After a difficult 3 years for London-listed smaller companies, Bruce looks at a couple of reasons to feel positive about the future. Companies covered: MOON, DUKE, EQLS.

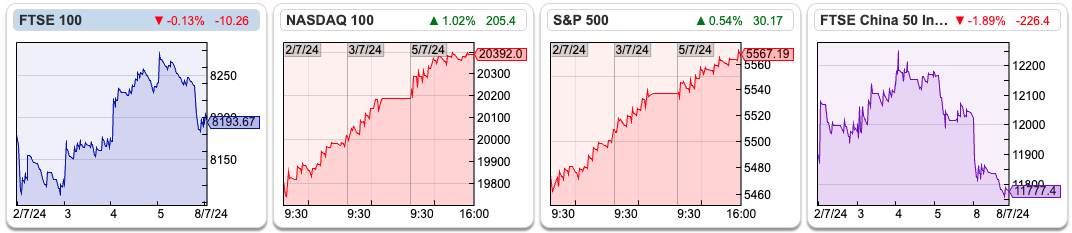

The FTSE 100 was up less than +0.5% last week to 8,194. The Nasdaq100 and S&P500 were up +3% and 1.6% respectively. China remains in the doldrums with the XIN0, Shanghai Composite and CSI 300 down -1%. The broader Chinese indices are both in negative territory for this year, and last week’s drop in markets comes ahead of the Chinese Communist Party’s third plenum next week. Copper remains above its 16/64 day moving average, suggesting that weaknesses in the Chinese economy are not enough to cause industrial activity in the rest of the world to decline.

In London, we have seen difficult inflation and interest rate conditions, and 3 years of professional fund managers’ outflows but now we could be close to a bottom for UK shares. Callastone reported UK equity fund flows remained negative in June -£0.5bn; but slowing modestly and the least bad month of 2024, with “significantly less selling” in the second half of the month. The AIM chart seems to be forming a nice bowl with support from moving average levels. So, I am feeling positive about the potential for gains in smaller UK companies over the next 18 to 36 months.

There have been some comments on the chat that I, and others, are taking a too negative tone on stocks like Intercede and Duke Capital (covered below). One person even questioned if I had actually read the most recent Intercede announcement.

To be clear, I do read the RNSs and would expect a rising market to lift many stocks over the coming months. I would be delighted if readers make money owning IGP or similar. That said, having worked in equity research and financial PR, I understand how company managements like to put a positive spin on results. Using Sharepad to cross-check the historic track record will often reveal that results are not quite as good as the bullet points on the first page of the RNS would have us believe.

It is not unknown for management to write an upbeat-sounding outlook statement, but ask their broker to cut numbers (DUKE) or leave numbers unchanged with a forecast revenue decline (IGP). On the other hand, it’s hard to think of times when management report a strong set of numbers but mask the positives. So it’s inevitable that anyone taking an analytical approach will end up sounding less upbeat than the management commentary. Although my tone might come across as pessimistic, I think we could be in a ‘rising tide lifts all boats’ scenario in the coming months.

This week I look at Duke, Moonpig and Equals. All of these look potentially interesting, but having missed the upside on Equals (up almost 5x since Nov 2020), I prefer the first two.

