Michael looks at some of this week’s action and notes some commonalities between trades.

Riddle me this…

If the market is efficient, then why don’t prices gap up and open without moving?

The simple answer is because the market isn’t efficient.

In this basic assumption, we assume that all (or at least a big majority) market participants have not only seen the information, but digested it, computed their own fair values, and inputted their orders and the stock has then moved to that fair value.

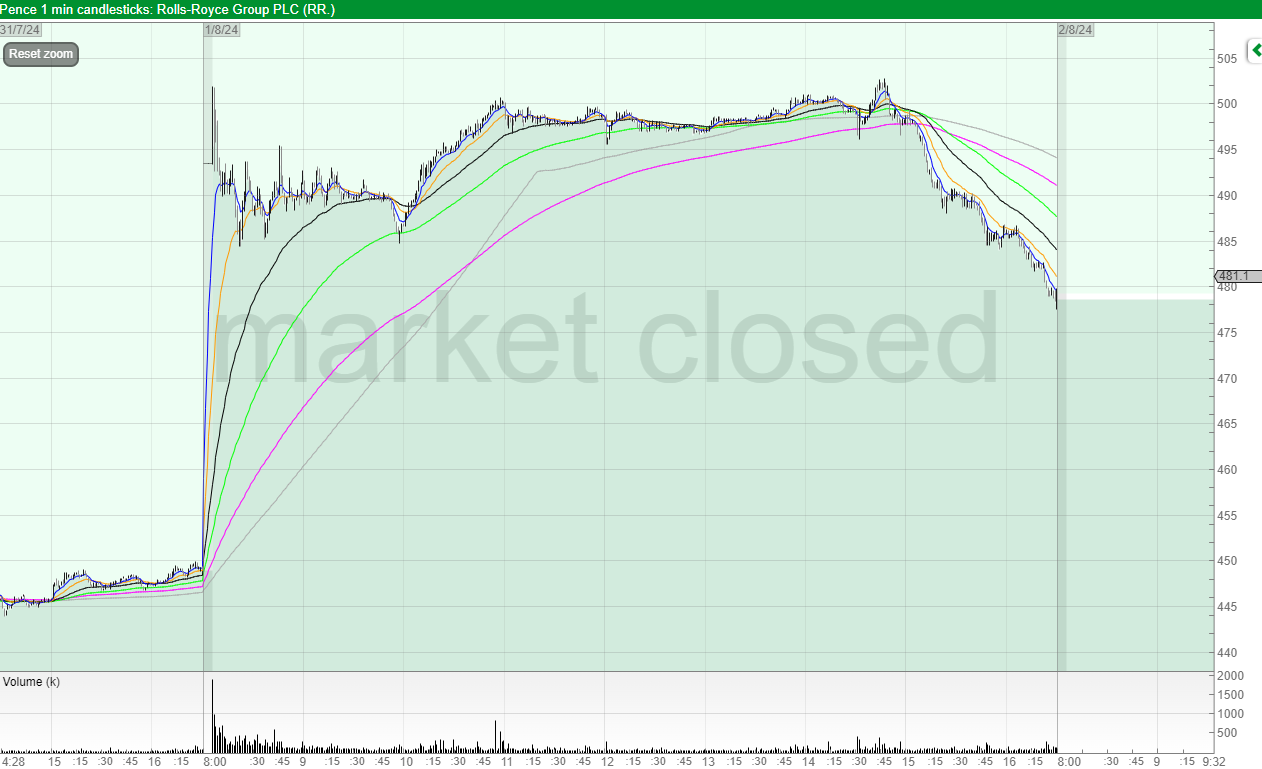

Even Rolls-Royce, a near £41 billion market cap company, didn’t do that this week.

The Big Round Number of 500p failed to be broken (funny how an ‘efficient market’ respects big round numbers) and the stock traded in a range of around 23p. That’s nearly five percent of the share price.

So I think we can safely assume that the market may be generally efficient, but to assume full efficiency and that you can’t make extra risk based on reward is silly.

But as you go down the market value, these disconnects between share price and efficiency become wider.

Here’s Metro Bank (MTRO).

We can see a big move from an extended stage 1 base on the results.

However, in the first 30 minutes, it wasn’t that exciting with the stock even falling despite raising its guidance.

Then, around 8.30am, the stock started taking off.

A near 50% move in price despite the uncrossing trade having only 5,355 shares matched.

Unfortunately, I left this trade due to the illiquidity and the fact that nothing happened.

