A look at a couple of stocks that are off 80-90% from their highs, but which may have formed a bottom with a +20% bounce last week. ONT and FDEV, plus taking a look at IKA.

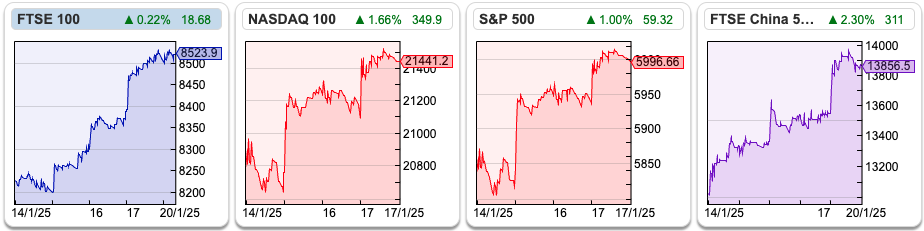

The FTSE 100 bounced +3.6% last week to 8,524. That’s ahead of the Nasdaq100 up +2.8% and the S&P500 +2.9%. Interestingly other European markets have also started the year strongly, with the German DAX up +5% and the French CAC40 +4.4%. The worst-performing market of 2025 is Japan’s Nikkei down -3.6%, followed by Shanghai -3.3%. Perhaps investors are anticipating that Trump might be good news for European markets v Asia indices.

My note at the start of the year suggested we might be optimistic for 2025 in the UK. I should clarify that I’m optimistic about potential stockmarket returns in the UK, but I think the newspapers are likely to be full of “doom and gloom”. With UK 5-year swap rates rising to 4.45%, we might even have the housing market wobble – if we’re lucky.

Times like the early 90’s, when the UK was in recession and interest rates peaked above 10% can feel very dispiriting, but turn out to be an attractive entry point for investing in shares. I bought my first ten-bagger (Adnams) around that time. Whereas in 1999 there was plenty of “feel good factor” but subsequent equity investing returns were disappointing with the FTSE 100 halving in value to March 2003 and AIM falling more than 80%. Investing is an expectations game, and very often what generates returns is not expectations themselves but correctly interpreting changes in expectations. The second derivative describes how the rate of change (the first derivative) is changing.

This week I look at a couple of stocks that have de-rated from their peak valuation, share prices falling 80-90%, but last week bounced more than +20% following “in line with expectations” comments from management: ONT and FDEV. Finally a look at IKA, which could be worth keeping an eye on, for similar reasons, I believe.

Oxford Nanopore FY Dec trading update

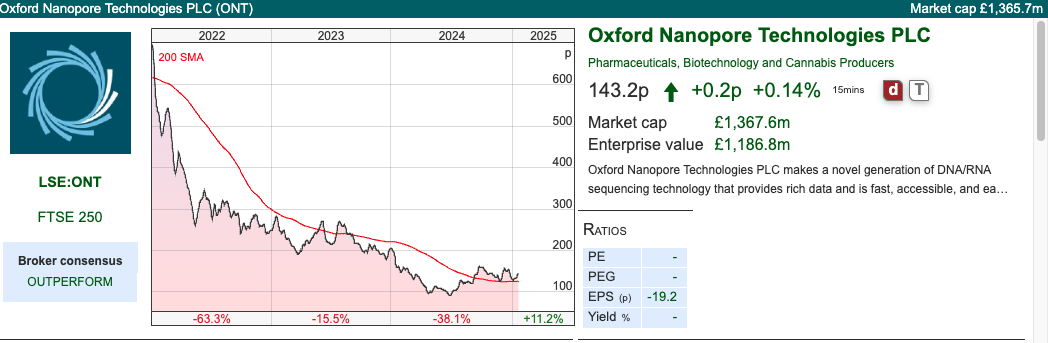

This molecular sensing technology company was a 2021 vintage IPO, spinning out of IP Group, which commercialises university research. The RNS says that FY Dec 2024F results are “in line with guidance” with no change to medium-term guidance. However, the share price was up +20% on the morning of the RNS, so in this case “in line” is positive.

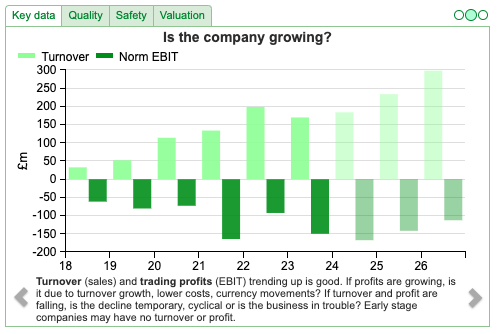

Management expect FY Dec 2024F to grow +11% on a constant currency basis to £170m. Underlying growth has been strongest across the PromethION product range +55%. At the H1 stage, PrometION was 38% of revenue, whereas the older, declining MinION range was a third of revenue. Gross margin for the year is expected to be slightly above previous guidance of 57%, but that could still be a decline from 59% reported in H1. There’s no mention of a statutory PBT figure, and I see that Sharepad is forecasting a £160m loss for 2024F. The group still has over £400m of cash as of the end of December.

