A look at Rory Sutherland’s idea of “slow intelligence”, and if it makes sense to make processes less efficient. Companies covered: RNWH, BBSN, FEVR.

We’ve seen significant volatility over the last couple of weeks, first with Nvidia’s reaction to DeepSeek’s AI model then Donald Trump’s tariff announcements. After all that, the FTSE 100 ended flat over the last 5 days at 8,542. The Nasdaq100 and S&P500 were also largely unchanged (less than 0.5% variance) although they exhibited considerable volatility. The best performing commodity has been coffee (KT-FM) up +9% over the last 5 days while Cocoa (CJ-FM) was the worst -3%; presumably if Valium and Olanzapine were quoted on the commodities market, we would have seen some volatility there too.

Given all the fuss about Nvidia and DeepSeek’s R-1 model, I thought this 30 minute Rory Sutherland talk about “slow intelligence” was relevant to investors. There’s good psychological insight in the marketing man’s observation that we are overvaluing “instant information” over “slow knowledge”. Please do watch the whole thing, but if you are too impatient (!) then jump to his conclusions. For instance, what we learn at university is not what to think, but how to think – investing effort to understand ideas. I agree, for instance: I used to find working at investment banks, that people with a mathematics or history degree, not directly relevant to the financial world, had significantly more insight into what was really going on, than colleagues who had studied economics at university.

Rory suggests that AI might be able to produce good adverts, but it will short cut the thought process, which is valuable in itself. “Forcing you to ask questions about a business that mostly people never get around to asking”, he says. One of my favourite books is Guy Claxton’s Hare Brain, Tortoise Mind, which was published almost 30 years ago and contains similar ideas.

When making investment decisions, I often do the work, using Sharescope’s filters, reading the RNS’s, listening to management presentations. Then I wait a few weeks or even months, to see if I might have missed something. There are things in life that you want to streamline and make more efficient. However, there are also things where the value lies in the inefficiency, the pain endured, the effort invested. So he ends with the question: “What does slow AI look like?”

This week I look at Renew Holdings profit warning and also Brave Bison, the marketing firm’s update. But I start with Fever Tree, a company that I’ve been pondering for a while, but was fortunate enough to invest a couple of days before last week’s announcement, which saw the share price jump +20%.

Fevertree Drinks strategic partnership

The tonic and alcoholic mixers company has struggled in recent years as it first warned on margins due to higher glass prices, then revenue disappointed in the UK and Europe. However, the shares jumped +20% last week when they announced a strategic partnership with Molson Coors, which will license exclusive sales, distribution and production of Fevertree in the US. The RNS says that there is

- A profit-sharing arrangement, with royalties paid by Molson Coors to Fevertree.

- Some annual profits attributable to Fevertree are guaranteed for the period from 2026 – 2030.

- Both Coors and Fevertree agree to “substantial” marketing spend on the brand.

Coors also bought 8.5% of FEVR, paying no premium to the “price on the screen” of 654p. Fevertree are issuing equity to the Canadian company, but then to prevent their existing shareholders being diluted, Fevertree will then buy back £71m of shares, beginning this month. Molson Coors are also buying Fevertree’s US subsidiary (Fevertree USA Inc) for $24m in cash, though the brand’s Intellectual Property continues to sit within the UK group.

Outlook: There was also a trading update at the bottom of the RNS, which looks like a mild profit warning, with revenue falling in the UK -4% and -2% in Europe. Growth in the US was +12% on a constant currency basis. Management now expect low single digit revenue growth for the group (Sharescope shows previous expectations were +6%) and a hit to EBITDA.

