Bruce looks at the spread of expressions like ‘platform’ and ‘flywheel’ from software companies to other sectors, including life sciences. Companies covered ORPH, MRK and AO.

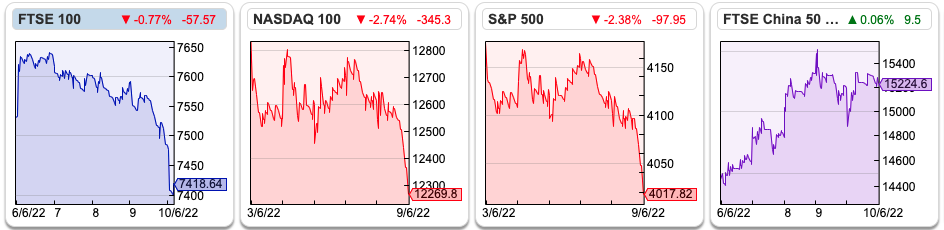

The FTSE 100 was down -1.5% in the last 5 days to 7,418. That’s better than the Nasdaq100 -4.8% and S&P500 down -3.8% over the same time frame. Brent crude rose to $124 per barrel, up +6% and the US 10-year Government bond yield rose back above 3%. The ECB said last week that it would stop buying bonds, as inflation in the Eurozone is now running at +8%. One thing to bear in mind is that in Germany, France and the Netherlands, most households borrow using 10-year fixed-rate mortgage deals. That’s not the case in Portugal, Italy, Greece and Spain (the PIGS). I mentioned a couple of weeks ago that one area of risk that has not been talked about recently is Italian banks and bond markets. Following the ECB press conference, 10-year Italian government bonds rose 20bp to 3.5%; that is 2% above the 10Y German govt bond yield.

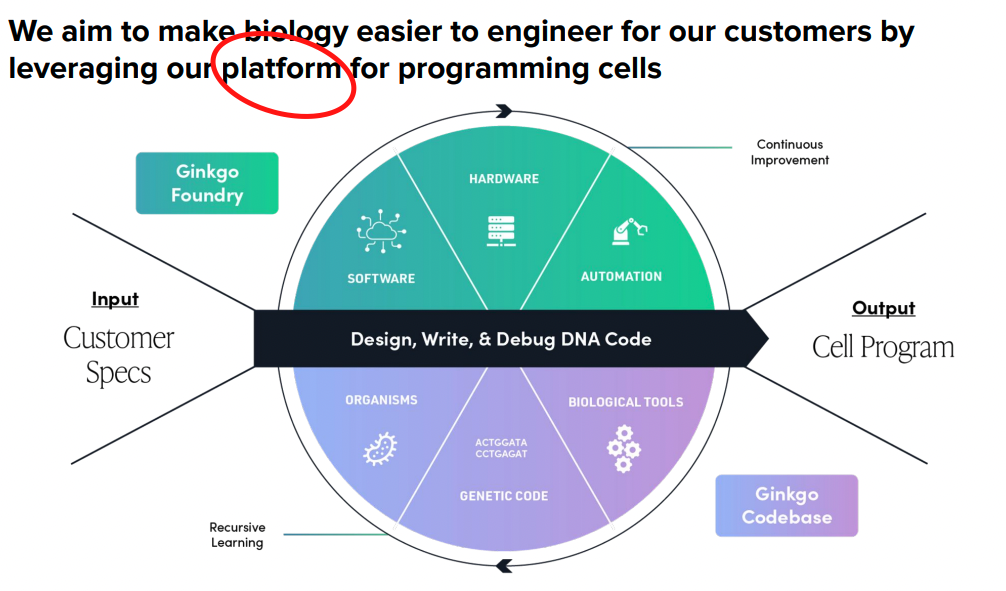

I had lunch last week with a neurologist friend, who helps me understand some of the trends going on in healthcare and life sciences, in return I help her to understand investing (or at least try to). Her husband is a programmer and has had various Chief Technology Officer roles at start-ups. The three of us were laughing about the contagion of the concepts like ‘platform’, ‘digital therapeutics’, ‘design, write, debug DNA code’ from software companies to life sciences.

