With the pound falling by -14% so far this year against the dollar, Bruce looks at two companies that help SME businesses manage currency risk: AFX and EQLS. Plus payments company PCIP.

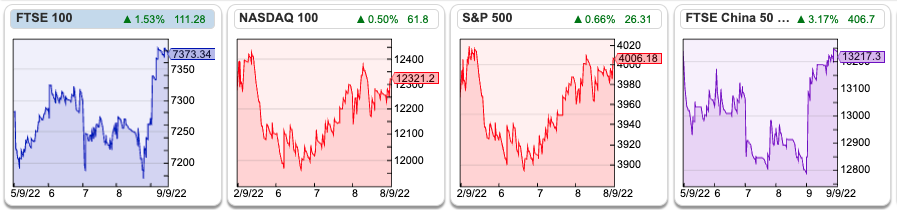

The FTSE was up +1.3% at 7373 last week, with power and commodity companies leading the way Centrica, Glencore, Antofagasta and Anglo American were all up between +8% and +10%. The S&P500 rose +2.1%, slightly ahead of the Nasdaq100 +1.8%. The Natural Gas contract (NG-MT) was down -11%, though has still more than doubled since the start of the year.

Last week the Bank of England Governor Andrew Bailey appeared in front of the Treasury Select Committee to answer questions on UK inflation and interest rate rises. The Governor and his Chief Economist, Huw Pill, were repeatedly asked about the government’s £150bn rescue package to keep energy bills down. In the short term, the BoE officials suggested that capping energy bills would help get inflation back under control (though probably still at double-digit rates in July 2023). According to the FT, UK interest rates are expected to rise from 1.75% currently to 3.0% by the end of this year. Longer term the combination of tax cuts and increased Govt borrowing to fund public expenditure could lead to higher inflation; in turn that would lead to the BoE setting higher interest rates.

The UK Government 10-year bond yield (UKTSY10 on Sharepad) has now risen to 3.15% versus 1.0% at the start of this year. There’s talk about windfall profits on energy companies, however, if UK banks can get away with paying just 0.20% on customer deposits and buy ‘risk free’ UK government bonds yielding above 3%, then their net interest margins are going to expand. Lloyds Bank has already raised RoE guidance from 10% at the start of the year to 13%. The risk is, of course, that if interest rates rise, this might lead to rising bad debts on credit cards or their mortgage book. So far though Lloyds management have guided to improving credit quality at their half-year results (FY 2022F bad debt impairments should be better than 20bp on their loan book, the bank said). The scenario also depends on customers keeping their money in bank accounts. In that respect, low consumer confidence and falling equity markets are probably helpful for banks, because it means that savings don’t leave bank accounts in favour of investing in the stock market.

I have been cautiously sitting on a large cash position. AIM is down -29% YTD, so that position has protected me from the market falls. Longer term though I want to be fully invested, as it seems likely inflation will erode the value of cash, when real savings rates (that is interest rates minus inflation) are so negative.

