I have written extensively about the forced transition from fossil-powered vehicles to electric vehicles (EVs). There is a lot to be said on the topic and from several market sectors, ranging from EV manufacturers, batteries, mining, recycling, and infrastructures, but what about the metals and the commodities?

If you remain a lithium bull, then read on. This will interest you, as it does me, because there are a few things to keep in mind.

Oil Gas investors will know that these are finite resources and will also be aware that the mega oil and gas fields are becoming rarer with each passing decade. Moreover, there is a reliance on technological advances to extract reserves once deemed uneconomical or not worth the investment for the majors. The North Sea oil fields are an excellent example of diminishing returns.

Government policies around the world seem to be in lockstep with each other when it comes to the energy transition from fossil fuels energy to renewables; this includes the pace of the transition, which we are ill-equipped to do at the scale and pace the powerbrokers say we must do to save the planet.

In my last editorial, I discussed the infrastructure problems for EV adoption, the costs associated with running an EV, lithium supply and demand, and a host of significant barriers society needs to overcome. Of course, resources such as mineral metals like manganese, nickel, cobalt, and copper are today’s main focus. Still, their other essential materials are needed if the energy transition is to be a success, and I do not believe we will transition at the pace to match the government’s goals. So this will be my focus today.

Before I discuss the resource supply issues and how this is likely to negatively impact the arbitrary goals set for the end of the internal combustion engine (ICE) powered by crude oil, which has helped improve the health and economies around the world and is now viewed as the death of the planet, we risk the health and well-being of millions in our urgency as we hurtle towards 2035, a critical date which signals the end of the ICE in most if not all developed countries, for which we are ill-prepared because of the urgency placed upon us.

The grand plan is to embrace wind and solar, which is brilliant if the sun shined 24/7 and the wind blows when the sun does not peep from behind the clouds. Even so, not every country has endless hours of sunshine or wind, and if this was a magical world where we were blessed with sun and wind when we needed it, we do not have the infrastructure to store the energy they supply. I am all for this as there is a need for energy transition, but it needs to be done at a sensible pace, preferably without blighting the landscape.

So, not gas, not coal, and not crude oil, and many of the climate fearmongers also argue against nuclear energy. This leaves us with electricity, but not generated for any of the energy above sources, but primarily wind and solar, and at a time when there is a rapidly growing need for electricity, for…yes, you guessed it. Have we not already established there is a lack of infrastructure for EV adoption?

Nationals Grid block

There are fundamental structural concerns as we transition from, let’s say, to petrol stations. The UK alone has almost 8400, which has fallen 36% since 2000. It isn’t easy to get an accurate figure on actual pumps, compared to forecourts, to EV charging points, of which there are over 22300, with 37800 charging devices. There are c30 million ICE cars on UK roads, so think of the infrastructure required.

A typical electric car (60kWh battery) takes under 8 hours to charge from empty to full of a 7kW charging point. Most drivers top up the charge rather than waiting for their battery to recharge from empty to full. You can add up to 100 miles of range in 35 minutes for many electric cars with a 50kW rapid charger. This should not be seen as a negative if you are a commuter for work, but long distances drivers have issues akin to hunger games.

The illustration above is one aspect of a massive structural overhaul that requires a significant investment in the electric grid, lest we be confined to 15-minute towns and cities.

