My biggest objection to investing in Moneysupermarket when I wrote about it in 2019 was that it was a solution to a problem that should really be fixed at source. In providing a work-around for the flawed insurance market, it might have been perpetuating the problem.

As it happens, the problem is being fixed, but that may not be good news for price comparison websites like Moneysupermarket.

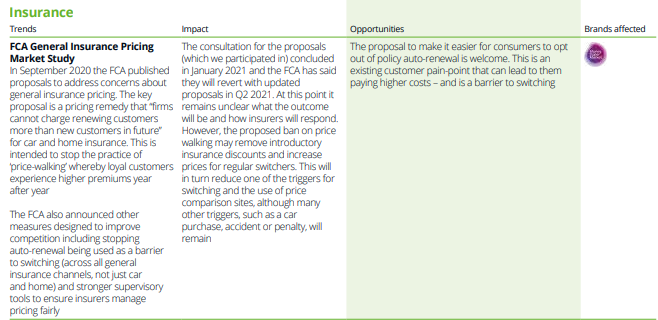

Regulatory risk

One of the main reasons people switch insurance policies is because the insurer has “walked up” the price at renewal.

This is a perverse way to treat loyal customers. It is a result of competition to acquire new business through discounted premiums.

To pay for the discounts the insurers must charge loyal customers more. The more loyal they are, the more they are charged.

The Financial Conduct Authority had proposed that so-called price walking be banned and it will reveal how it will achieve a ban later this month. By the end of this year, insurers will probably have to offer renewal prices that are no higher than new business prices.

My insurer, Aviva, which used to promise that it would be honourable in this way has removed the promise now all insurers will be compelled to behave.

This is not good news for price comparison sites because it takes away a reason people switch from one insurance company to another.

Source: Moneysupermarket annual report 2020

News that the market is being fixed puts me in a dilemma.

The result may well be an ecosystem I like better in which Moneysupermarket still offers a useful service. People will still need to switch periodically if their circumstances change or to check that their insurer has not been raising prices across the board.

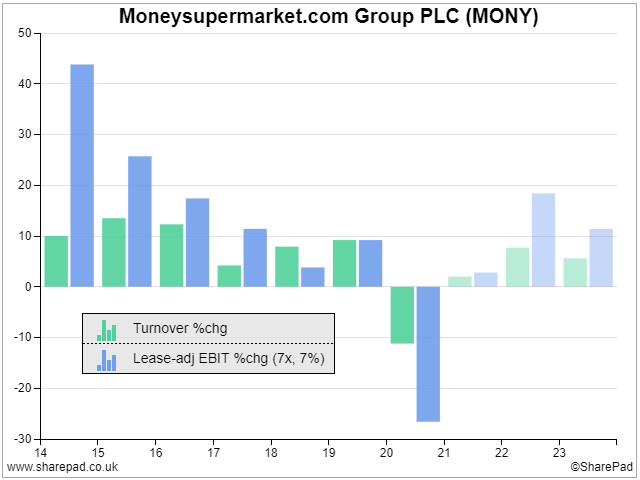

Source: Sharepad > Financials > Company

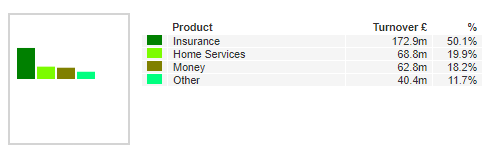

But stricter regulation of insurance could have a big impact. Insurance is responsible for about 50% of Moneysupermarket’s revenue and about 50% of profit, and the risk of regulatory intervention may exist in other parts of the business.

Pressed on the potential impact of the ban, Moneysupermarket will not be easily drawn. I have asked how much of its business depends on insurers walking up their prices and drawn a blank. When analysts asked the same question at the company’s 2020 results presentation I think it is fair to say executives danced around the issue.

