In this article, Michael looks at flipping direction and two trade ideas.

It’s been a big week for volatility.

China’s stimulus plan jumpstarted the resources sector and helped the luxury sector too.

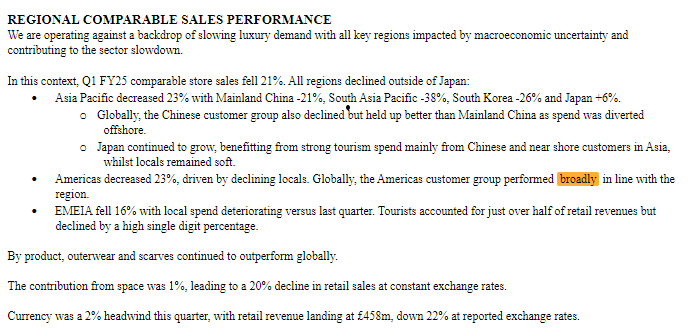

China’s slowdown in consumer spending has been responsible for a big part of the luxury slump, and sales collapsed in Mainland China for Burberry.

Source: Burberry Group PLC – First Quarter Trading Update

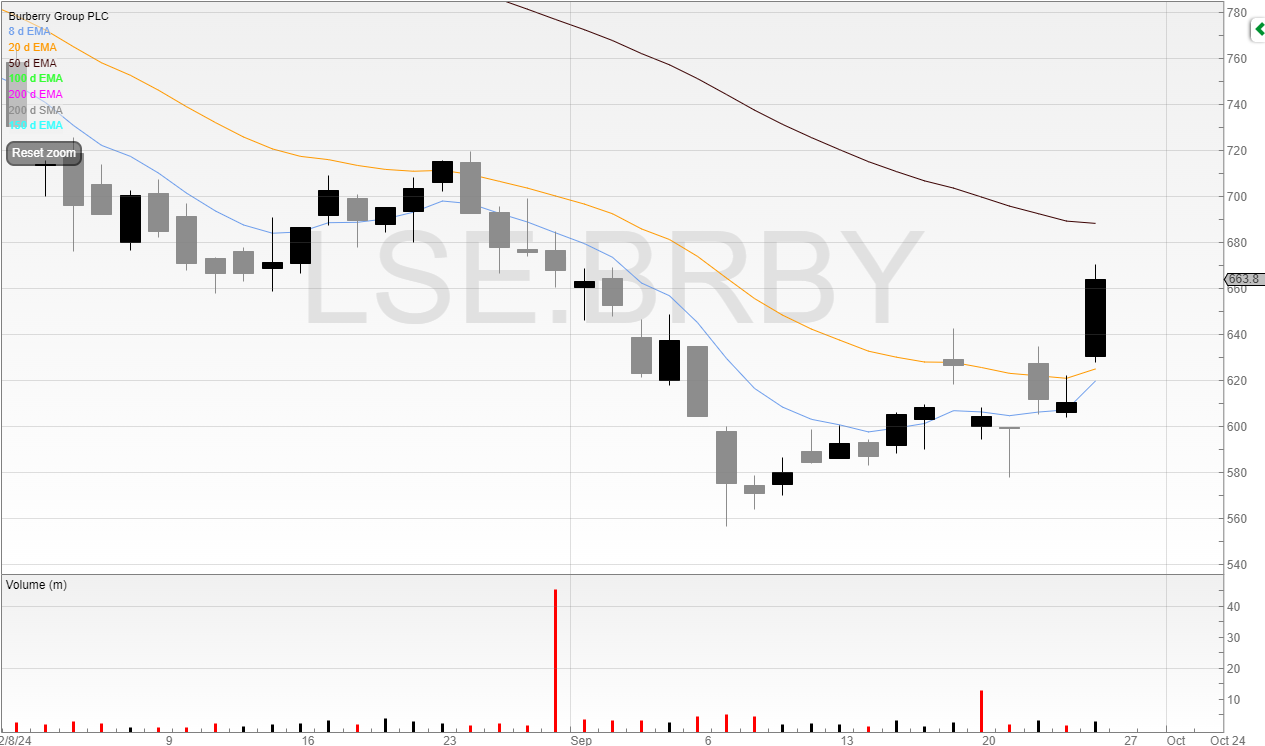

However, the stock reacted to the stimulus eventually.