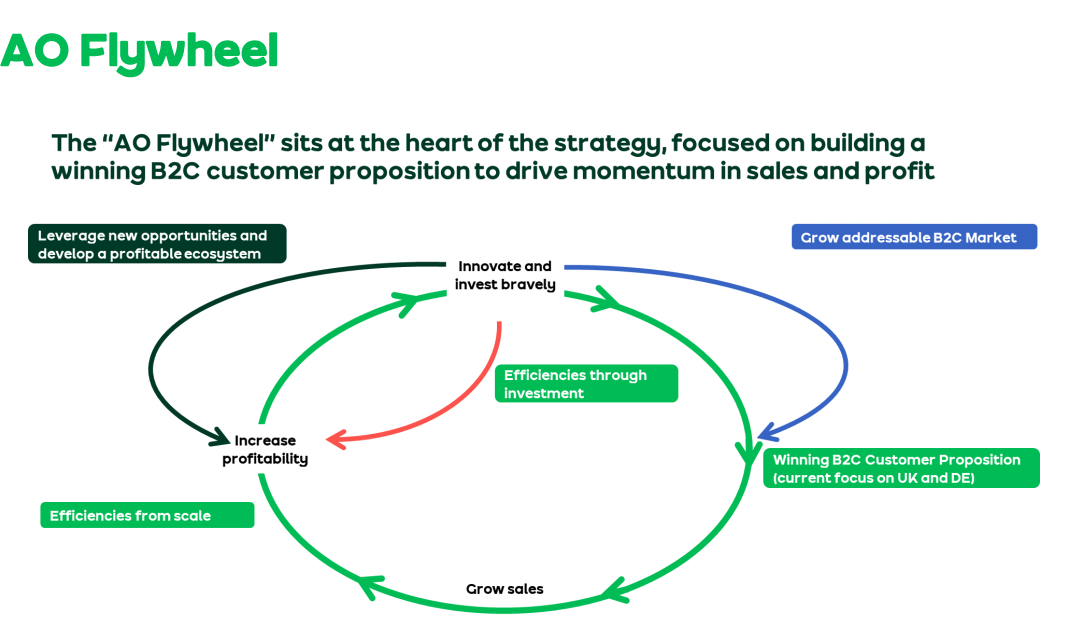

Some software companies have a ‘virtuous circle’ or ‘fly wheel’ which results in a better product as it gains more users. That’s true of Google’s search engine and also social networks like Facebook. Arguably it’s true of some “FinTechs” like PayPal, Wise and Revolut. It’s not true of every software company (LoopUp!) and certainly not true of every FinTech, for example, Funding Circle and LendingClub, just because more borrowers and lenders come to use the website, doesn’t mean that those customers get a better deal. It was definitely not true of WeWork, which claimed to have an ‘operating system’ for commercial space (“We OS” – yes, really! Watch from 8 minutes into this 2017 Adam Neumann YouTube talk). So we’ve already seen the language of software spread into financial and commercial property start-ups, with mixed results.

Of course, claiming to be a platform and telling a story about ‘flywheels’, ‘virtuous circles’ etc can mean your shares receive a higher valuation from Venture Capitalists. The collapse of WeWork and the performance of Funding Circle’s share price since the IPO at 440p in 2018 followed by a -86% fall suggests that eventually, the story has to be supported by evidence of increasing returns seen in the financial numbers though. Sharepad shows that LendingClub is now on a forecast PER of 10x and that while Funding Circle is forecast to be loss-making this year, the PER is forecast to be 9x in 2024F. Those kinds of valuations look more similar to traditional banks than exciting, disruptive platforms.

Now similar thinking and expressions like the word ‘platform’ has started appearing in life sciences: the word appears 7x in Nasdaq listed Atai Life’s May presentation and 15x in Ginkgo Bioworks (above) Q1 presentation.

Nasdaq listed Atai is interested in using psychedelics for treating mental health disorders while Ginkgo Bioworks want to make programming cells as easy as programming computers. Ginkgo came to the market as a SPAC, founded by former Hollywood executives. These sound like exciting stories but the share prices of Atai is down -56% YTD and Ginkgo down -63% YTD, suggest that the words may not match reality.

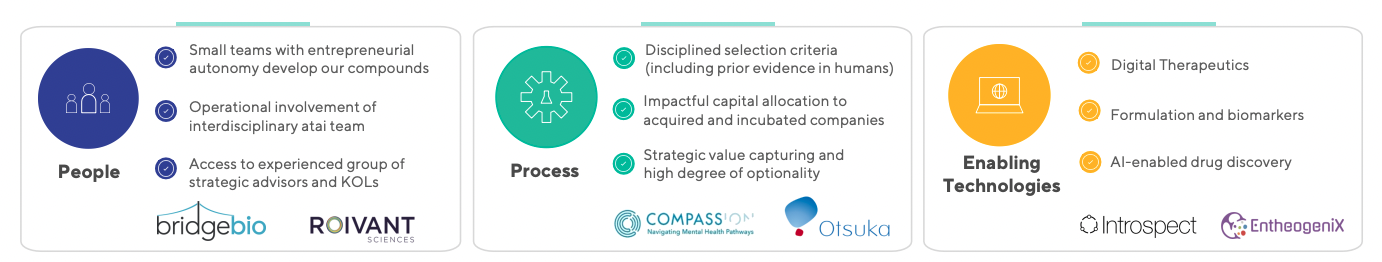

Atai is looking to profit from a change in drug policy. We already know the psychedelics work and are reasonably safe because so many people take them recreationally. Phrases like “enabling technologies”, “digital therapeutics” and “AI enabled drug discovery” from ATAI’s presentation do not fill me with confidence though.

These businesses will have to compete with the underground supply networks that don’t pay tax and have been functioning effectively for decades. So, I am sceptical of the commercial viability of Atai.

