Bruce looks at Dan McCrum’s book on Wirecard and suggests that there are still a couple of details that don’t make sense about the fraud. Plus upbeat releases from STEM, K3C and REC.

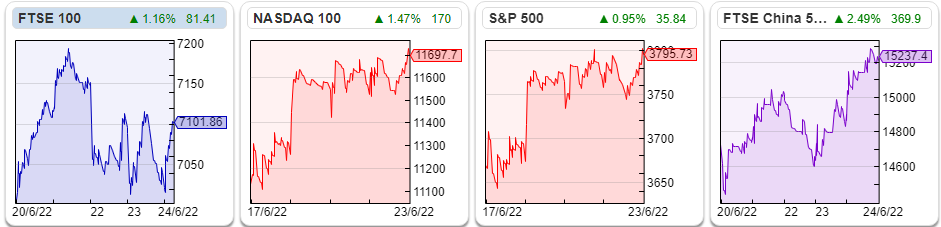

The FTSE 100 recovered +1.2% to 7,101 last week. The Nasdaq100 and S&P500 were up 0.9% and flat over the last 5 days. The US 10y bond yield fell back to 3.08%, down from 3.45% in mid-June, helped by a steep fall in the price of oil back to $108 per barrel for Brent Crude, the most traded contract.

I have just finished reading Dan McCrum’s book on Wirecard, the failed Munich-based ‘FinTech’. At one stage German prosecutors opened a criminal investigation into Dan’s FT articles. He was later exonerated when Ernst & Young admitted that they couldn’t find Eu1.9bn of cash.

A couple of interesting points stand out to me about Wirecard. First, Jan Marsalek, the COO who fled on a private jet to Minsk in 2020 when the auditors eventually refused to sign off on the accounts, was incompetent from the start. Marsalek was supposedly managing a project to upgrade Wirecard’s predecessor’s IT system, and dutifully ticked off milestones achieved. When the then Chief Executive (before Markus Braun arrived) asked for a demonstration, Marsalek demurred, saying: “that’s not necessary”. Bit by bit the CEO began to panic – eventually, Marsalek came clean. The Austrian admitted that he had lied and the project was a mess. There were only scattered pieces of code that didn’t work.

Most people would be fired for this, instead, Marsalek was promoted to Chief Operating Officer. The unwritten implication is that for some reason Marsalek was indispensable to Wirecard management, despite being incompetent and dishonest.

The other aspect is that there were two separate short theses i) there was no cash and management were lying ii) the cash and the profits were real, but Wirecard was money laundering.

Until May 2020, Ernst & Young, Wirecard’s auditors, said the cash was there, Dan knew it wasn’t. I found Dan’s 2015 articles on Wirecard confusing. His writing lacked clarity because he couldn’t spell out why he knew that the cash was missing; he had an internal source that he needed to protect.

Later Zatara and Shadowfall (Matt Earl and Fraser Perring – and a mysterious third person who remains in the shadows) published the second short thesis. The cash was there, but the German payments company was using shell companies to disguise transactions. Wirecard was facilitating gambling, buying ammunition, porn, drugs and money laundering. That is the profits were real, but the cash came from circumventing Visa and Mastercard’s policies. At the time I spoke to people in the payments industry, who thought that this was the best explanation for Wirecard’s scandal-tainted success.

So I, along with Zatara and Shadowfall, was wrong. Wirecard was a clear fraud with profits overstated and Eu1.9bn of missing cash. The second thesis was also true though. Wirecard were using shell companies to circumvent Visa and Mastercard’s policies. They also did a lot of ‘high-risk’ payments. Fahmi Quadir, another short-seller drove to Wirecard’s office in Pennsylvania, where a salesman told her that she could fill in Know Your Customer documents, then Wirecard would give her pre-paid cards with up to $150,000 loaded on them. Ray Akhavan*, a Wirecard business partner who set up ‘Uber for Weed’ has been sentenced to 2.5 years in prison. When Akhavan was arrested in March 2020, a Wirecard salesman showed up to pay his bail. So Wirecard was money laundering drug payments, but facilitating this business did not generate enough margin for the payments processor to report high profitability.

