Bruce looks at the reversal in the copper price, and what this might signal about global growth and interest rate expectations. Companies covered WOSG, HVO and FEVR.

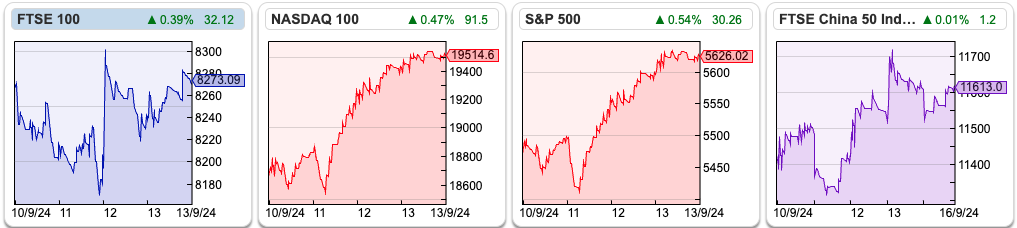

The FTSE 100 rose +1% to 8,273. US markets were much stronger, with the Nasdaq100 up +6.% and the S&P500 up +4%. That seems to be driven by expectations of US rate cuts, as the data on the US economy such as the Conference Board’s Leading Economic Index continues to be weak. The price of copper (Sharepad ticker HG-MT) is down roughly -20% since its peak in the middle of May earlier this year. The 64 day moving average is trending down towards the 16 day moving average.

Copper’s reversal seems to have been driven by concerns over Chinese economic activity, rather than a US recession. China’s net imports of the metal were at 13-year lows in June as the country exported 157,000 tonnes, presumably because the home market was oversupplied. Rio Tinto, said in August that steel demand from Chinese property developers was also down by as much as 30 per cent from its peak in 2020. So, although the recent headlines have been about a US recession, commodity prices seem to have been reacting to weak Asian demand.

I’ve mentioned before that I view copper as a better predictor of economic activity than the yield curve, as the latter has been distorted by Central Bank QE and pension funds being encouraged to buy long dated government bonds to match their liabilities. UK markets look more attractive than the US, but one worry is expectations of higher CGT or the possible withdrawal of Business Property Relief tax on AIM shares. Simon French at PanmureLiberum believes this could be the start of £5bn of outflows from a £48bn market. If so, we might expect to see recent weakness in standout long-term AIM performers, the likes of BioVentix, Judges Scientific and AB Dynamics. These are off -11%, -3% and -9% respectively since 5th July. I don’t think that is enough to “prove the hypothesis”, but an interesting idea nonetheless.

This week I look at Watches of Switzerland, which has been affected by the broader luxury sell-off (again, likely driven by Chinese demand). Also the infectious disease clinical trials business hVIVO and Fevertree, the tonic and mixers brand.

Watches of Switzerland FY Apr Trading Update

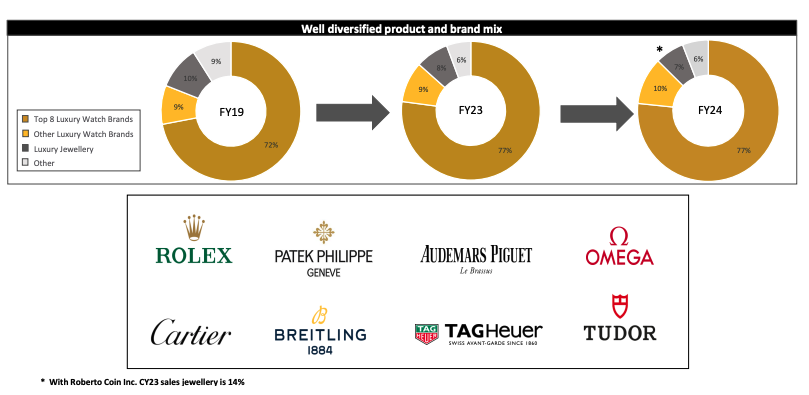

This luxury watch retailer announced “on track” trading for the first 18 weeks of their FY to April 2025F. They say demand remains strong in the US and UK, although they expect US growth to be H2 weighted. WOSG brands include Mappin & Webb, Goldsmiths, Mayors, Betteridge and Analog:Shift, plus recent acquisition Roberto Coin. As well as those brands, Watches of Switzerland is also the UK’s largest retailer of Rolex, Omega, Cartier, TAG Heuer and Breitling. 55% of revenue comes from the UK and Europe, and 45% from the US. Roberto Coin, the Vicenza founded jewellery designer and manufacturer, which they bought for $130m total consideration in May this year, integration is progressing well.

