Bruce questions why globalisation has been so bad for the FTSE All Share index versus the S&P500. Plus a look at CMC Markets H1 results.

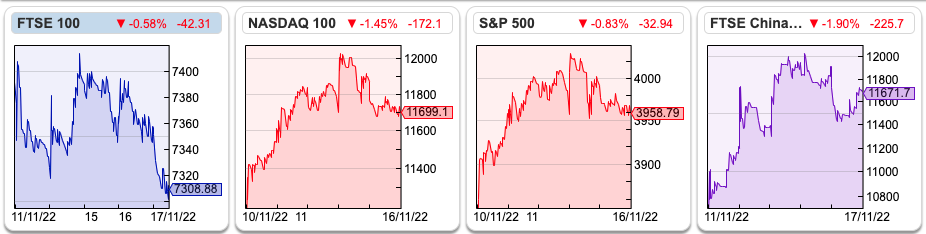

The FTSE 100 was down -0.9% in the last 5 days, at just above 7,300 with some of the selling coming as the new Chancellor announced his plans for tax and spending. The S&P500 and Nasdaq100 sold off by -0.8% and -1.5% following disappointing numbers from retailer Target earlier in the week. The US 10Y bond yield continued to decline from its October peak of 4.25% to 3.8%. The UK 10Y bond yield also fell to 3.14%, versus a peak of 4.5% at the beginning of October.

Unlike the encouraging inflation data coming from the US, the UK Office of National Statistics (ONS) said that inflation is still accelerating here and hit a 41-year high. October inflation hit +11.1%, up from +10.1% in October. Within that food price inflation was up +16.5%, the highest since the mid-1970’s. Sterling has now strengthened to above 1.19 against the dollar, presumably as traders believe that the Bank of England will need to be more hawkish than the Fed.

There’s a lot of bearishness on the UK economy, but it’s worth remembering that the ‘feel good factor’ and expected returns are not correlated. Pre-Iraq War it looked like we had a competent government, Brit Pop and Cool Britannia were in fashion, the only protestors against globalisation lived in Primrose Hill, ate homemade humous* and protested by smashing up MacDonalds on Oxford Street. Vodafone was worth almost £4 per share and making a hostile bid for a German company. The FTSE 100 peaked at 6,930 at the end of 1999. That exuberance meant that it wasn’t a great time to be buying equities, Vodafone is now worth less than £1 again.

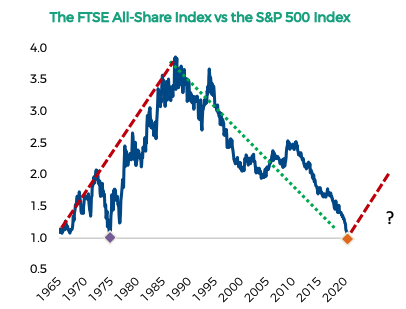

Gervais Williams of Premier Miton put up this chart (below) as part of his presentation at Mello.

He suggested that at a time of de-globalisation and inflation (up until the late 1980s), the FTSE All Share performed better than the S&P 500. He thinks many investors have forgotten this. The question mark on his chart implies we are only at the beginning of what could be a long-term trend of UK market outperformance relative to the US as the world becomes less connected. As an aside, Paul Tucker, ex-bank of England Deputy, has a new book out on fragmentation of globalisation.

I enjoy listening to what fund managers have to say, but like Chief Execs and Central Bankers, they are talking their own book. There’s nothing wrong with that, in History GCSE you used to get a tick on your essay for pointing out the bias in sources. So I’m not going to ignore any source with a bias, but instead will listen, then verify and form a judgement with my own research using Sharepad.