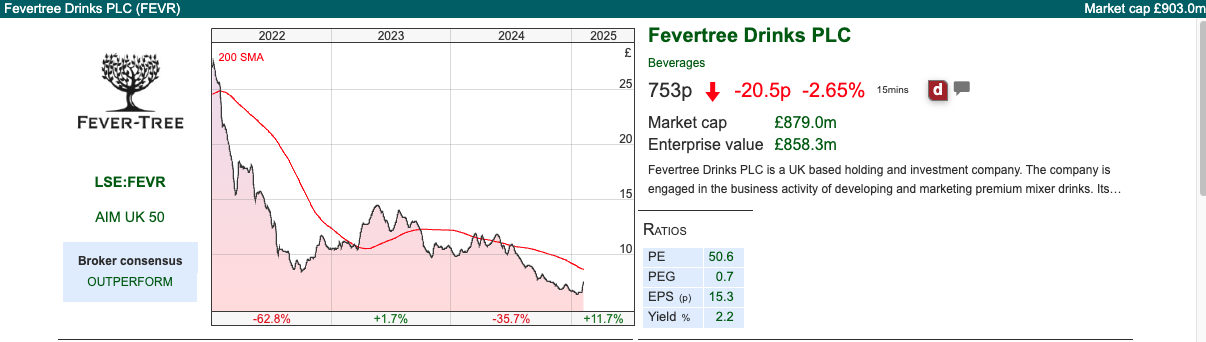

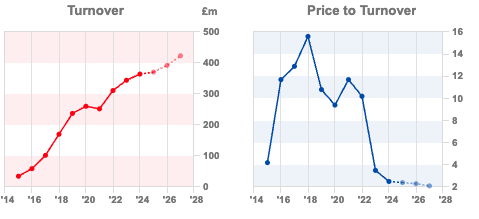

Valuation: Readers can see above the huge de-rating since 2018, when the shares traded around £40 per share and 16x turnover. The shares still look expensive on over 20x PER Dec 2025F and 2026F, though the price to turnover has dropped to around 2x forecast sales. I bought some earlier in January, because I felt that expectations were now realistic, and might even surprise positively. The most recent RNS doesn’t mention cash, but at the end of June FEVR had £66m of net cash or 8% of the current market cap. Management said on the call that the partnership with Molson Coors should be positive for working capital strain, so there’s potential for further capital returns to shareholders in future.

Opinion: My first reaction looking at the announcement was “why have they structure the deal this way?” – on reflection though I think no one loses out. Coors is able to buy shares in FEVR without paying a premium, but the buyback means existing shareholders see the price rise and are not diluted.

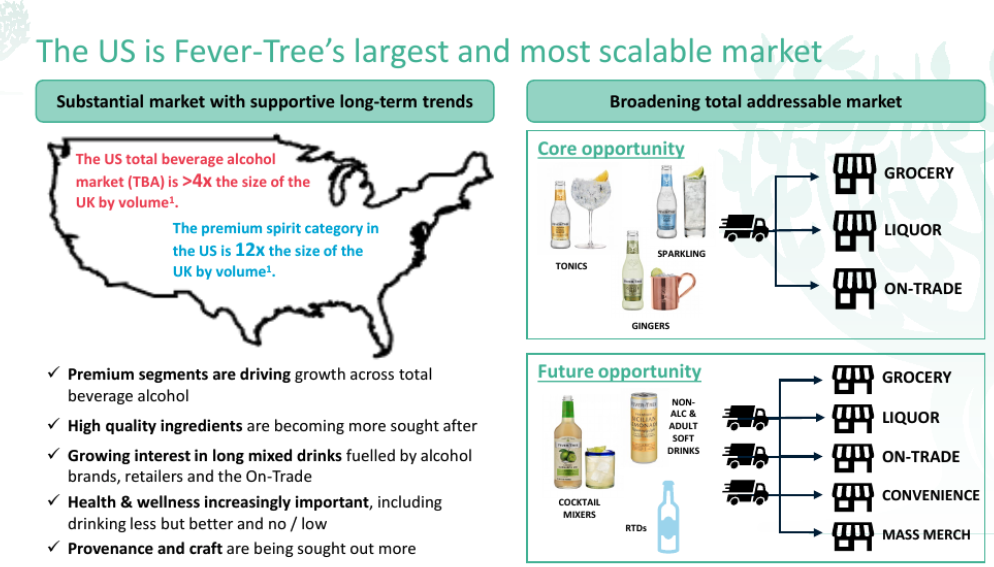

Fevertree has consistently delivered strong growth in the US and has become the number one tonic and ginger beer brand across America, so the US is Fevertree’s largest revenue generator. It does strike me as odd that they needed to sign this partnership agreement. As the US business has been doing well, shouldn’t management be focused on markets closer to home (UK and Europe), where growth has been disappointing in the last few years? Putting those concerns aside, as someone who bought earlier in January, I’m happy that the share price seems to have formed a bottom and hope the brand can regain its fizz.