Powering the World

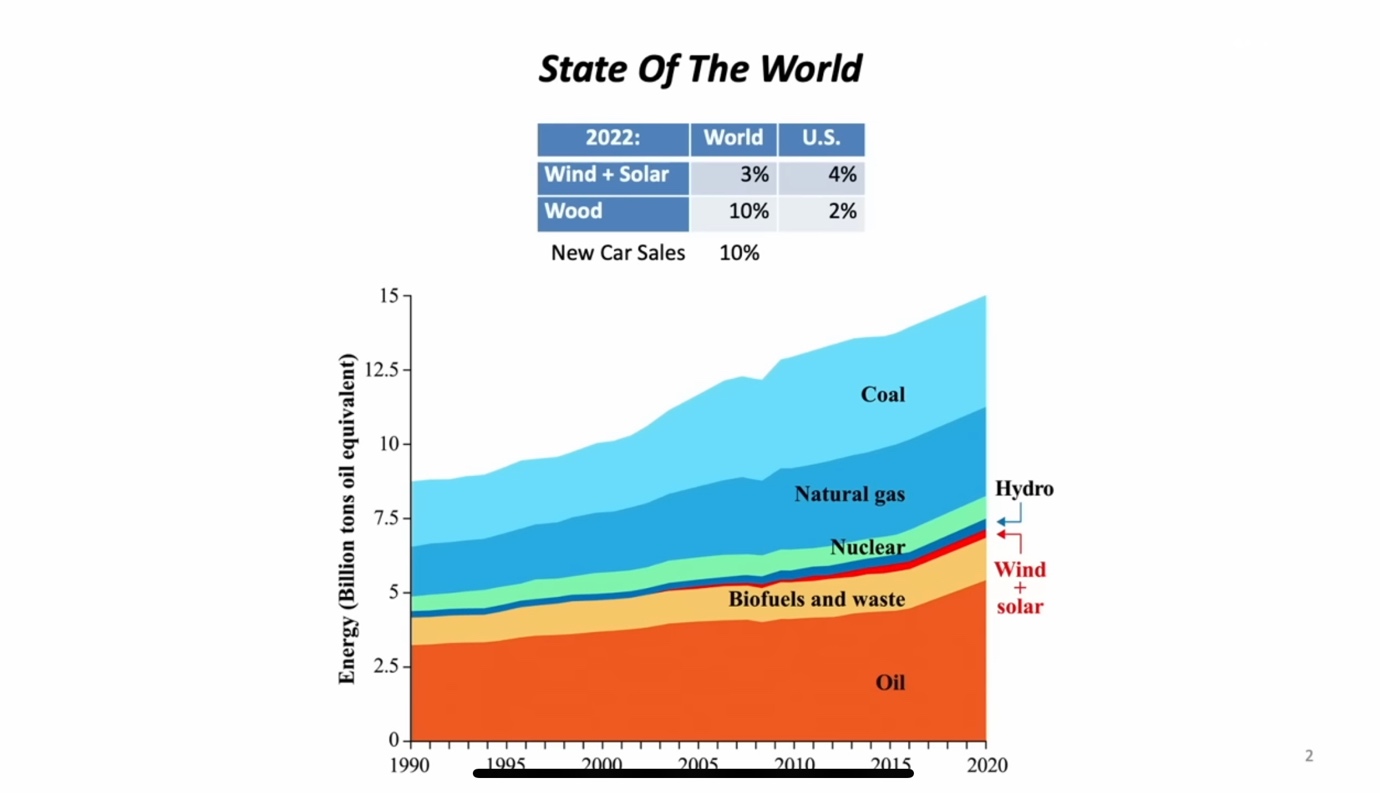

Please take a close look at the graph because it is essential to understand the difficulty that lies ahead of the transition.

To put this into context, the global elites have aspirations that 75%> of global energy be derived from wind and solar, backed by batteries as the primary sources. Instead, we have managed just 7% in two decades, which suggests the transition is prolonged.

