A look at whether rising Natural Gas prices might threaten the market rally, and whether renewables might help offset the pain. Companies mentioned NESF, TAM, TRU and MTEC.

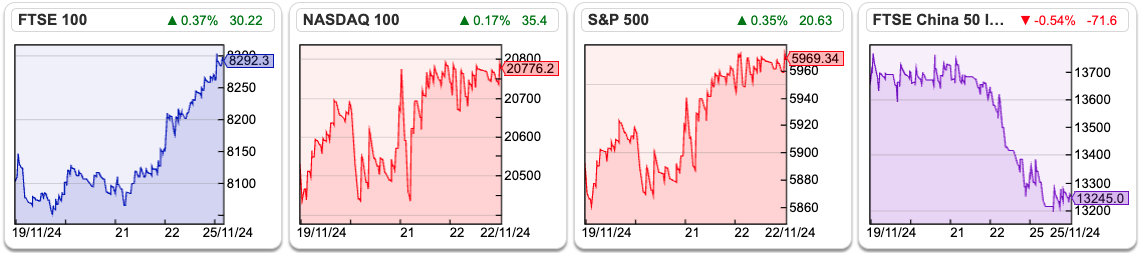

The FTSE 100 was up +2.3% last week to 8,294, helped by a weak pound. The pound has fallen -6% from 1.34 against the dollar to 1.26 since the start of October. The FTSE 100 performance was ahead of US markets, with the Nasdaq100 rising 1.9% and the S&P500 rising +1.7%. Over the last 5 days, China has been weak, with the FTSE China down -2.7%.

The price of Natural Gas (Sharepad ticker: NG-MT) was down at the start of this week but has risen +68% since the beginning of August. The commodity remains well below the initial spike upwards that we saw in 2022 when Putin sent the tanks in to try to seize Kyiv, but I think NG-MT is worth keeping an eye on.

Gas storage facilities in Europe are currently full, in preparation for the Winter, but the fear is that we may experience a cold winter and supply disruptions. In late October there was a problem with Norway’s state energy company Equinor. Around 30% of Europe’s Natural Gas comes from Norway, and another 20% of LNG goes through the Straits of Hormuz in the Gulf, so it’s understandable that traders are nervous.

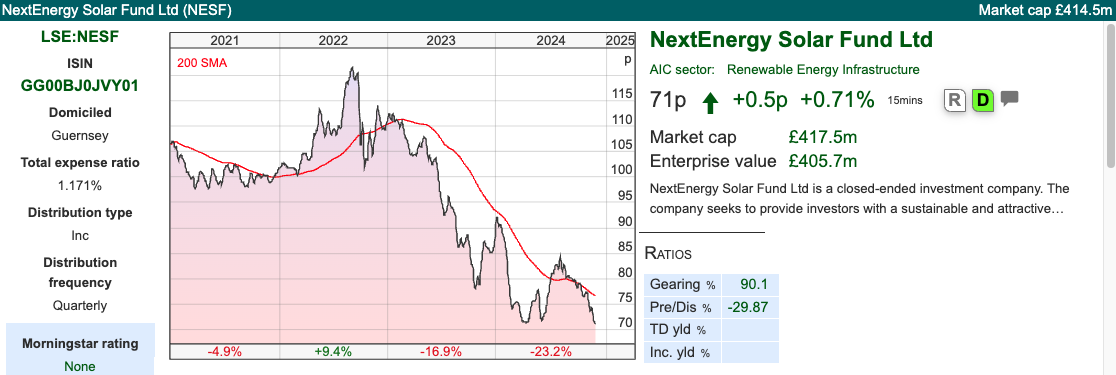

I am conscious that a second round of energy price inflation this winter could be bad news for markets, and I thought I was being clever by buying shares in Next Energy Solar Fund a couple of months ago. The company reported H1 to Sept last week, and are currently on a dividend yield of 12% and a discount to NAV of -30%. The group is selling off solar panel farms at a premium to NAV, so far raising £73m of capital, reinvesting in battery storage, and buying back up to £20m of shares. So far that trade hasn’t worked for me, but presumably, NESF should benefit from rising energy prices at some point.

I notice other renewable energy infrastructure funds have done badly, for instance, GRID is down -56% YTD and trades at a 56% discount to NAV. I’m not a sector specialist, so if I have missed something obvious, please let me know in the chat!

I hope everyone who attended David Stredder’s Mello event in Derby enjoyed it. Good to see that Mello isn’t just a London-centric event, and I am impressed that he manages to keep finding good quality companies to present to investors. I didn’t attend this time, but Jamie Ward was there, he suggested Brave Bison was a particularly good presentation and he thought that Richard Stavely at Rockwood came across well.

This week I look at Tatton, an investment company seeing inflows. Plus miscellaneous financial company TruFin and Made Tech which provide technology services to the Government.