Moonpig FY April Results

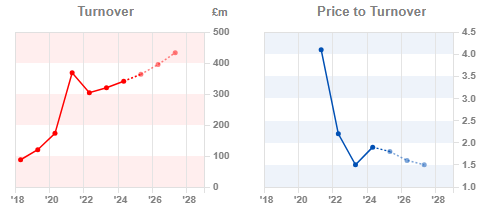

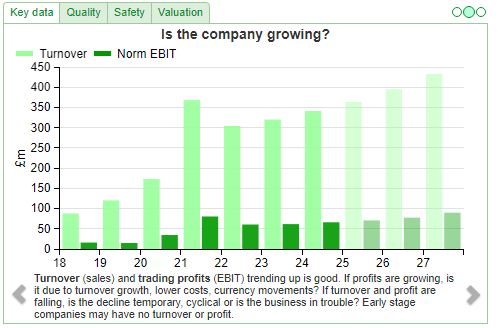

This gifting platform, which is Moonpig, has also bought Red Letter Days and Buyagift (£124m May 2022 for both) brands in the UK and the Greetz (£29m August 2018) brand in the Netherlands, announced FY April Results. Revenue was up +6% to £341m and statutory PBT was up +33% to £46m. The gross margin also improved from 3% to 59%. Net debt fell -25% to £125m, which represents 1.3x Adj EBITDA (so no longer distressed, I would say). They have a new, four-year £180m RCF in place, with margins of 2% to 2.5% above the reference rate (presumably SONIA and the European equivalent).

What it does: Moonpig sells personalised greeting cards, which is how they acquire customers. They have then expanded into offering a range of gifts and experiences (from sky diving and bungee jumping to spa days and mystery picnics etc). This expansion increases their average order value and customer lifetime value. The gross margin is high at around 60% because it’s a database business of reminders (90 million as of April 2024) that helps them prompt customers about upcoming occasions or anniversaries, encouraging repeat purchases. 89% of Moonpig and Greetz sales come from existing customers.

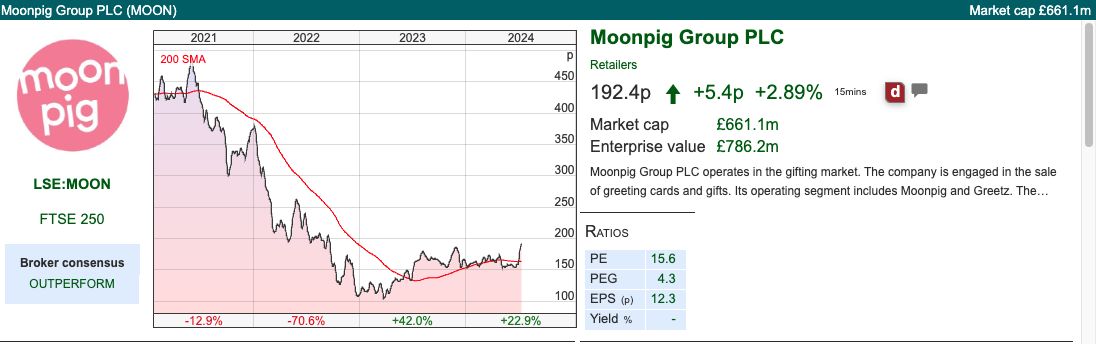

History: The business was founded at the tail end of the first internet bubble in 2000. The original vision was to combine digital printing with the internet to let customers create better cards than they could buy on the high street. MOON expanded to offer flowers in 2004, food, drink and other off-the-shelf gifts in 2007. It’s had a couple of Private Equity owners, most recently Exponent-backed Horizon Group. They IPO’ed in 2021 with the selling shareholders receiving £455m for 40% of the company, while there was just £20m of new money raised for further investment. As you would expect from a P.E. sellers, the shares have performed badly since their IPO at 350p, and have fallen -80% from peak to trough. I struggle to understand why professional fund managers buy into P.E. IPOs. However, the shares have now doubled since their low early in 2023, so I think this could be worth a second look.

Outlook: Trading since the start of the year has been in line with expectations, they expect mid-to-high single-digit revenue growth FY Apr 2025F. They mention some medium-term growth initiatives, such as marketing investment in Ireland, identifying ways to acquire customers in Australia and the US, and a prototype SME business offer for employee gifting. This should generate double-digit revenue growth, an Adjusted EBITDA margin rate of approximately 25% and growth in Adjusted EPS at a mid-teens percentage growth rate.

Valuation: The shares are trading on 15.1x FY Apr 2025F, dropping to 13.3x the following year. The shares are trading on below 2x forecast revenue, which does seem good value given the 20% historic EBIT margin.