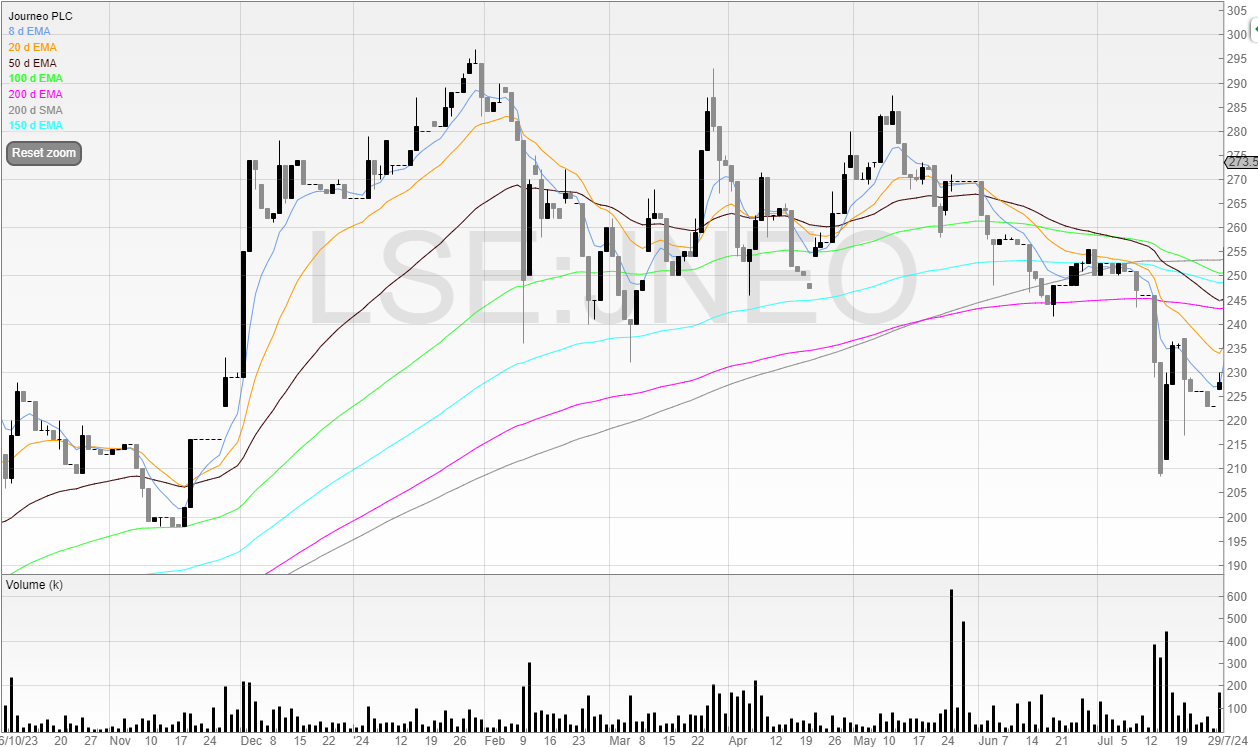

Journeo (JNEO) was another stock with a delayed reaction this week.

It fell from its highs and tested the 200 EMA, and then broke through the 200 EMA and puked.

We then saw a little rally, but the stock was still trading below its 200 EMA.

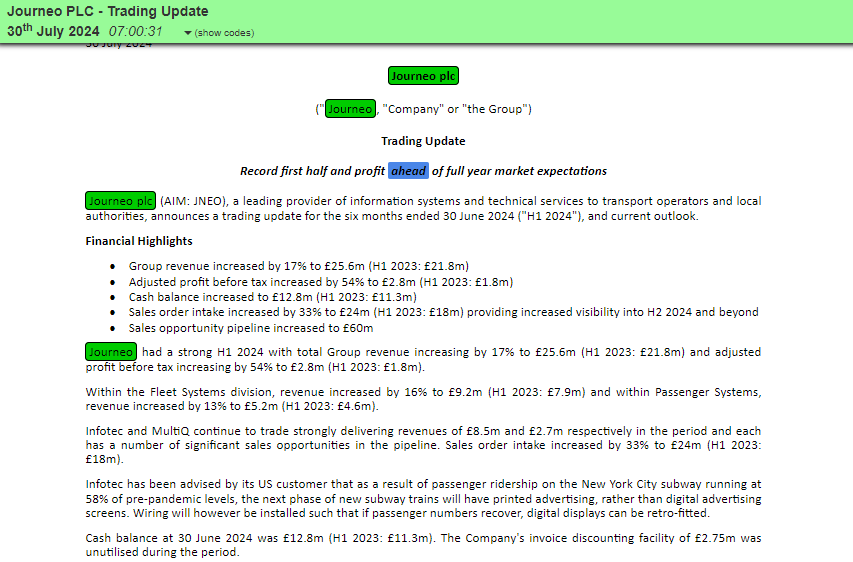

But then this RNS came out.

