Bitcoin fell -20% last week, and at the time of writing the price of $39,340 is back to the level it was a couple of months ago, but still up +35% since the start of this year. It seemed to recover towards the end of the week, but the “currency” is so volatile that it could easily change by the time this is released on Monday. For instance, last week the currency fell -30%, followed by a rise of +33%, then a fall of -13%, followed by a rise back up of +21%. The volatility followed an announcement from the People’s Bank of China (ie the Chinese Central Bank) warning banks not to accept Bitcoin as a payment.

If you’re interested in crypto prices, SharePad has added a selection in the “other lists” bottom right section, just below commodities. I’ve shown the log chart of Bitcoin going back to 2010, and the 200-day moving average.

Other cryptocurrencies were even more volatile: Ethereum was down by a third last week, but still up +275% from the start of this year. Dogecoin was down -40%. There’s a podcast that I listened to this week to understand the difference between Bitcoin and Ethereum. It’s full of interesting detail, and the interviewer Patrick O’Shaugnessy asks good questions. However, I’m still wondering “what problem does this help solve?” I can certainly see that Bitcoin is more fun than investing in shares that compound away; this guy probably gets invited to more parties than Warren Buffett.

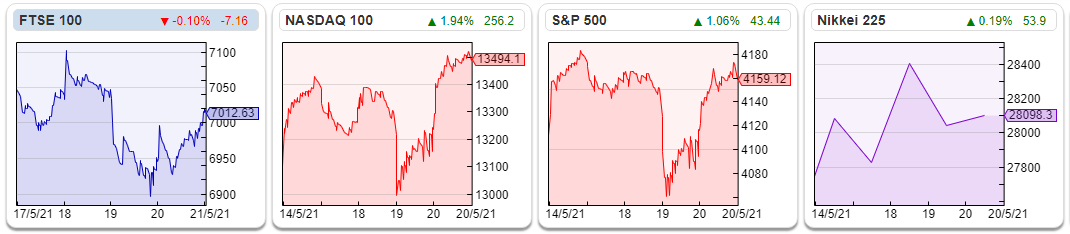

Equity stock market indices were much less volatile, both the FTSE 100 at 7,013 and Nasdaq 100 13,494 were up less than +1% while the S&P500 4,159 was down less than -1%. Within this there were some big moves of individual companies. On the FTSE 100 Antofagasta, the Chilean copper miner, was down -15%, Vodafone was down -9%, and BHP, Glencore, Anglo American all off -4 to -5%. It seems odd that Bitcoin should be correlated with real world miners, though perhaps the connection is China? A couple of weeks ago Iron Ore futures jumped +10% in a matter of minutes, which appeared to be driven by surging Chinese demand. Tesla’s (which no longer accepts Bitcoin as a payment) 2nd biggest market is China (around a third of revenue), and demand there for the EVs is slumping.

At the beginning of the financial crisis in 2007, an old broker with experience of the Japanese banking crisis gave me some wise advice: ignore what bank management say, look at how they act and how bank share prices behave, and try to understand what that is telling you. I think the same could be applied to price moves more generally; cryptocurrencies behave neither as a currency, nor as a store of value like gold. Instead they behave like a volatile equity, most like a tech stock, with huge potential but a wide variance of outcomes.

This week I look at Cerillion, the telco billing Group; Sanderson Design Group, the wallpaper and interior design company (previously known as Walker Greenbank); SigmaRoc, which is acquiring concrete quarries, and Games Workshop which needs no introduction to most readers.

