Bruce looks at UK retail equity fund flows, and their implications for future expected returns. Companies covered CMCX, EYE, TRCS.

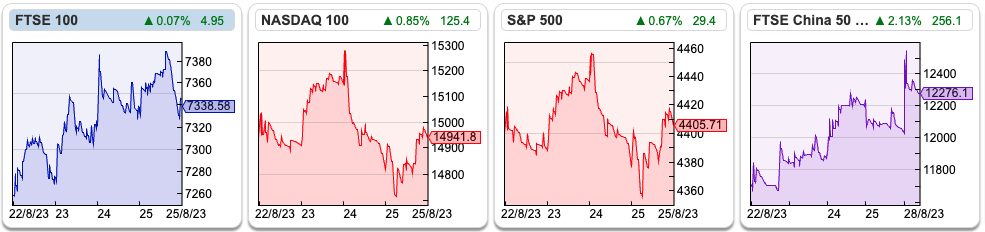

The FTSE 100 rose +1% to close at 7,338 over the bank holiday weekend. The Nasdaq100 was up +1.7%, while the FTSE China 50 was up very strongly +5.1% as their Ministry of Finance cut stamp duty on share trading, to “invigorate capital markets and boost investor confidence”. Things must be serious then. The price of copper (HG-MT), which ought to act as a proxy for a Chinese recovery remains flat YTD.

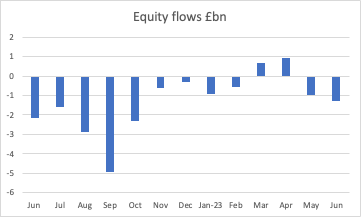

Taking a step back, one indicator that I sometimes look at is retail fund flows, published by the UK Investment Management Association. In the short term there is an obvious correlation between markets falling and retail investors are selling. We saw that in 2022, which had £18bn of outflows, the worst year since the financial crisis, while AIM fell -32%.

Short term this makes me cautious, but longer term more positive. For instance, the worst months of last year (Aug-Oct) for outflows, were just before the market its 2022 lows, which compares to £25bn of inflows over the previous two years, which included the “vaccine rally”. That £25bn inflow during the pandemic was huge, compared to under £6bn cumulatively for the 5 years between 2015-2019.

The monthly data (Jun 2022 to Jun 2023 chart below) also reveals that retail equity investors as a whole are terrible at longer term market timing.

Put another way, high levels of retail investors selling equity funds tend to increase the future expected return for anyone brave enough to take the other side of the trade. This makes sense when you think about it. Expected returns for investors were much higher in 2003, than at the height of excitement in the internet bubble in 1999. Similarly, when the newspapers were full of doom and gloom in Q1 2009, future expected returns were much higher after forced selling had crashed the market over the previous two years. Sometimes, as an investor, pessimism is your friend.

I would imagine that we might continue to see equity outflows for the rest of this year, however at some point this should create an opportunity. A potential catalyst is nine of the UK’s largest pension providers channelling £50bn into AIM and unlisted companies. In any case, I find it hard to believe the UK markets will remain moribund indefinitely, as interest rates rise people may fall out of love with the UK housing market, and their savings need to go somewhere.

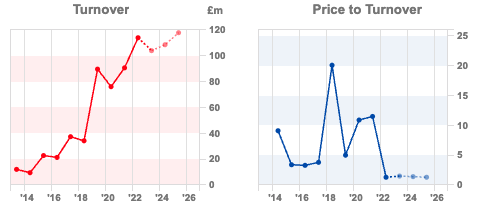

My most recent purchase has been FDEV, at 366p or 1.2x sales. Management have already said that the business will be loss making this year (FY May 2023) and the outlook is rather dull, as all computer games companies have struggled. However, Sharepad shows that historically investors were prepared to pay 20x times sales a couple of years ago. I could be wrong, but that’s quite some de-rating as the chart of FDEV turnover and price to turnover shows!

This week I look at a couple of data analytics companies, EYE and TRCS, but I start with CMC Markets’ profit warning.