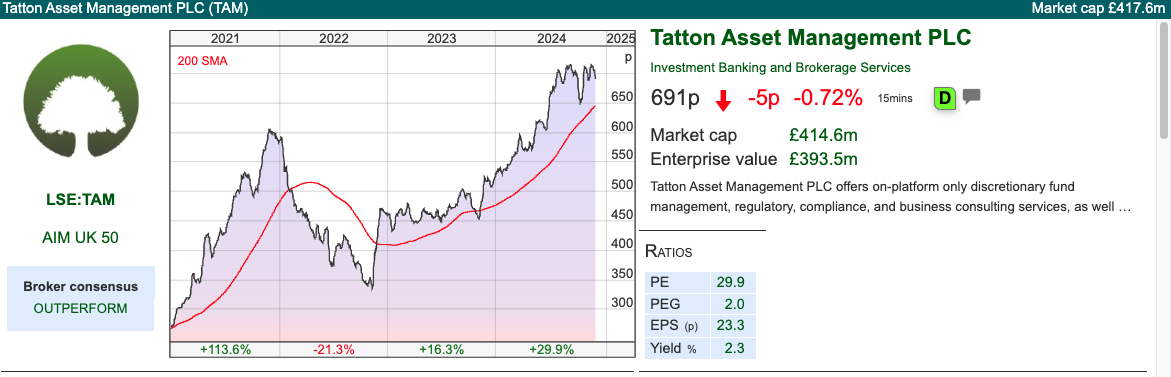

Tatton Asset Management H1 Sept Results

This investment management company is a rare bird: a fund manager reporting strong inflows. Assets under Management (AuM) increased by +35% to £20bn, with further net inflows continuing into H2. Group revenue was up +24%, statutory PBT was up +31% to £10m. Net cash stood at £27m at the end of September.

Cashflow statement: The cashflow statement has been restated, to reflect dividends received from joint ventures as “cash flows from investing activities” (previously recorded in “cash from financing activities”). I went back and checked, and the £2.27m decrease in cash H1 Sept 2023 remains unchanged, so this is just a case of shifting a payment received to a different line of the cashflow statement. There’s also £1m fair value gain that is recognised in the p&l and reversed out from “cash from investing activities” in the most recent set of accounts. In the past couple of halves, the cash position had been declining, but this trend has now reversed.

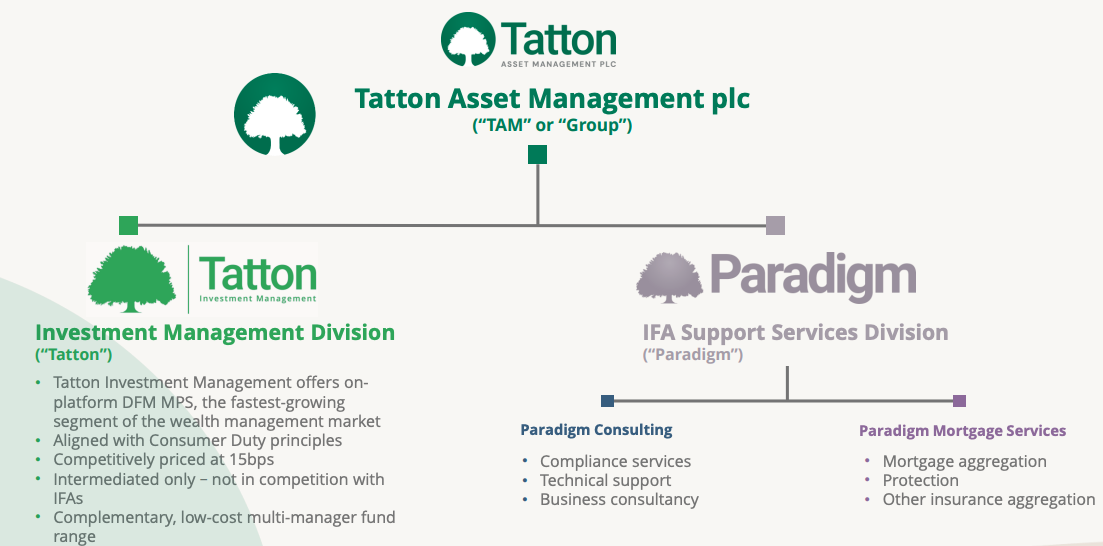

History: Tatton was founded in 2007 by the current Chief Executive, Paul Hogarth. It serves smaller, UK-based Independent Financial Advisers (IFAs) via two business units: i) Tatton Investment Management (85% of group revenue) which does discretionary fund management; and ii) Paradigm – regulatory and compliance consulting and outsourcing, plus insurance aggregation (15% of group revenue).