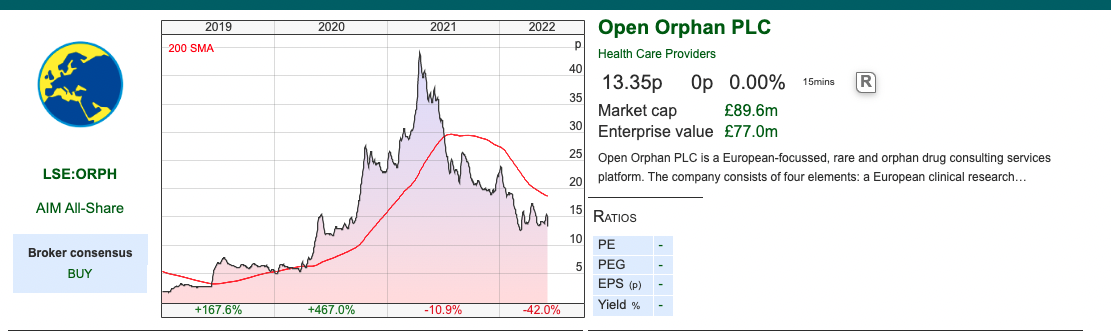

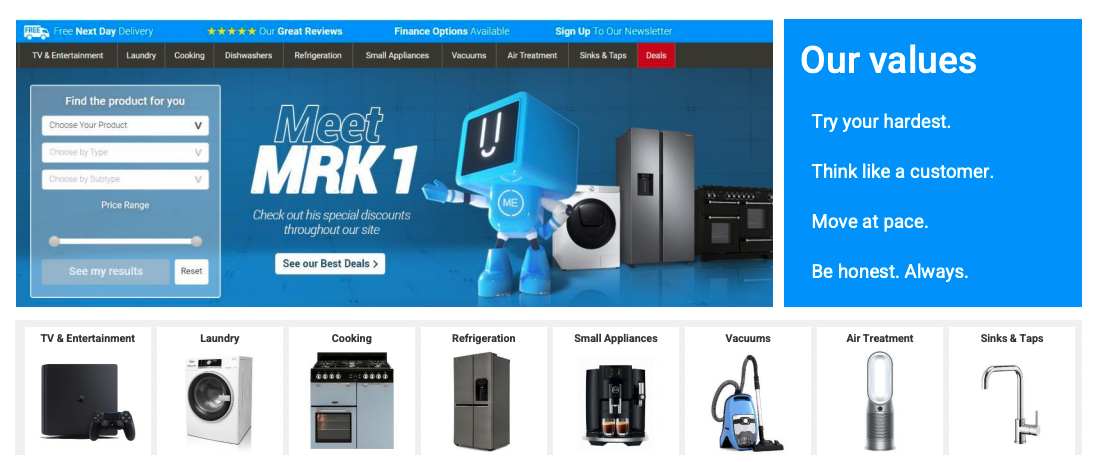

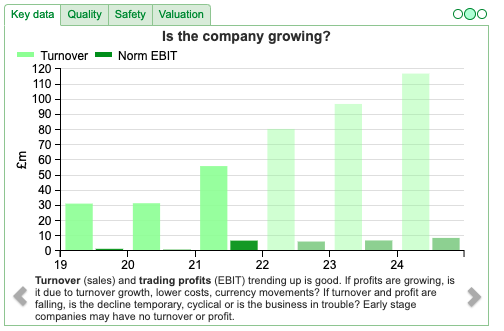

This week I look at Open Orphan below which claims to have a “Disease in Motion” platform which includes unique clinical datasets. Plus Marks Electrical and AO World, which both sell white goods online, the latter claims to have a ‘fly wheel’ while MRK claims an ‘operating platform’ and ‘API integration with suppliers’. Whereas AO World is loss-making, at least MRK reports a RoCE of +57%, demonstrating that it’s not just jumping on the platform bandwagon, but actually delivering.

Open Orphan FY Dec 2021

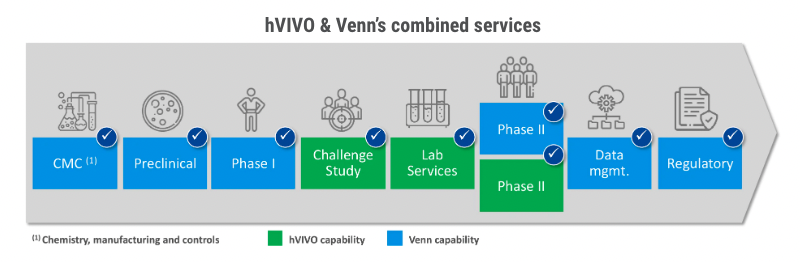

This Contract Research Organisation (CRO) which specialises in human challenge trials for infectious and respiratory disease announced FY 2021 results. A human challenge study compresses the time it takes for a vaccine to be approved through Phase II-III trials, but the environment needs to be more controlled for instance with overnight, quarantined bedrooms. Open Orphan operates two separate CROs, one (hVIVO) that is a 19-bedroom Whitechapel clinic plus lab services and a second (Venn Life Sciences) that offers trial design and data support from its Paris office. Looking at the balance sheet, I’m surprised that tangible fixed assets are not higher, for instance, Property, Plant and Equipment are less than £1m, which suggests that they don’t own the freehold of the Whitechapel property. The bulk of non-current assets are £6.2m of intangible assets (split roughly half/half between Venn and hVIVO) and £7m investments in associates (hVIVO owns 49% of Imutex, an unlisted company valued at £7m).

