This week Bruce looks at long-term multi-bagger Jet2, up around 120x from its 2008 low, and Filtronic, which has announced a contract win with Elon Musk’s SpaceX. Plus another bid from US Private Equity, this time for cybersecurity firm Darktrace.

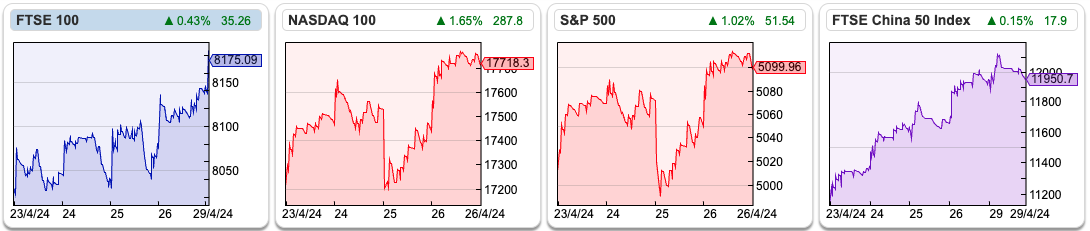

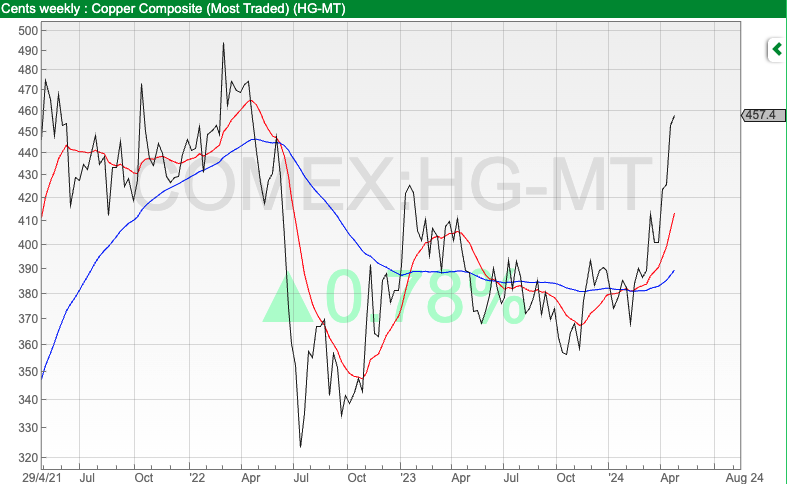

The FTSE 100 rose +1.9% to 8,175 last week. The US markets performed even better, with the Nasdaq100 +4% and S&P500 +2.7%. The FTSE China 50 was also remarkably strong, +7.4% last week, and is now up +9% YTD. Copper (HG-MT) is now up +18% YTD and is trading well above both its 16 and 64-day moving average, suggesting the economic outlook remains positive.

Dan Davies, who was the UK banks analyst at ABN Amro when I was at ING, has just published his latest book. Dan’s background as an equity research analyst covering UK banks, and then later working at Credit Suisse, means he is particularly well placed to write a book about why large corporations do self-destructive things: The Unaccountability Machine: Why Big Systems Make Terrible Decisions – and How The World Lost its Mind

The book isn’t just about the banking crisis, though it touches on it as a theme, but the scope is broader than that.

Anyone who has dealt with a corporation or bureaucracy of any size, and who is over the age of 40, is likely to have a vague sense that you used to be able to speak to a person and get things done; the world wasn’t always a maze of options menus.

Dan looks at the traits organisations that make poor decisions share. He suggests something to look for is what he calls an “accountability sink”. This is something that might be familiar to anyone who has been bumped from an overbooked flight. There is no point getting angry at the gate attendant or the person in the call centre; they are just implementing a corporate policy which they have no power to change. But there is no way of complaining to the person who actually made the decision that affects the customer. The airline has deliberately created an arrangement whereby their employee speaks to you with the voice of an amorphous algorithm, but the customer has no chance of getting a better outcome. The communication between the decision-maker and the decided-upon has been broken – the corporation has created a handy “accountability sink” into which negative feedback can be poured down the plug hole, without any danger of it affecting anything. It’s notable that many of the sectors where accountability sinks are prevalent (airlines, utilities, telcos and banks) have been poor performers for shareholders. I’m halfway through Dan’s book, and highly recommend it!