Renew Holdings Profit Warning

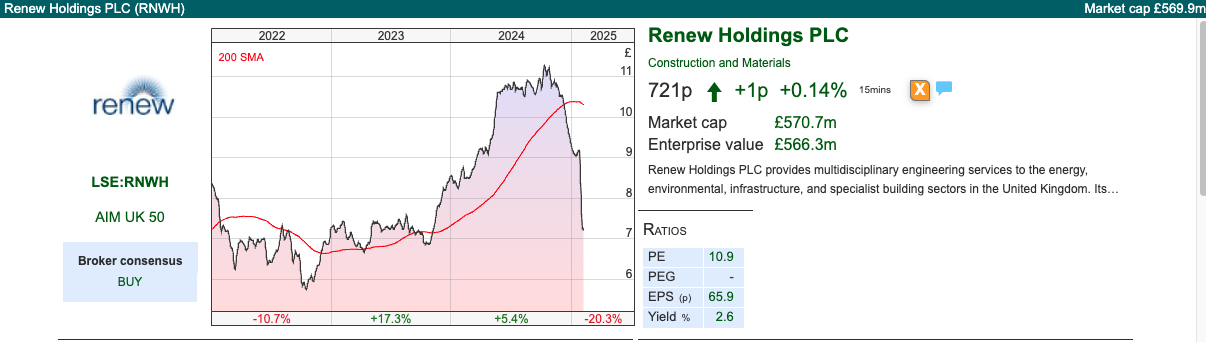

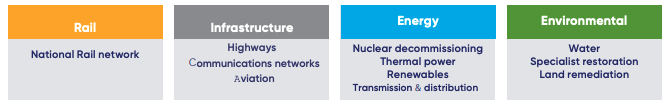

This engineering services company, with a September year-end, that does maintenance and renewal of critical UK infrastructure (rail, communication networks, energy, including nuclear and windfarms) had been a very strong performer, rising 37x from 2010 to October last year. Then the wheels began to fall off.

Network Rail has a maintenance budget of £32bn, and RNWH is the network’s largest supplier of maintenance. Renew benefits from regulation demanding that assets are well maintained, much of the spend is non-discretionary and management have long-term visibility of committed funding.

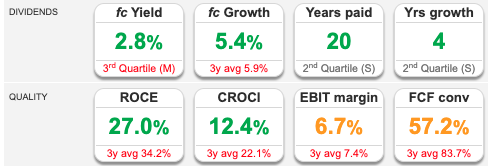

But it looks like something has gone wrong; the shares first sold off in November last year when the group warned in the FY Sept 2024 results that spending in the new rail control period had been slower than they would have expected. Worth noting too that net cash fell by £10m to £26m Sept 2024, from a year earlier. That’s driven by working capital movements, but also paying £15m of dividends, £30m of acquisitions and £19m capex. Sharescope says FCF conversion is 57%, down from the 84% 3-year historical average.

Inevitably, the first bullet point of the cash flow bridge in the analyst presentation is “strong cash generation” (red annotations are mine).

Then management announced a trading update at the end of January, which again warned that activity in Rail had been disappointing. The shares have fallen around -40% from their peak in October last year.

Management points to the latest Rail Control Period (RC7) which has just begun, and runs from 2024-2029 and says, having operated through previous Control Period transitions, they believe the problems are temporary and will normalise through the investment cycle. Management don’t seem to report divisional p&l, so it’s hard to know how much of the business is Rail.

Balance sheet: Net cash of £25m in September 2024 consisted of a gross cash balance of £80m, less a Revolving Credit Facility (RCF) with the bank of £52m, and a small discontinued liability. The upper limit of the RCF, which runs to Nov 2026, is £120m. The company has grown by 11 acquisitions over the past 14 years, so intangibles represent £195m, or 95% of shareholders’ equity. The nature of the business means that trade and other receivables stand at £183m, versus revenues of over £1bn. There’s a “key audit matter” discussing revenue recognition, as some of those receivables relate to multi-year performance obligations, two contract types are highlighted as risks: i) Reimbursable/Target Cost contracts which aim to share pain/gain of achieving targets ii) Fixed Price Contracts which involve a percentage completion assumption. That said, Sharescope’s financial health indicators (Altman Z and Beneish M) give it the thumbs up.