Opinion: Sharepad’s quality indicators suggest that like YouGov, this is a genuine ‘platform’ business. Although management says that 89% of sales come from repeat customers, it’s worth noting that this is still a consumer-discretionary business. Hence whenever consumer wallets are under pressure, revenue can decline and the operational gearing goes into reverse (which happened in 2022, not helped by a postal strike). In the previous year, some of this organic decline was masked by the acquisition of Buyagift, which contributed around £44m of revenue.

On the positive side, it looks like the group has returned to revenue growth, so the operational gearing should now be working in shareholders’ favour. I also like the captive customer database and this does seem to be solving a (rich world) problem that we all own too much ‘stuff’ and it is hard to find ideas for presents to give to friends and family. Unlike enterprise cybersecurity companies like DARK or IGP, this is a company where private investors can mystery shop and get a feel for the customer experience. On 16th October 2024, they intend to hold a Capital Markets Day. Thumbs up from me, and I have put a limit order on to buy some shares.

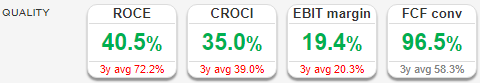

Duke Capital FY March Results

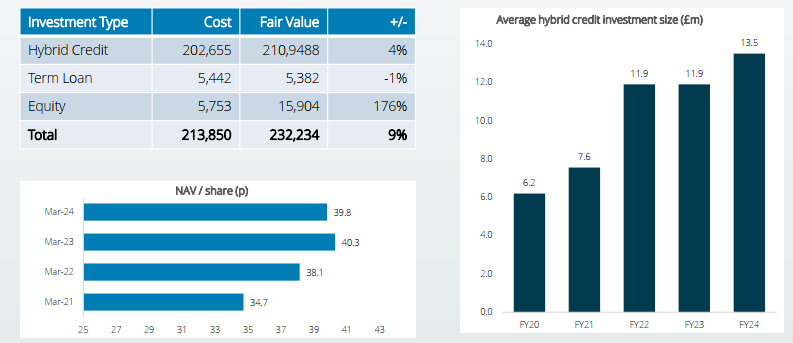

This alternative finance company changed its name from Duke Royalty to Duke Capital at the start of the year. They have changed their messaging from royalty lending, to emphasize more broadly “hybrid capital”, a financing solution that blends features of private equity and private credit products and is more flexible than traditional debt or equity. They also changed their strategy to be able to invest in equity ownership over 30% of their companies. So, for instance, they have invested £14.5m for a 49% equity stake in Integrum Care Group, which operates six care homes in the South of England.

FY March results showed a +12% increase in recurring cash revenue to £24m for FY Mar 2024. That figure excludes exit premiums (i.e. companies paying them back) and cash gains from the sale of equity investments, during the year they enjoyed three profitable exits (Instor, Fabrikat and Fairmed), which gave them £23mm of additional liquidity.

Despite the increasing cash revenue and exits, statutory PBT was down -40% to £12.3m. That was driven by a £14m swing in Fair Value accounting movements with FY Mar 24 showing a £4.5m FV loss across the investment portfolio compared to a £9.1m gain in FY23.

The total value of the investment portfolio was £232m end of March, up +11% on the previous March, split across hybrid credit, term credit and equity investments. DUKE has a £100m five-year term facility expiring in January 2028 with a bullet repayment on expiry. They had £27m undrawn at the March year-end, so net debt was around £73m, Cavendish, their broker says they estimate borrowing currently stands at £83m. The interest rate is equal to SONIA plus 5.0% per annum (an improvement on the previous rate of SONIA plus 7.25%). There are also 43,990 warrants with an exercise price of 45 per share associated with the debt facility.

