Bruce makes some broad observations about how economists’ models drive Central Bank behaviour and interest rate expectations. Companies covered: LLOY, TSTL, RBGP

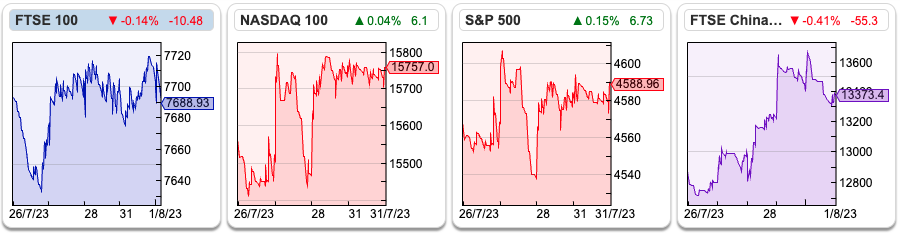

The FTSE 100 was flat in the last five days at 7,688. Nasdaq100 was up +2% and the S&P500 was +0.75%. The FTSE China 50 Index was up +3.9% as the renminbi rose against the dollar, as markets expected the Chinese policymakers to support the economy. The FED raised interest rates by 25bp last week and US rates are now at 5.5%, the highest level since 2001. The Japanese Central Bank widened their Yield Curve Control trading band to be within one percentage point either side of 0% (previously 0.5%). The Japanese 10Y Govt bond yield rose to a 9-year high of 0.61% in response.

The BoE is likely to raise interest rates in the UK on Thursday, though it’s not yet clear whether they will revert to 25bp or keep going with 50bp. There’s an interesting podcast discussion with former (2003-2013) Governor of the Bank of England Mervyn King and Merryn Somerset Webb. I haven’t listened to the whole episode yet, but the first half is very good, discussing whether economics is a science and what has gone wrong with Central Bank models and inflation forecasts.

It reminded me of An Engine Not a Camera, by a mathematician turned anthropologist Donald MacKenzie. His book is about how our models, that help us record reality (a camera), can also drive our behaviour and become part of the phenomenon that they are modelling (an engine). MacKenzie focuses on the Chicago Mercantile Exchange (CME), the options and futures market and the how legitimacy of derivatives could never have happened without academics’ economic theories. There’s also a fun chapter about Long Term Capital Management, which is worth the price of the book alone. It is fascinating that so much of the best insight about modern finance has come from writers like NN Taleb and MacKenzie who have a mathematical background combined with a deep understanding of the financial derivatives market. If you are interested in his other ideas, MacKenzie also published a book on how computers had changed the nature of proof in mathematics.

I think there are broader lessons from MacKenzie’s book. Any model has limitations, it is about what you leave out as much as what you choose to focus on, and how a model might become more or less useful over time. Soros and Buffett have very different investment styles, but both tend to be good at assessing their own thinking and are comfortable with uncertainty while avoiding risk of ruin. A much less academic book on the subject is Chris Mayer (who also wrote the book on 100 baggers) How Do You Know?

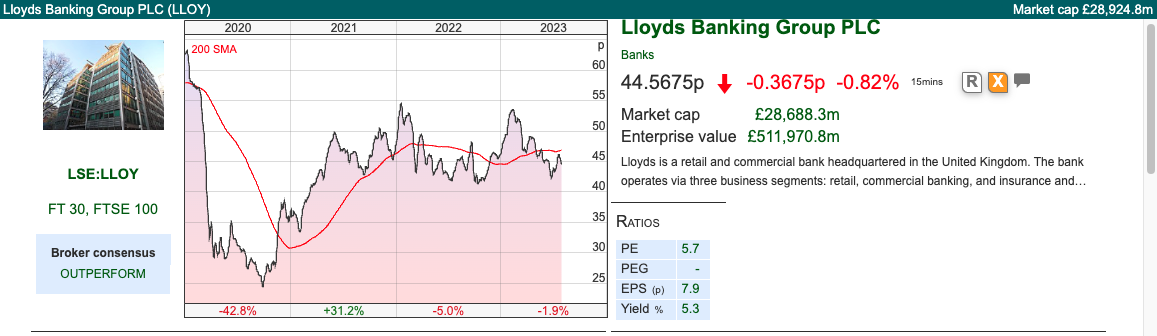

This week I look at Tristel and RBGP, but I begin with Lloyds Banks H1 results. I don’t intend to cover all the UK banks in detail, as my analysis of the Lloyds results suggests that upside is limited from here. I could be wrong, so if readers disagree or want to read more on UK banks let me know.