Over the coming months, as interest rates rise and the tide goes out, I think we could see more of this. We may see some businesses where management are flat out lying about the cash and profits. I suspect that we will see more of the second type though. Barely profitable companies doing high-risk activities that have flawed business models. There are likely some names in the adtech and cryptocurrency space. Possibly hydrogen fuel cells or other hyped areas too. Maybe we need a name for this because it’s not out-and-out lying, fraud in the traditional sense. As a conflation of flawed, fraud, and law….I suggest flawed.

This week I haven’t commented on WINE -76% YTD or DDDD -70% releases. I think companies like these are best avoided at the moment. Instead, I look at Sthree, the recruitment business that specialises in roles that require Science or Engineering backgrounds. Plus K3 Capital the professional services firm and Record the currency fund manager. All three companies released upbeat results (the first two raising expectations). In these markets, it is easy to become very ‘top down’. Better to follow closely what numbers companies are actually delivering, although I continue to treat the outlook statements with a healthy degree of scepticism.

Sthree H1 Trading Update

This international recruitment business focused on roles in Science, Technology, Engineering and Mathematics (‘STEM’), providing permanent and temporary workers announced a detailed H1 trading update to the end of May. They are now trading ahead of market expectations for FY Nov 2022. Fees from temporary contracts (c. ¾ of group fees) were up +30% to £157m in H1. Fees from permanent contracts were up +11% to £46m.

Net cash at 31 May 2022 of £48m (flat versus 31 May last year.) The Board now expects that profit before tax for the 12 months to 30 November 2022 will be at least 5% ahead of market consensus of £66m.

Background: Although it is a staffing company, which has mostly been a difficult sector for investors over the years, SThree claims to be at the centre of two long-term trends i) demand for STEM skills and ii) more flexible work. They are internationally diversified with a third of revenue coming from Germany, Austria and Switzerland (what they call DACH), a third coming from UK and the rest of Europe, a quarter coming from the US and the balance Asia, mostly Japan. Inevitably they claim to be a disruptive platform and the shares are off -23% so far this year.

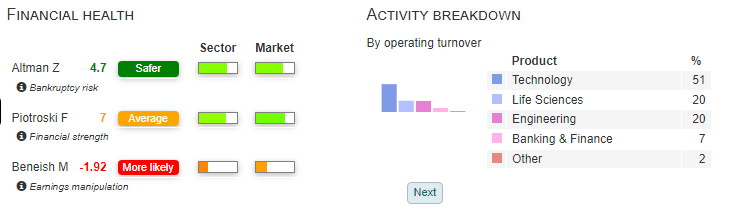

I’m pondering whether the focus on STEM really is a competitive ‘moat’ that allows them to achieve higher Returns on Capital Employed, through the cycle. Over half of revenue comes from technology, which may see a slowdown as Venture Capital money becomes more cautious about funding blue sky stories. Helped by the £48m of cash, the Altman Z score and Piotroski F score are reassuring though.

I don’t think brands in the recruitment sector operate in the traditional sense (I’ll go with the product that has the best marketing, even if they charge more money, because I trust the brand.) Instead, it could be that Sthree occupy a profitable niche.

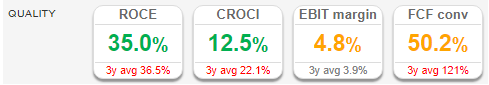

Valuation: the shares are trading on 10x FY Nov 2022F upgraded expectations and 9.5x FY Nov 2023F. In terms of the financials, the EBIT margin of below 5% and low FCF conversion are symptomatic of other staffing businesses. Those ratios probably explain the red Beneish M score too.

However, STEM does have a track record of above 30% RoCE (3 year avg 36.5%).

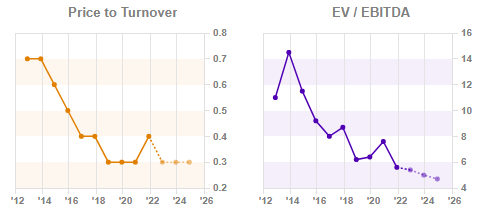

Opinion: The current indiscriminate sell-off could present opportunities. It strikes me that perhaps there is something to STEM’s niche of recruiting in maths and science subjects, certainly the track record of high RoCE would support that. They have suffered a de-rating on both a price/sales and EV/EBITDA basis over the past few years.

