Bruce looks at the bounce in markets over the last 2 months and suggests some ideas that could benefit from a recovery in risk appetite. C4XD, CRL, PEEL, FCAP

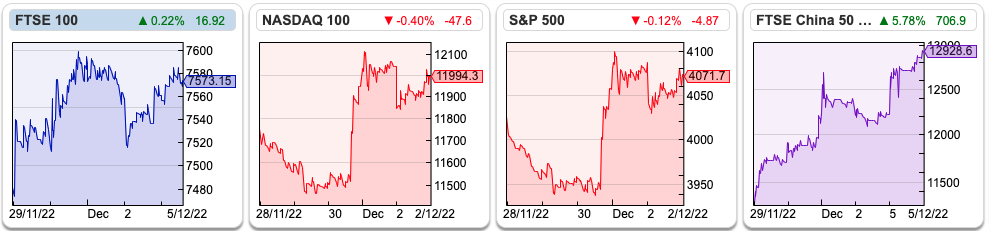

We’ve had a strong rally in markets since the lows at the beginning of October, the pound is up +15% against the dollar and AIM is up +13% since the Truss Trough. Global markets have rebounded strongly too, in the US Nasdaq is up +11% and the S&P500 is +14%. The FTSE China 50 is up by a very strong +39% over the same time period. My own portfolio has bounced +22% in the last couple of months, so I imagine others are also enjoying a strong end to the year. I’m not sure what has driven the optimism because it seems to me many of the worries about 2023 remain.

For instance, the US yield curve (2Y v 10Y spread) is becoming more inverted (currently around 80bp) which is normally an indicator of a recession. In Europe, the price of Natural Gas (NG-MT) began trending up through the second half of November, despite seasonally mild weather in Northern Europe. The problem seems to be a lack of wind is forcing a higher rate of gas burn, particularly for peak loads (when everyone puts the kettle on at halftime during key World Cup Games). This article says that France is close to seeing blackouts in January. In Germany, higher energy prices have reduced demand for natural gas by -23% , with industry rather than households responsible for the bulk of that. China seems to be reversing course from Covid zero policies. I can see why the latter might be a source of optimism, but the process of re-opening will be risky if China’s homemade vaccines are not as effective as the Moderna, BioNtech or AstraZeneca versions. China’s re-opening may also result in higher energy and commodity prices.

My friend Matt, who was observing the fighting in East Ukraine before Putin invaded the whole country has written this piece about land mines and reconstruction. It’s not directly relevant to short-term investing, but it does suggest to me that even if the two sides begin talking, the conflict is going to take a long time and be very costly to resolve.

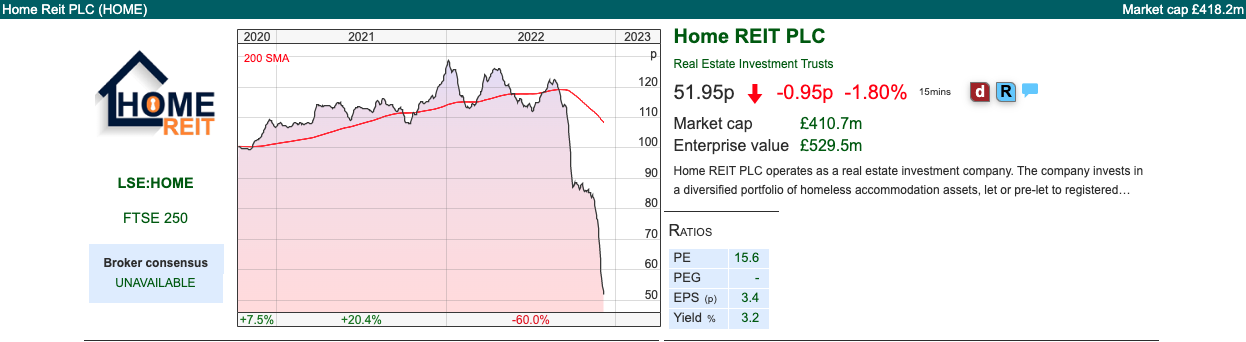

I have mixed feelings about the strength of markets because I still haven’t put all my cash to work. I’m worried, there could be more business models that break (not just crypto exchanges and loss-making Nasdaq stocks) as interest rates normalise. For instance, property funds would be an obvious candidate for problems to emerge, Blackstone have halted withdrawals from their $66bn BREIT property fund and in the UK we have HOME Reit -59% YTD which has become a target for short sellers Viceroy Research.