Outlook: Management sound optimistic saying “We are in an ideal position to capitalise on a highly attractive market opportunity and as such, have enlarged our investment team with three new hires during the period. This confidence will be boosted further when the economic backdrop improves and interest rates finally decrease.” Yet again this is another Cavendish client sounding positive in the outlook statement, but where the broker has cut FY Mar 2025F recurring revenue by -8% to £27m, which translates to a -16% cut in adj EPS to 3.2p. Cavendish also suggests that there has been some interest forbearance, which would also explain the Fair Value write-down through the P&L.

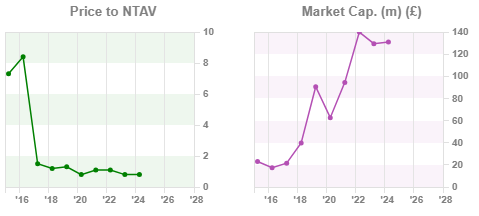

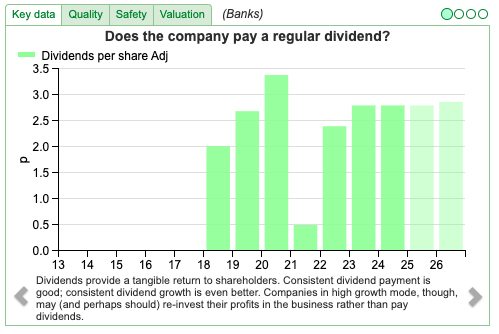

Valuation: The shares are trading on a PER of 9.6x FY March 2025F and just under 8x 2026F. Net assets (which is driven by fair value accounting on the asset side of the balance sheet) stood at £165m, so it’s trading on a -20% discount to book value. The dividend yield is 9%, but DPS is no longer forecast to grow by Cavendish and note my comments below.

Funding growth: I last wrote about the shares a couple of years ago, where I pointed out that the high dividend yield was illusory because DUKE was not profitable enough to self-fund income growth. They have raised £55m cumulatively from investors in April 2021 and May 2022, both at a placing price of 35p, which puts the £11.5m of annual dividends in perspective. There is no deception, management are open about what they are doing, but the investment proposition is different from say Somero (yield 6%) or Games Workshop (4% yield) which both pay out excess cash and are profitable enough to fund growth from internal resources. It could be that DUKE has now achieved the scale to not need any more capital raising, but management haven’t stated that explicitly.

Opinion: In 2022 I suggested that with the BoE forecasting a recession, it was the wrong point in the cycle to own companies that were financing SMEs. I have now bought some DUKE as I think this could be the right point in the cycle to invest in shares which should benefit from a strengthening economy and interest rate cuts. There is a risk that we see a second round of energy cost or food price inflation. On balance though, seems like the risk-reward is attractive, several readers on the chat agree, and “longterm1967” pointed out that Simon Thompson in the Investors Chronicle is a fan.

Equals H1 June Trading Update

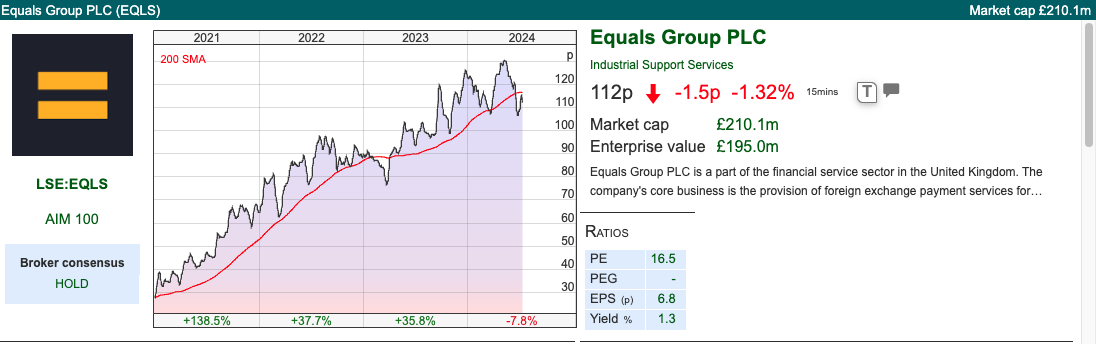

This FX company announced in a trading statement that H1 Jun revenues would be up +33% y-o-y to £60m. Though impressive, that still represents a slowdown from +84% in H1 in H1 Jun 2022, and +43% in H1 Jun last year. Results were also helped by the acquisition of Oonex, renamed Equals Money Europe (EMEU) without which revenue growth would have been +28%.

