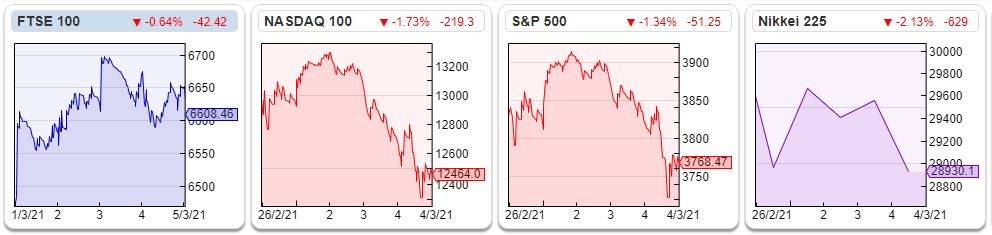

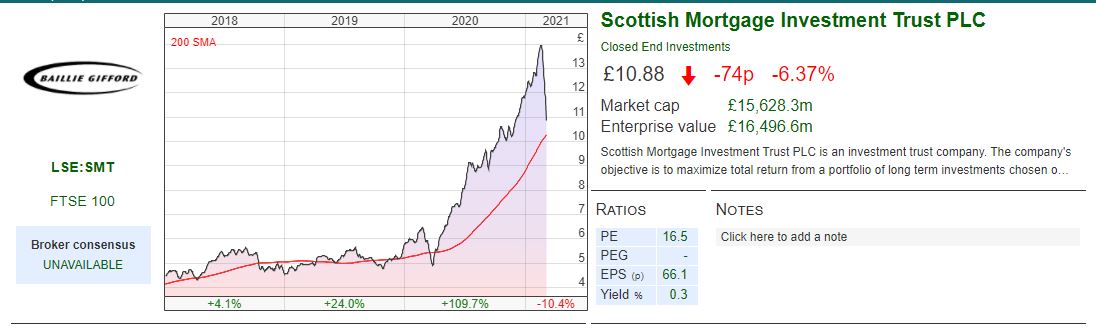

Scottish Mortgage Investment Trust, the Tesla owning £15bn technology fund was down 9% last week.

There’s a fun argument going on in the opinion section of the FT, between Lawrence “usually a mistake to sell” Burns of Baillie Gifford and Andrew “take profits” Dickson of Albert Bridge Capital. The Baillie Gifford (responsible for Tesla owning £17bn Scottish Mortgage Inv Trust) man points out that selling your winners too early is a mistake, and uses data from Henrik Bessembinder to argue that portfolio returns come from a few big winners.

Andrew Dickson at Albert Bridge doesn’t disagree, in fact he thinks that it is self-evident that portfolio names with the highest return drive the performance of the entire portfolio. However, the Albert Bridge man suggests though that for every Tesla, there’s a Nokia, Kodak and Cisco. So concluding that it is wrong to sell your big winners is “a song for fools”, he says, quoting Ben Graham: “nearly every issue (i.e. stock) might conceivably be cheap in one price range and dear in another.”

Historical perspective

Perhaps a historical perspective can shed some light on the debate? In 1917, Bernie Forbes first published the Forbes 100 list of America’s largest companies. By 1987, the 70th anniversary of the list, Forbes magazine looked at how the original companies had performed. 61 had ceased to exist (gone bankrupt, merged or been taken over). Of the remaining survivors, 21 had shrunk below the threshold and were no longer large enough to be included in the top 100. Only 18 companies were still on the list including Proctor & Gamble and Exxon. Of those surviving companies most had underperformed the average growth stock in the stock market. Only GE and Kodak had both survived and outperformed.*

Kodak filed for Chapter 11 bankruptcy in 2011, GE has now underperformed the S&P500 over 15, 10, 5 and 3 years, though it has just about survived. By 2017, a hundred years after the Forbes list was first published, the only other company apart from GE to have survived was AT&T, though this is debatable because the telco stock was broken up by the US Government in 1984. In 1917, 40% of America’s largest companies by assets were oil, steel and mining companies. By 1967, the largest company by market value was IBM, though utilities and oil and gas still made up the largest sectors. In 2017, the 11 largest companies ranked by market value were all technology companies. Apple was top, worth $770bn versus $2.1trn today.

