Bruce ponders if any large corporates are exposed as social proof in crypto disappear. Companies covered HVO and BMS

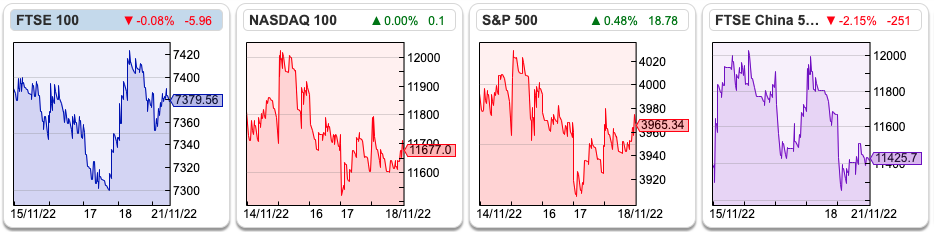

The FTSE has been flat at just below 7,400 for the last 5 days. The S&P500 and Nasdaq 100 are both down around -1%. The China FTSE 50, has enjoyed a +22% bounce from its October lows (though still down -31% YTD). I’m cautious about how sustained that bounce can be while the Covid Zero policy remains in place. Bitcoin (BTCUSD on Sharepad) has fallen below $16K to the dollar.

I came across this blog post by a former Amazon employee, about how they tried to assess the risks and opportunities from blockchain. He published it following the cancellation of the Australian Stock Exchange’s implementation of a blockchain-based clearing and settlement system. It reminded me that many of my friends who are programmers are sceptical of crypto, so blockchain doesn’t just divide people between a Luddite versus techie dichotomy. The technical people at Amazon Web Services asked:

“OK, if we had a distributed ledger technology, what would we build with it?”

That still seems to me, a pertinent question to ask. A second aspect to the blog post is that it describes the thought processes of intelligent, technical people trying to navigate corporate politics, where important clients with large sacks of gold want them to make exciting apparel. Management at AWS don’t want to turn business away, and so they are trying to think of new finery to make and sell. At the back of their mind, they have a nagging doubt, that the new clothes everyone else believes in, perhaps don’t exist.

Despite their doubts, AWS has hosted a lot of crypto processing power, according to Izzy Kaminska, who used to work at the FT and is now running her own media start up. I’ve always thought AMZN is a proper business, but sometimes ponder what the valuation would be without the AWS business.

Below I look at an hVIVO (previously Open Orphan) contract win and Braemar Shipping Services.

I originally switched to two shorter weekly updates because there was a lot going on at the end of September through October. It now looks as if company related newsflow is slowing down ahead of the holiday season. So from next week onwards, I intend to revert back to one update per week.

hVIVO contract win

This company used to be called Open Orphan but has changed its name to its operating brand hVIVO, so I missed earlier this month that they had announced a £13.6m contract win with a US firm. The revenue is expected to be recognised in the two coming financial years Dec 2023F and Dec 2024F. I wouldn’t normally write about contract wins if their broker (in this case FinnCap) leaves forecasts unchanged: revenue 2023F £54m and 2024F £59m. I do think there are a couple of interesting angles to this company though.

I last wrote about hVIVO / Open Orphan in June this year. At the time, their broker was only forecasting one year out, despite management claiming a £46m order book, which I suggested wasn’t very encouraging for investors. Then in mid-September hVIVO put out a statement responding to press speculation (presumably this article in The Irish Times) that they were helping the Irish Police (Garda) with their enquiries in a high-profile insider dealing case. At the time, the Board said there were no implications for the hVIVO and confirmed that no employee, executive, director or anyone connected with their company had any involvement. It seems slightly odd to have an insider trading case which doesn’t involve any company insiders, but I imagine that there could be material non-public information from another source (perhaps about awarding HVO a big contract?)

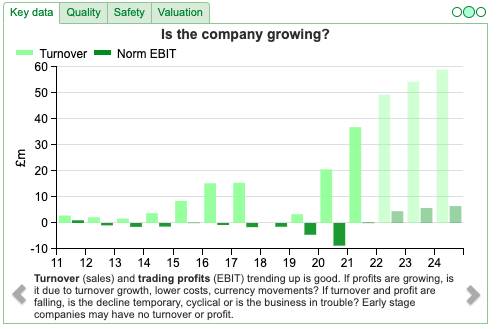

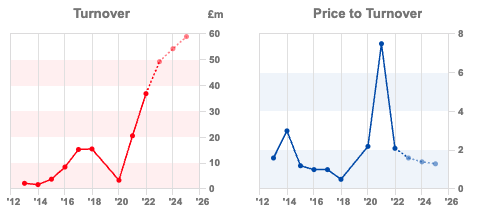

None of that sounds very auspicious. Now, however, FinnCap have published forecasts showing revenue to grow by +60% from 2021A to £59m in 2024F, and the broker expect the company to report a profit in those years. Secondly, the chart is looking interesting, though the shares are down -49% YTD, they have bounced +30% following the contract win announcement. Third, cash represents 21% of the company’s market cap. So, I thought that the company might be worth flagging.

