Bi-Weekly Market Commentary | 09/07/2025 | MANO, AOM | Are we asking the right questions about LLMs?

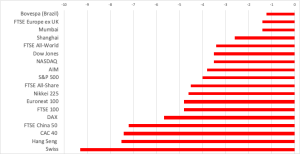

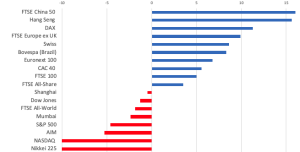

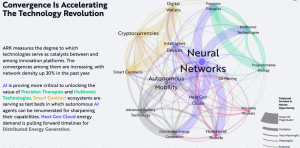

How confident can we be that the tech companies spending hundreds of billions of capex on LLM will generate adequate returns? Companies covered MANO and AOM. The FTSE 100 was up around +0.5% over the last 5 trading days. In comparison, the Nasdaq100 and S&P500 were up just under +1%. Platinum (PT$) is now the