In summary, the balance sheet is not as strong as management claim, but in better shape than Carillion, which operated in this sector and got into trouble with dubious accounting for multi-year contracts that were uneconomic to service. This is worth keeping an eye on though, and could explain the steep sell-off as investors sell first and ask questions later.

Valuation: Following the profit warning the shares now trade on 10x Sept 2026F PER. EV/EBITDA is 6x the same year, which is low for a company that has (until recently) enjoyed such a good track record.

Opinion: This is a low-margin business with high RoCE, so effectively the model relies on high asset turnover, (that is generating high revenue compared to the amount of capital employed.) That’s not necessarily a bad business model (supermarkets do the same), and RNWH’s track record shows that it has been very successful for a decade and a half.

However, when things go wrong they can be harder to fix than high-margin businesses. I would suggest revisiting in 6 to 12 months time – there are many good businesses on AIM trading on knockdown valuations at the moment – so I’m not rushing to buy this. Hopefully, management are correct and the disappointing rail activity is just a temporary blip, however, there’s a chance these warnings are a sign of broader problems.

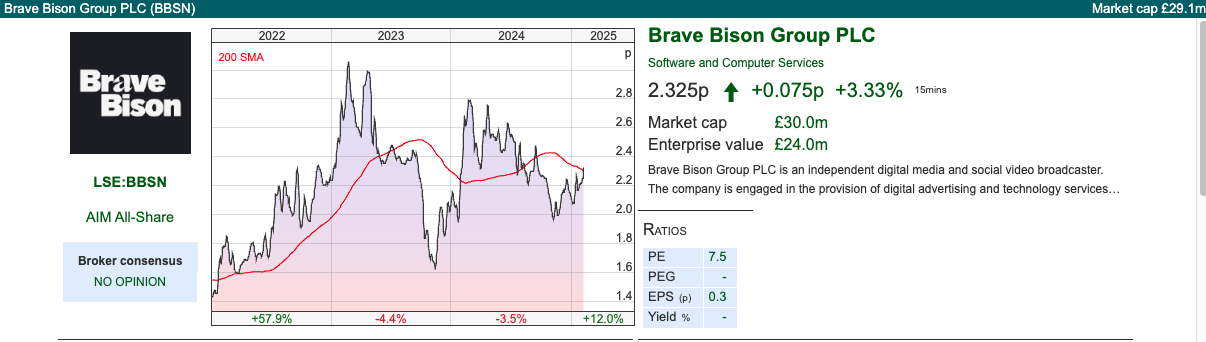

Brave Bison FY Dec ahead of expectations

This digital media and marketing company announced FY Dec 2024 net revenue up +2% to £21.3m, slightly ahead of expectations. FY Dec 2024 Adj PBT was up +8% to £3.9m (versus previous expectations of £3.7m). I see that Cavendish were forecasting adj PBT of £3.6m at the time of the H1 Jun results, which the board said they expected to exceed, so this “ahead of expectations” may have been announced twice.

BBSN made an opportunistic approach to The Mission Group in May last year, suggesting an all-share deal. However, this was rebuffed by TMG management, probably rightly as the deal valued TMG at 35p, versus a current valuation of 31p, now TMG have fixed their balance sheet. Brave Bison does have £7.5m of net cash and they talk about a “Platform for M&A” in their H1 analyst pack.