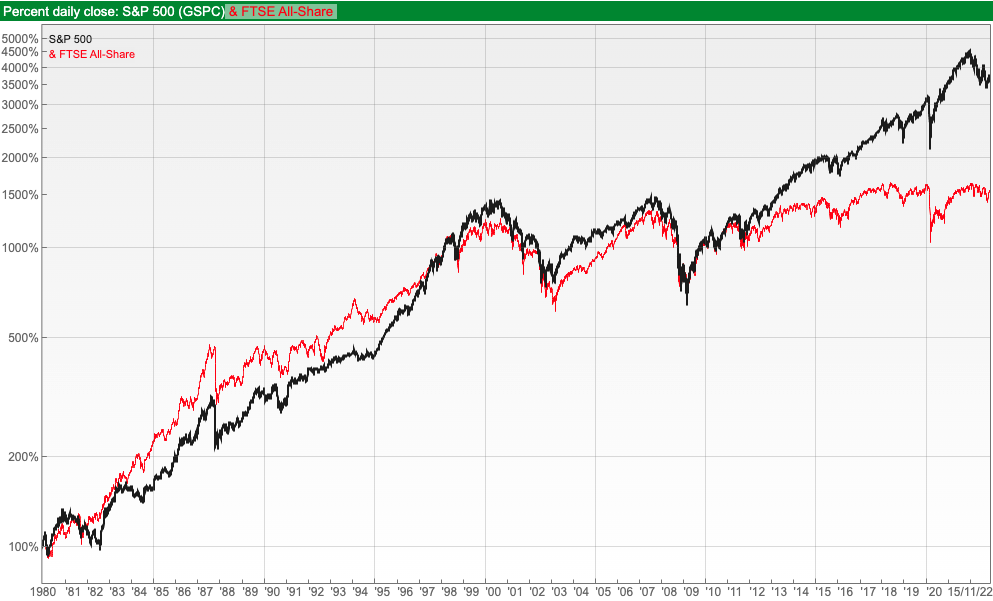

Below is the FTSE All Share relative to the S&P 500 using Sharepad’s multi-graph feature (see below, log scale) going back to 1980.

I was glad to see that the UK index did outperform the US in the 1980s, that wasn’t just pound weakness because in the latter half of the 1980s sterling strengthened against the dollar (from a low of 1.1 in 1985 to back to 2.0 GBP/USD by Dec 1990).

Then the US index was stronger in the 1990s, culminating in the internet bubble. In general, the two indices broadly tracked each other up until 2013, when the FAANGs weighting meant that the S&P began to outperform very strongly. Gervais’ idea that increases in global trade and interconnectedness don’t benefit all stock markets equally strikes me as economic heresy…so he’s probably right.

Fund managers tend to think about big themes like globalisation, demographics, and technology and how it affects their benchmarks, sectors and index performance. I think amateurs are better to concentrate on looking for idiosyncratic companies with high expected returns. Apple, Meta and Amazon probably have benefitted from globalisation more than Vodafone and HSBC. On the other hand, Games Workshop or Judges Scientific are not obvious winners from globalisation, instead, they have been such good performers because of management’s ability to execute successfully in a favourable niche.

I hope everyone enjoyed the physical event at Mello. Below I look at CMC Markets, which is investing to expand outside of its core trading markets.

