Shares in SDI have plummeted. Richard examines the price differential between the company, a manufacturer of scientific equipment, and Judges Scientific, a firm it is often compared to.

In the last two weeks, my 5 strikes system* has only surfaced two new investment ideas: SDI and Goodwin.

These businesses have good financial track records, but I recorded two strikes against each of them (the maximum allowed).

A tale of two buy and builds

SDI is a group of companies that has grown rapidly over the last decade by acquiring, or buying and building, businesses that manufacture scientific equipment. It is not too fussy about what the equipment is, as long as the acquisitions are cheap, profitable, niche businesses. It then operates the businesses at arms-length, supplying capital for them to grow if they need it and harvesting capital from them to help fund new acquisitions.

Unsurprisingly then, the two strikes against SDI are acquisitions and shares. The company has spent more on acquisitions in recent times than it has earned in free cash flow, which means it has relied on debt and shares to fund its expansion.

I have been a little harsh on SDI though, most of the growth in the share count happened before it embarked on its buy-and-build programme. Its recent growth has largely been self-financed.

SDI is often described as a mini Judges Scientific, and judging by this entertaining interview with chief executive Mike Creedon, there are remarkable similarities between the two company’s business models.

Not only do they target similar types of business, and run them independently, but they position themselves as good acquirers, honouring the offers they make or walking away, rather than attempting to renegotiate them during the due diligence process.

Whether being smaller and less experienced is a good thing or a bad thing, depends on your perspective.

There may be limits to how big companies can grow by rolling up similar businesses. The bigger a business gets, the bigger the businesses it acquires must be if it is to keep growing at the same rate.

Larger companies tend to be valued more highly, they have private equity investors with deep wallets pursuing them for example. Paying more for acquisitions reduces the return on the investment.

But Judges Scientific is by no means a giant in this world. Bigger companies like Diploma and Halma, arguably the granddaddy of buy and builds, are still growing despite their size.

A company with a record as long and distinguished as Judges Scientific inspires confidence not just in investors, but in the owners of companies that might sell up.

I use Return on Total Invested Capital (ROTIC) to measure how efficiently an acquisitive business turns investment into profit.

The table below shows ROTIC (including goodwill and acquired intangible assets at cost). The ratio tells us whether SDI and, for comparison, Judges Scientific is earning good returns from its acquisitions (10% is my benchmark), and I described it in more detail in this article.

It starts in 2015 for SDI, because that is when it started to acquire other business, and it ends in December 2022 and April 2023, Judges Scientific’s and SDI’s last year ends respectively:

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Ave |

|

|

JDG |

26% |

29% |

27% |

20% |

13% |

15% |

9% |

12% |

16% |

19% |

14% |

16% |

20% |

16% |

|

|

SDI |

8% |

11% |

11% |

14% |

13% |

13% |

18% |

22% |

15% |

15% |

|||||

|

Source: JDG and SDI annual reports, SharePad |

|||||||||||||||

|

Notes. JDG data is year to December, SDI data is year to April, Ave is the average since 2017 |

|||||||||||||||

Both companies routinely beat the 10% benchmark, but SDI’s results have been helped in recent years by sales of cameras to a manufacturer of Covid-19 PCR testing machines, which added £8.5 million to revenue in 2023 (12.5% of total revenue) and £10.9m in 2022 (22% of total revenue). I cannot find a figure for 2021, but the company says the last order was in February and it expects no more.

It seems likely that much of the company’s outstanding performance during the pandemic years was a result of this business, which may explain downbeat profit forecasts for SDI.

Bruce wrote up SDI’s results in August. They included a write down in the value of two of SDI’s acquisitions, an admission of failure, or at least overpayment, that to my knowledge Judges Scientific has never had to make.

Judges Scientific is the more established and reliable exponent of the buy-and-build model, and SDI has experienced a Covid boom that made it look better than it is. Nevertheless, it is questionable whether Judges Scientific is worth the price differential.

Valuing SDI

My earnings multiples are normalised. This reduces the impact of windfalls and leaner years on the earnings multiple or pe ratio and gives us a more robust measure of a company’s valuation at the current share price.

