I was initially unimpressed by the UK’s mass vaccination rollout. However it is important to keep updating your beliefs when data is better than you had been expecting and not miss the inflection point. From below 150K per week in December, we now have almost 5m vaccinated. My mistake was to extrapolate in a linear fashion from the early weeks of the rollout, whereas the acceleration has been impressive. The latest figures are showing c. 350K people a day are receiving their first dose of the vaccine, though there is considerable variation depending on the day of the week.

The government’s target of 25m in H1 of 2021 seemed wildly optimistic to me, yet it looks like we might actually come close to that goal. Good news! Investing is about the balance of expectation v surprise, like a Radiohead song.*

A moon shaped pig? That said, there are signs of speculative excess in the IPO market. Max Levchin’s Affirm doubled in value from its IPO price on the first day of trading on Nasdaq earlier this month. Moonpig, the online greeting cards business, announced it would IPO in London for £1.2bn. This is a Private Equity owned business, so caveat emptor. The FT reports that in the last set of statutory accounts, Moonpig made pre-tax profit of £18.4m on revenues of c. £100m. That would imply a 93x PER ratio on historic earnings and 12x historic sales. Not for me, thank you.

Terry Smith’s letter Terry Smith of Fundsmith published his Annual Letter last week. As a former banks analyst, he makes an interesting point about different types of investment funded by equity v debt. Banks and bond holders much prefer debt secured against fixed assets (more often than not property) because if the borrower defaults, the bank knows that the collateral the loan is secured against means the bank should recover some money. Often this is false security though, in a downturn all the banks are repossessing similar assets and selling for what they can get. But in a downturn banks are (no surprise) reluctant to increase their exposure by lending secured against assets falling in value. This causes a feedback loop driving prices lower.

Property crashes are an obvious example, but the same happens with other tangible assets financed with debt. People forget how much of the “internet bubble” of the late 90s was actually a telco infrastructure bubble, with heavily indebted companies like Global Crossing and WorldCom investing in tangible assets that then struggled to generate enough revenue to cover the cost of servicing the debt. The assets were tangible, but management used flawed accounting assumptions to overstate the income they were generating.

The second point Terry makes is that intangible assets are often not recorded on the balance sheet, but their costs are immediately expensed through the p&l. This accounting treatment understates earnings relative to a widget bashing company that buys equipment (capex) and records the value on the balance sheet, then depreciates it gradually through the p&l in future years. Plus if a brand is well maintained by advertising, marketing, innovation and product development the duration of that brand can outlast a fixed asset that wears out and needs to be replaced every few years.

Terry’s conclusion is that comparing these different types of business using a simple PE ratio leads to investors undervaluing the business that is expensing spend on intangibles through the p&l. He takes issue with the Cyclically Adjusted PE (or CAPE) which shows the S&P is expensive relative to history, because it is not comparing apples with apples (the “E” of the PE has changed over time). He doesn’t deny that some tech stocks may be overvalued but the growing significance of intangibles means that something really is different this time. He suggest it is important investors update their thinking and not miss the inflection point.

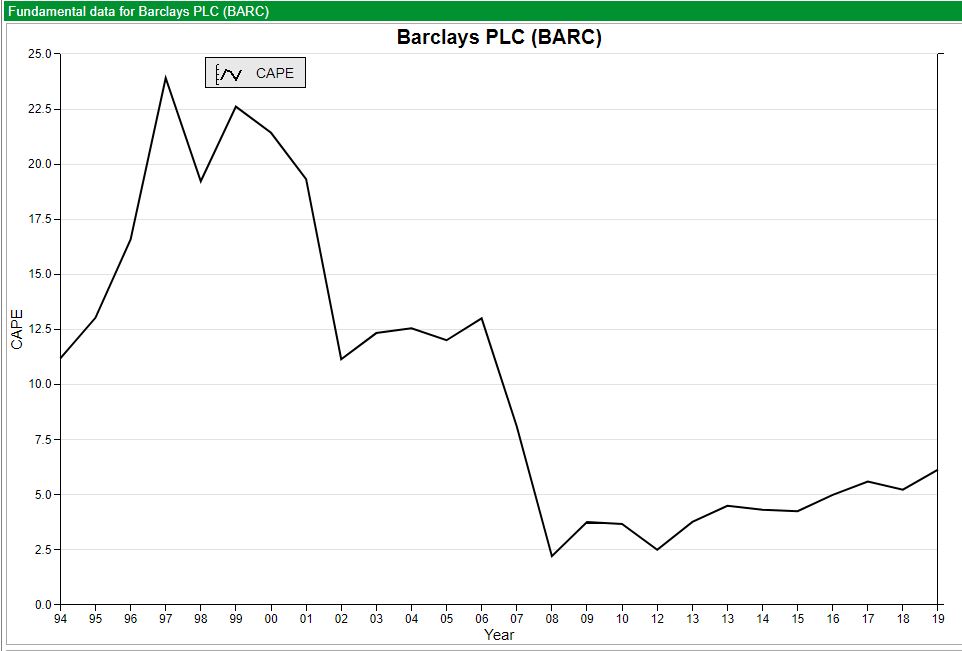

I think that’s fair enough, as far as it goes. I would only add that a second trend over the decades is low interest rates and large amounts of borrowing that companies have taken on. With SharePad it is possible to look at individual companies CAPE, and I show Barclays’ back to the early 1990s. As bank balance sheets expanded, CAPE for Barclays (and the banks sector as a whole) adjusted downwards to reflect the risk. Perhaps the growth in spending on intangibles and the increase in corporate borrowing have offset each other?

