In this article, Michael assesses whether sellers present opportunities and a potential early stage two stock.

I got asked this week about known sellers and if it is a good opportunity to buy a stock when there’s a seller.

The reasoning behind this is that once the seller clears, sometimes there isn’t much of a chance to get in at the bottom.

When you consider this, it makes logical sense. Buying when the seller is still around and depressing the price means you can get the merchandise on the low side whilst there is an artificially low price.

The problem here is that we’re assuming that it is an artificially low price.

What if it’s not?

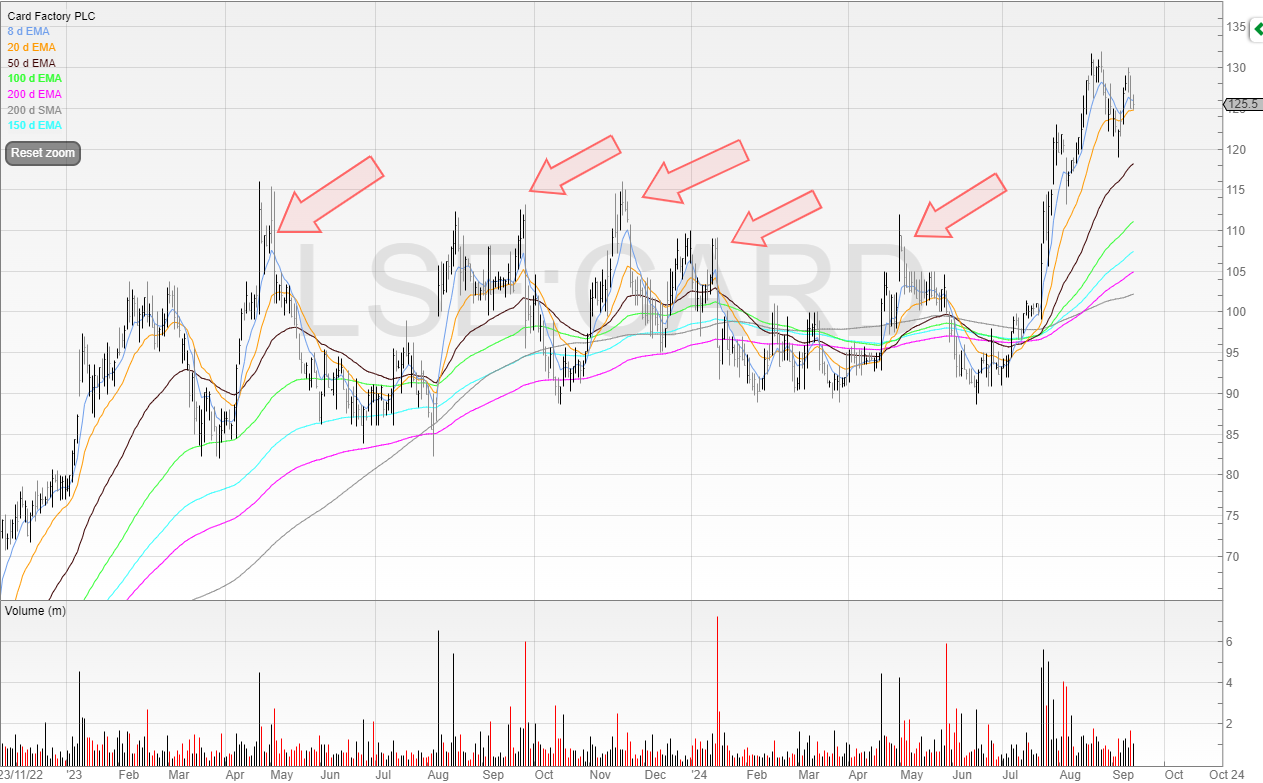

Consider Card Factory.

It was well known that Teleios were sellers of the shares, especially on increased volume days.

This was often on earnings news, and people would get excited and buy the shares, only for Teleios to use these people as exit liquidity.