Medium-term guidance: Between 2024 and FY Dec 2027F revenue is expected to compound at +30% on a constant currency basis. The gross margin is expected to exceed 52% by FY Dec 2027F, with adj EBITDA breakeven that year and cashflow positive FY Dec 2028F.

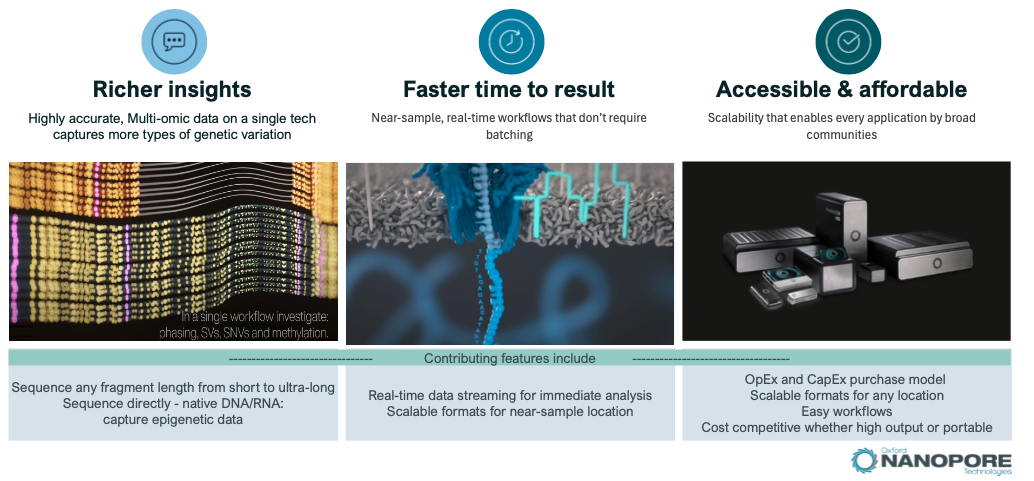

History: ONT was co-founded by the current Chief Exec Gordon Sanghera in 2005, as a spinout from Oxford University. In 2007 the group chose to focus on DNA/RNA sequencing as the first deployment of nanopore sensing: a nanopore is a tiny hole that only a single strand of DNA can pass through at a time, as the strand passes through the hole it creates a unique electrical signal which determines the sequence of (A, T, C or G) the DNA nucleotides. In 2014 the group began shipping MinION devices, the IPO prospectus points out as their technology is used for scientific research, the regulatory hurdles have been lower than for life science innovation (eg drugs, medical devices). That said, ONT’s products have been used to rapidly sequence COVID-19 genomes, to understand transmission of the virus and identify variants. By March 2021, researchers in more than 85 countries had used the Group’s technology to monitor Covid-19.

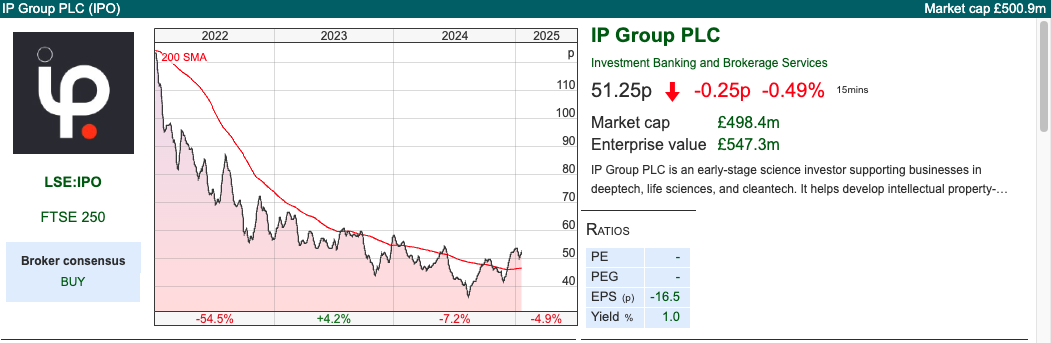

The company was listed at 425p per share in September 2021, valuing the market cap of the company at £3.4bn. At the time, the IPO was judged a success, as the shares jumped +40% on the first day of trading, but subsequently, the share price fell below 100p in April 2024. In the middle of last year, the company raised a further £80m at 120p per share, with much of the new money coming from Novo Holdings (from the Novo Nordisk Foundation). IP Group sold 25m shares at 120p, raising £30m.

