It has been a turgid couple of months for small cap investors.

Many stocks are well off their highs.

There are no longer placings where investors can’t write tickets quick enough.

The capital tap (for now) is no longer gushing and we’re seeing companies sell off as people become wary of a possible recession.

At the moment, in my view the risk/reward for equities is no longer as attractive as it was.

Almost a year ago, when the first vaccine news dropped into the market, the risk/reward for equities was phenomenal.

Instantly, there was hope and something concrete to believe in: that the vaccine would halt the virus and stand firm, turning the tide against the war for freedom.

For those who piled into stocks in the weeks after the news dropped they’ve been handsomely rewarded.

But what now?

What is there to look forward to?

Where is the good news going to come from?

These aren’t rhetorical questions – I don’t actually know.

Already, the talking heads are discussing reintroducing measures. Whilst the UK government is adamant that the UK won’t go back into “lockdown” (I use speech marks because lockdown can mean anything) – restrictions would certainly be most unwelcome in many sectors.

Another factor is the increase in gas prices.

Increases in heating and energy bills will mean consumer discretionary spending goes down.

If consumer discretionary spending goes down then there’s more competition for less spending.

Not to mention that many companies may not have forward-purchased their required energy commitments – that means higher costs.

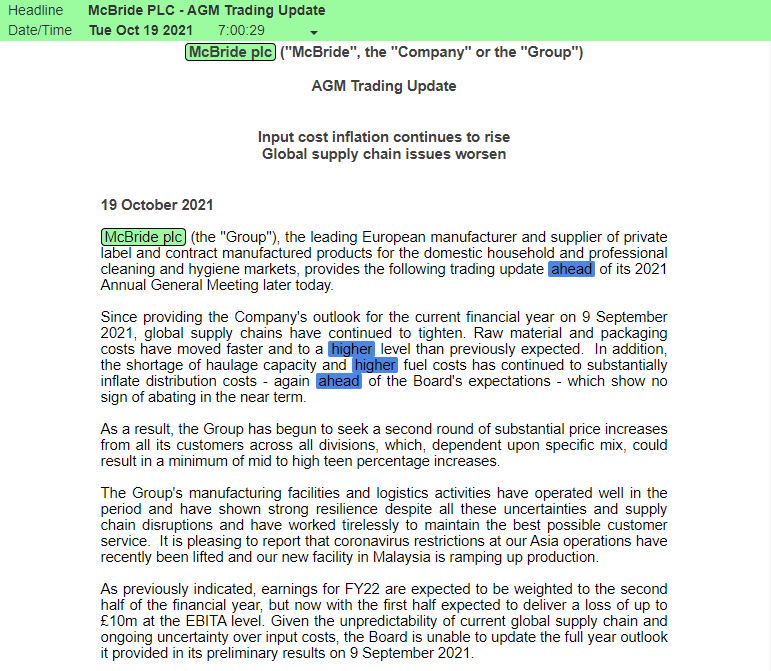

We only need to look at McBride’s RNS on 19 October 2021 to see how price increases change things:

“Given the unpredictability of current global supply chain and ongoing uncertainty over input costs, the Board is unable to update the full year outlook it provided in its preliminary results on 9 September 2021.”

The company has seen price increases for materials – which “show no sign of abating” – and now needs to pass on a second round of price increases.

And what will the customers who have a price increase do? Likely try and pass it on.

We’re now in a game of “price increase pass the parcel” (or ticking timebomb) to see who can charge each other the highest.

In my last piece, we looked at the indices.

The indices can be a good way to get short exposure because it’s like switching on a light bulb and turning a short on and off.

However, it’s often specific stocks that are the best trades.

It’s human nature to be long as people, in general, are more positive than they are negative.

And in times of boom, as we’ve seen over the past few months, this means people can be lazy as well as long.

It’s the lazy longs that get punished in markets like these.

Growth companies that are no longer growth companies can take a severe beating – especially in unforgiving conditions like we’re seeing.

