Although Arm will list in the USA, there should be nothing to stop us buying shares in Britain’s top tech company after it floats. This idea leads Richard to a potentially rich seam of investments he has not previously explored: UK firms listed in the USA.

Judging by the headlines, news that Arm is to list on the Nasdaq this year has been received with alarm here in the UK.

The Financial Times piles on the drama. Source: FT.com

Trading at Arm’s length

I have been wondering why the location of the listing of the illustrious chip designer matters so much.

It is domiciled here, so if Arm pays a dividend in dollars there should not be dividend withholding tax issues to complicate our tax affairs, and although it is slightly irksome to trade in dollars because we must convert pounds to do it, it is easily done for a small fee through most brokers.

The big fears, though, do not relate to the problems we might have investing in the firm. They relate to the economy.

People worry that Arm’s listing will catalyse a slow migration of its head office abroad, starting with finance, which will want to be closer to investors. That migration may lead to the company using American legal and financial advisers, at the expense of British companies.

Ultimately, because the USA is such a big commercial market, and for strategic reasons the country is seeking to design and manufacture more silicon chips at home, more and more of Arm might become Americanised.

This may be part of a broader drift of UK technology firms to the US, perhaps significant enough to hinder growth and development here.

There are plenty of reasons to fear this trend may be gathering steam.

Because there are more investors investing more money in US markets, companies are likely to go where it is easier to attract funding and achieve high share prices. The UK stock market on the other hand, has a reputation as a home for old economy shares, and a record, this past year aside, for sub-par performance.

Even so, speaking as a potential investor in Arm, the fact that the company is emerging from SoftBank, its Japanese owner, is good news, even if it does not bring unbridled joy.

Thinking about Arm, makes me wonder about other UK firms we could easily invest in that are listed in the USA. If there are good ones, they would increase the pool of UK businesses available to us.

If our worst fears about the relative virility of the stock markets in the US and the UK come true, that might be increasingly important.

Finding UK firms listed in the USA

It is pretty easy to find these firms in SharePad. All you have to do is:

- Bring up a list of all US Shares

- Add columns for country (country of registration) and exchange

- Sort it by country

- Select all the shares with the GBR country code

- Add them to a new portfolio for investigation

Here, I have exported the portfolio I made earlier this month. There are about 50 shares in it:

| TIDM | Name | Company’s Country | Exchange name |

| ABCM | Abcam | GBR | NASDAQ |

| ACHL | Achilles Therapeutics | GBR | NASDAQ |

| ADAP | Adaptimmune Therapeutics | GBR | NASDAQ |

| AY | Atlantica Yield | GBR | NASDAQ |

| BCYC | Bicycle Therapeutics | GBR | NASDAQ |

| CNTA | Centessa Pharmaceuticals | GBR | NASDAQ |

| CCEP | Coca-Cola Europacific Partners | GBR | NASDAQ |

| CMPS | Compass Pathways | GBR | NASDAQ |

| CWK | Cushman & Wakefield | GBR | New York Stock Exchange |

| DAVA | Endava | GBR | New York Stock Exchange |

| EXAI | Exscientia | GBR | NASDAQ |

| GSM | Ferroglobe | GBR | NASDAQ |

| GTES | Gates Industrial Corp | GBR | New York Stock Exchange |

| IMCR | Immunocore Holdings | GBR | NASDAQ |

| IGT | International Game Technology | GBR | New York Stock Exchange |

| LBTYA | Liberty Global Class A | GBR | NASDAQ |

| LBTYB | Liberty Global Class B | GBR | NASDAQ |

| LBTYK | Liberty Global Class C | GBR | NASDAQ |

| LIVN | LivaNova | GBR | NASDAQ |

| LXFR | Luxfer Holdings | GBR | New York Stock Exchange |

| MREO | Mereo Biopharma Group | GBR | NASDAQ |

| MFGP | Micro Focus Intl ADS | GBR | New York Stock Exchange |

| MTP | Midatech Pharma | GBR | NASDAQ |

| NWG | NatWest Group | GBR | New York Stock Exchange |

| NE | Noble Corp | GBR | New York Stock Exchange |

| NCNA | NuCana | GBR | NASDAQ |

| OKYO | OKYO Pharma Ltd | GBR | NASDAQ |

| PRTC | PureTech Health | GBR | NASDAQ |

| RNLX | Renalytix AI | GBR | NASDAQ |

| RNW | ReNew Energy Global | GBR | NASDAQ |

| RPRX | Royalty Pharma | GBR | NASDAQ |

| SLNA | Selina Hospitality | GBR | NASDAQ |

| ST | Sensata Technologies Holding NV | GBR | New York Stock Exchange |

| SLN | Silence Therapeutics | GBR | NASDAQ |

| TCBP | TC BioPharm (Holdings) | GBR | NASDAQ |

| FTI | TechnipFMC | GBR | New York Stock Exchange |

| TRMD | Torm | GBR | NASDAQ |

| TROX | Tronox Holdings | GBR | New York Stock Exchange |

| VACC | Vaccitech | GBR | NASDAQ |

| VNTR | Venator Materials | GBR | New York Stock Exchange |

| VRNA | Verona Pharma | GBR | NASDAQ |

| VVPR | VivoPower International | GBR | NASDAQ |

Source: SharePad custom table

Few of these businesses are well known in the UK, and looking at them through the lens of my “one custom table to rule them all”, some are of questionable quality. However, there are also pleasant surprises. It might well be worthwhile getting to know them better.

