The Bank of England released its twice yearly Financial Stability Report last week. The report says that UK bank balance sheets are in much better shape than the 2007-8 crisis and they expect impairments in 2021 to be lower than the £22bn credit losses taken last year. The “guardrails” against shareholder dividends have now been removed. Meanwhile Mark Kleinman at Sky reported that Revolut’s latest funding round from Tiger and SoftBank values the unlisted company at £24bn. That’s £24bn for a loss-making app that doesn’t have a banking licence.

Here is a comparison of UK banks’ share prices going back all the way back to 1994. I’ve used SharePad’s new (CTRL+click) multi-graph feature – here is a link to a 1 minute YouTube video showing how it works.

The best performer is HSBC in green, which is up only 60% over 25 years or less than 2% per annum. So the best-performing UK bank’s share price has failed to keep pace with inflation. The two worst performers are Natwest/RBS and Lloyds that needed to be bailed out by the Government in the financial crisis and have lost c. 80% of their value over that time period. In 2000, when I started as a banks’ analyst the sector was considered boring, and loss-making internet stocks were thought to be risky. For the first half of that timeframe banks reported very high profitability, for instance Lloyds averaged a c.35% post tax Return on Equity until 2007 versus 2.3% RoE reported by the bank in FY 2020.

Though bank shareholders have done badly, others have done well out of falling inflation, increased leverage and “carry trades” over the last two decades. There’s a comment in last week’s Financial Stability Report looking at the role of leveraged investors in bond markets. Using other people’s money to buy low-yielding Government bonds sounds like a crazy idea to me, but it’s been very successful. Then in March 2020, the Covid panic caused that trade to unwind with those leveraged investors caused turmoil by selling long dated bonds, the so called “dash for cash”.

Central banks stepped in to safeguard financial stability. These support measures came at a price though, and led to a US$7 trillion increase in G7 central bank assets in just eight months. That’s a $7trillion increase, not the total size of central bank balance sheets. For comparison, following the collapse of Lehman Brothers in 2008, G7 central bank assets “only” rose by US$3trillion. Central banks are keen to avoid forced sellers and instability, but sometimes the provision of liquidity and suppression of volatility by regulators helps to precipitate the next crisis. Stability creates instability. So I’m expecting the next problems to be focused on central banks and Governments and their liabilities.

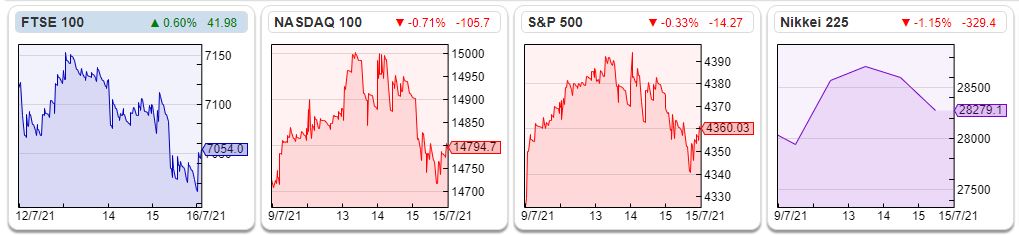

CPI inflation rose to +2.5% in June in the UK and in the US CPI rose to 5.4%, the highest in 30 years. For now inflation data seems to be driven by used car prices, however if we start to see wage inflation things could get “interesting”. If an inflation scare drives selling pressure in the bond markets, then I can’t see that Central Banks stepping in yet again and expanding their balance sheets to prevent a disorderly market makes sense – the normal response to control inflation is not to buy assets, but to raise interest rates.

This week I look at a couple of loss-making companies that have enough cash to see them through to profitability. ULS technology, the property conveyancing platform; Circassia, the medical diagnostic company specialising in asthma plus Capital Drilling, which hires out mining equipment for gold miners in Africa.