At the very least they seem to be bucking the trend of profit warnings caused by supply chain and food and energy inflation. I tend to be wary of low-margin companies and don’t own it, but may revisit in H2.

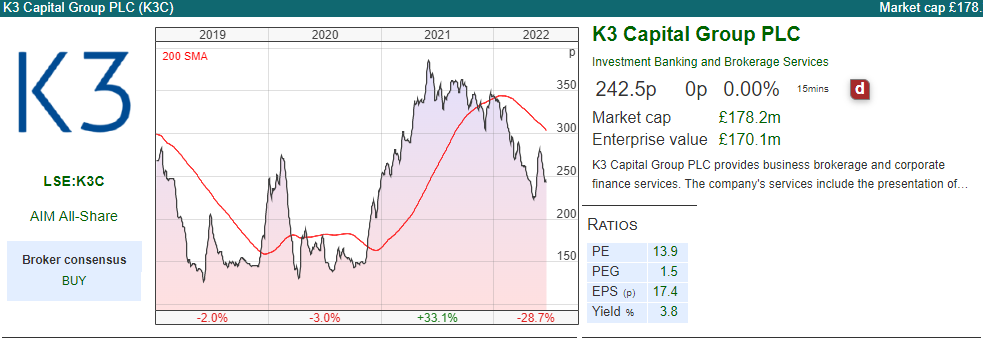

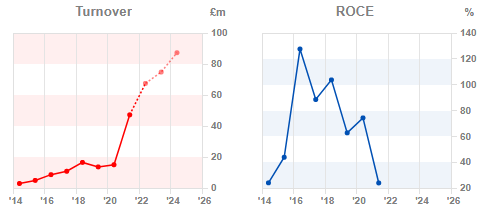

K3 Capital Trading Update

This professional services firm released a ‘comfortably ahead’ trading update for FY May 2022. Market expectations based upon their broker’s research (Numis) were £63.5m revenue and £18.2m EBITDA. The RNS says £67.5m revenue and £19.5m adj EBITDA, so c. 6% ahead on both lines.

Organic revenue growth was +18%, there’s no mention of profits and management preferred measure is adj EBITDA which was up +24% including acquisitions. Looking at the H1 to November, around half of adj EBITDA of £9.4m converts into statutory PBT of £5.2m, and at the H1 stage cash from operations was less than £50K.

There was £12m of cash at the end of May, down slightly from £14m May last year. The update is reassuring because there was a sharp sell-off at the beginning of May when the shares fell -27% to 215p on no news. They did put out an RNS following the decline, saying that they were not aware of any reason for it, and they confirmed a strong start to their second half and market expectations. Looking at Sharepad’s DD tab, I can’t see any significant share sales reported in April or May, and neither are there any RNS releases suggesting either management or large institutions have crossed any thresholds.

Miton is still the largest holder with 14%, followed by the Chief Exec John Rigby who owns 10.3%, so the reason for the sell-off remains something of a mystery. Although it is not mentioned in the trading statement, I have written about how the company accounts for earnouts. My point is that earnouts and deferred consideration make sense, but investors need to understand that they are liabilities. K3C tended to use ‘fair value’ accounting and scenarios, with a much larger potential liability tucked away in the notes to the accounts, rather than the face of the balance sheet. The number of shares increased +64% to 69m last year, so it could be that a large block of shares owned by employees overwhelmed the market maker, who struggled to find a buyer to take the other side of the trade.

Background: K3 started life as Knightsbridge, a business broker that specialised in selling businesses with less than £1m enterprise value, that had leaseholds rather than owning the freeholds, in 1998. They came to market as K3 Capital in April 2017, at a placing price of 95p raising £2m, and valuing the firm at £40m market cap. Since then, they’ve acquired RANDD, an R&D tax credit specialist for £9m (75% cash, 25% shares) + earnout. They then raised £30m in a placing for further acquisitions and bought Quantuma in August 2020, which does restructuring and insolvency, for £26m initial consideration plus £15m deferred. Revenue has grown very strongly, but profitability has fallen – albeit from over 100% RoCE which was likely too high to be sustainable.

