Another week passes and more takeover bids appear. This time for K3 Capital (K3C) and Crestchic (LOAD). And whilst takeovers are never terrible news, the majority of shareholders (at least the ones who voiced their sentiments on social media) appear to be disgruntled.

This is because both the bid prices of the two companies in question were – in their opinions – low.

With regards to LOAD, I bought this stock as it broke out of 180p and averaged up. The company had rid itself of its Tasman division to focus on the higher margin and faster-growing load bank business. This is why it changed its name from Northbridge Industrials to Crestchic.

To me, it was clear that this was a turnaround play in a huge market. Business was going well and the company was expanding. The addressable market meant that the stock could easily be a multi-bagger in time (although there’s no guarantee that I would’ve caught the entire move as I’m a trend follower and not an investor), and so to see the stock to be bid for at 401p from Aggreko (itself previously a listed company until it was bid for last year) is disappointing.

I expected the stock to get to 401p without the bid and now that upside will no longer be mine to retain. But that’s life, and capturing a 120% move in nine months is no cause to complain.

But what do these bids mean for traders? It means that private equity believes stocks on the London Stock Exchange are cheap enough to bid for and own outright. And in the case of Crestchic – the stock had bucked the market trend by breaking out and rallying.

It’s all well and good buying undervalued stocks that may be a bid target. But undervalued doesn’t appear on your broker P&L. And the danger of an undervalued stock is that as the price falls, it becomes an even bigger bargain. Those tempting words start to whisper in your ear about averaging down, and soon you’re throwing good money after bad.

The reality is any trader who averages down will have poor results. I’m not talking about investing. That’s a different discipline. But if you’re a trader who then decides to become a long-term investor, because you want to comfort yourself with a smiling face of Warren Buffett with a quote saying: “Our favourite holding period is forever”, then you’re kidding yourself. And harming your trading progress.

The best way to play bids is to start with a top-down approach.

Run your screens as you would (remember you can use my screens by searching Michael in the filter library) and find stocks that have traded sideways for an extended period of time.