ULS Technology FY March 2021

This online conveyancer rescheduled results a couple of weeks ago. We’ve seen this from a few companies (Renold, Gateley, probably some more) and it seems to be a problem with the auditors working remotely. Normally I’d be tempted to sell as soon as a delay is announced, fearing a problem agreeing the “going concern” statement with the auditors. That’s certainly not the case for ULS who sold a business (Conveyancing Alliance Limited or CAL) in November last year and have £24m of cash and no borrowing. Renold’s postponed results were released last Friday (16th July) with no nasty surprises and Gateley’s are due Tuesday 20th July.

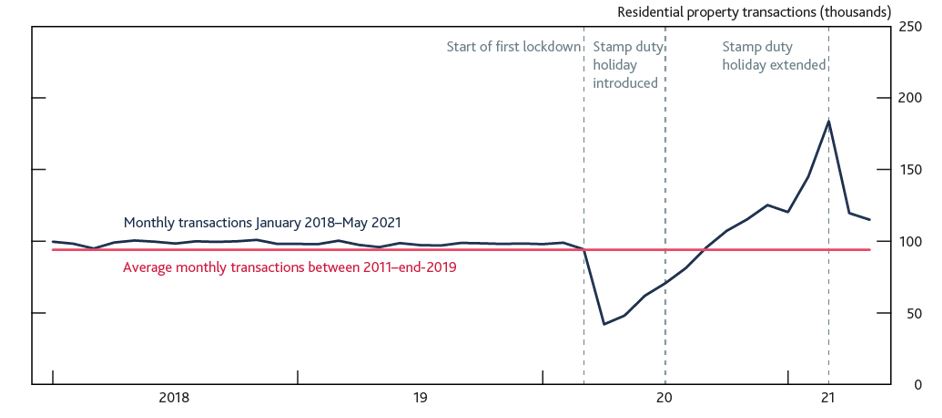

ULS reported FY to March revenue was down -18%, which management blame on Covid. The housing market was weak April-May 2020 (ie the first two months of their FY 2021 year) but I still think a -18% revenue drop is disappointing given how strong housing market transactions have been. The implication is that ULS is losing market share in a strong market. Below is a chart from the Bank of England FSR showing the effect of the stamp duty holiday and extension on housing market transactions.

The worry is that ULS’s DigitalMove service is just not very good and failing to win new business in a helpful market. Though the sample is small, there are some poor online reviews.

The company reported a statutory loss on continuing operations of £2.3m vs £2.1m PBT FY March 2020. In part the loss was caused by a £1.5m exceptional write-off of intangible assets when they re-worked DigitalMove, their online conveyancing tool to a low code environment. Even without the write-off they reported an underlying loss of £0.8m, which is disappointing. The gross margin also fell to 40.8% vs 42.0% last year.

Outlook The Chairman, Martin Rowland, says the housing market is “fluctuating”. Whereas Andy Haldane, Chief Economist at the BoE thinks the housing market is “on fire”. I think I’ll go with the central bank’s description. The Chairman’s statement points out rising house prices are not particularly helpful to ULS because they make things difficult for First Time Buyers, a key market for the company. I listened into the company’s webinar on investormeetcompany and asked for more detail. The Finance Director explained that home moving, as opposed to remortgaging, requires property searches and is inherently more complicated and higher margin. He also said re-mortgaging customers tend to come to the platform from brokers, rather than estate agents. I don’t think that response quite answers my question though, as I asked about FTB’ers vs home movers, and he answered a question about home movers vs re-mortgagers.

My fear is that demand in the housing market has been brought forward, and after the stamp duty holiday ends ULS will be in a more difficult revenue environment in 2022 and 2023. The shares fell -12% on the morning of the RNS. The company replaced their CEO at the end of last year, so that may explain some lack of momentum as the new chap, Jesper With-Fogstrup started in January. He is ex-HSBC, where he held the role of Global Head of Digital as a Channel and before that ComparetheMarket.com.