Results this week There have been a number of positive announcements coming out at the start of the year. Below I look at IQGeo, Air Partner, Somero, Kape and The Mission Marketing Group. The latter two have balance sheets that do record significant amounts of intangibles, as they have grown by acquisition.

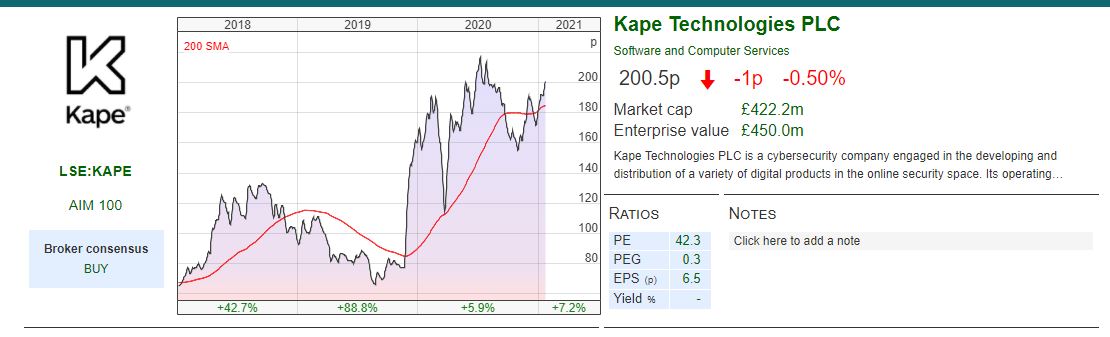

Kape Technologies Trading Update FY December

This is another @glasshalfull stock. Kape put out a trading update saying FY 2020 revenue would be c. $122m up +88%. Annoyingly the company don’t give an organic revenue growth number, because that headline figure of +88% has been helped by the acquisition of Private Internet Access (PIA) in December 2019. The company says it expects to increase marketing spend ($23m at H1) and R&D spending. Administrative expenses were $77m in FY 2019, versus $7.5m for cost of sales. So despite the company reporting a gross profit margin of 85% last year, the hefty “below the line” costs like marketing and admin expenses mean that Kape has struggled to report a significant PBT over the last few years.

History This company originally was focused on ad-tech before changing its name and switching to privacy and cybersecurity. It listed on AIM as Crossrider in September 2014, raising £46m at 103p valuing the company at £153m. Crossrider reported several years of losses, before changing tack to cybersecurity and turning a small profit from 2017 onwards. The company offers Virtual Private Networks (VPNs) which allows subscribers to hide their IP address from the websites that they’re visiting (eg you could watch BBC in Germany). An added benefit is if you live in a country where governments censor the media, you can get round this. I have a friend who visited Iran a couple of years ago, she said everyone was using VPNs to watch Game of Thrones.

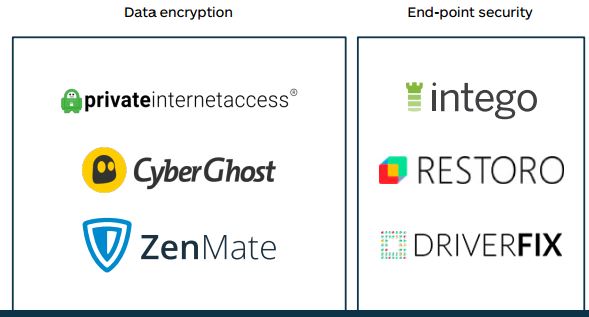

Kape also offers antivirus software, a password manager and encryption services all in one product called CyberGhost Privacy Suite. They have grown by acquisition (there’s $132m of goodwill on the balance sheet) and seem to have kept the customer facing brands that they have acquired (eg PIA and ZenMate) but then integrated the backend. I used to play beach volleyball with the founder of ZenMate (a small VPN company based in Berlin), who sold themselves to Kape in 2018. They have around 2.5m paying subscribers across the globe, according to their capital markets day which they held in June last year. They quote a Global Market Insight report that says the VPN market was worth more than $25bn in 2019, and is forecast to reach $70bn by 2026.

In October last year the company raised $116m of capital at 150p, which they say will be used for future M&A opportunities and to support organic growth. There was also $20m of deferred consideration from their purchase of PIA, which presumably the capital raise can go towards. Net debt was $25.6m at the end of June, the company should now have net cash following the capital raise, but they don’t give an end December figure in the statement. The Finance Director must know how much cash they had in the bank at the year end, so I find it remarkable that they decided to leave that figure out.

Forecasts Progressive Research put out a note on the day of the RNS, increasing revenue by 1% and Adjusted EBITDA by 8%. Progressive is forecasting $147m of revenue in 2022F, Adjusted PBT of $40m, Reported PBT of $22m and eps of 17.5c (13p) putting the stock on 15x PER 2022F. There’s no explanation why the difference between adjusted and reported PBT is so high. I’m assuming that the analyst is adjusting for the large amortisation charge for intangible assets.