Cyclical v structural

As investors it is worth thinking about which trends are cyclical (leading to mean reversion) and which trends are structural (where we might see increasing returns – the Matthew Effect). Mistaking a cyclical trend for a structural one is likely to prove expensive. I don’t recall reading any opinion pieces by fund managers arguing about this when the market hit its lows in March 2003 or March 2009. That two fund managers are having the debate about selling winners suggests we are close to the top of the cycle.

Some cyclical industries have also suffered a structural decline. Banking has always been recognised as a cyclical industry, yet UK banks have underperformed the main indices for 20 years (both pre and post the financial crisis). If we have reflation, I think we could see banks enjoy a cyclical recovery, though probably not a structural one. I first heard the phrase “super cycle” in 2006, but by the 2008 financial crisis everyone agreed that the “super cycle” was over.

It is also possible to correctly identify the sectors with structural growth (technology) but to back the wrong horse: IBM was the largest company in 1967, yet even as technology has become a larger and larger share of the S&P500 index, Big Blue has underperformed. For instance, in the 6 years between 2011 and 2018 when Buffett owned the shares, revenues declined.

Are tech stocks defended by ramparts similar to that built by the Emperor Theodosius II, protecting Constantinople that is still standing today, an effective defence against attackers for a thousand years? Or defences similar to the Maginot Line, circumvented by taking an oblique approach? Windows and Intel were once thought to have an impregnable duopoly. Their network effects were real, but have proved more vulnerable than was widely perceived 20 years ago.

Dogma that Baillie Gifford don’t hold To conclude i) it’s often a bad idea to sell your winners ii) never selling your winners is a bad idea. Absolutes like “never”, “always” or “impossible” rarely apply in investing. Albert Bridge have attributed to Baillie Gifford a “never sell” dogma, which Baillie Gifford don’t hold, as demonstrated earlier this year when BG reduced their stake in Tesla.

When to sell This still leaves the question of what to look for to trigger a sell decision. For me, the current Tesla share price seems to be assuming that the competitive response by “dinosaur” car company, like the Ford Mustang Mach E will fail to make a dent in Tesla’s sales. I’m not so sure.

So, the answer is to keep up to date with the investment case of the companies you own, as they report their numbers and see how their competition is doing. Good quality management will often communicate the challenges, uncertainties and ambiguities, as well as warning of deteriorating economics. Voluntary disclosure (ie what management choose to tell investors, not what they have to tell investors) is an area that I focus on.

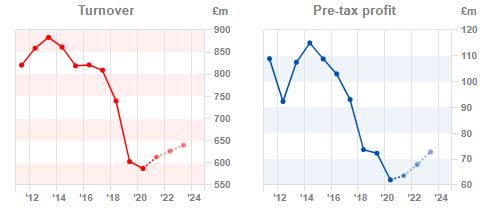

For instance I looked at PZ Cussons voluntary disclosure over the last 10 years. The company had been a 1000 bagger since the 1960s, before halving in value in the most recent decade. Interestingly when the share price was at an all-time high (above £4 in 2013), management warned that trading conditions would be difficult, but many investors ignored the warning because of the company’s exemplary track record. In retrospect that was a mistake; the company management gave investors a good signal when to sell, as subsequent results in the PZ Cussons charts underneath show.

