The latest haul of investment candidates from Richard includes a software company, a timber importer, a one-of-a-kind fantasy gaming and modelling company Games Workshop, a housebuilder and a business so small you may never have heard of it.

Just to recap and contextualise, 5 Strikes is a quick way of deciding which shares are the most promising candidates to research.

A low number of strikes does not necessarily mean a share will make us a lot of money, and a high number of strikes does not mean it won’t.

There will be shares that fail 5 Strikes and do very well. They have not grown profitably in the past but something is happening that will turn them around.

To my mind, it is difficult to be confident in the prospects of a share when major changes are required. Investing in turnarounds is more speculative than investing in companies that have to go on doing much the same thing to prosper.

Unless we have boundless time and energy we will only be able to invest in a few turnarounds. Once they have reached their potential, we have to find new candidates to invest in. This might be exhausting.

Since I prefer to own a diverse portfolio of twenty or more shares, I put my faith in simpler situations: companies that have prospered, and are likely to continue prospering.

The 5 Strikes method helps me with the first part of that process: finding companies that have prospered.

Studying their business models and strategies gives me confidence in the second part: whether they are likely to continue prospering.

5 Strikes

Only seven companies have passed my minimum quality filter and published annual reports since my last update. Five of them achieved two strikes or fewer.

| Name | TIDM | Prev AR | Strikes | # Strikes |

|---|---|---|---|---|

| Kainos | KNOS | 1/8/24 | 0 | |

| Games Workshop Group | GAW | 30/7/24 | – Holdings | 1 |

| Latham (James) | LTHM | 24/7/24 | – CROCI ? Growth | 1 |

| Berkeley Group Holdings | BKG | 2/8/24 | – CROCI – Growth | 2 |

| PHSC | PHSC | 2/8/24 | – Growth – ROCE | 2 |

| Diageo | DGE | 1/8/24 | – Holdings – Debt – Growth | 3 |

| Halfords Group | HFD | 6/8/24 | ? Holdings – Debt ? Growth – ROCE – Shares | 4 |

Note: This article explains each strike, but the Minimum Quality filter it describes has been modified. This is the new version.

PHSC (2 strikes) has turned its name into more than one acronym. It says it is known for Professional Help at Sensible Cost but it started life as Personnel Health and Safety Consultants in 1990, and it subsequently acquired a series of health and safety consultancies.

Since the acquisition trail ended in 2012, PHSC has failed to grow organically. Turnover in 2024 was just £3.8 million, compared to £4.4 million in 2012. It peaked at £7.7 million in 2015. PHSC lost money between 2016 and 2019 (ROCE, Return on Capital Employed, was negative).

Despite having only two strikes (for growth and ROCE), the failure to grow profitably means PHSC is a tiny business by stockmarket standards. It does not qualify as a business that has prospered.

Berkeley (2 strikes) is a housebuilder and property developer. It has twice achieved negative cash flow in the last eight years although average cash flow is more than satisfactory. The long-term growth trend is positive but somewhat cyclical. Revenue has declined slightly on two occasions in the past eight years.

I know next to nothing about housebuilders but Berkeley has performed more consistently than many of its rivals. If you are impressed by statistics relating to employee and customer satisfaction (I am) it does well on that front too.

If I were to investigate a housebuilder, Berkeley might be the one.

Source: Berkeley Group

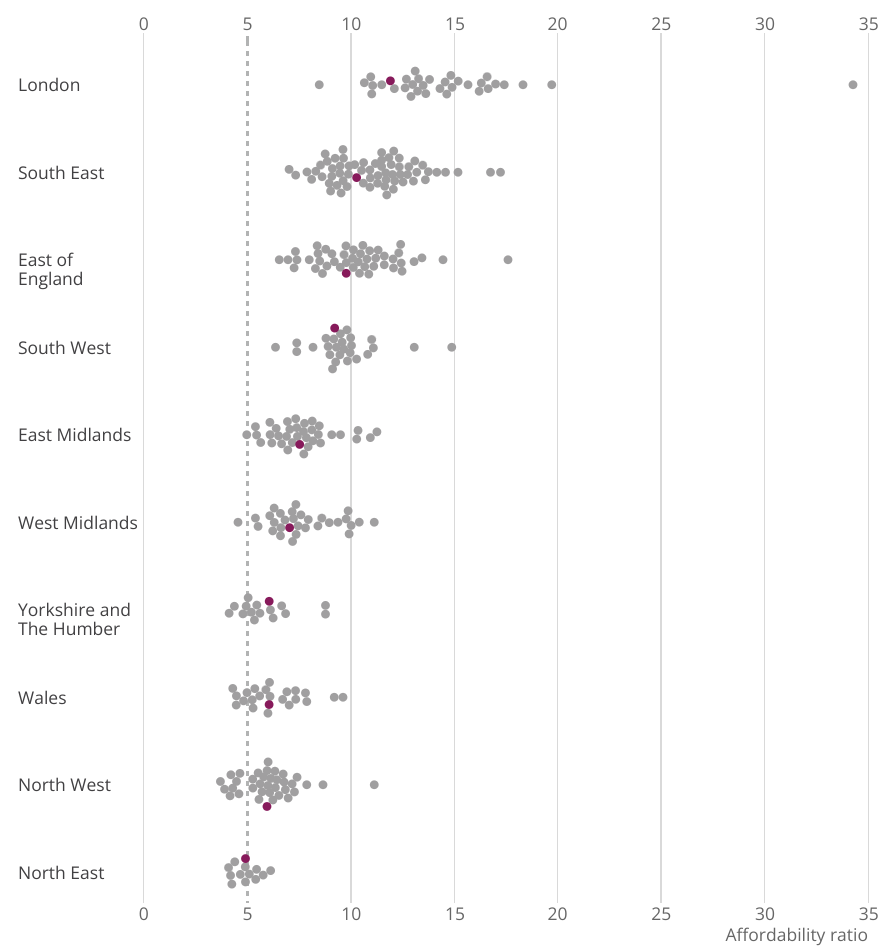

That said, judging by the menu of developments on its website, Berkeley has an exclusively London and home counties bias.