There were some other big moves this week, notably in a popular stock called Card Factory.

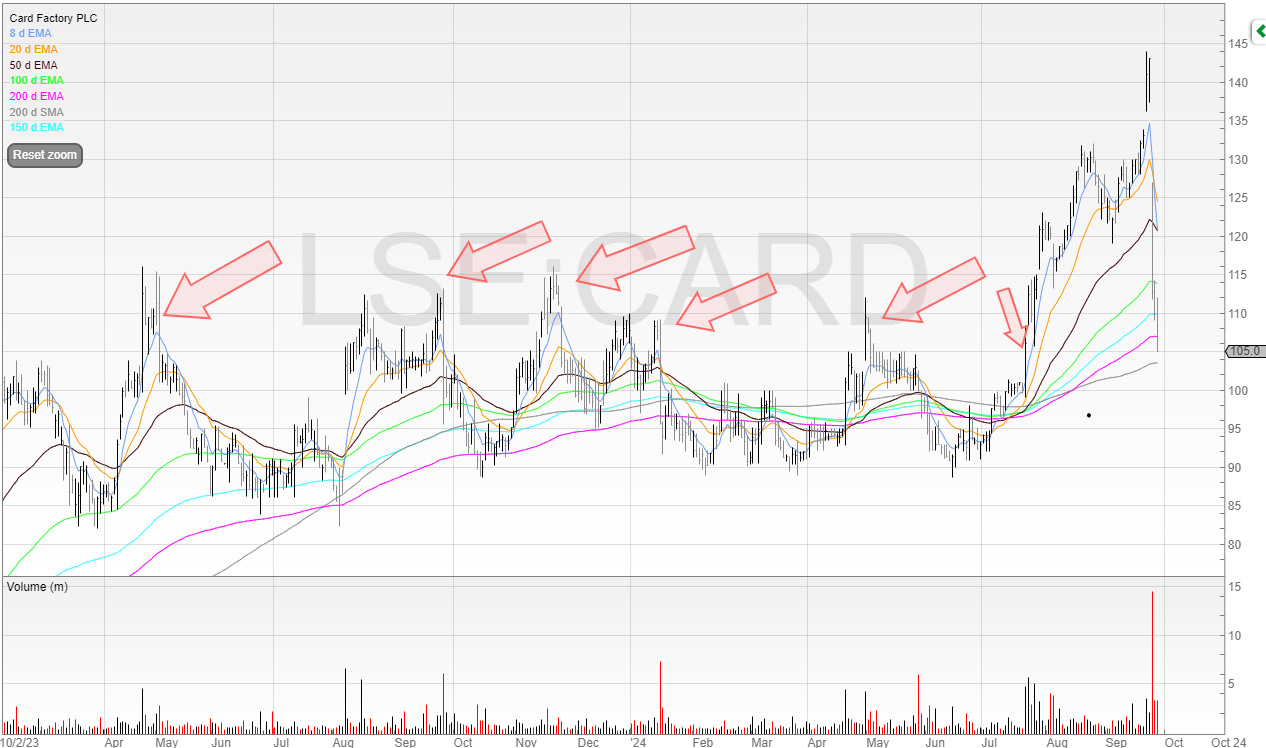

We looked at Card Factory in my last article ‘Do sellers present opportunity’ and I argued that buying whilst there is a seller is not worth it because you have no guarantee of 1) how long the seller will be around, and 2) if any buyers will have more potential bullets than the seller. In other words, the price might be depressed but it can always become more depressed.

Those who bought at the first sign of Teleios unwinding its position waited 15 months before they cleared. That’s a long wait.

The left-facing arrows show the liquidity events where good news was published and the price fell because Teleios was taking advantage of that liquidity.

The right-facing arrow shows the day the RNS was released that Teleios had sold its position to zero.