That said, below I’ve written about C4X Discovery, Creightons plus the brokers, FinnCap and Peel Hunt. All of these could be interesting ways to participate in recovering markets, but readers will need to judge the timing themselves.

FinnCap’s deal with Panmure called off

FinnCap and Panmure have called off their merger talks, with the former subsequently falling -20%. Talks were confirmed on the 18th of October, following speculation in the press. The Put Up or Shut Up (PUSU) deadline was then extended in mid-November.

It has been a tough time to be a broker, as IPOs and placings have dried up. Peel Hunt also had H1 to Sept results out last week showing revenue down -42% to £41m. They did manage to adjust their costs so that they were just about profitable, but it’s still a disappointing outcome versus £21.6m of PBT H1 last year.

Merging two broking businesses together like FinnCap and Panmure wouldn’t have generated more revenue, so it would have likely meant headcount reduction, only for there to be hiring when things improve in a year or two. I have friends working at both companies, so I’m glad that this hasn’t happened.

Panmure and Bob Diamond: This isn’t listed and I’ve never quite understood what Bob Diamond and the Qataris saw in Panmure Gordon. Bob paid £15.5m in 2018, and then funded £29m of losses in 2019 and £5m of loses in 2020. The Qataris had owned 43% of the company since the financial crisis. Bob has also founded a SPAC, Concord Acquisition Corp, in New York to merge with cryptocurrency company Circle. In February the deal was expected to close in December this year, but it’s gone rather quiet. Bob’s African bank, Atlas Mara, has been a disaster and de-listed after losing more than 95% of its value. His Private Equity vehicle, Atlas Merchant Capital bought a Greek consumer credit lender and a Bermuda-based reinsurer. Last weekend The Sunday Times suggested that he was now interested in Credit Suisse’s investment bank (CSFB) spin-out. I’m struggling to see the underlying strategic vision, other than that these are all assets that other investors might wish to avoid.

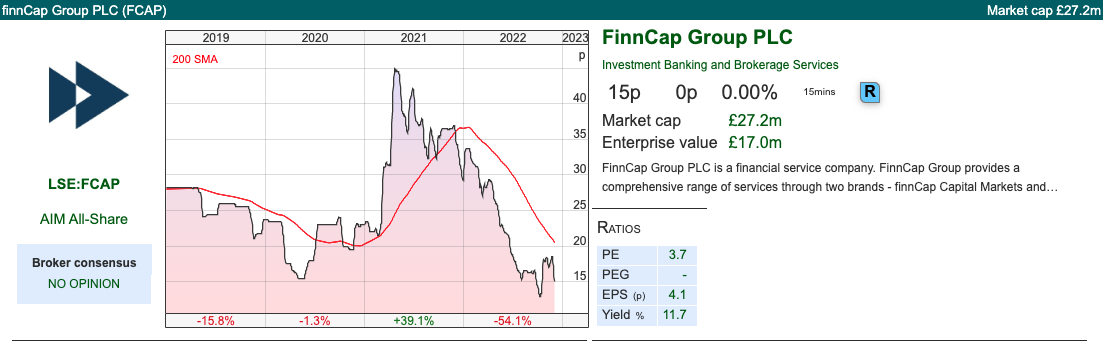

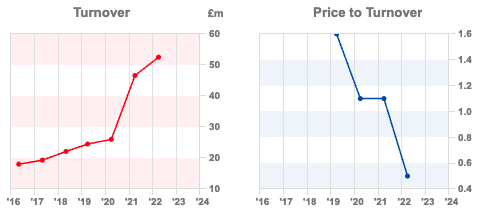

FinnCap: The broker was created in 2007 through a Jon Moulton-backed buyout from private client stockbrokers JM Finn & Co. Timing was not great, just ahead of the financial crisis, but the broker survived. They’ve grown steadily and listed on AIM in Nov 2018 at 28p, valuing the company at £47m. On admission, the company acquired Cavendish, a merger and acquisition advisor, for £14m. FinnCap’s revenues peaked at £53m FY Mar 2022, but in September this year, they said revenue would be down by approximately 30%. At the time they expected the second half to be “somewhat better”. We should see H1 results to September in the next few weeks and I’d keep an eye out for a change in that outlook assessment.