CMC Markets FY March 2024 Trading Update

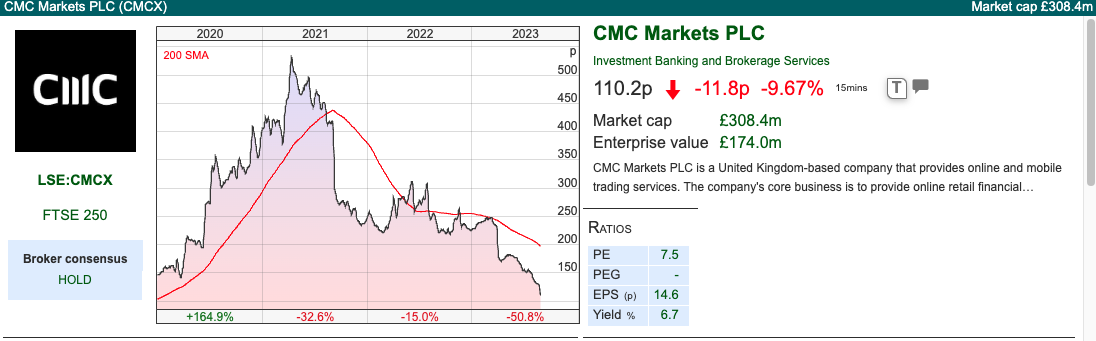

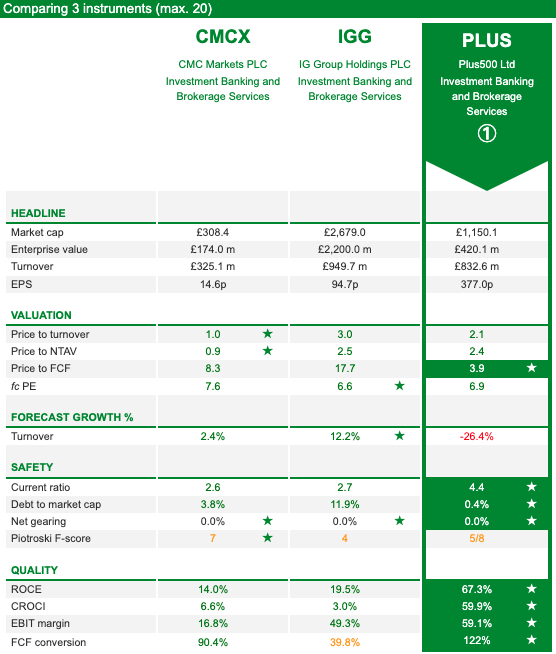

I was wondering if any companies might put out a profit warning on the Friday before the August bank holiday. CMC Markets have obliged. The whole sub sector of CFD traders like IG Group (previously IG Index), Plus500 or CMC, enjoyed a huge boost at the beginning of the pandemic, only to see a sharp drop of in activity last year. As a reminder, around 80% of clients using CFDs lose money. I have tried it myself and found the leverage too hard to manage.

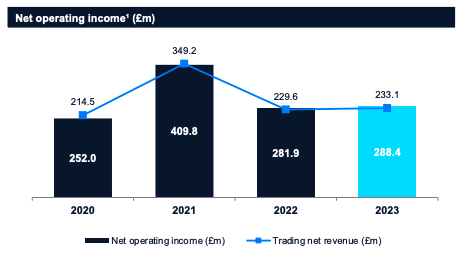

In July management had said that client activity was weak (down c. 15-20%) but they had managed to offset this by earning interest on client balances. Net Operating Income, which is revenue (£325m FY Mar 2023) less c. £36m of commission they pay to partners who drive traffic to their site, was tracking at a similar run rate to last year (FY Mar 2023 £288m, but down from £410m FY Mar 2021).

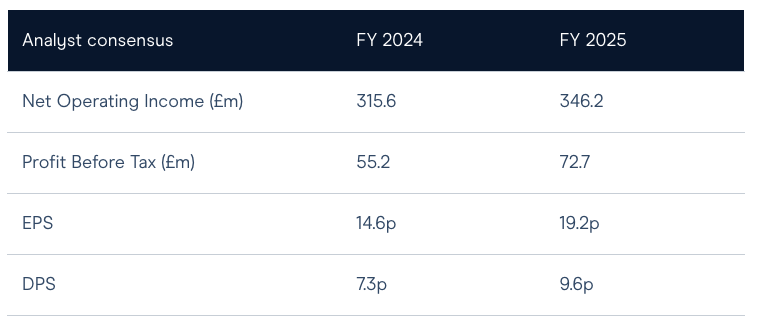

Last week they issued an unscheduled profit warning saying that August had been weak, with higher margin retail trader activity being particularly badly hit. They now expect Net Operating Income to be between £250m and £280m (analyst consensus on the company’s website was NOI £316m FY Mar 2024F and £346m FY Mar 2025F).