They say that Q1 of this year has been quiet, but they saw “a strong pick up” in Q2. FX revenues from B2C customers are subdued given macro-economic conditions whereas B2B revenues are more robust.

There’s been a strategic review ongoing since November last year when they were approached by a couple of potential bidders. The Put Up or Shut Up (PUSU) deadline has been extended several times. The trading statement says there’ll be a further update on 10th July.

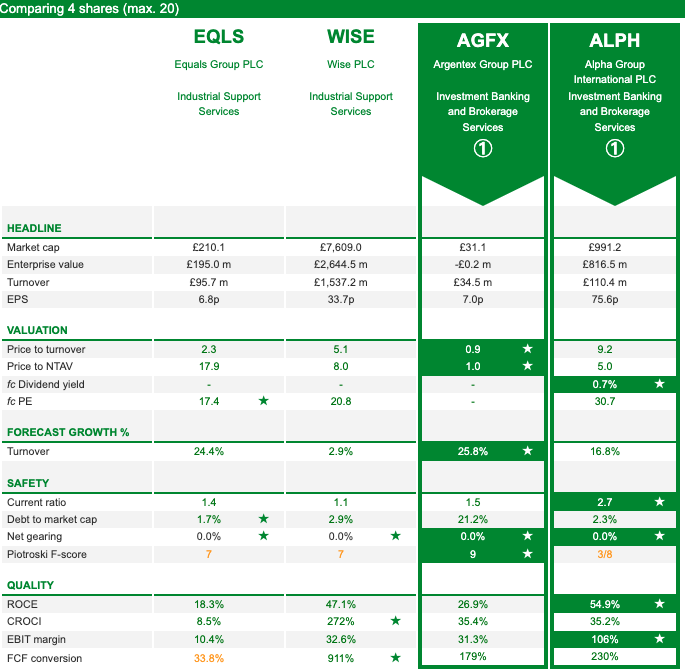

Valuation: The shares are trading on 15x FY Dec 2025F dropping to 12x the following year. The whole sector trades on a very wide valuation range, ALPH is on 9x revenue, WISE 5x, EQLS 2.3x but AGFX on a distressed valuation of 0.9x revenue.

Opinion: Although market conditions have been difficult, FY Dec 2024F revenue growth is forecast to be +24%, versus AGFX which is guiding to a c. -14% decline* and WISE +3% FY Mar 2025F. I’m a little wary because the share price has fallen through their 16/64-day moving average. But I know many smart readers who have been in this for a few years and seen it multi-bag, so well done to them.

*Sharepad’s forecast show AGFX forecast revenue growth of +25.8%. That’s misleading though, because the data is taken from comparing FY Dec 2024F (£43m) with FY Mar 2022F (£35m). The reported FY Dec 2023 number of £50m is not yet in Sharepad, but that implies a -14% decline to FY Dec 2024F.

Conclusion

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary | 09/07/2024 | MOON, DUKE, EQLS| Reasons to be cheerful

After a difficult 3 years for London-listed smaller companies, Bruce looks at a couple of reasons to feel positive about the future. Companies covered: MOON, DUKE, EQLS.

The FTSE 100 was up less than +0.5% last week to 8,194. The Nasdaq100 and S&P500 were up +3% and 1.6% respectively. China remains in the doldrums with the XIN0, Shanghai Composite and CSI 300 down -1%. The broader Chinese indices are both in negative territory for this year, and last week’s drop in markets comes ahead of the Chinese Communist Party’s third plenum next week. Copper remains above its 16/64 day moving average, suggesting that weaknesses in the Chinese economy are not enough to cause industrial activity in the rest of the world to decline.