Shareholders: Although there aren’t many institutions on the shareholder register there are some well-known individuals with good track records. Jon Moulton owns 11%, Vin Murria 10.3%, Sam Smith (former Chief Exec) owns 9.9%, Baron Leigh of Hurley owns 9% (not to be confused with John Lee, Baron Lee of Trafford).

Valuation: At the end of August they had £13m in cash, roughly half the market cap of £27m. Readers can see how the shares have de-rated from a price/turnover of 1.6x when they IPO’ed to 0.5x currently, despite the revenue showing strong progress over recent years.

Opinion: I think that it’s quite possible the business is loss-making for this year and maybe next too if market conditions are really challenging. However, they have the cash to see them through troubled times. Stockbroking firms lost money in the 1970’s but were then highly prized assets a decade later. I feel like this could be an interesting way to play the recovery. Timing is for readers to decide.

C4X Discovery deal with AstraZeneca

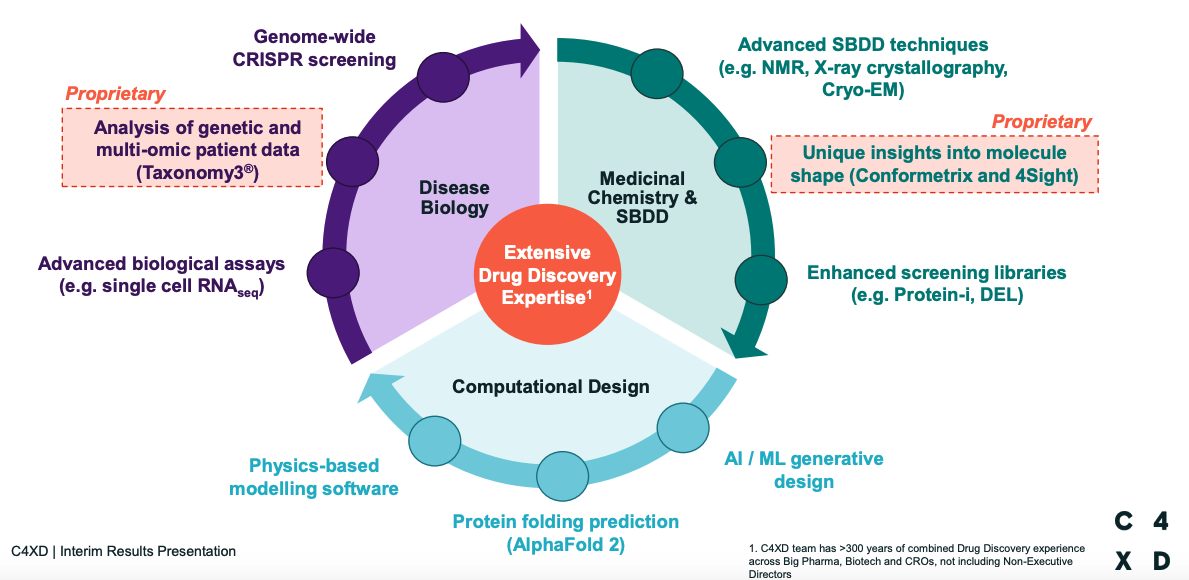

This company comes with a ‘health warning’ – it’s in the drug discovery space. On average it takes ten years to develop a new drug, receive regulatory approval and bring it to market, costing between £800m to £2bn. However, C4X Discovery already has partnered with Indivior (spun out from Reckitt Benkister a decade ago, which has a treatment for heroin addiction) headline value £230m; and Sanofi (market cap €111bn) headline value of £350m.