Ownership Unikmind Holdings owns 65% of the stock, which is a Teddy Sagi company. He’s a colourful Cypriot Israeli billionaire probably best known for Playtech and owning Camden Market, and before that was convicted of fraud in 1996*. Miton owns 3.3%, but aside from that there are no other institutions with disclosable stakes, presumably because of the lack of free float as much as the majority shareholder’s lively past.

Opinion This is an example of a company that does have significant intangible assets appearing on its balance sheet. As of December 2019 Kape had $37m of Intellectual Property, $39m of Trademarks, $29m of customer lists, $132m of goodwill and $4m of capitalised software costs recorded on its balance sheet. In total that comes to $242m v shareholders’ equity of $155m Dec 2019. The intangible assets may well be valuable, it’s hard to tell, because of the “winner takes almost all” nature of network effects businesses (eg Facebook v MySpace). Rather than look at the accounting in fine detail, I’d suggest the best way for investors to gain confidence before investing is to test the company’s product against competitors.

The company expects to report FY results on 17 March.

IQGeo Trading Update FY December

This loss making but fast growing telco software services group put out a trading statement. FY revenue (31 Dec y/e) should be not less than £9.0m v £7.8m FY 19. They acquired a US business in December called OSPI, but even without the acquisition organic growth has been +65% y-o-y. They expect gross margin to be 50% (v 42% FY 2019).

The group is expected to be loss making again this year, and next but profitable in 2023F according to their broker. They had £10.5m of net cash as of 31 December which should see the group through to profitability if all goes well.

History This company originally listed as Ubisense in June 2011 at 180p, raising £4.2m and valuing the company at £39m. The company had two divisions Real-Time Location Systems (RTLS) which could be used to track people, vehicles and tools, and was sold in 2018. The second division Geospatial focused on mapping telco and utility assets. IQGeo’s software gives fieldworkers access to information that previously was stored in legacy back-end systems. Armed with the right data engineers in the field can save the utilities money and increase customer satisfaction. The company says once their software is embedded it remains in use for many years, which should mean increasing recurring revenue.

The company has a long period of losses with 2017 being the only year that it managed to turn a small profit. In 2019 the company changed its name to IQGeo, and in November 2020 raised £5m at 78p per share to buy OSPInsight (a private company headquartered in Salt Lake City) for $6.6m initial consideration, plus $1.1m deferred and $1.1m earn out. OSPI had revenue of $4m in FY19 of which $2.5m is recurring. The rationale for the acquisition was to increase recurring revenue, to sell IQGeo’s products to OSPInsights customers and increase the geographic footprint.

Forecasts Their broker FinnCap initiated last month with forecasts out to 2023F. Following the RNS the broker has a new note out raising revenue forecasts by 2% to £21m FY 2023F but reducing PBT expectations by 5% to £2.9m. The latest forecasts are now still loss making in FY 2022F but positive EPS FY 2023F of 4.7p, putting the stock 21x PER.

Institutions Kestrel Partners software specialist investors (they also own ULS Technology) owns 25%, Columbia Threadneedle owns 17%.

Opinion This stock has had many disappointments, but seems to now have a clear path to profitability. The shares were up +8% on the day of the RNS. Like many other software companies IQGeo are switching from a licence model to Software as a Service (SaaS) model. This has the effect of depressing revenue currently, but should result in higher recurring revenue in future. The gross margin of 50% should mean that eventually the p&l should show the benefits of operational gearing. Again this looks like a company that has valuable intangible assets, but depressed profitability. The valuation that investors are prepared to pay for the stock, suggests that to some extent this is already being recognised though.

Air Partner Trading Update FY end January

This air charter company had a very strong first half given they were busy organising charters for the Foreign Office to repatriate UK citizens back from remote locations (including from Wuhan, where the virus started) in H1. In September last year the shares fell 17% after H1 results came out, despite reporting underlying H1 PBT up 3.2x to £10.5m, because management warned about the cloudy outlook once this initial windfall had tailed off from these expensive repatriations. They are now suggesting underlying FY PBT of no less than £11.5m, implying just £1m of PBT in H2. It seems likely that FY2021 is more likely to see similar trends to the second half.

The company has a conservative balance sheet structure (£18m of net cash at the end of July – which excludes the £18m of cash customers have prepaid on to their JetCards). The company is asset light, owning no aircraft, which offers flexibility when navigating a crisis.

Opinion RoCE peaked at over 30% FY Jan 2018, but even before Covid’s impact had been felt in Europe was down below 12% FY Jan 2020. Such volatility must make it a difficult business to manage, but I’m reassured by the cash on the balance sheet. Assuming 2019A EPS of 7p is a “normal” year, that would put the stock on 10x PER. Sharepad shows that forecasts are actually more optimistic than that, suggesting 12p EPS, which would put the stock on 5.7x PER. The next six months are likely to be difficult, but I’m happy to look through that and hold for the long term.