Record first half and profit ahead of full-year expectations. Because the stock had fallen into this update, it was likely that the news was a surprise. If it had leaked or the market was expecting a strong RNS, then stocks often rally into the news and then sell off. Hence the old stock market adage “buy the rumour, sell the news”.

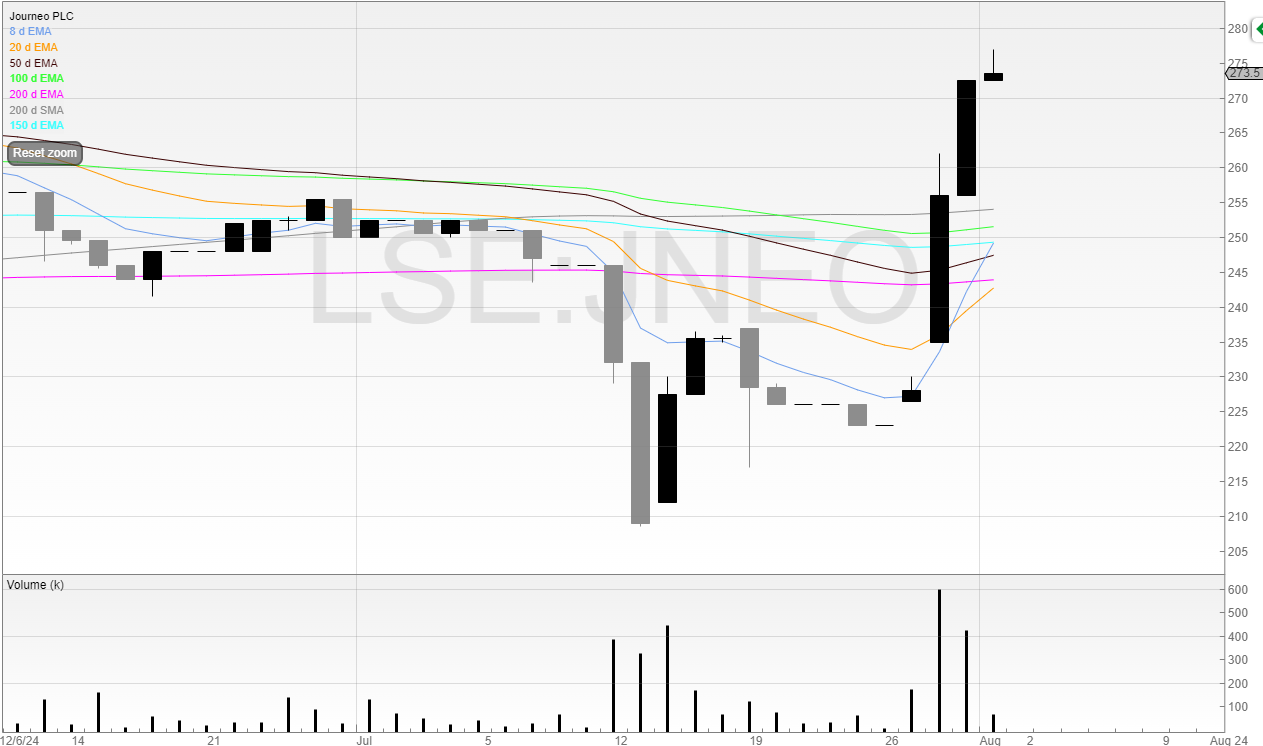

And since the news, the stock rallied sharply and followed through on the second day. A delayed reaction.