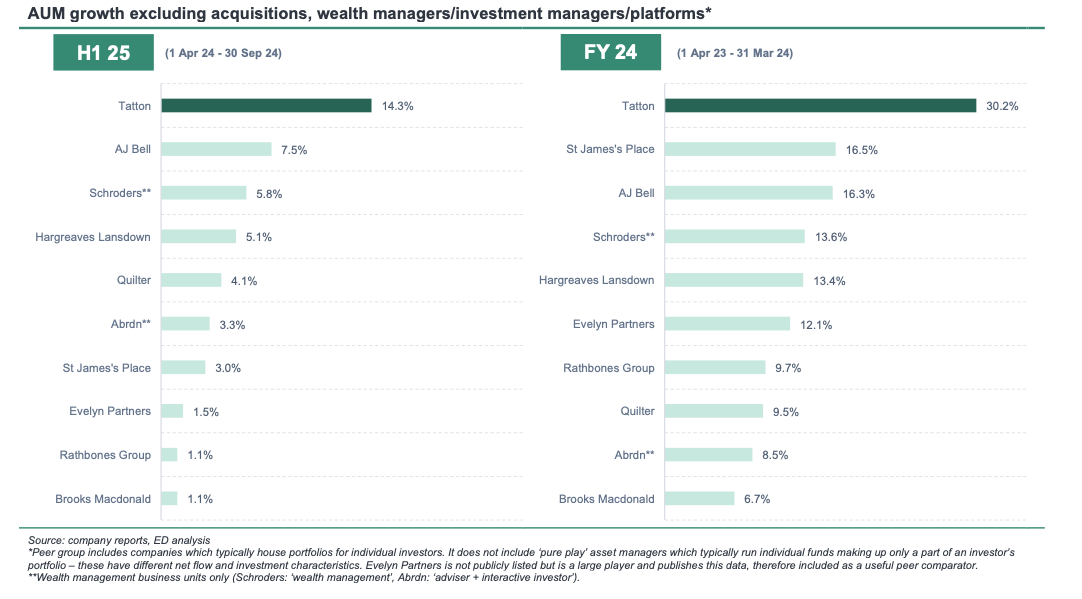

In other words, this isn’t a traditional fund manager, like Miton or Liontrust, but instead provides Managed Portfolio Services (MPS) allowing IFAs to administer clients’ “model portfolios” on investment platforms, for which it charges 15bp per annum. In other words, it has more in common with AJ Bell than a traditional active fund manager. The company listed on AIM in 2017, at 156p, raising £8m for the company but selling shareholders receiving £40m. This valued the company at £87m market cap on admission. Since then the company has trebled revenue and profits are up 8x – an impressive performance. I have taken the chart below from Equity Development’s not, showing that Tatton is reporting AuM growth well ahead of its rivals.

Growth targets: Management have a track record of setting demanding targets for AuM, but delivering. In Mar 2021, they outlined a plan to grow AuM from £9bn to £15bn in three years (ie by Mar 24). They figure achieved was £17.6bn, although helped by some acquisitions they still would have hit the £15bn target on an underlying basis. Then in Jun 2024, management set a new target of reaching £30bn AuM by end FY Mar 2029, implying an 11% CAGR.

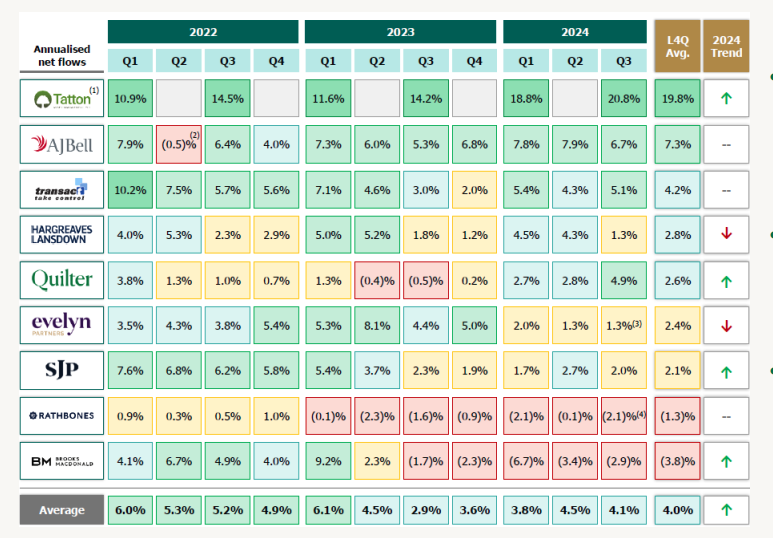

One slide I found useful in the analyst presentation, was management showing net annualised flows at Tatton versus other Wealth Management competitors. Platforms like AJ Bell, transact and Hargreaves Lansdown continue to attract assets versus the likes of SJP and Rathbones.

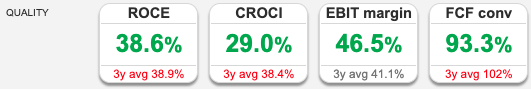

Valuation: The shares are trading on a PER of 23x Mar 2026F dropping to 20x the following year. It looks expensive on 9x forecast sales, but Sharepad’s Quality indicators give it the thumbs up. Notice the RoCE and margin close to 40%.

That’s a slightly lower return, but higher margin than AJ Bell.

Opinion: This has surprised me how well it’s done. I was sceptical of the long-term prospects for Discretionary Fund Management, I thought the trend was either going towards people taking investment decisions themselves, dealing execution-only or buying low-cost passive index trackers. So I am late to this, with the shares having doubled from 350p Oct 2022 low.