On the administrative side, from May, this Weekly Commentary will be converting to twice a month. As ever, you will still be able to find them on the SharePad homepage, via email (if you subscribe to ShareScope’s email service) and of course on the ShareScope website along with the full, searchable archive of all my Weekly Commentarys here.

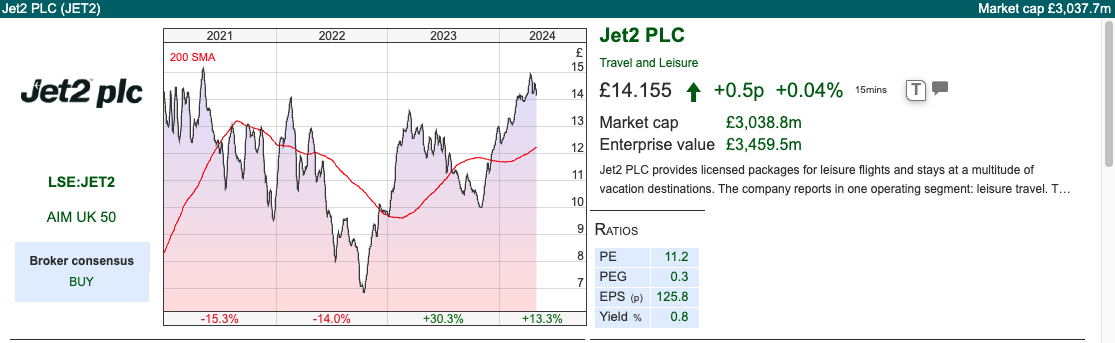

Jet2 FY Mar Trading Update

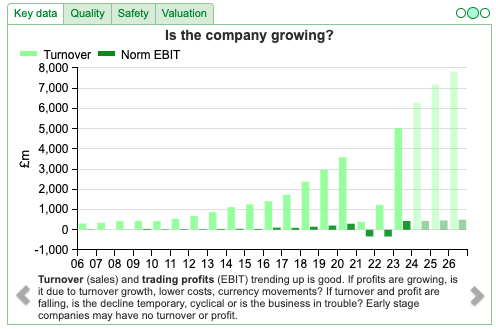

This package holiday company with a March year-end, announced a slightly ahead trading update, PBT before FX of between £515m and £520m (previously £510m to £525m). That represents a +33% increase on FY Mar 2023. Management does point out that with over 40% of Summer 2024 and the majority of Winter 2024/2025 seasons still to sell, it is too early to give FY Mar 2025 guidance, which I think is fair enough.

The balance sheet is strong with total cash at 31 March 2024 of £3.2bn and an ‘Own Cash’ balance (that is, excluding customer advance deposits) of £1.3bn. Despite Brent Crude rising +16% in the past few months, they shouldn’t be exposed to the rising oil price in the short term, as Jet2 are over 80% for the full financial year in line with their established hedging policy.

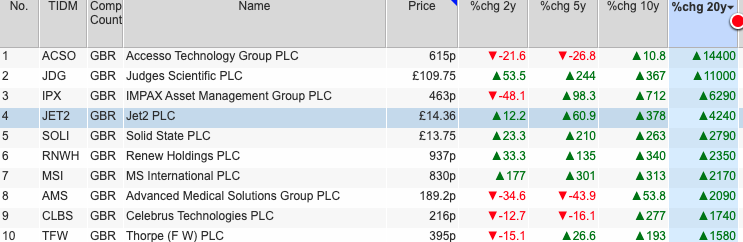

I’ve been meaning to look at this company for a while, they used to be called Dart, and have been one of the best AIM performers over the last 20 years, ahead of Solid State but behind Impax AM (both of which I’ve owned for a decade).