Lloyds Bank H1 Jun 2023

I thought Lloyds, which kicked off last week’s reporting season, looked particularly interesting. When I say “interesting” I really mean disappointing, but in an interesting way. First, I couldn’t help laughing at the strategic vision: “UK customer-focused digital leader and integrated financial services provider, capitalising on new opportunities, at scale” and the almost meaningless titles of the investor seminars they have planned over the next year:

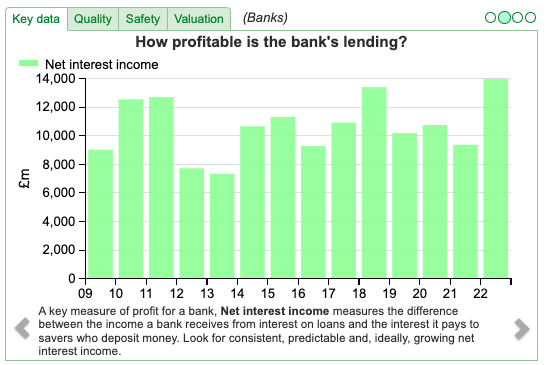

The results themselves showed net interest margin of 3.14% in Q2, down 8 basis points compared to Q1 this year, given headwinds from mortgage and deposit pricing. To be fair, on an H1 v H1 last year basis, Net Interest Income was up +13%. They also raised FY Dec 2023F guidance for NIM from 3.05% to 3.1%, with the text referring to strong margins. In all, management used the adjective “strong” 32 times in last week’s RNS, however, the share price reacted by falling -3%.

We only started seeing problems with US regional banks maturity mismatches in March, so I think investors will understandably focus on the weak Q2, as it is the first full quarter that we’ve seen any knock-on effects from SVB and First Republic Bank. I find that Q2 NIM disappointment surprising because the bank has been offering savers a particularly unattractive interest rate, but Lloyds retail deposit customers have proved more loyal than I was expecting. Current account balances only fell -2% in the quarter to £107.8bn, and total retail customer deposits were down less than a billion to £305.9bn. In fact, I’m surprised we haven’t seen the opposite trend of much higher deposit outflows but higher NIMs, as there are now much more attractive offers from other banks.

According to Martin Lewis on Moneysavingexpert Sainsbury’s Bank is currently offering 4.53%, and various building societies like Coventry BS and Skipton BS are offering around 4.5%. If you are prepared to save in a fixed rate account for a couple of years 6.1% is still available, although I imagine this might get pulled quite soon as the 2-year swap rate has dropped 40bp in the last month. The Blackrock, Fidelity and Lyxor cash funds that the investment platforms (ii, AJB and HL.) offer will be yielding similar returns. For comparison, up until a couple of weeks ago, LLOY were offering me 1% on my savings account.

Wholesale funding is a much lower proportion of LLOY’s balance sheet than following the HBOS acquisition but has begun to rise again +6% to £103.5bn. That’s important because wholesale funding markets react much more quickly to rising interest rate expectations than retail customer deposits, so LLOY is becoming more reliant on an expensive form of funding just when it ought to be enjoying the benefits of its retail customer franchise.

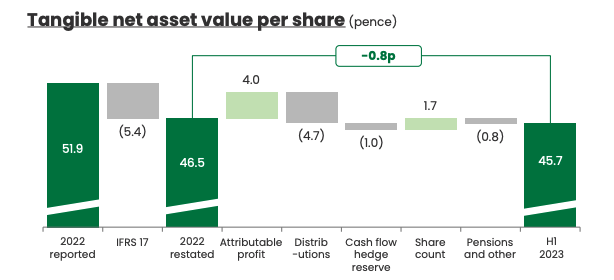

The other interesting disappointment was that despite statutory Profit After Tax (PAT) of £2.9bn and RoE of 13.6% in the half, both core equity tier 1 ratio at 14.2% and tangible book value per share at 45.7p are going backwards. I’m not sure how management can refer to “strong capital generation” a couple of times in the commentary when tangible book value is going backwards!