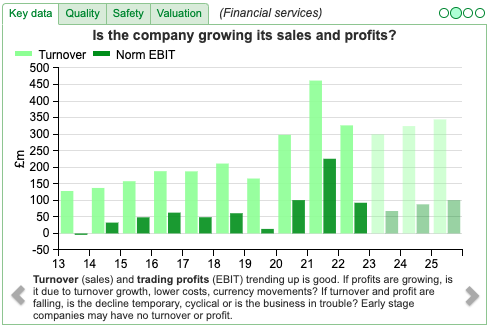

CMC Markets H1 Sept

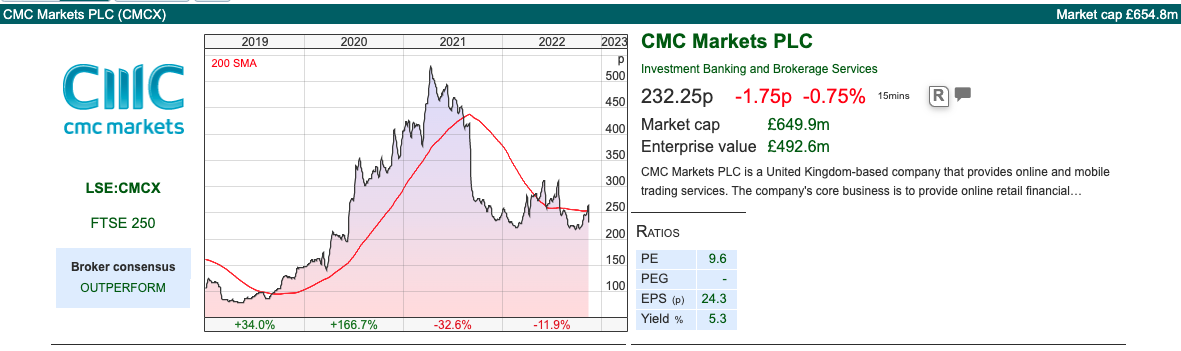

This CFD trading company that enjoyed a huge boost at the beginning of the pandemic followed by a sharp drop-off last year, has announced H1 results to September. Revenue was up +21% to £154m, and statutory PBT was up +1% to £36.6m. Active clients fell -11%, with the number of retail traders up +9% but institutional traders down -17%. However, revenue per client was up +36%.

The reason profits were flat despite the growing revenue environment was operating expenses are +29%. 8% of CMC costs are variable remuneration, however, expenses ex variable remuneration were also up +28%, as they hired more staff, invested in technology and spent more on marketing. So the fixed cost base is not as fixed as might be implied. The shares were down -13% on the day of the RNS.

Cash was down -20% to £141m and own funds held (which includes amounts due from brokers and longer-dated Govt securities, less TTFs which are client balances) were down -22% to £326m. The decline was largely from the dividend paid and £30m share buyback announced in March. At the back of the announcement, there is a prior year restatement of H1 Sept 2021 which reduces H1 last year’s cash from operations down £13m, with the balancing item a reduction in cashflow from investment in intangible assets. They also own around £4m of cryptocurrencies, down from £13m at the end of March, which are held to hedge clients’ trading positions.

Outlook: They say their three-year plan is on track and the cost guidance for FY Mar 2023F of £215m ex variable remuneration remains unchanged. That implies a +24% increase versus FY Mar 2022, but they also talk about some cost increases continuing in FY Mar 2024F. They expect net operating income (revenue less introducer commissions and betting levies) growth of +30% over the next three years. That would be an encouraging result versus the same item in FY Mar 2022 £282m but less impressive than the FY Mar 2021 figure of £410m which benefited from the lockdown online trading boom.

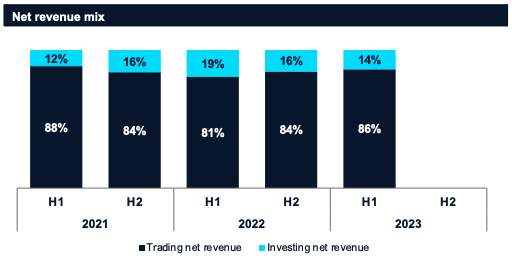

Split: In November last year management announced that they would hold a strategic review looking at possibly separating the business in two. The spread betting/CFD (leveraged) business is finding it harder to grow customer numbers versus the stockbroking (not leveraged) business. The review was expected to conclude in June this year but was delayed to this November. They have now concluded that “shareholder’s interests would be best served by ensuring that both businesses operate within the current Group structure for the time being rather than by pursuing a planned separation at this stage.”

Reading between the lines, I wonder if management extrapolated the strong growth in H1 last year when the Investing division peaked at 19% of net revenue and thought they could split the business. However, Investing has now fallen back to 14% of net revenue, and they mistook a short-term bounce for a trend.