I mentioned a few months ago, that packaged holidays and airline sectors weren’t somewhere most investors would be looking for long-term multibaggers. Jet2 must be doing something right, to be up 120x from its mid-2008 low. So I think that the company is worth a look, even if the 120x performance is not going to be repeated over the coming decades.

History: The company started life in 1971, founded by Art Carpenter to fly fresh flowers from Guernsey to the UK. They bought their first Handley Page Dart Herald, a type of airplane, giving inspiration to their later name Dart Group. In 1983 Philip Meeson, a former RAF pilot and five-time British Aerobatics Champion, bought the company and changed the name to Channel Express. Meeson is still an 18% shareholder. They diversified from flowers to Royal Mail parcels, Post Office and newspaper delivery.

They listed in 1988 on the Unlisted Securities Market (USM) which was the precursor to AIM (set up in 1995) and in 1991 changed their name to Dart Group. They launched Jet2.com, as a low-cost leisure airline, in 2002. The first route was from Leeds to Amsterdam, but they quickly expanded to Alicante, Barcelona, Malaga, Milan, Nice and Palma. Jet2 started out as chartered flights, but they then launched Jet2holidays, offering customers and travel agents “package holidays you can trust.” By 2017 they were the UK’s second biggest tour operator, carrying almost 3m passengers a year with high levels of customer satisfaction. 2020-2022 was a difficult time for all airlines due to Covid-19 with flights being cancelled and passengers refunded; the share price fell -75% from £19 to below £5 in the first half of 2020, but has since recovered to around £14.50.

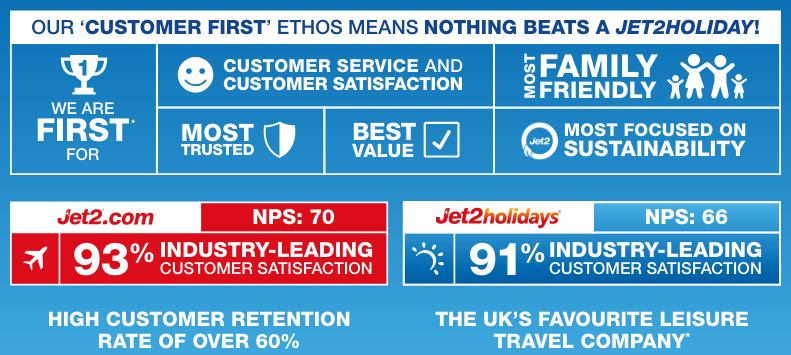

It doesn’t seem to me that Jet2’s success has come from doing anything particularly clever. A focus on value for money and customer service, as evidenced by the high Net Promoter Scores (NPS) and high customer retention rate. So rather than a clever strategy, the management seem focused on execution, doing the simple things well – which has resulted in a remarkable long-term track record. Add to this the group’s sustainability credentials, cutting single-use plastics, investing in sustainably produced aviation fuel and carbon offsetting. Customers can also filter hotel selection by sustainability criteria.

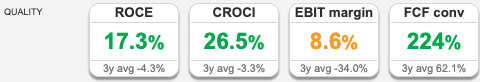

Valuation: The shares are trading on 8x PER Mar 2025F. EV/EBITDA is just 1.4x the same year. Sharepad’s quality indicators are positive, although the 3-year averages are still distorted by the pandemic.

Opinion: Fascinating company that has done well in a declining sector, where others (remember Lunn Poly, and Thomas Cook?) have stumbled. Tui, Europe’s largest travel group, is down -90% since 2018, and shareholders have voted in favour of de-listing from London. The trend of people booking Ryanair flights and Booking.com, or more recently Airbnb, accommodation separately has disintermediated the travel industry. Jet2 has done spectacularly well just to avoid the fate of those others. Well done to any readers who spotted this early as they would have made huge gains.

