IntegraFin and Shoe Zone are the only companies to achieve less than three strikes as the winter lull in annual reporting intensifies. Richard also takes a closer look at Renew.

5 Strikes

Since my last 5 Strikes update, I have only found two shares that achieve less than three strikes. A strike is a complicating factor in the company’s financial track record.

Companies with strong financial records are relatively easy to analyse. We need to work out what they do so successfully, what might stop them from prospering in future, and how they are responding to these challenges. If we like what we discover, we may well have a good long-term investment on our hands.

Five strikes is the preliminary stage, finding businesses that have been successful.

| Name | TIDM | Strikes | Score |

|---|---|---|---|

| IntegraFin Holdings | IHP | – IPO | 1 |

| Shoe Zone | SHOE | – Growth – Debt | 2 |

| Source: Sharepad and Richard Beddard. | |||

| Our guide to 5 Strikes: How the system works, and what the strikes mean. | |||

I am not finding many successful businesses because few companies publish annual reports this early in the year. The annual report is the document I rely on to evaluate the business, and its publication is the cue to kick the process off.

The good news is it gives me an opportunity to take a first look at Shoe Zone and revisit Renew from my last haul.

IntegraFin developed and operates an investment platform for financial advisers. The company has a founder-led back story and self-reliant culture, both of which are very promising, but its profitability is polluted with movements in the value of life assurance policies containing client money. Not even Maynard’s deep dive into the accounts has convinced me I would be able to make sense of it.

It is important to know our limits. The point of 5 Strikes is to keep things simple. IntegraFin is not a simple proposition for me.

Shoe Zone

Shoe Zone may be. It sources shoes cheaply in China and retails them at low cost through stores in somewhat unfashionable High Streets, big box stores in retail parks, and online.

The shoes are mostly cheap and cheerful, although the company also sells famous brands. Margins are modest but Shoe Zone sells the shoes in sufficient volume to earn a good Return on Capital in most years.

In the year to September 2023, Shoe Zone’s ROCE was 23%, which may be a record.

Shoe Zone’s profitability seems quite promising and the company only scores two strikes. But I find it hard to look past one of them: Growth in turnover.

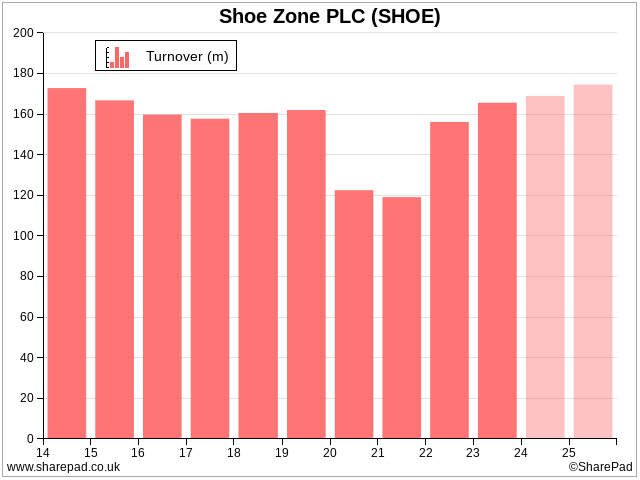

Ignoring the pandemic dip when Shoe Zone’s shops were not open for periods and people were not getting out and about much, Shoe Zone’s turnover in full-year 2023 was only £8 million higher than it was at its 2017 low of £158 million.

Shoe Zone has contracted since it floated in 2014

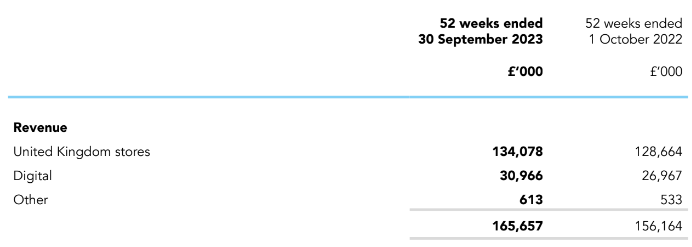

Casting around in Shoe Zone’s segmental report for reasons to be cheerful, it seems the company’s online sales grew faster than offline in 2023:

Source ShoeZone annual report 2023

Digital turnover grew 15%, store turnover grew 4%. A 30% increase in sales through Amazon helped, although Shoe Zone would probably rather these customers buy direct.

| Digital channel | 2023 | 2022 | Change |

|---|---|---|---|

| shoezone.com | £18.5m | £16.5m | 11.9% |

| Amazon | £11.4m | £8.8m | 30% |

Source Shoe Zone annual report

As you can see from the light pink columns in the SharePad turnover chart, the forecast of one analyst is for turnover growth of 2% and 3% in 2024 and 2025. That will probably be sub-inflationary.

