The standout share from Richard’s latest 5 Strikes haul is Pets at Home, a dominant pet care business in the UK with a strong financial track record.

Fifteen companies have passed the Minimum Quality Filter since my last update, but the finances of only three score less than three strikes, according to the 5 strikes system.

5 Strikes

The objective of 5 Strikes is to find businesses that have grown under their own steam.

I like these businesses because they have been financially sustainable, they have not required investors or lenders to stump up ever more capital to grow. Often all that will be required in future is more of what they are already doing, or a slight adaptation.

To my mind, these businesses are more predictable than companies that don’t yet know how to make profit, and businesses that try to transform themselves through large acquisitions, for example.

| Name | TIDM | AR date | Strikes | # Strikes |

|---|---|---|---|---|

| Pets at Home | PETS | 10/6/24 | – Holdings – ROCE | 2 [1] |

| Tate & Lyle | TATE | 8/6/24 | ? Holdings ? CROCI – Growth – ROCE | 3 |

| Sanderson Design | SDG | 4/6/24 | – Holdings – CROCI – Growth – Shares | 4 |

| Marks & Spencer | MKS | 3/6/24 | – Holdings – Debt – Growth – ROCE | 4 |

| Burberry | BRBY | 30/5/24 | – Holdings – Growth – Debt | 3 |

| NAHL | NAH | 30/5/24 | ? Holdings – Growth – ROCE- Shares | 4 |

| Anglo Asian Mining | AAZ | 29/5/24 | – CROCI – Growth – ROCE | 3 |

| Anpario | ANP | 24/5/24 | – Holdings ? CROCI – Growth – ROCE | 3 |

| Vodafone | VOD | 24/5/24 | – Holdings – Debt – Growth – ROCE | 4 |

| Braemar | BMS | 23/5/24 | ? CROCI – Growth – ROCE ? Shares | 3 |

| Metals Exploration | MTL | 23/5/24 | – CROCI ? Debt – ROCE – Shares | 3 |

| Animalcare | ANCR | 21/5/24 | ? Acquisitions ? CROCI – Growth – ROCE – Shares | 4 |

| London Security | LSC | 21/5/24 | 0 | |

| Science | SAG | 21/5/24 | ? ROCE | 1 |

| The Brighton Pier Group | PIER | 21/5/24 | – CROCI – Debt – Growth – ROCE – Shares | X |

Notes: Strikes are potential flaws in a company’s financial track record. This article contains an explanation of each strike, but please note the Minimum Quality filter has since been modified and the new version is described here.

Pets at Home (- Holdings – ROCE)

We are all probably aware of Pets at Home pet shops, there are after all more than 450 of them across the land.

That’s as far as it goes for me, but pet owners are likely much more familiar with the company because it claims a 24% share of £7.8 billion in annual UK pet spending.

That is impressive, for a company that was founded in 1991. It warrants a closer look, especially as the main strike against the business is for profitability (- ROCE), which is due to an accounting quirk.

Return on Capital is important because those returns can be reinvested in the business, they are the source of sustainable growth, so if Pets at Home is more profitable than it looks, it has a first-class financial history.

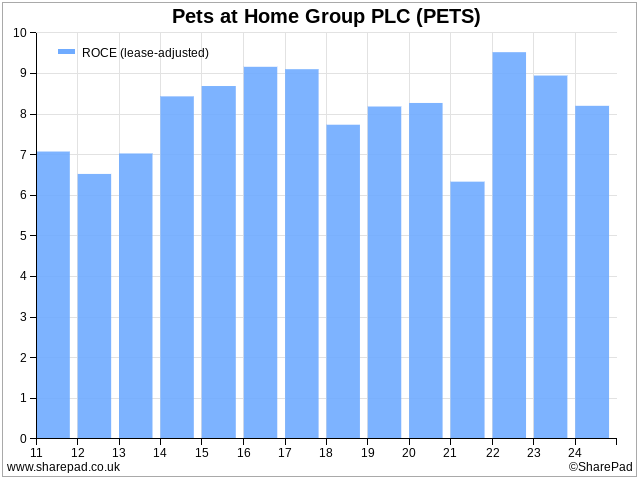

One of my criteria is that a business should achieve at least 10% Return on Capital Employed routinely, and judging by Pets at Home’s ROCE the firm is a modest underachiever:

But it pays to investigate how a company calculates its “alternative performance measures”. APMs are non-standard calculations adjusted to improve our understanding or put a positive gloss on things, depending on how honest management is.

ROCE is profit as a percentage of average capital employed during the year, which includes intangible assets like goodwill.

Pets at Home excludes £906 million of goodwill from its definition of capital employed, out of a total of £959 million (i.e. almost all of it). It says the goodwill was created when KKR, a private equity firm, acquired Pets at Home in 2010 (Pets at Home was subsequently listed in 2014).