Filtronic FY May Trading Update

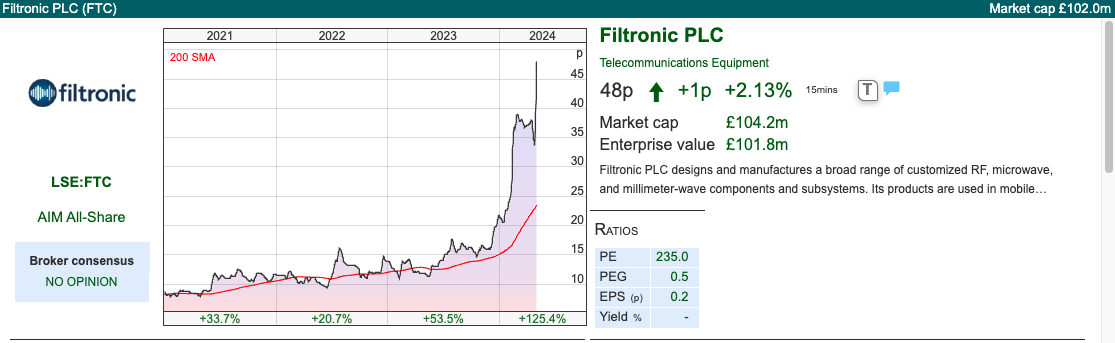

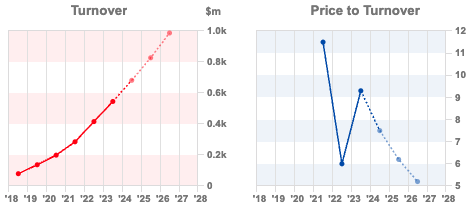

This aerospace and defence company announced that results for both FY May 2024F and FY May 2025F should exceed current forecasts. That’s driven by winning several contracts, including for Low Earth Orbit (LEO) systems.

They say FY May 2024F revenue will be slightly ahead, but on an EBITDA level, they’ll be significantly ahead. The following year, FY May 2025F, both revenue and EBITDA will be “significantly ahead”.

Partnership with SpaceX: In a separate RNS management announced an agreement with Elon Musk’s SpaceX, whose main product is Starlink, which provides high-speed, low-latency internet to users all around the world. The US company will buy E-band SSPA modules from FTC, scheduled for delivery in FY May 2025, with further order flow expected. FTC has issued 22m warrants (strike price 33p, so well in the money currently) to SpaceX across two tranches, to enable SpaceX to subscribe for up to a maximum of 10% of the Company’s existing share capital, with such warrants expected to vest, once $60m (£48m) of orders have been placed by SpaceX.

History: The company was founded in 1977 by Professor David Rhodes (Leeds University), using equipment based in his garage and bedroom, the original plan was to work on components for the Tornado fighter jet. Until 1989 the company’s products were purely in electronic warfare, then in the 1990s they expanded by acquisitions, for instance, buying semiconductor fab capability from Fujitsu. In October 1994, having demerged from the original Filtronic, Filtronic Comtek plc was listed on the London Stock Exchange. The business was subsequently renamed Filtronic plc following the acquisition in March 1998 of Filtronic Components Limited and Filtronic Cable Communications Limited.

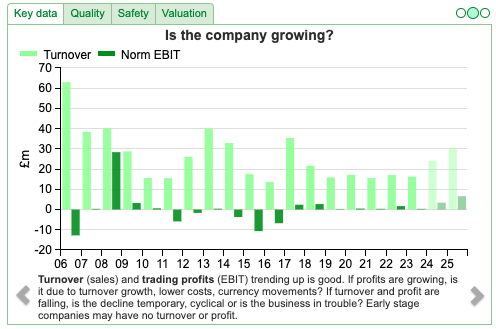

SharePad has financial data going back to the 1990s, and in the early 2000’s they were generating revenue of well over £200m but struggling to make profits. It looks like there were disposals, with revenue in the business shrinking to £16m per annum from 2010 onwards, again with the company struggling to report profits. The company de-listed from the main market on the LSE and migrated to AIM in 2015. At the same time, they raised £4.5m at 5p per share, giving them a market cap on admission of £13m.