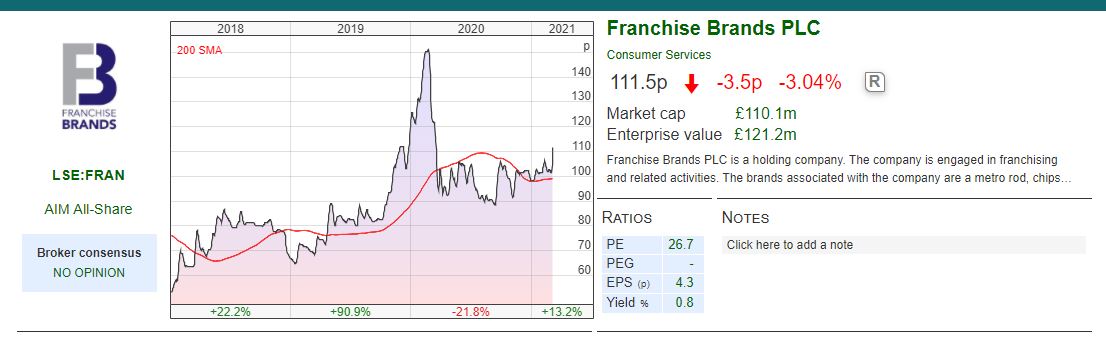

This week I’m not presenting a stock idea at Mello this week, but they have three companies presenting that I’ve written about in the past i) Rosenblatt Group, the legal services firm, ii) Duke Royalty and iii) Franchise Brands, for which I cover FY Dec results below. The link and discount code: MMScope21 for Sharepad / Sharescope readers gives you 50% off tickets.

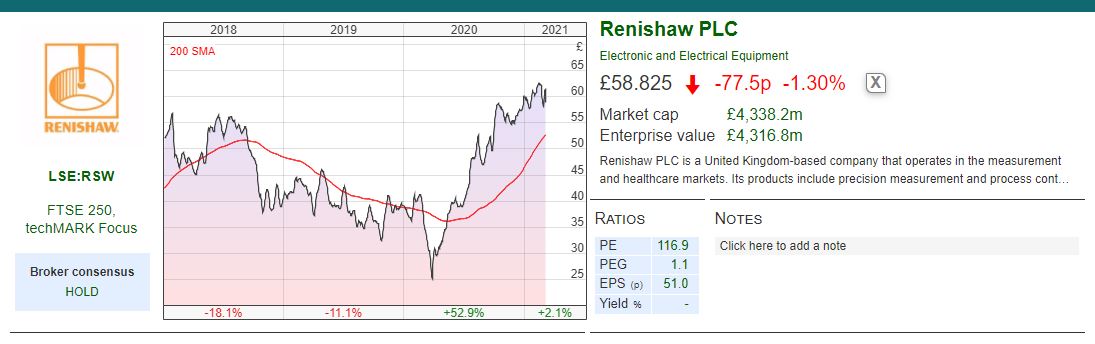

Sticking with the theme of long term winners, I cover Renishaw, where the founders have put their 53% stake up for sale, and Solid State plc which has made a couple of acquisitions. Plus K3 capital which reported a positive start to H2 (FY to May) and Franchise Brands FY Dec 2020 results.

Renishaw

This multi-bagger engineering company announced last week that the founders (Sir David McMurty and John Deer) who own 53% of the shares are looking to sell their shareholdings. Neither the company nor the founders are in talks at the moment. The shares were up +13% on the announcement.

The founders are in their 80s, so it is not surprising that they are thinking about an exit which secures the future of the business, and is sensitive to the heritage and culture. However we’ve also seen that the sale process for smaller, founder-led companies fail to complete (BOTB and French Connection spring to mind) so it’s not a given that a buyer acceptable to the founders can be found.

History Founded in 1973, the Company has grown into one of the world’s leading engineering and scientific technology companies, with revenue of £506m and a market cap of £4.2bn. The company’s first product was used to inspect Concorde’s engines and allowed accurate measurement of machined components. Historically management have reinvested between 13-18% of annual sales back into Research and Development.

The company then expanded from precision measurement mainly in aerospace and automotive to healthcare, energy (wind turbines), 3D printing and scientific research instruments. Over 90% of sales are outside the UK. The shares were trading at below £3 per share in March 2009, but are now close to £70 per share.

Results RSW has a June year end, but has recently reported H1 to December. Group revenue was down 2% to £255m, which seems remarkably resilient given the company’s history in aerospace. They reported statutory PBT of £64m, which included a fair value gain on financial instruments. On the 31st December they had £187m cash on the balance sheet. The outlook statement warned about an uncertain environment, but pointed to a strong order book, and management felt confident enough to suggest revenue in the range of between £515-£545m and PBT £85-£105m.

Valuation Revenue is forecast to grow +12% for FY to June 2022F, followed by +8% the year after. Forecast EPS of 136p FY 2022F and 152p FY 2023F, puts the company on 43x FY 2022F and 38 FY 2023F. Expensive, but you are buying a good quality company. The dividend is forecast to grow to 59p FY 2023 which implies a yield of 1%.