Goodwill usually represents the additional cost of an acquisition above the value of the identifiable assets, which are recorded at book value on the acquirer’s balance sheet. It is a historical cost and as far as I am concerned it has no bearing on future profitability unless the company is a serial acquirer.

In that case, if goodwill has depressed Return on Capital below 10% and the company’s strategy is to grow through acquisition, it may be paying too much for the acquired growth.

However, almost all of the goodwill on Pets at Home’s balance sheet is not from acquisitions of pet shops and veterinary practices by Pets at Home. The goodwill was paid by KKR for Pets at Home in a leveraged buyout. In this particular transaction, the goodwill is dumped on the balance sheet of the acquisition.

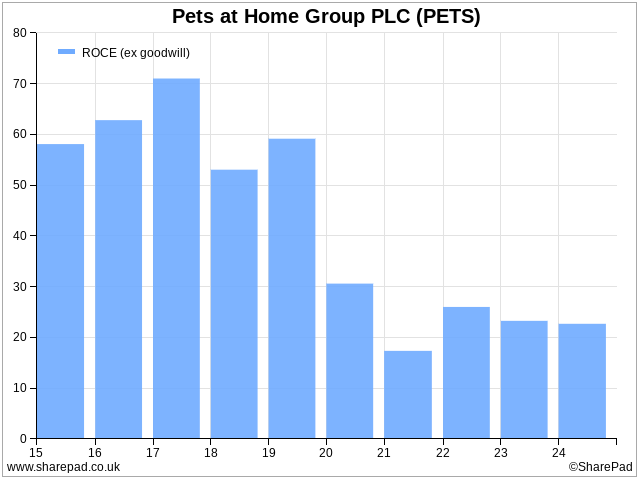

I don’t think this is relevant to Pets at Home’s performance, so we can get a more realistic impression of Pets at Home’s Return on Capital simply by excluding goodwill from ROCE, which is an option whenever we create a list, table or financial chart in SharePad.

At first glance, this chart, which excludes goodwill, looks more alarming than the one that includes goodwill. But it shows that currently Pets at Home’s return on capital employed is more than 20%, not less than 10%.

The decline in ROCE coincides with a rise in capital employed in 2020, which is also an accounting figment. It is probably due to a rule, IFRS 16, which was introduced in 2019 and requires companies to include the value of leases on their balance sheets, increasing their capital employed.

The bad news is the data before 2020 is not comparable with the data since 2020. The good news is I think the current data is closer to the truth, and Pets at Home’s financial history is probably pretty impressive.

Since Pets at Home does not deserve a strike for ROCE, I have decided it only deserves one strike for the relatively modest holdings of its directors.

There is another reason I like Pets at Home. The company just about made it into the top 50 of the Institute of Customer Service’s UK Customer Satisfaction Index (in 50th place). I know this because I am adding customer and employee data to SharePad using the note fields.

My very preliminary thoughts about the future are that we need to investigate Pets at Home’s strategy. A company with a 24% market share may have limited room for growth.

Pets at Home believes it can increase market share, perhaps by growing the in-store veterinary businesses in two-thirds of its pet-care centres. The vet business contributes 10% of total revenue.

Vet chains face a potential challenge from the Competition and Markets Authority (CMA), though, which is reviewing the sector. It says 60% of veterinary practices now belong to large groups, and Pets at Home is one of them. It thinks these chains may be overcharging customers.

Pets at Home says it is different from the rest of the industry because of the joint venture structure employed by most of its practices. This means they are half owned by local vets, who have operational and clinical freedom.

As always, more investigation is required, but Pets at Home is an interesting candidate for investment.

London Security and Science

The other two shares with few strikes to their names are London Security and Science.

London Security, which makes fire extinguishers and other protective equipment, is almost entirely owned by the same family interests that own Andrews Sykes. It appears to be equally as well managed.

As I mentioned when I skipped past Andrews Sykes last time, a holding of more than 75% is unsettling as it means the company could be voted private at any time by the majority shareholder, turning my long-term investment into a short-term trade.

My issue with Science is not about ownership per se. Science, a mishmash of consultancies and technology businesses, is 21% owned by Martyn Ratcliffe.

That is a level of ownership I would normally consider to be healthy. It gives the chairman a strong incentive to make sure the firm prospers. However, I sold my holding in the shares when I lost faith in the firm’s strategy because I couldn’t make out what it was.

Maybe I should take another look. Shareholders who stuck with Mr Ratcliffe, have done well.

The “buys” and “sells” on this chart relate to the Share Sleuth portfolio, a model portfolio Richard manages for interactive investor. He also owned shares in the company around the same time.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.