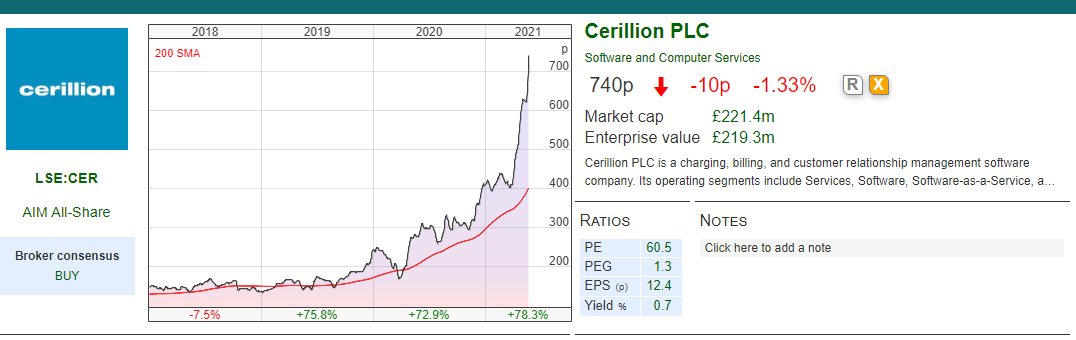

Cerillion

This telecoms billing company announced H1 to end of March reported revenue +26% to £12.8m, adjusted EBITDA +77% to £4.8m, net cash +60% to £7.7m. All three numbers are in line with the company’s trading update in April. Statutory PBT was £3.4m +93%, helped by a reduction in the share-based payment charge. The shares were up +10% on the day of the results.

Accruals When I wrote about this company at the end of April, I mentioned that revenue is recognised alongside percentage completion of projects. Relatively large levels of accrued income have built up in the past, which is revenue that the Group is yet to invoice or receive payment for. The company has the strange habit of changing the line item “Accruals” from Note 16 in its Annual Report to “Amounts recoverable on contracts” in the half year RNS statement. At H1 this figure totals £8.1m (consisting of £1.6m non-current and £6.5m current accruals). I’m confident that this line item is consistent with FY accruals, because the FY numbers are the same, but the company has decided to name them something else in the H1 reports both this year and last year. If Shakespeare had written about accounting concepts, rather than roses, I wonder if he would have thought that accruals by any other name would smell as sweet?

So accruals/amounts recoverable on contracts were flat versus 12 months ago, and down 5% versus 6 months ago, which is reassuring to see them growing more slowly than revenue. Nevertheless £8.1m of accruals (or £15m total receivables) still represents a hefty share of FY revenue. The working capital movements mean that “cash generated from operating activities” was £2.65m, below both PAT £2.9m and adjusted EBITDA of £4.8m.

Outlook The outlook statement is brief, with management saying that they are well placed operationally and financially. The new business pipeline should support revenue and earnings growth, and the Board is confident of future prospects this year and beyond. Management point to some large client wins in H1 and the back-order book was £42m, up +74% year on year. They also highlight new business opportunities +9% to £131m.

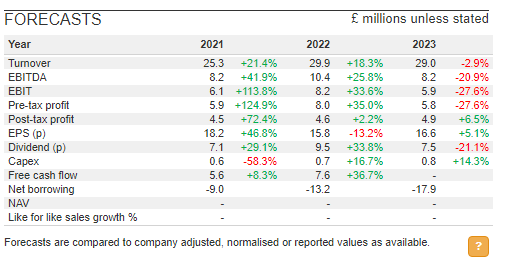

Forecasts There are a couple of brokers with very different forecasts. To keep things simple, I’ve just taken SharePad’s forecast figure, which should be a simple average. 17p of earnings in 2023F implies a PER of 44x, which seems rather expensive. If your preferred metric is EV/EBITDA then the valuation is 27x in 2023F, which is also expensive, in my view.

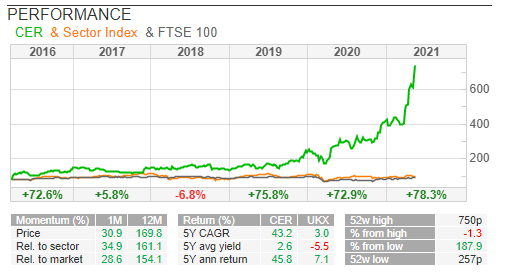

Opinion Well done to holders of this; it’s up +78% since the start of the year, following a +73% gain in 2020. It doesn’t feel like the type of market to chase expensive stocks higher. It’s one of the few IPOs to have done well from its listing price of 76p in March 2016, which reflects well on management. So I think if I owned it I wouldn’t sell, but as I don’t, I’d follow with interest and see if it ever fell back to a more reasonable valuation to time an entry point.