There was no profit guidance in the RNS, however management had already said that operating expenses ex variable remunerations (ie bonuses) would be £240m in FY Mar 2024F. So, if NOI comes in at the bottom of the range and management take no action, that implies that profits could fall another -80% from the previous consensus analysts’ forecast £55m FY Mar 2024F. The shares fell -15% on the morning of the RNS, then recovered in the afternoon. YTD they are down by just over -50% so perhaps some investors had already priced in last week’s disappointment.

Aside from profit guidance, the other piece of information missing from last week’s RNS was interest income expectations for FY Mar 2024F. Most of my career I have worked as an equity analyst, but in the words of Nightwish, I did once “join the sinful to regain innocence”. That is, I worked in financial PR. As a general principal of communications with investors, it is better when you have a profit warning to persuade shareholders that problems are temporary and fixable (for instance, weak revenue from clients not trading because they are on holiday in August) rather than permanent and structural (clients moving their money elsewhere that pays a higher rate of interest). The CMCX disappointment has likely been driven by both factors, but I am a little concerned about the lack of guidance on the interest earning balances. I have quoted from the same Nightwish song before: study silence to learn the music.

Ownership: The Chief Exec, Lord (Peter) Cruddas, who founded the business in 1989 owns 59% of the shares, Aberforth and Schroders, both with 5% are the only institutions with disclosable stakes.

There’s a risk that the founder might take the business private at an unfavourable valuation. The share price peaked at over £5 during the pandemic though we are unlikely to see that level any time soon.

Valuation: I haven’t seen any broker forecasts. The company has no bank debt or bonds, and reported cash of £156m at FY Mar 2023, so it does look very cheap in that context. At the FY Mar 2023 results management pointed out that they had returned £220m to shareholders since 2020, versus a current market cap of £308m.

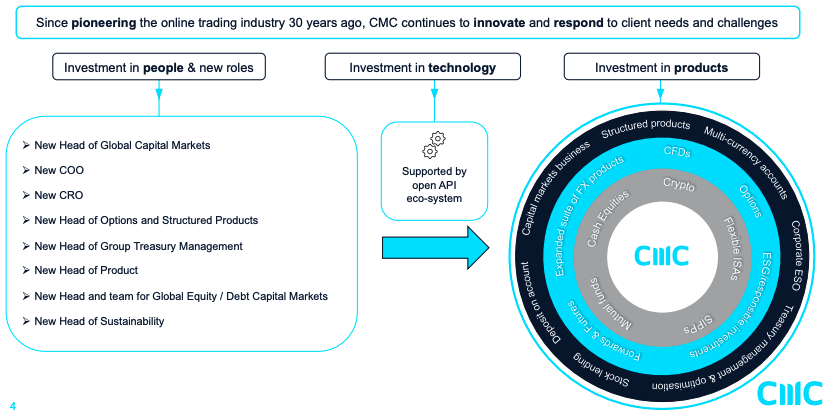

Opinion: I last wrote about the company in November last year, after they had held a strategic review looking at splitting the business in two between CFD trading and longer term investing. In the end they decided to keep the business together, which I agree with, I’m not sure breaking it up would have created any obvious value.

When client trading activity does return, the investment case for the whole sector is very operationally geared into the upside. For now, I prefer Hargreaves Lansdown as a safer, in my view, way to play that theme.

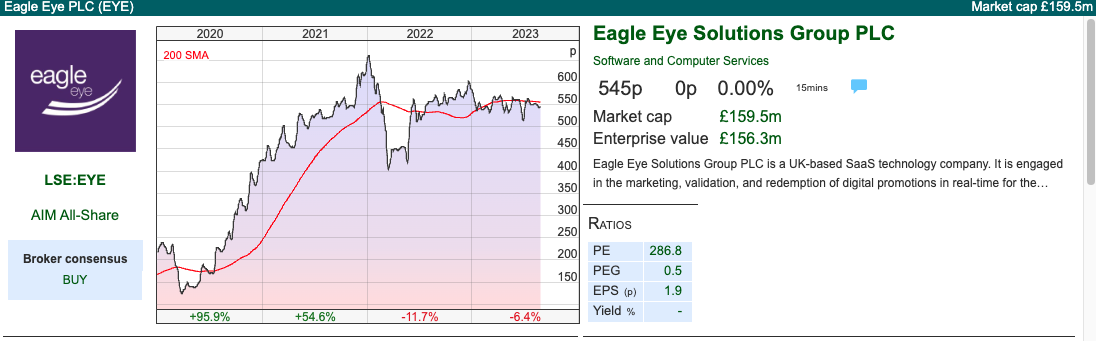

Eagle Eye Solutions Contract Win

This customer loyalty company that helps retailers, pubs and restaurants with promotions is due to report FY Jun results on the 19th September. They already name Asda, Tesco, Morrisons, Waitrose and John Lewis, JD Sports and Pret a Manager on their client list but last week announced they had signed up Hudson’s Bay, the Canadian department store, suggesting their international expansion is going well.