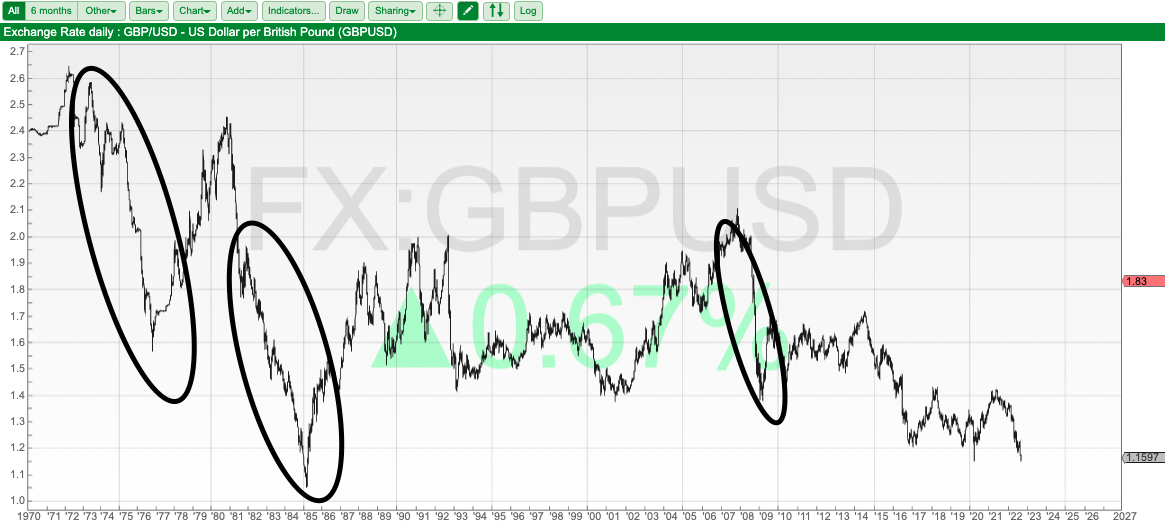

The other area to watch is currency markets, with the pound down -14% YTD versus the dollar, though only -3% YTD versus the Euro. Sharepad has the foreign exchange rate on cable (GBP/USD) going back to 1970.

During the mid-1970s secondary banking crisis (when the UK needed to be bailed out by the IMF) the exchange rate fell to 1.55 to the dollar, then went on to recover in the second half of the decade. The early years of the Thatcher government then saw another precipitous decline from above 2.4 to a nadir that was close to parity with the US dollar at the time of the Miners’ Strike. The FTSE 100 index was introduced at the beginning of 1984 and rose from 1,000 to peak at just below 7,000 at the beginning of the year 2000, so the correlation between a weak pound and a strong stock market wasn’t true in the second half of the 1980s or 1990s.

In the short term, inflation and interest rate expectations drive currencies. Longer-term economists are as baffled as everyone else, except to say that productivity (which economists don’t understand either) seems to drive both currency strength and stock market indices.

This week I look at results from Alpha FX and Equals, which both help SMEs manage their currency exposure and risks. Both of these are growing revenue very strongly: +35% and +86% respectively – it’s worth remembering that they are likely to be benefiting from the volatility in the currency markets. Plus an update from PCI-PAL, the payments company which allows consumers to give their credit card details over the phone securely.

Alpha FX H1 results June

This foreign exchange risk management company (ticker AFX) not to be confused with Alpha Financial Markets Consulting (ticker AFM) reported H1 results to the end of June. Group revenue was up +35% to £46m and reported PBT was up +16% to £18m, in line with the group’s trading update in July. The profit margin was down but still very healthy at 39% (v 45% H1 2021). The group reported £98m of net cash.

Outlook: Currency trading companies have been benefiting from recent volatility in markets, with Argentex reporting FY March revenues +23% and Equals (see below) reporting H1 to June revenues up +86%. AFX says trading has remained strong in H2 across both FX Risk Management (70% of revenue, growing at +31%) and Alternative Banking Solutions (30% of revenue, growing at +47%).

History: Alpha FX was founded in 2010 to help corporates manage their exchange rate risk. AFX provides a currency risk management service that seeks to help corporates decide when, how much, and how far forward to buy currency. The group listed on AIM in April 2017 with a placing at 196p, raising £12m and valuing the company at £64m market cap. The Admission Document lists ASOS, Holland & Barrett and Global Data as clients.

Like AGFX they operate as a matched principal meaning that when they execute a trade (either spot or forward contract) for a corporate, that trade is immediately offset by a transaction with a banking counterparty (often Lloyds Bank). I think that this means that the group needs to operate with considerable cash resources in order to facilitate trades, hence the £98m of net cash that they report could not be distributed to shareholders without affecting the business model. The Admission Document specifically mentions that proceeds raised will be used to provide collateral in order to expand the forward FX book and last week’s RNS says that will continue to increase. The group has 4 regulatory licences with the UK FCA and 2 with the Malta FSA.

Shareholders: The founder and Chief Executive, Morgan Tillbrook still owns 16% of the shares. Liontrust AM owns 11.4%, Jupiter 7.5% and JP Morgan AM 5% and Soros FM 3.7%.

Valuation: The shares are not cheap on 7x FY 2023F revenue and 26x PER. That rich valuation seems justifiable though given Sharepad’s quality metrics (EBIT margin greater than 40%) and impressive track record of growth and profitability (3-year avg RoCE 24%, rising to above 30% most recently reported).

Opinion: All of the currency traders (WISE, AGFX, EQLS and AFX) seem to be enjoying a favourable tailwind at the moment. Theoretically, this sector shouldn’t exist if universal banks like Lloyds, Barclays and NatWest looked after their SME customers. I do wonder if at some point we will see a response from the banks, but these forex specialists have been going for a decade and AFX’ track record has been particularly impressive.

