Bruce ponders the ingredients required to precipitate a systemic crisis, and why memories are so short in financial services.

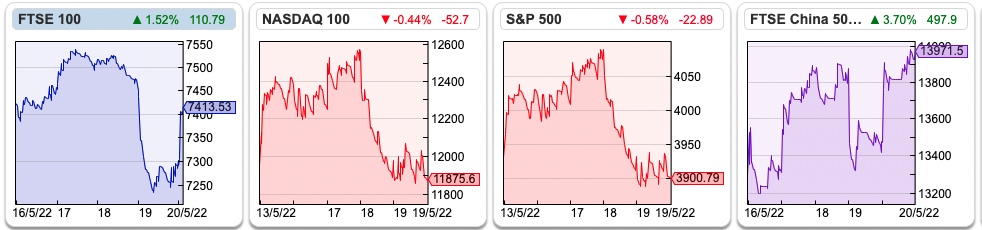

The FTSE 100 was flat at 7413 over the last 5 days. US markets had a more difficult week with the S&P500 -0.75% and Nasdaq100 -0.60%. The S&P500 is approaching bear market territory down -18% YTD, and the Nasdaq100 is already there -27% following profit warnings from Cisco, Walmart and Target last week. The US 10Y Govt bond yield fell back to 2.88%. The Brazilian Bovespa and FTSE 100 are the only two major market indices that are in positive territory this year – although the latter has been helped by a weak pound.

There’s a fun podcast between Tracy Alloway (FT Alphaville, Bloomberg) and Jim O’Shaugnessy (early quant manager, author of What Works on Wall Street ) about financial crises. One thing that I knew but had forgotten – is that a proper crisis involves assets that were once perceived to be safe to be reappraised as dangerous, combined with leverage. In 2008 these were triple AAA-rated mortgage-backed securities that were being used in the repo market (repo are an interest rate product used by banks for funding and are not supposed to involve credit risk). When the TMT bubble burst, it wasn’t the likes of Pets.com or Webvan that posed a systemic risk, because speculative internet stocks had been financed mainly with equity. Instead, it was the fraudulent accounting of Enron, Worldcom, Global Crossing, Tyco, and in Europe Parmalat that had borrowed billions from the banks and bond markets (helpful rated investment grade by the credit rating agencies, of course) some of which were being financed in the repo market, at least by Abbey National, if not other banks. In 1998 it was LTCM that was trading government bonds on huge amounts of leverage and again dependent on counterparties in the repo market to continue to finance them.

I remember having a one-on-one meeting with Douglas Flint in 2001, then Finance Director of HSBC (later Chairman), and him pointing out that rather than the defaults themselves, it was the very low recovery rates on the supposedly investment grade debt that would cause problems. As an aside you may wonder what a 26-year-old with a year’s worth of experience was doing meeting the Finance Director of one of the largest banks in the world. HSBC used to spend an hour with each analyst going through their business, but not saying anything specific that might have been helpful for forecasting revenues, costs, bad debts, or earnings. The team I worked for had left for another bank, so I went to the meeting on my own, not really sure what questions I was supposed to ask.

Later it struck me as odd that I was paid more in 2001 than I was ten years later in 2011. It’s almost as if the financial services industry relies on institutional amnesia, and anyone who has a memory quickly becomes redundant at CSFB and similar, which might explain why we have recurring financial crises. For this reason, if Ukraine defaults on its government debt obligations, this is hardly likely to cause a systemic crisis in bond markets. Up till now, I had thought crypto would not be a systemic risk because the prices are so volatile. My thinking is evolving though about “stable coins”.

Understandably crypto and expensive growth stocks have sold off this year as interest rates and bond yields have risen. Then last week US retailers Target and Walmart warned about the effect inflation was having on their margins, Walmart blamed higher staff wages and fuel costs for the disappointment. Wage growth among Walmart’s low-income employees doesn’t strike me as a reason not to own equities though, it implies consumer disposable income could prove to be more resilient than economists are expecting but at the expense of corporate margins (which have been very high in the last decade relative to history). That is, we may see similar profit warnings that won’t amount to a systemic crisis.

Instead, it is worth thinking about what could cause the next leg down: where fraud might be discovered, or what is currently perceived as i) safe, and ii) highly leveraged, but iii) containing hidden risks. The interaction of stable coins and the commercial paper market could be one candidate. Reichmann/Olympia and York financed the building of Canary Wharf in the early 1990s with short-dated maturity commercial paper, which ended badly for him, though several decades later the area is thriving and a monument to his legacy. Izabella Kaminska wrote about the parallels in 2017. UK house prices and Italian government bonds would be my other guess, but I’m interested in readers views too.