Ownership: The Chief Exec, Lord (Peter) Cruddas, who founded the business in 1989 owns 62% of the shares, Aberforth and Schroders, both with 5% are the only institutions with disclosable stakes. In March the company announced a £30m buyback, which was completed in October with no further buyback announced, and the dividend policy is to pay out half of the profits.

Valuation: Before these results consensus was for top-line growth of +9% to FY March 2024 (in line with the +30% increase over 3 years) and PBT of £91m, implying a +35% increase as investment spend reduced. It sounds like profit expectations are coming down, as management will continue their investment phase into the next financial year.

With that in mind, the shares are trading on 10x Mar 2024F, though EPS may be revised down. I’ve always liked the financials of this business (3 year average RoCE 35.5%, 3 year average EBIT margin 30%) but worried that the business is subject to regulators uncomfortable with the number of clients that lose money.

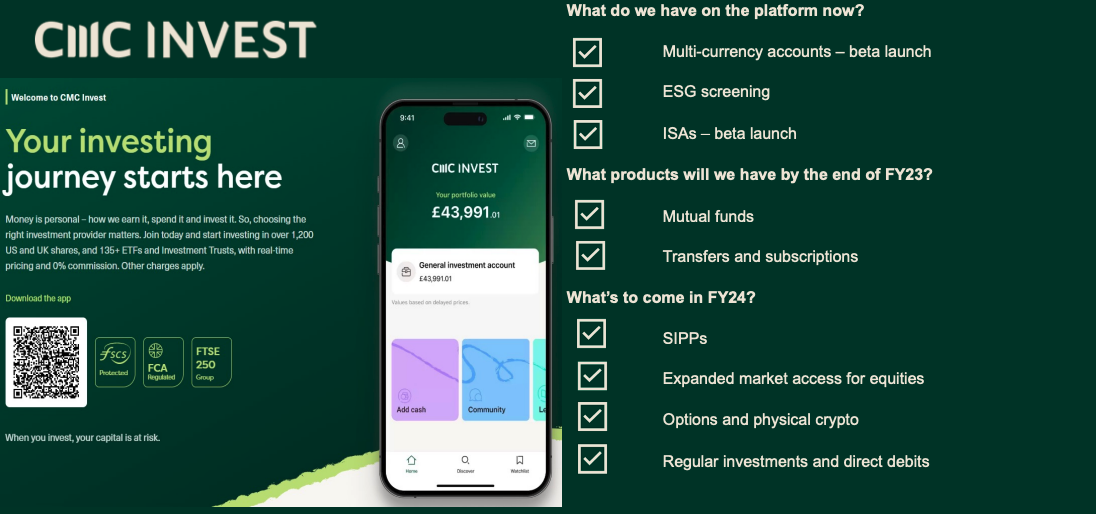

CMC Invest: A trading statement at the beginning of October announced the launch of CMC Invest, which suggests that it is “disrupting the investment industry with greater value and lower fees that do not punish you for growing your wealth.” It offers commission-free trading, and no monthly fees – so presumably is selling the order flow. If any readers use the service, perhaps you could report back in the chat function?

Opinion: CMC is trying to expand out of its core CFD / spread betting business. It looks like they’re trying to do this by appealing to long-term investors rather than traders. I mentioned a few weeks ago that I have tried CFD trading, but I’m not a trader and found the leverage too difficult to manage risk on the short side.

I have no problem paying an £11 commission for a trade – it’s the egregiously wide bid-offer spreads on the quote-driven stocks on AIM that need disrupting. It doesn’t look like CMC Invest is focused on disrupting that problem though.

*I once went on a date with an undercover journalist who had infiltrated the anti-globalisation movement in the 1990s. She told me the protest were organised by rich people living in Primrose Hill with Trust funds, but the most surreal detail was that they made homemade humous for the riot.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 2 | 18/11/22 |CMC |Globalisation and index returns

Bruce questions why globalisation has been so bad for the FTSE All Share index versus the S&P500. Plus a look at CMC Markets H1 results.