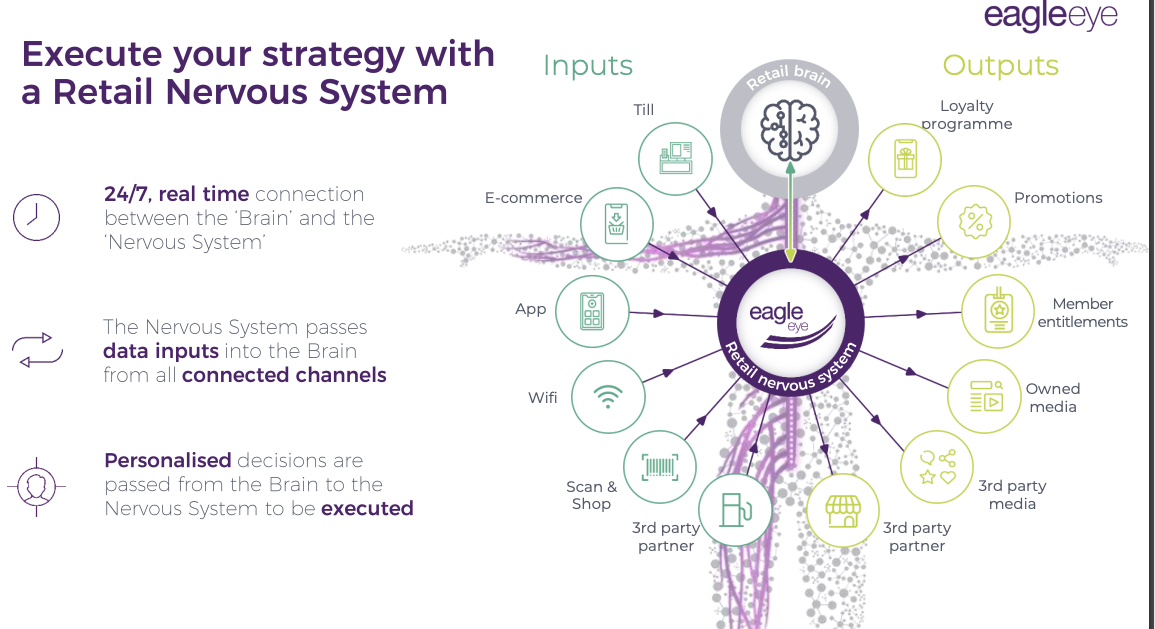

The technology is an API linked directly to Point of Sale terminals, which they say is like a “nervous system” and “brain” for companies.

History: The business was founded by Steve Rothwell in 2003, he has a background in secure payments and mobile marketing. The platform took 6 years to develop, but the Group began to trade in 2009 as it was granted a patent for its redemption coupons using a chip and pin machine. They signed up PayPal as a customer in 2011 and also announced the appointment of Sir Terry Leahy (Chief Exec of Tesco between 1997-2011) as a Non Exec Director. They listed on AIM in April 2014, at 164p per share valuing the company at a £33m market cap. They raised £5m of proceeds going to the company to support growth and less than £1m went to selling shareholders. The number of shares in issue has increased by +46% to just under 30m since admission.