You may have noticed that Sharepad has updated the chat facility, to drive more engagement. There’s a separate chat facility for this weekly, so if you have any comments then paste them there and let’s get a discussion going. There’s a traders’ chat, along with the very helpful support desk chat too. Here’s a link to the tutorial https://www.youtube.com/watch?v=FRLCnYm_rM8 or just get going by clicking on the chat button (circled below) at the top right of the screen.

Also, if you’re following Ukraine Paul Mason has written a very good blog post, on Putin’s next move. I know Paul from his BBC Newsnight days during the financial crisis, though I think he found the Beeb too right-wing for his politics. He’s one of those journalists who have an ideology, but it can sometimes give him insights that others, who are more mainstream, miss. He thinks Putin could declare a unilateral ceasefire, and then try to regain the initiative by causing divisions among Ukraine and her allies. Markets may take an end to hostilities positively, but Paul’s blog post suggests that an uneasy ceasefire might not be as positive as first assumed if it creates divisions between Europe and the more bellicose US.

This week I look at Brazilian ports business and investment vehicle Ocean Wilsons, Equals the forex and payments company, and Future, the media company and owner of GoCompare price comparison website.

Ocean Wilsons Q1 to March

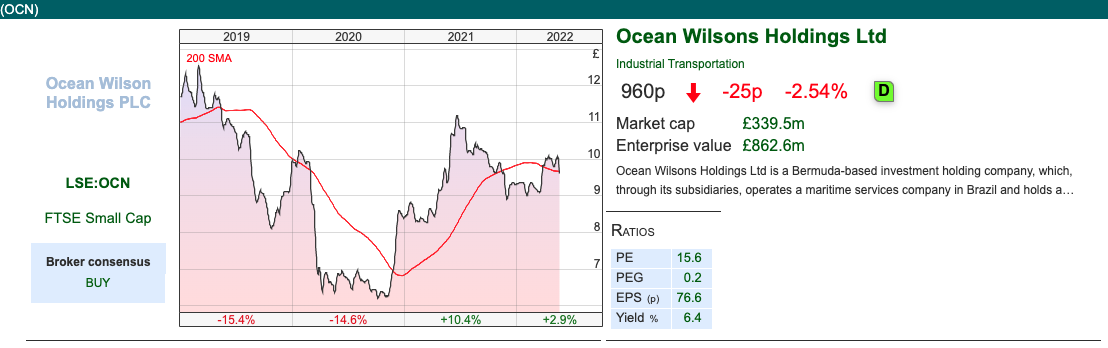

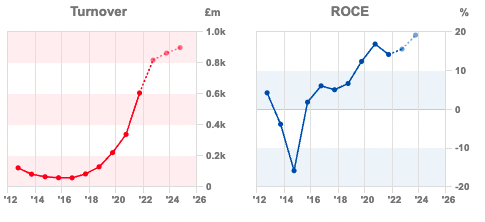

This Brazilian ports business (Wilson Sons) and investment vehicle (Ocean Wilsons Investments Ltd or OWIL) reported a Q1 update to March. As a reminder, OCN owns 58% of the ports business (Wilson Sons), which has just moved from the Luxemburg to the Novo Mercado on the Sao Paulo Stock Exchange followed by a share split (one to six) both moves to improve liquidity.

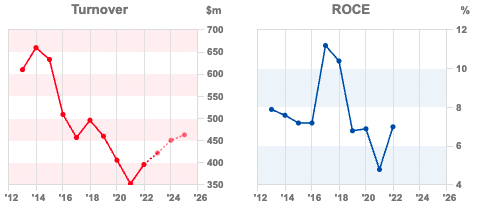

Wilson Sons reported revenue +10% to 493m and net profit rebounded by 5.8x to $28m in the quarter following the lifting of covid restrictions versus the same quarter last year. The results are still constrained by a lack of empty shipping containers and supply chain bottlenecks. Hence Q1 revenue growth has slowed slightly from the +12.4% reported at the FY to December.

Annualising Wilson Sons Q1 gives FY $372m revenue, well below peak revenue of $698m in FY 2011, though the operating margin is now considerably higher at 24.5% in FY 2021. Brazil is a commodity-based economy, with for example the huge offshore Tupi oil field and the Real is one of the few currencies to have strengthened against the US dollar so far this year. At some point, I would expect the volumes going through their ports to recover to previous levels. Wilson Sons P/E ratio is 12x and the dividend yield 4.9%.