In London, we have seen difficult inflation and interest rate conditions, and 3 years of professional fund managers’ outflows but now we could be close to a bottom for UK shares. Callastone reported UK equity fund flows remained negative in June -£0.5bn; but slowing modestly and the least bad month of 2024, with “significantly less selling” in the second half of the month. The AIM chart seems to be forming a nice bowl with support from moving average levels. So, I am feeling positive about the potential for gains in smaller UK companies over the next 18 to 36 months.

There have been some comments on the chat that I, and others, are taking a too negative tone on stocks like Intercede and Duke Capital (covered below). One person even questioned if I had actually read the most recent Intercede announcement.

To be clear, I do read the RNSs and would expect a rising market to lift many stocks over the coming months. I would be delighted if readers make money owning IGP or similar. That said, having worked in equity research and financial PR, I understand how company managements like to put a positive spin on results. Using Sharepad to cross-check the historic track record will often reveal that results are not quite as good as the bullet points on the first page of the RNS would have us believe.

It is not unknown for management to write an upbeat-sounding outlook statement, but ask their broker to cut numbers (DUKE) or leave numbers unchanged with a forecast revenue decline (IGP). On the other hand, it’s hard to think of times when management report a strong set of numbers but mask the positives. So it’s inevitable that anyone taking an analytical approach will end up sounding less upbeat than the management commentary. Although my tone might come across as pessimistic, I think we could be in a ‘rising tide lifts all boats’ scenario in the coming months.

This week I look at Duke, Moonpig and Equals. All of these look potentially interesting, but having missed the upside on Equals (up almost 5x since Nov 2020), I prefer the first two.

Moonpig FY April Results

This gifting platform, which is Moonpig, has also bought Red Letter Days and Buyagift (£124m May 2022 for both) brands in the UK and the Greetz (£29m August 2018) brand in the Netherlands, announced FY April Results. Revenue was up +6% to £341m and statutory PBT was up +33% to £46m. The gross margin also improved from 3% to 59%. Net debt fell -25% to £125m, which represents 1.3x Adj EBITDA (so no longer distressed, I would say). They have a new, four-year £180m RCF in place, with margins of 2% to 2.5% above the reference rate (presumably SONIA and the European equivalent).

What it does: Moonpig sells personalised greeting cards, which is how they acquire customers. They have then expanded into offering a range of gifts and experiences (from sky diving and bungee jumping to spa days and mystery picnics etc). This expansion increases their average order value and customer lifetime value. The gross margin is high at around 60% because it’s a database business of reminders (90 million as of April 2024) that helps them prompt customers about upcoming occasions or anniversaries, encouraging repeat purchases. 89% of Moonpig and Greetz sales come from existing customers.

History: The business was founded at the tail end of the first internet bubble in 2000. The original vision was to combine digital printing with the internet to let customers create better cards than they could buy on the high street. MOON expanded to offer flowers in 2004, food, drink and other off-the-shelf gifts in 2007. It’s had a couple of Private Equity owners, most recently Exponent-backed Horizon Group. They IPO’ed in 2021 with the selling shareholders receiving £455m for 40% of the company, while there was just £20m of new money raised for further investment. As you would expect from a P.E. sellers, the shares have performed badly since their IPO at 350p, and have fallen -80% from peak to trough. I struggle to understand why professional fund managers buy into P.E. IPOs. However, the shares have now doubled since their low early in 2023, so I think this could be worth a second look.

Outlook: Trading since the start of the year has been in line with expectations, they expect mid-to-high single-digit revenue growth FY Apr 2025F. They mention some medium-term growth initiatives, such as marketing investment in Ireland, identifying ways to acquire customers in Australia and the US, and a prototype SME business offer for employee gifting. This should generate double-digit revenue growth, an Adjusted EBITDA margin rate of approximately 25% and growth in Adjusted EPS at a mid-teens percentage growth rate.