Abcam

The delisting of this former AIM darling in December last year completely passed me by, as did its listing on the Nasdaq in October 2020. I last investigated the manufacturer and distributor of antibodies in 2018. Judging by the raw statistics in SharePad, muddied by acquisitions, the financials have deteriorated in recent years. However, Abcam is a world leader in research-grade antibodies, worthy of my watchlist.

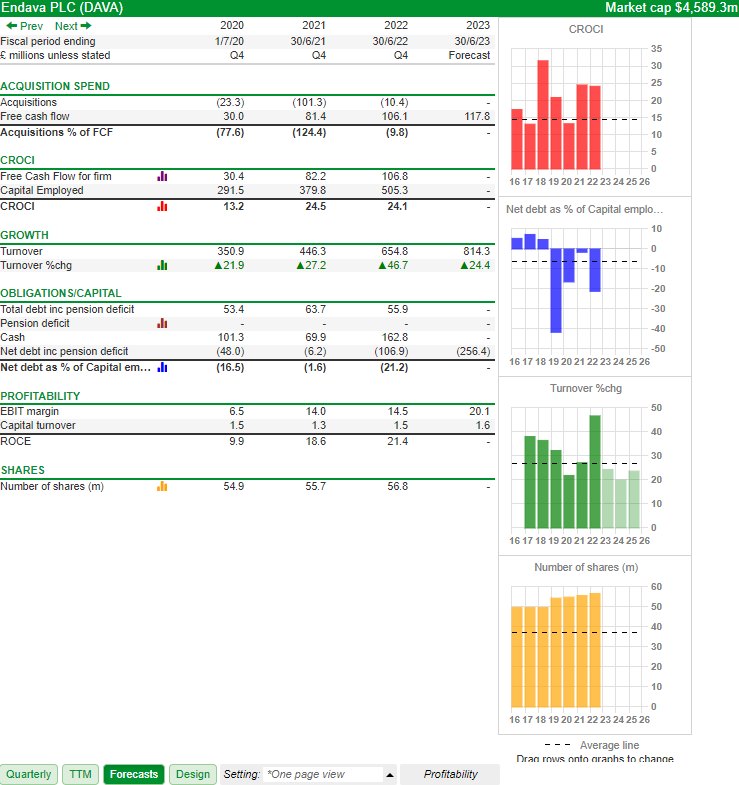

Endava

Endava’s financials prompt an upswell of anticipation. In short, affordable acquisitions, high returns, growth and net cash indicate it may well be a very strong business, although it has a relatively short track record as a listed firm. Endava listed in 2018:

Source: SharePad, custom table (One custom table to rule them all)

Endava builds software for other enterprises. It has grown into a substantial business since it was founded in London in 2000 by John Cotterell, who is still the company’s chief executive.

Although Endava’s website has a very international feel, its biggest market (40-odd per-cent of turnover) is the UK, it holds its AGM here, and watch some of the YouTube videos it publishes and you will hear many British accents, as well as a variety of others:

TechnipFMC

Judging by the raw statistics in SharePad, Newcastle-on-Tyne based TechnipFMC is earning low returns and growing inconsistently, so it is not an obvious candidate for investment.

It describes itself as “the energy architects”, which means it manufactures equipment and provides services to the oil and gas industry, although it is also working on renewable energy projects.

My interest is in its Magma subsidiary, which could have a big impact on one of my holdings, Victrex. Victrex supplies Magma with a super-tough polymer, which is combined with carbon fibre in a new kind of deep sea oil pipeline manufactured by Magma that TechnipFMC describes as a “gamechanger”:

Ferroglobe, also in the list, has caught my eye and along with the three companies already mentioned, it joins my watchlist.

Reassuring thoughts…

Thinking about UK firms listed abroad has also reassured me about another fear. What if shares we own up sticks and list in the USA like Abcam did? A prime candidate in my portfolio is 4Imprint, the promotional goods company that earns 98% of its turnover in the USA.

The government and the City must do what they can to attract successful technology businesses to London, but should the drift to the US stock market continue our adventure as shareholders in these companies need not end.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.