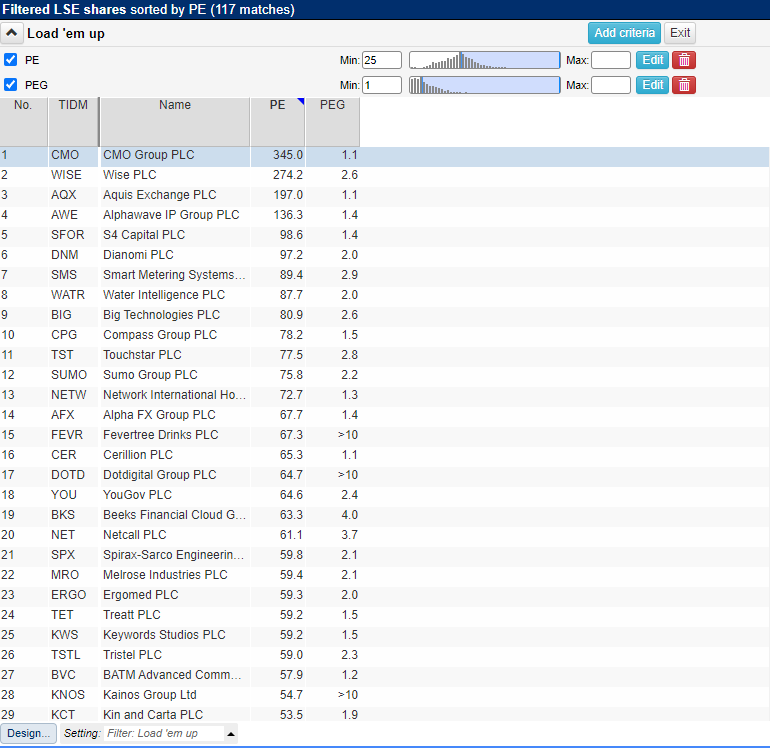

I’ve created a quick filter that can be found on SharePad’s library (Load ’em up) that focuses on two metrics.

First, the price to earnings ratio.

PE ratio

Shorting a stock because it’s overvalued is a one-way street to the poorhouse.

This is for two reasons:

- Contrary to popular belief, PE doesn’t actually tell you whether a stock is overvalued. It tells you what the multiple at which the market rates the stock

- Even if a stock is overvalued, betting that investor euphoric sentiment will turn is a dangerous game

Therefore, I’ve included PE not because I want to find overvalued stocks, but because I want to find stocks where the multiple is high as stocks that de-rate can see their valuation unravel quickly.

The PEG is the price to earnings to growth ratio.

It puts into context the PE in terms of the company’s EPS growth rate.

A company valued at 20x earnings growing at 20% a year would have a PEG of 1.

Here are the results from the Load ‘em up filter.

I’ve put a minimum of a PE of 25 (putting any number here will get rid of companies without a PE – not always a good thing as these companies can also be great candidates!).

I’ve also put in a minimum of 1 – because I want companies that are valued higher than their growth rate.

We can see 117 results.

Having a quick look at these, I know that Cerillion is an illiquid SETSqx stock.

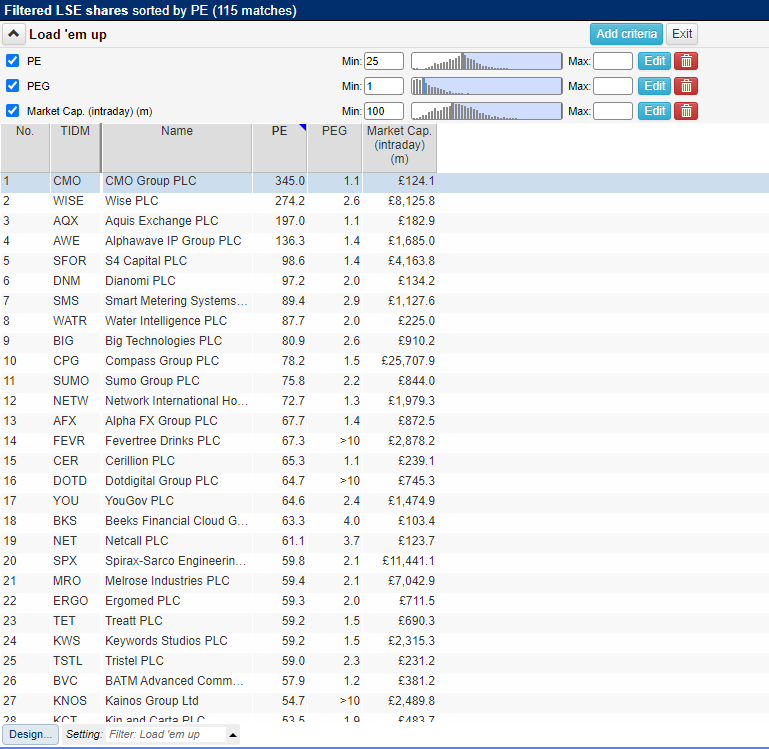

I don’t want to be shorting those, so I’ll add a market cap filter.

I’ll set the minimum market cap to £100m.

We now have 115 stocks. You can also go further and add a trading platform filter if you wish – that way you can filter for SETS and SETSqx stocks (see my Twitter thread on Level 2 here).

