In this article, Michael covers the recent stock market fall and two trade ideas.

Two weeks ago stocks were tanking. This week stocks are up.

If you were on holiday the last fortnight and didn’t bother checking the markets, then you might not have noticed anything was up.

As I wrote in my Slack group on the Monday of the fall, it appears I was wrong.

Markets have forgotten faster than I expected!

There will always be lots to worry about in the stock market.

Monkeypox is a new one. Will we be thrown into lockdowns again? Perhaps unlikely, but if you log onto Twitter there will be plenty of new experts on Monkeypox, as there were in politics a few weeks ago, as there were military strategists in 2022, Covid experts in 2020, and before that.. the B-word.

I don’t know what will happen in the market, and anyone who says they can predict it with amazing accuracy is either incredibly intelligent or a liar.

This is why stop losses and risk management will always be key to long-term success in the stock market.

It’s easy to get disheartened when many stops get hit and your positions are taken out of the market. You see your hard-earned P&L take a whacking after slowly trickling up.

And even worse when those same positions rally and power onwards.

Then the doubts come and the regret. “I should’ve just kept my positions open”.

It’s even worse because you’re right. You can see the evidence on the screen.

If you hadn’t shut down your positions then you’d still be in the market and your P&L would be higher.

The danger here though is that you’re using the benefit of hindsight.

If you could tell the future or had a crystal ball and could see that the sharp lurch downwards would be forgotten about in two weeks, then absolutely, keeping your positions open and not adhering to your stop losses would’ve been the right thing to do.

However, the chances are that you can’t and you don’t, and therefore you wouldn’t have known.

And so that means acting on the plan you put in place was 100% the right thing to do.

What if it wasn’t a brief fall and the start of something big?

One day – it will be.

And when that happens, you’ll be glad you had stop losses in place.

Greencore (GNC)

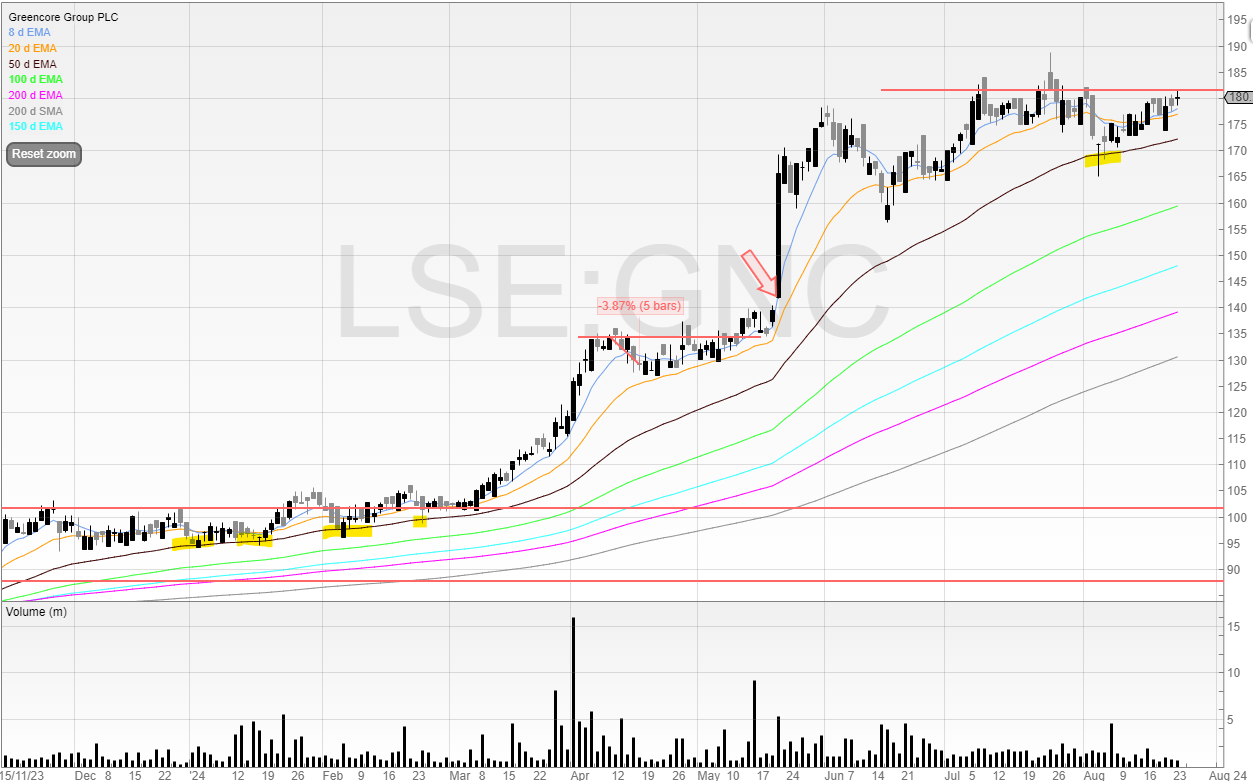

Lots of charts took a beating, however there are also plenty looking resilient with the trends intact.