Valuation: No profits are forecast, but the shares are trading on 5x FY Dec 2025F sales. Cash at just over £400m, represents a third of the market cap. It seems a little odd that the company raised £80m at less than a third of the IPO price, but presumably, this now means that the company is not coming back to dilute investors again.

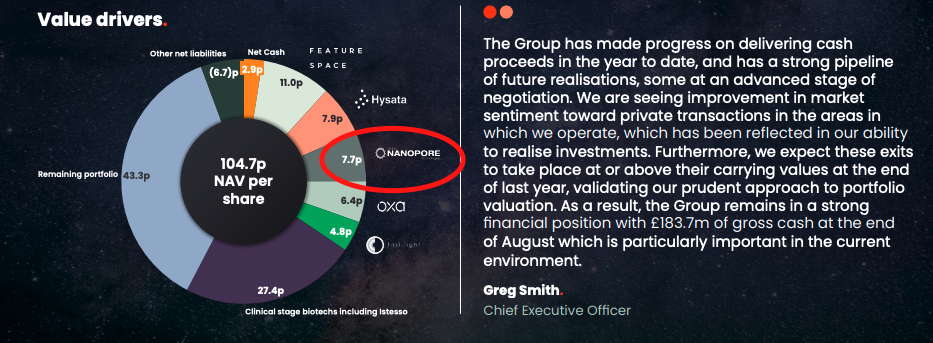

Read across to IP Group? IP Group currently holds an 8.9% stake in ONT, worth £121m, or a quarter of IPO’s market cap—plus a 1.3% stake owned through managed funds. Given the poor performance of ONT following the Sept 2021 listing, I did wonder if IP Group would struggle to float more of its unlisted portfolio. However, IP Group achieved £40m of exits in H1 last year, mainly from selling Garrison Technology to US cybersecurity firm Everfox. In H2, IPO sold another software company, Featurespace to Visa, meaning that FY Dec 2024, they have achieved £179m of cash from exits. Plus two other listing holdings, Intelligent Ultrasound (20.8% holding) and Abliva (9.5% holding) received takeover approaches. IPO has announced a £70m buyback in 2024 (£30m worth of shares at an average price of 44p completed as of 9th Jan), then a couple of weeks ago announced a further £25m buyback, extended to Dec 2025F.

Opinion: ONT looks like a decent quality company, with a high margin and exciting growth prospects. The disappointing share price performance since the IPO seems mainly driven by the high valuation and high expectations that were set in 2021. As noted above, one way to benefit from a turnaround in sentiment towards ONT is buying into IP Group, which is a more diversified but earlier-stage venture. I don’t have a strong feel for the technology here, so I think I would go for IP Group if I was going to pick one way to play this theme.

Frontier Developments H1 Nov

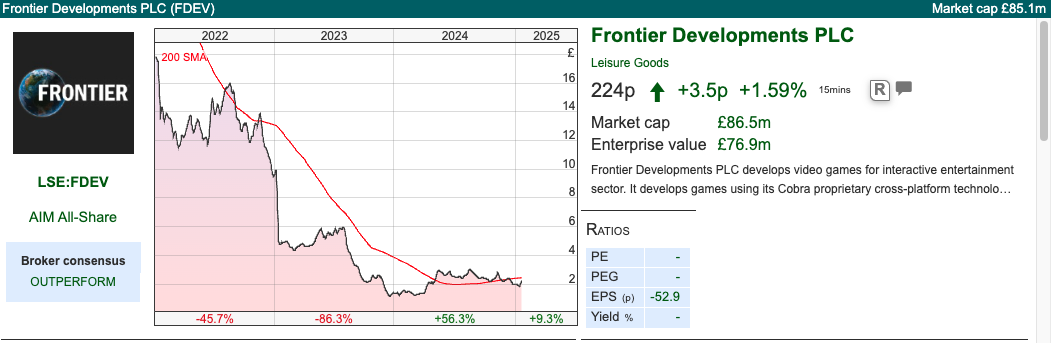

The shares bounced +27% on the morning of its H1 Nov results after management re-iterated “inline” FY May 2025F expectations. I mentioned a couple of weeks ago that when looking at fund managers, like Impax AM, the second derivative: ie “are things getting better or worse?” is more important than the absolute amount of AuM, and I think that applies to many other sectors where intangible assets and Intellectual Property (IP) are key to the investment case. Similar to ONT above, an “inline” RNS turns out to be positive a +27% positive for FDEV’s the share price as the second derivative improves. For contrast, Games Workshop, which is deservedly well-loved, sold off -6% despite delivering “in-line” H1 Nov results.

FDEV revenues were down -1% to £47.3m, but following significant cost-cutting last financial year the business returned to a statutory profit of £4.4m versus a huge £33m loss H1 Nov 2023. Cash at the end of Nov was £27m, down -8% from May. The cash position is expected to improve over the coming months, as the group enjoyed strong sales over the festive period (see below).