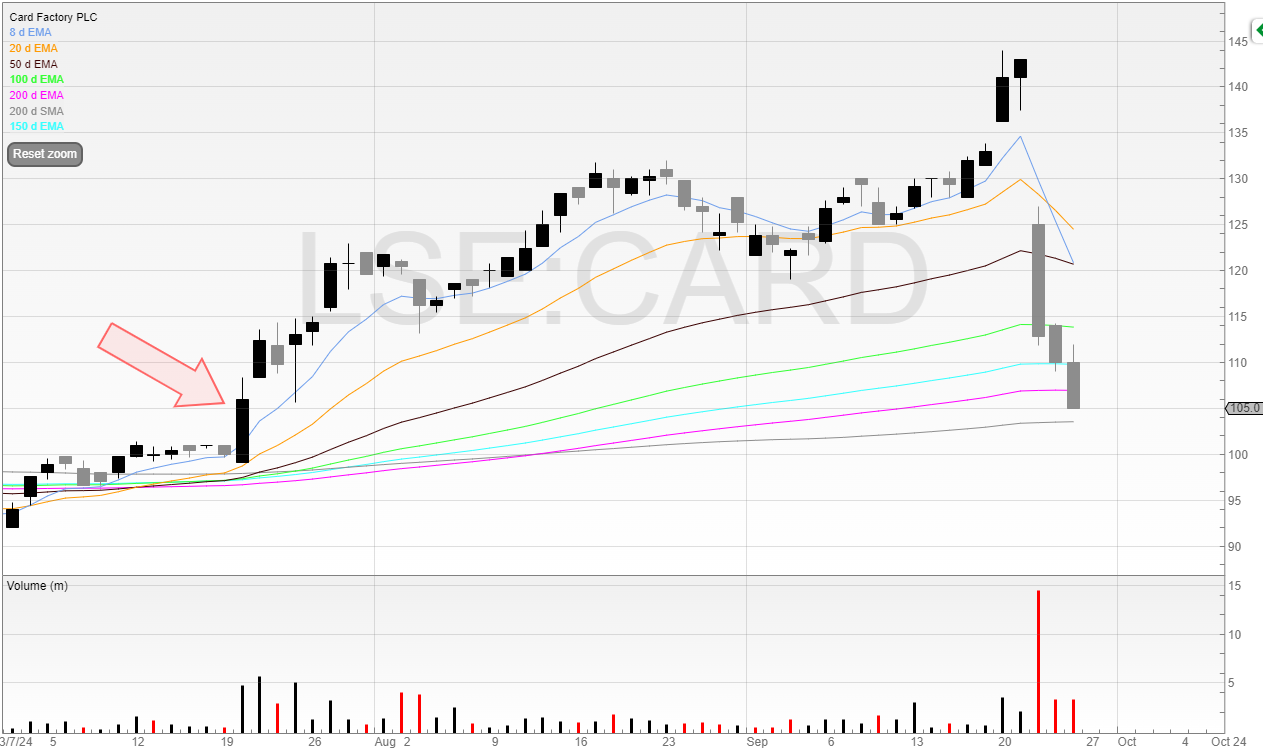

Let’s look closer here.

Firstly, this shows the importance of a good entry.

If you had waited for the price to rise as confirmation of Teleios clearing, you would’ve missed some of the move and also depending on where you entered potentially be at a loss once the stock had gapped down.

This is why a good entry is crucial.

Once you start waiting for confirmation, the risk/reward of that trade moves against you.