A week ago the shares were up +34%, as they announced they had signed a third licencing agreement, this time with AstraZeneca (market cap £170bn) for a treatment of inflammatory and respiratory diseases, with a focus on COPD. Chronic Obstructive Pulmonary Disease (COPD) is a narrowing of the airways in the lungs, which drives chronic inflammation, killing an estimated 3m people worldwide, and causing suffering for many others. Under the terms of the agreement, C4XD will receive $2m upfront, then up to $14m more subject to milestones being hit. If the drug goes to clinical trials C4XD is eligible to receive a further potential $386m if clinical development and commercial milestones are hit.

The second reason C4X business model is different is that they are using DNA-based target identification, which allows them to sign licensing deals early. Hence the high headline figure partnerships with Indivior, Sanofi and now AstraZeneca.

Background: I’m not a specialist in this area, but am trying to educate myself as there could be a lot of money flowing into healthcare, particularly respiratory diseases and inflammation over the next few years. Inflammation seems to be the underlying mechanism that links many diseases from COPD, fibromyalgia, allergies, arthritis, IBS, skin problems like psoriasis and even depression. I read Robert Lustig’s book Metabolical and Hanna Purdy’s Could it be Insulin Resistance? a month ago, and found them an interesting perspective.

Both authors (Lustig is an endocrinologist specialising in childhood diabetes, Purdy is a nurse) suggest that modern chronic ‘life style’ diseases may not be ‘drugable’ at all, but they are ‘foodable’. This is controversial, but if true, it means drug companies are focusing on downstream symptoms, whereas the root cause of the problem is upstream: insulin resistance. This can be improved with simple changes to diet (avoid sugar, avoid processed food, cut down on carbohydrates, intermittent fasting). Notice that exercise and calorie restriction are not on that list – because many people of normal weight and who exercise have developed insulin resistance from too much-processed food. Often that processed food is marketed as ‘healthy – low in fat!’ but turns out to be high in sugar, emulsifiers, stabilisers, preservatives, seed oils, transfats etc and lacks micronutrients. So symptoms are showing up not as obesity, but as inflammatory/chronic conditions, which have become so prevalent in the Western developed world.

Shareholders: this is another Richard Griffiths stock, like Circassian which has changed its name to NIOX. Richard owns 23% of C4X Discovery, with Polar Capital 17%, Lombard Odier 15% and Baillie Gifford 5.7%.

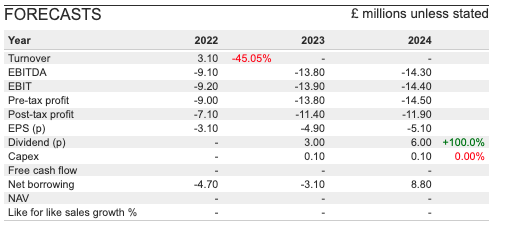

Results: The most recent set of results were the H1 to January, which they reported in April this year. The company reported a loss of £4.5m and had net cash of £11.7m at the end of January. The company then did a placing in August which raised £5.7m, at 25p per share, which despite the difficult market conditions was not at a discount to the then share price. Management will announce FY results to 31 July on 15th December. I expect to see that it is still loss-making, but there may be more colour around these partnerships.

Opinion: This could be a good way to play the recovery in risk appetite but I will avoid. Despite the upfront payments from partnering with ‘big pharma’ companies, C4X are forecast to be loss-making in FY July 2023F and FY July 2024F.

I have an uncomfortable feeling that there has been a huge misallocation of time, capital, intellectual effort and computer processing power going into sophisticated techniques to study the behaviour and physical properties of drug molecules. This is treating the symptoms, not the underlying cause of chronic diseases. Instead, the likely suspect is processed food and the Western diet, yet it’s impossible for a drug company to make money out of that insight, so we’re likely to see continued disappointment in this area. I’ve written more on the subject on my personal blog here. I did run it by a neurologist friend who now works on funding healthcare and life sciences start-ups, who agreed with the analysis.