Open Orphan have just turned profitable this year, though that includes a positive £1.8m R&D credit. There’s also a £2.3m lease payment that doesn’t go through the p&l. In general, I’m sceptical of small companies that take so long to report results: if an organisation as complex as HSBC can deliver audited results in 2-3 months it’s hard to understand why much simpler organisations can’t do similar. I also dislike that the top of the cash flow statement starts with cash from operating activities negative £2.9m and we have to turn to note 28 to find a reconciliation with PBT.

Revenue was up +76% to £39m and statutory PBT was less than £300K versus an £11m loss last year. Despite the profits, cash and cash equivalents fell to £15.7m in December 2021 a £3.5m reduction versus the previous December. Part of the difference between profits and cash is that lease payment – I couldn’t find an explanation why it doesn’t go through the p&l, as I would have expected.

Outlook: As of 1 June 2022, Open Orphan had an order book of signed contracts worth £64.2m which they expect to be recognised across 2022, 2023 and 2024. They see opportunities in flu, asthma, RSV, malaria and, of course, covid 19. They expect revenues “in the region of” £50m in FY 2022F.

Management: Exec Chairman Cathal Friel owns 7% of the shares. He has a finance background with Merrion Stockbrokers in Dublin then Raglan Capital. In 2011 he founded and IPO’ed Fastnet Oil & Gas which was not a success but then reversed into Amryt Pharma in 2015, which moved its listing from the LSE to Nasdaq in July 2020 and has a market cap of $500m. There are a couple of related party transactions, for instance with Cathal Friel’s pension owning a share in Loan Notes made to ORPH. His investment vehicle Raglan also owns 3% of the shares and rents office space. I’ve seen similar from other companies this size (in fact Marks Electrical, which I cover below has a related party transaction with a property that is rented by MRK) and don’t think that there’s anything untoward – but worth being aware of.

Poolbeg Pharma: In June last year the company span out Poolbeg Pharma, a clinical-stage company with a possible treatment for serious flu. The thinking was that running trials for other pharma companies and having its own clinical assets could represent a conflict. Poolbeg has a market cap of £30m.

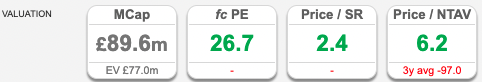

Valuation: FinnCap, their broker, is not forecasting beyond 2022F, they say that they will publish 2023F figures in September, following the H1 results. Presumably, that’s due to a lack of management visibility beyond the end of this year, but hardly encouraging for investors. That means the shares are trading on 2.4x revenues and 27x forecast PER. The cash of £15.7m represents 17% of the market cap, which should give some comfort in these market conditions though.

Opinion: The Executive Chairman presents well. Despite difficult market conditions in the near term, I think a lot of venture capital money has been directed towards healthcare and this appears to me, less speculative than looking at clinical-stage biotech companies.

As mentioned in my preamble life science companies are now talking the language of software, ORPH claims to have a valuable database of infectious disease data. The company’s Disease in Motion® platform is a unique dataset and “includes clinical, immunological, virological, and digital (wearable) biomarkers.” Unique data can be very valuable – but I think we need to see evidence of operational gearing before we get too excited about healthcare platforms.

Marks Electric FY Mar 2022

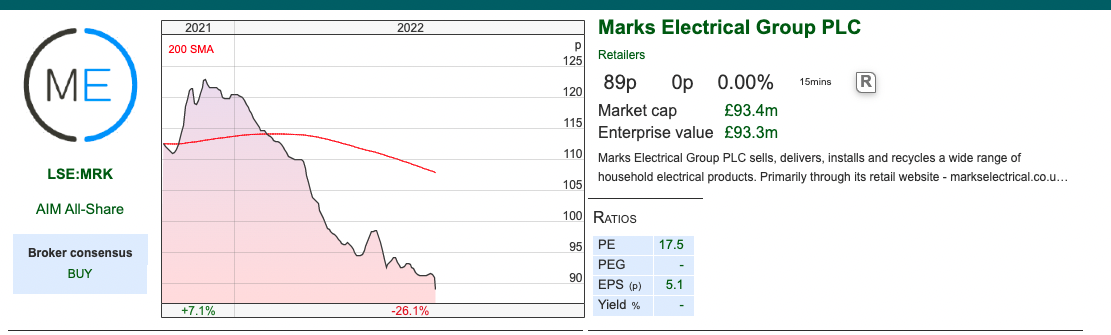

Thes online white goods and electrical retailer, that IPO’ed in November last year reported revenues +44% to £80.5m, exactly in line with their April trading update. The cost of the IPO was £2.7m, adjusting PBT for that gives £6m PBT, up +5% on the previous year. There are various other non-underlying measures the company adjusts for: i) a fair value gain from an investment in Combined Independents (Holdings) Limited, MRK’s buying group ii) share-based payments iii) finance costs. None of the above are significant though.