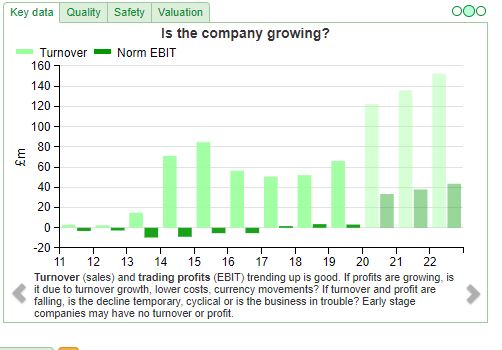

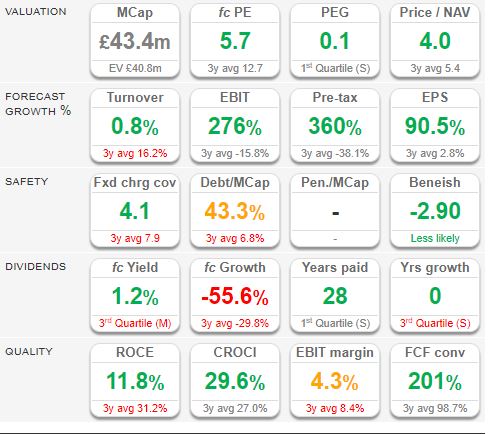

The Mission Marketing Group Trading Update FY December

TMG announced a trading update saying that FY PBT would be £1m “comfortably ahead” of expectations, following an H1 loss. The shares closed up 9% following the RNS. The company will pay its 2019 final dividend of 1.5p, which the Board had decided to defer paying when Covid hit. Bank debt is £1.3m. I couldn’t help wondering about the phrase “bank debt”, rather than “net debt” and whether that deliberately excludes other debt that the company doesn’t want to highlight in their trading update, so I went back and checked the H1 2020 results. Sure enough, there were £6.8m of contingent earnouts payable from acquisitions made in previous years. The group also took advantage of the government Time To Pay scheme, which wasn’t mentioned in the latest RNS.

These liabilities are real, even if they are not bank debt. I’m not sure how other investors feel when they read something that is technically correct, but not the full picture – for me, I wonder what else management are telling me which is correct, but unhelpful. There was also a “Growth Share Scheme” from 2017, which awarded management shares for hitting a share price target and also an LTIP with nil cost options awarded at the discretion of the Remuneration Committee.

That said, management did take a 20% pay cut at the start of the crisis. Underlying profitability should be strong enough to pay the non bank liabilities, plus there is a £15m revolving credit facility with the bank.

Forecasts Edison, the paid for research company, published a note in December last year, with revenue in 2021F recovering to £76m v last year £63m and £81m FY2019A. They are forecasting 8p of earnings in 2021F which seems reasonable given that the company reported 9p of earnings in 2019A. That puts the company on 10x. One thing to note when comparing historic data with forecasts is that “turnover” includes billings that TMG then pass on directly to clients. The company points analysts towards operating income £29m H1 2019 (v £58m turnover H1 2019) which analysts tend to forecast as the “top line”.

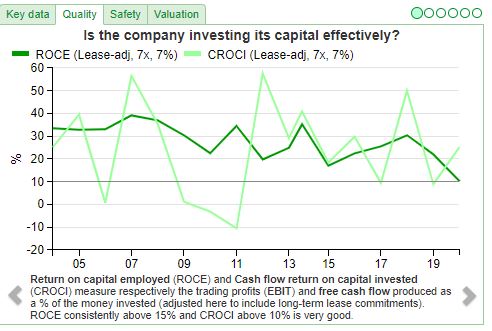

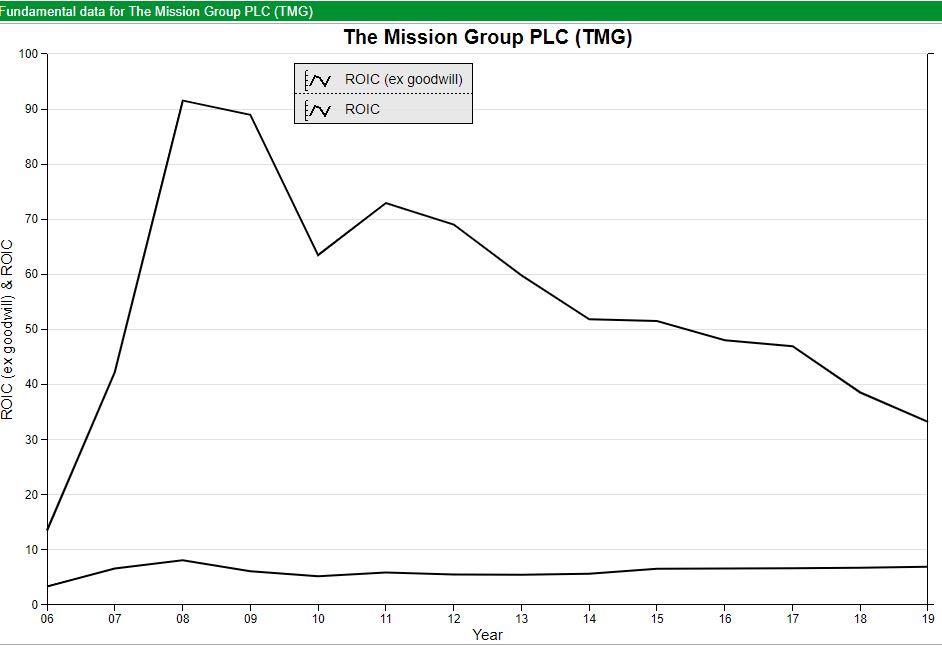

Opinion I’ve owned this stock for around 9 years. Seymour Pierce listed it in 2006, but it had a tough financial crisis, with an overleveraged balance sheet as the company’s customers cut their marketing spend, the shares fell 95% peak to trough. Intangible assets were £96m Dec FY19, which was higher than shareholders’ equity of £92m. My original thinking was that around ¾ of those intangible assets relate to acquisitions made before 2009, so shareholders equity is probably overstated and the company is generating a higher return on its capital than the accounting suggests.