Valuation: The shares are trading on 11x May 2023F and May 2024F, which is not expensive. The quality measures are impressive, but I do wonder if they’re enjoying a favourable part of the cycle, and how well they’ll do in a recession, particularly as they are a people business that has grown by acquisition.

A final observation: When you have professional services companies like RBGP, SFOR and K3C growing by acquisitions made partly with shares, then management have every incentive to try to keep their share price buoyant because their own share price serves as currency for acquisitions (both purchases already made but only partially paid for, and future deals). We’ve seen recently that there’s a downside to that with NextFifteen’s 30% share price fall, following the attempt to buy M&C Saatchi for 40p in cash and 0.1637 NFC shares. When the deal was announced in mid-May, that represented a 49% premium to the M&C closing price, but the value of the shares has fallen by 30% since then. M&C Saatchi itself got into trouble a couple of years ago, with share-based compensation that proved a serious liability when the share price declined.

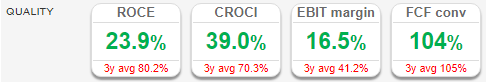

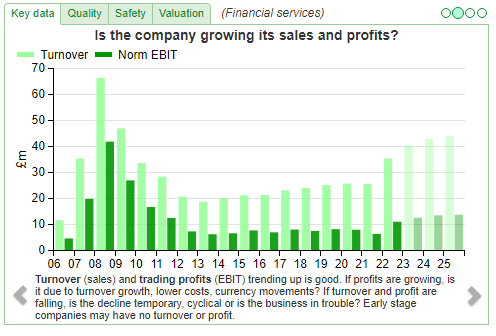

Record FY Mar 2022

This currency fund manager released FY Mar results, with revenue +38% to £35m and statutory PBT +76% to £10.9m. Assets under Management Equivalent (AuME) increased by +4% to $83bn. As a currency fund manager, Record, only manages the impact of foreign exchange movements, rather than underlying assets like a conventional fund manager such as Impax, Miton or similar. Hence, management preferred measure is AuME.

For reference, revenue was £35m in 2007, just before they listed. AuME was £55bn, so they’ve struggled to grow the top line following the financial crisis.

Cash was £3.3m, down from £6.8m the year before. That movement is not significant because the cash figure includes cash held by funds which Record is deemed to be in control of (ie the cash managed in funds belongs to customers). There were some funds closed in June 2021, which meant the figure fell. Both this year and last year, Record has paid out all its earnings in dividends and special dividends. They are talking about paying out 70-90% of earnings in dividends in future years.

History: Record was founded in 1983 by Neil Record, the current Chairman, who still owns 7% of the shares. Through the 1980s, the Group was predominantly focused on providing hedging services for corporate clients for whom foreign exchange exposures arose through the cross-border nature of their businesses. In the 1990s they developed a similar service for institutional investors, the Admission Doc specifically mentions defined-benefit corporate pension funds.

Record came to market in December 2007, raising £85m for selling shareholders at 160p, valuing the company at £354m market cap. Revenue doubled following the IPO to £66m FY Mar 2008, but then collapsed to a low of £18.6m by FY Mar 2013 (AuME was £31bn). Around this time the share price troughed at 10p per share. As an aside, I reckon you could outperform many sophisticated quant strategies by shorting recent IPOs, then after five years reversing your position and going long.

The company has announced a new strategy around modernising technology, diversification and succession. They’ve also launched an ESG initiative.

Outlook: Management expresses optimism for the firm’s future, but warn of difficult macroeconomic conditions. They say these conditions may impact growth, but their current judgement is that the positives will outweigh the negatives of global economic problems. The company think they can achieve revenue of c. £60 million by this time in 2025 (ie FY Mar 2024?) and will continue to improve operating margin, inflation willing. Operating margin was up from 24% to 31% FY Mar 2022.

When revenue collapsed from £66m FY Mar 2008 to £18.6m 5 years afterwards, they did still make a profit in FY Mar 2013, but PBT was down -85% to £6m v FY Mar 2008. UK bank management during the 2000-2003 sell-off, attempted to reassure analysts by saying that they weren’t LTCM or similar. Bank revenue from dealing profits was higher quality, they claimed because it was facilitating client activity. However reassuring that sounded, what actually happened was UK banks struggled for profits as customer-driven revenue fell, while costs (mainly people and technology) remained relatively fixed.