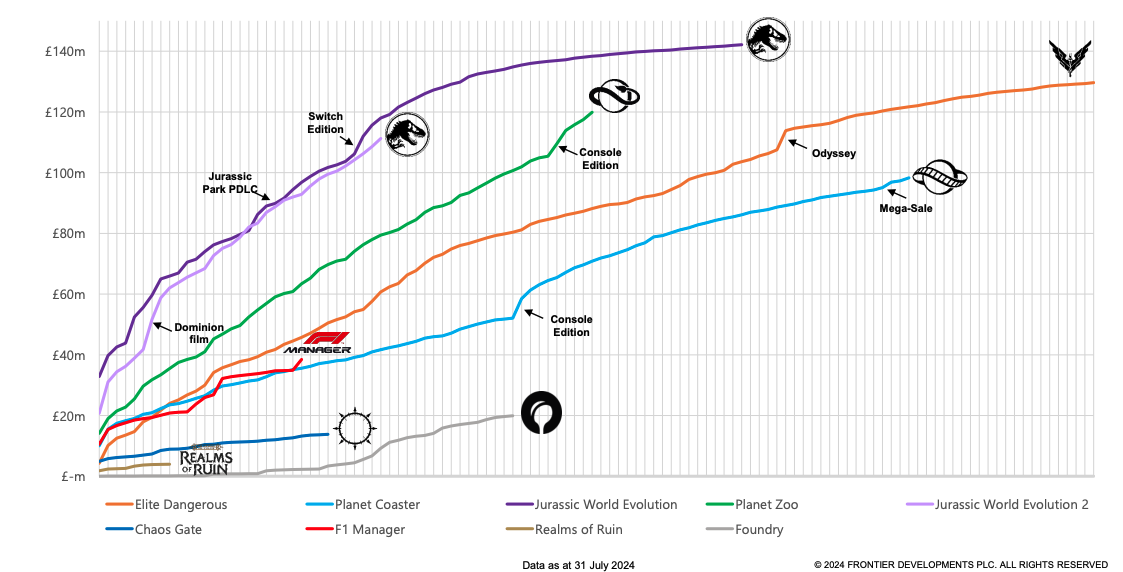

Outlook: management point out that Planet Coaster 2, their theme park simulation game, was top of the charts on Steam in November, following its release. The game launched just 4 weeks before the period ended but delivered 22% of group revenue (ie over £10m) to the end of Nov. For comparison, FDEV’s most successful game Jurassic World Evolution achieved £30m of sales in its first month, and £140m of lifetime revenue.

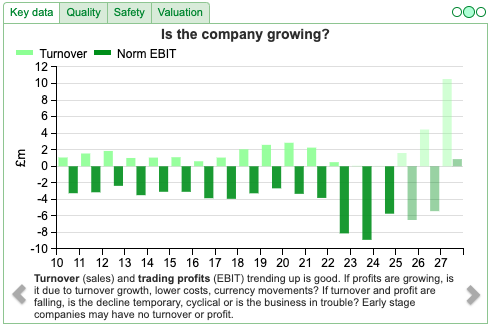

So the significance of a strong opening 4 weeks is that is one of the best predictors of the cumulative lifetime revenue of a game, as this chart from the company’s FY May 2024 analyst presentation shows. Jurassic World Evolution (dark purple) enjoyed a strong start and continued to do well, whereas the Games Workshop IP games: Realms of Ruin (light brown) and Chaos Gate (dark blue) had a disappointing start, then never generated momentum. It’s early days, but looking at the chart below suggests that Planet Coaster 2, could generate close to £100m of revenue over its lifetime.

Following that encouraging November, the group has also enjoyed its third-best Christmas, surpassed only by the pandemic years of 2020 and 2021. They are “confident” of delivering inline FY May 2025F revenue and profits – Sharescope shows £91m and a forecast loss of £3m, so I think if H1 (which doesn’t include the important festive season) was profitable, then there’s scope to see FY profits and an increase in forecasts.