Creightons H1 to September

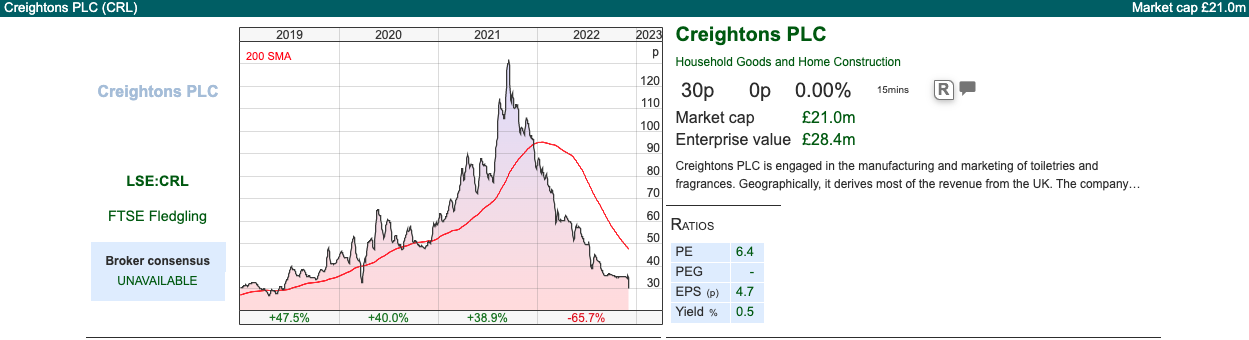

This toiletries, fragrances and skincare company announced flat revenues of £30m, and a small loss of £359K for the half to Sept versus £2.3m profits H1 last year. They made a couple of acquisitions last year, Brodie & Stone plus Emma Hardie, without which revenues would have been down -9%.

The damage by cost inflation from November last year onwards of approximately £4m, meaning that the gross margin has fallen from 42.7% H1 last year to 40.4% just reported. High street retailers have been reluctant to pass on costs to customers, something we saw earlier this year with Tesco’s refusing to stock Heinz baked beans and ketchup. Eventually, Tesco backed down and agreed to raise prices, CRL say that their retailers have now agreed to price increases from between +5% to +15%.

I listened in to the management call, and one questioner pointed out that if organic revenues were down -9% and they’d put through price increases, then that would imply underlying sales volumes would be down -20%. Management didn’t disagree. They said that they’ve begun to turn things around and were profitable from July onwards, and generating positive cashflow from August onwards, helped by reducing inventory levels. Aside from the gross margin, management also aim to reduce overheads by £2m.

Net debt was £9.0m at the end of September, up from £8.5m September last year. The bulk of the increase has been driven by invoice financing (currently over £4m) which I think is an expensive way to borrow.

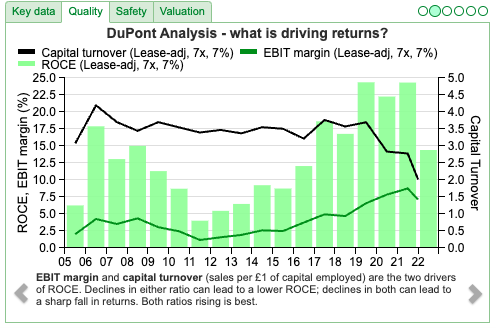

Valuation: The company doesn’t pay for broker forecasts. However, we can take the average 3-year (ie that includes the pandemic) EBIT margins of 7.7% (equating to 6.8% post tax, post interest). That would imply that if revenues hit £65m then £4.5m of post tax profit is achievable, if management can successfully turn things around, with the current market cap, that implies a multiple of just below 5x.

However, during the pandemic management enjoyed a boost from the sales of hand sanitiser £14.6m (or 24% of FY Mar 2021 revenue). Taking a 10-year average post-tax margin of 4.1% might be more conservative, which implies the shares are trading on 8x.

Opinion: I’ve owned the shares for a few years. I feel management are operationally very strong, but the damage to the share price (down -77% since the peak September last year) has been self-inflicted through poorly timed deals, in my view. They bought Emma Hardie at the top of the market last year. This wouldn’t have been too bad if CRL had paid for the deal with their own (at the time) overvalued paper. Instead, some of the Emma Hardie deal was in the shares that Creightons guaranteed the value of at 125p (versus 30p today).