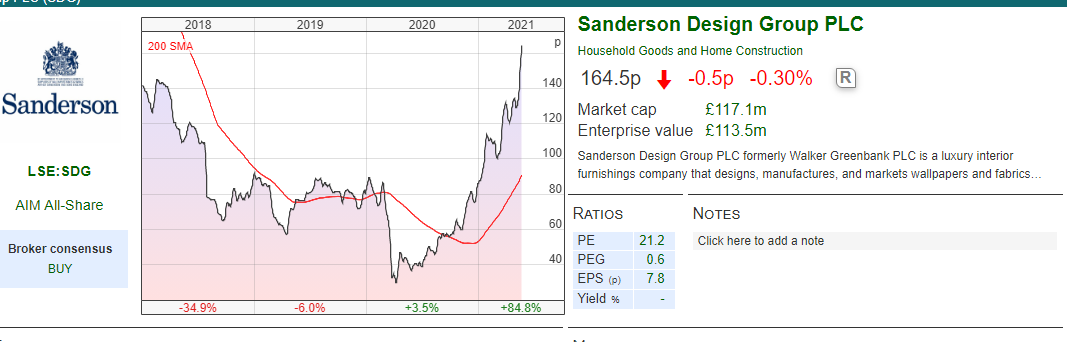

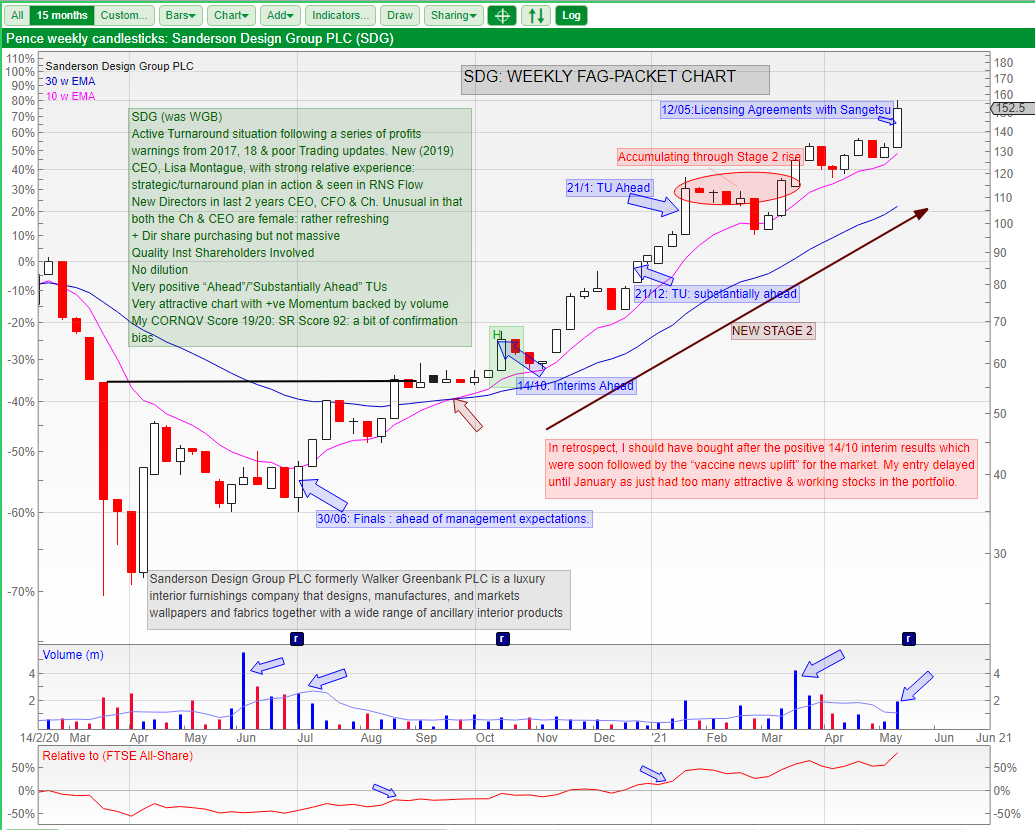

Sanderson Design Group FY to 31 Jan

This wallpaper company, with a 31 Jan year end, used to be called Walker Greenbank until they changed their name December last year. Their brands include Zoffany, Sanderson, Morris & Co., Harlequin, Scion, Anthology, Clarke & Clarke and Studio G. Some of these brands go back to 1860, and the business was incorporated in 1899. Although a luxury niche, they are a global brand with showrooms in London, New York, Chicago, Paris, Amsterdam and Dubai. Just over half of revenue is UK, the rest being International and licencing (less than 5% of revenue but high margin). Licencing revenue fell last year, but looks set to rise in future. In November last year they announced a licencing agreement with Next (the FTSE 100 retailer) and a couple of days ago they announced a licencing agreement with Sangetsu, a large Japanese interior design company. The company moved from a full LSE listing to AIM in 2003, so there’s no Admission Document.

The Group reported revenue down -15.9% to £93.8m, while statutory PBT was actually up +14.6% to £5.0m (there was a £1.1m restructuring charge in the prior year). Net cash including leases was £9.3m. The pandemic has caused a significant H1 v H2 split, with H1 revenue £38.8m and a -£0.9m statutory pre-tax loss, as both manufacturing and product launches were affected. But trading in the second half has now recovered to pre-pandemic levels. Despite the disruptive effects of Covid-19, the FY gross margin held constant at 61%. Cash generated from operations was a very healthy £18.2m, helped by an £8.1m inventory reduction and adding back a £5.7m depreciation charge, which seems high in the context of £12.1m of property, plant and equipment on the face of the balance sheet. No dividend, which is understandable given the company has received £3.1m of CJRS aid from the Government during the financial period. From April this year they have no staff furloughed (down from 510 employees furloughed in April last year).