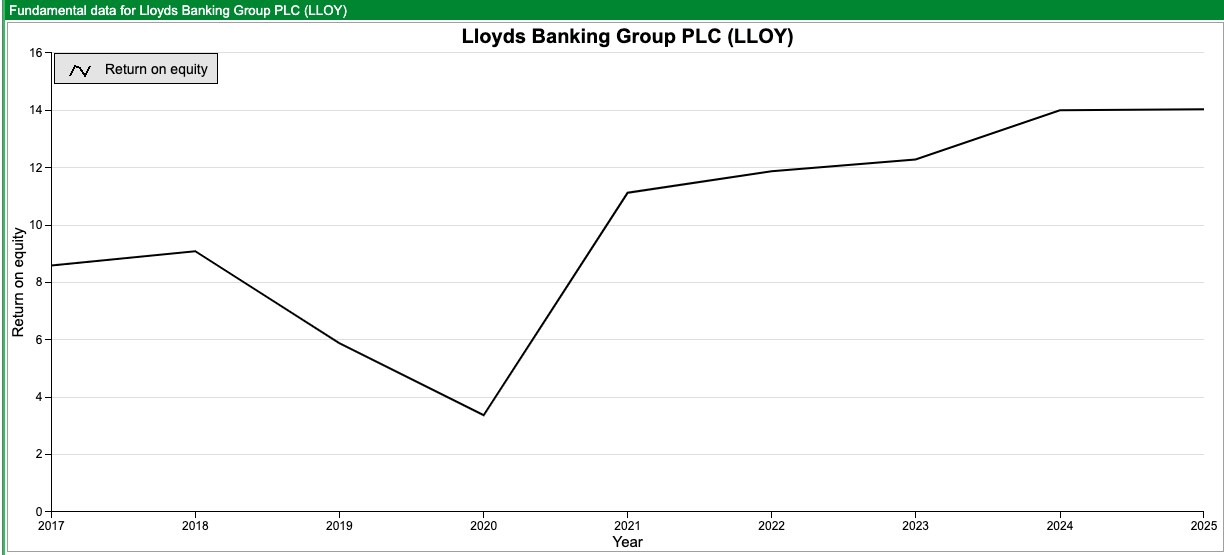

Vivek on Twitter points out that in Dec 2017 tangible book value was over 56p, so we have seen the book value falling partly as a consequence of paying out dividends, but also because rising RoE doesn’t seem to result in rising book value. Theoretically, a company reporting 13.6% RoE ought to trade roughly 1.4x-1.7x book value, but not if book value is shrinking!

Opinion: We ought to be enjoying the ideal scenario for LLOY: rising interest rates but without an economic recession and bad debts running out of control. Instead, what we’ve seen is that the bank doesn’t enjoy any competitive “moat” despite having 30% share of the UK banking market. My conclusion is that there are no economies of scale for Too Big To Fail (TBTF) banks, after a certain size they just become Too Complicated To Manage (TCTM). I would need to hear a very persuasive argument to own this share.

Tristel Trading Update FY Jun 2023

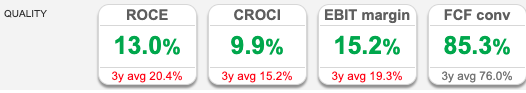

This company that distributes chlorine dioxide to clean medical devices released a trading update and also held an “open day” investor presentation available here. Chlorine dioxide itself is a standard chemical but TSTL’s organic acid blend and the protocols around its use with medical equipment are hard to replicate and the high RoCE suggests that the company does have a competitive advantage.

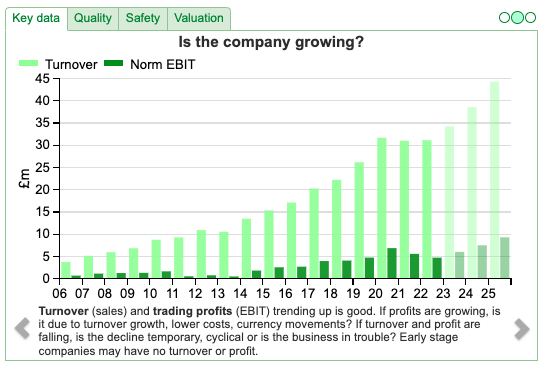

FY Jun 2023 revenues were up +16% to £36m, (which was +5% ahead of Sharepad’s forecast of £34.2m) and they say that PBT will be “slightly ahead” of consensus forecast of £6m. Net cash was £9.5m at the end of June versus £8.9m Jun last year.