Currently, the company’s products are a mix of transceivers, amplifiers and diplexers. I know what transceivers and amplifiers are, but the company’s website isn’t very good at explaining what these products do. That may be deliberate, as the company is in the defence sector. Here’s their explanation from the website:

Filtronic are technology leaders, with award-winning product and service solutions from 300MHz to 175GHz. We design and manufacture high-performance components and sub-systems across the RF, Microwave and mmWave spectrum. Our clients depend on us to deliver high-performance RF solutions solving their challenging requirements. We accelerate their market entry, reduce whole-life & development costs, minimise cost of quality and provide them with a competitive advantage.

Valuation: Cavendish forecasts revenue growing by +50% to £24.5m in FY Apr 2024F and +47% to £36m the following year. That puts the shares on a PER 19x Apr 2025F, which seems good value if they can sustain the level of revenue and profit growth. That’s possible, but this does seem like an industry where orders can be very lumpy.

Opinion: Beyond my circle of competence. I note the financial track record is patchy though, so this looks like a sector where even if you have the best technology, the “moat” might not last. The reported gross margin has been above 60% over the last 3 years, but the company has struggled to maintain a double-digit RoCE. That suggests to me that management need to grow the business to enjoy economies of scale. It looks like they are doing the right things and winning contracts, so high risk but could be very exciting.

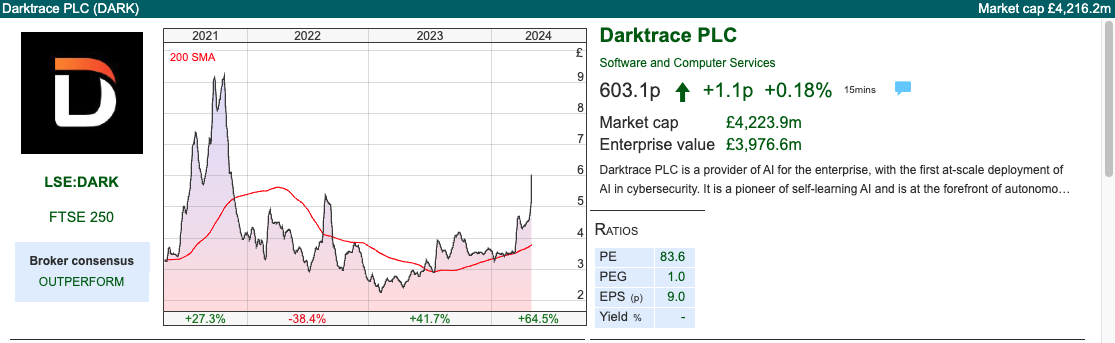

Darktrace Recommended cash offer

This cybersecurity company has received a cash bid at $7.75 per share (or 620p at the FX rate on the day of the RNS last week). That is a 20% premium to the undisturbed closing price of 517p on 25th April. The bid is from US tech Private Equity company Thoma Bravo and is worth $5.3bn (£4.2bn) of which Mike Lynch, the former Autonomy Chief Executive facing legal difficulties in the US, should gain around £170m.

Valuation: Thoma Bravo’s approach values DARK at just over 45x PER FY Jun 2024F and 7.5x sales the same year. On an EV/EBITDA basis that falls to just over 30x the same year. That suggests a full, but not eye-watering, valuation.

For comparison, Crowdstrike in the US trades on 80x PER, EV/EBITDA of 70x and price to sales of almost 20x.

History: The share price has a volatile history. They IPO’ed at 250p in April 2021, before trebling to 945p. Then analysts at Peel Hunt published a note questioning the valuation which saw the price decline back below 300p in mid-2022. Thoma Bravo first made an approach around that time, which then saw the shares spike above 500p, but pulled in September 2022, without explaining why it would not make an offer. The shares fell -30% the day after Thoma Bravo announced they would not go ahead.

Then at the beginning of 2023, DARK saw a short-selling attack, which suggested DARK had simulated sales to phantom end users. Quintessential Capital Management, a New York-based hedge fund, used phrases like “channel stuffing”, and “round-tripping” as well as “money laundering” and “fraud”. In early 2023 the shares fell below 250p following the attack. The 620p bid seems a good outcome for shareholders. Thoma Bravo’s bid is higher than the share price was in mid-2022, so whatever the PE company’s concerns were, they were unlikely to have been the price or multiple they were paying.