Valuation: The portfolio of hedge funds (OWIL) has fallen by -7% to the end of March, and at the time represented 708p per share. Since then, the S&P500 has sold off a further -11%, so that value could have shrunk further – offset somewhat by dollar strength versus the pound. The hedge funds are mainly absolute return funds, so might be expected to underperform the S&P500 in a bull market but perform relatively well v the index in a bear market.

Wilson Sons are valued at 4bn Brazilian Reals, or $810m at the current dollar exchange rate, which multiplied by the 58% share that OCN owns, represents 1081p per share. So, these two values together give a “market” valuation of 1789p versus a current share price of 960p, implying that the business is trading at an almost 50% discount.

Ownership: Hansa Investment Company owns 26%, and its investment officers William Salmon (via Victualia), and Christopher Townsend together over 50% of OCN shares. There are no UK institutions with disclosable stakes on the shareholder register, perhaps reflecting the lack of free float or the minority shareholder’s unfriendly policy of not distributing excess capital.

Opinion: If in 2011 management had bought an S&P500 index tracker, and compounded OWIL at 13.8% in line with the index, then OWIL alone would have been worth over 1750p per share at the end of last year. It’s hard to know what to make of majority shareholders that don’t want to maximise long-term value. I own the shares and am hoping that eventually Townsend and Salmon will see that either i) returning capital to shareholders or ii) at the very least investing funds in a low-cost tracker – would make more sense than tying up their cash in underperforming hedge funds. I suppose the example of OCN goes to show that sometimes there is no correlation between financial acumen and wealth.

Equals AGM statement

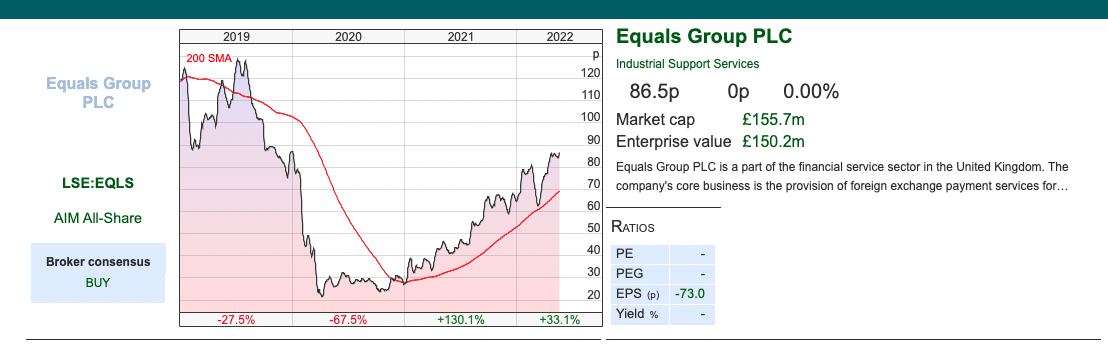

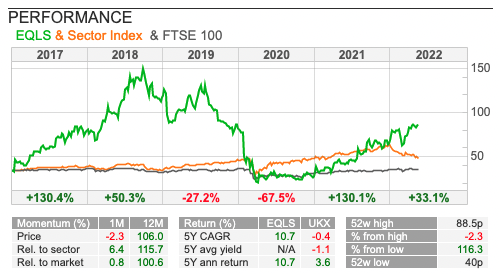

This foreign exchange and payments company gave an update for the first 91 business days of the year (to 15th May) ahead of their AGM which was last week. It’s good to see management can report on figures up to mid-May, which suggests that they have good control and reporting systems and means that they can respond quickly to changes in market conditions. Revenue was £22m, which translates as an average of £241k per working day. That’s an +86% versus the same time period in FY 2021, £129k per day (or £11.9m).

It sounds like costs may be rising too, with them hiring 10 more employees to bring the payroll to 265 employees. They’ve also hired a Chief Commercial Officer, Tom Kiddle, previously UK General Manager of payments group WorldFirst (which is owned by Ant Group – the Chinese affiliate of Alibaba / Jack Ma, that was supposed to IPO last year until the Chinese Communist Party decided otherwise). Later in the statement, they talk about investing in their customer on-boarding processes to make it easier to become a customer of Equals whilst not compromising on compliance. They conclude the RNS by saying:

“We have confidence that our revenue performance, offset with our investments in revenue-facing functions, will lead to Adjusted EBITDA being ahead of market expectations for FY-2022.” However, the share price didn’t respond, suggesting that if you want to persuade investors you are ahead of market expectations, you need to communicate with investors what those expectations actually are.