Equals H1 results June

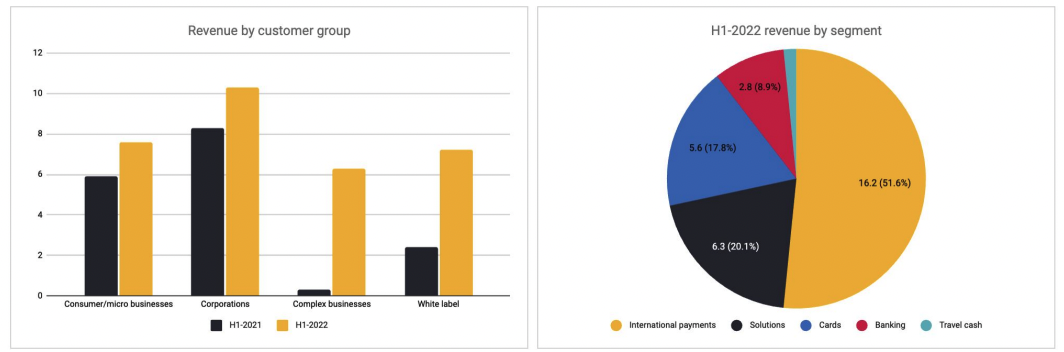

Equals operate in a similar space to AFX and announced H1 results and a trading update to 5 Sept. Revenue was +86% to £31.4m H1 to June.

Gross profit was +44% to £14.9m and statutory PBT was £0.9m (v a £2.2m loss H1 last year). That’s the first time they’ve reported a statutory PBT and positive EPS since 2018. On an after-tax basis, the group benefits from prior year tax losses plus R&D tax credits, so profit after tax was £848K.

Cash at bank was £16.5m up +63% and they repaid in full a £1.8m CBILS loan this August. One other figure that the company points to is that customers are loading pre-paid cards with cash deposits. Currently, that’s growing at +55% from a low base (less than £1m), and I would imagine that Equals is not paying interest on those sums. That seems fair enough when Bank of England rates are 0.25%, but as we see interest rates rise and customers pre-fund larger balances, that could turn into a valuable source of ‘free float’.

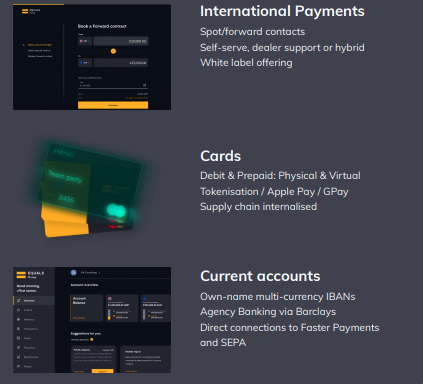

Like AFX and AGFX Equals offers spot/forward trading and dealer support. They also offer pre-paid cards and current accounts which other FinTechs offer, but they say no one else is offering all three products to SMEs on a unified platform.

Equals say that they are differentiated from high street banks because they can provide customers with a multi-currency account with a unique IBAN number. Banks can only provide one account per currency, each with a unique IBAN, which is more clunky. Having one IBAN for all currencies enables a customer to provide one single account identifier to all its customers and suppliers, thereby simplifying both sales and procurement processes.