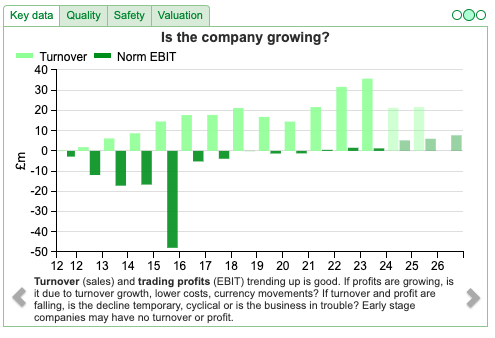

The group helps clients like New Balance and SharkNinja to buy digital advertising on Google, Meta, TikTok, Amazon and YouTube, as well as providing search engine optimisation and digital PR services. The business was originally called Rightster and listed on AIM at 60p in 2013. From that time the business struggled for profitability and the share price fell -90% in the following years – see the chart above for a huge £52m loss in FY 2015. More recently new management Oli (Exec Chair) and Theo Green (Chief Growth Officer) have managed to turn things around. They are brothers and sons of Michael Green (Carlton Communications). Net revenue has increased 4.3x since FY Dec 2020, with the group growing organically and by acquisition. They own 19.5% of the shares, I notice that the largest shareholder is Lord Michael Ashcroft, with 25% of the shares and Dr Graham Cooley, previously of ITM Power, holds 3%.

The business has grown by acquisition, so there were £12m of intangibles versus shareholders equity of £20m in Jun 2024. BBSN bought Social Chain, Steven Bartlett (of Dragon’s Den fame) start-up. Since then management have bought Engage Digital Partners, a specialist sports marketing and fan engagement.

Valuation: The shares are trading on a PER of 8x Dec 2025F, not expensive but a premium to below 6x which is TMG’s and SFOR’s multiple the same year. BBSN does seem to have more capable management and a stronger balance sheet, so that’s probably fair.

Opinion: Looks to be a well-run, growing company – but in a difficult sector. Cavendish, their broker, say that the company has beaten FY expectations four years in a row, while others like TMG and SFOR have profit warned. SFOR reported last week, and bounced +20% following an “in-line” Q4 – so if the revenue environment is improving, then that might benefit the likes of SFOR or TMG, which are more leveraged into the potential upside. I currently own TMG, but will ponder if it might be better to switch horses.

Notes

~

Bruce Packard

Bruce owns shares in Fevertree and The Mission Group.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 5/2/2025 | RNWH, BBSN, FEVR | Slow Intelligence

We’ve seen significant volatility over the last couple of weeks, first with Nvidia’s reaction to DeepSeek’s AI model then Donald Trump’s tariff announcements. After all that, the FTSE 100 ended flat over the last 5 days at 8,542. The Nasdaq100 and S&P500 were also largely unchanged (less than 0.5% variance) although they exhibited considerable volatility. The best performing commodity has been coffee (KT-FM) up +9% over the last 5 days while Cocoa (CJ-FM) was the worst -3%; presumably if Valium and Olanzapine were quoted on the commodities market, we would have seen some volatility there too.

Given all the fuss about Nvidia and DeepSeek’s R-1 model, I thought this 30 minute Rory Sutherland talk about “slow intelligence” was relevant to investors. There’s good psychological insight in the marketing man’s observation that we are overvaluing “instant information” over “slow knowledge”. Please do watch the whole thing, but if you are too impatient (!) then jump to his conclusions. For instance, what we learn at university is not what to think, but how to think – investing effort to understand ideas. I agree, for instance: I used to find working at investment banks, that people with a mathematics or history degree, not directly relevant to the financial world, had significantly more insight into what was really going on, than colleagues who had studied economics at university.

Rory suggests that AI might be able to produce good adverts, but it will short cut the thought process, which is valuable in itself. “Forcing you to ask questions about a business that mostly people never get around to asking”, he says. One of my favourite books is Guy Claxton’s Hare Brain, Tortoise Mind, which was published almost 30 years ago and contains similar ideas.

When making investment decisions, I often do the work, using Sharescope’s filters, reading the RNS’s, listening to management presentations. Then I wait a few weeks or even months, to see if I might have missed something. There are things in life that you want to streamline and make more efficient. However, there are also things where the value lies in the inefficiency, the pain endured, the effort invested. So he ends with the question: “What does slow AI look like?”

This week I look at Renew Holdings profit warning and also Brave Bison, the marketing firm’s update. But I start with Fever Tree, a company that I’ve been pondering for a while, but was fortunate enough to invest a couple of days before last week’s announcement, which saw the share price jump +20%.