I’ve marked these occurrences with the arrows, and we can see that as early as April 2023 every time the stock put out good news, the stock would get sold into.

So much so that it became a great stock to short on the day of results because you knew that there was a reasonable chance Teleios would be selling and marking the stock down.

Now, with Teleios gone, the price has broken out of this trading range and gone on to make new highs.

So with the benefit of hindsight, we can see that the price was low. But it took nearly 16 months for the stock to move.

If you’d bought in April 2023, you not only would’ve been in drawdown (the stock went below 85p at one point) you also would’ve tied up capital that can’t be used elsewhere.

This is terrible efficiency on capital.

So to answer the question succinctly… No, I don’t think it’s a good idea to buy a stock when there is a known seller. Not unless, 1, you are prepared to wait a long time, or 2, you’re an investor.

I was at the screens when the news came through that Teleios had gone to zero, so I was able to buy stock within a minute of the RNS appearing.

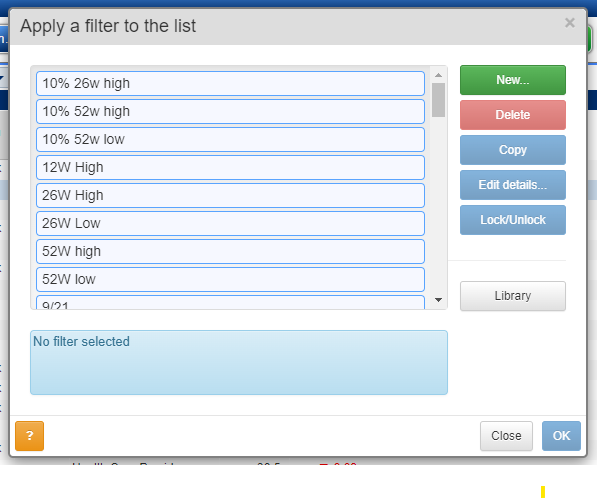

However, the stock appeared on my VOL filter after the close.

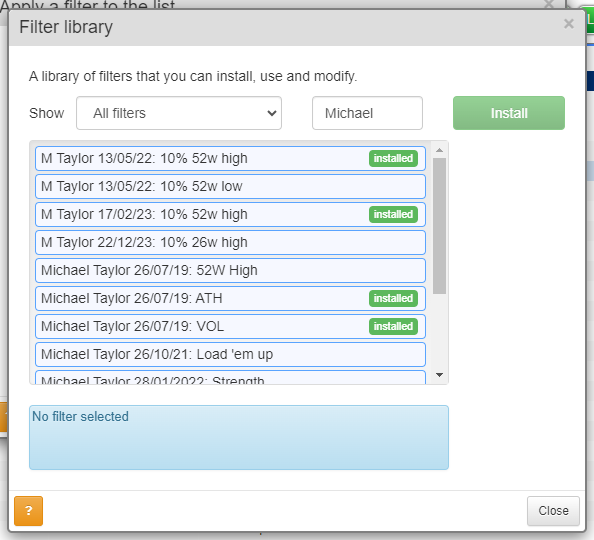

You can find my filters by going to the SharePad library.

Then hit “Library” to bring up the search function, and put “Michael” in the search bar.

Scroll down and you’ll see my VOL filter.

Card Factory showed up here due to the above-average volume.

I then highlighted this opportunity to my email subscribers the next morning before opening.

Despite the stock being up six percent, there was still a decent move to be caught from the seller clearing.

It’s better to arrive when the party is getting started, rather than being too early.

Doing so means:

- You stand a better chance of profiting as there is a catalyst

- You’re not waiting months or potentially more than a year

- Your capital efficiency is significantly improved

Here’s a company below where the party looks to have already started.

Restore (RST)

Restore is a company that helps companies manage their valuable data such as information, both digital and physical.