History: Mappin & Webb’s history goes back to 1775 when it was founded in Sheffield, and the brand was first granted a Royal Warrant in 1897. Goldsmiths was founded in Newcastle a couple of years later, and became the first authorised retailer of Rolex watches in the UK in 1919. Watches of Switzerland was formed in the UK in 1924. These three brands were amalgamated into a single corporate in 2005 by Baugur group, the Icelandic company headed by shaggy-haired billionaire Jón Ásgeir Jóhannesson, who also bought stakes in Hamley’s, House of Fraser and Karen Millen. During the financial crisis Baugur defaulted on its debt, so their WOSG stake went to Landsbanki, which itself was rescued by the Icelandic government.

Apollo bought the Icelandic government’s stake and became a 90% shareholder in 2013. In 2019, Watches of Switzerland raised £200m at 270p in an IPO for 34% of the company, valuing the company on admission at £650m market cap. The selling shareholder Apollo received £64m and the company received £140m. After the shares listed, Apollo still owned 59% of the shares, but has since sold down its stake to below a disclosable level (ie less than 3%). The two largest shareholders currently on the register are Capital Group and Pelham Capital, both with 5%.

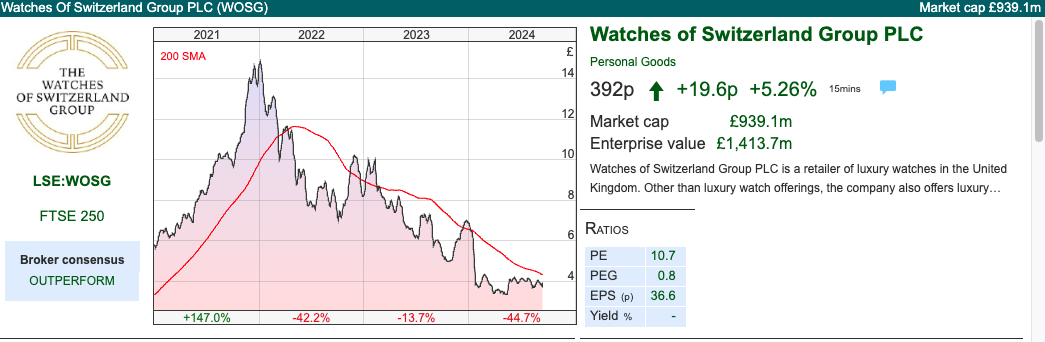

The shares hit a peak of almost £15 during the pandemic bubble, but have since disappointed a couple of times, most recently in January this year when the shares fell -30% after their FY Apr 2024 trading update. Chief Exec Brian Duffy blamed the disappointing average selling price on their suppliers sending low cost watches. For instance, Rolex sent WOSG predominately steel-based watches, rather than a greater number of more expensive gold watches. That explanation is no doubt correct; but misses the bigger picture of profit warnings from other luxury retailers like Burberry, Kering (owner of Gucci), Hugo Boss, Richemont Mulberry and Swatch Group. Perhaps the cost of living crisis is affecting the super-rich, and they are having to cut back on watches and jewellery, to afford the rising cost of food and energy? More likely, the luxury sector is driven by Chinese buyers, who are struggling to recover from the pandemic and property bust.

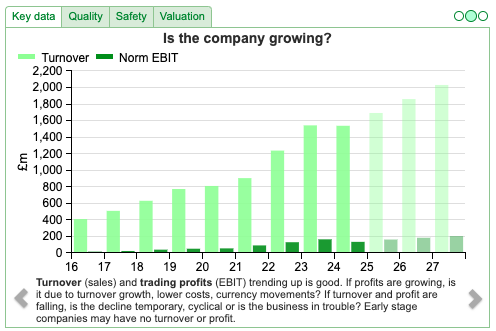

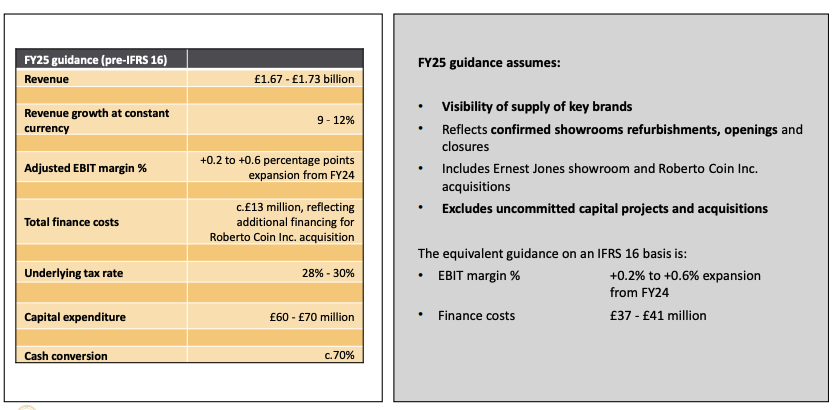

Guidance: After the disappointment at the start of the year, management reiterated their May guidance. Below is the slide they put up at their FY Apr results presentation. There’s also a long range plan out to 2028, which includes accelerating second hand (they call it “pre-owned”) watches, US online sales (currently less than 2% versus above 8% in the UK) and continued expansion in the US.