Results: The company put out H1 to June results in September, showing revenue falling -19% to £18.9m. PBT was down -69% to £453K. Worth noting that the p&l benefits from a £900K R&D tax credit, without which the business would have been loss-making. On the positive side, the group had £15.8m of net cash at the end of June. They held a Capital Markets Day for investors in October, sometimes that can be a precursor to raising more money. The cash on the balance sheet makes that unlikely though I think. Company guidance is for c. £50m of revenue in FY Dec 2022F and EBITDA margins of 13-15%. That was implying an H2 weighting of 37%/63% management. A heavy H2 weight could be a precursor to a profit warning but management said that they were confident because they had a stronger order book of signed contracts. The order book has now trebled from H1 last year to £70m at the end of June.

Ownership: Cathal Friel, the charismatic Chairman owns 10% (including Raglan Road Ltd which is a company he controls). Mo Khan, the Chief Exec was appointed Feb this year owns just £55K of shares. His background is Private Equity, I did look at what his share option package was but because he joined the company earlier this year, he wasn’t included in the 2021 Annual Report remuneration section. Presumably, he’s expecting more through the company’s share-based payment scheme.

There’s no institutional ownership, but Liberum were appointed NOMAD earlier this year, so I would imagine that’s a sign that management believes they need to get in front of fund managers. At £79m market cap hVIVO it’s understandable that there are no institutions on the shareholder register. If that’s about to change, then retail investors who can deal in smaller position sizes than professional fund managers could try to jump in ahead of any stakebuilding by larger players.

Valuation: Now we have forecasts the shares are trading on a PER of 16x FY Dec 2023F and 15x the following year. The valuation doesn’t look expensive, 1.4x next years sales, particularly with the cash. This is a company that has been loss-making for most of the last decade, but if forecasts are to be believed, it’s now at a stage where it starts to generate a track record of profits.

Opinion: This does seem to be an example of a company moving from ‘blue sky’ to GARP. The small-cap market sell-off has been brutal over the last 12 months, but it’s important not to become scarred by recent experiences. I like what I see, though haven’t taken a position yet and would still characterise the shares as speculative. If readers have thoughts, do let me know on the chat.

Braemar H1 to end of August

Again, this is a stock that released results earlier this month as no announcements caught my eye on Monday morning, I have decided to circle back and write up results. This shipbroking company announced revenue growth +46% to £69m (or +36% revenue growth in US dollars). Statutory PBT has more than doubled to £10.1m. They are now net cash £1.8m, versus net debt of £15m in August last year. Note the company’s version of net debt excludes £4.9m of acquisition liabilities, including these, net debt stood at £3.1m.

Outlook: Management say that they are on track to double profits in FY Feb 2024, and describe the outlook as ‘very positive’. Some of this is driven by Deep Sea Tankers (a quarter of revenue, growing at +93% versus H1 last year) which has been helped by sanctions-related volatility and Dry Cargo (also a quarter of revenue, growing at +61%) as global trade and supply chains have recovered from congestion bottlenecks last year.

Valuation: The shares are trading on below 10x FY Feb 2023F and 2024F. That’s understandable given that the company has not reported a RoCE of above 10% since 2016. The EBIT margin is forecast to rise to mid-teens level this year and next. This looks a reasonable valuation, but having been a UK banks’ analyst makes me cautious of cyclical stocks with rebounding earnings trading on cheap earnings multiples.