Equity Development, whose research is paid for by the company, suggest on p16 of their most recent note that Tatton can treble AuM per IFA firm, which would imply £26bn of new AuM without even winning any new clients. So, this may have many years of double-digit growth ahead with operating margins of 40-50%, which would justify the high valuation – but I’d have to do more work to understand the landscape to feel confident in this. Well done to buyers who were quick to see TAM’s potential.

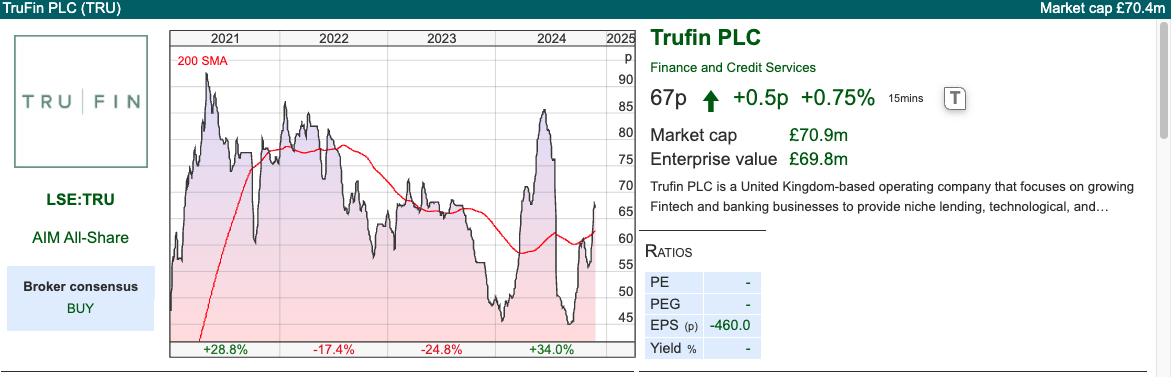

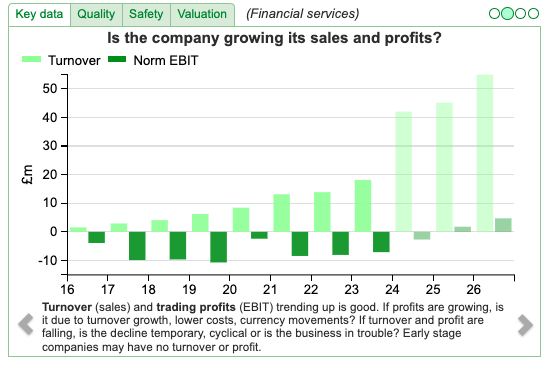

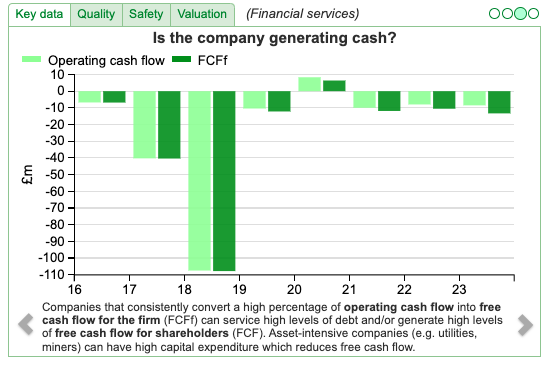

TruFin FY Dec revenue “significantly ahead of expectations”

This niche lender, factoring and computer game publisher announced FY Dec 2024F revenues to be “significantly ahead” of market expectations. They now expect £42m revenues (previous forecast £38m) implying growth of +132% versus last year. This has predominately been driven by their computer games division Playstack.

The company has been loss-making every year since it listed on AIM in Feb 2018 at 190p, hence Sharepad gives it a low Piotroski F score of 3 out of 9. It continues to be loss-making, expecting LBT of £2.5m, but first year of positive EBITDA £3.5m. They had £10m of net cash at the end of October.

History: Prior to 2017 TruFin was owned by VC firm Arrowgrass. The VC firm bought into Zopa in 2014, then added Oxygen Finance in 2016, and in 2017 the bought Satago. They sold Zopa in 2019, but TruFin is now a holding company with three growth-focused FinTech businesses (Oxygen, Satago and Playstack) operating in finance markets like invoice finance. TruFin was listed on AIM in February 2018, raising £70m at 190p per share. Arrowgrass, the VC firm, didn’t sell any shares at the IPO, but instead subscribed to 14m more, giving it a 73% holding. Then the company stumbled and Arrowgrass sold their stake in 2021 at 45p per share, and the largest shareholders are now Watrium (23%) and Gresham House (18%) and Miton (11%). In December 2022 management announced that they had received, and rejected, a bid for their Oxygen division, worth £26m (over 1/3 of the current group market cap). The most recent corporate action was placed in July 2023, raising £7.6m at 65p per share.

Activities: Oxygen is 14% of revenue and does dynamic discounting which involves paying suppliers faster in exchange for a discount – the dynamic part is that the discount is calculated on the number of days that the payment is accelerated.

