With inflation proving stickier than hoped, the pressure on company profits remains. This week Ben looks at how shares in good quality defensive shares could help protect your portfolio.

News this week that double-digit inflation in the UK is proving to be frustratingly sticky is a conundrum for investors. After the inflation-induced pressure on share prices we saw last year, hopes of interest rate cuts and a ‘soft landing’ for the economy still seem far out of reach.

A lesson from the last 18 months of bearish conditions is that ‘defence’ can be a very valuable ‘offence’ when confidence is on its knees.

Diversifying your portfolio with shares that can be resilient through the economic cycle and defend against unpredictable headwinds can make sound sense. Defensive ballast could protect against the worst drawdowns and help you sleep better at night. So what should you look for?

How inflationary headwinds affect markets

Inflationary pressures have been bubbling away since early 2021. Back then, all eyes were on the economic recovery from the Covid pandemic. So for central bankers at least, inflation rising from exceptionally low levels wasn’t much to worry about.

By August 2021, inflation in the UK hit 3.0%, and it’s really at this point that investors started to take note. Economic textbooks will tell you that rising inflation can be a signal of a strong economy, and businesses can benefit from it for a time. But when it runs away, they can quickly suffer too.

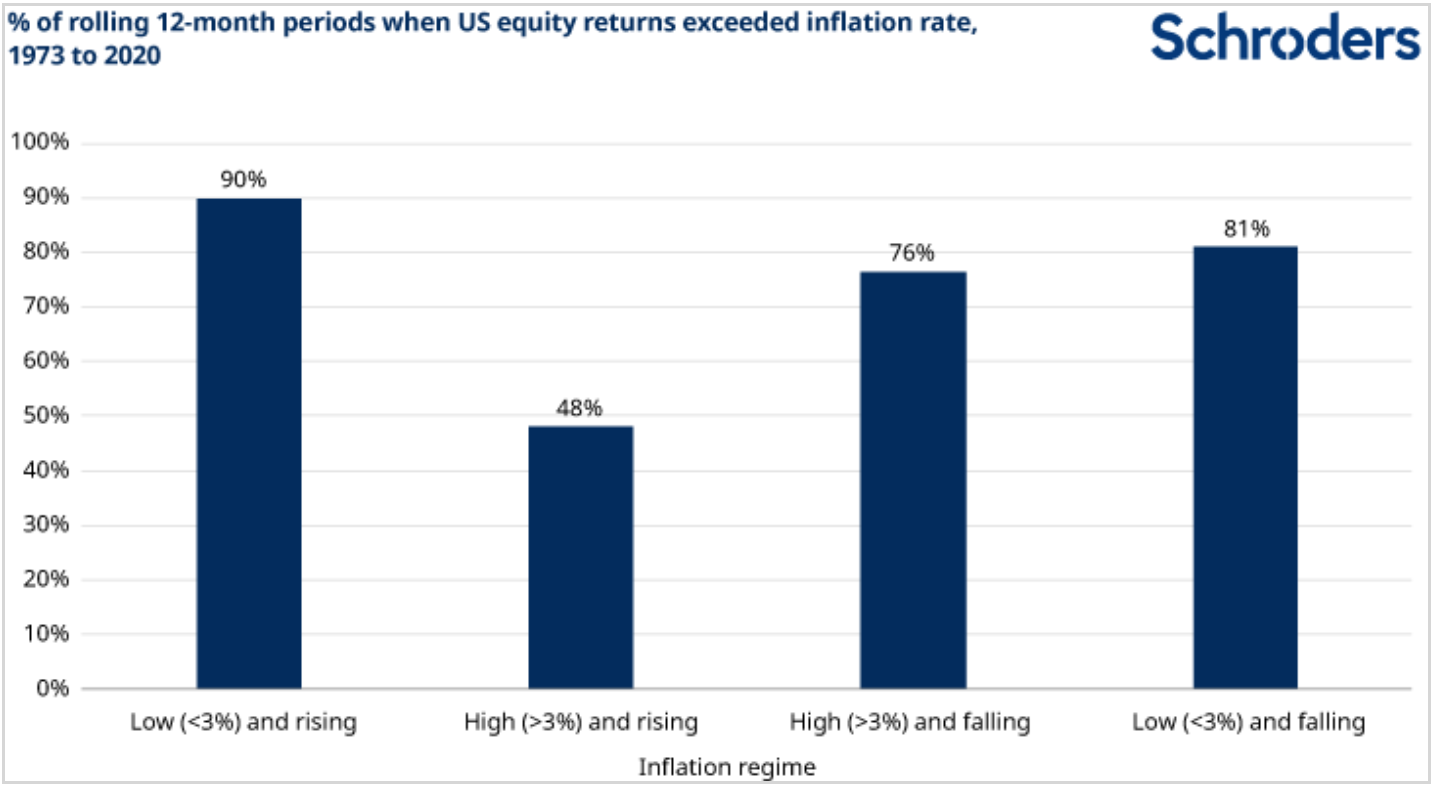

Research by the investment firm Schroders reveals how this difference shows up in equity returns. Their studies find that low (below 3%) and rising inflation has a very modest impact on returns. As you can see in the chart below, when inflation is falling, whether from a high or a low rate, it doesn’t bother stocks too much either.