Ownership Kestrel Partners, who had a lot of success with GB Group (market cap increased 24x from their first buy in Dec 2010) own 28.5% of ULS. Schroders 10.6%, Gresham House 6.8%, Herald the technology specialists 6.8%

Valuation Coming into the FY results, there were no forecasts for this stock. On the call management said that they were not prepared to commit to public targets currently, though they intend to start publishing Key Performance Indicators and perhaps then giving financial guidance in future. So that leaves us with two figures: cash £24m, and revenue of £17m. Subtracting the cash from the market cap, gives a valuation of 1.65x revenue.

Opinion I bought the shares a couple of years ago, and there’s no way of hiding the fact that I’m disappointed with the latest set of results. I think the idea of using technology to make conveyancing easier sounds good in theory, but I’m concerned that it may be harder to implement than first thought. Patience required.

Circassia H1 Trading Update

This medical devices company focused on asthma diagnosis and management with a December year end, announced revenue growing at +27% in H1. The group is still loss-making, but making progress with NIOX® product, used by doctors in clinical settings, which is EBITDA positive for the first time.

History The company has an interesting history, originally founded in 2006 to commercialise innovation developed at Imperial College, London. They were backed by some smart money, including Lansdowne Partners and Neil Woodford at Invesco Perpetual. Some readers may disagree with my characterisation of Woodford as “smart money”, but he had a long track record of picking winners and avoiding losers, his problem was lack of risk management (or hubris if you prefer the Greek word).

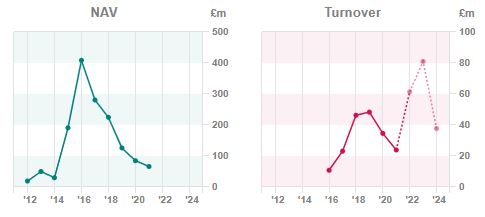

In 2014 Circassia IPO’ed raising £200m at 310p on the main market valuing the company at £581m, the money raised was to fund development and commercialisation of its cat allergy drug Cat-SPIRE. At the time of the IPO, it was the biggest bio-tech listing in London, with Cat-SPIRE in phase III study that was expected to complete in H1 2016.

Placebo Effect Unfortunately Cat-SPIRE failed its phase III trial, and the shares lost two thirds of their value on the day, falling to 88p. Cat-SPIRE failed not because the drug didn’t work; the treatment showed a dramatic improvements in subjects’ allergy symptoms. Instead the drug failed the trial because the placebo response was nearly 60%. Placebo effects are very difficult to control for in many chronic inflammatory illnesses (everything from Irritable Bowel Syndrome, psoriasis to depression, and also treatments for neuro-degenerative diseases like Parkinson’s can also exhibit strong placebo responses).

The company still had £140m of net cash from its IPO and had acquired a couple of promising asthma products in 2015. In 2017, the company announced a collaboration with Astra Zeneca, around the COPD (chronic obstructive pulmonary disease) products Turdorza and Duaklir. This involved AZ lending them money, again this ended in disappointment, and in February 2019 the company moved from the main market to AIM because it couldn’t comply with the LSE’s 25% free float rule. By June 2019 the shares had fallen below 15p. In April 2020 they transferred Turdorza and Duaklier back to AZ, in exchange for AZ writing off a loan to them of $150m.

Circassia also had a commercial agreement with a Chinese company, BeyondAir, which was resolved this May and the company should receive $16.5m in cash later this year.

Too hard? At this point many readers may be thinking that life sciences companies are beyond the circumference of their circle of competence. I have some sympathy with that view. But there’s going to be a flood of money coming into the sector because of a greater interest in medical innovation caused partly by the virus and partly by ageing populations. So I think it’s worth knowing some background, even if you’re not excited about Circassia’s prospects.

Niox The big hope is now their Niox device, which is used to measure airway inflammation in asthma sufferers. This is a diagnostic device that’s already approved and generating revenue growth +27% to £14.5m, the company has net cash of £11m at June 30, with a further $16.5m coming from BeyondAir in the second half of the year.

Ownership Richard Griffiths owns 28%. I used to work with him at Evolution Securities, he’s had some big winners, but also some losers too. Christopher Mill’s Harwood Capital are the next largest shareholder with 17.6%, AstraZeneca own 17% as a legacy from the Turdorz and Duaklir loan write off agreement, but they didn’t take part in the most recent fund raising.