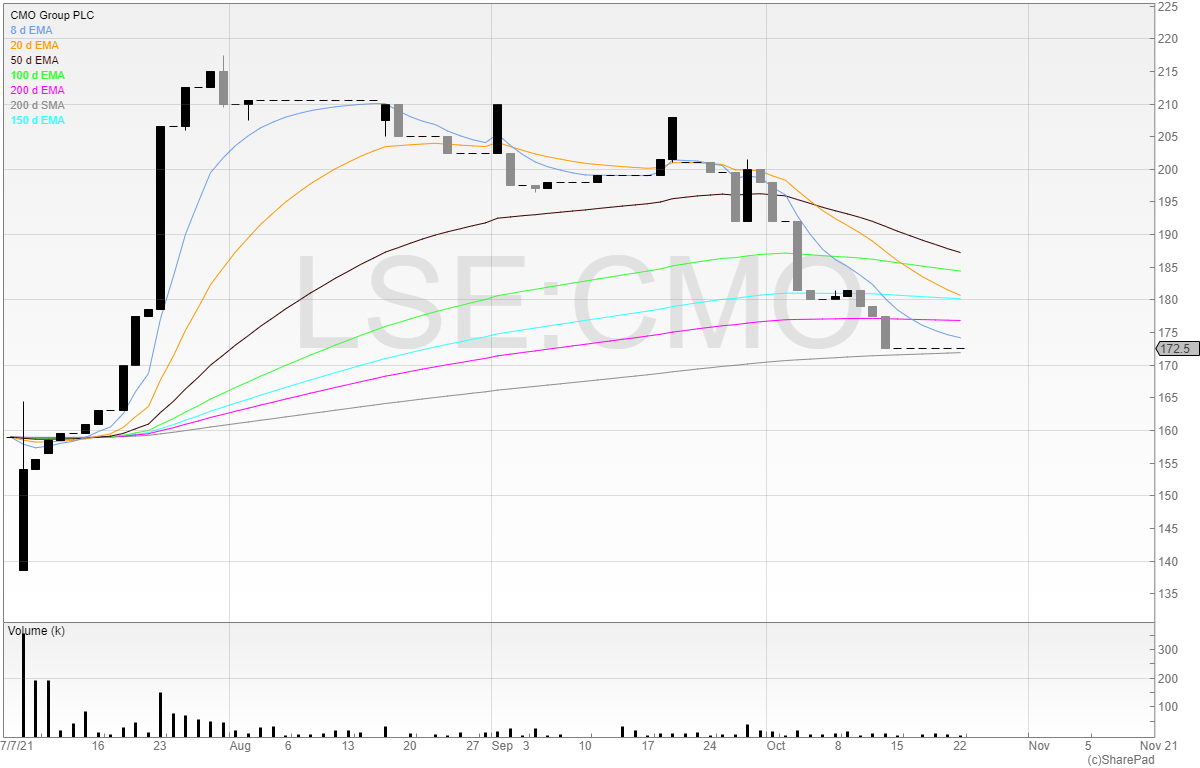

Let’s look at the first stock on the list, CMO.

CMO is a hot new list.

However, it’s now trading precariously just underneath the 200 EMA and a smidgeon above it.

IPOs in frothy markets are a good way for sellers to exit businesses at opportune prices, having dressed the piggy beforehand (obviously, not all IPOs are of this kind).

Things to look out for and check:

- Were there any sellers in the admission document?

- What does the business do and is it likely to run into tailwinds?

- How liquid is the stock?

The last point is the most important.

Being short an illiquid stock and being squeezed as the price runs up faster than you can close is not a nice experience.

Volumes in CMO look relatively thin compared to the opening day. I feel like caution would be required here.

The next stock is WISE. This trades on a PE of 274.

That means if you were to buy today, you’d need to wait 274 years (all things being consistent of course, which they are not) in order to have your shares repaid.

There was a placing of shares this week with the price done at 815p, I’ve heard.

I intend to wait this stock because it opened at 800p on its IPO day.

If it trades below that, it’s plumbing all-time lows on a rich valuation.

Let me know any ideas you have for potential shorts in the comments below!

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

I’ve never had much luck shorting, very much a case of the market remaining irrational longer than I remain solvent. Shorted Amazon when it hit $1000 c.2017…closed out $200 later 🙁 I was recently tempted to short AO World at 240p, still looks a one way bet at 150p. The market cap seems insane for an undifferentiated old school retailer. Amazon also looks good, again :(, this time it’s flatlined around $3000~3500 for a year, but the Nasdaq seems to be as indestructible as ever. Ryan air looks expensive?

Hi Rob, the problem with Amazon is that everyone thought it was overvalued.

What people didn’t see is that it generated huge operating cash flow which was then sunk into R&D.

It was richly rated yes, but there was a reason. This is the problem when shorting overvalued stocks. They can become more overvalued!

I’d be inclined to leave Amazon well alone given it’s one of the best businesses on the planet.

AO. World – the time to short was the profit warning. Not sure I’d short that now. Think you’re right – it does look expensive – but it’s no longer at the optimal point for a short.

Ryanair – not look at that. Thanks! I’ll take a look.

Can’t see the filter in the library (although I realise it would be easy enough to recreate myself).

Apologies for the delay! The filter is now in the SharePad library

Can’t see the filter

Sorry about that, the filter is now in the SharePad library