The chart above shows ROIC ex goodwill has been impressive (though trending down), whereas including the cost of expensive acquisitions in the company’s early years means invested capital is inflated and so the company has failed to generate ROIC above 10%.

I thought that eventually management would write down the goodwill related to expensive acquisitions made over a decade ago and this would give investors a better view of the more recent return on investment achieved. If management did impair goodwill then investors would reward the company with a higher PER multiple than 5-10x PER the shares have traded at. My “multiple expansion” hypothesis hasn’t worked out, but because earnings have trebled from 2012, I have still managed to treble my money.

The Mission expects to announce FY 2020 results on 14 April 2021.

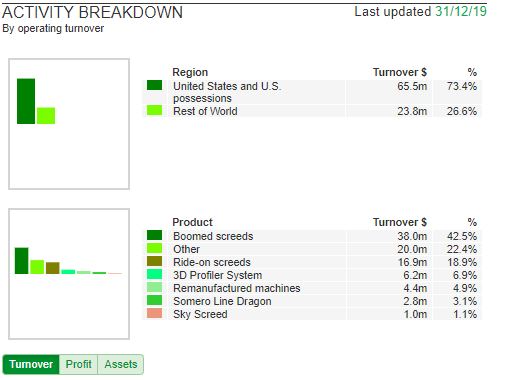

Somero Trading Update FY December

This US headquartered concrete screed company put out an RNS saying they expect FY 2020 (December y/e) revenue c. $88m (flat v $89m FY 19) but 10% ahead of guidance in November of $80m, and adjusted EBITDA of approximately $26m (down v $29m FY 19), but ahead of $21m November guidance. The company has done very well managing cashflow, and now expects $35m of net cash on balance sheet v previous guidance of $26m. The company expects to pay a supplementary dividend in March, but doesn’t say the amount.

In terms of geography, North America reported particularly strong H2 2020 which was driven by non-residential construction.

Forecasts FinnCap the company’s broker put out a note on the day of the RNS increasing FY 2020 EPS by 25% to 33.2ȼ. They are now forecasting a FY total dividend 32ȼ (23p) which is made up of 14ȼ normal and 17.8ȼ of supplemental dividend, putting the shares on a forecast yield of 6.1%. The broker are forecasting 32ȼ (23p) EPS in 2021F, putting the shares on 16x PER.

Opinion I’ve owned this share since November 2015, and am impressed how resilient performance has been through Covid. Before patting myself on the back too hard, I should have bought more in March this year, when the shares briefly touched 150p. The company generates around ¾ of its revenue from the US, so I think there’s considerable progress to be made both in Europe and in China. The shares were up 10% on the announcement.

Bruce Packard

Notes

The author owns shares in The Mission Marketing Group, Air Partner and Somero

*Everything in its Right Place: Analyzing Radiohead Brad Osborn See intro:

“Expanding on recent work in perception, this book approaches Radiohead’s music as a sonic ecosystem in which listeners participate, react and adapt in order to search for meaning. Listeners bring into these ecosystems a set of expectations learned (if only tacitly) from popular music, classical music, or even Radiohead’s own compositional idiolect, which is largely the product of the band’s primary songwriter and lyricist Thom Yorke. Particularly important in Radiohead’s music where a certain expectation – formal, rhythmic, timbral, or harmonic – is strongly cued through recognisable musical stimuli only to be violated by an unexpected realisation.”

*Teddy Sagi has an interesting past https://www.ft.com/content/5028e2b0-a474-11e3-9cb0-00144feab7de

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 25/01/21 – Expectation v surprise

I was initially unimpressed by the UK’s mass vaccination rollout. However it is important to keep updating your beliefs when data is better than you had been expecting and not miss the inflection point. From below 150K per week in December, we now have almost 5m vaccinated. My mistake was to extrapolate in a linear fashion from the early weeks of the rollout, whereas the acceleration has been impressive. The latest figures are showing c. 350K people a day are receiving their first dose of the vaccine, though there is considerable variation depending on the day of the week.

The government’s target of 25m in H1 of 2021 seemed wildly optimistic to me, yet it looks like we might actually come close to that goal. Good news! Investing is about the balance of expectation v surprise, like a Radiohead song.*

A moon shaped pig? That said, there are signs of speculative excess in the IPO market. Max Levchin’s Affirm doubled in value from its IPO price on the first day of trading on Nasdaq earlier this month. Moonpig, the online greeting cards business, announced it would IPO in London for £1.2bn. This is a Private Equity owned business, so caveat emptor. The FT reports that in the last set of statutory accounts, Moonpig made pre-tax profit of £18.4m on revenues of c. £100m. That would imply a 93x PER ratio on historic earnings and 12x historic sales. Not for me, thank you.