Opinion This looks a high quality, long term company. It would be a shame if it was sold to Private Equity who would probably gear up the balance sheet with debt, slash R&D spending, become overly focused on financial metrics. If it was listed in the US, it strikes me as exactly the sort of company that Buffett would be interested in. However the Sage has had mixed results investing in the UK (Tesco!) and the market cap is probably too small to make much of a difference to his $140bn cash pile.

Solid State

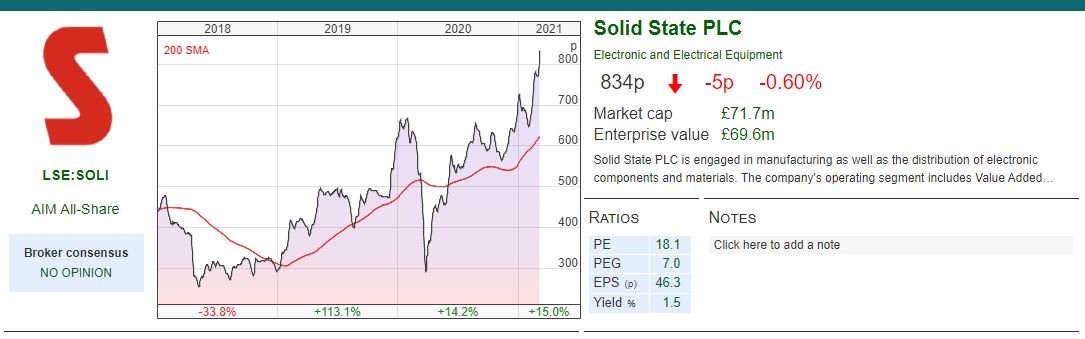

This manufacturer of “rugged” electronics announced a couple of acquisitions last week. Active Silicon for £2.7m, which complements the Group’s existing opto-electronics capabilities, and Willow Technologies Group for £5.5m effective consideration, which distributes electro-mechanical components in the UK, Germany, Spain and the US. Solid State, which has a March year end, last updated the market with a trading statement a couple of weeks ago, saying that revenue would be “broadly inline” and profits ahead (pleasingly this implies that the EBIT margin is improving, something that I’ve suggested the company should focus on). They did warn that semi-conductor supply chain issues that we’ve read about in the newspapers mean that there could be delays with programmes in FY 22.

Though listed on AIM since 1996, the shares trundled along at around 60p up until the financial crisis. However from a March 2009 low of 12p the shares hit 879p five years later (a 73x increase). The share price then fell back to below 300p, but it now looks like they could regain the previous high. The market cap is still less than £70m.

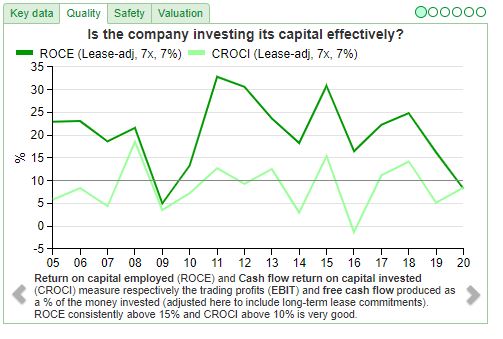

Broker forecasts FinnCap, their broker, is now forecasting £78m of revenue in 2022F, and Adj PBT of £5.8m and EPS of 55p. This puts the business on 15 PER FY 2022F. RoCE now seems to be improving from 13% reported in FY 2019, and pleasingly Cash RoCI was 26% in FY March 2020.

Opinion I listened in to the management webinar on investor meet company. They focused on the acquisition of Active Silicon. It seems to me that the complex engineering challenges that Solid State tackles and the acquisitions they’re making could be a high potential area and management are keen to grow the business to the next level.

K3 Capital H2 Trading Update

I covered this financial company’s H1 results to November three weeks ago. Following last week’s budget, they have now put out a positive H2 trading statement, saying that trading is ahead of expectations and they expect FY to 31 May 2021 to be “significantly” ahead of consensus market expectations with Adjusted EBITDA of no less than £12m. All business divisions have performed well (KBS does M&A advice, RandD does tax credit advice, Quantuma insolvency and restructuring – the latter two divisions both acquired last year). Management point to KBS M&A business as having been particularly strong, though it is worth pointing out that this is a cyclical business; last year revenue fell 26% at KBS.