In summary, this looks like to me like performance should recover eventually, but we’re still fairly early in the turnaround and it could be a long wait.

Notes

The author owns shares in Creightons

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 6/12/22 | C4XD, CRL, PEEL, FCAP | Santa Rally arrives early

Bruce looks at the bounce in markets over the last 2 months and suggests some ideas that could benefit from a recovery in risk appetite. C4XD, CRL, PEEL, FCAP

We’ve had a strong rally in markets since the lows at the beginning of October, the pound is up +15% against the dollar and AIM is up +13% since the Truss Trough. Global markets have rebounded strongly too, in the US Nasdaq is up +11% and the S&P500 is +14%. The FTSE China 50 is up by a very strong +39% over the same time period. My own portfolio has bounced +22% in the last couple of months, so I imagine others are also enjoying a strong end to the year. I’m not sure what has driven the optimism because it seems to me many of the worries about 2023 remain.

For instance, the US yield curve (2Y v 10Y spread) is becoming more inverted (currently around 80bp) which is normally an indicator of a recession. In Europe, the price of Natural Gas (NG-MT) began trending up through the second half of November, despite seasonally mild weather in Northern Europe. The problem seems to be a lack of wind is forcing a higher rate of gas burn, particularly for peak loads (when everyone puts the kettle on at halftime during key World Cup Games). This article says that France is close to seeing blackouts in January. In Germany, higher energy prices have reduced demand for natural gas by -23% , with industry rather than households responsible for the bulk of that. China seems to be reversing course from Covid zero policies. I can see why the latter might be a source of optimism, but the process of re-opening will be risky if China’s homemade vaccines are not as effective as the Moderna, BioNtech or AstraZeneca versions. China’s re-opening may also result in higher energy and commodity prices.

My friend Matt, who was observing the fighting in East Ukraine before Putin invaded the whole country has written this piece about land mines and reconstruction. It’s not directly relevant to short-term investing, but it does suggest to me that even if the two sides begin talking, the conflict is going to take a long time and be very costly to resolve.

I have mixed feelings about the strength of markets because I still haven’t put all my cash to work. I’m worried, there could be more business models that break (not just crypto exchanges and loss-making Nasdaq stocks) as interest rates normalise. For instance, property funds would be an obvious candidate for problems to emerge, Blackstone have halted withdrawals from their $66bn BREIT property fund and in the UK we have HOME Reit -59% YTD which has become a target for short sellers Viceroy Research.

That said, below I’ve written about C4X Discovery, Creightons plus the brokers, FinnCap and Peel Hunt. All of these could be interesting ways to participate in recovering markets, but readers will need to judge the timing themselves.

FinnCap’s deal with Panmure called off

FinnCap and Panmure have called off their merger talks, with the former subsequently falling -20%. Talks were confirmed on the 18th of October, following speculation in the press. The Put Up or Shut Up (PUSU) deadline was then extended in mid-November.

It has been a tough time to be a broker, as IPOs and placings have dried up. Peel Hunt also had H1 to Sept results out last week showing revenue down -42% to £41m. They did manage to adjust their costs so that they were just about profitable, but it’s still a disappointing outcome versus £21.6m of PBT H1 last year.

Merging two broking businesses together like FinnCap and Panmure wouldn’t have generated more revenue, so it would have likely meant headcount reduction, only for there to be hiring when things improve in a year or two. I have friends working at both companies, so I’m glad that this hasn’t happened.

Panmure and Bob Diamond: This isn’t listed and I’ve never quite understood what Bob Diamond and the Qataris saw in Panmure Gordon. Bob paid £15.5m in 2018, and then funded £29m of losses in 2019 and £5m of loses in 2020. The Qataris had owned 43% of the company since the financial crisis. Bob has also founded a SPAC, Concord Acquisition Corp, in New York to merge with cryptocurrency company Circle. In February the deal was expected to close in December this year, but it’s gone rather quiet. Bob’s African bank, Atlas Mara, has been a disaster and de-listed after losing more than 95% of its value. His Private Equity vehicle, Atlas Merchant Capital bought a Greek consumer credit lender and a Bermuda-based reinsurer. Last weekend The Sunday Times suggested that he was now interested in Credit Suisse’s investment bank (CSFB) spin-out. I’m struggling to see the underlying strategic vision, other than that these are all assets that other investors might wish to avoid.