Maynard owns it and covered the stock recently in a podcast here. The company’s product is widely used in the UK and Europe (72% of revenue), but has struggled for many years to enter into the USA. Ironically it would have been faster and less painless to gain approval if they had been selling opiates. Similar to Medica, which I wrote about here, they have struggled during the pandemic – sales were flat at £31m for 2 years between Jun 2020 and Jun 2022 – as routine operations were postponed as all the NHS resources were consumed by Covid-19. The shares fell -57% peak to trough and hit a low of around 290p in April last year.

Then in early June, the company announced that the US Food and Drug Administrator had completed its review and granted its approval for immediate sale and the shares have bounced +26% since that announcement. Last week’s announcement confirmed they are now making products and have distribution in the USA and Canada through their US partner (Parker Laboratories), and are also starting to expand into LatAm.

Valuation: FinnCap left their forecasts unchanged showing £40m of revenue FY Jun 2024 (implying +11% growth) and EPS of 12.4p. That suggests are price to sales ratio of 4.2x, and a PER Jun 2024F of 29x. The valuation appears high, but except for the pandemic years, TSTL has generated a RoCE in the mid-20s.

Opinion: This looks like a quality company, I saw management present a few years ago. Stupidly, I didn’t buy the shares because I was put off by the valuation, which was a mistake as the price trebled even before they received FDA approval. When the shares sold off following a profit warning in May 2021 they were still trading on above 50x PER (reduced) earnings, so this is a company that some investors seem willing to pay a sky-high multiple for, which suggests that possibly today’s valuation is a good entry point.

RBGP Trading Update H1 Jun 2023

I can understand that many investors are reluctant to invest in litigation finance companies like BUR, MANO, LIT and RBGP. The sector does seem to provide significant fair value accounting controversy, short-seller attacks and more general entertainment value. Here’s a background article I wrote for MoneyWeek last year.

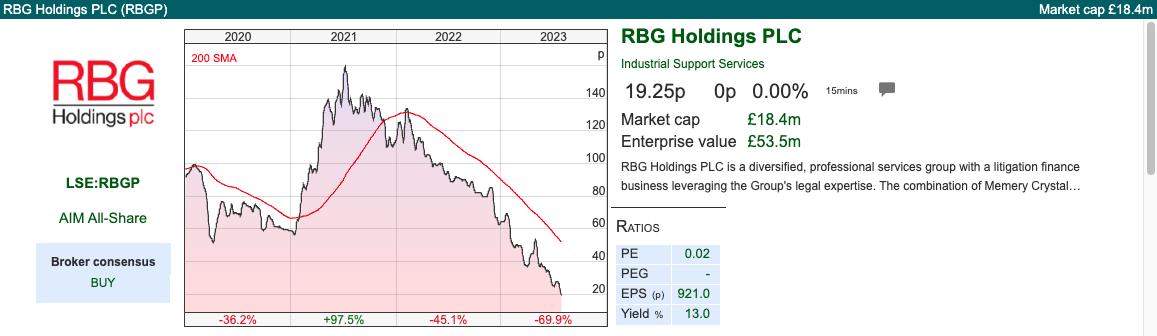

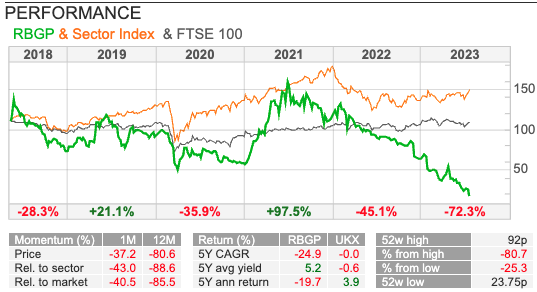

RBGP, which is a combination of law firms Rosenblatt and Memery Crystal, plus corporate finance house Convex Capital and LionFish its litigation funder, announced at the end of January that the Board had lost confidence in its Chief Executive. The announcement said Nicola Foulston was leaving “as a result of cultural concerns and the execution of the Group’s strategy”. Her employment contract was terminated with immediate effect and she wasn’t thanked. RBGP shares have fallen -88% since their high 2 years ago of 160p.