Fevertree Drinks strategic partnership

The tonic and alcoholic mixers company has struggled in recent years as it first warned on margins due to higher glass prices, then revenue disappointed in the UK and Europe. However, the shares jumped +20% last week when they announced a strategic partnership with Molson Coors, which will license exclusive sales, distribution and production of Fevertree in the US. The RNS says that there is

Coors also bought 8.5% of FEVR, paying no premium to the “price on the screen” of 654p. Fevertree are issuing equity to the Canadian company, but then to prevent their existing shareholders being diluted, Fevertree will then buy back £71m of shares, beginning this month. Molson Coors are also buying Fevertree’s US subsidiary (Fevertree USA Inc) for $24m in cash, though the brand’s Intellectual Property continues to sit within the UK group.

Outlook: There was also a trading update at the bottom of the RNS, which looks like a mild profit warning, with revenue falling in the UK -4% and -2% in Europe. Growth in the US was +12% on a constant currency basis. Management now expect low single digit revenue growth for the group (Sharescope shows previous expectations were +6%) and a hit to EBITDA.

Valuation: Readers can see above the huge de-rating since 2018, when the shares traded around £40 per share and 16x turnover. The shares still look expensive on over 20x PER Dec 2025F and 2026F, though the price to turnover has dropped to around 2x forecast sales. I bought some earlier in January, because I felt that expectations were now realistic, and might even surprise positively. The most recent RNS doesn’t mention cash, but at the end of June FEVR had £66m of net cash or 8% of the current market cap. Management said on the call that the partnership with Molson Coors should be positive for working capital strain, so there’s potential for further capital returns to shareholders in future.

Opinion: My first reaction looking at the announcement was “why have they structure the deal this way?” – on reflection though I think no one loses out. Coors is able to buy shares in FEVR without paying a premium, but the buyback means existing shareholders see the price rise and are not diluted.

Fevertree has consistently delivered strong growth in the US and has become the number one tonic and ginger beer brand across America, so the US is Fevertree’s largest revenue generator. It does strike me as odd that they needed to sign this partnership agreement. As the US business has been doing well, shouldn’t management be focused on markets closer to home (UK and Europe), where growth has been disappointing in the last few years? Putting those concerns aside, as someone who bought earlier in January, I’m happy that the share price seems to have formed a bottom and hope the brand can regain its fizz.

Renew Holdings Profit Warning

This engineering services company, with a September year-end, that does maintenance and renewal of critical UK infrastructure (rail, communication networks, energy, including nuclear and windfarms) had been a very strong performer, rising 37x from 2010 to October last year. Then the wheels began to fall off.

Network Rail has a maintenance budget of £32bn, and RNWH is the network’s largest supplier of maintenance. Renew benefits from regulation demanding that assets are well maintained, much of the spend is non-discretionary and management have long-term visibility of committed funding.

But it looks like something has gone wrong; the shares first sold off in November last year when the group warned in the FY Sept 2024 results that spending in the new rail control period had been slower than they would have expected. Worth noting too that net cash fell by £10m to £26m Sept 2024, from a year earlier. That’s driven by working capital movements, but also paying £15m of dividends, £30m of acquisitions and £19m capex. Sharescope says FCF conversion is 57%, down from the 84% 3-year historical average.

Inevitably, the first bullet point of the cash flow bridge in the analyst presentation is “strong cash generation” (red annotations are mine).

Then management announced a trading update at the end of January, which again warned that activity in Rail had been disappointing. The shares have fallen around -40% from their peak in October last year.

Management points to the latest Rail Control Period (RC7) which has just begun, and runs from 2024-2029 and says, having operated through previous Control Period transitions, they believe the problems are temporary and will normalise through the investment cycle. Management don’t seem to report divisional p&l, so it’s hard to know how much of the business is Rail.