FinnCap: The broker was created in 2007 through a Jon Moulton-backed buyout from private client stockbrokers JM Finn & Co. Timing was not great, just ahead of the financial crisis, but the broker survived. They’ve grown steadily and listed on AIM in Nov 2018 at 28p, valuing the company at £47m. On admission, the company acquired Cavendish, a merger and acquisition advisor, for £14m. FinnCap’s revenues peaked at £53m FY Mar 2022, but in September this year, they said revenue would be down by approximately 30%. At the time they expected the second half to be “somewhat better”. We should see H1 results to September in the next few weeks and I’d keep an eye out for a change in that outlook assessment.

Shareholders: Although there aren’t many institutions on the shareholder register there are some well-known individuals with good track records. Jon Moulton owns 11%, Vin Murria 10.3%, Sam Smith (former Chief Exec) owns 9.9%, Baron Leigh of Hurley owns 9% (not to be confused with John Lee, Baron Lee of Trafford).

Valuation: At the end of August they had £13m in cash, roughly half the market cap of £27m. Readers can see how the shares have de-rated from a price/turnover of 1.6x when they IPO’ed to 0.5x currently, despite the revenue showing strong progress over recent years.

Opinion: I think that it’s quite possible the business is loss-making for this year and maybe next too if market conditions are really challenging. However, they have the cash to see them through troubled times. Stockbroking firms lost money in the 1970’s but were then highly prized assets a decade later. I feel like this could be an interesting way to play the recovery. Timing is for readers to decide.

C4X Discovery deal with AstraZeneca

This company comes with a ‘health warning’ – it’s in the drug discovery space. On average it takes ten years to develop a new drug, receive regulatory approval and bring it to market, costing between £800m to £2bn. However, C4X Discovery already has partnered with Indivior (spun out from Reckitt Benkister a decade ago, which has a treatment for heroin addiction) headline value £230m; and Sanofi (market cap €111bn) headline value of £350m.

A week ago the shares were up +34%, as they announced they had signed a third licencing agreement, this time with AstraZeneca (market cap £170bn) for a treatment of inflammatory and respiratory diseases, with a focus on COPD. Chronic Obstructive Pulmonary Disease (COPD) is a narrowing of the airways in the lungs, which drives chronic inflammation, killing an estimated 3m people worldwide, and causing suffering for many others. Under the terms of the agreement, C4XD will receive $2m upfront, then up to $14m more subject to milestones being hit. If the drug goes to clinical trials C4XD is eligible to receive a further potential $386m if clinical development and commercial milestones are hit.

The second reason C4X business model is different is that they are using DNA-based target identification, which allows them to sign licensing deals early. Hence the high headline figure partnerships with Indivior, Sanofi and now AstraZeneca.

Background: I’m not a specialist in this area, but am trying to educate myself as there could be a lot of money flowing into healthcare, particularly respiratory diseases and inflammation over the next few years. Inflammation seems to be the underlying mechanism that links many diseases from COPD, fibromyalgia, allergies, arthritis, IBS, skin problems like psoriasis and even depression. I read Robert Lustig’s book Metabolical and Hanna Purdy’s Could it be Insulin Resistance? a month ago, and found them an interesting perspective.

Both authors (Lustig is an endocrinologist specialising in childhood diabetes, Purdy is a nurse) suggest that modern chronic ‘life style’ diseases may not be ‘drugable’ at all, but they are ‘foodable’. This is controversial, but if true, it means drug companies are focusing on downstream symptoms, whereas the root cause of the problem is upstream: insulin resistance. This can be improved with simple changes to diet (avoid sugar, avoid processed food, cut down on carbohydrates, intermittent fasting). Notice that exercise and calorie restriction are not on that list – because many people of normal weight and who exercise have developed insulin resistance from too much-processed food. Often that processed food is marketed as ‘healthy – low in fat!’ but turns out to be high in sugar, emulsifiers, stabilisers, preservatives, seed oils, transfats etc and lacks micronutrients. So symptoms are showing up not as obesity, but as inflammatory/chronic conditions, which have become so prevalent in the Western developed world.