The former Chief Exec is now suing RBGP, and there’s some background here, including that she wasn’t allowed into the AGM because she held her shares in a nominee account. I should say that I haven’t been able to independently verify the assertions made in the article.

Then in early July RBGP announced that the disposal of their litigation funding arm, LionFish had completed, with a loss on disposal of £1m. RBGP had already recognised litigation finance losses of £4.3m in their FY 2022 results.

Legal disputes are hard to value, so the buyer of LionFish, Blackmead only bought 4 of the 8 live investments (NAV of £4.05m). RBGP was left with the other 4 (NAV of £2.6m). Last week’s announcement corrected Blackmead’s £4.05m NAV to £3.7m NAV, with a reduced loss on disposal of £0.64m (rather than £1m). It also announced that having taken advice (presumably from their auditors) they have now decided to write down the remaining 4 LionFish cases from £2.6m to zero and take a further writedown of cases held in the legal services division (Rosenblatt and Memery Crystal) to give a total writedown of £13.3m.

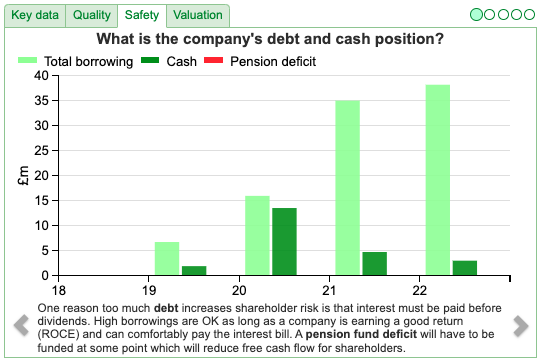

That compares to net assets of £61m at FY Dec, of which intangible assets were £83m so tangible book value is negative. Net debt stood at £19m at the end of last year, which is larger than the market cap. I think that Sharepad shows a higher figure for total borrowing, as the chart below also takes into account around £15m of lease liabilities, of which just £2.2m was a current lease liability due within the next 12 months.

Last week’s trading update for H1 30 Jun also said Rosenblatt and Memery Crystal had performed “broadly inline” (ie slightly disappointing). Convex Capital, the corporate finance division had unsurprisingly suffered a difficult H1 and transactions are taking longer to complete. They said in April that Convex had “a strong pipeline of 24 deals, with a number of deals in advanced stages of negotiation.” It doesn’t sound like any deals have completed since then, and the pipeline has now fallen to 18 deals. That compares to 6 deals completed in FY Dec 2022 (revenue £5.3m) and 14 deal completions in FY Dec 2021 (£9.4m of revenue).

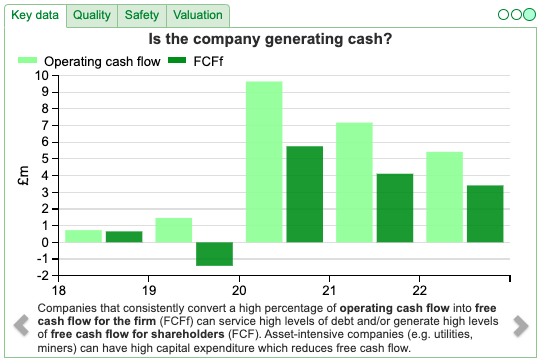

Opinion: My view is that investors are rightly suspicious of fair value accounting when it comes to hard-to-value assets recorded on the balance sheet. We saw that with Enron 25 years ago, and assets on banks’ balance sheets in the financial crisis. Historic cost accounting seems much easier to understand and would result in less FV write-downs. One antidote to FV accounting is to use Sharepad’s cashflow measures and charts, as shown below.

For some reason, company management in the litigation finance sector much prefer to use fair value accounting. For instance, LIT another litigation funding company announced earlier this month that they would move from historic costs to fair value accounting.

RBGP shares look like a distressed asset, this is very risky with a huge range of outcomes. I feel confident that the share price won’t be 20p in two years’ time, the risk-loving contrarian in me could take a position but prefers the brokers like FinnCap/Cenkos as a way to play the re-opening of IPOs and corporate finance deal pipelines.