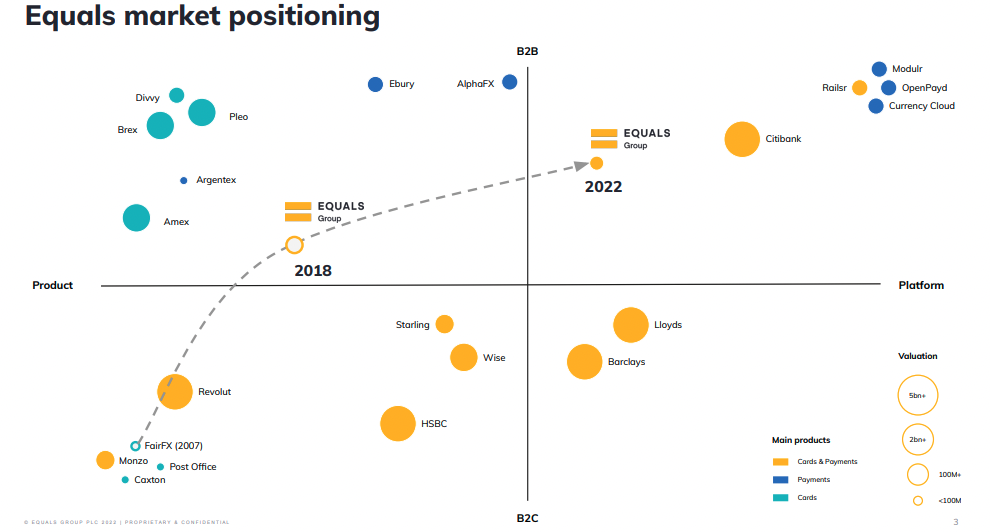

That said, I think this is an advantage versus banks, but I’m not sure that this is a superior product to other FinTechs. The company did put up this slide when they presented on InvestorMeetCompany, showing their positioning versus the competition. The chart shows that EQLS has gone from a single product b2c company to a ‘platform’ business, serving b2b customers.

Management talked about potential acquisition opportunities. Historically they have acquired small FX firms for their trading book of business, but suggest that given the sell-off in FinTech, there might be opportunities to buy technology or expertise, which they could then add to their existing client base.

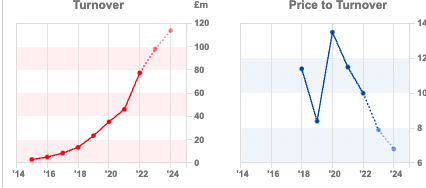

Outlook: Revenue from July to 5 September 2022 was £13.3 million, a +55% increase on the same period in 2021. The FY guidance remains ‘in-line’ and +86% growth achieved in H1 was going to slow at some point. Sharepad shows revenue forecasts of £65m (which implies +47% FY v FY growth, though given the very strong first half that means H2 v H2 would by implication slow to +24%). Hence, it seems likely we see the company beat FY 2022F expectations.

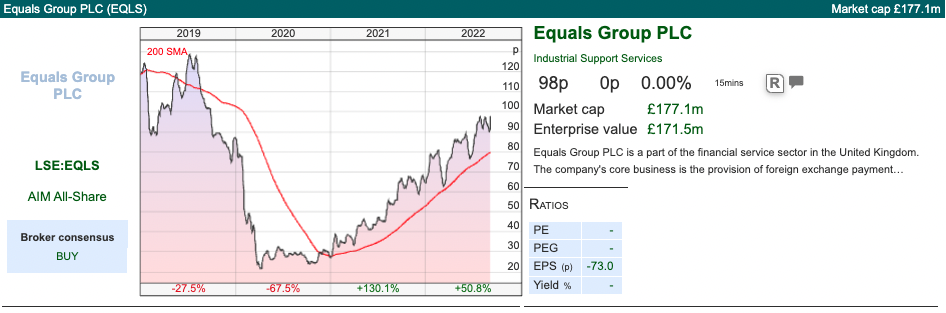

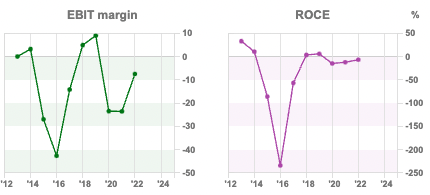

That said, EQLS impressive revenue growth is not matched by its track record of profitability, with 3 years of losses between 2019 and 2021.

Valuation: The more patchy track record means that Equals trades on a lower price/revenue multiple 2.3x FY 2023F and a PER 16x FY 2023F despite delivering higher growth. The broker forecasts of 2023F of £77m revenue and £15m PBT, imply a profit margin of 19%, suggesting that now EQLS has reached break even, the economics could be more attractive in the future.

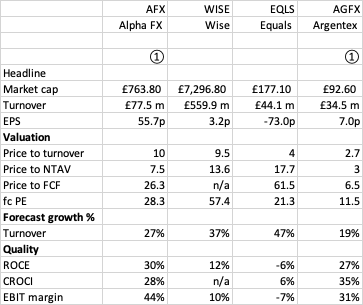

Opinion: I like this sector, but have invested in AGFX, because of the cheaper valuation. Below is a table comparing AFX, WISE, EQLS and AGFX that I have downloaded from Sharepad into Excel, which gives a good summary.