Opinion: Well done to holders. I found it difficult to know from the outside how good DARK’s technology really was. To some extent, that’s a problem with all enterprise software companies, that have large corporations, rather than individuals, as customers. However it’s also a problem for anti-virus and cyber security software if I buy Norton or Avast, it’s very hard for me to know what I’m getting for my money, I just have to trust the reviews from Techradar or similar. For that reason I avoided this company, I would imagine many other investors also put it in the “too hard” pile.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 30/04/2024 | JET2, FTC, DARK | Accountability sinks

This week Bruce looks at long-term multi-bagger Jet2, up around 120x from its 2008 low, and Filtronic, which has announced a contract win with Elon Musk’s SpaceX. Plus another bid from US Private Equity, this time for cybersecurity firm Darktrace.

The FTSE 100 rose +1.9% to 8,175 last week. The US markets performed even better, with the Nasdaq100 +4% and S&P500 +2.7%. The FTSE China 50 was also remarkably strong, +7.4% last week, and is now up +9% YTD. Copper (HG-MT) is now up +18% YTD and is trading well above both its 16 and 64-day moving average, suggesting the economic outlook remains positive.

Dan Davies, who was the UK banks analyst at ABN Amro when I was at ING, has just published his latest book. Dan’s background as an equity research analyst covering UK banks, and then later working at Credit Suisse, means he is particularly well placed to write a book about why large corporations do self-destructive things: The Unaccountability Machine: Why Big Systems Make Terrible Decisions – and How The World Lost its Mind

The book isn’t just about the banking crisis, though it touches on it as a theme, but the scope is broader than that.

Anyone who has dealt with a corporation or bureaucracy of any size, and who is over the age of 40, is likely to have a vague sense that you used to be able to speak to a person and get things done; the world wasn’t always a maze of options menus.

Dan looks at the traits organisations that make poor decisions share. He suggests something to look for is what he calls an “accountability sink”. This is something that might be familiar to anyone who has been bumped from an overbooked flight. There is no point getting angry at the gate attendant or the person in the call centre; they are just implementing a corporate policy which they have no power to change. But there is no way of complaining to the person who actually made the decision that affects the customer. The airline has deliberately created an arrangement whereby their employee speaks to you with the voice of an amorphous algorithm, but the customer has no chance of getting a better outcome. The communication between the decision-maker and the decided-upon has been broken – the corporation has created a handy “accountability sink” into which negative feedback can be poured down the plug hole, without any danger of it affecting anything. It’s notable that many of the sectors where accountability sinks are prevalent (airlines, utilities, telcos and banks) have been poor performers for shareholders. I’m halfway through Dan’s book, and highly recommend it!

On the administrative side, from May, this Weekly Commentary will be converting to twice a month. As ever, you will still be able to find them on the SharePad homepage, via email (if you subscribe to ShareScope’s email service) and of course on the ShareScope website along with the full, searchable archive of all my Weekly Commentarys here.

Jet2 FY Mar Trading Update

This package holiday company with a March year-end, announced a slightly ahead trading update, PBT before FX of between £515m and £520m (previously £510m to £525m). That represents a +33% increase on FY Mar 2023. Management does point out that with over 40% of Summer 2024 and the majority of Winter 2024/2025 seasons still to sell, it is too early to give FY Mar 2025 guidance, which I think is fair enough.

The balance sheet is strong with total cash at 31 March 2024 of £3.2bn and an ‘Own Cash’ balance (that is, excluding customer advance deposits) of £1.3bn. Despite Brent Crude rising +16% in the past few months, they shouldn’t be exposed to the rising oil price in the short term, as Jet2 are over 80% for the full financial year in line with their established hedging policy.

I’ve been meaning to look at this company for a while, they used to be called Dart, and have been one of the best AIM performers over the last 20 years, ahead of Solid State but behind Impax AM (both of which I’ve owned for a decade).