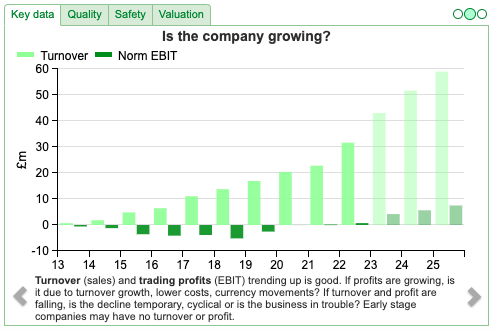

Since the IPO they have reported seriously impressive revenue growth, up 18x from less than £2m FY Jun 2014 to £32m FY Jun 2022, but struggled to generate a profit until recently. In their most recent trading update in mid-July they said revenue for FY Jun 2023F should grow +36% (of which +29% was organic) to £43m. 79% of that revenue is recurring. Net cash trebled to £9.3m. In January 2023, the Group acquired France-based Untie Nots, an AI-powered personalised promotions business, adding Carrefour, E. Leclerc, Auchan to their European customer base, for Eu15m initial consideration (of which Eu9m was payable in cash and Eu6m in shares). Management funded this with a placing of £7m at 555p per share. There’s a very large performance linked “earn-out” of up to Eu23m in cash or shares, or a combination of both.

Ownership: Terry Leahy owns 9.3%, and the founder Steve Rothwell also owns 5.4%. He has the title of Chief Technology Officer, while Tim Mason, who owns a 1.3% stake is the Chief Exec. Liontrust and Stonehage Fleming both own 5% stakes.

Valuation: The shares are trading on 38x PER Jun 2024F and a more reasonable 3.1 price to sales the same year. If you assume that the EBIT margin might improve with operational gearing, then I can see the argument that this is a Growth at a Reasonable Price (GaaRP) stock.

Opinion: On the expensive side, but intriguing. I wouldn’t be in a hurry to buy this and would wait to read the FY Results in mid September. As it is a Software as a Service (SaaS) business the gross margin is attractive at 90%, so as the revenue grows we should see some benefits of scale. That combined with the recurring nature of top line, means I can see why investors would pay a high multiple for this company, because it has the potential to be one of the top performers on AIM. In fact, it is already in the top 10 best performers over the last 5 years.

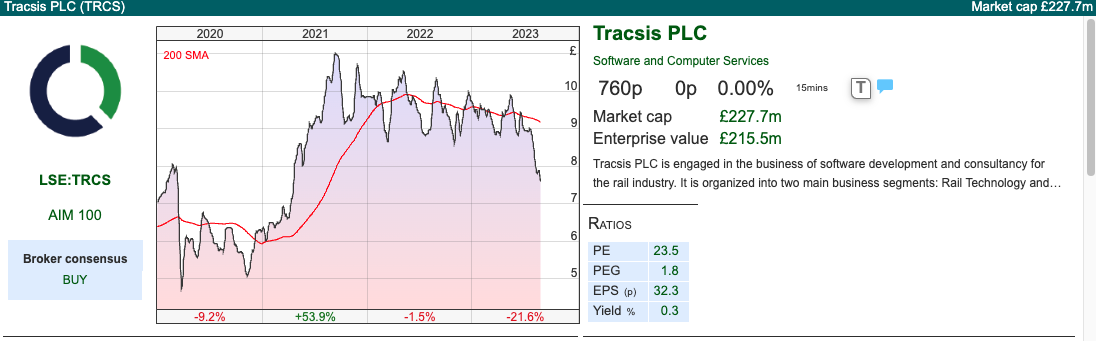

Tracsis FY July Trading Update

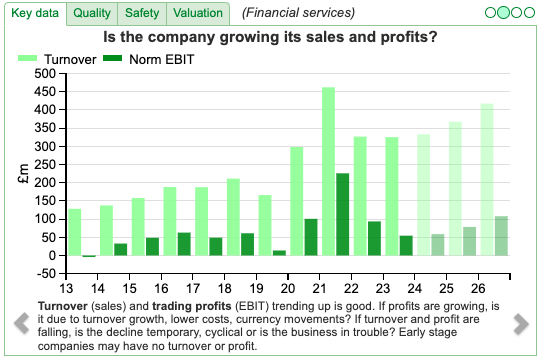

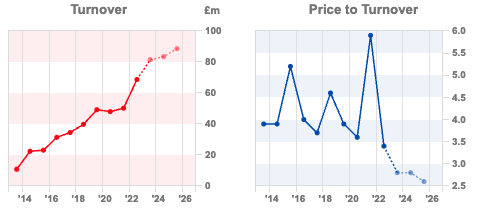

This rail traffic and travel data company announced an “in line” trading update for FY July 2023, with revenues up +19% to £82m. Not all of that revenue growth is organic though, at the H1 stage they reported +34% revenue growth, of which +13% was organic. The charts below show that the price/sales rating has been volatile, perhaps reflecting concerns about those historic acquisitions.