Opinion: With the shares trebling from their pandemic low in April 2020, Braemar now seems to navigate through stormy waters and charting the right course. I have always struggled to explain why Clarkson had done so well over the last couple of decades and Braemar was stuck in the doldrums. Despite the forecast recovery in FY Feb 2023F Braemar revenues to £129m, that’s still below the level achieved in 2012. Shipping is a cyclical industry, so I would need to feel confident that I was not buying the shares just at the wrong point of the cycle.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 1 | 22/11/22 |HVO, BMS | The Emperor’s New Blockchain

Bruce ponders if any large corporates are exposed as social proof in crypto disappear. Companies covered HVO and BMS

The FTSE has been flat at just below 7,400 for the last 5 days. The S&P500 and Nasdaq 100 are both down around -1%. The China FTSE 50, has enjoyed a +22% bounce from its October lows (though still down -31% YTD). I’m cautious about how sustained that bounce can be while the Covid Zero policy remains in place. Bitcoin (BTCUSD on Sharepad) has fallen below $16K to the dollar.

I came across this blog post by a former Amazon employee, about how they tried to assess the risks and opportunities from blockchain. He published it following the cancellation of the Australian Stock Exchange’s implementation of a blockchain-based clearing and settlement system. It reminded me that many of my friends who are programmers are sceptical of crypto, so blockchain doesn’t just divide people between a Luddite versus techie dichotomy. The technical people at Amazon Web Services asked:

“OK, if we had a distributed ledger technology, what would we build with it?”

That still seems to me, a pertinent question to ask. A second aspect to the blog post is that it describes the thought processes of intelligent, technical people trying to navigate corporate politics, where important clients with large sacks of gold want them to make exciting apparel. Management at AWS don’t want to turn business away, and so they are trying to think of new finery to make and sell. At the back of their mind, they have a nagging doubt, that the new clothes everyone else believes in, perhaps don’t exist.

Despite their doubts, AWS has hosted a lot of crypto processing power, according to Izzy Kaminska, who used to work at the FT and is now running her own media start up. I’ve always thought AMZN is a proper business, but sometimes ponder what the valuation would be without the AWS business.

Below I look at an hVIVO (previously Open Orphan) contract win and Braemar Shipping Services.

I originally switched to two shorter weekly updates because there was a lot going on at the end of September through October. It now looks as if company related newsflow is slowing down ahead of the holiday season. So from next week onwards, I intend to revert back to one update per week.

hVIVO contract win

This company used to be called Open Orphan but has changed its name to its operating brand hVIVO, so I missed earlier this month that they had announced a £13.6m contract win with a US firm. The revenue is expected to be recognised in the two coming financial years Dec 2023F and Dec 2024F. I wouldn’t normally write about contract wins if their broker (in this case FinnCap) leaves forecasts unchanged: revenue 2023F £54m and 2024F £59m. I do think there are a couple of interesting angles to this company though.

I last wrote about hVIVO / Open Orphan in June this year. At the time, their broker was only forecasting one year out, despite management claiming a £46m order book, which I suggested wasn’t very encouraging for investors. Then in mid-September hVIVO put out a statement responding to press speculation (presumably this article in The Irish Times) that they were helping the Irish Police (Garda) with their enquiries in a high-profile insider dealing case. At the time, the Board said there were no implications for the hVIVO and confirmed that no employee, executive, director or anyone connected with their company had any involvement. It seems slightly odd to have an insider trading case which doesn’t involve any company insiders, but I imagine that there could be material non-public information from another source (perhaps about awarding HVO a big contract?)

None of that sounds very auspicious. Now, however, FinnCap have published forecasts showing revenue to grow by +60% from 2021A to £59m in 2024F, and the broker expect the company to report a profit in those years. Secondly, the chart is looking interesting, though the shares are down -49% YTD, they have bounced +30% following the contract win announcement. Third, cash represents 21% of the company’s market cap. So, I thought that the company might be worth flagging.

Results: The company put out H1 to June results in September, showing revenue falling -19% to £18.9m. PBT was down -69% to £453K. Worth noting that the p&l benefits from a £900K R&D tax credit, without which the business would have been loss-making. On the positive side, the group had £15.8m of net cash at the end of June. They held a Capital Markets Day for investors in October, sometimes that can be a precursor to raising more money. The cash on the balance sheet makes that unlikely though I think. Company guidance is for c. £50m of revenue in FY Dec 2022F and EBITDA margins of 13-15%. That was implying an H2 weighting of 37%/63% management. A heavy H2 weight could be a precursor to a profit warning but management said that they were confident because they had a stronger order book of signed contracts. The order book has now trebled from H1 last year to £70m at the end of June.

Ownership: Cathal Friel, the charismatic Chairman owns 10% (including Raglan Road Ltd which is a company he controls). Mo Khan, the Chief Exec was appointed Feb this year owns just £55K of shares. His background is Private Equity, I did look at what his share option package was but because he joined the company earlier this year, he wasn’t included in the 2021 Annual Report remuneration section. Presumably, he’s expecting more through the company’s share-based payment scheme.