Terry Smith’s letter Terry Smith of Fundsmith published his Annual Letter last week. As a former banks analyst, he makes an interesting point about different types of investment funded by equity v debt. Banks and bond holders much prefer debt secured against fixed assets (more often than not property) because if the borrower defaults, the bank knows that the collateral the loan is secured against means the bank should recover some money. Often this is false security though, in a downturn all the banks are repossessing similar assets and selling for what they can get. But in a downturn banks are (no surprise) reluctant to increase their exposure by lending secured against assets falling in value. This causes a feedback loop driving prices lower.

Property crashes are an obvious example, but the same happens with other tangible assets financed with debt. People forget how much of the “internet bubble” of the late 90s was actually a telco infrastructure bubble, with heavily indebted companies like Global Crossing and WorldCom investing in tangible assets that then struggled to generate enough revenue to cover the cost of servicing the debt. The assets were tangible, but management used flawed accounting assumptions to overstate the income they were generating.

The second point Terry makes is that intangible assets are often not recorded on the balance sheet, but their costs are immediately expensed through the p&l. This accounting treatment understates earnings relative to a widget bashing company that buys equipment (capex) and records the value on the balance sheet, then depreciates it gradually through the p&l in future years. Plus if a brand is well maintained by advertising, marketing, innovation and product development the duration of that brand can outlast a fixed asset that wears out and needs to be replaced every few years.

Terry’s conclusion is that comparing these different types of business using a simple PE ratio leads to investors undervaluing the business that is expensing spend on intangibles through the p&l. He takes issue with the Cyclically Adjusted PE (or CAPE) which shows the S&P is expensive relative to history, because it is not comparing apples with apples (the “E” of the PE has changed over time). He doesn’t deny that some tech stocks may be overvalued but the growing significance of intangibles means that something really is different this time. He suggest it is important investors update their thinking and not miss the inflection point.

I think that’s fair enough, as far as it goes. I would only add that a second trend over the decades is low interest rates and large amounts of borrowing that companies have taken on. With SharePad it is possible to look at individual companies CAPE, and I show Barclays’ back to the early 1990s. As bank balance sheets expanded, CAPE for Barclays (and the banks sector as a whole) adjusted downwards to reflect the risk. Perhaps the growth in spending on intangibles and the increase in corporate borrowing have offset each other?

Results this week There have been a number of positive announcements coming out at the start of the year. Below I look at IQGeo, Air Partner, Somero, Kape and The Mission Marketing Group. The latter two have balance sheets that do record significant amounts of intangibles, as they have grown by acquisition.

Kape Technologies Trading Update FY December

This is another @glasshalfull stock. Kape put out a trading update saying FY 2020 revenue would be c. $122m up +88%. Annoyingly the company don’t give an organic revenue growth number, because that headline figure of +88% has been helped by the acquisition of Private Internet Access (PIA) in December 2019. The company says it expects to increase marketing spend ($23m at H1) and R&D spending. Administrative expenses were $77m in FY 2019, versus $7.5m for cost of sales. So despite the company reporting a gross profit margin of 85% last year, the hefty “below the line” costs like marketing and admin expenses mean that Kape has struggled to report a significant PBT over the last few years.

History This company originally was focused on ad-tech before changing its name and switching to privacy and cybersecurity. It listed on AIM as Crossrider in September 2014, raising £46m at 103p valuing the company at £153m. Crossrider reported several years of losses, before changing tack to cybersecurity and turning a small profit from 2017 onwards. The company offers Virtual Private Networks (VPNs) which allows subscribers to hide their IP address from the websites that they’re visiting (eg you could watch BBC in Germany). An added benefit is if you live in a country where governments censor the media, you can get round this. I have a friend who visited Iran a couple of years ago, she said everyone was using VPNs to watch Game of Thrones.

Kape also offers antivirus software, a password manager and encryption services all in one product called CyberGhost Privacy Suite. They have grown by acquisition (there’s $132m of goodwill on the balance sheet) and seem to have kept the customer facing brands that they have acquired (eg PIA and ZenMate) but then integrated the backend. I used to play beach volleyball with the founder of ZenMate (a small VPN company based in Berlin), who sold themselves to Kape in 2018. They have around 2.5m paying subscribers across the globe, according to their capital markets day which they held in June last year. They quote a Global Market Insight report that says the VPN market was worth more than $25bn in 2019, and is forecast to reach $70bn by 2026.

In October last year the company raised $116m of capital at 150p, which they say will be used for future M&A opportunities and to support organic growth. There was also $20m of deferred consideration from their purchase of PIA, which presumably the capital raise can go towards. Net debt was $25.6m at the end of June, the company should now have net cash following the capital raise, but they don’t give an end December figure in the statement. The Finance Director must know how much cash they had in the bank at the year end, so I find it remarkable that they decided to leave that figure out.

Forecasts Progressive Research put out a note on the day of the RNS, increasing revenue by 1% and Adjusted EBITDA by 8%. Progressive is forecasting $147m of revenue in 2022F, Adjusted PBT of $40m, Reported PBT of $22m and eps of 17.5c (13p) putting the stock on 15x PER 2022F. There’s no explanation why the difference between adjusted and reported PBT is so high. I’m assuming that the analyst is adjusting for the large amortisation charge for intangible assets.