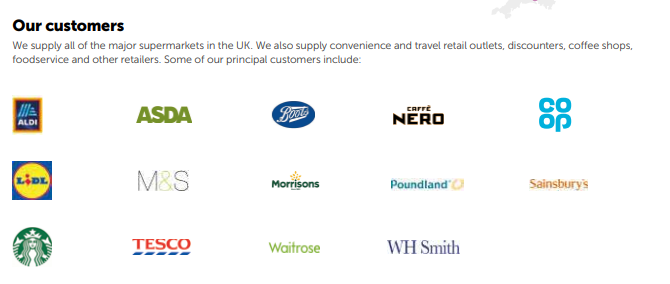

Greencore is a convenience food manufacturer that supplies chilled and frozen food to its customers in the UK and the US. Many of its products are stocked in the biggest UK supermarkets, Starbucks, Boots, etc.

Source: https://www.greencore.com/app/uploads/2020/12/Greencore-at-a-glance-Pg-2-3.pdf

In fact, if you’ve ever bought an overpriced sandwich in a rip-off airport WH Smith, then you’ve probably contributed to some of Greencore’s profits.

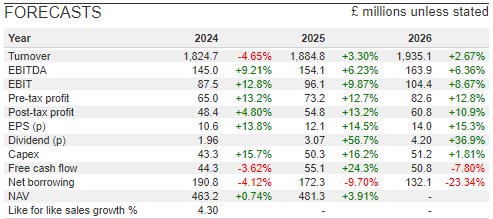

Sales and profits are forecast to steadily grow.

But what is more interesting to me is the chart.

The stock is clearly in a stage 2 uptrend and is looking like it’s making a new stage 2 base.

Let’s look closer.

We can see the 50 EMA has been continued support for the stock in this uptrend.

And that was the case in the recent pullback too. A sign of strength.

I think Greencore could be a nice swing trade if it takes out the recent high.

Capita (CPI)

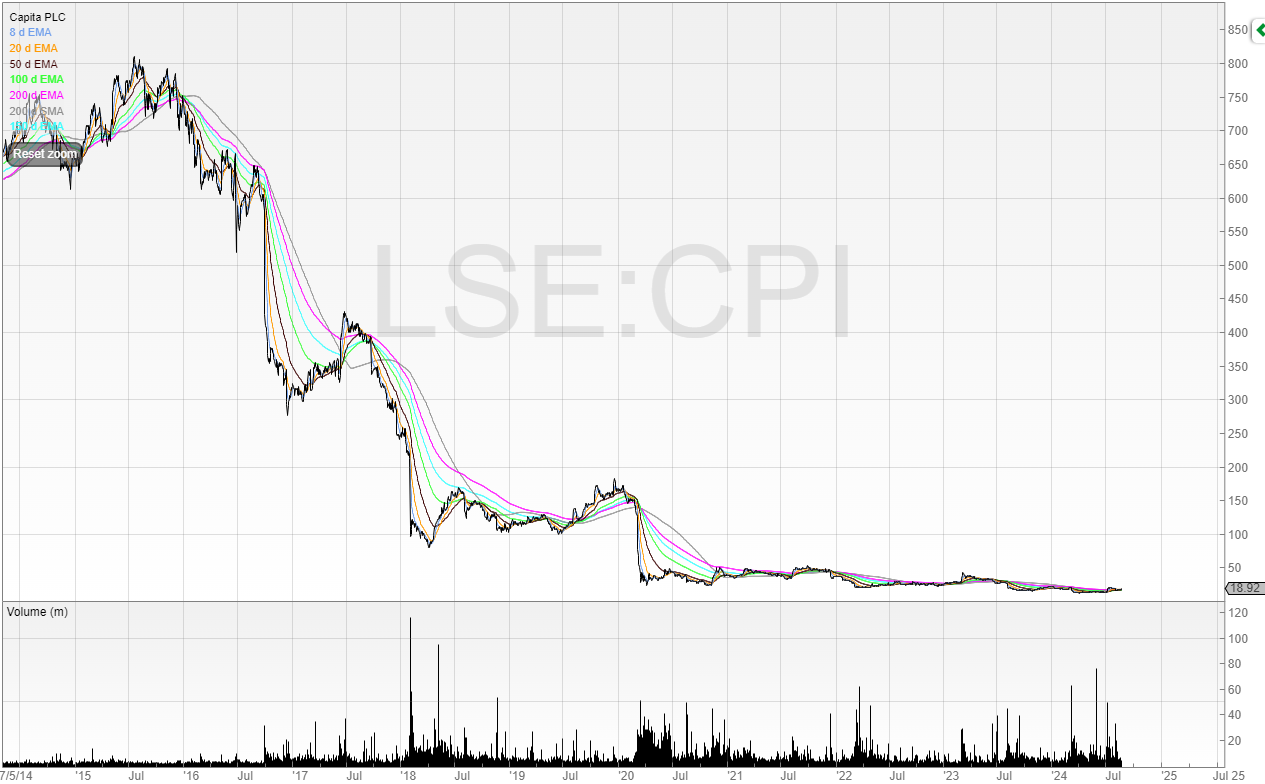

Capita was once a FTSE 100 company – one of the stocks that people generally believe are the least risky.