The FTSE 100 was down -0.9% in the last 5 days, at just above 7,300 with some of the selling coming as the new Chancellor announced his plans for tax and spending. The S&P500 and Nasdaq100 sold off by -0.8% and -1.5% following disappointing numbers from retailer Target earlier in the week. The US 10Y bond yield continued to decline from its October peak of 4.25% to 3.8%. The UK 10Y bond yield also fell to 3.14%, versus a peak of 4.5% at the beginning of October.

Unlike the encouraging inflation data coming from the US, the UK Office of National Statistics (ONS) said that inflation is still accelerating here and hit a 41-year high. October inflation hit +11.1%, up from +10.1% in October. Within that food price inflation was up +16.5%, the highest since the mid-1970’s. Sterling has now strengthened to above 1.19 against the dollar, presumably as traders believe that the Bank of England will need to be more hawkish than the Fed.

There’s a lot of bearishness on the UK economy, but it’s worth remembering that the ‘feel good factor’ and expected returns are not correlated. Pre-Iraq War it looked like we had a competent government, Brit Pop and Cool Britannia were in fashion, the only protestors against globalisation lived in Primrose Hill, ate homemade humous* and protested by smashing up MacDonalds on Oxford Street. Vodafone was worth almost £4 per share and making a hostile bid for a German company. The FTSE 100 peaked at 6,930 at the end of 1999. That exuberance meant that it wasn’t a great time to be buying equities, Vodafone is now worth less than £1 again.

Gervais Williams of Premier Miton put up this chart (below) as part of his presentation at Mello.

He suggested that at a time of de-globalisation and inflation (up until the late 1980s), the FTSE All Share performed better than the S&P 500. He thinks many investors have forgotten this. The question mark on his chart implies we are only at the beginning of what could be a long-term trend of UK market outperformance relative to the US as the world becomes less connected. As an aside, Paul Tucker, ex-bank of England Deputy, has a new book out on fragmentation of globalisation.

I enjoy listening to what fund managers have to say, but like Chief Execs and Central Bankers, they are talking their own book. There’s nothing wrong with that, in History GCSE you used to get a tick on your essay for pointing out the bias in sources. So I’m not going to ignore any source with a bias, but instead will listen, then verify and form a judgement with my own research using Sharepad.

Below is the FTSE All Share relative to the S&P 500 using Sharepad’s multi-graph feature (see below, log scale) going back to 1980.

I was glad to see that the UK index did outperform the US in the 1980s, that wasn’t just pound weakness because in the latter half of the 1980s sterling strengthened against the dollar (from a low of 1.1 in 1985 to back to 2.0 GBP/USD by Dec 1990).

Then the US index was stronger in the 1990s, culminating in the internet bubble. In general, the two indices broadly tracked each other up until 2013, when the FAANGs weighting meant that the S&P began to outperform very strongly. Gervais’ idea that increases in global trade and interconnectedness don’t benefit all stock markets equally strikes me as economic heresy…so he’s probably right.

Fund managers tend to think about big themes like globalisation, demographics, and technology and how it affects their benchmarks, sectors and index performance. I think amateurs are better to concentrate on looking for idiosyncratic companies with high expected returns. Apple, Meta and Amazon probably have benefitted from globalisation more than Vodafone and HSBC. On the other hand, Games Workshop or Judges Scientific are not obvious winners from globalisation, instead, they have been such good performers because of management’s ability to execute successfully in a favourable niche.

I hope everyone enjoyed the physical event at Mello. Below I look at CMC Markets, which is investing to expand outside of its core trading markets.

CMC Markets H1 Sept

This CFD trading company that enjoyed a huge boost at the beginning of the pandemic followed by a sharp drop-off last year, has announced H1 results to September. Revenue was up +21% to £154m, and statutory PBT was up +1% to £36.6m. Active clients fell -11%, with the number of retail traders up +9% but institutional traders down -17%. However, revenue per client was up +36%.