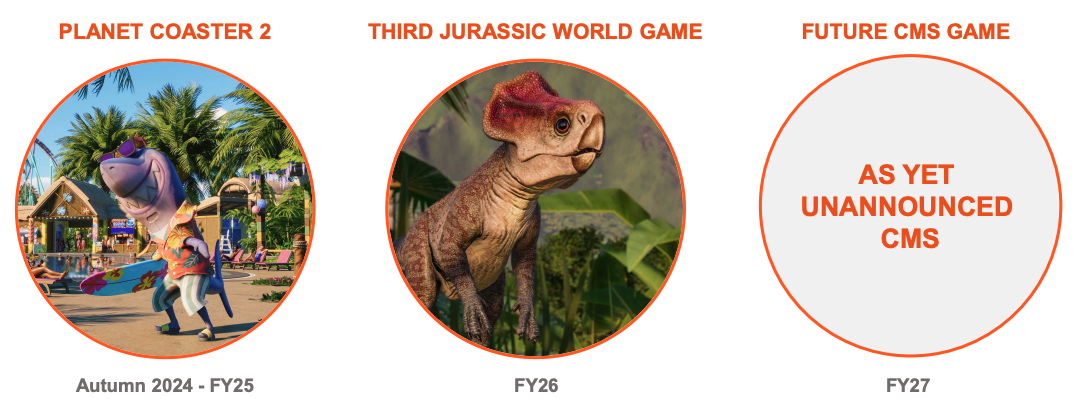

The other reason to be positive is that Planet Coaster 2’s success seems to validate management’s focus on Creative Management Simulation (CMS) games. It’s the first of three CMS games, with a Jurassic World game scheduled for release in FY May 2026F and a third game then to follow that in FY May 2027F.

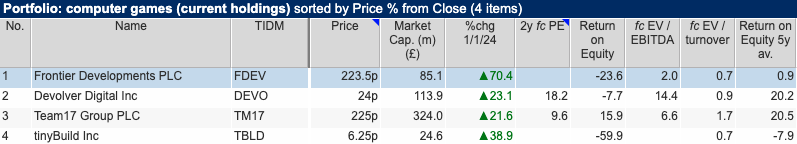

Valuation: The shares are trading on 0.9x revenues, but as yet no profits are forecast according to Sharepad. Sharepad does show 2.0 EV/EBITDA which is a very good value compared to a peak valuation of 80x EV/EBITDA in 2021 when the price reached close to £33 per share. End of December cash of £30.5m represents 35% of the market cap.

Opinion: I like it, though I bought into the turnaround too early, I’m pleased that I didn’t sell. Clearly there are risks, and if one of the future CMS games disappoints, that will be a step backwards. So a significant proportion of the investment case now rests on the third Jurassic World game. It looks like management are doing the right things and we are heading in the right direction though. Also, the founder David Braben still owns over 33% of the shares, which I find reassuring.

Ilika H1 Oct results

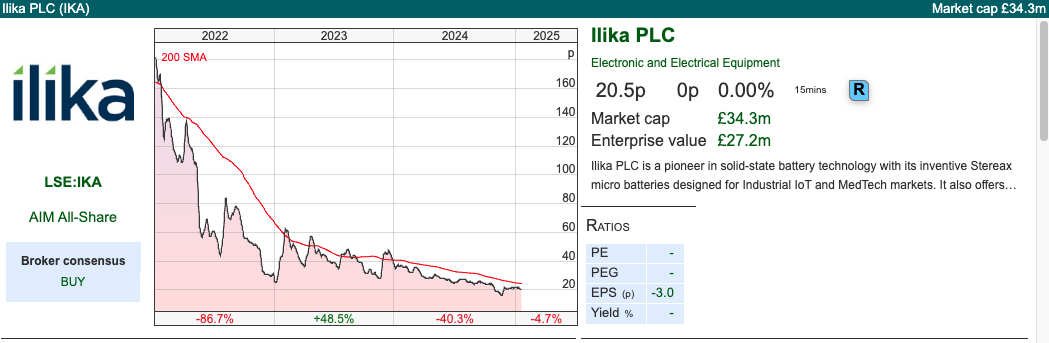

This section comes with a “not for widows and orphans” health warning. The Ilika share price is down c. -90% since early 2021 and the company is forecast to be loss-making by their broker (Cavendish) out to FY Apr 2027F. However, I think it could be worth a second look.