Last week’s RNS does not mention profit, but says adj EBITDA will be +13% to c. £16m and cash of £15m at the end of July. That cash figure is down £2m on the previous year because they paid £9.5m for contingent consideration on a historic acquisitions.

The Group is split into to divisions:

Rail Technology & Services (half of revenue, more than 100% of H1 PBT before central costs, mainly £666K of share based payments): A software business that helps solve resource, asset optimisation and control problems for Train Operators, Smart Ticketing, and also Delay Repay when customers receive mandatory refunds when the trains run late.

Data, Analytics, Consultancy & Events (half of revenue, 22% of H1 PBT before central costs) : A data capture, data analytics, GIS, earth observation, consultancy and event traffic management within a range of transport and pedestrian rich environments.

Balance sheet: The company has shareholders’ equity of £63m versus total assets of £104m, however deducting intangible assets that falls to less than £1m. Management haven’t split out the intangibles by goodwill from acquisitions versus capitalised software development costs, but they do show intangibles divisionally. Over 80% of the intangibles are attributable to the first division Rail Technology & Services. Aside from the £9.5m contingent consideration they paid out in cash in this half, there’s just over £1m still to pay as a non current liability. However, this is accounted for using fair value, the maximum consideration is much higher, and they did take a £118K “exceptional” charge in H1, as they revised upwards the fair value of their liabilities due to increased profit performance at 3 recent acquisitions: Bellvedi, iBlocks and Icon.

Valuation: The shares are trading on PER of 19x July 2024F, or 2.8x sales the same year, or over 10x EV/EBITDA.

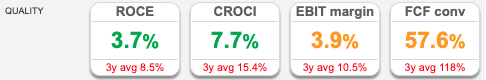

Opinion: As this is a software business the gross margin is over 60%, however Sharepad shows the EBIT margin is currently just 3.9%. The RoCE at below 3.7% doesn’t look very attractive. The recent acquisitions, lack of organic growth figure in the RNS and the fair value accounting make the investment case hard to call. The valuation isn’t particularly compelling, so I will avoid for now. FY July results will be announced on the 15th November.

Bruce Packard

Notes

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/

The author owns shares in Hargreaves Lansdown and Frontier Developments.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 29/08/23 | CMCX, EYE, TRCS | Join the sinful to regain innocence

Bruce looks at UK retail equity fund flows, and their implications for future expected returns. Companies covered CMCX, EYE, TRCS.

The FTSE 100 rose +1% to close at 7,338 over the bank holiday weekend. The Nasdaq100 was up +1.7%, while the FTSE China 50 was up very strongly +5.1% as their Ministry of Finance cut stamp duty on share trading, to “invigorate capital markets and boost investor confidence”. Things must be serious then. The price of copper (HG-MT), which ought to act as a proxy for a Chinese recovery remains flat YTD.

Taking a step back, one indicator that I sometimes look at is retail fund flows, published by the UK Investment Management Association. In the short term there is an obvious correlation between markets falling and retail investors are selling. We saw that in 2022, which had £18bn of outflows, the worst year since the financial crisis, while AIM fell -32%.

Short term this makes me cautious, but longer term more positive. For instance, the worst months of last year (Aug-Oct) for outflows, were just before the market its 2022 lows, which compares to £25bn of inflows over the previous two years, which included the “vaccine rally”. That £25bn inflow during the pandemic was huge, compared to under £6bn cumulatively for the 5 years between 2015-2019.

The monthly data (Jun 2022 to Jun 2023 chart below) also reveals that retail equity investors as a whole are terrible at longer term market timing.

Put another way, high levels of retail investors selling equity funds tend to increase the future expected return for anyone brave enough to take the other side of the trade. This makes sense when you think about it. Expected returns for investors were much higher in 2003, than at the height of excitement in the internet bubble in 1999. Similarly, when the newspapers were full of doom and gloom in Q1 2009, future expected returns were much higher after forced selling had crashed the market over the previous two years. Sometimes, as an investor, pessimism is your friend.

I would imagine that we might continue to see equity outflows for the rest of this year, however at some point this should create an opportunity. A potential catalyst is nine of the UK’s largest pension providers channelling £50bn into AIM and unlisted companies. In any case, I find it hard to believe the UK markets will remain moribund indefinitely, as interest rates rise people may fall out of love with the UK housing market, and their savings need to go somewhere.