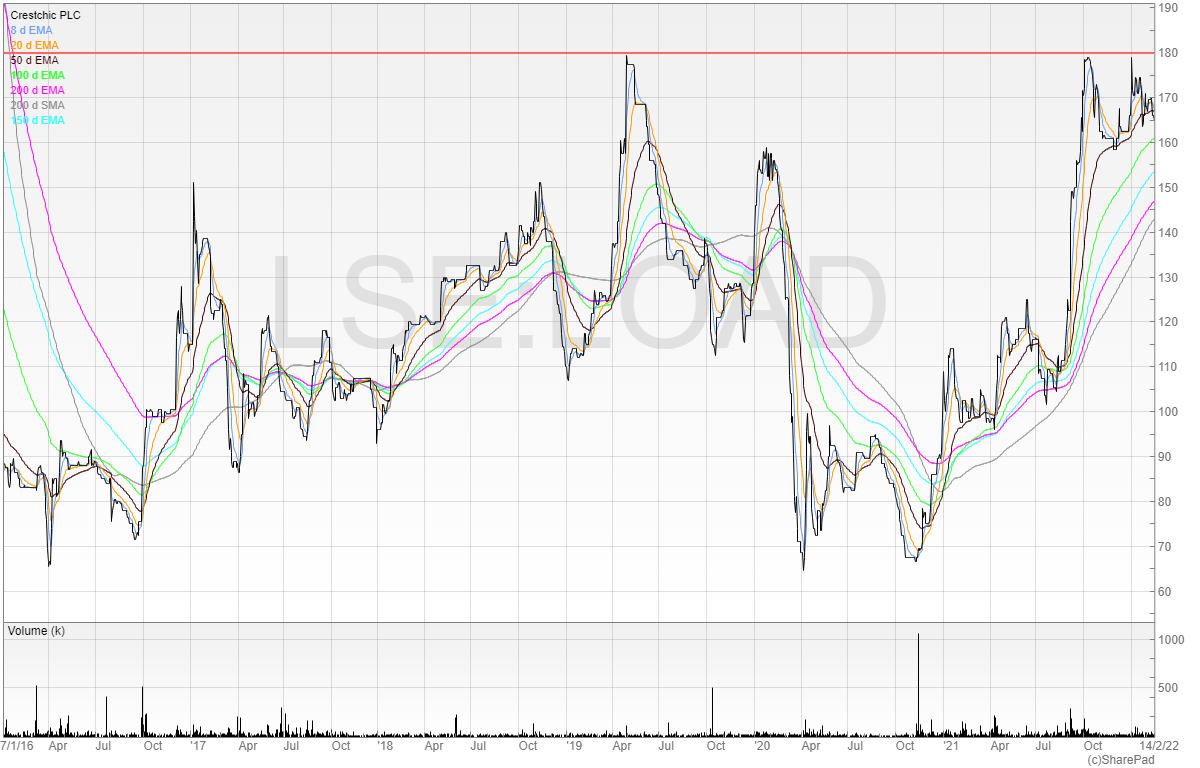

Here’s the chart from Crestchic:

Notice how as you zoom out the chart looks like it’s trading sideways. But zoom in and it’ll show you something different! This is why chart reading is still an art. Two people can look at the same chart and see different things.

Here’s a closer look:

Now the price looks like it’s all over the shop. There’s no reference price from before to show the full range of the chart.

It’s important to acknowledge that stage one bases will often have ranges of 100%+. The clue is to wait for the stock to tighten up and go through a significant high.

In this case, the stock was going through a 7-year high:

The volatility had also tightened up prior to the breakout, and there were fundamental catalysts pushing the stock forward.

The business had rid itself of the Tasman business and changed its name to focus on the higher margin and higher growth opportunity of load banks. That made itself a bid target for bigger load bank companies who would be interested in acquiring a smaller and growing company.

I highlighted the stock in my weekly newsletter, and averaged up along the way.

Finding charts like this, along with the fundamental factors, is the key to finding bid targets and playing them profitably.

But the reality is that finding bid targets is actually no different to what a good trader does anyway. If you trade right, bid targets will find you. It doesn’t need to be the other way around.

People have been waiting years for FeverTree to be taken over. Maybe it never will. Focus on the price, and a bid target can be your reward.. or in this case, rob you of potential upside!

Here is one stock I’m looking at (not as a potential bid target!).

Begbies Traynor (BEGB)

Begbies Traynor provides insolvency and restructuring services to other businesses. Given the economic backdrop, it’s no secret that there is an increasing amount of work for companies like Begbies. Despite that though, it hasn’t translated into huge share price success.