Ownership Unikmind Holdings owns 65% of the stock, which is a Teddy Sagi company. He’s a colourful Cypriot Israeli billionaire probably best known for Playtech and owning Camden Market, and before that was convicted of fraud in 1996*. Miton owns 3.3%, but aside from that there are no other institutions with disclosable stakes, presumably because of the lack of free float as much as the majority shareholder’s lively past.

Opinion This is an example of a company that does have significant intangible assets appearing on its balance sheet. As of December 2019 Kape had $37m of Intellectual Property, $39m of Trademarks, $29m of customer lists, $132m of goodwill and $4m of capitalised software costs recorded on its balance sheet. In total that comes to $242m v shareholders’ equity of $155m Dec 2019. The intangible assets may well be valuable, it’s hard to tell, because of the “winner takes almost all” nature of network effects businesses (eg Facebook v MySpace). Rather than look at the accounting in fine detail, I’d suggest the best way for investors to gain confidence before investing is to test the company’s product against competitors.

The company expects to report FY results on 17 March.

IQGeo Trading Update FY December

This loss making but fast growing telco software services group put out a trading statement. FY revenue (31 Dec y/e) should be not less than £9.0m v £7.8m FY 19. They acquired a US business in December called OSPI, but even without the acquisition organic growth has been +65% y-o-y. They expect gross margin to be 50% (v 42% FY 2019).

The group is expected to be loss making again this year, and next but profitable in 2023F according to their broker. They had £10.5m of net cash as of 31 December which should see the group through to profitability if all goes well.

History This company originally listed as Ubisense in June 2011 at 180p, raising £4.2m and valuing the company at £39m. The company had two divisions Real-Time Location Systems (RTLS) which could be used to track people, vehicles and tools, and was sold in 2018. The second division Geospatial focused on mapping telco and utility assets. IQGeo’s software gives fieldworkers access to information that previously was stored in legacy back-end systems. Armed with the right data engineers in the field can save the utilities money and increase customer satisfaction. The company says once their software is embedded it remains in use for many years, which should mean increasing recurring revenue.

The company has a long period of losses with 2017 being the only year that it managed to turn a small profit. In 2019 the company changed its name to IQGeo, and in November 2020 raised £5m at 78p per share to buy OSPInsight (a private company headquartered in Salt Lake City) for $6.6m initial consideration, plus $1.1m deferred and $1.1m earn out. OSPI had revenue of $4m in FY19 of which $2.5m is recurring. The rationale for the acquisition was to increase recurring revenue, to sell IQGeo’s products to OSPInsights customers and increase the geographic footprint.

Forecasts Their broker FinnCap initiated last month with forecasts out to 2023F. Following the RNS the broker has a new note out raising revenue forecasts by 2% to £21m FY 2023F but reducing PBT expectations by 5% to £2.9m. The latest forecasts are now still loss making in FY 2022F but positive EPS FY 2023F of 4.7p, putting the stock 21x PER.

Institutions Kestrel Partners software specialist investors (they also own ULS Technology) owns 25%, Columbia Threadneedle owns 17%.

Opinion This stock has had many disappointments, but seems to now have a clear path to profitability. The shares were up +8% on the day of the RNS. Like many other software companies IQGeo are switching from a licence model to Software as a Service (SaaS) model. This has the effect of depressing revenue currently, but should result in higher recurring revenue in future. The gross margin of 50% should mean that eventually the p&l should show the benefits of operational gearing. Again this looks like a company that has valuable intangible assets, but depressed profitability. The valuation that investors are prepared to pay for the stock, suggests that to some extent this is already being recognised though.

Air Partner Trading Update FY end January

This air charter company had a very strong first half given they were busy organising charters for the Foreign Office to repatriate UK citizens back from remote locations (including from Wuhan, where the virus started) in H1. In September last year the shares fell 17% after H1 results came out, despite reporting underlying H1 PBT up 3.2x to £10.5m, because management warned about the cloudy outlook once this initial windfall had tailed off from these expensive repatriations. They are now suggesting underlying FY PBT of no less than £11.5m, implying just £1m of PBT in H2. It seems likely that FY2021 is more likely to see similar trends to the second half.

The company has a conservative balance sheet structure (£18m of net cash at the end of July – which excludes the £18m of cash customers have prepaid on to their JetCards). The company is asset light, owning no aircraft, which offers flexibility when navigating a crisis.

Opinion RoCE peaked at over 30% FY Jan 2018, but even before Covid’s impact had been felt in Europe was down below 12% FY Jan 2020. Such volatility must make it a difficult business to manage, but I’m reassured by the cash on the balance sheet. Assuming 2019A EPS of 7p is a “normal” year, that would put the stock on 10x PER. Sharepad shows that forecasts are actually more optimistic than that, suggesting 12p EPS, which would put the stock on 5.7x PER. The next six months are likely to be difficult, but I’m happy to look through that and hold for the long term.