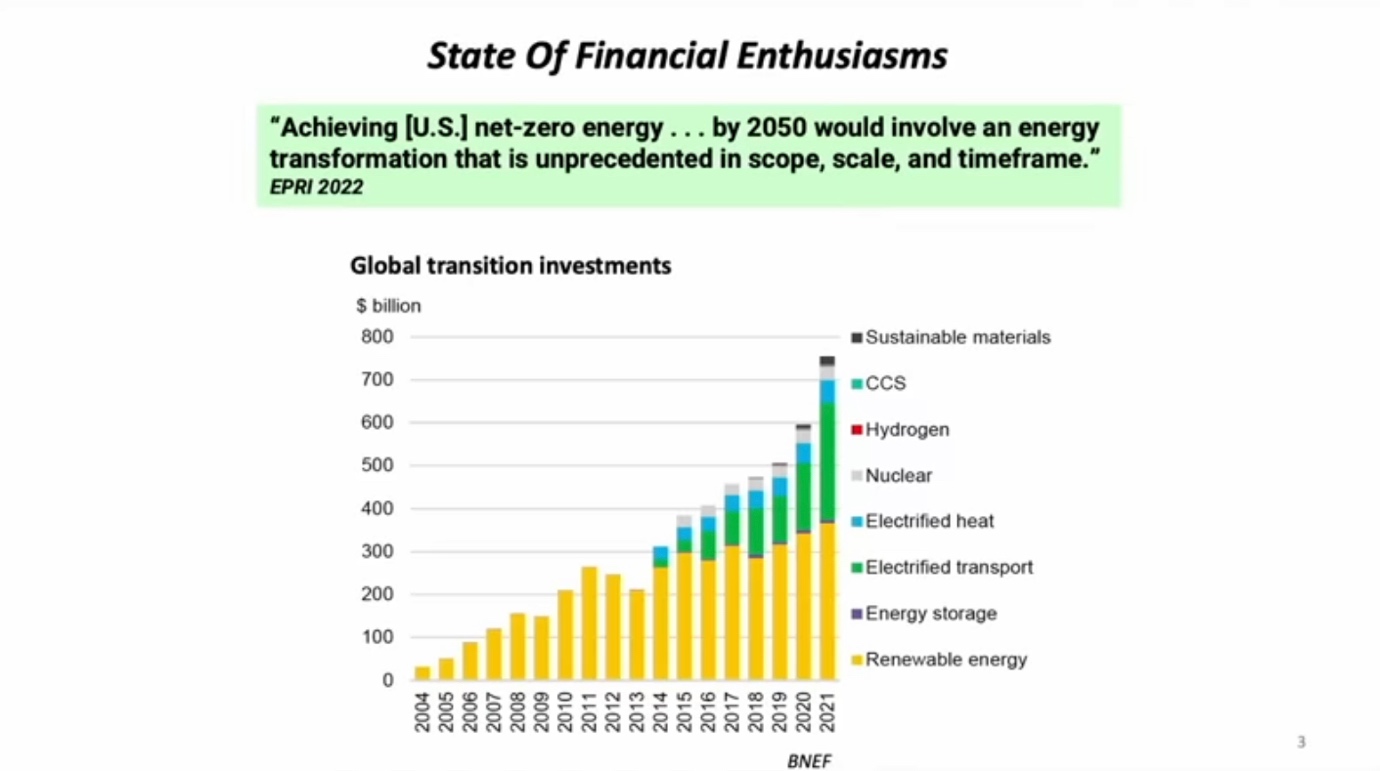

As you can see from the following graph, there is no shortage of money being invested in the energy transition project.

The illustration suggests almost $800 billion each year is being spent on the energy transition project; this is likely to be even higher in indirect spending. You may ask what I mean by indirect expenditures. So put mentioned earlier, governments worldwide have agreed to mandates, which include directives and mandates to utilities, which do not show up in direct spending but have an impact on economies. In addition to these costs, there are higher taxes and direct subsidies for wind and solar projects; these are all costs in addition to the $800 billion.

Resource Reality

I often wonder how many climate activists are fully aware of what they are demanding, how these demands impact us and the planet and how we overcome our overreliance on fossil fuels because we do, which I have no illusion of. There are serious environmental issues we are storing up just transitioning from ICE to EV. Our mineral resources are essential to the grand plan. But there seems to be a huge issue, and it is not clear how we overcome the finite resources, minerals and grades required for success.