Playstack is a games publisher and generated 80% of group revenue in H1. They have software called Magnitude, which finds games which are expected to deliver “exceptional” returns on invested capital. They had great success with a game, Balatro, which has sold over 2m units, they say that Playstack’s Return on Invested Development Capital (ROIDC) across its entire console portfolio stands at more than 500%, with an Internal Rate of Return (IRR) of more than 150%. The division has already secured an exciting lineup of 10 games for release in 2025 and 2026.

Satago does invoice financing, and claims to do “Lending as a Service” (LaaS) and has a partnership with accountancy software group Sage. Lloyds Bank was working with Satago but terminated the contract in H1. Playstack and Oxygen are now profitable, which implies that Satago is heavily loss-making.

Medium-term Outlook: Management expects to record its first annual profit in 2025, partly from cutting costs in Satago. 2026F revenue are expected to be more than £55m with an expected Group EBITDA margin of no less than 20% – NB added £3m of intangibles (presumably capitalised internally developed software costs) to the balance sheet in H1 and there’s £26m of intangible assets on the balance sheet, so I would not see that as a proxy for free cashflow. They do say that PBT should grow materially in 2026F as the group benefits from operating leverage.

Valuation: The shares are trading on a PER of 36x Dec 2025F, dropping to below 15x PER the following year. They are on 1.5x sales and EV/EBITDA of 8x Dec 2025F – which doesn’t seem expensive if management can generate sustainable revenue and profit growth.

Opinion: I’m often interested in businesses where a couple of divisions are profitable and growing fast, but the group as a whole is being held back by a loss-making division. That seems to be the case here. I wouldn’t describe what Satago does (invoice discounting and cashflow management) as FinTech or “Lending as a Service”, it’s a dull business without much opportunity to differentiate (unless your name is Lex Greensill).

I think TRU has enough cash to see it through to self-funding growth, particularly if they continue to enjoy success with publishing games (NB we’ve seen that this can go wrong though! eg FDEV, TM17, DEVO and TBLD all down > 80% from their peak). I noticed Paul Hill at Vox interviewed M&G small cap fund manager James Taylor a month ago, who gave TRU a nod. So think this could turn into an interesting story, but haven’t taken a position yet.

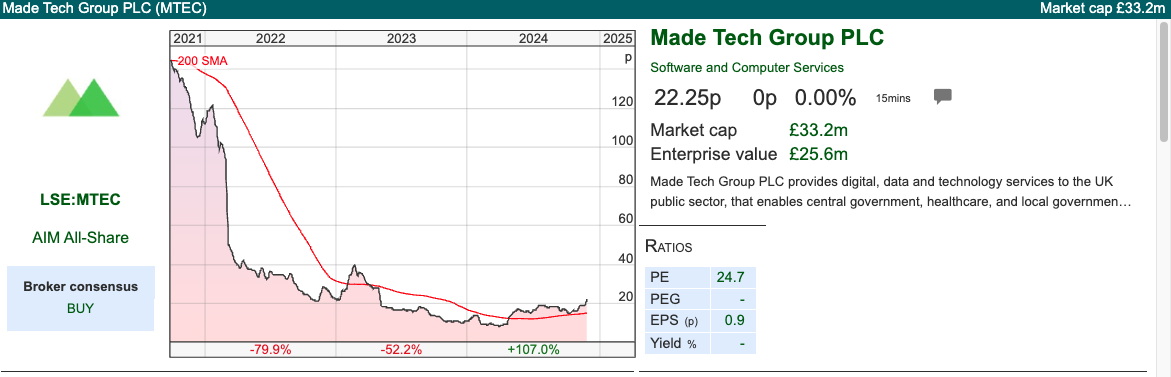

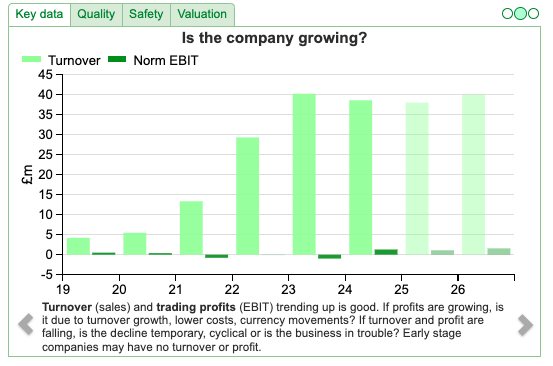

Made Tech Group FY May 2025F “ahead of expectations”

This technology services provider to the public sector (government and healthcare) was a 2021 vintage IPO. Unsurprisingly it has been a poor performer: of the 60 companies that listed on AIM in 2021, just 6 are now in positive territory. The performance of the bottom two-fifths is even worse: 23 (including MTEC) of the 60 have fallen more than 80%.

However, MTEC management said in September that the FY May 2025F had started well, and they announced last week in an AGM statement that revenue should be ahead of expectations (the company says £35m in a footnote). The shares have almost trebled since their March low and are hitting a 52-week high.