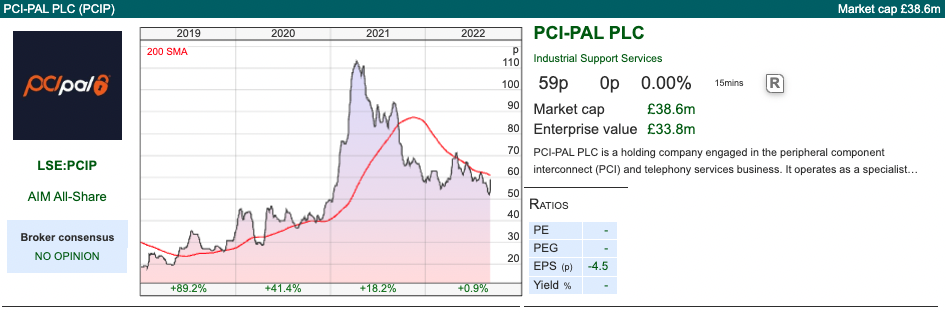

PCI-PAL FY results June

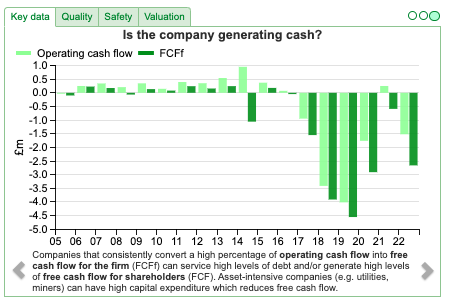

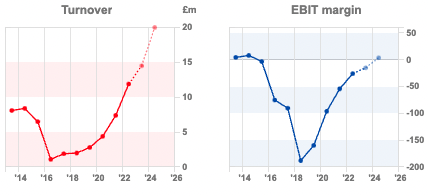

This Ipswich-based payments company announced FY revenues +62% to £12m and a gross margin of 84% (improved on last year’s 75% level). The business is still loss-making, reporting a FY June £3.1m loss before tax. Revenues were in line with the company’s trading update in July, and adjusted loss (excludes exceptional and share option charge) was ahead of previous guidance at £2.02m (v £2.9m loss in their July guidance). Having raised money last year, the group has £5.9m of cash and no debt (down from £7.5m a year ago).

The technology allows companies to securely take payment data over the phone or in a ‘webchat’ (using a URL that opens in a different browser window). There’s a 2 min demo video here. This means that the call centre worker doesn’t see the customer’s payment data or credit card details.

Court case: There’s a legal dispute where a competitor, Sycurio (previously known as Semafone), has accused them of patent infringement. PCI PAL spent £80K during the period on legal costs. Last week’s RNS said that a court hearing has been scheduled for June 2023 in the UK with the court proceedings expected to begin in the US in mid-2024. PCI-PAL management says that they haven’t infringed on Sycurio patents and so they haven’t taken a provision for anticipated future legal costs. To date they have spent £800K on legal costs, and estimate a £3.7m total cost to fight the claim (ie £2.9m still to be incurred in future). Again there is an InvestorMeetCompany video with Q&A.

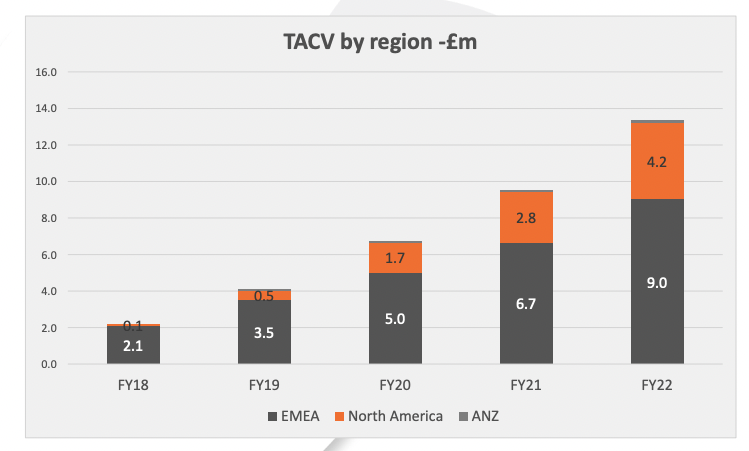

Outlook: they say that current trading is in-line with management expectations. Since the year-end they have signed two deals: i) a US-focused retailer with 1,500 stores and ii) international food and drink company in the UK. One thing to note is that though the business is small, it is genuinely global, growing fast in both North America and Europe, the Middle East, and Asia (EMEA).