Valuation: The shares are trading on 8x PER Apr 2026F or an EV/EBITDA of 6x the same year. Alternatively, a 0.5x price to sales ratio also seems good value, and likely reflects that EBIT margins have declined from above to 10%. Presumably though the perennial nature of the watch brands means that EBIT margins should expand, in line with management guidance.

Opinion: At one point I wondered if the trend for people to buy wearable gadgets like Apple Watch, which came out 10 years ago, might have slowed sales of analogue watches; but that doesn’t seem to have happened. Instead, the disappointment has been driven by the sell-off in luxury goods. I can’t see that changing in the near term. The WOSG valuation does seem attractive though, so this may appeal to old-fashioned value investors who don’t care about a near-term catalyst.

hVIVO H1 June results

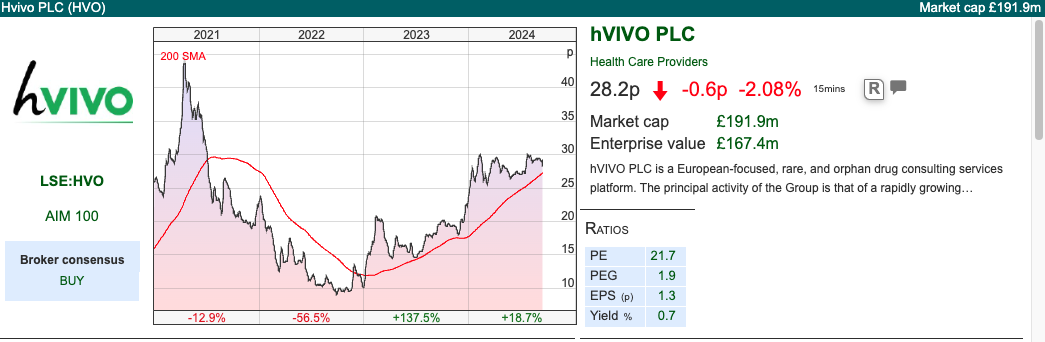

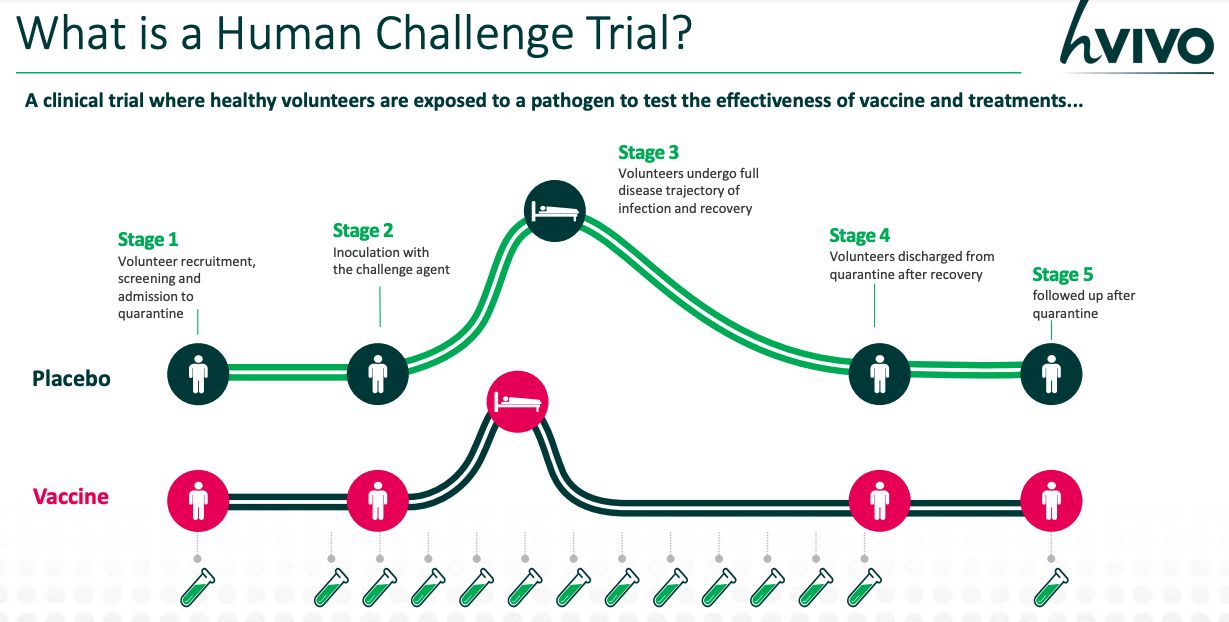

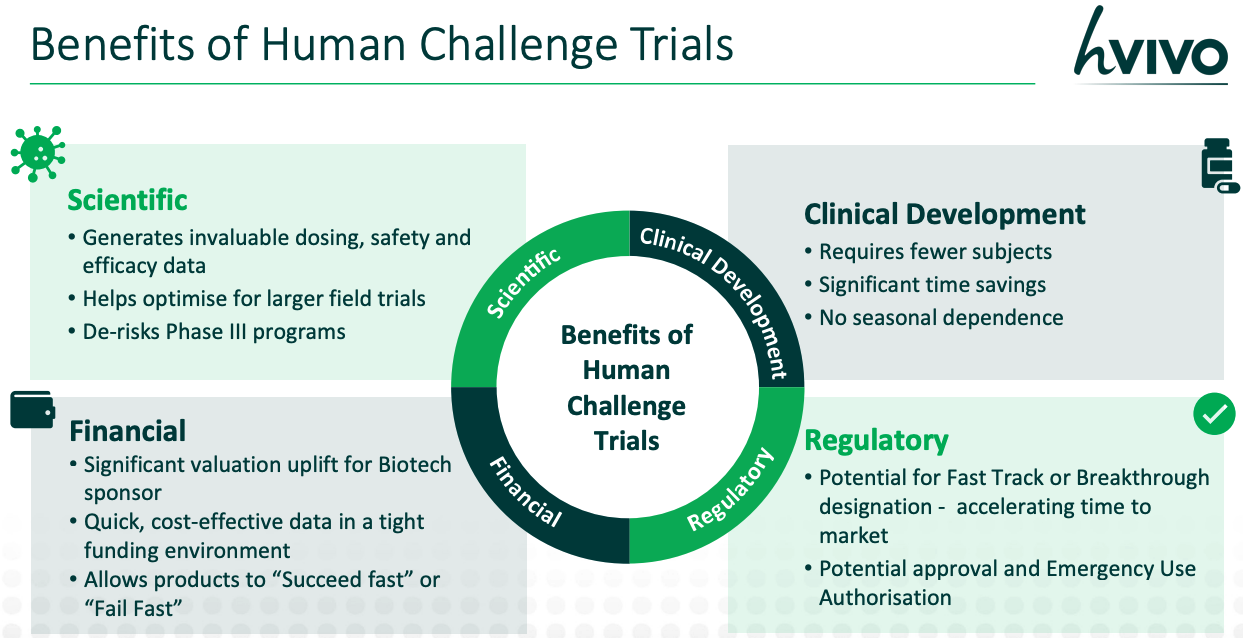

There’s much interest in this infectious disease clinical trials business on the Sharepad chat function. Some of that is because the Chairman Cathal Friel has been good at presenting the story to investors at events like Mello, but also because infectious and respiratory diseases are seeing significant investment following Covid-19 and the shares have trebled since the start of 2023. hVIVO runs human challenge trials in their Canary Wharf facilities, which opened in 2024. They are currently working with 4 of the top 10 largest global biopharma companies.