There’s no institutional ownership, but Liberum were appointed NOMAD earlier this year, so I would imagine that’s a sign that management believes they need to get in front of fund managers. At £79m market cap hVIVO it’s understandable that there are no institutions on the shareholder register. If that’s about to change, then retail investors who can deal in smaller position sizes than professional fund managers could try to jump in ahead of any stakebuilding by larger players.

Valuation: Now we have forecasts the shares are trading on a PER of 16x FY Dec 2023F and 15x the following year. The valuation doesn’t look expensive, 1.4x next years sales, particularly with the cash. This is a company that has been loss-making for most of the last decade, but if forecasts are to be believed, it’s now at a stage where it starts to generate a track record of profits.

Opinion: This does seem to be an example of a company moving from ‘blue sky’ to GARP. The small-cap market sell-off has been brutal over the last 12 months, but it’s important not to become scarred by recent experiences. I like what I see, though haven’t taken a position yet and would still characterise the shares as speculative. If readers have thoughts, do let me know on the chat.

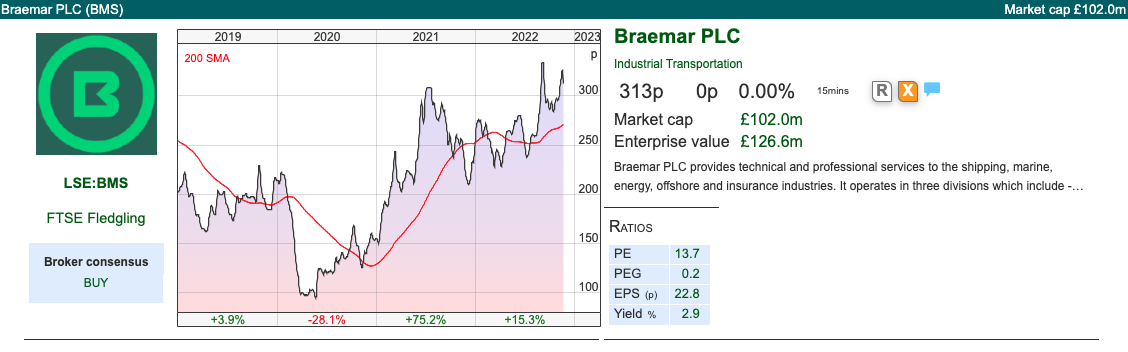

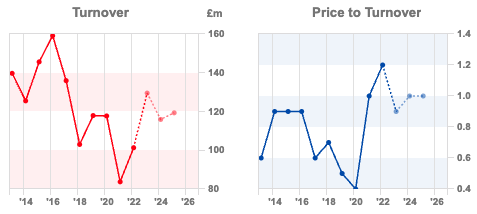

Braemar H1 to end of August

Again, this is a stock that released results earlier this month as no announcements caught my eye on Monday morning, I have decided to circle back and write up results. This shipbroking company announced revenue growth +46% to £69m (or +36% revenue growth in US dollars). Statutory PBT has more than doubled to £10.1m. They are now net cash £1.8m, versus net debt of £15m in August last year. Note the company’s version of net debt excludes £4.9m of acquisition liabilities, including these, net debt stood at £3.1m.

Outlook: Management say that they are on track to double profits in FY Feb 2024, and describe the outlook as ‘very positive’. Some of this is driven by Deep Sea Tankers (a quarter of revenue, growing at +93% versus H1 last year) which has been helped by sanctions-related volatility and Dry Cargo (also a quarter of revenue, growing at +61%) as global trade and supply chains have recovered from congestion bottlenecks last year.

Valuation: The shares are trading on below 10x FY Feb 2023F and 2024F. That’s understandable given that the company has not reported a RoCE of above 10% since 2016. The EBIT margin is forecast to rise to mid-teens level this year and next. This looks a reasonable valuation, but having been a UK banks’ analyst makes me cautious of cyclical stocks with rebounding earnings trading on cheap earnings multiples.

Opinion: With the shares trebling from their pandemic low in April 2020, Braemar now seems to navigate through stormy waters and charting the right course. I have always struggled to explain why Clarkson had done so well over the last couple of decades and Braemar was stuck in the doldrums. Despite the forecast recovery in FY Feb 2023F Braemar revenues to £129m, that’s still below the level achieved in 2012. Shipping is a cyclical industry, so I would need to feel confident that I was not buying the shares just at the wrong point of the cycle.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.