The Mission Marketing Group Trading Update FY December

TMG announced a trading update saying that FY PBT would be £1m “comfortably ahead” of expectations, following an H1 loss. The shares closed up 9% following the RNS. The company will pay its 2019 final dividend of 1.5p, which the Board had decided to defer paying when Covid hit. Bank debt is £1.3m. I couldn’t help wondering about the phrase “bank debt”, rather than “net debt” and whether that deliberately excludes other debt that the company doesn’t want to highlight in their trading update, so I went back and checked the H1 2020 results. Sure enough, there were £6.8m of contingent earnouts payable from acquisitions made in previous years. The group also took advantage of the government Time To Pay scheme, which wasn’t mentioned in the latest RNS.

These liabilities are real, even if they are not bank debt. I’m not sure how other investors feel when they read something that is technically correct, but not the full picture – for me, I wonder what else management are telling me which is correct, but unhelpful. There was also a “Growth Share Scheme” from 2017, which awarded management shares for hitting a share price target and also an LTIP with nil cost options awarded at the discretion of the Remuneration Committee.

That said, management did take a 20% pay cut at the start of the crisis. Underlying profitability should be strong enough to pay the non bank liabilities, plus there is a £15m revolving credit facility with the bank.

Forecasts Edison, the paid for research company, published a note in December last year, with revenue in 2021F recovering to £76m v last year £63m and £81m FY2019A. They are forecasting 8p of earnings in 2021F which seems reasonable given that the company reported 9p of earnings in 2019A. That puts the company on 10x. One thing to note when comparing historic data with forecasts is that “turnover” includes billings that TMG then pass on directly to clients. The company points analysts towards operating income £29m H1 2019 (v £58m turnover H1 2019) which analysts tend to forecast as the “top line”.

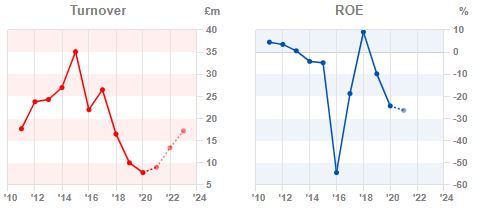

Opinion I’ve owned this stock for around 9 years. Seymour Pierce listed it in 2006, but it had a tough financial crisis, with an overleveraged balance sheet as the company’s customers cut their marketing spend, the shares fell 95% peak to trough. Intangible assets were £96m Dec FY19, which was higher than shareholders’ equity of £92m. My original thinking was that around ¾ of those intangible assets relate to acquisitions made before 2009, so shareholders equity is probably overstated and the company is generating a higher return on its capital than the accounting suggests.

The chart above shows ROIC ex goodwill has been impressive (though trending down), whereas including the cost of expensive acquisitions in the company’s early years means invested capital is inflated and so the company has failed to generate ROIC above 10%.

I thought that eventually management would write down the goodwill related to expensive acquisitions made over a decade ago and this would give investors a better view of the more recent return on investment achieved. If management did impair goodwill then investors would reward the company with a higher PER multiple than 5-10x PER the shares have traded at. My “multiple expansion” hypothesis hasn’t worked out, but because earnings have trebled from 2012, I have still managed to treble my money.

The Mission expects to announce FY 2020 results on 14 April 2021.

Somero Trading Update FY December

This US headquartered concrete screed company put out an RNS saying they expect FY 2020 (December y/e) revenue c. $88m (flat v $89m FY 19) but 10% ahead of guidance in November of $80m, and adjusted EBITDA of approximately $26m (down v $29m FY 19), but ahead of $21m November guidance. The company has done very well managing cashflow, and now expects $35m of net cash on balance sheet v previous guidance of $26m. The company expects to pay a supplementary dividend in March, but doesn’t say the amount.

In terms of geography, North America reported particularly strong H2 2020 which was driven by non-residential construction.

Forecasts FinnCap the company’s broker put out a note on the day of the RNS increasing FY 2020 EPS by 25% to 33.2ȼ. They are now forecasting a FY total dividend 32ȼ (23p) which is made up of 14ȼ normal and 17.8ȼ of supplemental dividend, putting the shares on a forecast yield of 6.1%. The broker are forecasting 32ȼ (23p) EPS in 2021F, putting the shares on 16x PER.

Opinion I’ve owned this share since November 2015, and am impressed how resilient performance has been through Covid. Before patting myself on the back too hard, I should have bought more in March this year, when the shares briefly touched 150p. The company generates around ¾ of its revenue from the US, so I think there’s considerable progress to be made both in Europe and in China. The shares were up 10% on the announcement.

Bruce Packard

Notes

The author owns shares in The Mission Marketing Group, Air Partner and Somero

*Everything in its Right Place: Analyzing Radiohead Brad Osborn See intro:

“Expanding on recent work in perception, this book approaches Radiohead’s music as a sonic ecosystem in which listeners participate, react and adapt in order to search for meaning. Listeners bring into these ecosystems a set of expectations learned (if only tacitly) from popular music, classical music, or even Radiohead’s own compositional idiolect, which is largely the product of the band’s primary songwriter and lyricist Thom Yorke. Particularly important in Radiohead’s music where a certain expectation – formal, rhythmic, timbral, or harmonic – is strongly cued through recognisable musical stimuli only to be violated by an unexpected realisation.”

*Teddy Sagi has an interesting past https://www.ft.com/content/5028e2b0-a474-11e3-9cb0-00144feab7de

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.