Broker forecasts FinnCap K3’s broker has increased their FY 2021F revenue forecast by 17% to £43m, though future years forecasts £58m of revenue FY May 2023F remain unchanged for now. The broker is forecasting Adj EPS of 14p FY May 2021F growing to 21p FY May 2023F. This puts the business on 21x this year’s earnings and 14x FY May 2023F.

As the company has grown by acquisition, there was £53m of intangible assets on the balance sheet at H1, versus shareholders’ equity of £46m (so the business has negative tangible assets). That said, net cash from operations was £4.2m at H1 and they still ended the period with £10m of net cash on the balance sheet. There is no debt, but they do have an unused £10m facility.

Opinion This is a people business that has grown by acquisition with negative net tangible assets. Such businesses are easier to manage in a cyclical upturn, when earnouts and incentives are likely to be paid. There was no M&A for six months last year, so there should be a significant backlog of deals. These results also augur well for Cenkos which should benefit from similar trends in M&A. FinnCap also put out a “materially ahead” trading statement last week while RBG Holdings, said the corporate finance business they acquired last year (Convex Capital), has completed four transactions since the start of January, resulting in a total fee income year to date of £2.6m. Manolete have warned that insolvencies in England and Wales declined 37% in 2020 (from 17,225 to 12,557) so I find it interesting that Quantuma is still performing well. For now I’m keeping an open mind whether there is “read-across” from Manolete to the likes of RGB and K3 Capital’s Quantuma division.

Franchise Brands FY results Dec 2020

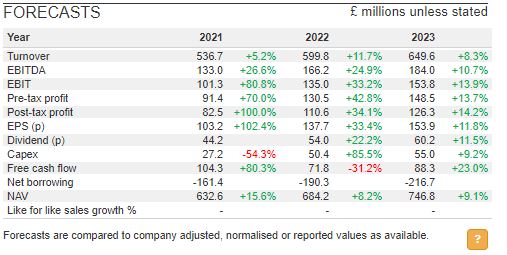

This franchising company is presenting at Mello, founded in 2008 by Stephen Hemsley and Nigel Wray, who both did well from Domino’s Pizza and hence have a deep knowledge of the franchise sector. They’d already announced in January that they expected revenue, adjusted EBITDA and adjusted EPS to be ahead of expectations. FY 2020 revenue of £49m and statutory PBT of £3.7m were both up 12%, though this was helped by the acquisition of Willow Pumps. They don’t give an organic growth figure, though looking at the divisional reporting it looks like revenue would have fallen around 15% ex acquisitions. Still investors took the FY results positively with the shares marked up 5% on the day of the announcement.

The company splits its operations into 2 divisions i) B2B division (some of which is direct labour, rather than franchise): Metro Rod, Metro Plumb, and Willow Pumps 84% of Adjusted EBITDA and ii) B2C ChipsAway, Ovenclean, Barking Mad 32% of Adjusted EBITDA. The percentages do not sum to 100%, because the company deducts £1.1m of central overheads from Adjusted EBITDA of £6.6m at FY 2020. In the B2C divisions franchisees pay a fixed monthly fee, and in the B2B divisions franchisees pay a turnover-related fee.

Outlook statement By the end of 2023 management are looking to achieve revenues of £100m (v £49m FY 2020) and adjusted EBITDA of £15m (v 36.6m FY 2020). They say that trading has started strongly in 2021 in both divisions. They point to £20m of cash and undrawn credit facilities (to be clear, net cash was £4.9m 31 Dec 2020, but gross cash was £13.2m and they had £7m of undrawn credit).

Opinion This is an acquisitive business. Intangible assets were £34m v shareholders’ equity of £44m. The outlook statement suggests that the revenue target will be achieved with more acquisitions. The valuation 26x PER suggests investors are giving management the benefit of the doubt (probably correctly given the track record and Domino’s Pizza).

Bruce Packard

You can follow more of Bruce’s investing thoughts and blog at brucepackard.com and on Twitter @bruce_packard

Notes

The author owns shares in Solid State plc.

* The Origin of Wealth Eric Beinhocker but see also

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

I Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

online casino philippines