In this article, Michael looks at the ramifications for Nvidia’s fall and his RNS layout.

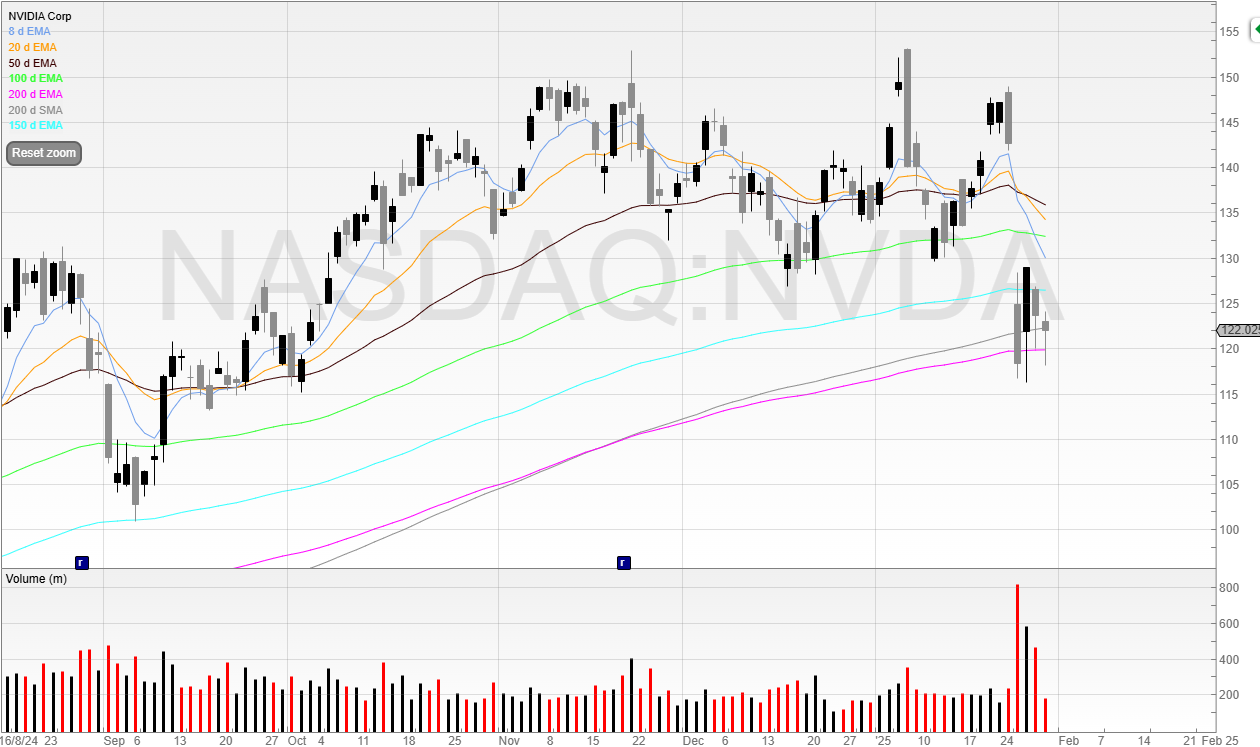

What a week. Nvidia took a dive on news of DeepSeek which, if we’re to believe is true, is able to compete with ChatGPT-4 and Claude for a fraction of the resources.

It might not look much. But that drop was around $600 billion.

To put that into perspective, the biggest company in the UK, AstraZeneca, is valued at £175 billion.