I mentioned a few months ago, that packaged holidays and airline sectors weren’t somewhere most investors would be looking for long-term multibaggers. Jet2 must be doing something right, to be up 120x from its mid-2008 low. So I think that the company is worth a look, even if the 120x performance is not going to be repeated over the coming decades.

History: The company started life in 1971, founded by Art Carpenter to fly fresh flowers from Guernsey to the UK. They bought their first Handley Page Dart Herald, a type of airplane, giving inspiration to their later name Dart Group. In 1983 Philip Meeson, a former RAF pilot and five-time British Aerobatics Champion, bought the company and changed the name to Channel Express. Meeson is still an 18% shareholder. They diversified from flowers to Royal Mail parcels, Post Office and newspaper delivery.

They listed in 1988 on the Unlisted Securities Market (USM) which was the precursor to AIM (set up in 1995) and in 1991 changed their name to Dart Group. They launched Jet2.com, as a low-cost leisure airline, in 2002. The first route was from Leeds to Amsterdam, but they quickly expanded to Alicante, Barcelona, Malaga, Milan, Nice and Palma. Jet2 started out as chartered flights, but they then launched Jet2holidays, offering customers and travel agents “package holidays you can trust.” By 2017 they were the UK’s second biggest tour operator, carrying almost 3m passengers a year with high levels of customer satisfaction. 2020-2022 was a difficult time for all airlines due to Covid-19 with flights being cancelled and passengers refunded; the share price fell -75% from £19 to below £5 in the first half of 2020, but has since recovered to around £14.50.

It doesn’t seem to me that Jet2’s success has come from doing anything particularly clever. A focus on value for money and customer service, as evidenced by the high Net Promoter Scores (NPS) and high customer retention rate. So rather than a clever strategy, the management seem focused on execution, doing the simple things well – which has resulted in a remarkable long-term track record. Add to this the group’s sustainability credentials, cutting single-use plastics, investing in sustainably produced aviation fuel and carbon offsetting. Customers can also filter hotel selection by sustainability criteria.

Valuation: The shares are trading on 8x PER Mar 2025F. EV/EBITDA is just 1.4x the same year. Sharepad’s quality indicators are positive, although the 3-year averages are still distorted by the pandemic.

Opinion: Fascinating company that has done well in a declining sector, where others (remember Lunn Poly, and Thomas Cook?) have stumbled. Tui, Europe’s largest travel group, is down -90% since 2018, and shareholders have voted in favour of de-listing from London. The trend of people booking Ryanair flights and Booking.com, or more recently Airbnb, accommodation separately has disintermediated the travel industry. Jet2 has done spectacularly well just to avoid the fate of those others. Well done to any readers who spotted this early as they would have made huge gains.

Filtronic FY May Trading Update

This aerospace and defence company announced that results for both FY May 2024F and FY May 2025F should exceed current forecasts. That’s driven by winning several contracts, including for Low Earth Orbit (LEO) systems.

They say FY May 2024F revenue will be slightly ahead, but on an EBITDA level, they’ll be significantly ahead. The following year, FY May 2025F, both revenue and EBITDA will be “significantly ahead”.

Partnership with SpaceX: In a separate RNS management announced an agreement with Elon Musk’s SpaceX, whose main product is Starlink, which provides high-speed, low-latency internet to users all around the world. The US company will buy E-band SSPA modules from FTC, scheduled for delivery in FY May 2025, with further order flow expected. FTC has issued 22m warrants (strike price 33p, so well in the money currently) to SpaceX across two tranches, to enable SpaceX to subscribe for up to a maximum of 10% of the Company’s existing share capital, with such warrants expected to vest, once $60m (£48m) of orders have been placed by SpaceX.

History: The company was founded in 1977 by Professor David Rhodes (Leeds University), using equipment based in his garage and bedroom, the original plan was to work on components for the Tornado fighter jet. Until 1989 the company’s products were purely in electronic warfare, then in the 1990s they expanded by acquisitions, for instance, buying semiconductor fab capability from Fujitsu. In October 1994, having demerged from the original Filtronic, Filtronic Comtek plc was listed on the London Stock Exchange. The business was subsequently renamed Filtronic plc following the acquisition in March 1998 of Filtronic Components Limited and Filtronic Cable Communications Limited.