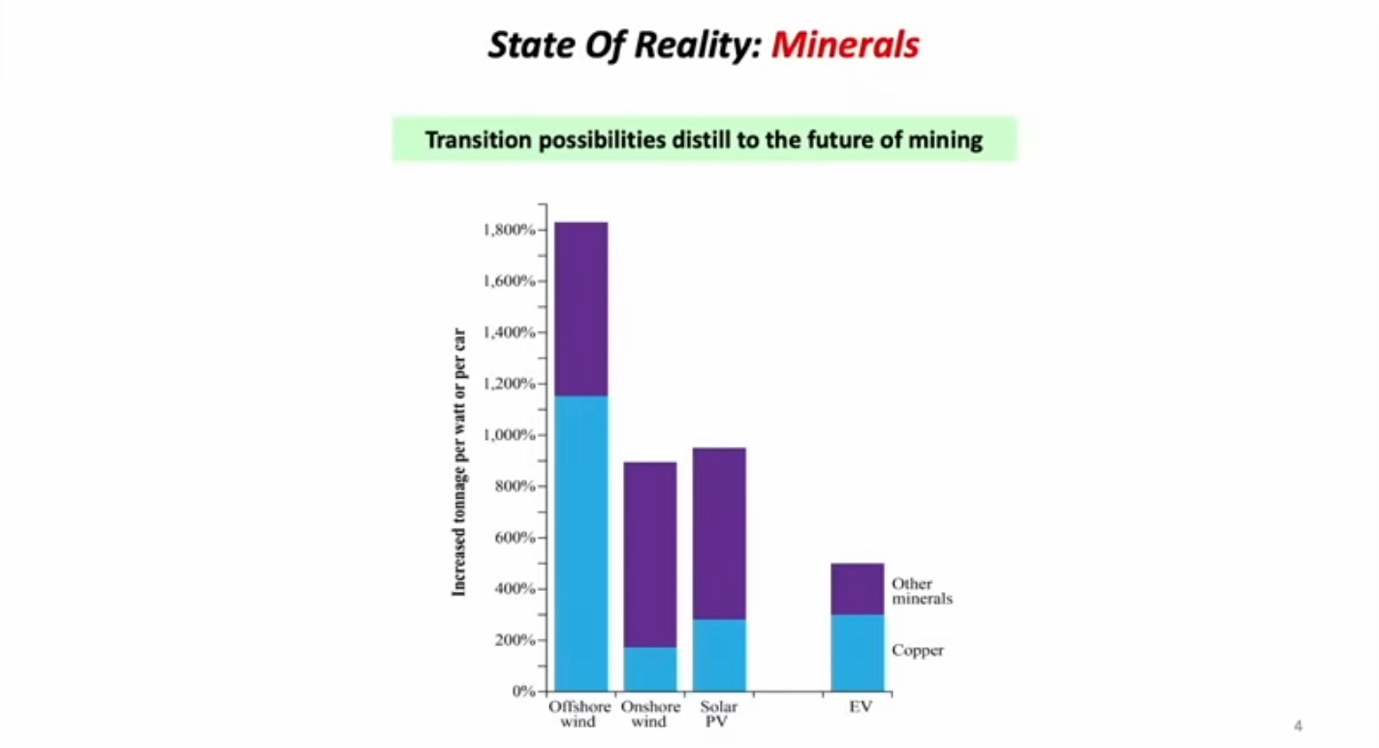

As you can see from the illustration below, the primary energy sources require resource minerals, such as lithium, cobalt, nickel and graphene.

Not so trivial trivia

Did you know an average car requires between 1000 – 2000% more minerals (aluminium, lithium, copper, cobalt, manganese, etc.) to generate the same unit of power as an ICE vehicle?

Did you know the average EV required more than 400% metals to produce the exact vehicle?

I expect more European countries to follow the German route, voting to phase out ICE vehicles by 2035; after all, this is an EU priority – I am only surprised the EU have not mandated the phasing out of ICE in preference for EVs yet. Obviously, the more widespread the phasing out of ICE vehicles, the more minerals used in EV batteries are required, which brings me to the most pressing issue we have not begone to figure out yet, and could, IMHO, threaten the EV revolution in the tight timeframe the elites are demanding.

