You’ve probably seen Jaguar’s new rebrand, which looks similar to a cosmetic or a fashion ad, without any mention of cars, and some vague slogans which mean little to anyone.

Marketers worldwide have crowed about how “Jaguar has destroyed its brand” and that this is financial suicide.

Maybe.

But they missed the point.

Jaguar barely makes any money. Its sales were down 66% in 2022 from 2018.

In fact, the CEO said Jaguar makes “close to zero profitability”.

The CCO said it has “no brand equity whatsoever”.

This is what happens when you take a luxury brand and mass-market it. Brand equity goes down, and nobody wants it.

Potential customers are choosing premium options such as Bentley, or entry-level luxury such as Audi or Mercedes.

So if there is no brand equity, you can pretty much do whatever you want.

And yes, I’m sure Jaguar’s core customers will be alienated by the bright colours and weird ad, but they weren’t making the business any money anyway.

Jaguar is scrapping its existing line-up and releasing entirely new products, at a £100k+ price point, with a view of a higher brand equity position.

So basically trying to fix everything that wasn’t working.

I don’t know if this will work. I’m not a marketing expert.

But what I do know, is that Jaguar are trying something new instead of fading away into irrelevance. It has to do something, that’s for sure.

And it got everyone talking ahead of its new launch in 10 days. So maybe the ad did what it was supposed to after all? We’ll see!

Brand equity matters more than people think.

It’s why people will pay £50 for a T-shirt with a Nike logo on it when you can buy an almost identical t-shirt without a Nike logo for £5.

And it’s a big factor in Games Workshop’s (GAW) success too.

It has built a huge fanbase of customers loyal to its products, who engage with the products by painting soldiers and armies and then using these decorated figures in games.

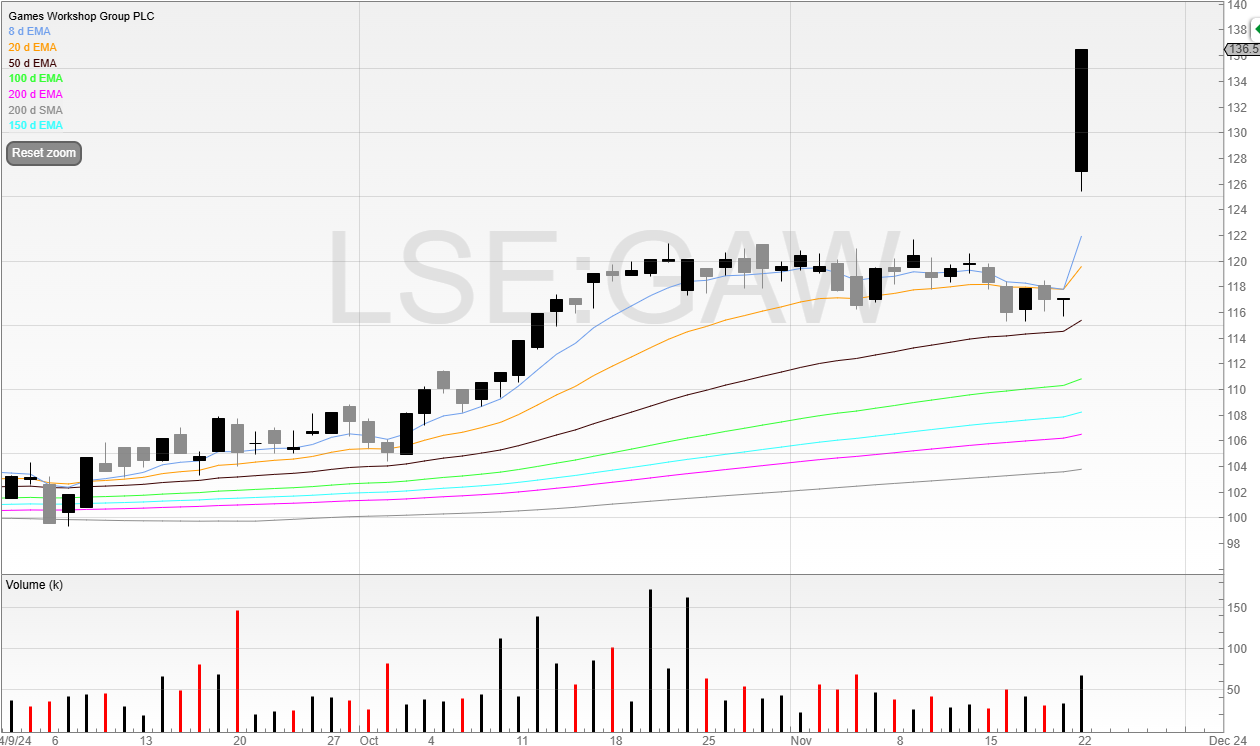

It’s one of the UK’s biggest stock market success stories (previously the companies names reserved for the same sentence were ASOS and Boohoo but both of those are now circling the toilet bowl) and despite the volatility during Covid has now reached new highs.

The stock offered a great entry point for an opening drive trade.

The stock was flat for the last six weeks and even trended down slightly.

To me, that means a positive news update wasn’t expected.

If it was, then the stock would’ve rallied.