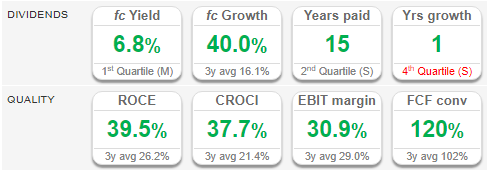

Valuation: Record doesn’t have a broker on their RNS and Edison their paid-for research publisher haven’t put out a note following the results. Edison’s most recent note in April shows revenue of less than £40m in Mar 2023F, which seems a long way from the companies aspiration of £60m the following year. The shares are trading on 15.5x PER Edison’s latest Mar 2023F forecast.

Opinion: So I think the investment case on Record hangs on your view of revenue growth. Management tell a good story and come across as straightforward, but it’s not clear what levers they can pull if clients do less hedging, as they did after the financial crisis. The dividend yield is 6.8% and high RoCE and CashRoCI jump out – but it’s worth bearing in mind that management are returning almost all excess capital to shareholders because they can’t reinvest at the historic rates of RoCE. To be clear, I would rather they did that than splurge on ‘moonshots’ or duff acquisitions.

I also wonder if those high returns are vulnerable to a FinTech such as Wise or Revolut trying to target corporates and institutions, rather than individuals. One to keep an eye on, I think.

Notes

* Ray Akhavan was born in Iran but is a US citizen. He lived in Calabas, Californian and made his money from a porn empire. According to the book he liked fast cars, guns (including a walk-in armoury of automatic weapons) and helicopters. He controlled 200 Wirecard bank accounts through shell companies in 2013. On one occasion Marsalek asked his assistant to take Eu300K in cash to Arkhavan to the airport for collection.

Akhavan was arrested on 27 March 2020, found guilty and sentenced to 30 months in prison for money laundering $150m of card payments for drugs, disguising the transactions through phoney merchants as purchases for face creams and dog toys. The business was described as Uber for Weed by Reuters.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 27/06/22|STEM, K3C, REC| Wirecard: fraud and flawed

Bruce looks at Dan McCrum’s book on Wirecard and suggests that there are still a couple of details that don’t make sense about the fraud. Plus upbeat releases from STEM, K3C and REC.

The FTSE 100 recovered +1.2% to 7,101 last week. The Nasdaq100 and S&P500 were up 0.9% and flat over the last 5 days. The US 10y bond yield fell back to 3.08%, down from 3.45% in mid-June, helped by a steep fall in the price of oil back to $108 per barrel for Brent Crude, the most traded contract.

I have just finished reading Dan McCrum’s book on Wirecard, the failed Munich-based ‘FinTech’. At one stage German prosecutors opened a criminal investigation into Dan’s FT articles. He was later exonerated when Ernst & Young admitted that they couldn’t find Eu1.9bn of cash.

A couple of interesting points stand out to me about Wirecard. First, Jan Marsalek, the COO who fled on a private jet to Minsk in 2020 when the auditors eventually refused to sign off on the accounts, was incompetent from the start. Marsalek was supposedly managing a project to upgrade Wirecard’s predecessor’s IT system, and dutifully ticked off milestones achieved. When the then Chief Executive (before Markus Braun arrived) asked for a demonstration, Marsalek demurred, saying: “that’s not necessary”. Bit by bit the CEO began to panic – eventually, Marsalek came clean. The Austrian admitted that he had lied and the project was a mess. There were only scattered pieces of code that didn’t work.

Most people would be fired for this, instead, Marsalek was promoted to Chief Operating Officer. The unwritten implication is that for some reason Marsalek was indispensable to Wirecard management, despite being incompetent and dishonest.

The other aspect is that there were two separate short theses i) there was no cash and management were lying ii) the cash and the profits were real, but Wirecard was money laundering.

Until May 2020, Ernst & Young, Wirecard’s auditors, said the cash was there, Dan knew it wasn’t. I found Dan’s 2015 articles on Wirecard confusing. His writing lacked clarity because he couldn’t spell out why he knew that the cash was missing; he had an internal source that he needed to protect.