H1 Jun revenues from customers were up +30% to £35m, they also earned around £1.6m “other operating income” which is presumably from the £37m of cash on the balance sheet. NB there is also £34m of trade and other payables in current liabilities on the balance sheet, of which £21.6m is deferred income. In other words, they receive cash in advance for the clinical trial services they run for their customers, so although the balance sheet isn’t stretched, it is not as strong as the headline cash figure would suggest.

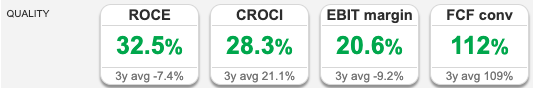

Similarly, although PBT was up +71% to £7.1m, cash from operations fell from £6.5m H1 last year to £2.6m H1 June this year. The difference was caused by working capital strain of around £5m. Not a deal breaker, but just something to be aware of as the company emphasises EBITDA up +70% to £8.7m, and EBITDA margin of 25%. EBITDA is not cash from operations. That said, Sharepad’s Quality indicators, including FCF conversion, give it the thumbs up.

History: This used to be called Open Orphan, and was a spin out from Poolbeg Pharma (rare and orphan diseases) in 2021. Interestingly, hVIVO’s market cap of £190m is now over 3x larger than POLB’s of £56m. I wrote about HVO in 2022, when the company announced a £13.6m contract win, but their broker, FinnCap left forecasts unchanged. Around the same time, the hVIVO put out an RNS responding to press speculation that they were helping the Irish Police (Garda) with their enquiries in a high-profile insider dealing case. At the time, the Board said there were no implications for the hVIVO and confirmed that no employee, executive, director or anyone connected with their company had any involvement.