The reason profits were flat despite the growing revenue environment was operating expenses are +29%. 8% of CMC costs are variable remuneration, however, expenses ex variable remuneration were also up +28%, as they hired more staff, invested in technology and spent more on marketing. So the fixed cost base is not as fixed as might be implied. The shares were down -13% on the day of the RNS.

Cash was down -20% to £141m and own funds held (which includes amounts due from brokers and longer-dated Govt securities, less TTFs which are client balances) were down -22% to £326m. The decline was largely from the dividend paid and £30m share buyback announced in March. At the back of the announcement, there is a prior year restatement of H1 Sept 2021 which reduces H1 last year’s cash from operations down £13m, with the balancing item a reduction in cashflow from investment in intangible assets. They also own around £4m of cryptocurrencies, down from £13m at the end of March, which are held to hedge clients’ trading positions.

Outlook: They say their three-year plan is on track and the cost guidance for FY Mar 2023F of £215m ex variable remuneration remains unchanged. That implies a +24% increase versus FY Mar 2022, but they also talk about some cost increases continuing in FY Mar 2024F. They expect net operating income (revenue less introducer commissions and betting levies) growth of +30% over the next three years. That would be an encouraging result versus the same item in FY Mar 2022 £282m but less impressive than the FY Mar 2021 figure of £410m which benefited from the lockdown online trading boom.

Split: In November last year management announced that they would hold a strategic review looking at possibly separating the business in two. The spread betting/CFD (leveraged) business is finding it harder to grow customer numbers versus the stockbroking (not leveraged) business. The review was expected to conclude in June this year but was delayed to this November. They have now concluded that “shareholder’s interests would be best served by ensuring that both businesses operate within the current Group structure for the time being rather than by pursuing a planned separation at this stage.”

Reading between the lines, I wonder if management extrapolated the strong growth in H1 last year when the Investing division peaked at 19% of net revenue and thought they could split the business. However, Investing has now fallen back to 14% of net revenue, and they mistook a short-term bounce for a trend.

Ownership: The Chief Exec, Lord (Peter) Cruddas, who founded the business in 1989 owns 62% of the shares, Aberforth and Schroders, both with 5% are the only institutions with disclosable stakes. In March the company announced a £30m buyback, which was completed in October with no further buyback announced, and the dividend policy is to pay out half of the profits.

Valuation: Before these results consensus was for top-line growth of +9% to FY March 2024 (in line with the +30% increase over 3 years) and PBT of £91m, implying a +35% increase as investment spend reduced. It sounds like profit expectations are coming down, as management will continue their investment phase into the next financial year.

With that in mind, the shares are trading on 10x Mar 2024F, though EPS may be revised down. I’ve always liked the financials of this business (3 year average RoCE 35.5%, 3 year average EBIT margin 30%) but worried that the business is subject to regulators uncomfortable with the number of clients that lose money.

CMC Invest: A trading statement at the beginning of October announced the launch of CMC Invest, which suggests that it is “disrupting the investment industry with greater value and lower fees that do not punish you for growing your wealth.” It offers commission-free trading, and no monthly fees – so presumably is selling the order flow. If any readers use the service, perhaps you could report back in the chat function?

Opinion: CMC is trying to expand out of its core CFD / spread betting business. It looks like they’re trying to do this by appealing to long-term investors rather than traders. I mentioned a few weeks ago that I have tried CFD trading, but I’m not a trader and found the leverage too difficult to manage risk on the short side.

I have no problem paying an £11 commission for a trade – it’s the egregiously wide bid-offer spreads on the quote-driven stocks on AIM that need disrupting. It doesn’t look like CMC Invest is focused on disrupting that problem though.

*I once went on a date with an undercover journalist who had infiltrated the anti-globalisation movement in the 1990s. She told me the protest were organised by rich people living in Primrose Hill with Trust funds, but the most surreal detail was that they made homemade humous for the riot.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.