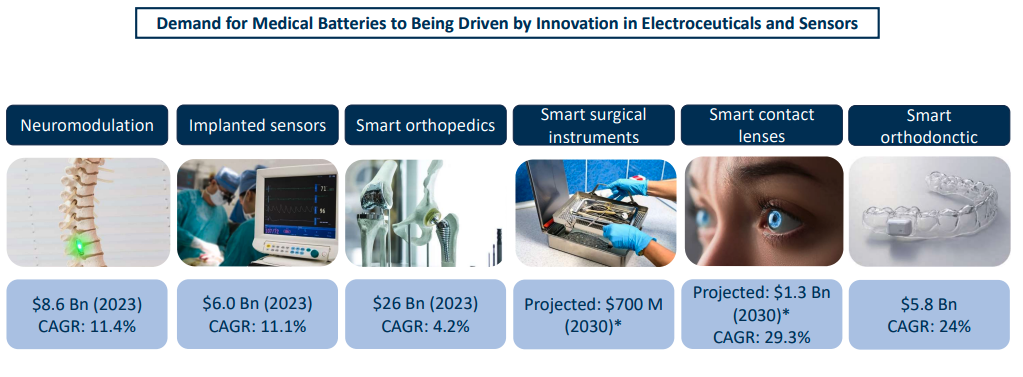

The company develops ceramic oxide Solid State Batteries (SSBs), which have the advantage of being non-flammable. Lithium-ion batteries, currently being used in Electric Vehicles (EVs) are generally safe, but if they do catch fire, they can burn 1,000 degrees hotter (called “thermal runaway”) than traditional Internal Combustion Engine (ICEs) and take up to 90 minutes for the emergency services to put out. Ceramic oxide batteries should also have higher energy density and longer lifespan compared to lithium-ion batteries. Ilika call their EV batteries Goliath, but have also been licensed a second product line Stereax, for use in medical devices. They expect to recognise revenues from Stereax in the calendar year 2025, given the October year-end that implies FY Oct 2026F.

The results themselves are full of positive-sounding noises about shipping a first batch of prototype Goliath batteries, and plans for production runs of Stereax. The numbers show that this is still pre-revenue, with £0.9m of grant funding and a statutory loss of £2.9m.

What caught my eye, was that Cavendish have gone to the trouble of publishing a 44-page note at the beginning of January. From a corporate broking point of view, it’s unusual to see a broker publishing such a long note on a company that doesn’t have any future. So this seems a “signal” to me that there could be something interesting with the Ilika investment case.

Competition: A quick search of the internet reveals that other companies are also trying to commercialise ceramic oxide battery technology. For instance, Qkera based in Munich and Taiwan-based ProLogium, is building a huge 48GWh plant in France for €5.2bn, so it’s possible that someone beats Ilika in the race for the prize. Even so, Cavendish points out that if forecasts for the SSB market to be worth $14bn in 2032 turn out to be justified, then even if Ilika achieves just a 10% market share, that could still be worth $200m discounted back today at 10% cost of capital.

Valuation: The company has spent £55m of invested capital developing 62 patents, well above the current market cap of £34m. At the end of October management had £10m of cash remaining, which Cavendish says can fund the company towards the end of FY April 2026F. The broker’s forecast is for revenues to more than quadruple over the next 2 years, and they have a target price of 83p, which shows the upside if progress goes to plan.

Opinion: I am flagging this as one to put on the “watchlist”. The shares are trading well below their 200-day moving average, and there’s no sign of a bowl forming. I don’t own any myself currently. But I would rather start looking at IKA now in early 2025 when the share price is 20p, than 4 years ago when the share price was above 250p. If there are any widows and orphans who have read this far, then I reiterate my health warning in the first paragraph.

~

Bruce Packard

Notes

Bruce owns shares in Frontier Developments

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 22/1/2025 | ONT, FDEV, IKA | The second derivative

A look at a couple of stocks that are off 80-90% from their highs, but which may have formed a bottom with a +20% bounce last week. ONT and FDEV, plus taking a look at IKA.

The FTSE 100 bounced +3.6% last week to 8,524. That’s ahead of the Nasdaq100 up +2.8% and the S&P500 +2.9%. Interestingly other European markets have also started the year strongly, with the German DAX up +5% and the French CAC40 +4.4%. The worst-performing market of 2025 is Japan’s Nikkei down -3.6%, followed by Shanghai -3.3%. Perhaps investors are anticipating that Trump might be good news for European markets v Asia indices.

My note at the start of the year suggested we might be optimistic for 2025 in the UK. I should clarify that I’m optimistic about potential stockmarket returns in the UK, but I think the newspapers are likely to be full of “doom and gloom”. With UK 5-year swap rates rising to 4.45%, we might even have the housing market wobble – if we’re lucky.

Times like the early 90’s, when the UK was in recession and interest rates peaked above 10% can feel very dispiriting, but turn out to be an attractive entry point for investing in shares. I bought my first ten-bagger (Adnams) around that time. Whereas in 1999 there was plenty of “feel good factor” but subsequent equity investing returns were disappointing with the FTSE 100 halving in value to March 2003 and AIM falling more than 80%. Investing is an expectations game, and very often what generates returns is not expectations themselves but correctly interpreting changes in expectations. The second derivative describes how the rate of change (the first derivative) is changing.

This week I look at a couple of stocks that have de-rated from their peak valuation, share prices falling 80-90%, but last week bounced more than +20% following “in line with expectations” comments from management: ONT and FDEV. Finally a look at IKA, which could be worth keeping an eye on, for similar reasons, I believe.

Oxford Nanopore FY Dec trading update

This molecular sensing technology company was a 2021 vintage IPO, spinning out of IP Group, which commercialises university research. The RNS says that FY Dec 2024F results are “in line with guidance” with no change to medium-term guidance. However, the share price was up +20% on the morning of the RNS, so in this case “in line” is positive.