They are calculated from the average return on capital achieved by a company, in SDI’s case over the last eight years, and the current level of operating capital (acquisitions are treated as a sunk cost in this calculation, and not included).

So SDI has earned a return (profit) on operating capital of 52% over the last eight years and the average operating capital in 2023 was £20.6 million. In a typical year, one might have expected it to achieve £10.7 million in profit (52% of £20.6 million).

Since SDI’s enterprise value (at a share price of 96p) is about £132 million, the value of the business is about 12 times the normalised profit.

On the same basis, Judges Scientific is valued at 41 times the normalised profit (at a share price £90).

Confidence and reliability gets you a high share price. As a shareholder in Judges Scientific, it is the aspect of the investment that makes me most uneasy.

SDI looked as though it was a decent business before the pandemic, from 2016 to 2020 when it did not have the covid dividend it achieved my 10% ROTIC hurdle, and it is probably still a decent business now.

On the other hand, that is a short sequence of years to extrapolate from.

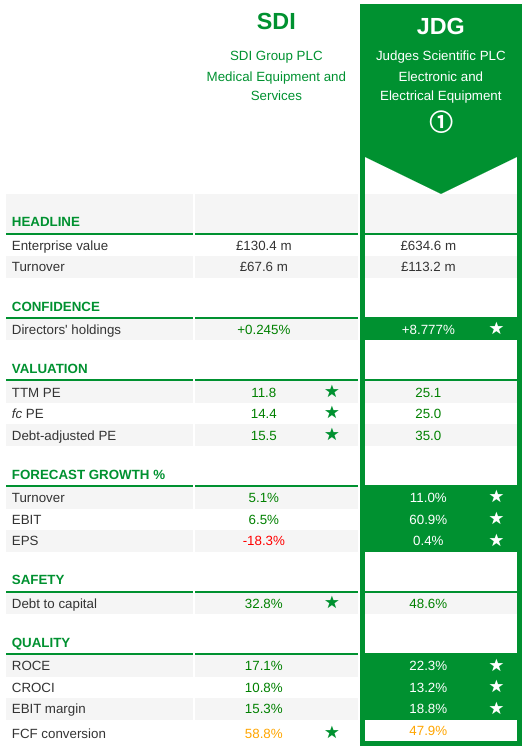

SharePad’s comparison tool, a rough and ready way of weighing up two or more companies, also says SDI wins on price, but Judges Scientific wins on quality:

Goodwin

I will not talk about Goodwin at length because it is in the Share Sleuth portfolio, a model portfolio I manage for Interactive Investor and I will be writing it up in due course there.

However, I need to tell you about the two strikes, because obviously, I do not believe they are sufficient to prevent me from holding the shares.

Goodwin is a family-run conglomerate. It casts steel and machines it into huge components for the nuclear power industry and submarines, it manufactures minerals used to make jewellery and tyres, and it manufactures pumps for mines.

It is a difficult business to summarise, partly because those are just some of the more significant things it makes, but I would say Goodwin is a survivor. It is one of a handful of businesses worldwide that can cast steel in the sizes required by its customers, and a few years ago its main competitor in the manufacture of plaster-based moulding materials for tyres went to the wall.

It is also an innovator. Perhaps its most exciting new innovation is Duvelco, a new high-performance polymer. Goodwin is currently building a facility to manufacture it.

Most of Goodwins’ businesses are capital intensive, and so investment precedes profit and cash flows and CROCI (Cash Return on Capital Investment) is typically quite weak (first strike). Revenue has also contracted, particularly during the second half of the last decade (second strike).

I think investment is the nature of the beast, and Goodwin has invested particularly heavily in recent years to reorient its steel business away from the manufacture of valves for oil and gas pipelines on which it was previously dependent, and to establish Duvelco.

The contraction in turnover prompted that reorientation, and now Goodwin’s order book is revived, may not be repeated.

~

* I have described this system in more detail in a number of articles. This one is a good starting point if you want to know more.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.