The IPO price last November was 110p, giving them a market cap of £115m on admission. The share price reaction since then down -19% to 89p looks rather harsh, given that performance has been so strong. Mark Smithson, the founder, still owns 74% of the shares. He started the business in 1987 as a 21-year-old, so is clearly an impressive individual and deserves his rewards. There’s a 12 month ‘lock in’ agreement mentioned in the Admission Document, if we see price weakness as the insiders sell in November and early 2023 then that could represent an opportunity – depending on what trading conditions are like at the time.

Outlook: Positive trading has continued in the first months of FY Mar 2023F, with revenue growth +20% y-o-y. That does look like slowing revenue growth, the previous year was +78%, falling to +44% just reported to +20% this coming year.

However, the Marks Electrical market share is still 2.6% of the online market. As MRK deliver from the central warehouse in Leicestershire, there is some exposure to rising fuel costs. Despite fuel costs rising +16% last year, they were able to expand deliveries on their own fleet by +47%, add 38 additional drivers and minimise the impact on our cost of delivery per item to only a +5% increase y-o-y.

There’s also the idea that people won’t buy new washing machines and fridges when disposable incomes are under pressure from energy costs. However, management point out that 80% of revenues come from distressed purchases (ie broken fridge or similar). If your washing machine is broken, you don’t put off buying a new one because of worries about the wider economy. Add-ons like warranties, make up a very small proportion of their revenue, mitigating any impact on the Group should customers cut back on these options.

Valuation: The business has a very high RoCE 57% FY Mar 2022, so it’s rather pleasing to see that the high level of growth isn’t being achieved through sacrificing profitability. That compares to AO World which Sharepad shows has a 3-year historic avg of -5.8% RoCE and an EBIT margin below 2%. Equity Development are forecasting revenues of £118m for MRK in FY Mar 2024F, implying +21% revenue growth this year and next. That translates to EPS of 5.3p and 6.3p implying a PER ratio of14x Mar 2024F.

Opinion: I like it. The fact the founder still owns 74% explains why there are not more institutions on the shareholder register. I think that I’d like to see him present and answer questions before I invested and also wait until the lock-in has expired this November. In general, though I’m impressed, and also think that the business compares favourably with AO World which I look at below.

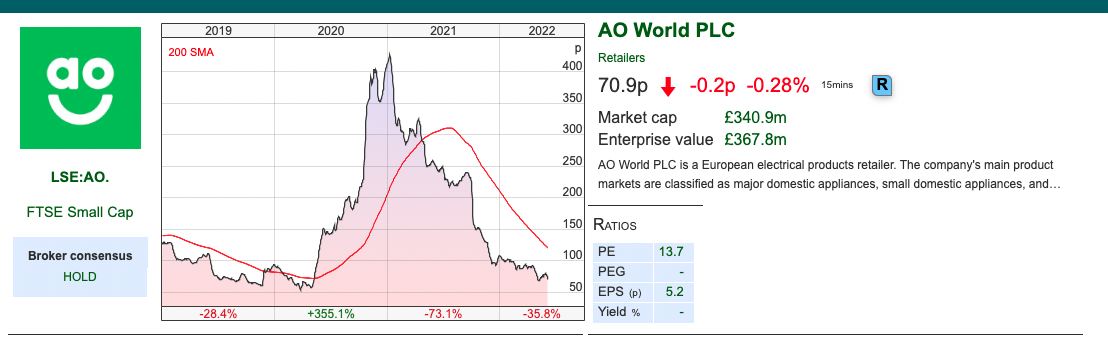

AO World Conclusion of Strategic Review

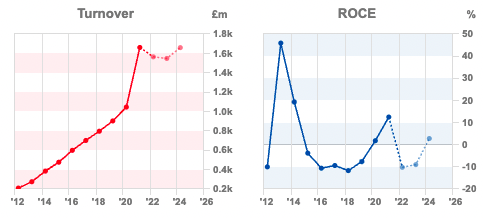

This loss-making online white goods retailer announced last week that it would close down its German business, at a cost of £15m. They say that Germany is c. 10% of AO’s £1.6bn Group revenue. Although AO World claims to be a European retailer if it closes Germany then close to 99% of revenue will come from the UK.

Eve Sleep, the mattress company and Funding Circle have closed down their German operations in the last couple of years, while N26, the Peter Thiel-backed FinTech withdrew from the UK saying that competition was too tough. AO World blamed intensifying competitive landscape, a substantial increase in digital marketing costs, and a constrained supply chain.