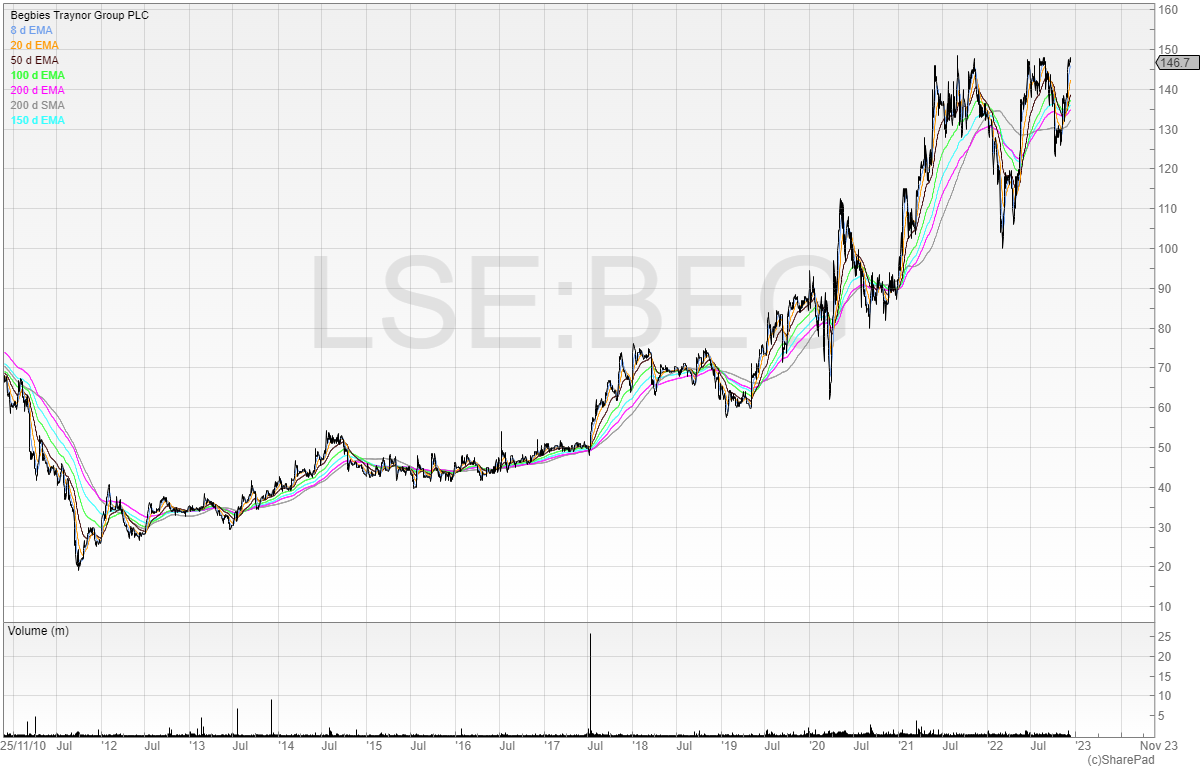

In fairness, the stock price hasn’t done too badly since 2011.

But since the start of 2021, the stock has been stuck in a range of around 50%.