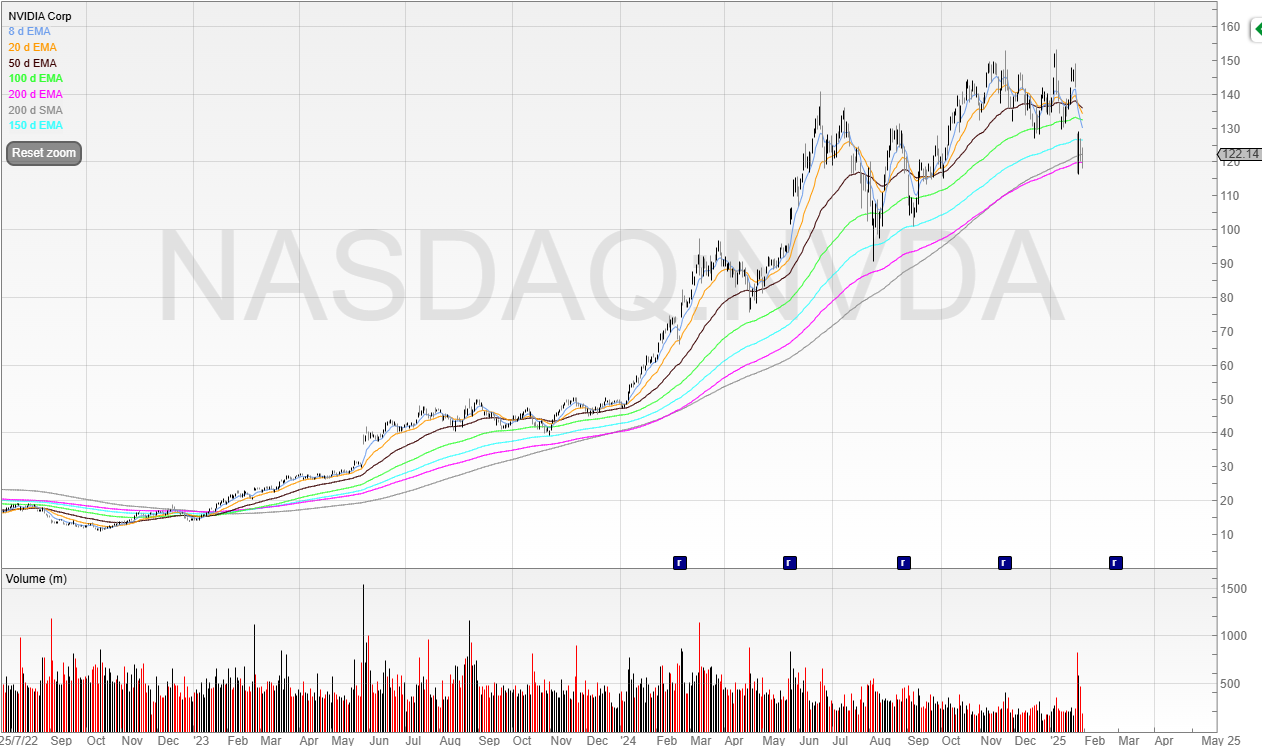

And when you zoom out – we can see the 200 moving averages are under threat.

Here’s an actual pic of Nvidia investors who are all in right now…

If Nvidia doesn’t hold, then it could be the start of a stage four downtrend.

Stage four downtrends are for schmucks, and lots of trend followers will be watching this closely.

The 200 moving averages will be a fierce battle. There are, quite literally, hundreds of billions of dollars at stake.

If it holds and rallies, then there’ll be a big sigh of relief and the stock can continue its uptrend, at least for now.

And if it falls, then it’ll invite a lot more selling pressure and creating overhead supply to churn through.