Back then I gave it a clean bill of health and concluded: “This does seem to be an example of a company moving from ‘blue sky’ to GARP. The small-cap market sell-off has been brutal over the last 12 months, but it’s important not to become scarred by recent experiences. I like what I see, though haven’t taken a position yet and would still characterise the shares as speculative. If readers have thoughts, do let me know on the chat.” Annoyingly I didn’t buy any. I should have because the shares are up 2.5x since then, but there have been some encouraging posts in the chat from the likes of Wheelie Dealer, David and Ali.

Outlook: Management reaffirmed £62m of FY Dec 2024F revenue guidance and pointed out that they have good visibility into 2025F. They are targeting revenue of £100m by 2028F and mention small bolt-on acquisitions that meet the Company’s strategic and financial criteria. Cavendish reduced their EPS forecast by -4% for this year and -2% for next year, due to higher lease interest and tax charge.

Valuation: The shares are trading on 21x PER Dec 2024F, dropping to 18x PER the following year. There’s a small dividend, but less than 1% yield.

Opinion: The financials look good. One concern I have that isn’t in the forecasts, is that the clinical trials business might still be benefiting from the post-Covid research budgets throwing money at respiratory and infectious diseases. I’m not a sector specialist, but one risk I see is that the company might extrapolate £100m of revenues into 2028F, then at some point warn. If that’s right, I wonder how easy it would be to cut costs in the face of reduced demand. So if I had bought the shares a couple of years ago, I would be tempted to take some profit. Again, if readers have thoughts on this, then keep posting in the hVIVO chat group.

Fevertree H1 June results

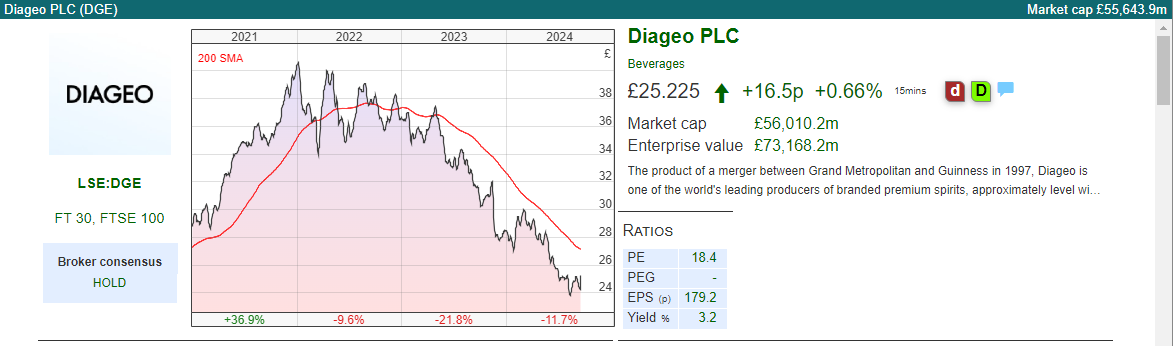

This tonic and mixers brand strikes me as the sort of company where private investors may enjoy some advantages versus the professionals. Unlike Judges Scientific, AB Dynamics or similar companies, investors can discuss Fevertree with friends, wander around the supermarkets and keep an eye on which mixers hosts are serving at cocktail parties. All this “research” is anecdotal and unscientific, but it can kick off a fun discussion and perhaps reveal valuable insights. For instance, both Diageo and Fevertree seem to have benefited from consumers stocking up their drinks’ cabinets during the pandemic, while professional fund managers extrapolated this behaviour into the future, consumers presumably knew that they had more than enough gin and tonic.