The real problem comes when you’ve got high (above 3%) inflation and it’s still rising. And this is what shares have been up against for two and a half years now.

Source: Schroders

For companies, of course, issues like inflation, constrained consumer and business spending, and the prospect of recession are all problematic. Lower demand can affect sales revenues while rising costs for materials, energy, staff and interest on borrowing can damage profits.

The good news is that some companies are better able to defend themselves from these headwinds. Here’s a checklist to consider when it comes to thinking about the resilience of different companies…

#1 Is the company in a defensive sector?

Standard industry classifications used to categorise companies in the stock market can offer a hint about their economic exposure. At a high level, shares are classed as either cyclical, sensitive or defensive.

Research shows that those in defensive industry sectors are more resilient than cyclicals and sensitives in times of economic stress.

As the name suggests, cyclicals (where you find many consumer-facing and retail shares, housebuilders, financials and mining), move in well-understood economic cycles. Likewise, sensitives (where you get technology and industrials) are home to industries that to varying degrees have links to economic conditions.

By contrast, defensives (including consumer staples (supermarkets, beverages and tobacco), healthcare and utilities) are widely viewed as being more insulated from the economy. It doesn’t mean they are immune from market sentiment, but they do benefit from producing goods and services that stay in demand in good times and bad.

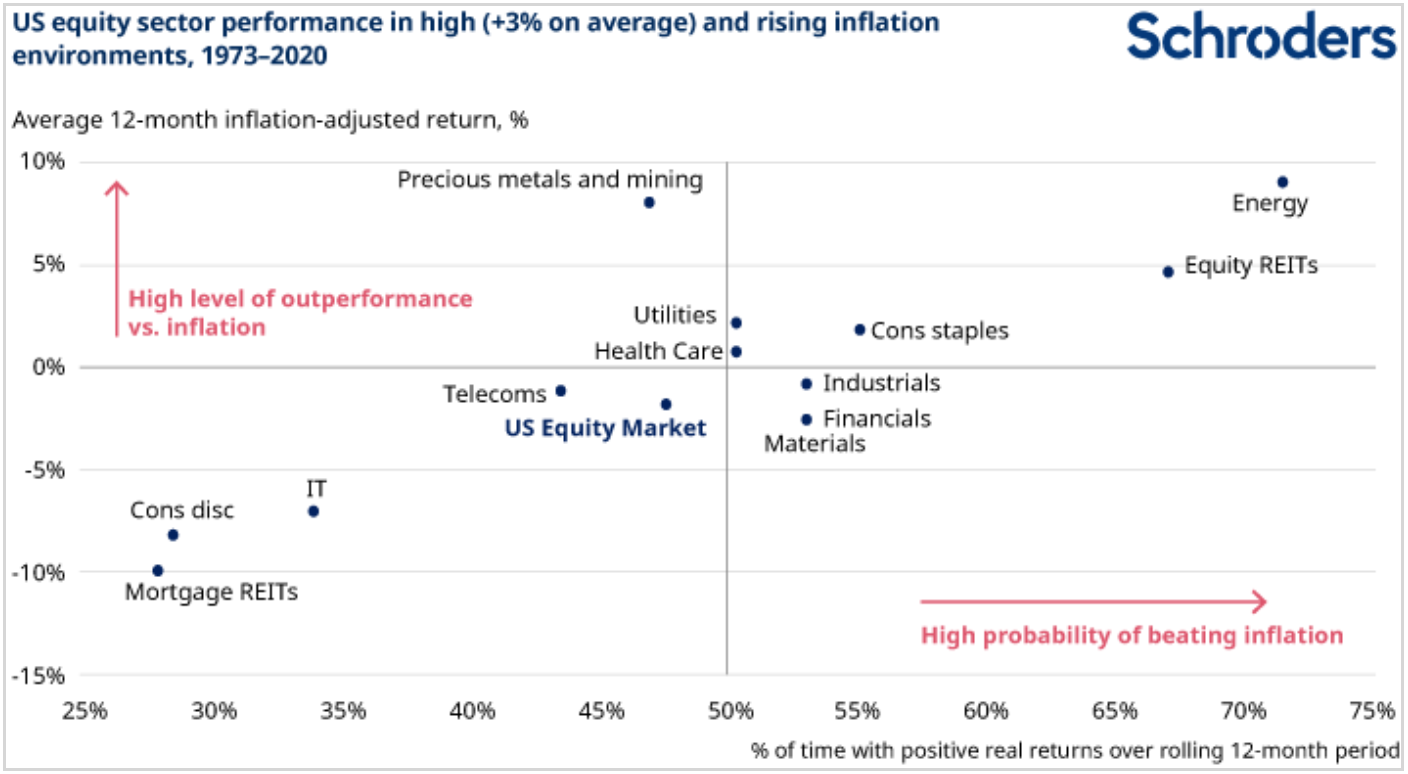

This chart from Schroders shows how defensive industry sectors tend to perform better than cyclical sectors during periods of rising inflation:

Source: Schroders

#2 Does the company have wide profit margins?