Valuation: The shares are trading on 15.1x FY Apr 2025F, dropping to 13.3x the following year. The shares are trading on below 2x forecast revenue, which does seem good value given the 20% historic EBIT margin.

Opinion: Sharepad’s quality indicators suggest that like YouGov, this is a genuine ‘platform’ business. Although management says that 89% of sales come from repeat customers, it’s worth noting that this is still a consumer-discretionary business. Hence whenever consumer wallets are under pressure, revenue can decline and the operational gearing goes into reverse (which happened in 2022, not helped by a postal strike). In the previous year, some of this organic decline was masked by the acquisition of Buyagift, which contributed around £44m of revenue.

On the positive side, it looks like the group has returned to revenue growth, so the operational gearing should now be working in shareholders’ favour. I also like the captive customer database and this does seem to be solving a (rich world) problem that we all own too much ‘stuff’ and it is hard to find ideas for presents to give to friends and family. Unlike enterprise cybersecurity companies like DARK or IGP, this is a company where private investors can mystery shop and get a feel for the customer experience. On 16th October 2024, they intend to hold a Capital Markets Day. Thumbs up from me, and I have put a limit order on to buy some shares.

Duke Capital FY March Results

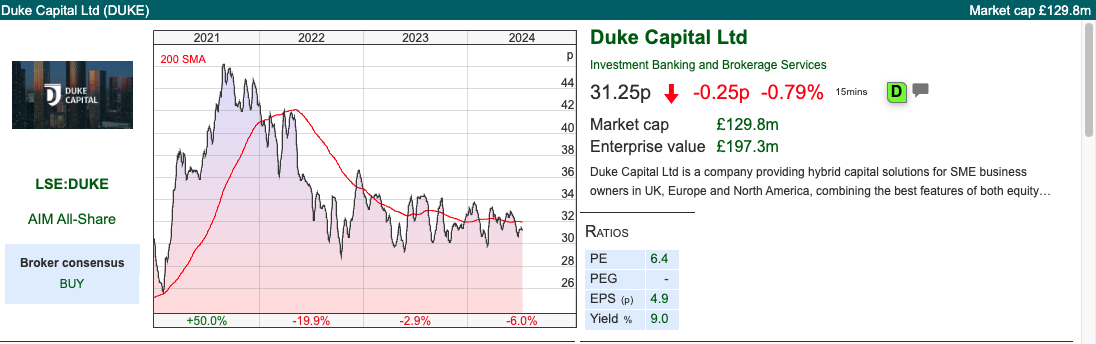

This alternative finance company changed its name from Duke Royalty to Duke Capital at the start of the year. They have changed their messaging from royalty lending, to emphasize more broadly “hybrid capital”, a financing solution that blends features of private equity and private credit products and is more flexible than traditional debt or equity. They also changed their strategy to be able to invest in equity ownership over 30% of their companies. So, for instance, they have invested £14.5m for a 49% equity stake in Integrum Care Group, which operates six care homes in the South of England.

FY March results showed a +12% increase in recurring cash revenue to £24m for FY Mar 2024. That figure excludes exit premiums (i.e. companies paying them back) and cash gains from the sale of equity investments, during the year they enjoyed three profitable exits (Instor, Fabrikat and Fairmed), which gave them £23mm of additional liquidity.

Despite the increasing cash revenue and exits, statutory PBT was down -40% to £12.3m. That was driven by a £14m swing in Fair Value accounting movements with FY Mar 24 showing a £4.5m FV loss across the investment portfolio compared to a £9.1m gain in FY23.

The total value of the investment portfolio was £232m end of March, up +11% on the previous March, split across hybrid credit, term credit and equity investments. DUKE has a £100m five-year term facility expiring in January 2028 with a bullet repayment on expiry. They had £27m undrawn at the March year-end, so net debt was around £73m, Cavendish, their broker says they estimate borrowing currently stands at £83m. The interest rate is equal to SONIA plus 5.0% per annum (an improvement on the previous rate of SONIA plus 7.25%). There are also 43,990 warrants with an exercise price of 45 per share associated with the debt facility.