One ‘voluntary disclosure’ item that annoys me is when ‘other costs’ are the most significant item. For AO World ‘other admin’ expenses are more than half of the total, and almost 3x marketing costs, and 2x warehousing costs. The commentary claims economies of scale matter, yet MRK is profitable despite being almost 20x smaller in terms of revenue.

Current trading: AO World has a March year-end, and released a trading statement in April saying that FY Mar 2022F revenue is expected to be £1,557m, down -6% versus the prior year. Germany was down -12%. That decline was helped by very strong sales during the early stages of the pandemic, on a 2-year comparison Group revenues were up +52%. Still loss-making, and declining revenue doesn’t make for a particularly exciting story, in my view.

Scale: AO World claimed in their H1 Sept 2021 commentary: “Ultimately, our structural advantage is our ability to leverage our fixed-cost base investment over a greater addressable market in the medium term. Our model is cash generative and capital-efficient, and scale leads to operational gearing as a result of sales growth.”

There seems to be a disconnect between the words and the numbers (cash from operations was negative £56m at H1 and net debt increasing from £74m to £102m doesn’t sound cash generative to me). Here’s a picture of the AO World ‘flywheel’ from the H1 presentation.

Valuation: Ahead of last week’s announcement forecasts were for AO World to be loss-making out to March 2024F. Presumably shutting down the German operations brings breakeven forward in future years. To be fair they did make £20m of PBT in FY Mar 2021, though that was an exceptionally helpful year because of the pandemic. The shares trade on 0.2x price/revenue, which seems fair to me for a company that doesn’t have an obvious ‘path to profitability’.

Opinion: This looks too much of a ‘story stock’ at the moment. They’ve been listed since the start of 2014, and the business model is still unproven. I’ll avoid this one – though it is possible that at some point they begin to generate free cash flow in future, there’s not much evidence of that now.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 13/06/22|ORPH, MRK, AO|Life sciences catch the software bug

Bruce looks at the spread of expressions like ‘platform’ and ‘flywheel’ from software companies to other sectors, including life sciences. Companies covered ORPH, MRK and AO.

The FTSE 100 was down -1.5% in the last 5 days to 7,418. That’s better than the Nasdaq100 -4.8% and S&P500 down -3.8% over the same time frame. Brent crude rose to $124 per barrel, up +6% and the US 10-year Government bond yield rose back above 3%. The ECB said last week that it would stop buying bonds, as inflation in the Eurozone is now running at +8%. One thing to bear in mind is that in Germany, France and the Netherlands, most households borrow using 10-year fixed-rate mortgage deals. That’s not the case in Portugal, Italy, Greece and Spain (the PIGS). I mentioned a couple of weeks ago that one area of risk that has not been talked about recently is Italian banks and bond markets. Following the ECB press conference, 10-year Italian government bonds rose 20bp to 3.5%; that is 2% above the 10Y German govt bond yield.

I had lunch last week with a neurologist friend, who helps me understand some of the trends going on in healthcare and life sciences, in return I help her to understand investing (or at least try to). Her husband is a programmer and has had various Chief Technology Officer roles at start-ups. The three of us were laughing about the contagion of the concepts like ‘platform’, ‘digital therapeutics’, ‘design, write, debug DNA code’ from software companies to life sciences.

Some software companies have a ‘virtuous circle’ or ‘fly wheel’ which results in a better product as it gains more users. That’s true of Google’s search engine and also social networks like Facebook. Arguably it’s true of some “FinTechs” like PayPal, Wise and Revolut. It’s not true of every software company (LoopUp!) and certainly not true of every FinTech, for example, Funding Circle and LendingClub, just because more borrowers and lenders come to use the website, doesn’t mean that those customers get a better deal. It was definitely not true of WeWork, which claimed to have an ‘operating system’ for commercial space (“We OS” – yes, really! Watch from 8 minutes into this 2017 Adam Neumann YouTube talk). So we’ve already seen the language of software spread into financial and commercial property start-ups, with mixed results.

Of course, claiming to be a platform and telling a story about ‘flywheels’, ‘virtuous circles’ etc can mean your shares receive a higher valuation from Venture Capitalists. The collapse of WeWork and the performance of Funding Circle’s share price since the IPO at 440p in 2018 followed by a -86% fall suggests that eventually, the story has to be supported by evidence of increasing returns seen in the financial numbers though. Sharepad shows that LendingClub is now on a forecast PER of 10x and that while Funding Circle is forecast to be loss-making this year, the PER is forecast to be 9x in 2024F. Those kinds of valuations look more similar to traditional banks than exciting, disruptive platforms.

Now similar thinking and expressions like the word ‘platform’ has started appearing in life sciences: the word appears 7x in Nasdaq listed Atai Life’s May presentation and 15x in Ginkgo Bioworks (above) Q1 presentation.

Nasdaq listed Atai is interested in using psychedelics for treating mental health disorders while Ginkgo Bioworks want to make programming cells as easy as programming computers. Ginkgo came to the market as a SPAC, founded by former Hollywood executives. These sound like exciting stories but the share prices of Atai is down -56% YTD and Ginkgo down -63% YTD, suggest that the words may not match reality.