TACV stands for total annual recurring revenue of all signed contracts, whether invoiced and included in deferred revenue or still to be deployed and/or not yet invoiced. The company says that this is a key indicator of future cash flow and stands at £13.m, +40% on the previous year.

Forecasts: FinnCap has forecast revenue almost doubling in two years’ time to £20m FY June 2024F, and adj PBT of £700K that year. That gives adj EPS of 1.3p, so a PER of 45x Jun 2024F.

Valuation: The history of losses and high PER valuation may put some investors off. Relatively fixed costs on a growing revenue base (ie operational gearing) could be exciting though. Perhaps price/revenue 3.6x FY Jun 2022 sales, dropping to 2.1x FY Jun 2024F might be a better way of looking at the company than the low level of earnings two years out.

Opinion: This is a tricky one. Fast growth, operational gearing, and recurring revenues tick many boxes, but the court case adds considerable uncertainty. The shares have changed hands at over 110p earlier this year, suggesting some investors see lots of upside in the story. I’m going to follow progress, but don’t feel this is the kind of market to be chasing something as uncertain. Hopefully, from here they can fund growth internally so they won’t need to raise money again but at the moment I don’t think we can rule that out completely.

Notes

The author owns shares in AGFX

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 12/09/22 |AFX, EQLS, PCIP|Interest by the pound

With the pound falling by -14% so far this year against the dollar, Bruce looks at two companies that help SME businesses manage currency risk: AFX and EQLS. Plus payments company PCIP.

The FTSE was up +1.3% at 7373 last week, with power and commodity companies leading the way Centrica, Glencore, Antofagasta and Anglo American were all up between +8% and +10%. The S&P500 rose +2.1%, slightly ahead of the Nasdaq100 +1.8%. The Natural Gas contract (NG-MT) was down -11%, though has still more than doubled since the start of the year.

Last week the Bank of England Governor Andrew Bailey appeared in front of the Treasury Select Committee to answer questions on UK inflation and interest rate rises. The Governor and his Chief Economist, Huw Pill, were repeatedly asked about the government’s £150bn rescue package to keep energy bills down. In the short term, the BoE officials suggested that capping energy bills would help get inflation back under control (though probably still at double-digit rates in July 2023). According to the FT, UK interest rates are expected to rise from 1.75% currently to 3.0% by the end of this year. Longer term the combination of tax cuts and increased Govt borrowing to fund public expenditure could lead to higher inflation; in turn that would lead to the BoE setting higher interest rates.

The UK Government 10-year bond yield (UKTSY10 on Sharepad) has now risen to 3.15% versus 1.0% at the start of this year. There’s talk about windfall profits on energy companies, however, if UK banks can get away with paying just 0.20% on customer deposits and buy ‘risk free’ UK government bonds yielding above 3%, then their net interest margins are going to expand. Lloyds Bank has already raised RoE guidance from 10% at the start of the year to 13%. The risk is, of course, that if interest rates rise, this might lead to rising bad debts on credit cards or their mortgage book. So far though Lloyds management have guided to improving credit quality at their half-year results (FY 2022F bad debt impairments should be better than 20bp on their loan book, the bank said). The scenario also depends on customers keeping their money in bank accounts. In that respect, low consumer confidence and falling equity markets are probably helpful for banks, because it means that savings don’t leave bank accounts in favour of investing in the stock market.

I have been cautiously sitting on a large cash position. AIM is down -29% YTD, so that position has protected me from the market falls. Longer term though I want to be fully invested, as it seems likely inflation will erode the value of cash, when real savings rates (that is interest rates minus inflation) are so negative.

The other area to watch is currency markets, with the pound down -14% YTD versus the dollar, though only -3% YTD versus the Euro. Sharepad has the foreign exchange rate on cable (GBP/USD) going back to 1970.

During the mid-1970s secondary banking crisis (when the UK needed to be bailed out by the IMF) the exchange rate fell to 1.55 to the dollar, then went on to recover in the second half of the decade. The early years of the Thatcher government then saw another precipitous decline from above 2.4 to a nadir that was close to parity with the US dollar at the time of the Miners’ Strike. The FTSE 100 index was introduced at the beginning of 1984 and rose from 1,000 to peak at just below 7,000 at the beginning of the year 2000, so the correlation between a weak pound and a strong stock market wasn’t true in the second half of the 1980s or 1990s.

In the short term, inflation and interest rate expectations drive currencies. Longer-term economists are as baffled as everyone else, except to say that productivity (which economists don’t understand either) seems to drive both currency strength and stock market indices.