Management expect FY Dec 2024F to grow +11% on a constant currency basis to £170m. Underlying growth has been strongest across the PromethION product range +55%. At the H1 stage, PrometION was 38% of revenue, whereas the older, declining MinION range was a third of revenue. Gross margin for the year is expected to be slightly above previous guidance of 57%, but that could still be a decline from 59% reported in H1. There’s no mention of a statutory PBT figure, and I see that Sharepad is forecasting a £160m loss for 2024F. The group still has over £400m of cash as of the end of December.

Medium-term guidance: Between 2024 and FY Dec 2027F revenue is expected to compound at +30% on a constant currency basis. The gross margin is expected to exceed 52% by FY Dec 2027F, with adj EBITDA breakeven that year and cashflow positive FY Dec 2028F.

History: ONT was co-founded by the current Chief Exec Gordon Sanghera in 2005, as a spinout from Oxford University. In 2007 the group chose to focus on DNA/RNA sequencing as the first deployment of nanopore sensing: a nanopore is a tiny hole that only a single strand of DNA can pass through at a time, as the strand passes through the hole it creates a unique electrical signal which determines the sequence of (A, T, C or G) the DNA nucleotides. In 2014 the group began shipping MinION devices, the IPO prospectus points out as their technology is used for scientific research, the regulatory hurdles have been lower than for life science innovation (eg drugs, medical devices). That said, ONT’s products have been used to rapidly sequence COVID-19 genomes, to understand transmission of the virus and identify variants. By March 2021, researchers in more than 85 countries had used the Group’s technology to monitor Covid-19.

The company was listed at 425p per share in September 2021, valuing the market cap of the company at £3.4bn. At the time, the IPO was judged a success, as the shares jumped +40% on the first day of trading, but subsequently, the share price fell below 100p in April 2024. In the middle of last year, the company raised a further £80m at 120p per share, with much of the new money coming from Novo Holdings (from the Novo Nordisk Foundation). IP Group sold 25m shares at 120p, raising £30m.

Valuation: No profits are forecast, but the shares are trading on 5x FY Dec 2025F sales. Cash at just over £400m, represents a third of the market cap. It seems a little odd that the company raised £80m at less than a third of the IPO price, but presumably, this now means that the company is not coming back to dilute investors again.

Read across to IP Group? IP Group currently holds an 8.9% stake in ONT, worth £121m, or a quarter of IPO’s market cap—plus a 1.3% stake owned through managed funds. Given the poor performance of ONT following the Sept 2021 listing, I did wonder if IP Group would struggle to float more of its unlisted portfolio. However, IP Group achieved £40m of exits in H1 last year, mainly from selling Garrison Technology to US cybersecurity firm Everfox. In H2, IPO sold another software company, Featurespace to Visa, meaning that FY Dec 2024, they have achieved £179m of cash from exits. Plus two other listing holdings, Intelligent Ultrasound (20.8% holding) and Abliva (9.5% holding) received takeover approaches. IPO has announced a £70m buyback in 2024 (£30m worth of shares at an average price of 44p completed as of 9th Jan), then a couple of weeks ago announced a further £25m buyback, extended to Dec 2025F.

Opinion: ONT looks like a decent quality company, with a high margin and exciting growth prospects. The disappointing share price performance since the IPO seems mainly driven by the high valuation and high expectations that were set in 2021. As noted above, one way to benefit from a turnaround in sentiment towards ONT is buying into IP Group, which is a more diversified but earlier-stage venture. I don’t have a strong feel for the technology here, so I think I would go for IP Group if I was going to pick one way to play this theme.

Frontier Developments H1 Nov

The shares bounced +27% on the morning of its H1 Nov results after management re-iterated “inline” FY May 2025F expectations. I mentioned a couple of weeks ago that when looking at fund managers, like Impax AM, the second derivative: ie “are things getting better or worse?” is more important than the absolute amount of AuM, and I think that applies to many other sectors where intangible assets and Intellectual Property (IP) are key to the investment case. Similar to ONT above, an “inline” RNS turns out to be positive a +27% positive for FDEV’s the share price as the second derivative improves. For contrast, Games Workshop, which is deservedly well-loved, sold off -6% despite delivering “in-line” H1 Nov results.

FDEV revenues were down -1% to £47.3m, but following significant cost-cutting last financial year the business returned to a statutory profit of £4.4m versus a huge £33m loss H1 Nov 2023. Cash at the end of Nov was £27m, down -8% from May. The cash position is expected to improve over the coming months, as the group enjoyed strong sales over the festive period (see below).