Later Zatara and Shadowfall (Matt Earl and Fraser Perring – and a mysterious third person who remains in the shadows) published the second short thesis. The cash was there, but the German payments company was using shell companies to disguise transactions. Wirecard was facilitating gambling, buying ammunition, porn, drugs and money laundering. That is the profits were real, but the cash came from circumventing Visa and Mastercard’s policies. At the time I spoke to people in the payments industry, who thought that this was the best explanation for Wirecard’s scandal-tainted success.

So I, along with Zatara and Shadowfall, was wrong. Wirecard was a clear fraud with profits overstated and Eu1.9bn of missing cash. The second thesis was also true though. Wirecard were using shell companies to circumvent Visa and Mastercard’s policies. They also did a lot of ‘high-risk’ payments. Fahmi Quadir, another short-seller drove to Wirecard’s office in Pennsylvania, where a salesman told her that she could fill in Know Your Customer documents, then Wirecard would give her pre-paid cards with up to $150,000 loaded on them. Ray Akhavan*, a Wirecard business partner who set up ‘Uber for Weed’ has been sentenced to 2.5 years in prison. When Akhavan was arrested in March 2020, a Wirecard salesman showed up to pay his bail. So Wirecard was money laundering drug payments, but facilitating this business did not generate enough margin for the payments processor to report high profitability.

Over the coming months, as interest rates rise and the tide goes out, I think we could see more of this. We may see some businesses where management are flat out lying about the cash and profits. I suspect that we will see more of the second type though. Barely profitable companies doing high-risk activities that have flawed business models. There are likely some names in the adtech and cryptocurrency space. Possibly hydrogen fuel cells or other hyped areas too. Maybe we need a name for this because it’s not out-and-out lying, fraud in the traditional sense. As a conflation of flawed, fraud, and law….I suggest flawed.

This week I haven’t commented on WINE -76% YTD or DDDD -70% releases. I think companies like these are best avoided at the moment. Instead, I look at Sthree, the recruitment business that specialises in roles that require Science or Engineering backgrounds. Plus K3 Capital the professional services firm and Record the currency fund manager. All three companies released upbeat results (the first two raising expectations). In these markets, it is easy to become very ‘top down’. Better to follow closely what numbers companies are actually delivering, although I continue to treat the outlook statements with a healthy degree of scepticism.

Sthree H1 Trading Update

This international recruitment business focused on roles in Science, Technology, Engineering and Mathematics (‘STEM’), providing permanent and temporary workers announced a detailed H1 trading update to the end of May. They are now trading ahead of market expectations for FY Nov 2022. Fees from temporary contracts (c. ¾ of group fees) were up +30% to £157m in H1. Fees from permanent contracts were up +11% to £46m.

Net cash at 31 May 2022 of £48m (flat versus 31 May last year.) The Board now expects that profit before tax for the 12 months to 30 November 2022 will be at least 5% ahead of market consensus of £66m.

Background: Although it is a staffing company, which has mostly been a difficult sector for investors over the years, SThree claims to be at the centre of two long-term trends i) demand for STEM skills and ii) more flexible work. They are internationally diversified with a third of revenue coming from Germany, Austria and Switzerland (what they call DACH), a third coming from UK and the rest of Europe, a quarter coming from the US and the balance Asia, mostly Japan. Inevitably they claim to be a disruptive platform and the shares are off -23% so far this year.

I’m pondering whether the focus on STEM really is a competitive ‘moat’ that allows them to achieve higher Returns on Capital Employed, through the cycle. Over half of revenue comes from technology, which may see a slowdown as Venture Capital money becomes more cautious about funding blue sky stories. Helped by the £48m of cash, the Altman Z score and Piotroski F score are reassuring though.

I don’t think brands in the recruitment sector operate in the traditional sense (I’ll go with the product that has the best marketing, even if they charge more money, because I trust the brand.) Instead, it could be that Sthree occupy a profitable niche.