Balance sheet Like many companies with a long history, there is a pension deficit. The Group paid £2.1m to reduce the deficit which was £5.6m at the Jan 2021 year end. However that £5.6m is the balancing item between two large figures: £84m present value of obligations and £78m of pension plan assets. That is in the context of a market cap of £117m and net tangible book value of £39m. It’s possible that as corporate bond yields rise, the discount rate of the obligations rises and the deficit reduces. But otherwise the continued contributions look like they could be a drag on profits for some time to come?

Outlook Sales in Q1 of this financial year (ie Feb, Mar, Apr) are slightly ahead of the Board’s expectations. This June the Group plans to launch an online shop to market its Scion “upbeat, modern living” brand direct to consumers. They use the phrase cautiously optimistic.

Ownership Octopus owns 12.2%, Fidelity 8.3% Ennismore 7.2%, BGF 6% Schroders 5%.

Opinion Cockney Rebel pitched this at Mello a month ago as a recovery play. The chart (source: StockWhittler) does look like a nice bowl! Although the pandemic has meant that people have spent time at home renovating and DIY’ing, this isn’t really Sanderson’s core market. If you’re going to put up wallpaper at £80 a metre, you’ll probably pay a professional to do it. So SDG was hit hard by the first lockdown, though pleasingly H2 was much stronger. This has already risen 4.7x from its 52-week low of 35p, so well done to investors who had confidence enough to back it. I think it could have further to go; to me it feels like a company to buy and hold rather than trade in and out of.