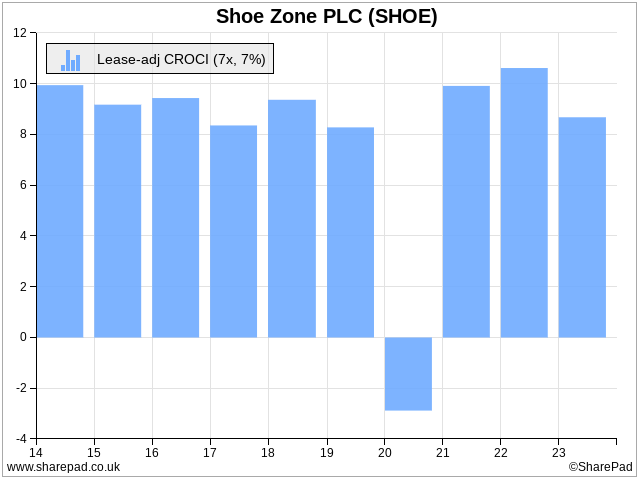

That said, ShoeZone is buying back shares so on a per-share basis, turnover will grow faster. The company can afford the buy-backs because it earns pretty consistent cash returns, close to 10% except for the first year of the pandemic:

The other strike is Debt. Shoe Zone has reduced Debt to about 28% of capital employed, which is just above the level at which I award a strike (25%). It is a difficult benchmark for any retailer that leases stores to achieve, as Debt includes lease obligations, and most retailers lease their stores.

I might turn a blind eye to the Debt if I thought Shoe Zone was a long-term grower, but I think more likely it is earning decent profits in a pretty commoditised market.

The business looks efficient. Ponderous growth, though, is a really worrisome strike, if, like me, you are after long-term capital gains.

Source: shoezone.com. Made in Britain does not get you these prices.

Glancing through the risk report, Shoe Zone’s dependence on China ought to give shareholders pause for thought too. A trade war affecting cheap shoes seems unlikely, but unlikely things have a nasty habit of happening.

Renew

When I scored Renew I gave it only one Strike, well maybe one and a half. The company’s chief executive does not have a significant shareholding, but neither is it totally insignificant.

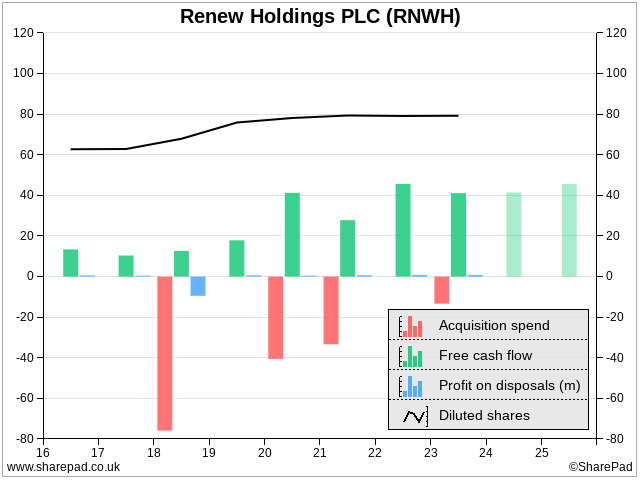

The big Strike was for the share count (black line in the chart below), which has jumped 26% since 2017. It coincided with considerable spending on acquisitions (pink bars) and probably helped fund them.

I compare acquisition spend to free cash flow and changes to the share count to see whether the business is living within its means. Clearly Renew was living beyond its means in 2018, but subsequent cash flow has been strong and Renew has not been overspending.

Otherwise, Renew is highly profitable in cash and accounting terms. It has net cash, and it has grown too. Turnover is up 70% since 2017, which is not surprising given the acquisitions.

Renew maintains the nation’s infrastructure. The annual report is full of pictures of people in white hard hats and orange hi-vis clothing working on railway lines, posing by girders and debating serious matters over manholes.

You may have realised by now that this is not my world. So often we hear about engineering contractors losing money on contracts, I am surprised one can be so profitable.

Hard hats and hi-vis, source Renew annual report

The annual report tells us Renew’s business model focuses on maintaining and renewing infrastructure rather than constructing it anew. This requires less expensive capital equipment and involves shorter contracts that are easier to price and can be repriced comparatively easily.

The company says this flexibility has enabled it to cope with cost inflation.

Paying to keep the trains running, the water flowing, and to decontaminate and decommission nuclear facilities largely comes out of customers’ operating expenses, which might come under pressure during tough times but should not dry up like construction budgets can.

Renew’s profit margins are quite low although they are decent by industry standards, so perhaps the low capital requirement and consistent demand explain its profitability.

More consistent demand may make it easier for the company to directly employ its workforce, which means it can ensure standards of safety, train up engineers to do highly skilled jobs, and not pay extra for contractors.

One customer, probably Network Rail, accounted for nearly 43% of revenue in 2022, but I am not sure how much of a risk this is. Such relationships are often codependent and represent many individual projects.

To invest for the long-term I need to believe a business could be earning twice as much revenue in ten years time and be just as profitable in terms of return on capital.

To believe, we need to be able to answer two questions. Is the business good enough to gain market share? And is the market big enough?

There are ingredients of a good business.

As for the market, Renew’s turnover in 2023 is just under £1 billion. Public and private sector spending on infrastructure runs at about £55 billion a year according to the National Infrastructure Commission, and needs to go up.

Much of this spending, the majority, I think, relates to new infrastructure, though, and may not be available to Renew.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.