Valuation: Sharepad shows revenue forecasts raised from £54m revenue FY 2022F (implying +24% y-o-y growth) and EBITDA of £9m (implying +40% growth) at the start of the week to £62m and EBITDA of £9.8m (now implying +41% and +46% respectively). The shares are trading on 16x FY Dec 2023F, which looks about right given the turnaround but also questions about how helpful markets might be in H2.

Opinion: This company has been loss-making for the past three years, cumulatively losing £16m – but now looks to have turned the corner. The shares are up to 3.4x in the last 18 months. I own shares in Argentex, which is trading close to its 52-week low of 69p, so I’m hoping that these results from Equals have a positive read-across on AGFX.

Future H1 results to end March

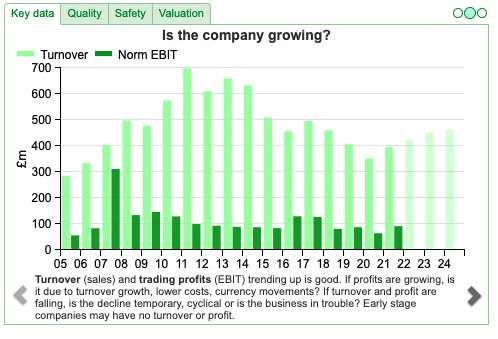

This media publisher (owner of TechRadar. Marie Claire, PC GAMER, and MoneyWeek who I write for) bought GoCompare, the price comparison website, for £594m in February last year and H1 results to end of March last week. They have an impressive track record of growth, with operating profit outpacing revenue suggesting that as the business grows, margins improve so demonstrating returns to scale and operational gearing.

Revenue is split into advertising 35% (i.e., ads displayed on their websites and physical magazines), content 31% (i.e., sale of magazine subscriptions or online membership), and 34% affiliate marketing (i.e., commission they earn when an online user clicks through to another website to buy something). In terms of geography, 62% of revenue is from the UK, and 38% is from the US.

Traditional quality newspapers earn revenue from subscriptions and advertising but have a policy of keeping editorial independent of advertising. For instance, the FT might carry adverts from fund managers, but that wouldn’t sway their coverage of how index trackers outperform most large-cap active funds. Future has blurred this boundary with their affiliate marketing. The content is free for review sites (e.g. tom’s guide or tech radar) but there’s a clear reminder at the top of these sites saying that “When you purchase through links on our site, we may earn an affiliate commission.”

Statutory revenue was up +48% to £404m in H1 March 2022, and PBT +42% to £81m.

Organic revenue growth was a more pedestrian +4% though. That said they faced a difficult comparison, as online advertising revenue boomed during the pandemic last year. The adjusted operating margin was 33%, in line with H1 last year, and an improvement in the second half. That’s a positive for shareholders, though it indicates to me that they are not paying their hard-working writers (specifically me) enough money.

I note that there’s an alphabet soup of remuneration schemes PSP, DAB, taxable benefits, annual bonus, and pension for the Chief Executive, Zillah Byng-Thorne which seems like an attempt to mask the fact that she’s overpaid. Companies often make a voluntary disclosure in the remuneration report so complicated that it’s very hard to work out what management is being rewarded for, or how much. Barclays were masters at this, one year producing a 16-page remuneration report, just before Bob Diamond was forced to resign as Chief Executive following the Libor rigging scandal. To counter these regulators introduced a rule where the company had to disclose a single-figure pay amount, adding up all the different schemes and benefits. So, we can see that Zillah Byng-Thorne was paid £8.8m in FY 2021.

Between 2017 and 2019 she was awarded 600,00 of nil cost options (worth £11m at today’s share price). The FT however reported earlier this year that the proposed future incentive scheme was even more generous, and could award the Chief Executive £40m. The controversial scheme would payout if the FUTR’s share price increased by +10% or more a year from September 2020 to September 2025. She also received a basic salary increase of more than 21% to £575,000. Nice work, if you can get it.

Outlook: They say there will be “a modest upgrade to our FY 2022 guidance, which reflects: ongoing resilience of the underlying business, despite the inflationary backdrop with the Group on track to deliver year-on-year margin progression as previously anticipated.” That all sounds very positive, but there has been a recent sell-off in Adtech with YTD The Trade Desk down -45%, Tremor -21%, Sir Martin Sorrell’s S4 Capital down -58% and newspaper publisher Reach -59%. So, I am surprised that FUTR can be so upbeat – their shares are down -50% YTD suggesting other investors have a degree of scepticism towards the bullish outlook statement too.