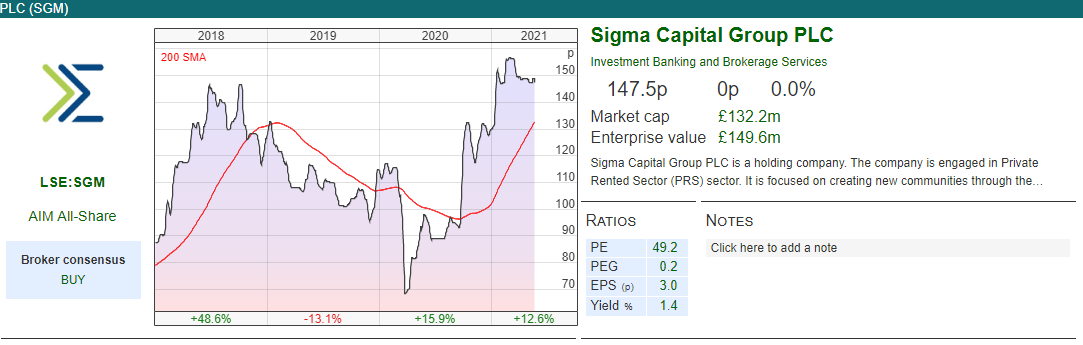

SigmaRoc AGM Trading Update

This acquisitive concrete company “roll up” with a December year end put out a positive trading statement for the first 4 months of 2021 ahead of their AGM. Q1 2021 is ahead of internal expectations (without saying what they are), but at least they have given some numbers: revenues of £36.7m in Q1, ex acquisitions an increase of +12%. They say that both margins and cash generation continued to be strong in the quarter.

Outlook Momentum has continued into April this year. Q2 last year was when the company started to experience the bulk of Covid disruption, so the year-on-year comparatives will be much more flattering than earlier in the year. The integration of acquisitions they made is going well: B-Mix, Casters (total consideration of €13m, announced 13 April this year) and Carrieres du Hainaut in Belgium (total consideration of €45m, announced Oct 2019).

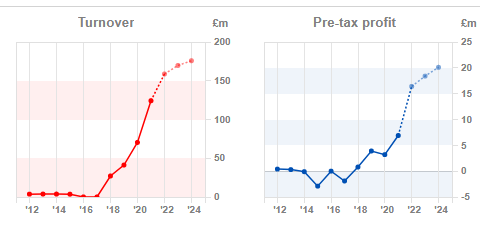

Financials In April, the Group reported FY 2020 revenues +77% to £124m and statutory PBT trebling to £7.1m. The growth is a combination of organic and acquisitions, and the company tends to pay around 5-8x adjusted EBITDA for the companies that it buys. Intangible assets were £48.8m and net debt was £43m at the Dec year end. The company actually wrote down goodwill last year by £43.8m, which related to CDH. This wasn’t an impairment, instead the company wrote up the value of the Land and Buildings (ie tangible assets). I’m not quite sure what I make of this. Presumably banks prefer to lend money against fixed assets rather than intangible assets and that’s why they’ve done it? But in the end it’s an accounting entry, it doesn’t change the underlying economics or the future cashflows.

History The company listed on AIM at the start of 2017 through a placing at 40p per share, raising £50m and acquiring Ronez from LafargeHolcim for £45m in cash. Ronez operates two hard rock quarries across Jersey and Guernsey, construction materials to the local area, including aggregates, concrete, asphalt and cement. In 2015, Ronez recorded revenue of £26.3m, EBITDA of £5.0m and profit before tax of £2.94m, so revenues are up just under 5x since the initial placing on AIM and acquisition. Management have then executed their “buy and build” strategy. The chart below shows good revenue and profit progression; ignore the numbers pre-2017, as the company was a previously a cash share and that performance isn’t relevant to the current Group.

Management The Executive Directors all earned less than £1m total compensation last year, with the Chief Exec Max Vermorken earning £937K. He owns half a million shares, but has been awarded 11.4m of options most of which have a strike price at 40p (ie worth about £5m at today’s share price).

Ownership M&G own 9.5%, BGF 7.8%, Ravenscroft 7.7% with half a dozen more institutions on the register. Nigel Wray also own 3.8%.

Opinion Management present a good investment case suggesting that although there are global concrete companies like Lafarge Holcim, there is potential for a regional business to consolidate local quarries, and also buy unwanted subsidiaries from the global players. You might not think concrete is the most exciting industry, but Breedon Group has been a ten bagger in the last decade, so it’s obviously possible to generate high returns if you know what you’re doing. It’s hard for me to have a strong view, because I don’t have a feel for how much future capex is required, and I’d also be worried about how cyclical the industry is. So I think that the investment case comes down to a qualitative judgement call on management.