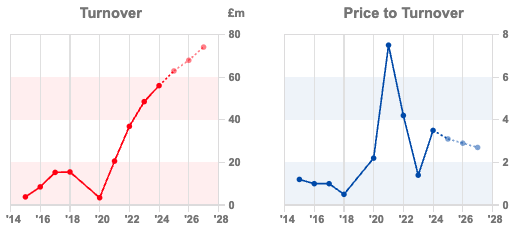

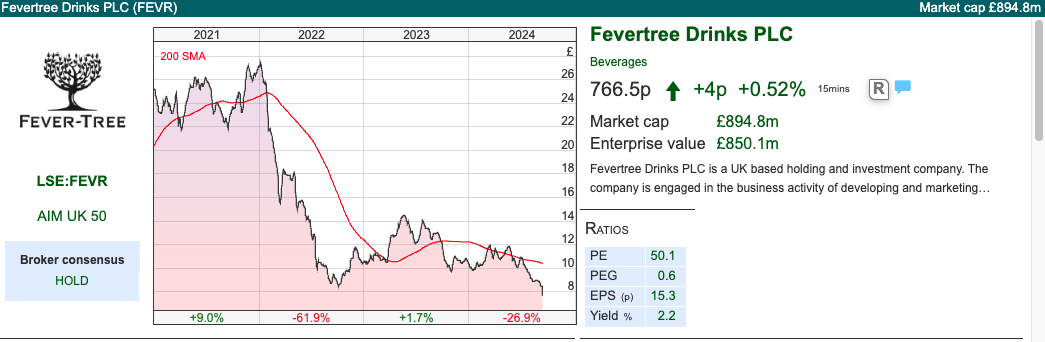

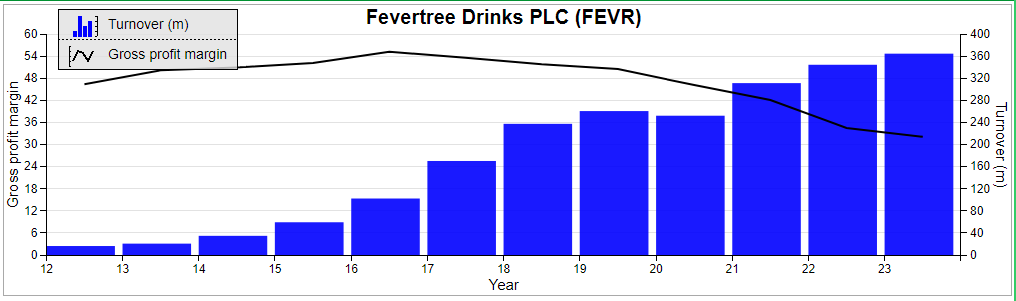

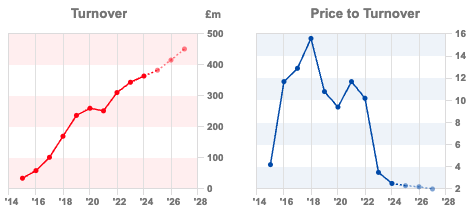

Fevertree shares fell a further c. -10% on Thursday last week when the company released their H1 Jun results, showing group revenue -2% to £173m. There were contrasting revenue trends, with the UK and Europe going backwards by -6% and -12% respectively, blamed on poor weather in the UK and Germany’s stumbling consumer confidence. The US was growing at +10% on a constant currency basis, and now represents over a third of group revenue.

Although the revenue was disappointing, gross margin improved by 520bp to 38% helped by lower energy costs for the glass bottles. For context, the group’s gross margin was 55% five years ago but fell to 31% in H1 2023. I wrote up the margin expansion story here, but didn’t anticipate that the company would struggle to grow the top line.

Valuation: Despite the shares falling -27% YTD, the PER ratio remains above 20x Dec 2025F. The price/sales ratio has de-rated from above 15x in 2018 to 2x, which seems much more reasonable. This is unlikely to be a share that ever trades at a “bargain” valuation, so with the shares trading below £8 this might be a good entry point.

Opinion: I like the story, but don’t own any as I have always been put off by the valuation. Amazing to think that the shares were changing hands at £40 per share in 2018, I think due to the unusual combination of fast growing sales and increasing margin. Those days are long gone, though I still think if we see revenue growth combined with stable profitability, the shares have the potential to regain their fizz.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 17/09/2024 |WOSG, HVO, FEVR| Dr Copper calls it once again

Bruce looks at the reversal in the copper price, and what this might signal about global growth and interest rate expectations. Companies covered WOSG, HVO and FEVR.

The FTSE 100 rose +1% to 8,273. US markets were much stronger, with the Nasdaq100 up +6.% and the S&P500 up +4%. That seems to be driven by expectations of US rate cuts, as the data on the US economy such as the Conference Board’s Leading Economic Index continues to be weak. The price of copper (Sharepad ticker HG-MT) is down roughly -20% since its peak in the middle of May earlier this year. The 64 day moving average is trending down towards the 16 day moving average.

Copper’s reversal seems to have been driven by concerns over Chinese economic activity, rather than a US recession. China’s net imports of the metal were at 13-year lows in June as the country exported 157,000 tonnes, presumably because the home market was oversupplied. Rio Tinto, said in August that steel demand from Chinese property developers was also down by as much as 30 per cent from its peak in 2020. So, although the recent headlines have been about a US recession, commodity prices seem to have been reacting to weak Asian demand.

I’ve mentioned before that I view copper as a better predictor of economic activity than the yield curve, as the latter has been distorted by Central Bank QE and pension funds being encouraged to buy long dated government bonds to match their liabilities. UK markets look more attractive than the US, but one worry is expectations of higher CGT or the possible withdrawal of Business Property Relief tax on AIM shares. Simon French at PanmureLiberum believes this could be the start of £5bn of outflows from a £48bn market. If so, we might expect to see recent weakness in standout long-term AIM performers, the likes of BioVentix, Judges Scientific and AB Dynamics. These are off -11%, -3% and -9% respectively since 5th July. I don’t think that is enough to “prove the hypothesis”, but an interesting idea nonetheless.