Opinion Although this company is a serial disappointer, starting from where we are I do think that it’s worth looking at with fresh eyes. Though still loss-making currently, the company looks to have enough cash to see it through to profitability, particularly if revenue growth continues in the current pace. Circassia also offers uncorrelated risk and returns (ie the performance won’t be driven by markets, but by the company’s own results) which could be an additional attraction in markets which have enjoyed such a strong “vaccine rally”.

Capital Drilling H1 trading update to June

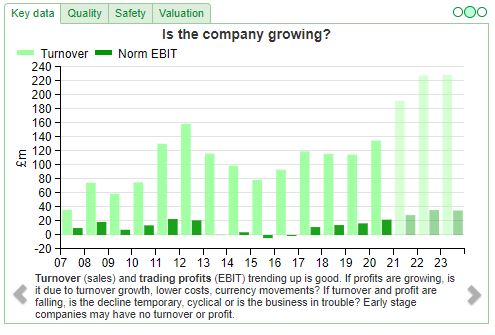

This mining equipment and services provider with a December year end put out a positive trading update. They supply African mining companies with drilling, mining equipment hire. To me the concept makes sense, because presumably it reduces mining companies own capex, and for Capital they’re not taking on the inherent risk of being a mining company themselves. Capital has a strong tailwind from the rising gold price, because c. 90% of their revenue comes from the African gold mining sector.

CAPD has reported revenue up +52% to $98.7m in H1 2021. They’ve increased their FY revenue guidance by +8% to a range of $200-210m. There’s no profit figure in the trading update, but net debt was $33.6m at the end of June, vs net cash of $5m at the end of December 2020.

History The company has been around since 2005, when it began drilling in Tanzania and now has operations across Africa. They have long standing relationships with well-known UK listed goldminers like Centamin, AngloGold Ashanti and Barrick Gold. They struggled in the 2013-2017 period because of a weak gold price, with the shares trading in a 20-30p range. At the end of last year they raised £30m in a placing at 58p, valuing the company at £100m. They needed to raise the cash because they’d won a c. $250m contract from Centamin, the gold miner, to supply equipment for their Sukari open pit gold mine in Egypt.

Ownership The Chairman Jamie Boyton owns 12.1%, and Exec Director Brian Rudd owns 6.4%. Institutions on the shareholder register are Aberforth 11.2%, Allianz 9.7%, BlackRock 5.5%, Ruffer 4.6%

Financials Peak revenue was $159m in 2012, though this should now be surpassed with the company’s guidance $200-210m for 2021F. Even before the raised guidance the shares were on less than 10x 2022F.

Opinion The shares look good value. Both @DangerCapital (aka Mark Simpson) and Leo is a fan. Rather than the revenue growth, he points to the number of rigs being used, 81 in Q2 2021 vs 64 Q1 2021, as the number that is exciting for those positive on the stock. If you’re an equipment hire business, and your utilisation rate is increasing, plus the absolute number of drill rigs is increasing, then both your margin and Returns on Capital Employed are going to look better than your historic reported returns.

Mark also points out the company’s net debt figure of $33.6m mentioned in the press release is not netted off against equity stakes that CAPD have taken in customers such as Allied Gold and Predictive Discovery. At Dec 2020 these were marked to market at $27m in the group’s balance sheet using fair value accounting. It’s likely that the value of these assets has risen due to buoyant markets and the price of gold. Investors need to do their own thinking and research, but it helps if you start your search digging in the right places. Leo and Mark know the company well and are fans, so I’m following Capital Drilling with interest.

Bruce Packard

Notes

The author owns shares in ULS Technology

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This website was… how do I say it? Relevant!! Finally I have found something that helped me. Kudos!

Having read this I thought it was very informative. I appreciate you finding the time and effort to put this content together. I once again find myself personally spending a significant amount of time both reading and commenting. But so what, it was still worth it!