Valuation: the shares are trading on 10x FY Nov 2022F upgraded expectations and 9.5x FY Nov 2023F. In terms of the financials, the EBIT margin of below 5% and low FCF conversion are symptomatic of other staffing businesses. Those ratios probably explain the red Beneish M score too.

However, STEM does have a track record of above 30% RoCE (3 year avg 36.5%).

Opinion: The current indiscriminate sell-off could present opportunities. It strikes me that perhaps there is something to STEM’s niche of recruiting in maths and science subjects, certainly the track record of high RoCE would support that. They have suffered a de-rating on both a price/sales and EV/EBITDA basis over the past few years.

At the very least they seem to be bucking the trend of profit warnings caused by supply chain and food and energy inflation. I tend to be wary of low-margin companies and don’t own it, but may revisit in H2.

K3 Capital Trading Update

This professional services firm released a ‘comfortably ahead’ trading update for FY May 2022. Market expectations based upon their broker’s research (Numis) were £63.5m revenue and £18.2m EBITDA. The RNS says £67.5m revenue and £19.5m adj EBITDA, so c. 6% ahead on both lines.

Organic revenue growth was +18%, there’s no mention of profits and management preferred measure is adj EBITDA which was up +24% including acquisitions. Looking at the H1 to November, around half of adj EBITDA of £9.4m converts into statutory PBT of £5.2m, and at the H1 stage cash from operations was less than £50K.

There was £12m of cash at the end of May, down slightly from £14m May last year. The update is reassuring because there was a sharp sell-off at the beginning of May when the shares fell -27% to 215p on no news. They did put out an RNS following the decline, saying that they were not aware of any reason for it, and they confirmed a strong start to their second half and market expectations. Looking at Sharepad’s DD tab, I can’t see any significant share sales reported in April or May, and neither are there any RNS releases suggesting either management or large institutions have crossed any thresholds.

Miton is still the largest holder with 14%, followed by the Chief Exec John Rigby who owns 10.3%, so the reason for the sell-off remains something of a mystery. Although it is not mentioned in the trading statement, I have written about how the company accounts for earnouts. My point is that earnouts and deferred consideration make sense, but investors need to understand that they are liabilities. K3C tended to use ‘fair value’ accounting and scenarios, with a much larger potential liability tucked away in the notes to the accounts, rather than the face of the balance sheet. The number of shares increased +64% to 69m last year, so it could be that a large block of shares owned by employees overwhelmed the market maker, who struggled to find a buyer to take the other side of the trade.

Background: K3 started life as Knightsbridge, a business broker that specialised in selling businesses with less than £1m enterprise value, that had leaseholds rather than owning the freeholds, in 1998. They came to market as K3 Capital in April 2017, at a placing price of 95p raising £2m, and valuing the firm at £40m market cap. Since then, they’ve acquired RANDD, an R&D tax credit specialist for £9m (75% cash, 25% shares) + earnout. They then raised £30m in a placing for further acquisitions and bought Quantuma in August 2020, which does restructuring and insolvency, for £26m initial consideration plus £15m deferred. Revenue has grown very strongly, but profitability has fallen – albeit from over 100% RoCE which was likely too high to be sustainable.

Valuation: The shares are trading on 11x May 2023F and May 2024F, which is not expensive. The quality measures are impressive, but I do wonder if they’re enjoying a favourable part of the cycle, and how well they’ll do in a recession, particularly as they are a people business that has grown by acquisition.

A final observation: When you have professional services companies like RBGP, SFOR and K3C growing by acquisitions made partly with shares, then management have every incentive to try to keep their share price buoyant because their own share price serves as currency for acquisitions (both purchases already made but only partially paid for, and future deals). We’ve seen recently that there’s a downside to that with NextFifteen’s 30% share price fall, following the attempt to buy M&C Saatchi for 40p in cash and 0.1637 NFC shares. When the deal was announced in mid-May, that represented a 49% premium to the M&C closing price, but the value of the shares has fallen by 30% since then. M&C Saatchi itself got into trouble a couple of years ago, with share-based compensation that proved a serious liability when the share price declined.