Investors who look for high-quality traits in shares almost always look at profit margins. Margins can be measured in different ways, but they capture the difference between a business’s revenues and its costs. When you find a firm with wide margins – especially compared to others in the same industry – it can be a clue to pricing power.

Pricing power can be a major competitive advantage and a pointer to durable profitability. Faced with economic pressures, it can also offer some comfort that the company is capable of protecting itself from rising input prices and lower demand. Firms with pricing power are often better at passing on higher costs to customers. Consistently high (and preferably growing) double-digit margins are ideal.

#3 Is the company efficient at generating a profit?

In the years since the financial crisis in 2008/2009, a generally bullish trend in markets saw investors gravitate to growth shares. This strategy often means deferring profits today in return for fast growth and hopefully bigger payoffs later. But in a more unpredictable environment, quality profitability soars up the priority list.

Companies with a good track record of generating strong returns from the cash they invest to grow can be a safer option in a recession. Solid profitability gives them more options and makes them less dependent on debt, where rising interest rates can cause problems.

There are various measures of efficient profitability – and both Phil (How to understand return on capital employed) and Richard (Refining ROCE) write about them a lot. But the essence here, when faced with taking a more defensive position, is to target profits. A useful start is Return on Capital Employed. This compares a company’s operating profit to the capital it is employing to generate it. Like other profitability measures, high, stable and improving ROCEs are desirable and it’s best to keep comparisons within similar industry sectors.

How to find defensive shares

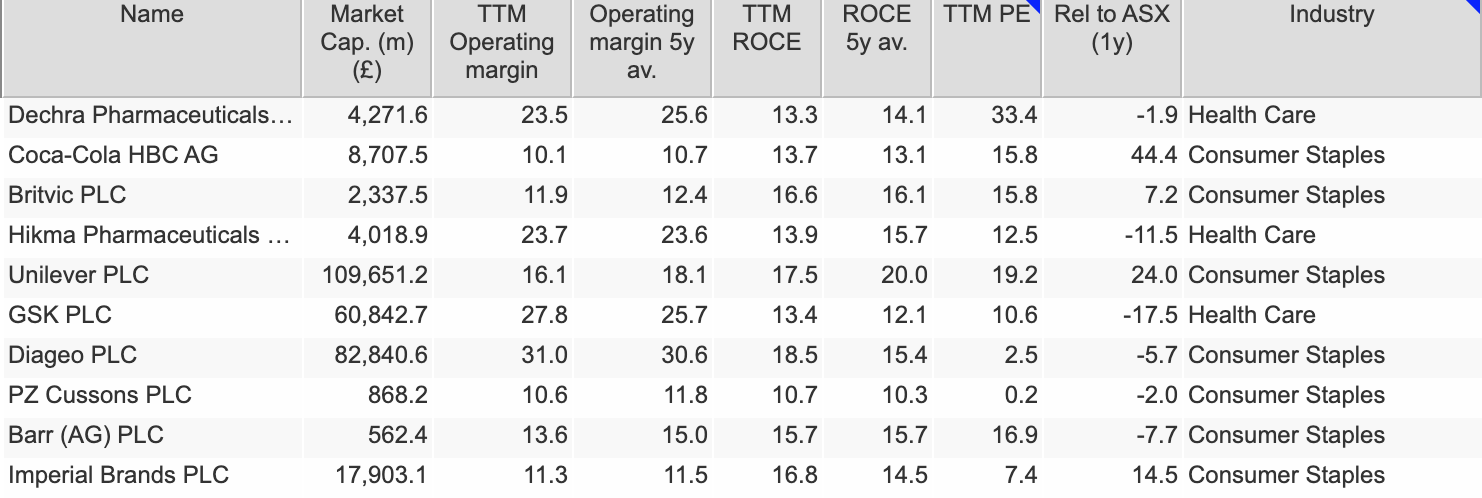

SharePad’s flexible library of financial ratios allows you to dig as deep as you like in search of defensive characteristics. This simple set of rules is just a starting point to give you a feel for what quality defensive criteria would look like.

Here I’m looking for reasonably high and stable operating margins and ROCEs in defensive industries of healthcare, consumer staples and utilities (of which there are relatively few)”

These results are limited to companies with a market cap of at least £500 million. There isn’t necessarily a need to add size limits like this, but it’s worth considering given how badly affected some smaller stocks have been by the difficult conditions.

What can we learn from a defensive strategy?

High and rising inflation has been a major influence on the stock market over the past couple of years. While it is unclear how events will play out, it’s been an important reminder of why a defensive approach can make sense.

Weak conditions are more likely to hurt growth shares and those firms that operate in sectors sensitive to the economy. So considering holdings that can offer some protection – through their inherent sensitivity to the economy and the strength of their profitability – could be worth integrating into your strategy.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.