To invest for the long-term I look for companies that are largely in control of their own destinies. Berkeley, perhaps to an even greater degree than some of its rivals, has been a beneficiary of house price inflation for many many years.

The prospect of investing in a company that builds houses in the least affordable part of the country at a time when houses are so unaffordable fills me with doubt.

Berkeley has hallmarks of a good business but market forces may be more important to its future earnings. Despite the low number of strikes, it may not be my kind of investment after all.

James Latham (1 strike) is a timber importer and distributor.

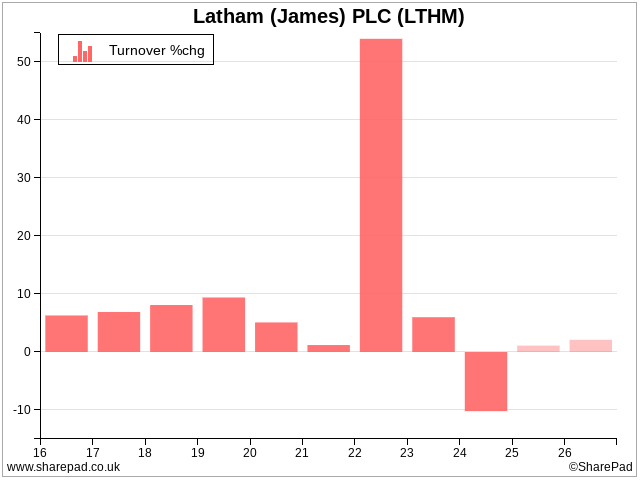

I gave it a strike for CROCI (Cash Return on Capital Invested) because it achieved a negative return (cash flowed out of the business) in 2018.

Lathams is a capital-intensive business. To grow it must invest in warehouses and vehicle fleets and grow its stock of timber. It is quite impressive that it has achieved positive cash flow in every other year in the last eight, and its ability to invest profitably is something of a competitive advantage.

The question mark for growth is a technicality. In the year to March 2024, turnover fell 10% but the long-term trend is almost certainly intact.

Not that you would know it from the chart I am about to show you, James Latham is a steady but unspectacular grower. In a typical year, its percentage growth might be in the mid to high single digits.

That all changed during the pandemic when supply was short. As a big customer with long-established supplier relationships and strong finances, James Latham could source the timber builders and joiners needed.

In 2022, turnover grew 55% and in 2023 it grew 6%. Inevitably demand and supply would eventually fall back to more normal levels. Like many good businesses though, it looks to me like James Latham will have grown its market share during a crisis.

Fantasy wargaming and modelling company Games Workshop’s strike is for modest director’s shareholdings (0.08% of its more than £3 billion market capitalisation). Long-term chief executive Kevin Rountree owns 19,000 shares. They are worth about £1.9 million because coincidentally a share costs £100. This is not an insubstantial amount, at least.

We want directors to own substantial shareholdings so they are incentivised to grow the business for the long-term. Judging by management’s actions rather than their holdings, I have no doubt Games Workshop is being run in this way. Games Workshop’s strike is a technicality too.

James Latham and Games Workshop are among the high-quality businesses I score annually for Interactive Investor and I will be re-scoring them soon.

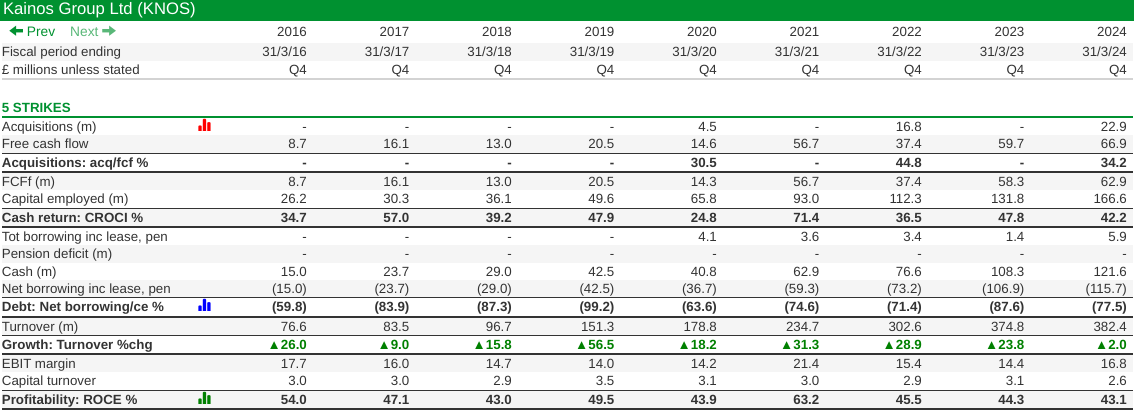

Standing proud at the top of the table with no strikes is software developer Kainos. It also stood at the top of the table this time last year, when I took a closer look at the business. Turnover increased only 2% in the year to March 2024, but perhaps I should take an even closer look.

This is what the numbers look like, for a near-perfect 5 Strikes company:

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.