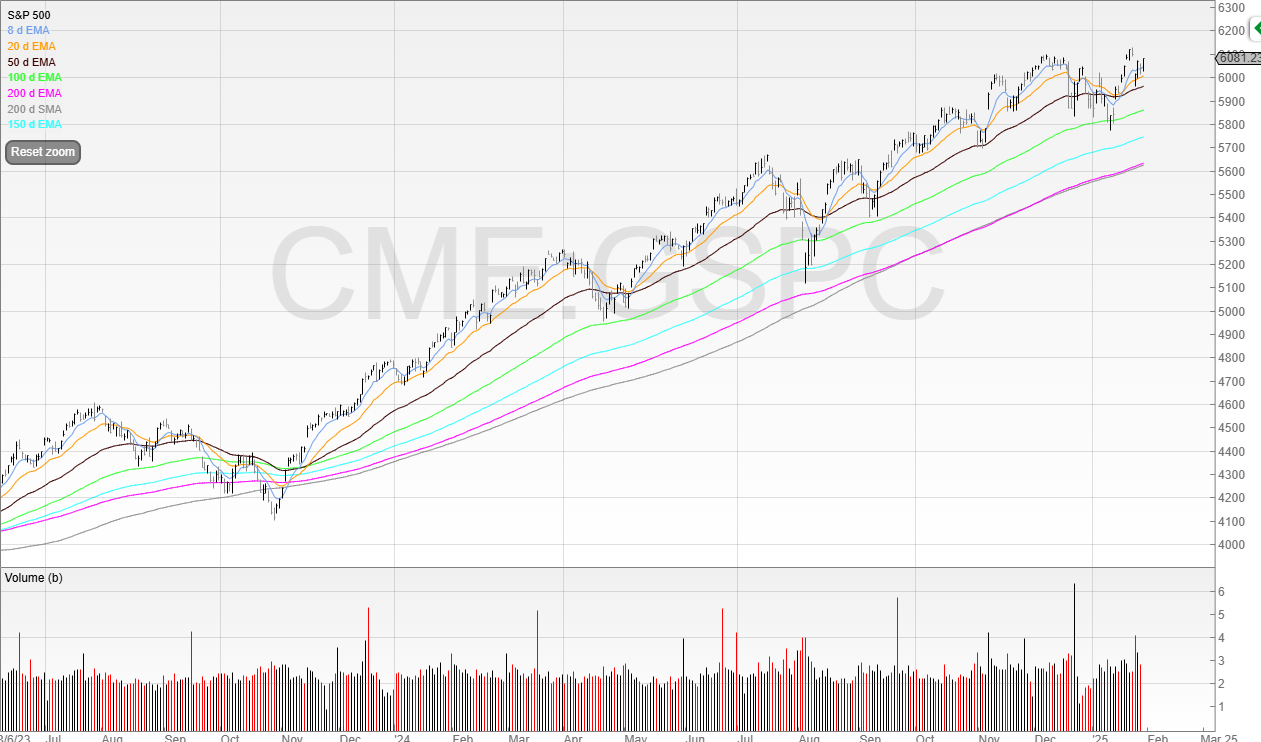

Interestingly, the S&P looks relatively unbothered.

So whilst Nvidia may be taking a battering, the rest of the market carried on.

In other news, Halfords put out better than expected news.

It would’ve been great if the company could’ve told us FY25 underlying profit before tax before the upgrade to £32 million to £37 million.

No matter, we’ll go back to the last trading update.

“Our outlook for FY25 is unchanged”.

Yes, but what is it?

No matter, we’ll look back at the last results…

Where nothing is given!

If Halfords was intentionally trying to wind people up – it succeeded.

The good thing is that if the company does lead you on a wild goose chase but eventually does give you the numbers, then it’s information that other people probably didn’t bother to find out.

Plus, sometimes the company doesn’t explicitly tell you the results are ahead. Sometimes you need to go back and do the work yourself to find out.