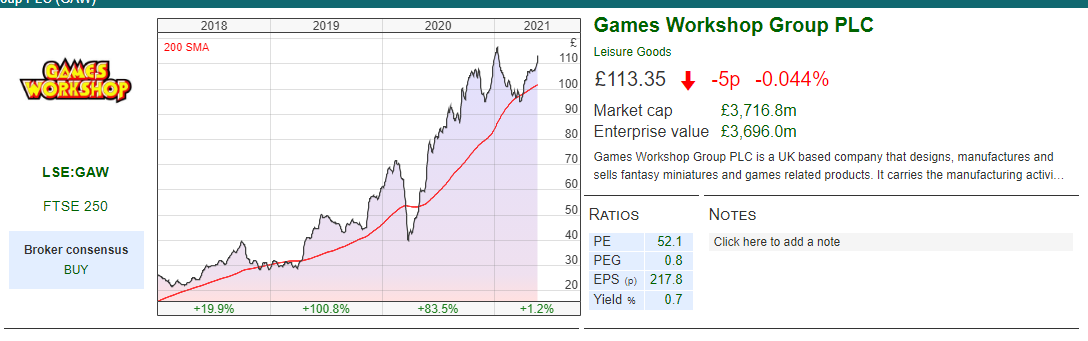

Games Workshop Trading Update 30 May Y/E

This remarkable company with a May year end put out a trading update to say that revenue should be not less than £350m and PBT not less than £150m, implying +30% and +69% growth respectively. This looks like a 7% beat on the PBT line. For much of the year UK and European retail stores were subject to Covid-19 closures and distribution disruption, so this is very encouraging. One slight disappointment is that licencing revenue is down a couple of million to £15m. FY dividend per share will be 235p. They expect to announce results on the 27th July.

This remarkable company with a May year end put out a trading update to say that revenue should be not less than £350m and PBT not less than £150m, implying +30% and +69% growth respectively. This looks like a 7% beat on the PBT line. For much of the year UK and European retail stores were subject to Covid-19 closures and distribution disruption, so this is very encouraging. One slight disappointment is that licencing revenue is down a couple of million to £15m. FY dividend per share will be 235p. They expect to announce results on the 27th July.

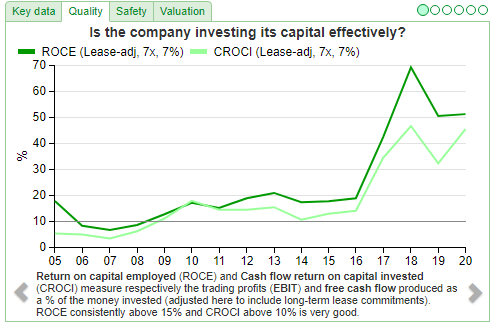

Forecasts Edison, the “paid for” research providers, forecast revenue FY 2021/2F of £381m and PBT £157m, putting the shares on 32x PER and 24x P/Cashflow. I’d expect forecast to nudge upwards, so perhaps closer to 20x next year’s cashflow might be more realistic? In any case, that doesn’t look expensive in the context of the growth rate and high ROCE achieved since 2016.

Ownership Baillie Gifford announced earlier this month that they had a disclosable stake of 5%, which seems a vote of confidence. Other institutions are Schroders 5.7%, and Abrdn 5%.

Opinion Strong companies tend to get stronger through a crisis, and this certainly applies to GAW through the pandemic. The shares haven’t participated in the vaccine rally, the shares were actually down from 1 Jan this year. But they should benefit as stores are allowed to reopen, as I think much of the success of Warhammer is not painting the figures, but in playing the game and mixing with others. I’m a happy holder.

Bruce Packard

Notes

The author owns shares in Games Workshop

Got some thoughts on this week’s commentary? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

It’s very trouble-free to find out any matter

on net as compared to textbooks, as I found this

piece of writing at this site.

Hi this is somewhat of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding expertise so I wanted

to get advice from someone with experience. Any help would be greatly appreciated!

Thank you very much for sharing such a useful article. Will definitely saved and revisit your site

How to Bet on Sabong?