History: The group was founded in 2008 by Rory MacDonald (current CEO and 28.5% shareholder). Interestingly his LinkedIn profile shows that he held various CTO roles, for instance, Finery, a Rocket Internet start-up, via Made Tech). The original idea was to provide technology services to venture capital-backed start-ups in the UK, but in 2017 they repositioned the business to focus on the UK public sector. They came to market at 122p, raising £15m and valuing the market cap of the company at £180m on admission.

Then in February 2022 management reported that public bodies had introduced rules, called IR 35, to make sure contractors and employees paid broadly the same Income Tax and National Insurance. The tighter restrictions on working with external contractors reduced MTEC’s expectations for Q4 May 2022 and FY May 2023. The shares halved in value. I don’t have access to Singers’ (their broker) research note but this looks like another example of a management team sounding upbeat in the commentary while telling their brokers to cut forecasts dramatically. See what you think about the Chief Exec’s comment from Feb 2022 and compare it with the subsequent share price performance:

“Despite some short-term challenges relating to IR35 and staffing of public sector contracts and increased overhead costs, which we expect to impact our trading performance in Q4 FY22 and into the first half of FY23, the Group’s significant new contract bookings and robust pipeline underpin the Board’s confidence in the medium term outlook. We look forward to continuing to deliver strong revenue growth in the second half of FY22 and beyond, and remain incredibly positive about the Group’s long-term prospects.”

Then in April 2024 Made Tech announced they had been awarded a new contract of £19.5m with The Department for Levelling Up, Housing & Communities (DLUHC), with revenue recognised over 24 months. The shares have bounced almost 3x following that April RNS.

Valuation: The shares are trading on a PER of 37x May 2025F, dropping to 24x the following year. The price/sales ratio is below 1x, and the EV/EBITDA 9x.

Opinion: The low price-to-sales ratio might appear optically cheap, but I also pay attention to management’s “voluntary disclosure” style: how management chooses to communicate in words, rather than just the statutory numbers they have to report.

The market cap is well below £150m, management needs to win trust with individual retail investors, as most professional fund managers will avoid companies below that threshold. So for instance, I would like to see broker research easily available to the likes of you and me. Readers may want to buy into the recovery story but should be aware of the previous upbeat-sounding commentary and subsequent disappointing share price performance. This is an “avoid” for me, given the history.

~

Bruce Packard

Notes

Bruce owns shares in Next Energy Solar Fund

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 26/11/2024 | NESF, TAM, TRU, MTEC | Natural Gas on the rise again

A look at whether rising Natural Gas prices might threaten the market rally, and whether renewables might help offset the pain. Companies mentioned NESF, TAM, TRU and MTEC.

The FTSE 100 was up +2.3% last week to 8,294, helped by a weak pound. The pound has fallen -6% from 1.34 against the dollar to 1.26 since the start of October. The FTSE 100 performance was ahead of US markets, with the Nasdaq100 rising 1.9% and the S&P500 rising +1.7%. Over the last 5 days, China has been weak, with the FTSE China down -2.7%.

The price of Natural Gas (Sharepad ticker: NG-MT) was down at the start of this week but has risen +68% since the beginning of August. The commodity remains well below the initial spike upwards that we saw in 2022 when Putin sent the tanks in to try to seize Kyiv, but I think NG-MT is worth keeping an eye on.

Gas storage facilities in Europe are currently full, in preparation for the Winter, but the fear is that we may experience a cold winter and supply disruptions. In late October there was a problem with Norway’s state energy company Equinor. Around 30% of Europe’s Natural Gas comes from Norway, and another 20% of LNG goes through the Straits of Hormuz in the Gulf, so it’s understandable that traders are nervous.

I am conscious that a second round of energy price inflation this winter could be bad news for markets, and I thought I was being clever by buying shares in Next Energy Solar Fund a couple of months ago. The company reported H1 to Sept last week, and are currently on a dividend yield of 12% and a discount to NAV of -30%. The group is selling off solar panel farms at a premium to NAV, so far raising £73m of capital, reinvesting in battery storage, and buying back up to £20m of shares. So far that trade hasn’t worked for me, but presumably, NESF should benefit from rising energy prices at some point.

I notice other renewable energy infrastructure funds have done badly, for instance, GRID is down -56% YTD and trades at a 56% discount to NAV. I’m not a sector specialist, so if I have missed something obvious, please let me know in the chat!

I hope everyone who attended David Stredder’s Mello event in Derby enjoyed it. Good to see that Mello isn’t just a London-centric event, and I am impressed that he manages to keep finding good quality companies to present to investors. I didn’t attend this time, but Jamie Ward was there, he suggested Brave Bison was a particularly good presentation and he thought that Richard Stavely at Rockwood came across well.

This week I look at Tatton, an investment company seeing inflows. Plus miscellaneous financial company TruFin and Made Tech which provide technology services to the Government.

Tatton Asset Management H1 Sept Results

This investment management company is a rare bird: a fund manager reporting strong inflows. Assets under Management (AuM) increased by +35% to £20bn, with further net inflows continuing into H2. Group revenue was up +24%, statutory PBT was up +31% to £10m. Net cash stood at £27m at the end of September.