Physical archiving sounds ancient yet it’s still very much a big part of the business (around 70 percent). Government documents, NHS records, legal records, and more are kept here. To show how big the business is, Restore has 22 million boxes lying around. These not only collect dust but also recurring cash.

Restore chief executive Charles Skinner bought 22 nuclear bunkers from the US which sold them when the Cold War ended. Due to the lack of secondary uses, these (perhaps unsurprisingly) were cost-effective, and now these boxes are stored here.

Restore and its biggest competitor Iron Mountain make up 70 percent of the market which means that it’s reasonably stable with little capital expenditure required.

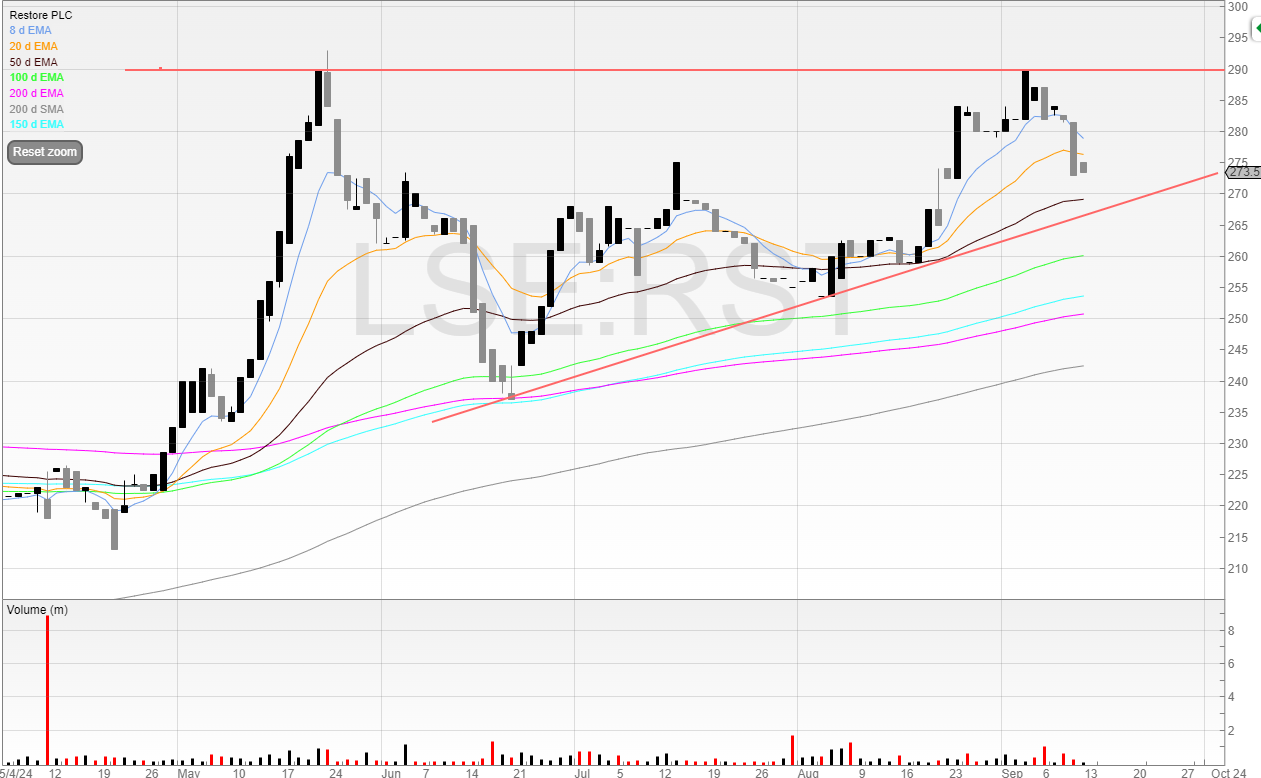

However, the chart is certainly looking better.

We can see that the stock trended downwards from late 2021 into the first half of 2023 in a stage four downtrend.