This week I look at results from Alpha FX and Equals, which both help SMEs manage their currency exposure and risks. Both of these are growing revenue very strongly: +35% and +86% respectively – it’s worth remembering that they are likely to be benefiting from the volatility in the currency markets. Plus an update from PCI-PAL, the payments company which allows consumers to give their credit card details over the phone securely.

Alpha FX H1 results June

This foreign exchange risk management company (ticker AFX) not to be confused with Alpha Financial Markets Consulting (ticker AFM) reported H1 results to the end of June. Group revenue was up +35% to £46m and reported PBT was up +16% to £18m, in line with the group’s trading update in July. The profit margin was down but still very healthy at 39% (v 45% H1 2021). The group reported £98m of net cash.

Outlook: Currency trading companies have been benefiting from recent volatility in markets, with Argentex reporting FY March revenues +23% and Equals (see below) reporting H1 to June revenues up +86%. AFX says trading has remained strong in H2 across both FX Risk Management (70% of revenue, growing at +31%) and Alternative Banking Solutions (30% of revenue, growing at +47%).

History: Alpha FX was founded in 2010 to help corporates manage their exchange rate risk. AFX provides a currency risk management service that seeks to help corporates decide when, how much, and how far forward to buy currency. The group listed on AIM in April 2017 with a placing at 196p, raising £12m and valuing the company at £64m market cap. The Admission Document lists ASOS, Holland & Barrett and Global Data as clients.

Like AGFX they operate as a matched principal meaning that when they execute a trade (either spot or forward contract) for a corporate, that trade is immediately offset by a transaction with a banking counterparty (often Lloyds Bank). I think that this means that the group needs to operate with considerable cash resources in order to facilitate trades, hence the £98m of net cash that they report could not be distributed to shareholders without affecting the business model. The Admission Document specifically mentions that proceeds raised will be used to provide collateral in order to expand the forward FX book and last week’s RNS says that will continue to increase. The group has 4 regulatory licences with the UK FCA and 2 with the Malta FSA.

Shareholders: The founder and Chief Executive, Morgan Tillbrook still owns 16% of the shares. Liontrust AM owns 11.4%, Jupiter 7.5% and JP Morgan AM 5% and Soros FM 3.7%.

Valuation: The shares are not cheap on 7x FY 2023F revenue and 26x PER. That rich valuation seems justifiable though given Sharepad’s quality metrics (EBIT margin greater than 40%) and impressive track record of growth and profitability (3-year avg RoCE 24%, rising to above 30% most recently reported).

Opinion: All of the currency traders (WISE, AGFX, EQLS and AFX) seem to be enjoying a favourable tailwind at the moment. Theoretically, this sector shouldn’t exist if universal banks like Lloyds, Barclays and NatWest looked after their SME customers. I do wonder if at some point we will see a response from the banks, but these forex specialists have been going for a decade and AFX’ track record has been particularly impressive.

Equals H1 results June

Equals operate in a similar space to AFX and announced H1 results and a trading update to 5 Sept. Revenue was +86% to £31.4m H1 to June.

Gross profit was +44% to £14.9m and statutory PBT was £0.9m (v a £2.2m loss H1 last year). That’s the first time they’ve reported a statutory PBT and positive EPS since 2018. On an after-tax basis, the group benefits from prior year tax losses plus R&D tax credits, so profit after tax was £848K.

Cash at bank was £16.5m up +63% and they repaid in full a £1.8m CBILS loan this August. One other figure that the company points to is that customers are loading pre-paid cards with cash deposits. Currently, that’s growing at +55% from a low base (less than £1m), and I would imagine that Equals is not paying interest on those sums. That seems fair enough when Bank of England rates are 0.25%, but as we see interest rates rise and customers pre-fund larger balances, that could turn into a valuable source of ‘free float’.

Like AFX and AGFX Equals offers spot/forward trading and dealer support. They also offer pre-paid cards and current accounts which other FinTechs offer, but they say no one else is offering all three products to SMEs on a unified platform.

Equals say that they are differentiated from high street banks because they can provide customers with a multi-currency account with a unique IBAN number. Banks can only provide one account per currency, each with a unique IBAN, which is more clunky. Having one IBAN for all currencies enables a customer to provide one single account identifier to all its customers and suppliers, thereby simplifying both sales and procurement processes.