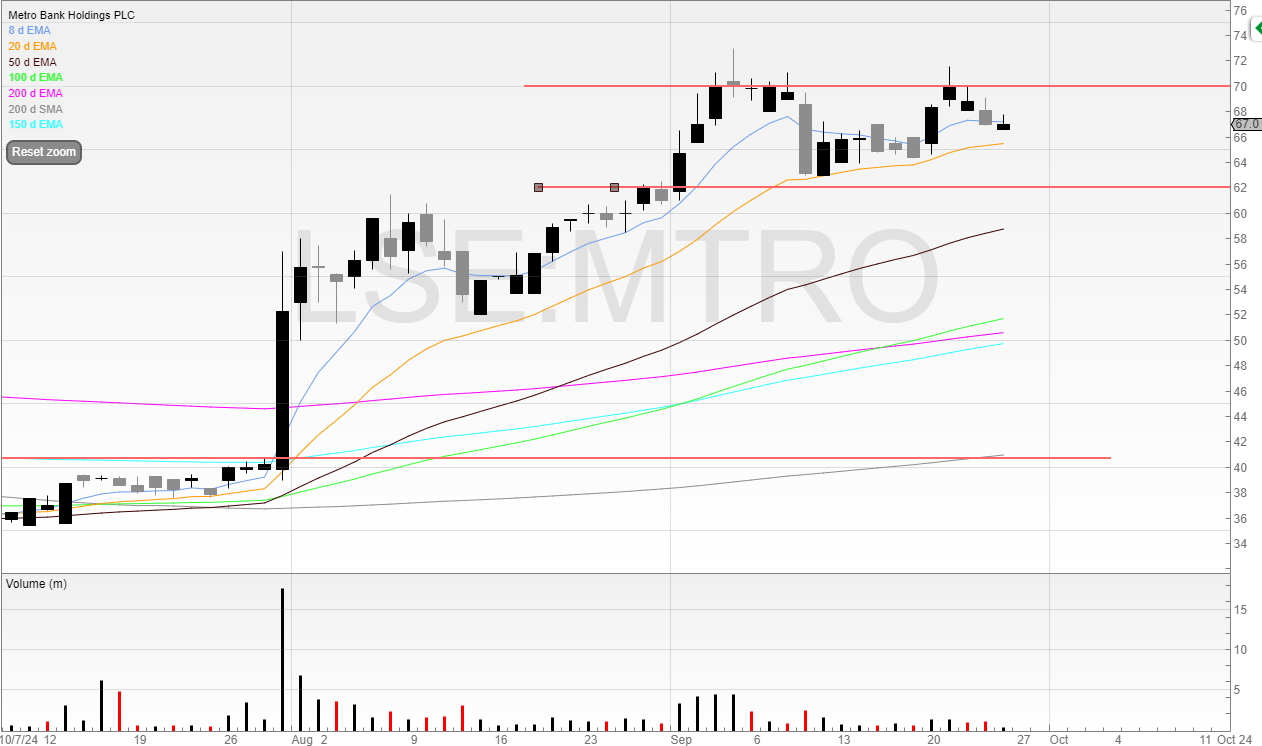

For example, let’s imagine we’re looking to trade Metro Bank.

I’ve marked the breakout at 70p and put a stop at 61.8p (round numbers are for amateurs).

That gives us a risk per share of 8.2p.

However, if we decide to wait to see if the stock has actually broken out and want to buy at 75p instead, our risk per share is now 13.2p.

We would need to decrease our position size to accommodate and adjust for this wider risk per share otherwise our risk would be significantly higher.

But that’s not all.

The stock could fall back, and if it falls back, it has more to fall back to a key support/resistance point, in this case, 70p.

Whereas if you’re buying when the stock breaks that resistance, there is a reason for the stock to move.

Waiting for ‘confirmation’ is harming you as a trader.

Hopefully, this makes sense!

Let’s go back to CARD.

If you’d entered late, the risk/reward wouldn’t have been as great.

And you might’ve even taken a loss on the trade due to the gap down on the earnings.

Even though the company stated that “full year expectations unchanged” the stock still opened up at 125p from 143p.

H1 profits are down as a result of “substantial increases in National Living Wage, plus freight inflation and phasing of strategic investments”.

The danger here is that Card Factory is now dependent on a strong second half and therefore has a H2 weighting with a lot of work to be done.

Plus, the shares had rallied strongly since Teleios and rallied sharply in the days leading up to the results.

No doubt that some traders were expecting better results, and an in-line wasn’t good enough for them.

Whenever a stock gaps down sharply, there is usually a reason for it.

Stocks don’t gap down strongly on in-line news unless there is something the market doesn’t like.

It’s your job to find out the reason and assess it.

In this instance, the uncrossing trade would’ve been one of the best exit points of the day, and the stock price kept falling.

Anyone long would’ve wanted to question if they should take their profits based on the open.

However, the better trade would be to do a 180 and flip completely from long to short.

This is hard to do because whenever we have a trade-on, we always have an inherent bias to that position and its direction.

Most people usually go from long to flat, or short to flat. It’s rare that anyone flips completely from long to short, or short to long.

However, these can sometimes be excellent trades, and in the Card Factory instance any trader who was long, realised that the stock was gapping down through their stop, and then shorted the stock would’ve had a great few days.

In my opinion, Card Factory is now out of play due to no immediate catalyst and now plenty of overhead supply.

There may be a scalp trade if the stock tests the Big Round Number (BRN) of 100p.

Placing an entry on the bid to get hit in the high 90s means that if the trade fails you’re out quick.

And if it sharply rallies then it could be a nice trade.

This would be a quick trade but I believe the swing trade at Card Factory is now no more.

Michael Taylor

Buy The Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.