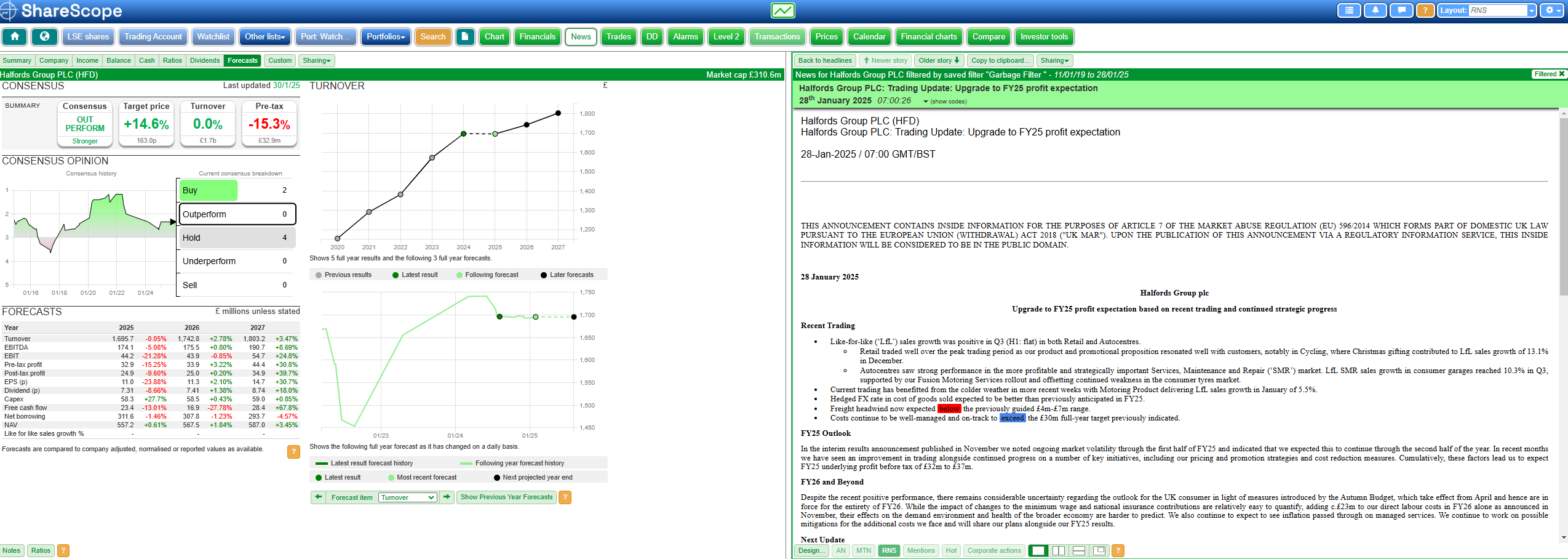

You can also use my RNS layout on ShareScope, which is two green screens (unconnected).

Forecasts on the left, and results on the right. This allows you to quickly check what is in the RNS with what is in the forecasts.

One question I’ve been asked a lot recently is what do I think of a specific chart as I’m in a trade.

Firstly, I can’t answer this. I’m not one to give advice. I can tell you my opinion, but that opinion is useless. Why?

Because you are the one that placed the trade.

Only you know your entry, your intended exit and risk/reward ratio, position size and risk tolerance, psychological discipline…

This all needs to be decided upfront.

You’ll have no doubt heard of the trading cliché: Plan your trades and trade your plan.

It’s a cliché but when you actually stop to look at what it means rather than paying lip service, then you realise it’s actually quite insightful.

Plan your trade means to actually think about what can happen before you even press buy (or sell if you’re shorting!). How might the stock react? Have you done your red flag checkup? Is there an earnings report?

If the stock rallies sharply – what will you do? Will you take some off and put in a tight stop? Or will you accept short term volatility may see the stock pull back in the hope to see a higher move?

If you don’t make these decisions beforehand, then you’ll make them when you’re a big bowl of bias Bolognese. Your emotions will decide what you do, and this probably won’t be optimum.

You also want to consider if the stock is a Move 2 Move trade (a trade based on one move to the next) or a Trade 2 Hold (a trade you’re holding for a stronger gain).

If it’s a M2M – you won’t want to be averaging up. You’ll be taking profits at a predetermined point, and if the data in your journal is telling you that these trades are working you may want to bank half and then whack on a tight stop loss.

And it’s a T2H – you probably will want to average up.

Averaging up involves purchasing additional shares of a stock you already own as its price appreciates.

This strategy is often employed when you have high conviction in a stock’s continued upward trajectory. By adding to a winning position, this is how we stack on more exposure to stocks acting correctly and potentially amplify our gains.

One of the key principles in trading is to let your winners run. Averaging up aligns with this principle by allowing us to capitalise on momentum. When a stock confirms its strength through price appreciation, adding to the position can be a logical move.

Whatever your plan is, make sure you trade it.

And yes, there’s the Mike Tyson quote about having a plan until you get punched in the face.

But plan your trades, and make sure you trade your plan.

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.