This week I look at Watches of Switzerland, which has been affected by the broader luxury sell-off (again, likely driven by Chinese demand). Also the infectious disease clinical trials business hVIVO and Fevertree, the tonic and mixers brand.

Watches of Switzerland FY Apr Trading Update

This luxury watch retailer announced “on track” trading for the first 18 weeks of their FY to April 2025F. They say demand remains strong in the US and UK, although they expect US growth to be H2 weighted. WOSG brands include Mappin & Webb, Goldsmiths, Mayors, Betteridge and Analog:Shift, plus recent acquisition Roberto Coin. As well as those brands, Watches of Switzerland is also the UK’s largest retailer of Rolex, Omega, Cartier, TAG Heuer and Breitling. 55% of revenue comes from the UK and Europe, and 45% from the US. Roberto Coin, the Vicenza founded jewellery designer and manufacturer, which they bought for $130m total consideration in May this year, integration is progressing well.

History: Mappin & Webb’s history goes back to 1775 when it was founded in Sheffield, and the brand was first granted a Royal Warrant in 1897. Goldsmiths was founded in Newcastle a couple of years later, and became the first authorised retailer of Rolex watches in the UK in 1919. Watches of Switzerland was formed in the UK in 1924. These three brands were amalgamated into a single corporate in 2005 by Baugur group, the Icelandic company headed by shaggy-haired billionaire Jón Ásgeir Jóhannesson, who also bought stakes in Hamley’s, House of Fraser and Karen Millen. During the financial crisis Baugur defaulted on its debt, so their WOSG stake went to Landsbanki, which itself was rescued by the Icelandic government.

Apollo bought the Icelandic government’s stake and became a 90% shareholder in 2013. In 2019, Watches of Switzerland raised £200m at 270p in an IPO for 34% of the company, valuing the company on admission at £650m market cap. The selling shareholder Apollo received £64m and the company received £140m. After the shares listed, Apollo still owned 59% of the shares, but has since sold down its stake to below a disclosable level (ie less than 3%). The two largest shareholders currently on the register are Capital Group and Pelham Capital, both with 5%.

The shares hit a peak of almost £15 during the pandemic bubble, but have since disappointed a couple of times, most recently in January this year when the shares fell -30% after their FY Apr 2024 trading update. Chief Exec Brian Duffy blamed the disappointing average selling price on their suppliers sending low cost watches. For instance, Rolex sent WOSG predominately steel-based watches, rather than a greater number of more expensive gold watches. That explanation is no doubt correct; but misses the bigger picture of profit warnings from other luxury retailers like Burberry, Kering (owner of Gucci), Hugo Boss, Richemont Mulberry and Swatch Group. Perhaps the cost of living crisis is affecting the super-rich, and they are having to cut back on watches and jewellery, to afford the rising cost of food and energy? More likely, the luxury sector is driven by Chinese buyers, who are struggling to recover from the pandemic and property bust.

Guidance: After the disappointment at the start of the year, management reiterated their May guidance. Below is the slide they put up at their FY Apr results presentation. There’s also a long range plan out to 2028, which includes accelerating second hand (they call it “pre-owned”) watches, US online sales (currently less than 2% versus above 8% in the UK) and continued expansion in the US.

Valuation: The shares are trading on 8x PER Apr 2026F or an EV/EBITDA of 6x the same year. Alternatively, a 0.5x price to sales ratio also seems good value, and likely reflects that EBIT margins have declined from above to 10%. Presumably though the perennial nature of the watch brands means that EBIT margins should expand, in line with management guidance.

Opinion: At one point I wondered if the trend for people to buy wearable gadgets like Apple Watch, which came out 10 years ago, might have slowed sales of analogue watches; but that doesn’t seem to have happened. Instead, the disappointment has been driven by the sell-off in luxury goods. I can’t see that changing in the near term. The WOSG valuation does seem attractive though, so this may appeal to old-fashioned value investors who don’t care about a near-term catalyst.

hVIVO H1 June results

There’s much interest in this infectious disease clinical trials business on the Sharepad chat function. Some of that is because the Chairman Cathal Friel has been good at presenting the story to investors at events like Mello, but also because infectious and respiratory diseases are seeing significant investment following Covid-19 and the shares have trebled since the start of 2023. hVIVO runs human challenge trials in their Canary Wharf facilities, which opened in 2024. They are currently working with 4 of the top 10 largest global biopharma companies.

