Quality Stock Screening Guide – Spot Financially Resilient Companies with ShareScope

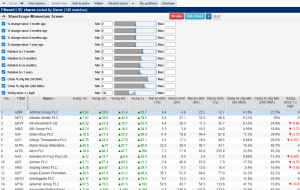

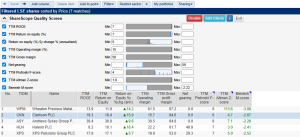

Looking to find financially sound businesses with ShareScope? We’ve created this Quality Stock Screening Guide to go with our off-the-shelf Quality Screen to help you learn how to spot them. It’s designed to highlight the key signals we believe matter when searching for companies built on strong foundations. ShareScope subscribers can apply this screen at