Commendably Moneysupermarket publishes a transcript, so you can judge for yourself (just search the document for “FCA”). The closest anyone got to getting a number out of the chief executive was that walking up was not responsible for the 99% of switching ventured by one of the analysts. He said:

“But I can let you know that the answer isn’t 99%, which is why, you know, there’s a tone of voice here that makes me say, yeah, you know, this could potentially be an issue. But can we manage it? You know, I would hope we could begin to, you know, see our way through it.”

Perhaps sensing this would not reassure anybody, chief financial officer Scilla Grimble added that “by far the majority” of switching is due to other factors, principally the general drift upwards of premiums.

More competitive markets

My theory, and I suspect that of many of the analysts who attended the presentation, is that regulation, while aimed at the suppliers, is a sign that the price comparison industry is maturing.

Having sat through consumer goods company PZ Cussons’ strategy reboot, it also seems to me that in general online retailers won phase one of the migration of shopping to the Internet by offering a huge choice of brands and forcing many to compete on price.

Now brands are adapting, partly by making better products, and partly by selling direct, as well, of course, as being savvier in their relationships with retailers.

These changes, as well as the simple fact that growing in a newly established market is often easier than growing in one that is well established, may mean price comparison sites find it harder to grow in the future than they have in the past.

That is a shame because if I were to invest by the historical numbers, Moneysupermarket would be near the top of my list of prospective investments.

It is a highly profitable business unencumbered by debt and it was still growing until the pandemic hit in 2020 and robbed it of business across the board. It earned virtually no income from travel insurance.

My misgivings may reflect the consensus. Moneysupermarket shares are no more expensive than they were in 2015 and the valuation ratios are modest. Despite below-par profit, SharePad gives it a PE of 20.

Strategic shifts

Trends in the marketplace are only one side of the story. The other is how Moneysupermarket is responding.

Its schtick is written on the Moneysupermarket.com home page, which says: “The better we know you, the more we can help you, by finding personalised offers that are just right for you.”

We funnel in information about ourselves, and it spits out product recommendations. If we buy through its websites, Moneysupermarket earns a fee from the product provider.

Its guiding policy is to help us save money, the chief executive thinks the mantra “runs through the organisation like the letters in a stick of rock.”

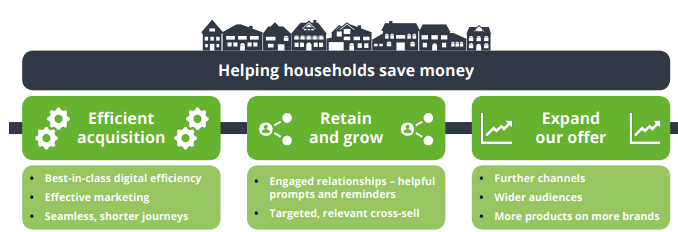

This is how Moneysupermarket is helping us save money while responding to the challenge of growing in an increasingly competitive market:

Source: Moneysupermarket Annual Report 2020

The strategy is to recruit more consumers through advertising, turn them into customers by finding clever ways to nudge us into switching or doing the switching for us automatically, and find more stuff to sell us. At the moment Moneysupermarket is targeting mortgages.

Perhaps the most interesting aspect of the strategy is an ambition to reduce costly “re-recruitment” of customers through online and TV advertising by making its money-saving services so compelling we allow it to decide for us.

That is quite an exciting ambition, but I wonder if it would be best for the consumers whose data is being mined. No price comparison website is cheapest across all product categories, and not all suppliers sell through price comparison websites, so cutting out the middleman might be better for customers sometimes too.

Moneysupermarket also plans to grow the number of channels it sells through, an allusion to Decision Tech, which it acquired in 2018. DecisionTech supplies price comparison services to price comparison sites and fintech companies like Snoop, Revolut and Zopa.

Decision Tech is currently a small part of the business though, part of the 12% revenue earned in the “other” segment.

Moneysupermarket’s strategy is evolving from the brash hawker of cheap insurance it once was to a service that offers to take the angst out of purchasing the services we rely on.

While that sounds like an attractive proposition, I am not sure it can live up to the promise and I find the extent to which the landscape is shifting unsettling.

Richard Beddard

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on buying Moneysupermarket? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.