Conclusion

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 01/08/23 | LLOY, TSTL, RBGP | An Engine, Not a Camera

Bruce makes some broad observations about how economists’ models drive Central Bank behaviour and interest rate expectations. Companies covered: LLOY, TSTL, RBGP

The FTSE 100 was flat in the last five days at 7,688. Nasdaq100 was up +2% and the S&P500 was +0.75%. The FTSE China 50 Index was up +3.9% as the renminbi rose against the dollar, as markets expected the Chinese policymakers to support the economy. The FED raised interest rates by 25bp last week and US rates are now at 5.5%, the highest level since 2001. The Japanese Central Bank widened their Yield Curve Control trading band to be within one percentage point either side of 0% (previously 0.5%). The Japanese 10Y Govt bond yield rose to a 9-year high of 0.61% in response.

The BoE is likely to raise interest rates in the UK on Thursday, though it’s not yet clear whether they will revert to 25bp or keep going with 50bp. There’s an interesting podcast discussion with former (2003-2013) Governor of the Bank of England Mervyn King and Merryn Somerset Webb. I haven’t listened to the whole episode yet, but the first half is very good, discussing whether economics is a science and what has gone wrong with Central Bank models and inflation forecasts.

It reminded me of An Engine Not a Camera, by a mathematician turned anthropologist Donald MacKenzie. His book is about how our models, that help us record reality (a camera), can also drive our behaviour and become part of the phenomenon that they are modelling (an engine). MacKenzie focuses on the Chicago Mercantile Exchange (CME), the options and futures market and the how legitimacy of derivatives could never have happened without academics’ economic theories. There’s also a fun chapter about Long Term Capital Management, which is worth the price of the book alone. It is fascinating that so much of the best insight about modern finance has come from writers like NN Taleb and MacKenzie who have a mathematical background combined with a deep understanding of the financial derivatives market. If you are interested in his other ideas, MacKenzie also published a book on how computers had changed the nature of proof in mathematics.

I think there are broader lessons from MacKenzie’s book. Any model has limitations, it is about what you leave out as much as what you choose to focus on, and how a model might become more or less useful over time. Soros and Buffett have very different investment styles, but both tend to be good at assessing their own thinking and are comfortable with uncertainty while avoiding risk of ruin. A much less academic book on the subject is Chris Mayer (who also wrote the book on 100 baggers) How Do You Know?

This week I look at Tristel and RBGP, but I begin with Lloyds Banks H1 results. I don’t intend to cover all the UK banks in detail, as my analysis of the Lloyds results suggests that upside is limited from here. I could be wrong, so if readers disagree or want to read more on UK banks let me know.

Lloyds Bank H1 Jun 2023

I thought Lloyds, which kicked off last week’s reporting season, looked particularly interesting. When I say “interesting” I really mean disappointing, but in an interesting way. First, I couldn’t help laughing at the strategic vision: “UK customer-focused digital leader and integrated financial services provider, capitalising on new opportunities, at scale” and the almost meaningless titles of the investor seminars they have planned over the next year:

The results themselves showed net interest margin of 3.14% in Q2, down 8 basis points compared to Q1 this year, given headwinds from mortgage and deposit pricing. To be fair, on an H1 v H1 last year basis, Net Interest Income was up +13%. They also raised FY Dec 2023F guidance for NIM from 3.05% to 3.1%, with the text referring to strong margins. In all, management used the adjective “strong” 32 times in last week’s RNS, however, the share price reacted by falling -3%.

We only started seeing problems with US regional banks maturity mismatches in March, so I think investors will understandably focus on the weak Q2, as it is the first full quarter that we’ve seen any knock-on effects from SVB and First Republic Bank. I find that Q2 NIM disappointment surprising because the bank has been offering savers a particularly unattractive interest rate, but Lloyds retail deposit customers have proved more loyal than I was expecting. Current account balances only fell -2% in the quarter to £107.8bn, and total retail customer deposits were down less than a billion to £305.9bn. In fact, I’m surprised we haven’t seen the opposite trend of much higher deposit outflows but higher NIMs, as there are now much more attractive offers from other banks.

According to Martin Lewis on Moneysavingexpert Sainsbury’s Bank is currently offering 4.53%, and various building societies like Coventry BS and Skipton BS are offering around 4.5%. If you are prepared to save in a fixed rate account for a couple of years 6.1% is still available, although I imagine this might get pulled quite soon as the 2-year swap rate has dropped 40bp in the last month. The Blackrock, Fidelity and Lyxor cash funds that the investment platforms (ii, AJB and HL.) offer will be yielding similar returns. For comparison, up until a couple of weeks ago, LLOY were offering me 1% on my savings account.