My most recent purchase has been FDEV, at 366p or 1.2x sales. Management have already said that the business will be loss making this year (FY May 2023) and the outlook is rather dull, as all computer games companies have struggled. However, Sharepad shows that historically investors were prepared to pay 20x times sales a couple of years ago. I could be wrong, but that’s quite some de-rating as the chart of FDEV turnover and price to turnover shows!

This week I look at a couple of data analytics companies, EYE and TRCS, but I start with CMC Markets’ profit warning.

CMC Markets FY March 2024 Trading Update

I was wondering if any companies might put out a profit warning on the Friday before the August bank holiday. CMC Markets have obliged. The whole sub sector of CFD traders like IG Group (previously IG Index), Plus500 or CMC, enjoyed a huge boost at the beginning of the pandemic, only to see a sharp drop of in activity last year. As a reminder, around 80% of clients using CFDs lose money. I have tried it myself and found the leverage too hard to manage.

In July management had said that client activity was weak (down c. 15-20%) but they had managed to offset this by earning interest on client balances. Net Operating Income, which is revenue (£325m FY Mar 2023) less c. £36m of commission they pay to partners who drive traffic to their site, was tracking at a similar run rate to last year (FY Mar 2023 £288m, but down from £410m FY Mar 2021).

Last week they issued an unscheduled profit warning saying that August had been weak, with higher margin retail trader activity being particularly badly hit. They now expect Net Operating Income to be between £250m and £280m (analyst consensus on the company’s website was NOI £316m FY Mar 2024F and £346m FY Mar 2025F).

There was no profit guidance in the RNS, however management had already said that operating expenses ex variable remunerations (ie bonuses) would be £240m in FY Mar 2024F. So, if NOI comes in at the bottom of the range and management take no action, that implies that profits could fall another -80% from the previous consensus analysts’ forecast £55m FY Mar 2024F. The shares fell -15% on the morning of the RNS, then recovered in the afternoon. YTD they are down by just over -50% so perhaps some investors had already priced in last week’s disappointment.

Aside from profit guidance, the other piece of information missing from last week’s RNS was interest income expectations for FY Mar 2024F. Most of my career I have worked as an equity analyst, but in the words of Nightwish, I did once “join the sinful to regain innocence”. That is, I worked in financial PR. As a general principal of communications with investors, it is better when you have a profit warning to persuade shareholders that problems are temporary and fixable (for instance, weak revenue from clients not trading because they are on holiday in August) rather than permanent and structural (clients moving their money elsewhere that pays a higher rate of interest). The CMCX disappointment has likely been driven by both factors, but I am a little concerned about the lack of guidance on the interest earning balances. I have quoted from the same Nightwish song before: study silence to learn the music.

Ownership: The Chief Exec, Lord (Peter) Cruddas, who founded the business in 1989 owns 59% of the shares, Aberforth and Schroders, both with 5% are the only institutions with disclosable stakes.

There’s a risk that the founder might take the business private at an unfavourable valuation. The share price peaked at over £5 during the pandemic though we are unlikely to see that level any time soon.

Valuation: I haven’t seen any broker forecasts. The company has no bank debt or bonds, and reported cash of £156m at FY Mar 2023, so it does look very cheap in that context. At the FY Mar 2023 results management pointed out that they had returned £220m to shareholders since 2020, versus a current market cap of £308m.

Opinion: I last wrote about the company in November last year, after they had held a strategic review looking at splitting the business in two between CFD trading and longer term investing. In the end they decided to keep the business together, which I agree with, I’m not sure breaking it up would have created any obvious value.

When client trading activity does return, the investment case for the whole sector is very operationally geared into the upside. For now, I prefer Hargreaves Lansdown as a safer, in my view, way to play that theme.

Eagle Eye Solutions Contract Win

This customer loyalty company that helps retailers, pubs and restaurants with promotions is due to report FY Jun results on the 19th September. They already name Asda, Tesco, Morrisons, Waitrose and John Lewis, JD Sports and Pret a Manager on their client list but last week announced they had signed up Hudson’s Bay, the Canadian department store, suggesting their international expansion is going well.

The technology is an API linked directly to Point of Sale terminals, which they say is like a “nervous system” and “brain” for companies.

History: The business was founded by Steve Rothwell in 2003, he has a background in secure payments and mobile marketing. The platform took 6 years to develop, but the Group began to trade in 2009 as it was granted a patent for its redemption coupons using a chip and pin machine. They signed up PayPal as a customer in 2011 and also announced the appointment of Sir Terry Leahy (Chief Exec of Tesco between 1997-2011) as a Non Exec Director. They listed on AIM in April 2014, at 164p per share valuing the company at a £33m market cap. They raised £5m of proceeds going to the company to support growth and less than £1m went to selling shareholders. The number of shares in issue has increased by +46% to just under 30m since admission.