Balance sheet: Since 2017 they have made 18 acquisitions, totalling c. £1.5bn. So, there’s £1.54bn of intangibles on the balance sheet, (around 60% of which is goodwill) and tangible book value is negative £606m.

Net debt was £389m at the end of March.

That’s fine as long as the group can continue generating free cash flow (£138m at H1) but if there is an advertising downturn coming, the group’s balance sheet does look rather vulnerable.

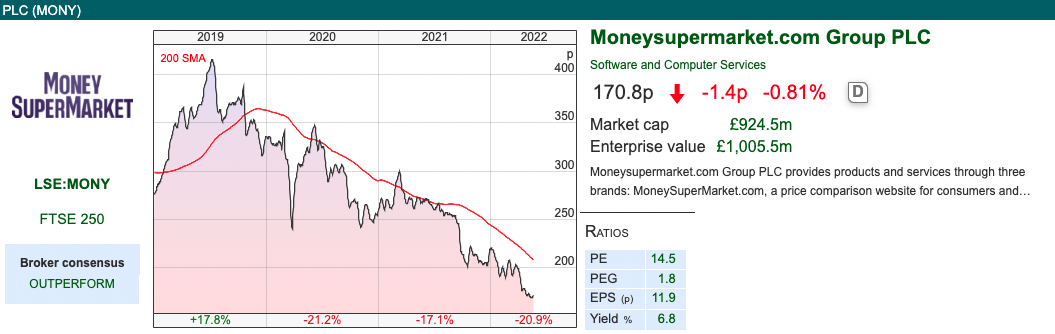

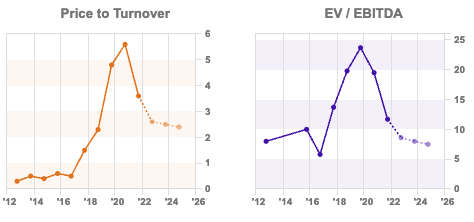

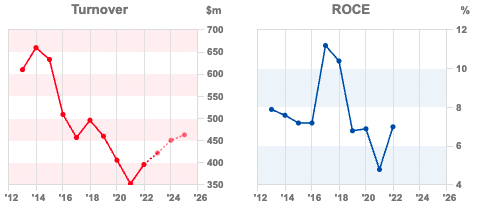

It’s worth mentioning too that Moneysupermarket.com, a rival price comparison website has had a difficult 18 months. The price has sold off as investors first worried about the rising cost of online marketing to drive users to the site – a trend that benefits publishers like FUTR, but is negative for price comparison websites like GoCompare, which they own.

Then we saw investors question the price comparison business model as energy providers withdrew price switching offers from MONY and GoCompare, due to the uneconomic nature of the natural gas price cap last winter. Following the sell-off, MONY shares are trading on 10x historic EV/EBITDA, whereas FUTR paid a full 16x EV/EBITDA for GoCompare at the beginning of last year.

Valuation: FUTR is trading on 11x Sept 2023F P/E. That’s could prove a good entry point if management can integrate all their acquisitions. However, I think the risk is on the downside here, so I would be cautious, and that seems to be what is driving the de-rating.

Opinion: We’ve seen with BOTB that operational gearing can have a downside if revenue comes under pressure. When high growth, acquisitive companies go wrong, they can go badly wrong so I think I would avoid it at this point in the cycle. I also feel that the best companies don’t tend to reward management with nil cost options, companies with top-heavy incentive schemes and well-paid, “star” Chief Execs are inherently unstable.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in Argentex and Ocean Wilsons

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 23/05/22| OWIL, EQLS, FUTR, MONY| The value of amnesia

Bruce ponders the ingredients required to precipitate a systemic crisis, and why memories are so short in financial services.

The FTSE 100 was flat at 7413 over the last 5 days. US markets had a more difficult week with the S&P500 -0.75% and Nasdaq100 -0.60%. The S&P500 is approaching bear market territory down -18% YTD, and the Nasdaq100 is already there -27% following profit warnings from Cisco, Walmart and Target last week. The US 10Y Govt bond yield fell back to 2.88%. The Brazilian Bovespa and FTSE 100 are the only two major market indices that are in positive territory this year – although the latter has been helped by a weak pound.