Record FY Mar 2022

This currency fund manager released FY Mar results, with revenue +38% to £35m and statutory PBT +76% to £10.9m. Assets under Management Equivalent (AuME) increased by +4% to $83bn. As a currency fund manager, Record, only manages the impact of foreign exchange movements, rather than underlying assets like a conventional fund manager such as Impax, Miton or similar. Hence, management preferred measure is AuME.

For reference, revenue was £35m in 2007, just before they listed. AuME was £55bn, so they’ve struggled to grow the top line following the financial crisis.

Cash was £3.3m, down from £6.8m the year before. That movement is not significant because the cash figure includes cash held by funds which Record is deemed to be in control of (ie the cash managed in funds belongs to customers). There were some funds closed in June 2021, which meant the figure fell. Both this year and last year, Record has paid out all its earnings in dividends and special dividends. They are talking about paying out 70-90% of earnings in dividends in future years.

History: Record was founded in 1983 by Neil Record, the current Chairman, who still owns 7% of the shares. Through the 1980s, the Group was predominantly focused on providing hedging services for corporate clients for whom foreign exchange exposures arose through the cross-border nature of their businesses. In the 1990s they developed a similar service for institutional investors, the Admission Doc specifically mentions defined-benefit corporate pension funds.

Record came to market in December 2007, raising £85m for selling shareholders at 160p, valuing the company at £354m market cap. Revenue doubled following the IPO to £66m FY Mar 2008, but then collapsed to a low of £18.6m by FY Mar 2013 (AuME was £31bn). Around this time the share price troughed at 10p per share. As an aside, I reckon you could outperform many sophisticated quant strategies by shorting recent IPOs, then after five years reversing your position and going long.

The company has announced a new strategy around modernising technology, diversification and succession. They’ve also launched an ESG initiative.

Outlook: Management expresses optimism for the firm’s future, but warn of difficult macroeconomic conditions. They say these conditions may impact growth, but their current judgement is that the positives will outweigh the negatives of global economic problems. The company think they can achieve revenue of c. £60 million by this time in 2025 (ie FY Mar 2024?) and will continue to improve operating margin, inflation willing. Operating margin was up from 24% to 31% FY Mar 2022.

When revenue collapsed from £66m FY Mar 2008 to £18.6m 5 years afterwards, they did still make a profit in FY Mar 2013, but PBT was down -85% to £6m v FY Mar 2008. UK bank management during the 2000-2003 sell-off, attempted to reassure analysts by saying that they weren’t LTCM or similar. Bank revenue from dealing profits was higher quality, they claimed because it was facilitating client activity. However reassuring that sounded, what actually happened was UK banks struggled for profits as customer-driven revenue fell, while costs (mainly people and technology) remained relatively fixed.

Valuation: Record doesn’t have a broker on their RNS and Edison their paid-for research publisher haven’t put out a note following the results. Edison’s most recent note in April shows revenue of less than £40m in Mar 2023F, which seems a long way from the companies aspiration of £60m the following year. The shares are trading on 15.5x PER Edison’s latest Mar 2023F forecast.

Opinion: So I think the investment case on Record hangs on your view of revenue growth. Management tell a good story and come across as straightforward, but it’s not clear what levers they can pull if clients do less hedging, as they did after the financial crisis. The dividend yield is 6.8% and high RoCE and CashRoCI jump out – but it’s worth bearing in mind that management are returning almost all excess capital to shareholders because they can’t reinvest at the historic rates of RoCE. To be clear, I would rather they did that than splurge on ‘moonshots’ or duff acquisitions.

I also wonder if those high returns are vulnerable to a FinTech such as Wise or Revolut trying to target corporates and institutions, rather than individuals. One to keep an eye on, I think.

Notes

* Ray Akhavan was born in Iran but is a US citizen. He lived in Calabas, Californian and made his money from a porn empire. According to the book he liked fast cars, guns (including a walk-in armoury of automatic weapons) and helicopters. He controlled 200 Wirecard bank accounts through shell companies in 2013. On one occasion Marsalek asked his assistant to take Eu300K in cash to Arkhavan to the airport for collection.

Akhavan was arrested on 27 March 2020, found guilty and sentenced to 30 months in prison for money laundering $150m of card payments for drugs, disguising the transactions through phoney merchants as purchases for face creams and dog toys. The business was described as Uber for Weed by Reuters.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.