Atai is looking to profit from a change in drug policy. We already know the psychedelics work and are reasonably safe because so many people take them recreationally. Phrases like “enabling technologies”, “digital therapeutics” and “AI enabled drug discovery” from ATAI’s presentation do not fill me with confidence though.

These businesses will have to compete with the underground supply networks that don’t pay tax and have been functioning effectively for decades. So, I am sceptical of the commercial viability of Atai.

This week I look at Open Orphan below which claims to have a “Disease in Motion” platform which includes unique clinical datasets. Plus Marks Electrical and AO World, which both sell white goods online, the latter claims to have a ‘fly wheel’ while MRK claims an ‘operating platform’ and ‘API integration with suppliers’. Whereas AO World is loss-making, at least MRK reports a RoCE of +57%, demonstrating that it’s not just jumping on the platform bandwagon, but actually delivering.

Open Orphan FY Dec 2021

This Contract Research Organisation (CRO) which specialises in human challenge trials for infectious and respiratory disease announced FY 2021 results. A human challenge study compresses the time it takes for a vaccine to be approved through Phase II-III trials, but the environment needs to be more controlled for instance with overnight, quarantined bedrooms. Open Orphan operates two separate CROs, one (hVIVO) that is a 19-bedroom Whitechapel clinic plus lab services and a second (Venn Life Sciences) that offers trial design and data support from its Paris office. Looking at the balance sheet, I’m surprised that tangible fixed assets are not higher, for instance, Property, Plant and Equipment are less than £1m, which suggests that they don’t own the freehold of the Whitechapel property. The bulk of non-current assets are £6.2m of intangible assets (split roughly half/half between Venn and hVIVO) and £7m investments in associates (hVIVO owns 49% of Imutex, an unlisted company valued at £7m).

Open Orphan have just turned profitable this year, though that includes a positive £1.8m R&D credit. There’s also a £2.3m lease payment that doesn’t go through the p&l. In general, I’m sceptical of small companies that take so long to report results: if an organisation as complex as HSBC can deliver audited results in 2-3 months it’s hard to understand why much simpler organisations can’t do similar. I also dislike that the top of the cash flow statement starts with cash from operating activities negative £2.9m and we have to turn to note 28 to find a reconciliation with PBT.

Revenue was up +76% to £39m and statutory PBT was less than £300K versus an £11m loss last year. Despite the profits, cash and cash equivalents fell to £15.7m in December 2021 a £3.5m reduction versus the previous December. Part of the difference between profits and cash is that lease payment – I couldn’t find an explanation why it doesn’t go through the p&l, as I would have expected.

Outlook: As of 1 June 2022, Open Orphan had an order book of signed contracts worth £64.2m which they expect to be recognised across 2022, 2023 and 2024. They see opportunities in flu, asthma, RSV, malaria and, of course, covid 19. They expect revenues “in the region of” £50m in FY 2022F.

Management: Exec Chairman Cathal Friel owns 7% of the shares. He has a finance background with Merrion Stockbrokers in Dublin then Raglan Capital. In 2011 he founded and IPO’ed Fastnet Oil & Gas which was not a success but then reversed into Amryt Pharma in 2015, which moved its listing from the LSE to Nasdaq in July 2020 and has a market cap of $500m. There are a couple of related party transactions, for instance with Cathal Friel’s pension owning a share in Loan Notes made to ORPH. His investment vehicle Raglan also owns 3% of the shares and rents office space. I’ve seen similar from other companies this size (in fact Marks Electrical, which I cover below has a related party transaction with a property that is rented by MRK) and don’t think that there’s anything untoward – but worth being aware of.

Poolbeg Pharma: In June last year the company span out Poolbeg Pharma, a clinical-stage company with a possible treatment for serious flu. The thinking was that running trials for other pharma companies and having its own clinical assets could represent a conflict. Poolbeg has a market cap of £30m.

Valuation: FinnCap, their broker, is not forecasting beyond 2022F, they say that they will publish 2023F figures in September, following the H1 results. Presumably, that’s due to a lack of management visibility beyond the end of this year, but hardly encouraging for investors. That means the shares are trading on 2.4x revenues and 27x forecast PER. The cash of £15.7m represents 17% of the market cap, which should give some comfort in these market conditions though.

Opinion: The Executive Chairman presents well. Despite difficult market conditions in the near term, I think a lot of venture capital money has been directed towards healthcare and this appears to me, less speculative than looking at clinical-stage biotech companies.

As mentioned in my preamble life science companies are now talking the language of software, ORPH claims to have a valuable database of infectious disease data. The company’s Disease in Motion® platform is a unique dataset and “includes clinical, immunological, virological, and digital (wearable) biomarkers.” Unique data can be very valuable – but I think we need to see evidence of operational gearing before we get too excited about healthcare platforms.

