Trump getting shot on Saturday saw several stocks and sectors move quickly. Overall, the market saw it as a positive. Not that he was shot, but because of his now significantly increased chances of winning. President Biden calling President Zelensky “Mr Putin” does nothing to inspire confidence, especially when these gaffes are becoming a regular occurrence.

The S&P 500 and Dow Jones Industrial Average saw new highs. And Trump Media & Technology also saw a big jump.

Crypto fell with Bitcoin diving, then rallying quickly as the market realised that Trump is pro-crypto.

We may see Biden stepping down as according to news sources he’s more open to stepping down. This could be testing the reaction and then seeing the response. In any case, whilst Trump is now the firm favourite a lot can happen in politics, and the election is still several months away.

For me – it’s business as usual. Stocks go up, stocks go down, stocks hit my targets, and stocks hit my stops. We’re currently seeing a tailwind in small caps and hopefully that will continue.

Labour’s majority win saw oil stocks dip slightly and then rally as it appears it was priced in. We’ve had a rally since but there is clearly a conundrum.

Labour needs to find a lot of money in taxation, and UBS reckons some 500,000 millionaires will leave the UK by 2028. This is because when taxes increase, and people are able to move freely to places where taxes are lower, they do so. Many people will ask if this is morally right and this isn’t the question to be asking – the question is what happens to UK equities?

If Capital Gains Tax increases this reduces the appetite for investing in UK stocks. And if the ISA allowance is capped then this dampens that further.

Now, you can get around this by putting your positions onto spread bet accounts and paying a financing fee instead of Capital Gains Tax. But many people aren’t comfortable with doing this and so the net effect will just be less investment into UK stocks.

At a time when the market badly needs this more investment, it’s something to be aware of.

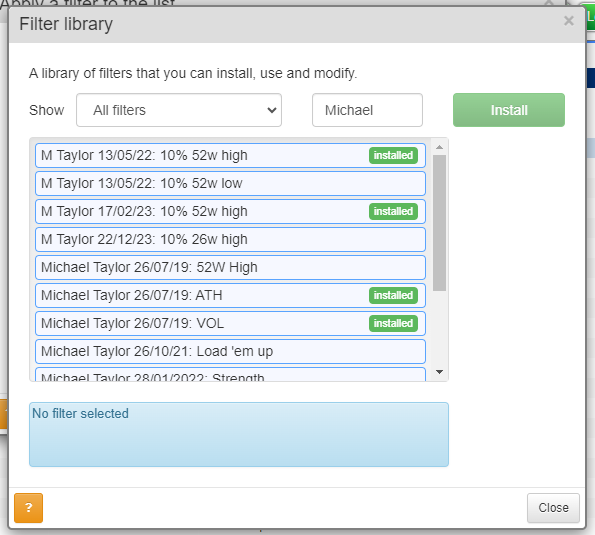

Remember, you can go to the SharePad library and search “Michael” to get access to all of my filters.

All of my filters are uploaded here.

The psychology of loss

Losses are an unavoidable part of trading. They’re an occupational hazard, and unavoidable (unless, of course, you’re an Instagram trader).

How you deal with loss is ultimately what will shape your P&L.

I recently made a video on Superdry delisting, and many of the comments were saying that I was wrong because if they were 90% down, then they should just continue to hold.

Naturally, they failed to realise that this attitude is exactly why they were down 90% in the first place.

It’s human nature to want to be right. Who likes being wrong? And it’s also human nature to protect the ego.

In an untrained individual competing in the stock market, this will often result in snatching at winners (to be right) and to run losses (protect the ego).

The ego comes up with all sorts of silly thoughts such as “I haven’t lost if I don’t sell”.

The reality is you’ve already lost because the current value of your position is down. You just haven’t crystallised it.

This leads to risk increasing as the untrained individual refuses to sell and eventually the taking of a big loss. Either because the trader reaches the capitulation point, or the stock goes bust.

There are four outcomes to every trade.

- Small win

- Big win

- Small loss

- Big loss

Almost all of your trades (ideally every single one) should be in outcomes 1-3.

Small losses are natural, small wins are common, and every now and again a big win drives your P&L higher.

Focusing on removing outcome 4 is the single best thing any trader can do.

What I say to anyone asking me about a stock when they’re 90% down is always the same. Sell it, chalk it up to experience, and go spend whatever is left on a dinner out or treat your family.

Large losses don’t only deplete physical capital. They affect psychological capital too.

If you’re looking at a 90% loss on your screen it affects you. You hope for it to go back up. You give it mental energy that should be redirected elsewhere.

This is why holding onto losers is damaging. As Paul Tudor Jones wrote on a sticky note, losers average losers.

And if you can’t lose well, you can’t win well.

Make sure you have a premortem on every trade. Think about what can go wrong. Think about how you’ll act if it does go wrong.

And look at what happened as a postmortem on every trader too. What did you think could happen, and what did happen? Check again after a few weeks to see what happened after you sold it.

Bull markets are great at making people complacent.

Stocks go up, dips get bought, and everyone makes money.

But when stocks fall, dips get bought and not sold, and paper profits get wiped out.

Hence the old phrase: “bull markets make paper millionaires”.

~

Michael Taylor

Get Michael’s trade ideas: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.