SharePad has financial data going back to the 1990s, and in the early 2000’s they were generating revenue of well over £200m but struggling to make profits. It looks like there were disposals, with revenue in the business shrinking to £16m per annum from 2010 onwards, again with the company struggling to report profits. The company de-listed from the main market on the LSE and migrated to AIM in 2015. At the same time, they raised £4.5m at 5p per share, giving them a market cap on admission of £13m.

Currently, the company’s products are a mix of transceivers, amplifiers and diplexers. I know what transceivers and amplifiers are, but the company’s website isn’t very good at explaining what these products do. That may be deliberate, as the company is in the defence sector. Here’s their explanation from the website:

Filtronic are technology leaders, with award-winning product and service solutions from 300MHz to 175GHz. We design and manufacture high-performance components and sub-systems across the RF, Microwave and mmWave spectrum. Our clients depend on us to deliver high-performance RF solutions solving their challenging requirements. We accelerate their market entry, reduce whole-life & development costs, minimise cost of quality and provide them with a competitive advantage.

Valuation: Cavendish forecasts revenue growing by +50% to £24.5m in FY Apr 2024F and +47% to £36m the following year. That puts the shares on a PER 19x Apr 2025F, which seems good value if they can sustain the level of revenue and profit growth. That’s possible, but this does seem like an industry where orders can be very lumpy.

Opinion: Beyond my circle of competence. I note the financial track record is patchy though, so this looks like a sector where even if you have the best technology, the “moat” might not last. The reported gross margin has been above 60% over the last 3 years, but the company has struggled to maintain a double-digit RoCE. That suggests to me that management need to grow the business to enjoy economies of scale. It looks like they are doing the right things and winning contracts, so high risk but could be very exciting.

Darktrace Recommended cash offer

This cybersecurity company has received a cash bid at $7.75 per share (or 620p at the FX rate on the day of the RNS last week). That is a 20% premium to the undisturbed closing price of 517p on 25th April. The bid is from US tech Private Equity company Thoma Bravo and is worth $5.3bn (£4.2bn) of which Mike Lynch, the former Autonomy Chief Executive facing legal difficulties in the US, should gain around £170m.

Valuation: Thoma Bravo’s approach values DARK at just over 45x PER FY Jun 2024F and 7.5x sales the same year. On an EV/EBITDA basis that falls to just over 30x the same year. That suggests a full, but not eye-watering, valuation.

For comparison, Crowdstrike in the US trades on 80x PER, EV/EBITDA of 70x and price to sales of almost 20x.

History: The share price has a volatile history. They IPO’ed at 250p in April 2021, before trebling to 945p. Then analysts at Peel Hunt published a note questioning the valuation which saw the price decline back below 300p in mid-2022. Thoma Bravo first made an approach around that time, which then saw the shares spike above 500p, but pulled in September 2022, without explaining why it would not make an offer. The shares fell -30% the day after Thoma Bravo announced they would not go ahead.

Then at the beginning of 2023, DARK saw a short-selling attack, which suggested DARK had simulated sales to phantom end users. Quintessential Capital Management, a New York-based hedge fund, used phrases like “channel stuffing”, and “round-tripping” as well as “money laundering” and “fraud”. In early 2023 the shares fell below 250p following the attack. The 620p bid seems a good outcome for shareholders. Thoma Bravo’s bid is higher than the share price was in mid-2022, so whatever the PE company’s concerns were, they were unlikely to have been the price or multiple they were paying.

Opinion: Well done to holders. I found it difficult to know from the outside how good DARK’s technology really was. To some extent, that’s a problem with all enterprise software companies, that have large corporations, rather than individuals, as customers. However it’s also a problem for anti-virus and cyber security software if I buy Norton or Avast, it’s very hard for me to know what I’m getting for my money, I just have to trust the reviews from Techradar or similar. For that reason I avoided this company, I would imagine many other investors also put it in the “too hard” pile.

Notes

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.