Marks Electric FY Mar 2022

Thes online white goods and electrical retailer, that IPO’ed in November last year reported revenues +44% to £80.5m, exactly in line with their April trading update. The cost of the IPO was £2.7m, adjusting PBT for that gives £6m PBT, up +5% on the previous year. There are various other non-underlying measures the company adjusts for: i) a fair value gain from an investment in Combined Independents (Holdings) Limited, MRK’s buying group ii) share-based payments iii) finance costs. None of the above are significant though.

The IPO price last November was 110p, giving them a market cap of £115m on admission. The share price reaction since then down -19% to 89p looks rather harsh, given that performance has been so strong. Mark Smithson, the founder, still owns 74% of the shares. He started the business in 1987 as a 21-year-old, so is clearly an impressive individual and deserves his rewards. There’s a 12 month ‘lock in’ agreement mentioned in the Admission Document, if we see price weakness as the insiders sell in November and early 2023 then that could represent an opportunity – depending on what trading conditions are like at the time.

Outlook: Positive trading has continued in the first months of FY Mar 2023F, with revenue growth +20% y-o-y. That does look like slowing revenue growth, the previous year was +78%, falling to +44% just reported to +20% this coming year.

However, the Marks Electrical market share is still 2.6% of the online market. As MRK deliver from the central warehouse in Leicestershire, there is some exposure to rising fuel costs. Despite fuel costs rising +16% last year, they were able to expand deliveries on their own fleet by +47%, add 38 additional drivers and minimise the impact on our cost of delivery per item to only a +5% increase y-o-y.

There’s also the idea that people won’t buy new washing machines and fridges when disposable incomes are under pressure from energy costs. However, management point out that 80% of revenues come from distressed purchases (ie broken fridge or similar). If your washing machine is broken, you don’t put off buying a new one because of worries about the wider economy. Add-ons like warranties, make up a very small proportion of their revenue, mitigating any impact on the Group should customers cut back on these options.

Valuation: The business has a very high RoCE 57% FY Mar 2022, so it’s rather pleasing to see that the high level of growth isn’t being achieved through sacrificing profitability. That compares to AO World which Sharepad shows has a 3-year historic avg of -5.8% RoCE and an EBIT margin below 2%. Equity Development are forecasting revenues of £118m for MRK in FY Mar 2024F, implying +21% revenue growth this year and next. That translates to EPS of 5.3p and 6.3p implying a PER ratio of14x Mar 2024F.

Opinion: I like it. The fact the founder still owns 74% explains why there are not more institutions on the shareholder register. I think that I’d like to see him present and answer questions before I invested and also wait until the lock-in has expired this November. In general, though I’m impressed, and also think that the business compares favourably with AO World which I look at below.

AO World Conclusion of Strategic Review

This loss-making online white goods retailer announced last week that it would close down its German business, at a cost of £15m. They say that Germany is c. 10% of AO’s £1.6bn Group revenue. Although AO World claims to be a European retailer if it closes Germany then close to 99% of revenue will come from the UK.

Eve Sleep, the mattress company and Funding Circle have closed down their German operations in the last couple of years, while N26, the Peter Thiel-backed FinTech withdrew from the UK saying that competition was too tough. AO World blamed intensifying competitive landscape, a substantial increase in digital marketing costs, and a constrained supply chain.

One ‘voluntary disclosure’ item that annoys me is when ‘other costs’ are the most significant item. For AO World ‘other admin’ expenses are more than half of the total, and almost 3x marketing costs, and 2x warehousing costs. The commentary claims economies of scale matter, yet MRK is profitable despite being almost 20x smaller in terms of revenue.

Current trading: AO World has a March year-end, and released a trading statement in April saying that FY Mar 2022F revenue is expected to be £1,557m, down -6% versus the prior year. Germany was down -12%. That decline was helped by very strong sales during the early stages of the pandemic, on a 2-year comparison Group revenues were up +52%. Still loss-making, and declining revenue doesn’t make for a particularly exciting story, in my view.

Scale: AO World claimed in their H1 Sept 2021 commentary: “Ultimately, our structural advantage is our ability to leverage our fixed-cost base investment over a greater addressable market in the medium term. Our model is cash generative and capital-efficient, and scale leads to operational gearing as a result of sales growth.”

There seems to be a disconnect between the words and the numbers (cash from operations was negative £56m at H1 and net debt increasing from £74m to £102m doesn’t sound cash generative to me). Here’s a picture of the AO World ‘flywheel’ from the H1 presentation.

Valuation: Ahead of last week’s announcement forecasts were for AO World to be loss-making out to March 2024F. Presumably shutting down the German operations brings breakeven forward in future years. To be fair they did make £20m of PBT in FY Mar 2021, though that was an exceptionally helpful year because of the pandemic. The shares trade on 0.2x price/revenue, which seems fair to me for a company that doesn’t have an obvious ‘path to profitability’.

Opinion: This looks too much of a ‘story stock’ at the moment. They’ve been listed since the start of 2014, and the business model is still unproven. I’ll avoid this one – though it is possible that at some point they begin to generate free cash flow in future, there’s not much evidence of that now.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.