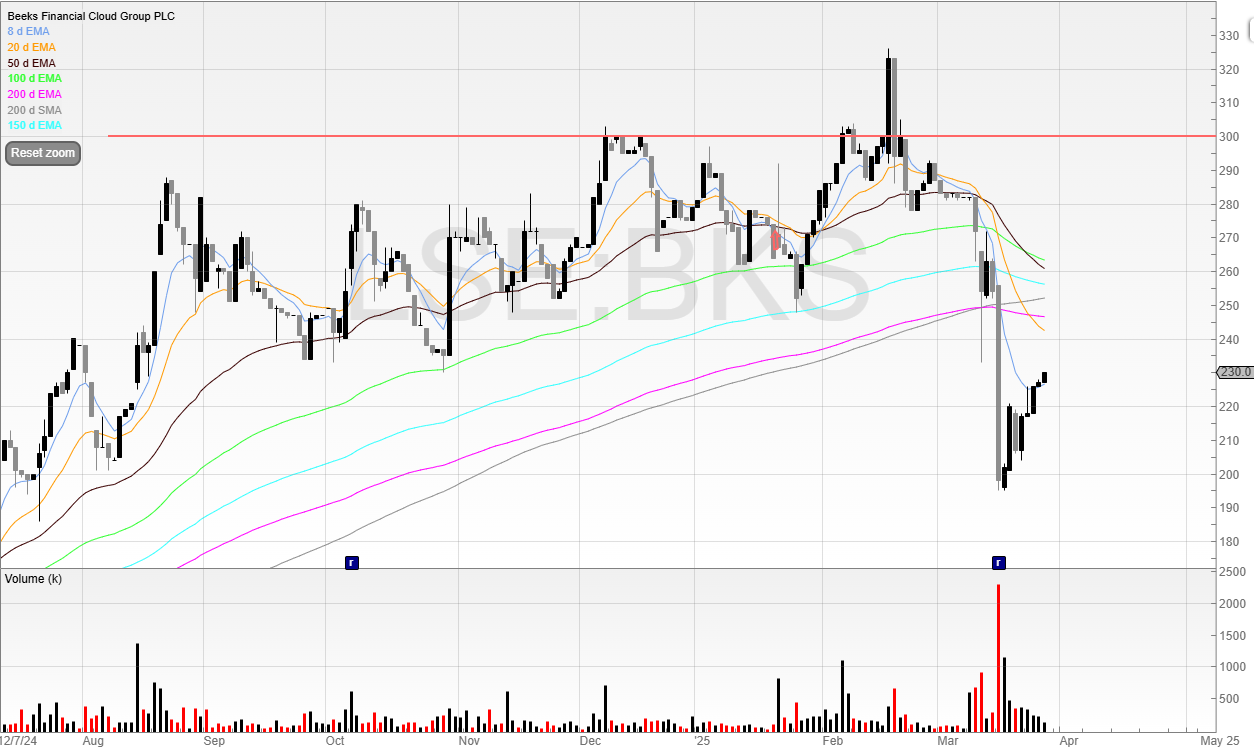

Look at Beeks Financial Cloud (BKS) below.

I’ve been stopped out of BKS now during this fall, but notice how the stock tested the Big Round Number of 200p and rallied.

This was the puke point, where the last longs fold and the price reverts to the mean.

To play this, I should’ve gone long just below 200p.

This would’ve meant I could take the opposite side to the capitulation, but exit swiftly if 200p didn’t hold.

Unfortunately, I didn’t, but in hindsight it would’ve been a nice trade.

However, not all stocks test underneath the key level.

To get around this, we can layer our entry.

By splitting our position into three mini positions, we can increase the chances of getting filled whilst keeping the risk down.

1/3 @ 205p

1/3 @ 200p

1/3 @ 195p

Whilst this would’ve cost three sets of commissions, we would have an average of 200p and be in the trade from 205p. So if the stock didn’t test below 200p, we would have a small position.

We could’ve also positioned so that our average was lower.

1/3 @ 205p

1/3 @ 195p

1/3 @ 190p.

This would’ve given an average of 196.67p – a few pence below the BRN.

Could Evoke (EVOK) be another one?

It’s collapsed into the 50p level, which hasn’t been seen since 2012.

Let’s look closer.

I would not want to stick around for long.

The Puke is a high-risk trade, and you must trade it with a tight stop.

Evoke’s news wasn’t taken well, and the shares have fallen nearly 30 percent in two sessions.

The balance sheet is a wreck, and I consider this stock an absolute dog.

But that doesn’t mean there couldn’t be a quick trade on capitulation.

Just use a tight stop, and nothing you can’t afford to lose.

~

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.