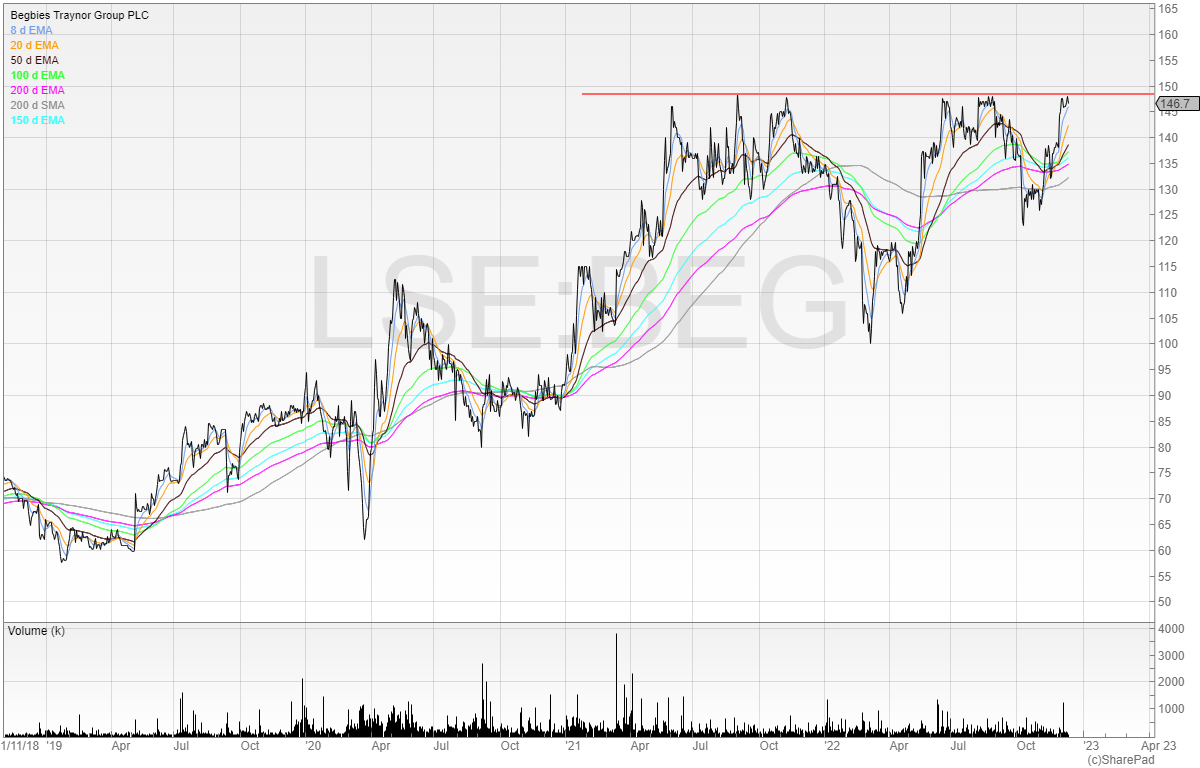

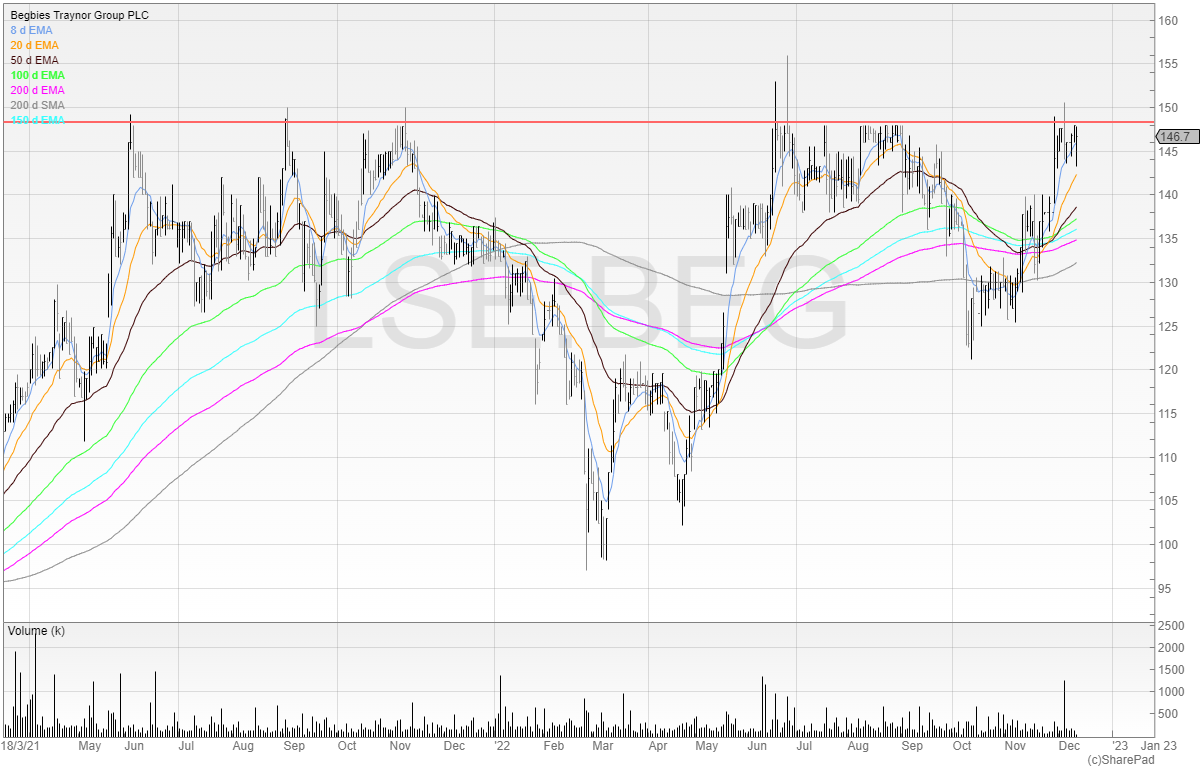

However, a scruffy cup and handle is forming. Here’s what I like about this chart.

- Positive moving average trends

- Repeat higher lows in the stock

- Tightening up at the handle

Let’s look closer.

We’re seeing the price cluster towards that breakout and hug the resistance area. I’m interested in this stock as long as the drawdowns continue to stay tight in the stock.

A breakout here would mean the stock is hitting prices not seen since 2008. I’m watching closely.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.