Since the IPO they have reported seriously impressive revenue growth, up 18x from less than £2m FY Jun 2014 to £32m FY Jun 2022, but struggled to generate a profit until recently. In their most recent trading update in mid-July they said revenue for FY Jun 2023F should grow +36% (of which +29% was organic) to £43m. 79% of that revenue is recurring. Net cash trebled to £9.3m. In January 2023, the Group acquired France-based Untie Nots, an AI-powered personalised promotions business, adding Carrefour, E. Leclerc, Auchan to their European customer base, for Eu15m initial consideration (of which Eu9m was payable in cash and Eu6m in shares). Management funded this with a placing of £7m at 555p per share. There’s a very large performance linked “earn-out” of up to Eu23m in cash or shares, or a combination of both.

Ownership: Terry Leahy owns 9.3%, and the founder Steve Rothwell also owns 5.4%. He has the title of Chief Technology Officer, while Tim Mason, who owns a 1.3% stake is the Chief Exec. Liontrust and Stonehage Fleming both own 5% stakes.

Valuation: The shares are trading on 38x PER Jun 2024F and a more reasonable 3.1 price to sales the same year. If you assume that the EBIT margin might improve with operational gearing, then I can see the argument that this is a Growth at a Reasonable Price (GaaRP) stock.

Opinion: On the expensive side, but intriguing. I wouldn’t be in a hurry to buy this and would wait to read the FY Results in mid September. As it is a Software as a Service (SaaS) business the gross margin is attractive at 90%, so as the revenue grows we should see some benefits of scale. That combined with the recurring nature of top line, means I can see why investors would pay a high multiple for this company, because it has the potential to be one of the top performers on AIM. In fact, it is already in the top 10 best performers over the last 5 years.

Tracsis FY July Trading Update

This rail traffic and travel data company announced an “in line” trading update for FY July 2023, with revenues up +19% to £82m. Not all of that revenue growth is organic though, at the H1 stage they reported +34% revenue growth, of which +13% was organic. The charts below show that the price/sales rating has been volatile, perhaps reflecting concerns about those historic acquisitions.

Last week’s RNS does not mention profit, but says adj EBITDA will be +13% to c. £16m and cash of £15m at the end of July. That cash figure is down £2m on the previous year because they paid £9.5m for contingent consideration on a historic acquisitions.

The Group is split into to divisions:

Rail Technology & Services (half of revenue, more than 100% of H1 PBT before central costs, mainly £666K of share based payments): A software business that helps solve resource, asset optimisation and control problems for Train Operators, Smart Ticketing, and also Delay Repay when customers receive mandatory refunds when the trains run late.

Data, Analytics, Consultancy & Events (half of revenue, 22% of H1 PBT before central costs) : A data capture, data analytics, GIS, earth observation, consultancy and event traffic management within a range of transport and pedestrian rich environments.

Balance sheet: The company has shareholders’ equity of £63m versus total assets of £104m, however deducting intangible assets that falls to less than £1m. Management haven’t split out the intangibles by goodwill from acquisitions versus capitalised software development costs, but they do show intangibles divisionally. Over 80% of the intangibles are attributable to the first division Rail Technology & Services. Aside from the £9.5m contingent consideration they paid out in cash in this half, there’s just over £1m still to pay as a non current liability. However, this is accounted for using fair value, the maximum consideration is much higher, and they did take a £118K “exceptional” charge in H1, as they revised upwards the fair value of their liabilities due to increased profit performance at 3 recent acquisitions: Bellvedi, iBlocks and Icon.

Valuation: The shares are trading on PER of 19x July 2024F, or 2.8x sales the same year, or over 10x EV/EBITDA.

Opinion: As this is a software business the gross margin is over 60%, however Sharepad shows the EBIT margin is currently just 3.9%. The RoCE at below 3.7% doesn’t look very attractive. The recent acquisitions, lack of organic growth figure in the RNS and the fair value accounting make the investment case hard to call. The valuation isn’t particularly compelling, so I will avoid for now. FY July results will be announced on the 15th November.

Bruce Packard

Notes

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: https://privateinvestors.supercast.com/

The author owns shares in Hargreaves Lansdown and Frontier Developments.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.