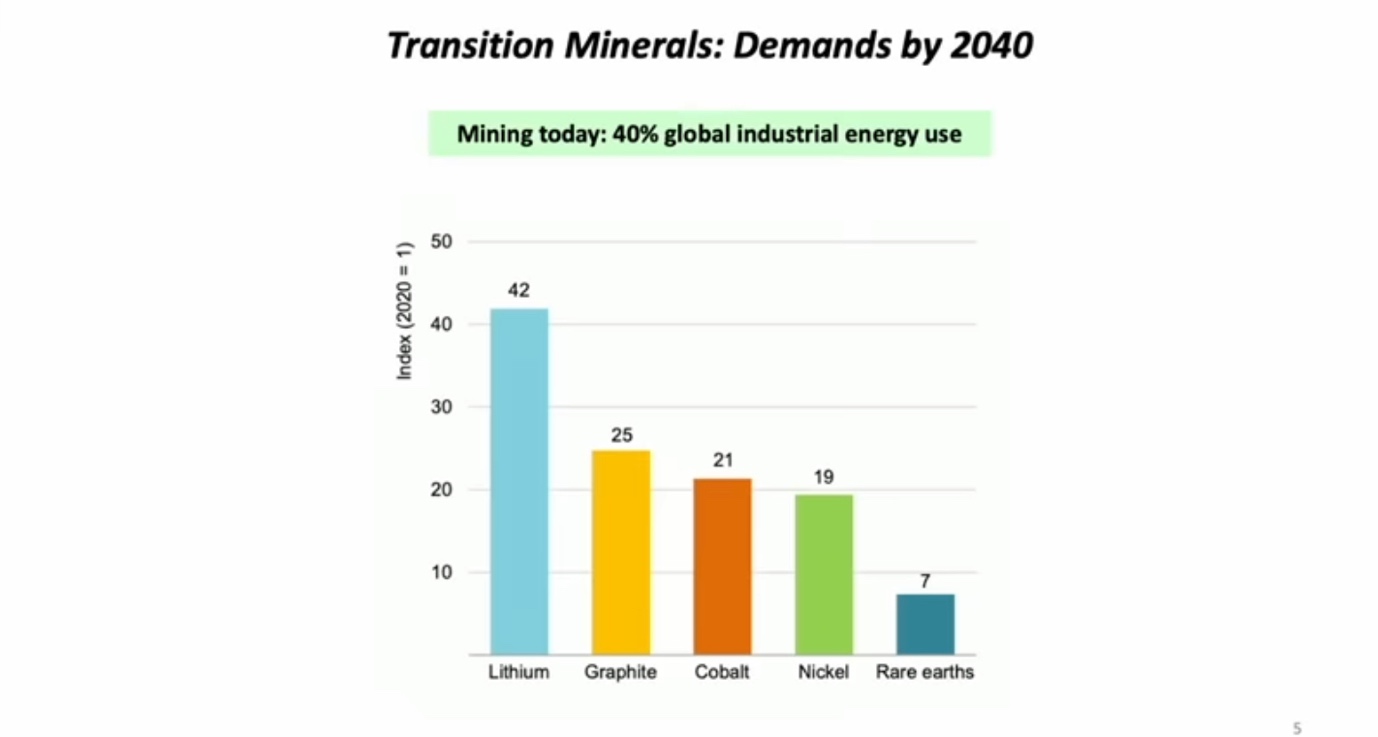

According to NXTMINE, EV sales are expected to jump from 2 million to 73 million pa by 2040. This is excellent news for investors like me with lithium exposure, but I suspect the 73 million figure is somewhat optimistic. My pessimism is not for the large-scale motor manufacturers; they are committed; it is the everyday infrastructure, such as charging points and electricity demand. My dismay is reserved for the battery minerals supply chain, which is set to come under significant stress.

The big question yet to be put to the elites driving the transition is how effective and how expensive in every term, economic, geopolitical, social environmental. How expensive an energy transition will be with wind turbines, EVs, and batteries that are now being built is anchored entirely in this one slide the magnitude of the increase in the amount of demand four medals in medals in the world. If you’re leading a business, you talked about increasing supply or demand depending on which side of the equation you are on in the Heavy Industries by numbers like 5 or 10%; a movement in oil markets of five percentage points is massive. A 5% loss of demand or supply, if it’s a 5% loss of supply prices, takes off a 5% increase in supply with the market not following a massive collapse in price.

At the 5% and 10% points, changes are enormous. In commodity markets, this is a change in demand from 700% to the order of 4000% in the total supply of these metals; this is the increase in demand and increasing, therefore, supply that we required in the coming two decades. Not to put too fine a point on this – if it were to be achieved, it would be the most significant single increase in demand or supply of medals in all human history; it has never happened before!

Our political class and the elites pulling their strings are exceptionally delusions about what the possibilities in the mining sector can deliver.

To put this into perspective, the worlds mining industry would need to increase the production of these kinds of metals, not by 10% or 20%, not by 50%, not by 200% but from 700% to 7000% in timeframes that are meaningful which is in the next decade or two?

It is an exciting problem I fear has been overlooked and will most likely have severe consequences for our economies and society.

There is far more to discuss, such as degrading mineral grades, which pose more problems within the supply and demand. But I think that is best for another instalment.

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Twitter: @LEMMINGINVESTOR

Got some thoughts on this week’s article from Elric? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.