There’s a fun podcast between Tracy Alloway (FT Alphaville, Bloomberg) and Jim O’Shaugnessy (early quant manager, author of What Works on Wall Street ) about financial crises. One thing that I knew but had forgotten – is that a proper crisis involves assets that were once perceived to be safe to be reappraised as dangerous, combined with leverage. In 2008 these were triple AAA-rated mortgage-backed securities that were being used in the repo market (repo are an interest rate product used by banks for funding and are not supposed to involve credit risk). When the TMT bubble burst, it wasn’t the likes of Pets.com or Webvan that posed a systemic risk, because speculative internet stocks had been financed mainly with equity. Instead, it was the fraudulent accounting of Enron, Worldcom, Global Crossing, Tyco, and in Europe Parmalat that had borrowed billions from the banks and bond markets (helpful rated investment grade by the credit rating agencies, of course) some of which were being financed in the repo market, at least by Abbey National, if not other banks. In 1998 it was LTCM that was trading government bonds on huge amounts of leverage and again dependent on counterparties in the repo market to continue to finance them.

I remember having a one-on-one meeting with Douglas Flint in 2001, then Finance Director of HSBC (later Chairman), and him pointing out that rather than the defaults themselves, it was the very low recovery rates on the supposedly investment grade debt that would cause problems. As an aside you may wonder what a 26-year-old with a year’s worth of experience was doing meeting the Finance Director of one of the largest banks in the world. HSBC used to spend an hour with each analyst going through their business, but not saying anything specific that might have been helpful for forecasting revenues, costs, bad debts, or earnings. The team I worked for had left for another bank, so I went to the meeting on my own, not really sure what questions I was supposed to ask.

Later it struck me as odd that I was paid more in 2001 than I was ten years later in 2011. It’s almost as if the financial services industry relies on institutional amnesia, and anyone who has a memory quickly becomes redundant at CSFB and similar, which might explain why we have recurring financial crises. For this reason, if Ukraine defaults on its government debt obligations, this is hardly likely to cause a systemic crisis in bond markets. Up till now, I had thought crypto would not be a systemic risk because the prices are so volatile. My thinking is evolving though about “stable coins”.

Understandably crypto and expensive growth stocks have sold off this year as interest rates and bond yields have risen. Then last week US retailers Target and Walmart warned about the effect inflation was having on their margins, Walmart blamed higher staff wages and fuel costs for the disappointment. Wage growth among Walmart’s low-income employees doesn’t strike me as a reason not to own equities though, it implies consumer disposable income could prove to be more resilient than economists are expecting but at the expense of corporate margins (which have been very high in the last decade relative to history). That is, we may see similar profit warnings that won’t amount to a systemic crisis.

Instead, it is worth thinking about what could cause the next leg down: where fraud might be discovered, or what is currently perceived as i) safe, and ii) highly leveraged, but iii) containing hidden risks. The interaction of stable coins and the commercial paper market could be one candidate. Reichmann/Olympia and York financed the building of Canary Wharf in the early 1990s with short-dated maturity commercial paper, which ended badly for him, though several decades later the area is thriving and a monument to his legacy. Izabella Kaminska wrote about the parallels in 2017. UK house prices and Italian government bonds would be my other guess, but I’m interested in readers views too.

You may have noticed that Sharepad has updated the chat facility, to drive more engagement. There’s a separate chat facility for this weekly, so if you have any comments then paste them there and let’s get a discussion going. There’s a traders’ chat, along with the very helpful support desk chat too. Here’s a link to the tutorial https://www.youtube.com/watch?v=FRLCnYm_rM8 or just get going by clicking on the chat button (circled below) at the top right of the screen.

Also, if you’re following Ukraine Paul Mason has written a very good blog post, on Putin’s next move. I know Paul from his BBC Newsnight days during the financial crisis, though I think he found the Beeb too right-wing for his politics. He’s one of those journalists who have an ideology, but it can sometimes give him insights that others, who are more mainstream, miss. He thinks Putin could declare a unilateral ceasefire, and then try to regain the initiative by causing divisions among Ukraine and her allies. Markets may take an end to hostilities positively, but Paul’s blog post suggests that an uneasy ceasefire might not be as positive as first assumed if it creates divisions between Europe and the more bellicose US.

This week I look at Brazilian ports business and investment vehicle Ocean Wilsons, Equals the forex and payments company, and Future, the media company and owner of GoCompare price comparison website.

Ocean Wilsons Q1 to March

This Brazilian ports business (Wilson Sons) and investment vehicle (Ocean Wilsons Investments Ltd or OWIL) reported a Q1 update to March. As a reminder, OCN owns 58% of the ports business (Wilson Sons), which has just moved from the Luxemburg to the Novo Mercado on the Sao Paulo Stock Exchange followed by a share split (one to six) both moves to improve liquidity.