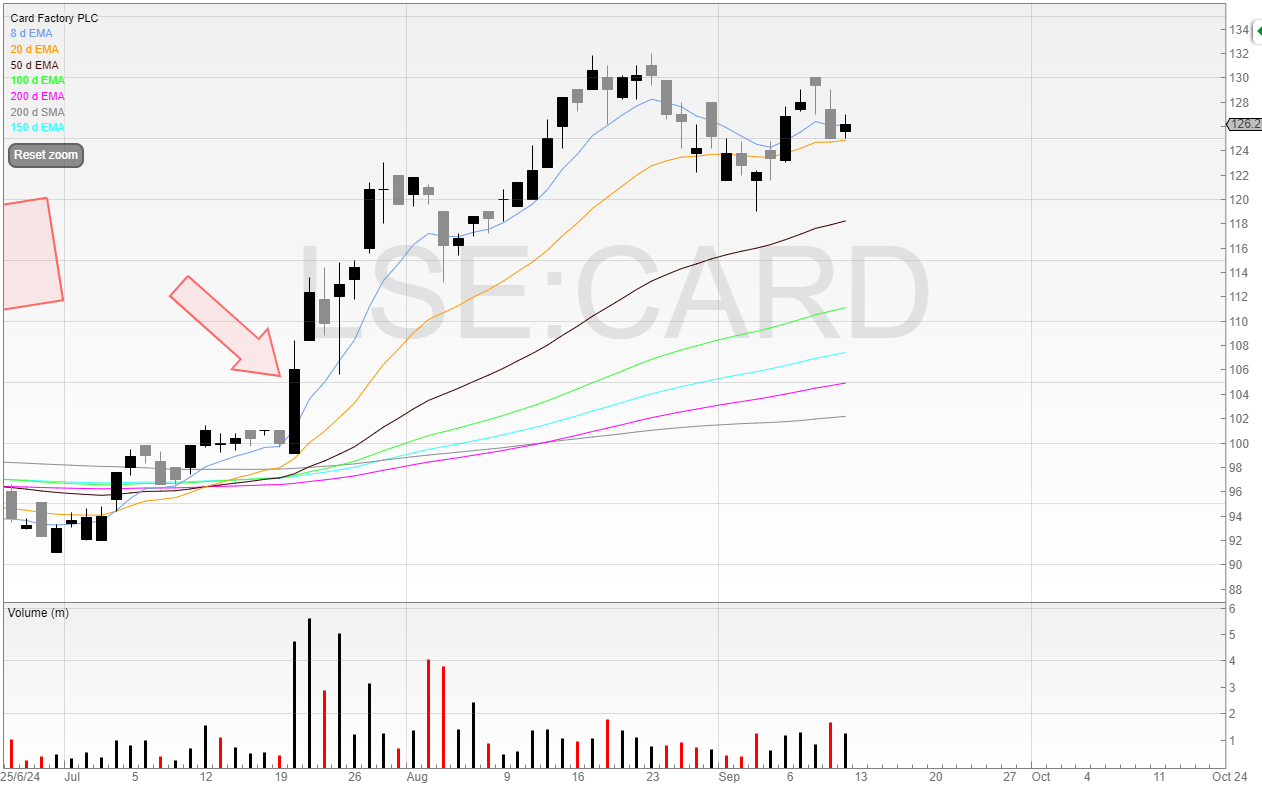

Looking closer, this is looking more like a stage two.

We can see the capitulation in August of 2023, and earlier this the price broke through all of the moving averages with these pointing upwards.

It now has the hallmarks of a stage two stock with the price putting in higher lowers in recent months.

I’d like to see the stock consolidate around the breakout area of 290p.

It’s worth noting that this stock would also have appeared in my 10% within 26w highs filter (again available on the filter library).

This is how I’m looking for uptrending stocks that may break out.

~

Michael Taylor

Buy The Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.