Outlook: Management sound optimistic saying “We are in an ideal position to capitalise on a highly attractive market opportunity and as such, have enlarged our investment team with three new hires during the period. This confidence will be boosted further when the economic backdrop improves and interest rates finally decrease.” Yet again this is another Cavendish client sounding positive in the outlook statement, but where the broker has cut FY Mar 2025F recurring revenue by -8% to £27m, which translates to a -16% cut in adj EPS to 3.2p. Cavendish also suggests that there has been some interest forbearance, which would also explain the Fair Value write-down through the P&L.

Valuation: The shares are trading on a PER of 9.6x FY March 2025F and just under 8x 2026F. Net assets (which is driven by fair value accounting on the asset side of the balance sheet) stood at £165m, so it’s trading on a -20% discount to book value. The dividend yield is 9%, but DPS is no longer forecast to grow by Cavendish and note my comments below.

Funding growth: I last wrote about the shares a couple of years ago, where I pointed out that the high dividend yield was illusory because DUKE was not profitable enough to self-fund income growth. They have raised £55m cumulatively from investors in April 2021 and May 2022, both at a placing price of 35p, which puts the £11.5m of annual dividends in perspective. There is no deception, management are open about what they are doing, but the investment proposition is different from say Somero (yield 6%) or Games Workshop (4% yield) which both pay out excess cash and are profitable enough to fund growth from internal resources. It could be that DUKE has now achieved the scale to not need any more capital raising, but management haven’t stated that explicitly.

Opinion: In 2022 I suggested that with the BoE forecasting a recession, it was the wrong point in the cycle to own companies that were financing SMEs. I have now bought some DUKE as I think this could be the right point in the cycle to invest in shares which should benefit from a strengthening economy and interest rate cuts. There is a risk that we see a second round of energy cost or food price inflation. On balance though, seems like the risk-reward is attractive, several readers on the chat agree, and “longterm1967” pointed out that Simon Thompson in the Investors Chronicle is a fan.

Equals H1 June Trading Update

This FX company announced in a trading statement that H1 Jun revenues would be up +33% y-o-y to £60m. Though impressive, that still represents a slowdown from +84% in H1 in H1 Jun 2022, and +43% in H1 Jun last year. Results were also helped by the acquisition of Oonex, renamed Equals Money Europe (EMEU) without which revenue growth would have been +28%.

They say that Q1 of this year has been quiet, but they saw “a strong pick up” in Q2. FX revenues from B2C customers are subdued given macro-economic conditions whereas B2B revenues are more robust.

There’s been a strategic review ongoing since November last year when they were approached by a couple of potential bidders. The Put Up or Shut Up (PUSU) deadline has been extended several times. The trading statement says there’ll be a further update on 10th July.

Valuation: The shares are trading on 15x FY Dec 2025F dropping to 12x the following year. The whole sector trades on a very wide valuation range, ALPH is on 9x revenue, WISE 5x, EQLS 2.3x but AGFX on a distressed valuation of 0.9x revenue.

Opinion: Although market conditions have been difficult, FY Dec 2024F revenue growth is forecast to be +24%, versus AGFX which is guiding to a c. -14% decline* and WISE +3% FY Mar 2025F. I’m a little wary because the share price has fallen through their 16/64-day moving average. But I know many smart readers who have been in this for a few years and seen it multi-bag, so well done to them.

*Sharepad’s forecast show AGFX forecast revenue growth of +25.8%. That’s misleading though, because the data is taken from comparing FY Dec 2024F (£43m) with FY Mar 2022F (£35m). The reported FY Dec 2023 number of £50m is not yet in Sharepad, but that implies a -14% decline to FY Dec 2024F.

Conclusion

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.