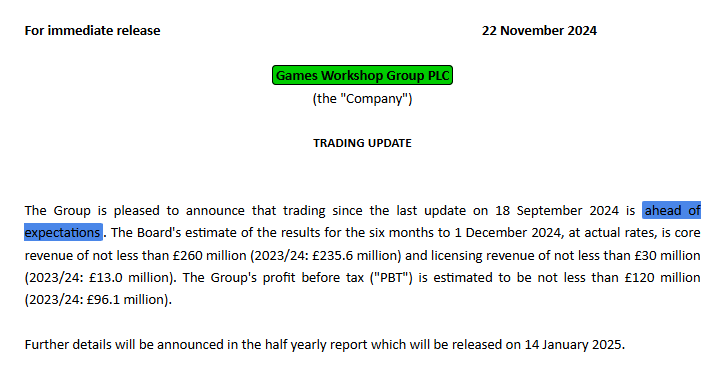

Here’s the update:

Games Workshop is always nice and succinct. No corporate buzzwords. No nonsense. The exact type of wording I like, and new guidance given.

My only gripe is that I struggled to find the old guidance quickly, and so didn’t put an order in for as much as I would’ve wanted.

But it’s also the first in potentially a new cycle.

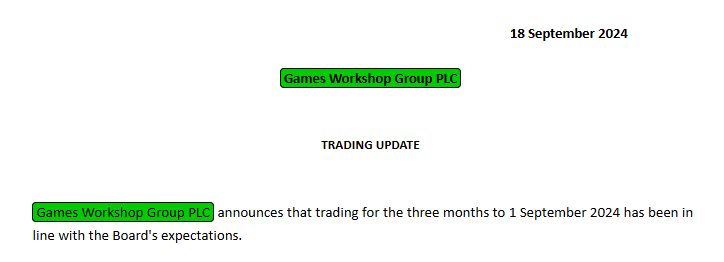

Here’s the last earnings update.

So the update is not only a surprise but also the first.

Here’s how the stock reacted.

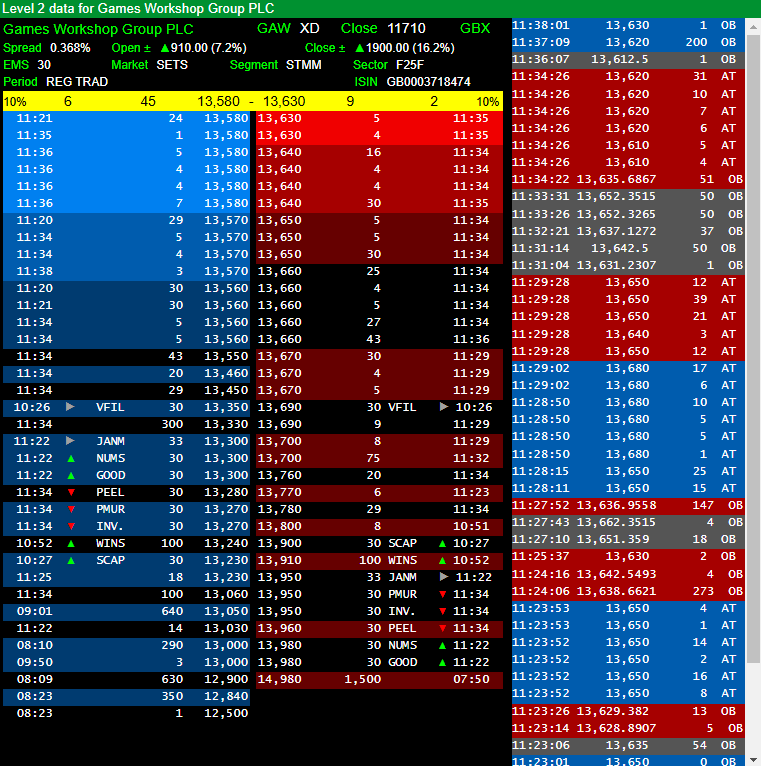

This is why I believe the opening auction is a great opportunity for traders, and why Level 2 comes into play.

Level 2 shows you the market in real-time, with bid orders on the left and ask orders on the right.

During an auction, the yellow strip (showing the most competitive bid and ask prices) will show a single price. This is the indicative uncrossing trade, which means it’s the uncrossing trade price if the auction was to uncross at that moment, hence ‘indicative’.

But this can and does change rapidly, especially as orders pile into the auction in the last few seconds before the uncrossing period begins (08:00:00). Why show your hand when you don’t need to?

The indicative uncrossing will show you the price and also the volume taking place in the auction.

You can use this to gauge the auction’s pulse and enter your order accordingly.

Using auctions to trade what I call the ‘Opening Drive’ is a great strategy to take advantage of unexpected surprise news – both positive and negative.

As we’re not huge >£100m institutions (well, I’m not at least) we can use position agility to get ahead and get in and out of stocks quickly, especially at the size of Games Workshop which is now a £4bn+ company.

Many institutions will not be able to buy as much stock as they want in the opening auction. That means they could be buyers over several days or even weeks. There’ll always be sellers, but when inflows exceed outflows over a period of time, the net effect is a price rise.

We can ride these coattails either as an intraday trade or a swing trade.

Next time you see a stock with:

- Unexpected positive news

- A flat or falling chart

Make sure you look deeper. There could be a trade there.

It doesn’t work all the time, of course. Nothing ever does. And nothing is guaranteed.

However, it has been a consistently profitable strategy over time for me with careful risk management.

Michael holds a long position in Games Workshop (GAW).

Michael Taylor

Get Michael’s trade ideas: https://newsletter.buythebullmarket.com/

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.