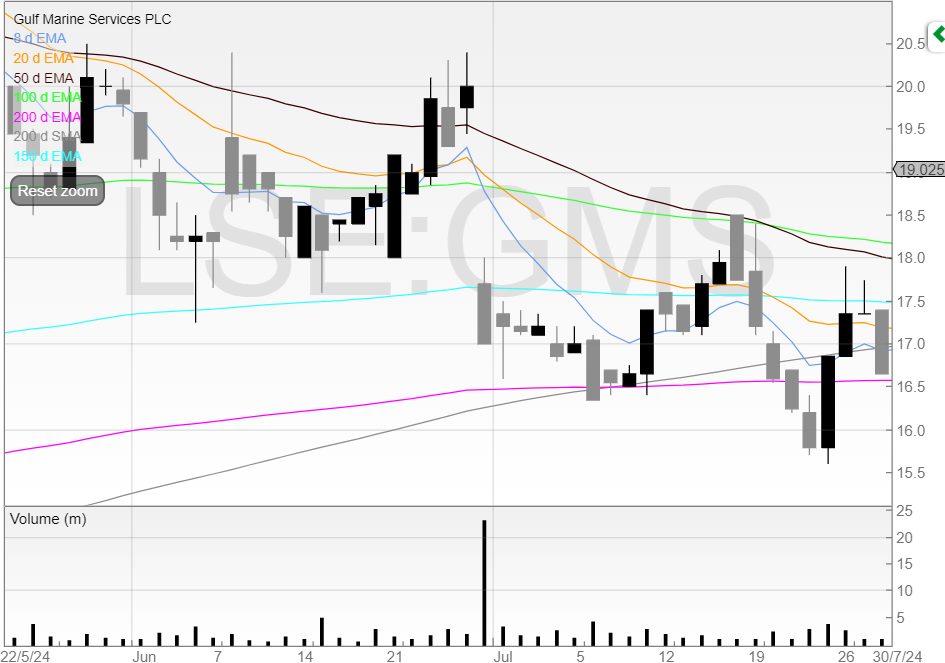

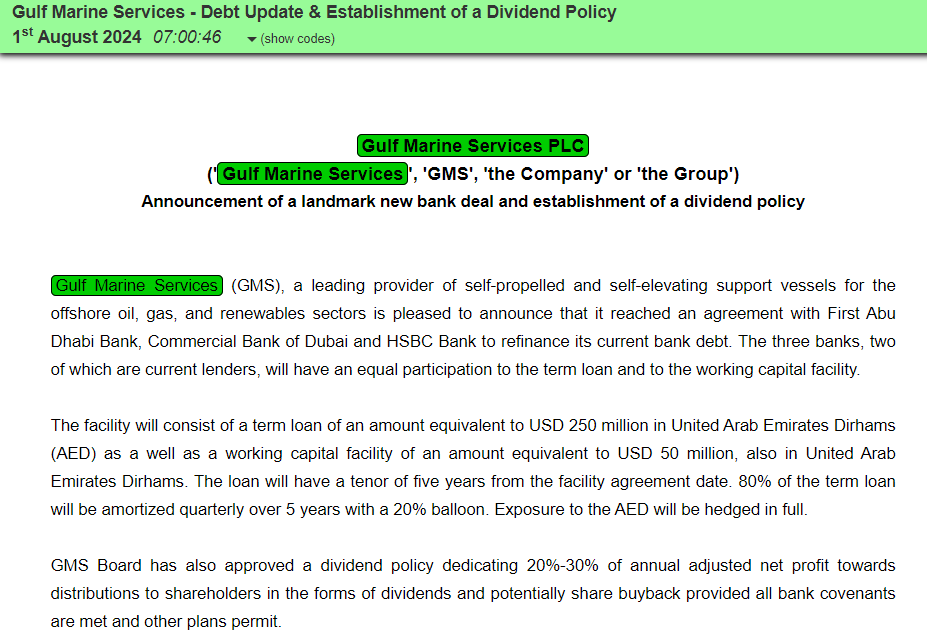

Gulf Marine Services (GMS) is another.

The stock was tracking lower and arguably the appeal has decreased as a result of Seafox selling and having some shares placed.

However, again we saw good news and a response.

News of a ‘landmark bank deal’ and announcement of a dividend policy – a sign that management sees the business as sufficiently stable financially to support a dividend.

Here’s the response.

Some of these moves didn’t follow through on the second day (MTRO & GMS) but it pays to be aware of the stories of many stocks so you can put the latest news into context when you look at the chart.

Whilst you can make money trading solely based off charts, understanding the stock’s narrative and what has been driving it can help when it comes to trading from the open.

That said, you can certainly know too much about a stock and allow that to influence your thinking. It’s tricky. But trading isn’t easy!

Interest rates

Yesterday, the Bank of England lowered the base interest rate from 5.25% to 5%, marking the first cut in four years since the mega low cut in March 2020!

It’s good news for investors. Everyone hopes it’ll stimulate economic growth as the interest rate cut signals that inflation has started to stabilise. And regardless of whether that is the case or not, it’s what people believe, and so that’s what matters.

Lower interest rates of course make borrowing cheaper, and so it’s hoped that this will boost consumer spending and investment.

For the UK stock market, this rate cut is positive. Lower interest rates often lead to higher stock prices as borrowing costs decrease for companies, potentially increasing their profitability.

My view is that whilst the worst is over, we still need to be vigilant when it comes to risk management and position sizing.

Bull markets let you get away with lots of mistakes and build complacency. It’s easy when everything is shooting upwards. But don’t get caught out.

~

Michael Taylor

Buy The Bull Market free and premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.