That said, I think this is an advantage versus banks, but I’m not sure that this is a superior product to other FinTechs. The company did put up this slide when they presented on InvestorMeetCompany, showing their positioning versus the competition. The chart shows that EQLS has gone from a single product b2c company to a ‘platform’ business, serving b2b customers.

Management talked about potential acquisition opportunities. Historically they have acquired small FX firms for their trading book of business, but suggest that given the sell-off in FinTech, there might be opportunities to buy technology or expertise, which they could then add to their existing client base.

Outlook: Revenue from July to 5 September 2022 was £13.3 million, a +55% increase on the same period in 2021. The FY guidance remains ‘in-line’ and +86% growth achieved in H1 was going to slow at some point. Sharepad shows revenue forecasts of £65m (which implies +47% FY v FY growth, though given the very strong first half that means H2 v H2 would by implication slow to +24%). Hence, it seems likely we see the company beat FY 2022F expectations.

That said, EQLS impressive revenue growth is not matched by its track record of profitability, with 3 years of losses between 2019 and 2021.

Valuation: The more patchy track record means that Equals trades on a lower price/revenue multiple 2.3x FY 2023F and a PER 16x FY 2023F despite delivering higher growth. The broker forecasts of 2023F of £77m revenue and £15m PBT, imply a profit margin of 19%, suggesting that now EQLS has reached break even, the economics could be more attractive in the future.

Opinion: I like this sector, but have invested in AGFX, because of the cheaper valuation. Below is a table comparing AFX, WISE, EQLS and AGFX that I have downloaded from Sharepad into Excel, which gives a good summary.

PCI-PAL FY results June

This Ipswich-based payments company announced FY revenues +62% to £12m and a gross margin of 84% (improved on last year’s 75% level). The business is still loss-making, reporting a FY June £3.1m loss before tax. Revenues were in line with the company’s trading update in July, and adjusted loss (excludes exceptional and share option charge) was ahead of previous guidance at £2.02m (v £2.9m loss in their July guidance). Having raised money last year, the group has £5.9m of cash and no debt (down from £7.5m a year ago).

The technology allows companies to securely take payment data over the phone or in a ‘webchat’ (using a URL that opens in a different browser window). There’s a 2 min demo video here. This means that the call centre worker doesn’t see the customer’s payment data or credit card details.

Court case: There’s a legal dispute where a competitor, Sycurio (previously known as Semafone), has accused them of patent infringement. PCI PAL spent £80K during the period on legal costs. Last week’s RNS said that a court hearing has been scheduled for June 2023 in the UK with the court proceedings expected to begin in the US in mid-2024. PCI-PAL management says that they haven’t infringed on Sycurio patents and so they haven’t taken a provision for anticipated future legal costs. To date they have spent £800K on legal costs, and estimate a £3.7m total cost to fight the claim (ie £2.9m still to be incurred in future). Again there is an InvestorMeetCompany video with Q&A.

Outlook: they say that current trading is in-line with management expectations. Since the year-end they have signed two deals: i) a US-focused retailer with 1,500 stores and ii) international food and drink company in the UK. One thing to note is that though the business is small, it is genuinely global, growing fast in both North America and Europe, the Middle East, and Asia (EMEA).

TACV stands for total annual recurring revenue of all signed contracts, whether invoiced and included in deferred revenue or still to be deployed and/or not yet invoiced. The company says that this is a key indicator of future cash flow and stands at £13.m, +40% on the previous year.

Forecasts: FinnCap has forecast revenue almost doubling in two years’ time to £20m FY June 2024F, and adj PBT of £700K that year. That gives adj EPS of 1.3p, so a PER of 45x Jun 2024F.

Valuation: The history of losses and high PER valuation may put some investors off. Relatively fixed costs on a growing revenue base (ie operational gearing) could be exciting though. Perhaps price/revenue 3.6x FY Jun 2022 sales, dropping to 2.1x FY Jun 2024F might be a better way of looking at the company than the low level of earnings two years out.

Opinion: This is a tricky one. Fast growth, operational gearing, and recurring revenues tick many boxes, but the court case adds considerable uncertainty. The shares have changed hands at over 110p earlier this year, suggesting some investors see lots of upside in the story. I’m going to follow progress, but don’t feel this is the kind of market to be chasing something as uncertain. Hopefully, from here they can fund growth internally so they won’t need to raise money again but at the moment I don’t think we can rule that out completely.

Notes

The author owns shares in AGFX

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.