Cashflow statement: The cashflow statement has been restated, to reflect dividends received from joint ventures as “cash flows from investing activities” (previously recorded in “cash from financing activities”). I went back and checked, and the £2.27m decrease in cash H1 Sept 2023 remains unchanged, so this is just a case of shifting a payment received to a different line of the cashflow statement. There’s also £1m fair value gain that is recognised in the p&l and reversed out from “cash from investing activities” in the most recent set of accounts. In the past couple of halves, the cash position had been declining, but this trend has now reversed.

History: Tatton was founded in 2007 by the current Chief Executive, Paul Hogarth. It serves smaller, UK-based Independent Financial Advisers (IFAs) via two business units: i) Tatton Investment Management (85% of group revenue) which does discretionary fund management; and ii) Paradigm – regulatory and compliance consulting and outsourcing, plus insurance aggregation (15% of group revenue).

In other words, this isn’t a traditional fund manager, like Miton or Liontrust, but instead provides Managed Portfolio Services (MPS) allowing IFAs to administer clients’ “model portfolios” on investment platforms, for which it charges 15bp per annum. In other words, it has more in common with AJ Bell than a traditional active fund manager. The company listed on AIM in 2017, at 156p, raising £8m for the company but selling shareholders receiving £40m. This valued the company at £87m market cap on admission. Since then the company has trebled revenue and profits are up 8x – an impressive performance. I have taken the chart below from Equity Development’s not, showing that Tatton is reporting AuM growth well ahead of its rivals.

Growth targets: Management have a track record of setting demanding targets for AuM, but delivering. In Mar 2021, they outlined a plan to grow AuM from £9bn to £15bn in three years (ie by Mar 24). They figure achieved was £17.6bn, although helped by some acquisitions they still would have hit the £15bn target on an underlying basis. Then in Jun 2024, management set a new target of reaching £30bn AuM by end FY Mar 2029, implying an 11% CAGR.

One slide I found useful in the analyst presentation, was management showing net annualised flows at Tatton versus other Wealth Management competitors. Platforms like AJ Bell, transact and Hargreaves Lansdown continue to attract assets versus the likes of SJP and Rathbones.

Valuation: The shares are trading on a PER of 23x Mar 2026F dropping to 20x the following year. It looks expensive on 9x forecast sales, but Sharepad’s Quality indicators give it the thumbs up. Notice the RoCE and margin close to 40%.

That’s a slightly lower return, but higher margin than AJ Bell.

Opinion: This has surprised me how well it’s done. I was sceptical of the long-term prospects for Discretionary Fund Management, I thought the trend was either going towards people taking investment decisions themselves, dealing execution-only or buying low-cost passive index trackers. So I am late to this, with the shares having doubled from 350p Oct 2022 low.

Equity Development, whose research is paid for by the company, suggest on p16 of their most recent note that Tatton can treble AuM per IFA firm, which would imply £26bn of new AuM without even winning any new clients. So, this may have many years of double-digit growth ahead with operating margins of 40-50%, which would justify the high valuation – but I’d have to do more work to understand the landscape to feel confident in this. Well done to buyers who were quick to see TAM’s potential.

TruFin FY Dec revenue “significantly ahead of expectations”

This niche lender, factoring and computer game publisher announced FY Dec 2024F revenues to be “significantly ahead” of market expectations. They now expect £42m revenues (previous forecast £38m) implying growth of +132% versus last year. This has predominately been driven by their computer games division Playstack.

The company has been loss-making every year since it listed on AIM in Feb 2018 at 190p, hence Sharepad gives it a low Piotroski F score of 3 out of 9. It continues to be loss-making, expecting LBT of £2.5m, but first year of positive EBITDA £3.5m. They had £10m of net cash at the end of October.

History: Prior to 2017 TruFin was owned by VC firm Arrowgrass. The VC firm bought into Zopa in 2014, then added Oxygen Finance in 2016, and in 2017 the bought Satago. They sold Zopa in 2019, but TruFin is now a holding company with three growth-focused FinTech businesses (Oxygen, Satago and Playstack) operating in finance markets like invoice finance. TruFin was listed on AIM in February 2018, raising £70m at 190p per share. Arrowgrass, the VC firm, didn’t sell any shares at the IPO, but instead subscribed to 14m more, giving it a 73% holding. Then the company stumbled and Arrowgrass sold their stake in 2021 at 45p per share, and the largest shareholders are now Watrium (23%) and Gresham House (18%) and Miton (11%). In December 2022 management announced that they had received, and rejected, a bid for their Oxygen division, worth £26m (over 1/3 of the current group market cap). The most recent corporate action was placed in July 2023, raising £7.6m at 65p per share.

Activities: Oxygen is 14% of revenue and does dynamic discounting which involves paying suppliers faster in exchange for a discount – the dynamic part is that the discount is calculated on the number of days that the payment is accelerated.