Shareholders: this is another Richard Griffiths stock, like Circassian which has changed its name to NIOX. Richard owns 23% of C4X Discovery, with Polar Capital 17%, Lombard Odier 15% and Baillie Gifford 5.7%.

Results: The most recent set of results were the H1 to January, which they reported in April this year. The company reported a loss of £4.5m and had net cash of £11.7m at the end of January. The company then did a placing in August which raised £5.7m, at 25p per share, which despite the difficult market conditions was not at a discount to the then share price. Management will announce FY results to 31 July on 15th December. I expect to see that it is still loss-making, but there may be more colour around these partnerships.

Opinion: This could be a good way to play the recovery in risk appetite but I will avoid. Despite the upfront payments from partnering with ‘big pharma’ companies, C4X are forecast to be loss-making in FY July 2023F and FY July 2024F.

I have an uncomfortable feeling that there has been a huge misallocation of time, capital, intellectual effort and computer processing power going into sophisticated techniques to study the behaviour and physical properties of drug molecules. This is treating the symptoms, not the underlying cause of chronic diseases. Instead, the likely suspect is processed food and the Western diet, yet it’s impossible for a drug company to make money out of that insight, so we’re likely to see continued disappointment in this area. I’ve written more on the subject on my personal blog here. I did run it by a neurologist friend who now works on funding healthcare and life sciences start-ups, who agreed with the analysis.

Creightons H1 to September

This toiletries, fragrances and skincare company announced flat revenues of £30m, and a small loss of £359K for the half to Sept versus £2.3m profits H1 last year. They made a couple of acquisitions last year, Brodie & Stone plus Emma Hardie, without which revenues would have been down -9%.

The damage by cost inflation from November last year onwards of approximately £4m, meaning that the gross margin has fallen from 42.7% H1 last year to 40.4% just reported. High street retailers have been reluctant to pass on costs to customers, something we saw earlier this year with Tesco’s refusing to stock Heinz baked beans and ketchup. Eventually, Tesco backed down and agreed to raise prices, CRL say that their retailers have now agreed to price increases from between +5% to +15%.

I listened in to the management call, and one questioner pointed out that if organic revenues were down -9% and they’d put through price increases, then that would imply underlying sales volumes would be down -20%. Management didn’t disagree. They said that they’ve begun to turn things around and were profitable from July onwards, and generating positive cashflow from August onwards, helped by reducing inventory levels. Aside from the gross margin, management also aim to reduce overheads by £2m.

Net debt was £9.0m at the end of September, up from £8.5m September last year. The bulk of the increase has been driven by invoice financing (currently over £4m) which I think is an expensive way to borrow.

Valuation: The company doesn’t pay for broker forecasts. However, we can take the average 3-year (ie that includes the pandemic) EBIT margins of 7.7% (equating to 6.8% post tax, post interest). That would imply that if revenues hit £65m then £4.5m of post tax profit is achievable, if management can successfully turn things around, with the current market cap, that implies a multiple of just below 5x.

However, during the pandemic management enjoyed a boost from the sales of hand sanitiser £14.6m (or 24% of FY Mar 2021 revenue). Taking a 10-year average post-tax margin of 4.1% might be more conservative, which implies the shares are trading on 8x.

Opinion: I’ve owned the shares for a few years. I feel management are operationally very strong, but the damage to the share price (down -77% since the peak September last year) has been self-inflicted through poorly timed deals, in my view. They bought Emma Hardie at the top of the market last year. This wouldn’t have been too bad if CRL had paid for the deal with their own (at the time) overvalued paper. Instead, some of the Emma Hardie deal was in the shares that Creightons guaranteed the value of at 125p (versus 30p today).

In summary, this looks like to me like performance should recover eventually, but we’re still fairly early in the turnaround and it could be a long wait.

Notes

The author owns shares in Creightons

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.