Wholesale funding is a much lower proportion of LLOY’s balance sheet than following the HBOS acquisition but has begun to rise again +6% to £103.5bn. That’s important because wholesale funding markets react much more quickly to rising interest rate expectations than retail customer deposits, so LLOY is becoming more reliant on an expensive form of funding just when it ought to be enjoying the benefits of its retail customer franchise.

The other interesting disappointment was that despite statutory Profit After Tax (PAT) of £2.9bn and RoE of 13.6% in the half, both core equity tier 1 ratio at 14.2% and tangible book value per share at 45.7p are going backwards. I’m not sure how management can refer to “strong capital generation” a couple of times in the commentary when tangible book value is going backwards!

Vivek on Twitter points out that in Dec 2017 tangible book value was over 56p, so we have seen the book value falling partly as a consequence of paying out dividends, but also because rising RoE doesn’t seem to result in rising book value. Theoretically, a company reporting 13.6% RoE ought to trade roughly 1.4x-1.7x book value, but not if book value is shrinking!

Opinion: We ought to be enjoying the ideal scenario for LLOY: rising interest rates but without an economic recession and bad debts running out of control. Instead, what we’ve seen is that the bank doesn’t enjoy any competitive “moat” despite having 30% share of the UK banking market. My conclusion is that there are no economies of scale for Too Big To Fail (TBTF) banks, after a certain size they just become Too Complicated To Manage (TCTM). I would need to hear a very persuasive argument to own this share.

Tristel Trading Update FY Jun 2023

This company that distributes chlorine dioxide to clean medical devices released a trading update and also held an “open day” investor presentation available here. Chlorine dioxide itself is a standard chemical but TSTL’s organic acid blend and the protocols around its use with medical equipment are hard to replicate and the high RoCE suggests that the company does have a competitive advantage.

FY Jun 2023 revenues were up +16% to £36m, (which was +5% ahead of Sharepad’s forecast of £34.2m) and they say that PBT will be “slightly ahead” of consensus forecast of £6m. Net cash was £9.5m at the end of June versus £8.9m Jun last year.

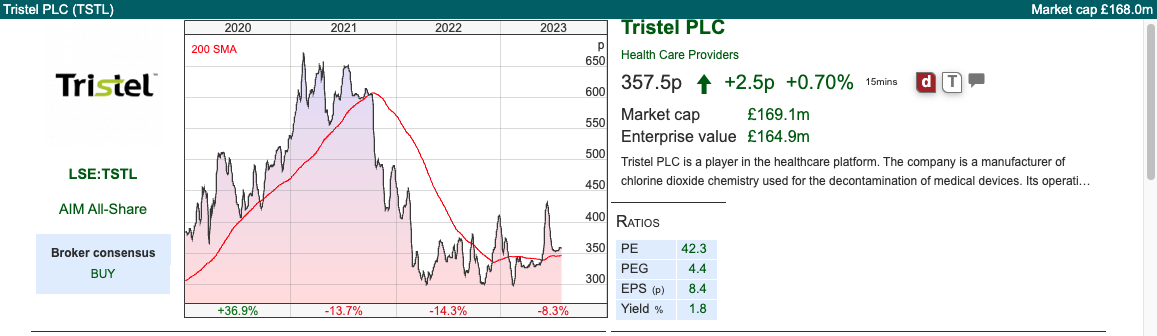

Maynard owns it and covered the stock recently in a podcast here. The company’s product is widely used in the UK and Europe (72% of revenue), but has struggled for many years to enter into the USA. Ironically it would have been faster and less painless to gain approval if they had been selling opiates. Similar to Medica, which I wrote about here, they have struggled during the pandemic – sales were flat at £31m for 2 years between Jun 2020 and Jun 2022 – as routine operations were postponed as all the NHS resources were consumed by Covid-19. The shares fell -57% peak to trough and hit a low of around 290p in April last year.

Then in early June, the company announced that the US Food and Drug Administrator had completed its review and granted its approval for immediate sale and the shares have bounced +26% since that announcement. Last week’s announcement confirmed they are now making products and have distribution in the USA and Canada through their US partner (Parker Laboratories), and are also starting to expand into LatAm.