Playstack is a games publisher and generated 80% of group revenue in H1. They have software called Magnitude, which finds games which are expected to deliver “exceptional” returns on invested capital. They had great success with a game, Balatro, which has sold over 2m units, they say that Playstack’s Return on Invested Development Capital (ROIDC) across its entire console portfolio stands at more than 500%, with an Internal Rate of Return (IRR) of more than 150%. The division has already secured an exciting lineup of 10 games for release in 2025 and 2026.

Satago does invoice financing, and claims to do “Lending as a Service” (LaaS) and has a partnership with accountancy software group Sage. Lloyds Bank was working with Satago but terminated the contract in H1. Playstack and Oxygen are now profitable, which implies that Satago is heavily loss-making.

Medium-term Outlook: Management expects to record its first annual profit in 2025, partly from cutting costs in Satago. 2026F revenue are expected to be more than £55m with an expected Group EBITDA margin of no less than 20% – NB added £3m of intangibles (presumably capitalised internally developed software costs) to the balance sheet in H1 and there’s £26m of intangible assets on the balance sheet, so I would not see that as a proxy for free cashflow. They do say that PBT should grow materially in 2026F as the group benefits from operating leverage.

Valuation: The shares are trading on a PER of 36x Dec 2025F, dropping to below 15x PER the following year. They are on 1.5x sales and EV/EBITDA of 8x Dec 2025F – which doesn’t seem expensive if management can generate sustainable revenue and profit growth.

Opinion: I’m often interested in businesses where a couple of divisions are profitable and growing fast, but the group as a whole is being held back by a loss-making division. That seems to be the case here. I wouldn’t describe what Satago does (invoice discounting and cashflow management) as FinTech or “Lending as a Service”, it’s a dull business without much opportunity to differentiate (unless your name is Lex Greensill).

I think TRU has enough cash to see it through to self-funding growth, particularly if they continue to enjoy success with publishing games (NB we’ve seen that this can go wrong though! eg FDEV, TM17, DEVO and TBLD all down > 80% from their peak). I noticed Paul Hill at Vox interviewed M&G small cap fund manager James Taylor a month ago, who gave TRU a nod. So think this could turn into an interesting story, but haven’t taken a position yet.

Made Tech Group FY May 2025F “ahead of expectations”

This technology services provider to the public sector (government and healthcare) was a 2021 vintage IPO. Unsurprisingly it has been a poor performer: of the 60 companies that listed on AIM in 2021, just 6 are now in positive territory. The performance of the bottom two-fifths is even worse: 23 (including MTEC) of the 60 have fallen more than 80%.

However, MTEC management said in September that the FY May 2025F had started well, and they announced last week in an AGM statement that revenue should be ahead of expectations (the company says £35m in a footnote). The shares have almost trebled since their March low and are hitting a 52-week high.

History: The group was founded in 2008 by Rory MacDonald (current CEO and 28.5% shareholder). Interestingly his LinkedIn profile shows that he held various CTO roles, for instance, Finery, a Rocket Internet start-up, via Made Tech). The original idea was to provide technology services to venture capital-backed start-ups in the UK, but in 2017 they repositioned the business to focus on the UK public sector. They came to market at 122p, raising £15m and valuing the market cap of the company at £180m on admission.

Then in February 2022 management reported that public bodies had introduced rules, called IR 35, to make sure contractors and employees paid broadly the same Income Tax and National Insurance. The tighter restrictions on working with external contractors reduced MTEC’s expectations for Q4 May 2022 and FY May 2023. The shares halved in value. I don’t have access to Singers’ (their broker) research note but this looks like another example of a management team sounding upbeat in the commentary while telling their brokers to cut forecasts dramatically. See what you think about the Chief Exec’s comment from Feb 2022 and compare it with the subsequent share price performance:

“Despite some short-term challenges relating to IR35 and staffing of public sector contracts and increased overhead costs, which we expect to impact our trading performance in Q4 FY22 and into the first half of FY23, the Group’s significant new contract bookings and robust pipeline underpin the Board’s confidence in the medium term outlook. We look forward to continuing to deliver strong revenue growth in the second half of FY22 and beyond, and remain incredibly positive about the Group’s long-term prospects.”

Then in April 2024 Made Tech announced they had been awarded a new contract of £19.5m with The Department for Levelling Up, Housing & Communities (DLUHC), with revenue recognised over 24 months. The shares have bounced almost 3x following that April RNS.

Valuation: The shares are trading on a PER of 37x May 2025F, dropping to 24x the following year. The price/sales ratio is below 1x, and the EV/EBITDA 9x.

Opinion: The low price-to-sales ratio might appear optically cheap, but I also pay attention to management’s “voluntary disclosure” style: how management chooses to communicate in words, rather than just the statutory numbers they have to report.

The market cap is well below £150m, management needs to win trust with individual retail investors, as most professional fund managers will avoid companies below that threshold. So for instance, I would like to see broker research easily available to the likes of you and me. Readers may want to buy into the recovery story but should be aware of the previous upbeat-sounding commentary and subsequent disappointing share price performance. This is an “avoid” for me, given the history.

~

Bruce Packard

Notes

Bruce owns shares in Next Energy Solar Fund

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.