Outlook: management point out that Planet Coaster 2, their theme park simulation game, was top of the charts on Steam in November, following its release. The game launched just 4 weeks before the period ended but delivered 22% of group revenue (ie over £10m) to the end of Nov. For comparison, FDEV’s most successful game Jurassic World Evolution achieved £30m of sales in its first month, and £140m of lifetime revenue.

So the significance of a strong opening 4 weeks is that is one of the best predictors of the cumulative lifetime revenue of a game, as this chart from the company’s FY May 2024 analyst presentation shows. Jurassic World Evolution (dark purple) enjoyed a strong start and continued to do well, whereas the Games Workshop IP games: Realms of Ruin (light brown) and Chaos Gate (dark blue) had a disappointing start, then never generated momentum. It’s early days, but looking at the chart below suggests that Planet Coaster 2, could generate close to £100m of revenue over its lifetime.

Following that encouraging November, the group has also enjoyed its third-best Christmas, surpassed only by the pandemic years of 2020 and 2021. They are “confident” of delivering inline FY May 2025F revenue and profits – Sharescope shows £91m and a forecast loss of £3m, so I think if H1 (which doesn’t include the important festive season) was profitable, then there’s scope to see FY profits and an increase in forecasts.

The other reason to be positive is that Planet Coaster 2’s success seems to validate management’s focus on Creative Management Simulation (CMS) games. It’s the first of three CMS games, with a Jurassic World game scheduled for release in FY May 2026F and a third game then to follow that in FY May 2027F.

Valuation: The shares are trading on 0.9x revenues, but as yet no profits are forecast according to Sharepad. Sharepad does show 2.0 EV/EBITDA which is a very good value compared to a peak valuation of 80x EV/EBITDA in 2021 when the price reached close to £33 per share. End of December cash of £30.5m represents 35% of the market cap.

Opinion: I like it, though I bought into the turnaround too early, I’m pleased that I didn’t sell. Clearly there are risks, and if one of the future CMS games disappoints, that will be a step backwards. So a significant proportion of the investment case now rests on the third Jurassic World game. It looks like management are doing the right things and we are heading in the right direction though. Also, the founder David Braben still owns over 33% of the shares, which I find reassuring.

Ilika H1 Oct results

This section comes with a “not for widows and orphans” health warning. The Ilika share price is down c. -90% since early 2021 and the company is forecast to be loss-making by their broker (Cavendish) out to FY Apr 2027F. However, I think it could be worth a second look.

The company develops ceramic oxide Solid State Batteries (SSBs), which have the advantage of being non-flammable. Lithium-ion batteries, currently being used in Electric Vehicles (EVs) are generally safe, but if they do catch fire, they can burn 1,000 degrees hotter (called “thermal runaway”) than traditional Internal Combustion Engine (ICEs) and take up to 90 minutes for the emergency services to put out. Ceramic oxide batteries should also have higher energy density and longer lifespan compared to lithium-ion batteries. Ilika call their EV batteries Goliath, but have also been licensed a second product line Stereax, for use in medical devices. They expect to recognise revenues from Stereax in the calendar year 2025, given the October year-end that implies FY Oct 2026F.

The results themselves are full of positive-sounding noises about shipping a first batch of prototype Goliath batteries, and plans for production runs of Stereax. The numbers show that this is still pre-revenue, with £0.9m of grant funding and a statutory loss of £2.9m.

What caught my eye, was that Cavendish have gone to the trouble of publishing a 44-page note at the beginning of January. From a corporate broking point of view, it’s unusual to see a broker publishing such a long note on a company that doesn’t have any future. So this seems a “signal” to me that there could be something interesting with the Ilika investment case.

Competition: A quick search of the internet reveals that other companies are also trying to commercialise ceramic oxide battery technology. For instance, Qkera based in Munich and Taiwan-based ProLogium, is building a huge 48GWh plant in France for €5.2bn, so it’s possible that someone beats Ilika in the race for the prize. Even so, Cavendish points out that if forecasts for the SSB market to be worth $14bn in 2032 turn out to be justified, then even if Ilika achieves just a 10% market share, that could still be worth $200m discounted back today at 10% cost of capital.

Valuation: The company has spent £55m of invested capital developing 62 patents, well above the current market cap of £34m. At the end of October management had £10m of cash remaining, which Cavendish says can fund the company towards the end of FY April 2026F. The broker’s forecast is for revenues to more than quadruple over the next 2 years, and they have a target price of 83p, which shows the upside if progress goes to plan.

Opinion: I am flagging this as one to put on the “watchlist”. The shares are trading well below their 200-day moving average, and there’s no sign of a bowl forming. I don’t own any myself currently. But I would rather start looking at IKA now in early 2025 when the share price is 20p, than 4 years ago when the share price was above 250p. If there are any widows and orphans who have read this far, then I reiterate my health warning in the first paragraph.

~

Bruce Packard

Notes

Bruce owns shares in Frontier Developments

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.