H1 Jun revenues from customers were up +30% to £35m, they also earned around £1.6m “other operating income” which is presumably from the £37m of cash on the balance sheet. NB there is also £34m of trade and other payables in current liabilities on the balance sheet, of which £21.6m is deferred income. In other words, they receive cash in advance for the clinical trial services they run for their customers, so although the balance sheet isn’t stretched, it is not as strong as the headline cash figure would suggest.

Similarly, although PBT was up +71% to £7.1m, cash from operations fell from £6.5m H1 last year to £2.6m H1 June this year. The difference was caused by working capital strain of around £5m. Not a deal breaker, but just something to be aware of as the company emphasises EBITDA up +70% to £8.7m, and EBITDA margin of 25%. EBITDA is not cash from operations. That said, Sharepad’s Quality indicators, including FCF conversion, give it the thumbs up.

History: This used to be called Open Orphan, and was a spin out from Poolbeg Pharma (rare and orphan diseases) in 2021. Interestingly, hVIVO’s market cap of £190m is now over 3x larger than POLB’s of £56m. I wrote about HVO in 2022, when the company announced a £13.6m contract win, but their broker, FinnCap left forecasts unchanged. Around the same time, the hVIVO put out an RNS responding to press speculation that they were helping the Irish Police (Garda) with their enquiries in a high-profile insider dealing case. At the time, the Board said there were no implications for the hVIVO and confirmed that no employee, executive, director or anyone connected with their company had any involvement.

Back then I gave it a clean bill of health and concluded: “This does seem to be an example of a company moving from ‘blue sky’ to GARP. The small-cap market sell-off has been brutal over the last 12 months, but it’s important not to become scarred by recent experiences. I like what I see, though haven’t taken a position yet and would still characterise the shares as speculative. If readers have thoughts, do let me know on the chat.” Annoyingly I didn’t buy any. I should have because the shares are up 2.5x since then, but there have been some encouraging posts in the chat from the likes of Wheelie Dealer, David and Ali.

Outlook: Management reaffirmed £62m of FY Dec 2024F revenue guidance and pointed out that they have good visibility into 2025F. They are targeting revenue of £100m by 2028F and mention small bolt-on acquisitions that meet the Company’s strategic and financial criteria. Cavendish reduced their EPS forecast by -4% for this year and -2% for next year, due to higher lease interest and tax charge.

Valuation: The shares are trading on 21x PER Dec 2024F, dropping to 18x PER the following year. There’s a small dividend, but less than 1% yield.

Opinion: The financials look good. One concern I have that isn’t in the forecasts, is that the clinical trials business might still be benefiting from the post-Covid research budgets throwing money at respiratory and infectious diseases. I’m not a sector specialist, but one risk I see is that the company might extrapolate £100m of revenues into 2028F, then at some point warn. If that’s right, I wonder how easy it would be to cut costs in the face of reduced demand. So if I had bought the shares a couple of years ago, I would be tempted to take some profit. Again, if readers have thoughts on this, then keep posting in the hVIVO chat group.

Fevertree H1 June results

This tonic and mixers brand strikes me as the sort of company where private investors may enjoy some advantages versus the professionals. Unlike Judges Scientific, AB Dynamics or similar companies, investors can discuss Fevertree with friends, wander around the supermarkets and keep an eye on which mixers hosts are serving at cocktail parties. All this “research” is anecdotal and unscientific, but it can kick off a fun discussion and perhaps reveal valuable insights. For instance, both Diageo and Fevertree seem to have benefited from consumers stocking up their drinks’ cabinets during the pandemic, while professional fund managers extrapolated this behaviour into the future, consumers presumably knew that they had more than enough gin and tonic.

Fevertree shares fell a further c. -10% on Thursday last week when the company released their H1 Jun results, showing group revenue -2% to £173m. There were contrasting revenue trends, with the UK and Europe going backwards by -6% and -12% respectively, blamed on poor weather in the UK and Germany’s stumbling consumer confidence. The US was growing at +10% on a constant currency basis, and now represents over a third of group revenue.

Although the revenue was disappointing, gross margin improved by 520bp to 38% helped by lower energy costs for the glass bottles. For context, the group’s gross margin was 55% five years ago but fell to 31% in H1 2023. I wrote up the margin expansion story here, but didn’t anticipate that the company would struggle to grow the top line.

Valuation: Despite the shares falling -27% YTD, the PER ratio remains above 20x Dec 2025F. The price/sales ratio has de-rated from above 15x in 2018 to 2x, which seems much more reasonable. This is unlikely to be a share that ever trades at a “bargain” valuation, so with the shares trading below £8 this might be a good entry point.

Opinion: I like the story, but don’t own any as I have always been put off by the valuation. Amazing to think that the shares were changing hands at £40 per share in 2018, I think due to the unusual combination of fast growing sales and increasing margin. Those days are long gone, though I still think if we see revenue growth combined with stable profitability, the shares have the potential to regain their fizz.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.