Wilson Sons reported revenue +10% to 493m and net profit rebounded by 5.8x to $28m in the quarter following the lifting of covid restrictions versus the same quarter last year. The results are still constrained by a lack of empty shipping containers and supply chain bottlenecks. Hence Q1 revenue growth has slowed slightly from the +12.4% reported at the FY to December.

Annualising Wilson Sons Q1 gives FY $372m revenue, well below peak revenue of $698m in FY 2011, though the operating margin is now considerably higher at 24.5% in FY 2021. Brazil is a commodity-based economy, with for example the huge offshore Tupi oil field and the Real is one of the few currencies to have strengthened against the US dollar so far this year. At some point, I would expect the volumes going through their ports to recover to previous levels. Wilson Sons P/E ratio is 12x and the dividend yield 4.9%.

Valuation: The portfolio of hedge funds (OWIL) has fallen by -7% to the end of March, and at the time represented 708p per share. Since then, the S&P500 has sold off a further -11%, so that value could have shrunk further – offset somewhat by dollar strength versus the pound. The hedge funds are mainly absolute return funds, so might be expected to underperform the S&P500 in a bull market but perform relatively well v the index in a bear market.

Wilson Sons are valued at 4bn Brazilian Reals, or $810m at the current dollar exchange rate, which multiplied by the 58% share that OCN owns, represents 1081p per share. So, these two values together give a “market” valuation of 1789p versus a current share price of 960p, implying that the business is trading at an almost 50% discount.

Ownership: Hansa Investment Company owns 26%, and its investment officers William Salmon (via Victualia), and Christopher Townsend together over 50% of OCN shares. There are no UK institutions with disclosable stakes on the shareholder register, perhaps reflecting the lack of free float or the minority shareholder’s unfriendly policy of not distributing excess capital.

Opinion: If in 2011 management had bought an S&P500 index tracker, and compounded OWIL at 13.8% in line with the index, then OWIL alone would have been worth over 1750p per share at the end of last year. It’s hard to know what to make of majority shareholders that don’t want to maximise long-term value. I own the shares and am hoping that eventually Townsend and Salmon will see that either i) returning capital to shareholders or ii) at the very least investing funds in a low-cost tracker – would make more sense than tying up their cash in underperforming hedge funds. I suppose the example of OCN goes to show that sometimes there is no correlation between financial acumen and wealth.

Equals AGM statement

This foreign exchange and payments company gave an update for the first 91 business days of the year (to 15th May) ahead of their AGM which was last week. It’s good to see management can report on figures up to mid-May, which suggests that they have good control and reporting systems and means that they can respond quickly to changes in market conditions. Revenue was £22m, which translates as an average of £241k per working day. That’s an +86% versus the same time period in FY 2021, £129k per day (or £11.9m).

It sounds like costs may be rising too, with them hiring 10 more employees to bring the payroll to 265 employees. They’ve also hired a Chief Commercial Officer, Tom Kiddle, previously UK General Manager of payments group WorldFirst (which is owned by Ant Group – the Chinese affiliate of Alibaba / Jack Ma, that was supposed to IPO last year until the Chinese Communist Party decided otherwise). Later in the statement, they talk about investing in their customer on-boarding processes to make it easier to become a customer of Equals whilst not compromising on compliance. They conclude the RNS by saying:

“We have confidence that our revenue performance, offset with our investments in revenue-facing functions, will lead to Adjusted EBITDA being ahead of market expectations for FY-2022.” However, the share price didn’t respond, suggesting that if you want to persuade investors you are ahead of market expectations, you need to communicate with investors what those expectations actually are.

Valuation: Sharepad shows revenue forecasts raised from £54m revenue FY 2022F (implying +24% y-o-y growth) and EBITDA of £9m (implying +40% growth) at the start of the week to £62m and EBITDA of £9.8m (now implying +41% and +46% respectively). The shares are trading on 16x FY Dec 2023F, which looks about right given the turnaround but also questions about how helpful markets might be in H2.

Opinion: This company has been loss-making for the past three years, cumulatively losing £16m – but now looks to have turned the corner. The shares are up to 3.4x in the last 18 months. I own shares in Argentex, which is trading close to its 52-week low of 69p, so I’m hoping that these results from Equals have a positive read-across on AGFX.

Future H1 results to end March

This media publisher (owner of TechRadar. Marie Claire, PC GAMER, and MoneyWeek who I write for) bought GoCompare, the price comparison website, for £594m in February last year and H1 results to end of March last week. They have an impressive track record of growth, with operating profit outpacing revenue suggesting that as the business grows, margins improve so demonstrating returns to scale and operational gearing.