But the value destruction at Capita is truly eye-watering.

Despite having fallen 98 percent from its highs, the stock is still a £319 million market cap company at 19p.

However, the chart appears to be looking better.

There’s a lot of volume at the lows which signifies accumulation. The price is now trading significantly above those lows too – another potential sign of a stage 2 stock.

Added to that, the price is printing above the long-term moving averages, and many of those are now pointing upwards.

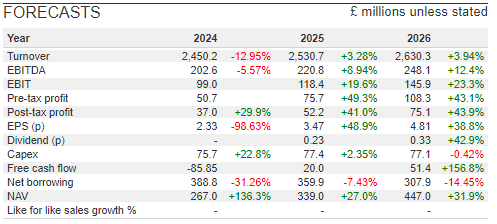

Capita has been reducing its debt by selling off noncore businesses.

There’s a new chief executive at the helm, and so it could potentially be a turnaround play.

The business is forecast to be profitable in 2024 but free cash flow negative. That changes however in 2025 (or at least it’s forecast to!).

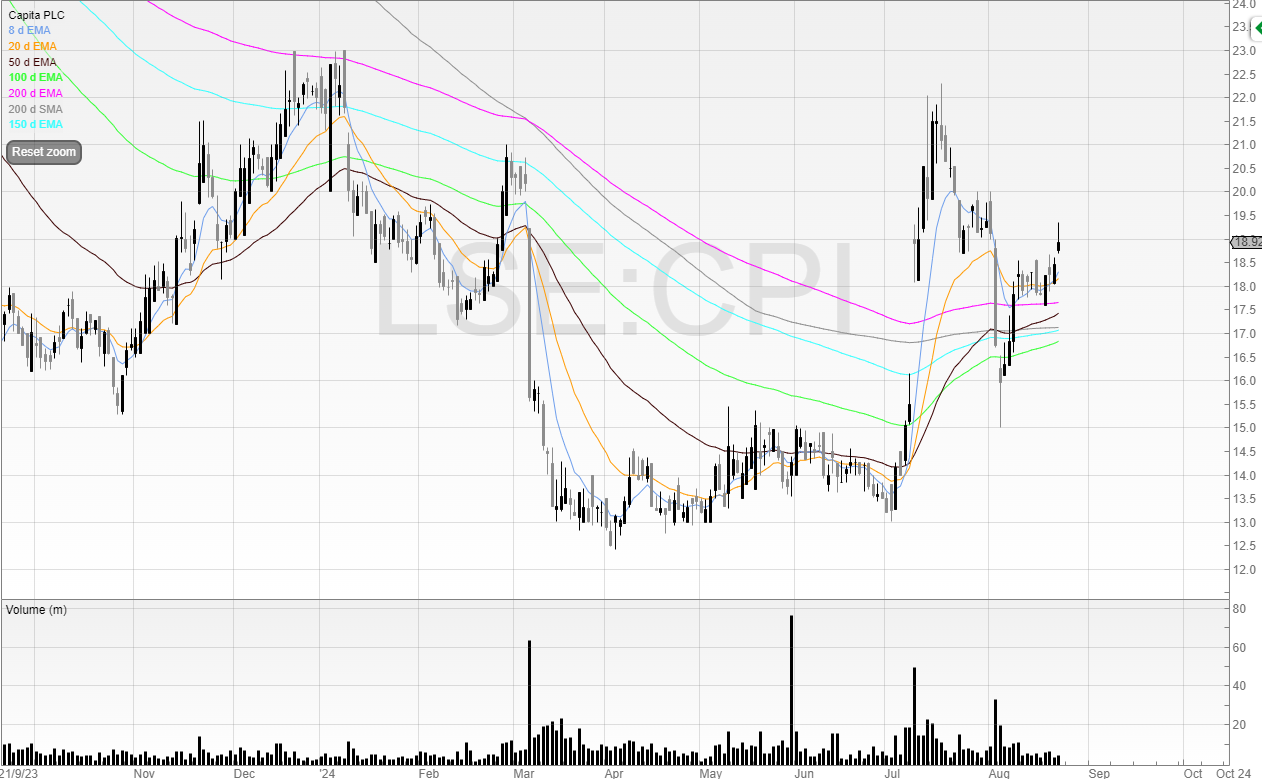

Here’s a closer look at the chart.

I see the 21.5p area as being significant.

But I’d want to see the stock gently consolidate around the area then breakout.

The issue with quick rallies is that people make quick profits and are logically tempted to bank those at resistance.

I’ve seen stocks rally sharply into resistance and continue rallying, but I prefer to take trades that suit my criteria.

I think Capita is worth watching as it could be an early stage 2 recovery stock.

Michael Taylor

Buy The Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.