Balance sheet: Net cash of £25m in September 2024 consisted of a gross cash balance of £80m, less a Revolving Credit Facility (RCF) with the bank of £52m, and a small discontinued liability. The upper limit of the RCF, which runs to Nov 2026, is £120m. The company has grown by 11 acquisitions over the past 14 years, so intangibles represent £195m, or 95% of shareholders’ equity. The nature of the business means that trade and other receivables stand at £183m, versus revenues of over £1bn. There’s a “key audit matter” discussing revenue recognition, as some of those receivables relate to multi-year performance obligations, two contract types are highlighted as risks: i) Reimbursable/Target Cost contracts which aim to share pain/gain of achieving targets ii) Fixed Price Contracts which involve a percentage completion assumption. That said, Sharescope’s financial health indicators (Altman Z and Beneish M) give it the thumbs up.

In summary, the balance sheet is not as strong as management claim, but in better shape than Carillion, which operated in this sector and got into trouble with dubious accounting for multi-year contracts that were uneconomic to service. This is worth keeping an eye on though, and could explain the steep sell-off as investors sell first and ask questions later.

Valuation: Following the profit warning the shares now trade on 10x Sept 2026F PER. EV/EBITDA is 6x the same year, which is low for a company that has (until recently) enjoyed such a good track record.

Opinion: This is a low-margin business with high RoCE, so effectively the model relies on high asset turnover, (that is generating high revenue compared to the amount of capital employed.) That’s not necessarily a bad business model (supermarkets do the same), and RNWH’s track record shows that it has been very successful for a decade and a half.

However, when things go wrong they can be harder to fix than high-margin businesses. I would suggest revisiting in 6 to 12 months time – there are many good businesses on AIM trading on knockdown valuations at the moment – so I’m not rushing to buy this. Hopefully, management are correct and the disappointing rail activity is just a temporary blip, however, there’s a chance these warnings are a sign of broader problems.

Brave Bison FY Dec ahead of expectations

This digital media and marketing company announced FY Dec 2024 net revenue up +2% to £21.3m, slightly ahead of expectations. FY Dec 2024 Adj PBT was up +8% to £3.9m (versus previous expectations of £3.7m). I see that Cavendish were forecasting adj PBT of £3.6m at the time of the H1 Jun results, which the board said they expected to exceed, so this “ahead of expectations” may have been announced twice.

BBSN made an opportunistic approach to The Mission Group in May last year, suggesting an all-share deal. However, this was rebuffed by TMG management, probably rightly as the deal valued TMG at 35p, versus a current valuation of 31p, now TMG have fixed their balance sheet. Brave Bison does have £7.5m of net cash and they talk about a “Platform for M&A” in their H1 analyst pack.

The group helps clients like New Balance and SharkNinja to buy digital advertising on Google, Meta, TikTok, Amazon and YouTube, as well as providing search engine optimisation and digital PR services. The business was originally called Rightster and listed on AIM at 60p in 2013. From that time the business struggled for profitability and the share price fell -90% in the following years – see the chart above for a huge £52m loss in FY 2015. More recently new management Oli (Exec Chair) and Theo Green (Chief Growth Officer) have managed to turn things around. They are brothers and sons of Michael Green (Carlton Communications). Net revenue has increased 4.3x since FY Dec 2020, with the group growing organically and by acquisition. They own 19.5% of the shares, I notice that the largest shareholder is Lord Michael Ashcroft, with 25% of the shares and Dr Graham Cooley, previously of ITM Power, holds 3%.

The business has grown by acquisition, so there were £12m of intangibles versus shareholders equity of £20m in Jun 2024. BBSN bought Social Chain, Steven Bartlett (of Dragon’s Den fame) start-up. Since then management have bought Engage Digital Partners, a specialist sports marketing and fan engagement.

Valuation: The shares are trading on a PER of 8x Dec 2025F, not expensive but a premium to below 6x which is TMG’s and SFOR’s multiple the same year. BBSN does seem to have more capable management and a stronger balance sheet, so that’s probably fair.

Opinion: Looks to be a well-run, growing company – but in a difficult sector. Cavendish, their broker, say that the company has beaten FY expectations four years in a row, while others like TMG and SFOR have profit warned. SFOR reported last week, and bounced +20% following an “in-line” Q4 – so if the revenue environment is improving, then that might benefit the likes of SFOR or TMG, which are more leveraged into the potential upside. I currently own TMG, but will ponder if it might be better to switch horses.

Notes

~

Bruce Packard

Bruce owns shares in Fevertree and The Mission Group.

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.