Revenue is split into advertising 35% (i.e., ads displayed on their websites and physical magazines), content 31% (i.e., sale of magazine subscriptions or online membership), and 34% affiliate marketing (i.e., commission they earn when an online user clicks through to another website to buy something). In terms of geography, 62% of revenue is from the UK, and 38% is from the US.

Traditional quality newspapers earn revenue from subscriptions and advertising but have a policy of keeping editorial independent of advertising. For instance, the FT might carry adverts from fund managers, but that wouldn’t sway their coverage of how index trackers outperform most large-cap active funds. Future has blurred this boundary with their affiliate marketing. The content is free for review sites (e.g. tom’s guide or tech radar) but there’s a clear reminder at the top of these sites saying that “When you purchase through links on our site, we may earn an affiliate commission.”

Statutory revenue was up +48% to £404m in H1 March 2022, and PBT +42% to £81m.

Organic revenue growth was a more pedestrian +4% though. That said they faced a difficult comparison, as online advertising revenue boomed during the pandemic last year. The adjusted operating margin was 33%, in line with H1 last year, and an improvement in the second half. That’s a positive for shareholders, though it indicates to me that they are not paying their hard-working writers (specifically me) enough money.

I note that there’s an alphabet soup of remuneration schemes PSP, DAB, taxable benefits, annual bonus, and pension for the Chief Executive, Zillah Byng-Thorne which seems like an attempt to mask the fact that she’s overpaid. Companies often make a voluntary disclosure in the remuneration report so complicated that it’s very hard to work out what management is being rewarded for, or how much. Barclays were masters at this, one year producing a 16-page remuneration report, just before Bob Diamond was forced to resign as Chief Executive following the Libor rigging scandal. To counter these regulators introduced a rule where the company had to disclose a single-figure pay amount, adding up all the different schemes and benefits. So, we can see that Zillah Byng-Thorne was paid £8.8m in FY 2021.

Between 2017 and 2019 she was awarded 600,00 of nil cost options (worth £11m at today’s share price). The FT however reported earlier this year that the proposed future incentive scheme was even more generous, and could award the Chief Executive £40m. The controversial scheme would payout if the FUTR’s share price increased by +10% or more a year from September 2020 to September 2025. She also received a basic salary increase of more than 21% to £575,000. Nice work, if you can get it.

Outlook: They say there will be “a modest upgrade to our FY 2022 guidance, which reflects: ongoing resilience of the underlying business, despite the inflationary backdrop with the Group on track to deliver year-on-year margin progression as previously anticipated.” That all sounds very positive, but there has been a recent sell-off in Adtech with YTD The Trade Desk down -45%, Tremor -21%, Sir Martin Sorrell’s S4 Capital down -58% and newspaper publisher Reach -59%. So, I am surprised that FUTR can be so upbeat – their shares are down -50% YTD suggesting other investors have a degree of scepticism towards the bullish outlook statement too.

Balance sheet: Since 2017 they have made 18 acquisitions, totalling c. £1.5bn. So, there’s £1.54bn of intangibles on the balance sheet, (around 60% of which is goodwill) and tangible book value is negative £606m.

Net debt was £389m at the end of March.

That’s fine as long as the group can continue generating free cash flow (£138m at H1) but if there is an advertising downturn coming, the group’s balance sheet does look rather vulnerable.

It’s worth mentioning too that Moneysupermarket.com, a rival price comparison website has had a difficult 18 months. The price has sold off as investors first worried about the rising cost of online marketing to drive users to the site – a trend that benefits publishers like FUTR, but is negative for price comparison websites like GoCompare, which they own.

Then we saw investors question the price comparison business model as energy providers withdrew price switching offers from MONY and GoCompare, due to the uneconomic nature of the natural gas price cap last winter. Following the sell-off, MONY shares are trading on 10x historic EV/EBITDA, whereas FUTR paid a full 16x EV/EBITDA for GoCompare at the beginning of last year.

Valuation: FUTR is trading on 11x Sept 2023F P/E. That’s could prove a good entry point if management can integrate all their acquisitions. However, I think the risk is on the downside here, so I would be cautious, and that seems to be what is driving the de-rating.

Opinion: We’ve seen with BOTB that operational gearing can have a downside if revenue comes under pressure. When high growth, acquisitive companies go wrong, they can go badly wrong so I think I would avoid it at this point in the cycle. I also feel that the best companies don’t tend to reward management with nil cost options, companies with top-heavy incentive schemes and well-paid, “star” Chief Execs are inherently unstable.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Notes

The author owns shares in Argentex and Ocean Wilsons

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.