Valuation: FinnCap left their forecasts unchanged showing £40m of revenue FY Jun 2024 (implying +11% growth) and EPS of 12.4p. That suggests are price to sales ratio of 4.2x, and a PER Jun 2024F of 29x. The valuation appears high, but except for the pandemic years, TSTL has generated a RoCE in the mid-20s.

Opinion: This looks like a quality company, I saw management present a few years ago. Stupidly, I didn’t buy the shares because I was put off by the valuation, which was a mistake as the price trebled even before they received FDA approval. When the shares sold off following a profit warning in May 2021 they were still trading on above 50x PER (reduced) earnings, so this is a company that some investors seem willing to pay a sky-high multiple for, which suggests that possibly today’s valuation is a good entry point.

RBGP Trading Update H1 Jun 2023

I can understand that many investors are reluctant to invest in litigation finance companies like BUR, MANO, LIT and RBGP. The sector does seem to provide significant fair value accounting controversy, short-seller attacks and more general entertainment value. Here’s a background article I wrote for MoneyWeek last year.

RBGP, which is a combination of law firms Rosenblatt and Memery Crystal, plus corporate finance house Convex Capital and LionFish its litigation funder, announced at the end of January that the Board had lost confidence in its Chief Executive. The announcement said Nicola Foulston was leaving “as a result of cultural concerns and the execution of the Group’s strategy”. Her employment contract was terminated with immediate effect and she wasn’t thanked. RBGP shares have fallen -88% since their high 2 years ago of 160p.

The former Chief Exec is now suing RBGP, and there’s some background here, including that she wasn’t allowed into the AGM because she held her shares in a nominee account. I should say that I haven’t been able to independently verify the assertions made in the article.

Then in early July RBGP announced that the disposal of their litigation funding arm, LionFish had completed, with a loss on disposal of £1m. RBGP had already recognised litigation finance losses of £4.3m in their FY 2022 results.

Legal disputes are hard to value, so the buyer of LionFish, Blackmead only bought 4 of the 8 live investments (NAV of £4.05m). RBGP was left with the other 4 (NAV of £2.6m). Last week’s announcement corrected Blackmead’s £4.05m NAV to £3.7m NAV, with a reduced loss on disposal of £0.64m (rather than £1m). It also announced that having taken advice (presumably from their auditors) they have now decided to write down the remaining 4 LionFish cases from £2.6m to zero and take a further writedown of cases held in the legal services division (Rosenblatt and Memery Crystal) to give a total writedown of £13.3m.

That compares to net assets of £61m at FY Dec, of which intangible assets were £83m so tangible book value is negative. Net debt stood at £19m at the end of last year, which is larger than the market cap. I think that Sharepad shows a higher figure for total borrowing, as the chart below also takes into account around £15m of lease liabilities, of which just £2.2m was a current lease liability due within the next 12 months.

Last week’s trading update for H1 30 Jun also said Rosenblatt and Memery Crystal had performed “broadly inline” (ie slightly disappointing). Convex Capital, the corporate finance division had unsurprisingly suffered a difficult H1 and transactions are taking longer to complete. They said in April that Convex had “a strong pipeline of 24 deals, with a number of deals in advanced stages of negotiation.” It doesn’t sound like any deals have completed since then, and the pipeline has now fallen to 18 deals. That compares to 6 deals completed in FY Dec 2022 (revenue £5.3m) and 14 deal completions in FY Dec 2021 (£9.4m of revenue).

Opinion: My view is that investors are rightly suspicious of fair value accounting when it comes to hard-to-value assets recorded on the balance sheet. We saw that with Enron 25 years ago, and assets on banks’ balance sheets in the financial crisis. Historic cost accounting seems much easier to understand and would result in less FV write-downs. One antidote to FV accounting is to use Sharepad’s cashflow measures and charts, as shown below.

For some reason, company management in the litigation finance sector much prefer to use fair value accounting. For instance, LIT another litigation funding company announced earlier this month that they would move from historic costs to fair value accounting.

RBGP shares look like a distressed asset, this is very risky with a huge range of outcomes. I feel confident that the share price won’t be 20p in two years’ time, the risk-loving contrarian in me could take a position but prefers the brokers like FinnCap/Cenkos as a way to play the re-opening of IPOs and corporate finance deal pipelines.

Conclusion

Bruce Packard

brucepackard.com

Bruce co-hosts the Investors’ Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton. To listen you can sign up here: privateinvestors.supercast.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.